In a world where banking transactions are quicker than ever, the importance of safeguarding your financial assets cannot be overstated. That's where our bank fraud monitoring service comes into play, offering you peace of mind with real-time alerts and comprehensive protections. Our dedicated team works relentlessly to identify and prevent fraudulent activities, ensuring that your funds remain secure. Ready to learn more about how you can protect yourself from fraud? Keep reading!

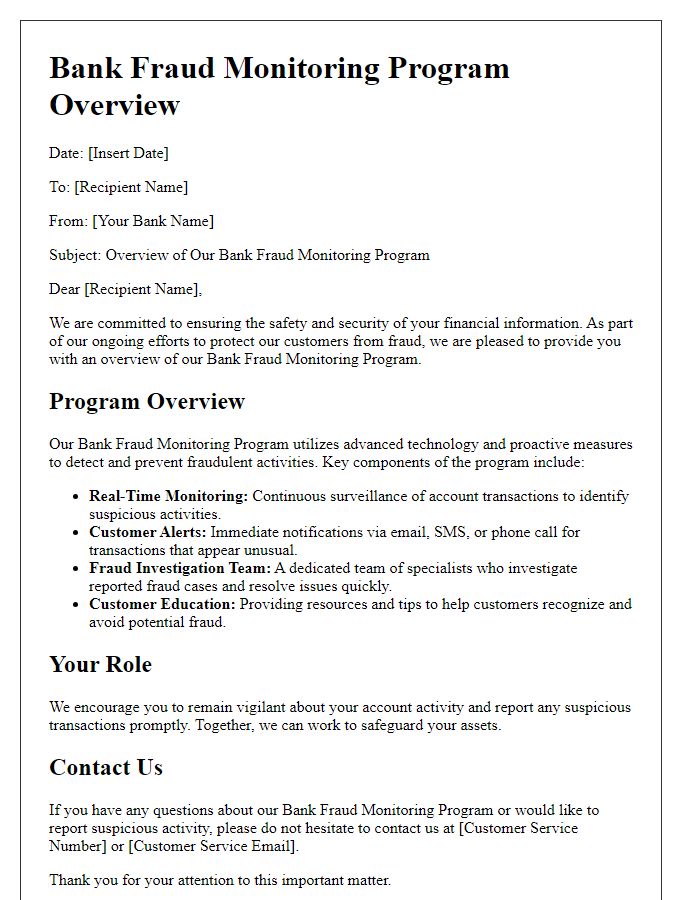

Subject line: Clear and precise.

Bank Fraud Monitoring Service offers real-time alerts and advanced analytics to protect financial accounts from unauthorized transactions. Automated systems use machine learning algorithms to identify suspicious activities, analyzing patterns in spending behavior. Customers receive instant notifications via mobile apps or emails when unusual transactions occur, ensuring rapid response to potential threats. Regular reports provided by the service also help ensure compliance with regulatory standards, such as the Federal Trade Commission guidelines for consumer protection. Users can customize alert settings based on personal preferences, enhancing security measures tailored to individual needs.

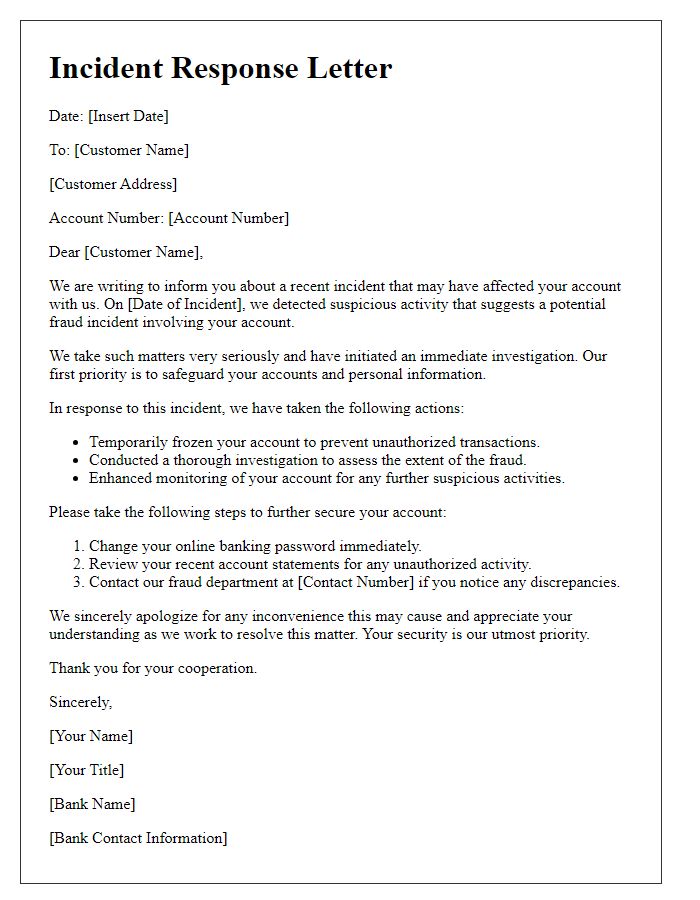

Introduction: Personalized greeting.

Bank fraud monitoring services utilize advanced technology to protect individual accounts from unauthorized access and suspicious activity. These systems constantly analyze transaction patterns, looking for anomalies or irregular behavior that could suggest fraudulent actions. Enhanced security measures include two-factor authentication and real-time alerts for transactions above a specific threshold, often set at $100 or more. Clients receive immediate notifications through SMS or email when unusual activities are detected, safeguarding personal assets in financial institutions such as Chase and Bank of America. Regular reports provide insights into account security status, enabling users to stay informed and take proactive measures against potential fraud, especially during peak periods like Black Friday or Cyber Monday when fraudulent activity typically spikes.

Body: Explanation of fraud monitoring service.

Fraud monitoring services play a crucial role in safeguarding financial transactions and protecting individuals from potential scams. These services utilize advanced algorithms and machine learning techniques to analyze transaction patterns and detect any unusual activities in real-time. For instance, transactions exceeding typical spending behaviors, such as a sudden purchase of over $500 from an overseas merchant, can trigger immediate alerts. Monitoring often includes round-the-clock surveillance by financial institutions, ensuring swift responses to suspicious activities. Additionally, notifications can be sent to customers via SMS or email whenever a transaction appears inconsistent with their spending habits, providing an extra layer of security. Ultimately, fraud monitoring services not only protect personal finances but also enhance consumer confidence in digital banking environments.

Call to action: Steps for activation or review.

Bank fraud monitoring services provide essential protection against unauthorized transactions and identity theft. Customers should promptly activate their service for maximum security. To begin, visit the online banking portal of your bank, such as Wells Fargo or Bank of America, and navigate to the security settings. Fill out the required form to enroll, which typically includes your account number, email address, and phone number for alerts. After enrollment, review your transaction history regularly to identify any unfamiliar activities. Set up two-factor authentication to enhance account security, reducing the risk of fraud. Regularly updating passwords, focusing on strong combinations, is vital for safeguarding personal financial information.

Closing: Contact information and reassurance.

Bank fraud monitoring services provide essential protection for customers against unauthorized transactions and identity theft. These services actively monitor account activity for suspicious behavior, alerting customers in real-time via SMS or email notifications. Clients can reach the dedicated customer support line at 1-800-555-0199, available 24/7, to report any anomalies or receive assistance. Rest assured, account security is a top priority, employing advanced encryption technologies and fraud detection algorithms to safeguard personal information and financial assets. Regular updates on account status and tips for enhancing security are also provided, ensuring customers remain informed and secure.

Comments