Are you curious about how interchange fees affect your business's bottom line? Understanding these charges can be crucial for improving your financial strategy. In this article, we'll break down the intricacies of interchange fees and provide a simple template to request an analysis from your payment processor. Stick around to discover how to navigate these fees and optimize your operations!

Merchant account details

Merchant account details provide crucial insights needed for interchange fee analysis. Merchant ID, a unique identifier, plays a pivotal role in tracking transaction activities. Processor name, indicating the financial institution responsible for transactions, impacts fee structures and rates. Transaction volume, usually expressed in monthly dollar amounts, shows the scale of operations and potential cost variances. Average transaction size offers insight into pricing tiers within the payment network. Lastly, payment methods utilized (credit, debit, mobile) influence the applicable interchange fees, revealing patterns in consumer behavior and preferences. These aspects are essential for identifying savings opportunities and optimizing costs related to payment processing.

Transaction volume data

In the realm of interchange fees, transaction volume data serves as a critical element in understanding the dynamics of payment processing. Analyzing transaction volumes, which may reflect figures such as thousands to millions of transactions per month across various payment networks (Visa, Mastercard, etc.), is essential in determining the impact of interchange rates on merchant costs. This data often varies significantly depending on factors like industry sectors, geographical regions (e.g., United States, Europe), and payment methods (card, mobile, contactless). Additionally, detailed examination of chargebacks (disputed transactions), processing times, and settlement periods enhances the comprehension of fee structures. Evaluating this data helps stakeholders, including banks, payment processors, and merchants, strategize effectively while navigating the complexities of transaction economics.

Detailed fee breakdown

Interchange fees play a crucial role in the payment processing ecosystem, significantly impacting merchants and financial institutions. These fees are charged by card networks such as Visa and Mastercard for processing credit and debit card transactions, often varying based on card type (e.g., rewards cards, corporate cards). A detailed fee breakdown typically includes categories such as transaction fees, percentage fees, and fixed fees, with rates often expressed as a percentage of the transaction value plus a flat fee per transaction. Furthermore, factors such as merchant category codes (MCC), average transaction values, and processing volumes influence the overall costs for merchants. Understanding these intricacies enables businesses to effectively manage and optimize their payment processing expenses.

Interchange rate comparison

Interchange fees play a critical role in the cost structure of payment processing for merchants and financial institutions. These fees, often expressed as a percentage of the transaction value, vary significantly across different card networks, such as Visa, Mastercard, and Discover. Notably, interchange rates can be categorized based on various factors, including card type (e.g., corporate, consumer, or rewards cards), transaction method (e.g., in-person or online), and regional regulations. Recent industry studies indicate that merchants in the European Union could face an average interchange fee of 0.3% for credit cards, contrasting with 1.5% in some regions of the United States. These disparities underline the importance of a detailed analysis of interchange rates to identify potential cost savings opportunities for businesses. Understanding this comparison helps inform strategic decisions regarding payment providers and processing methods.

Compliance regulations

Interchange fees play a critical role in the electronic payment ecosystem, influencing the costs incurred by merchants and consumers alike. Financial institutions, such as banks and credit card companies, impose these fees for processing card transactions, which can range from 1% to 3% of the transaction value. Regulatory frameworks like the European Union's Regulation (EU) 2015/751 introduced caps on interchange fees to foster competition and transparency, impacting billions of euros in transactions annually. Compliance with these regulations is essential for maintaining fair pricing structures and ensuring that merchants are not unfairly burdened by excessive fees. Furthermore, analyzing recent data from the Payments Systems Regulator (PSR) can provide insights into trends and compliance levels across various payment networks in the United Kingdom, aiding stakeholders in making informed decisions.

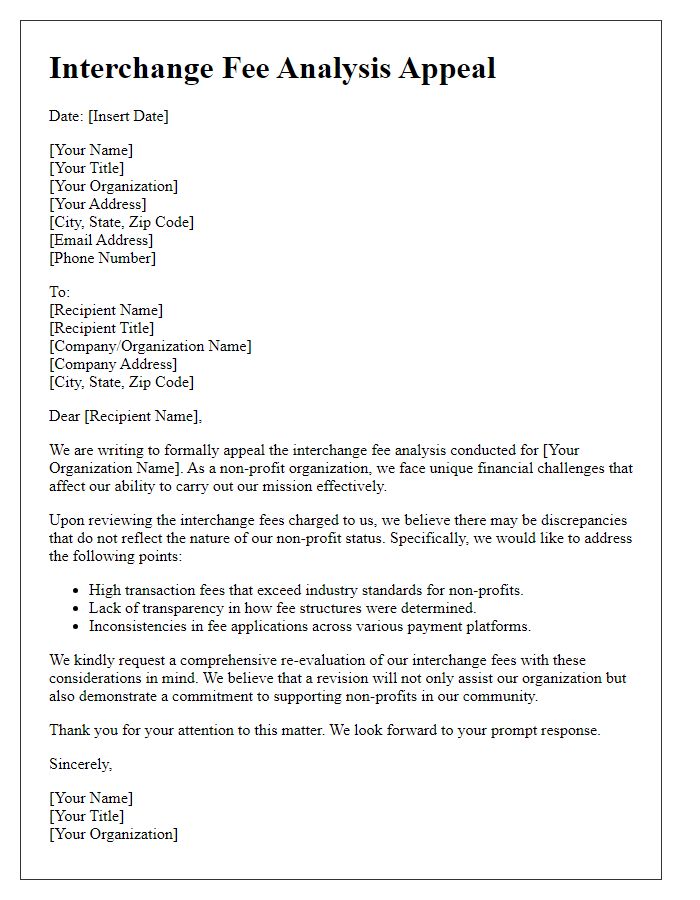

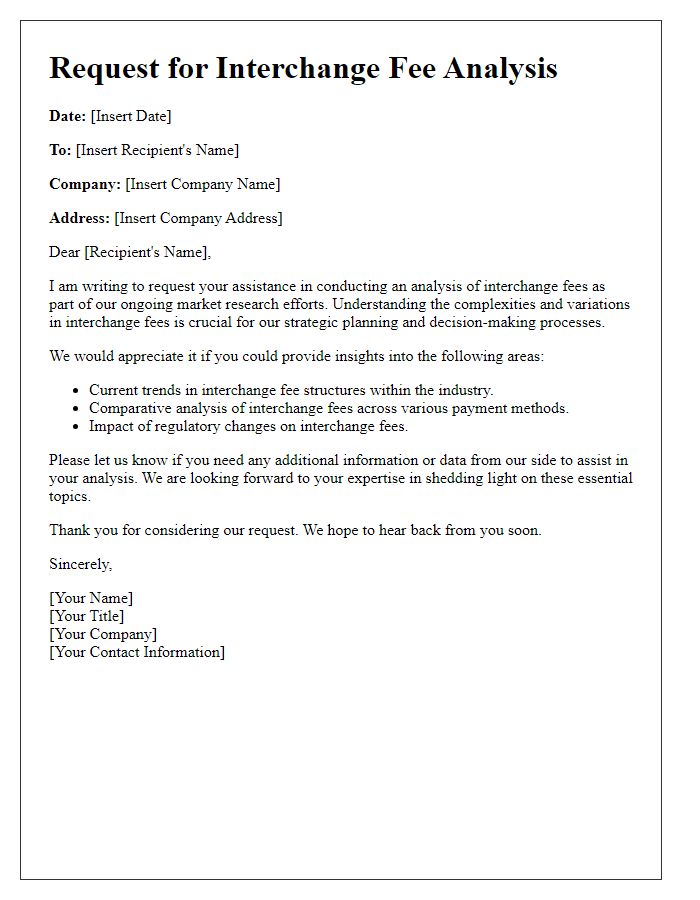

Letter Template For Interchange Fee Analysis Request Samples

Letter template of interchange fee analysis inquiry for commercial clients

Letter template of interchange fee analysis request for financial institutions

Letter template of interchange fee analysis solicitation for e-commerce platforms

Letter template of interchange fee analysis demand for payment processors

Letter template of interchange fee analysis request for retail businesses

Letter template of interchange fee analysis petition for service providers

Letter template of interchange fee analysis proposal for corporate clients

Comments