Are you curious about how to effectively analyze your rental income? Understanding the ins and outs of your earnings can empower you to make informed decisions about your investment properties. From calculating expenses to evaluating market trends, it's essential to dive deep into the numbers. So, let's explore the key elements of rental income analysis that can set you on the path to financial successâkeep reading to uncover valuable insights!

Rental Property Overview

A comprehensive rental property overview includes essential elements such as location, property type, rental income, expenses, and market trends. The location typically involves city or neighborhood names, enhancing appeal to potential tenants. For example, properties in Manhattan, New York, or in neighborhoods like Silver Lake, Los Angeles, tend to attract higher rental rates due to demand. The property type--be it a single-family home, multi-unit building, or commercial property--impacts rental strategies and income potential. Identifying rental income provides insights into cash flow, specifically detailing monthly rent amounts and occupancy rates. Expenses factor in maintenance costs, property management fees, and taxes, crucial for calculating net income. Finally, market trends such as average rental prices, vacancy rates, and economic conditions within specific areas (like a 3% annual growth in surrounding districts) help assess investment viability and long-term equity potential.

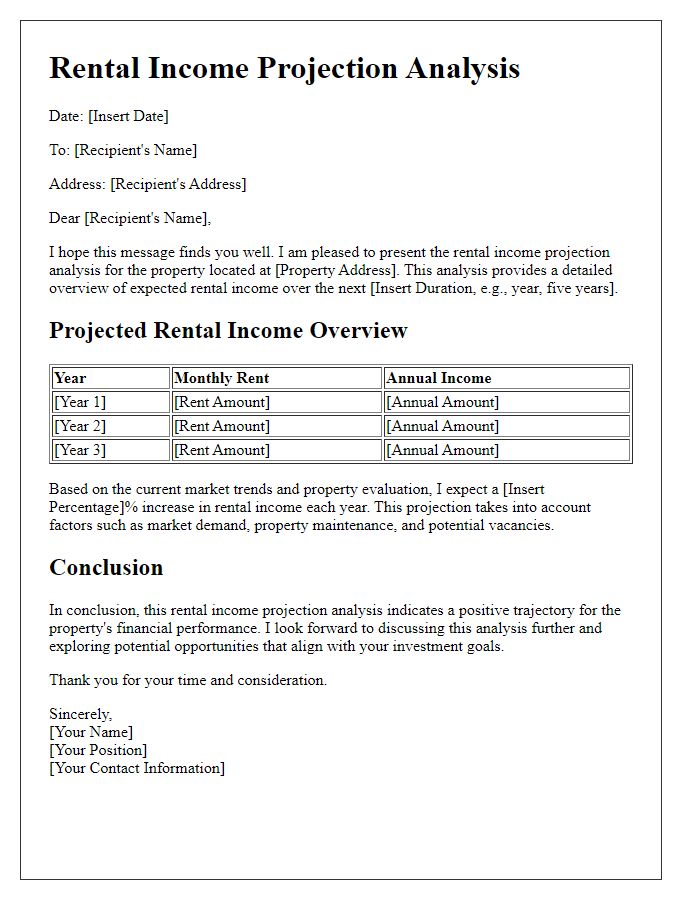

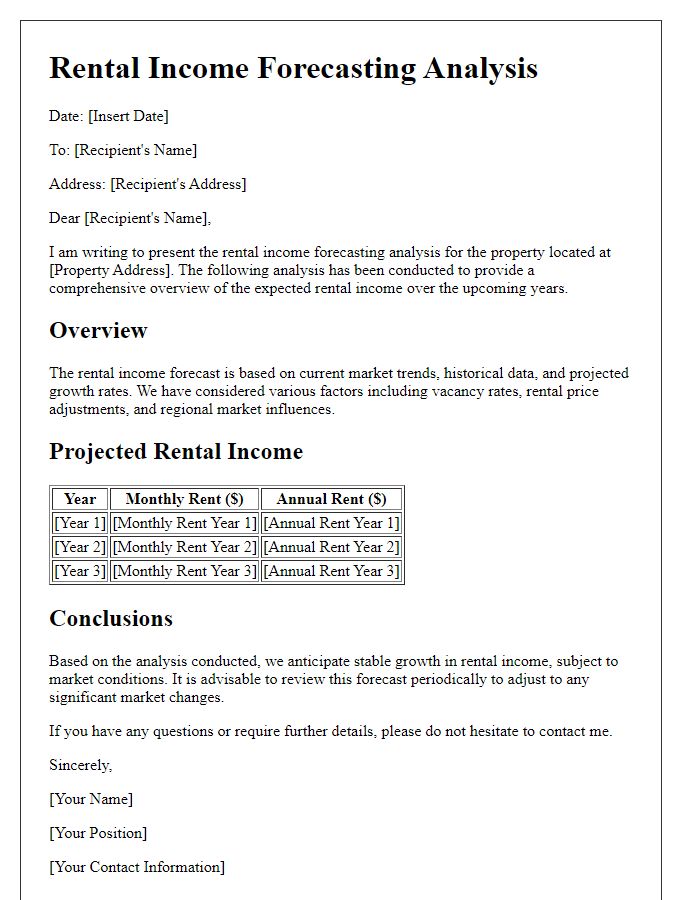

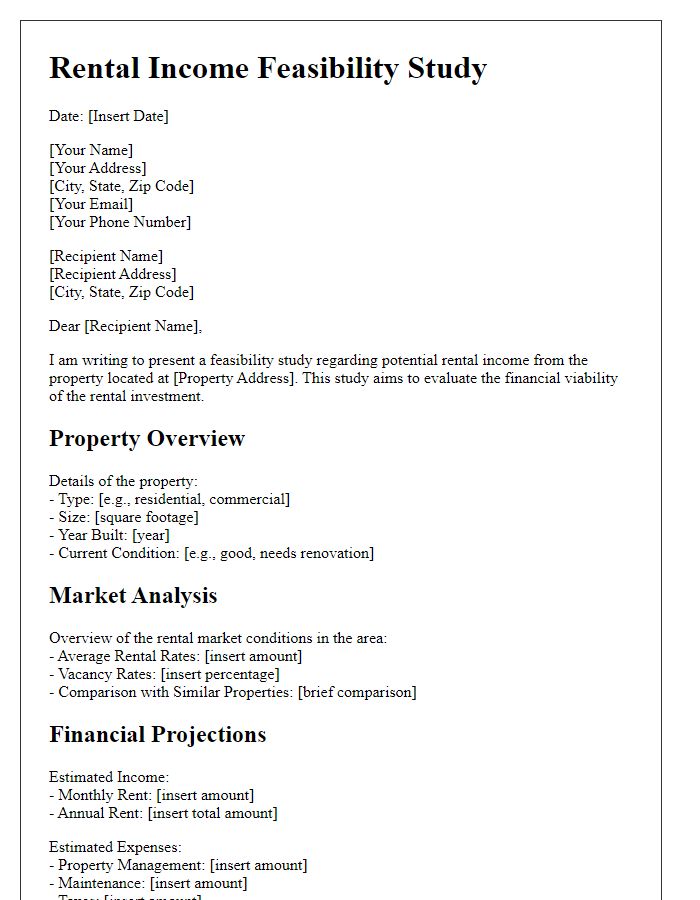

Income Details and Projections

Analyzing rental income involves examining key components such as current rent prices, historical occupancy rates, and projected income growth in a specific market, usually urban areas like New York City or San Francisco. Average rental prices in these locations can fluctuate, with a recent analysis indicating that the average monthly rent for a one-bedroom apartment is approximately $2,800. Additionally, understanding occupancy rates, which can average around 95% in thriving neighborhoods, is crucial for accurate income estimates. Future projections may account for real estate market trends, potential rent increases (around 3-5% annually), and local economic factors influencing tenant demand. Gathering information from reliable sources such as market reports, housing studies, and regional economic forecasts enhances the robustness of the rental income analysis.

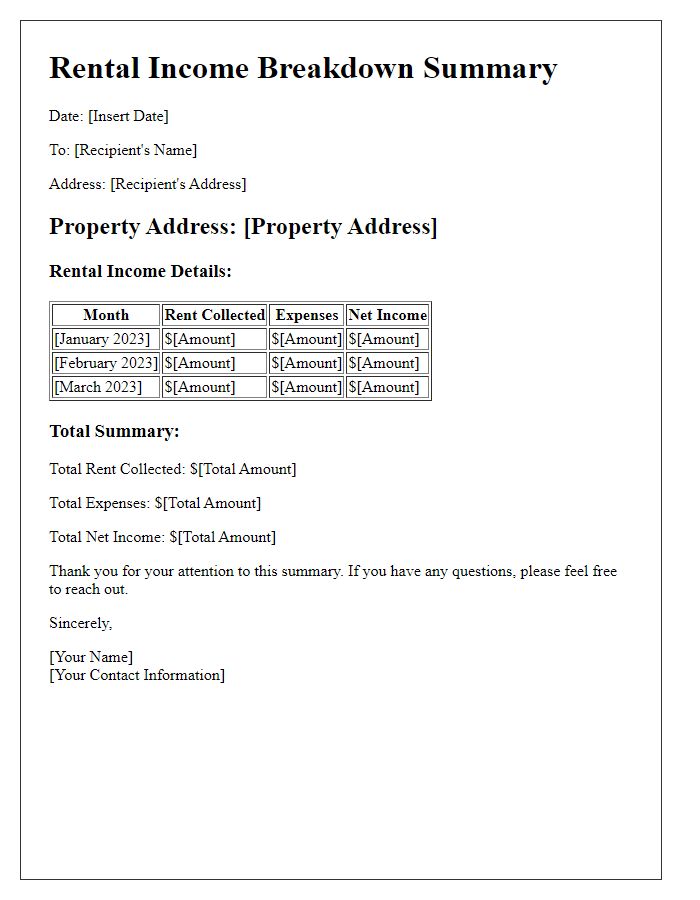

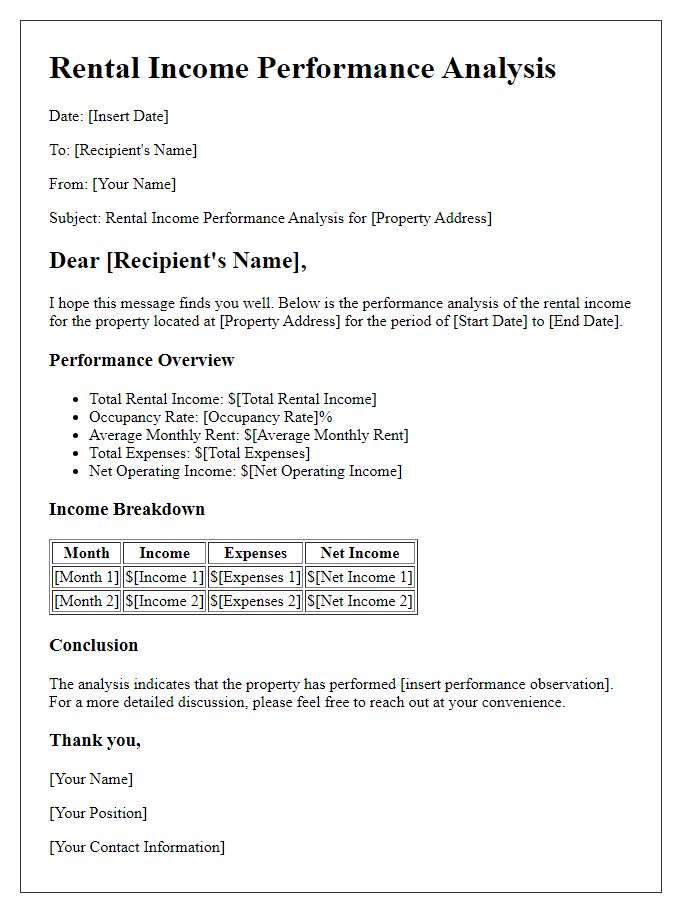

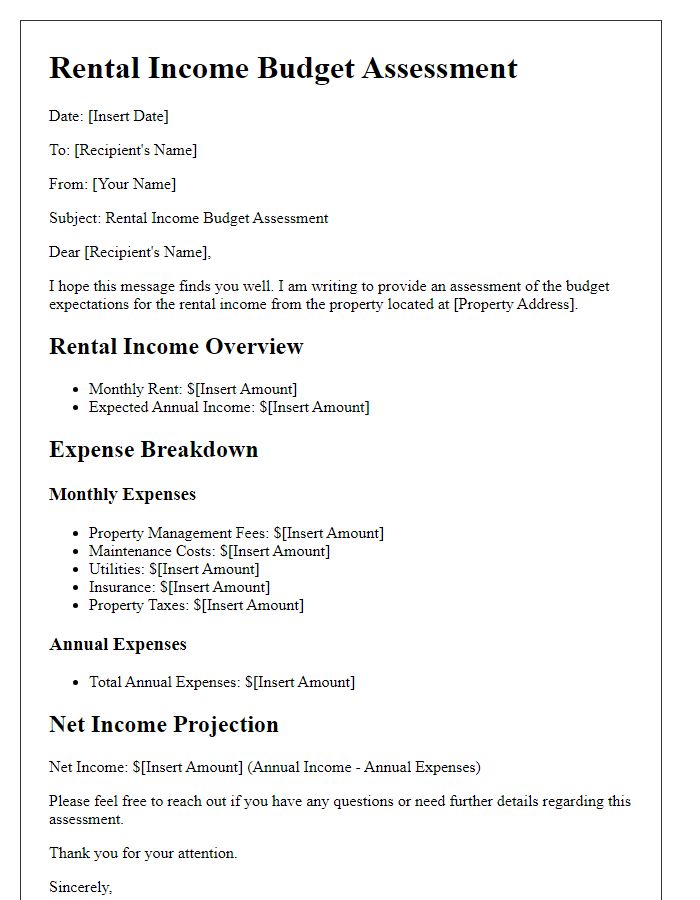

Expense Breakdown

In a comprehensive rental income analysis, the expense breakdown plays a crucial role in determining overall profitability. Key categories include property management fees, typically around 10% of gross rental income, maintenance costs averaging $200 per month, and property taxes, varying by location such as New York City where rates can exceed $2,000 annually. Additionally, insurance premiums, often estimated at $800 yearly, safeguard against unforeseen damages. Utilities, which may include water, gas, and electricity, frequently total $150 monthly, depending on usage and family size. Moreover, vacancy rates, historically ranging from 5% to 10%, impact overall income projections significantly, showcasing the necessity for thorough planning and budgeting in real estate investments.

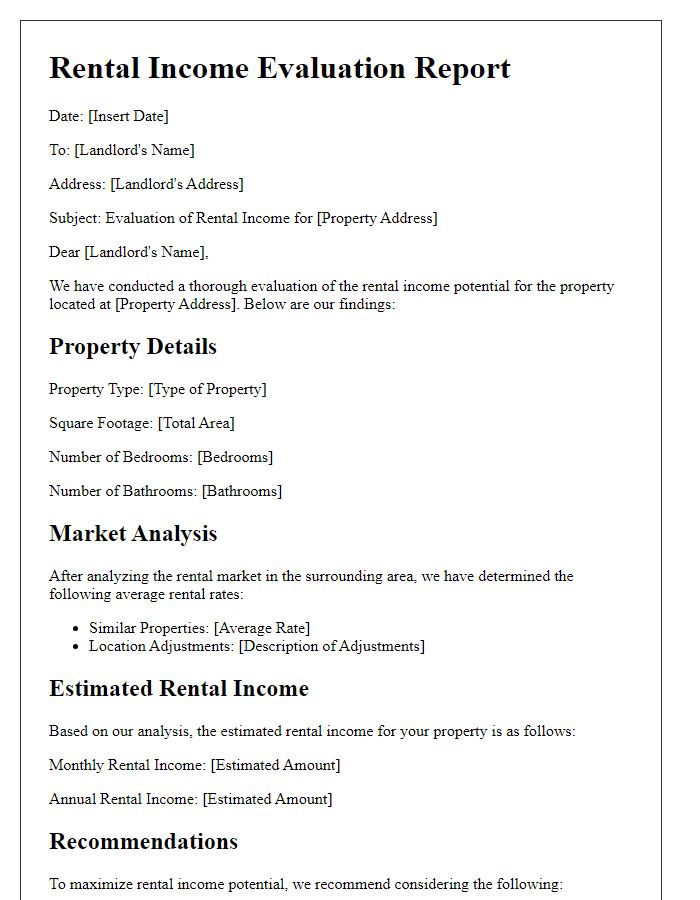

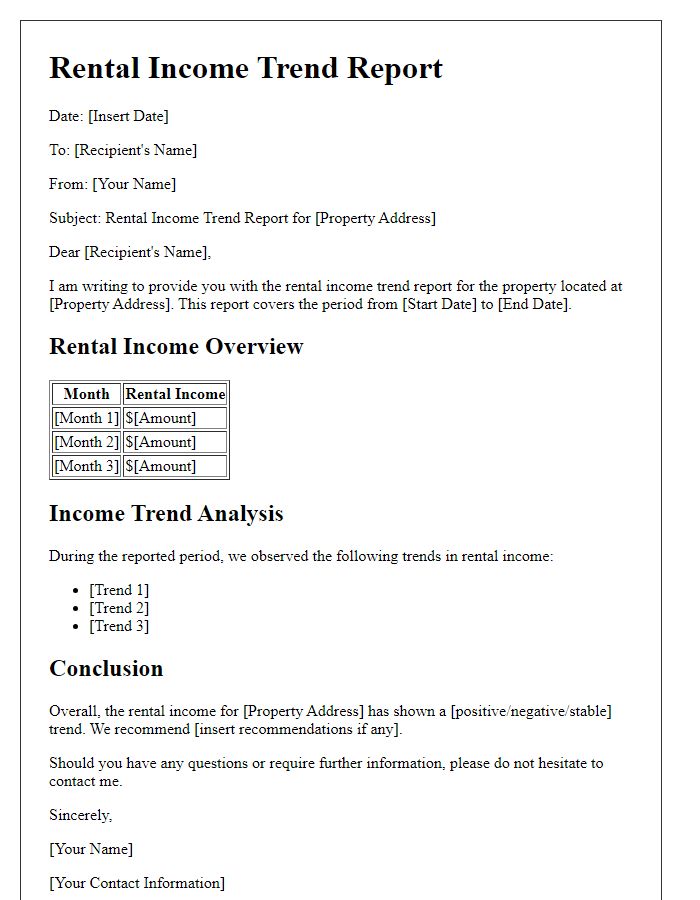

Market Comparison and Trends

An effective rental income analysis requires a comprehensive understanding of market comparisons and prevailing trends in the real estate sector. Investors observe comparative rental rates in neighborhoods, such as Manhattan in New York City, where studios average $3,000 per month, or in Austin, Texas, with an average of $1,500 per month for similar properties. Analyzing vacancy rates, typically ranging from 5% to 10% in urban areas, helps assess demand and profitability. Additionally, examining factors influencing the rental market, including economic indicators like employment rates and population growth, shapes investment decisions. Future trends, such as the rise of remote work, influence suburban rental demand, reflecting changes in tenant preferences. Regular assessment of local zoning laws and regulations is crucial for optimizing rental strategies and ensuring compliance.

Conclusion and Recommendations

The comprehensive rental income analysis of the property located on 123 Elm Street, conducted over a six-month period, indicates consistent rental yields averaging $1,800 per month. This figure represents a gross rental income of $21,600 annually. The occupancy rate stood at 95%, with only a few weeks of vacancies, yielding a net income of approximately $20,520 after accounting for minor maintenance costs and property management fees. The analysis suggests diversifying rental strategies, perhaps exploring short-term leasing options through platforms like Airbnb, which could significantly increase profit margins. Additionally, considering the local real estate market trends in Springfield, which indicate a 7% annual appreciation rate, retaining this property may yield substantial long-term capital gains. The recommendation includes conducting periodic rent reviews to ensure alignment with market rates and implementing strategic upgrades to enhance property appeal and justify potential rent increases.

Comments