Are you looking to make the most of your cash reserves and enhance your financial strategy? Optimizing your cash reserves can lead to increased liquidity and greater investment opportunities, allowing you to make smarter decisions with your funds. In today's fast-paced financial landscape, having a solid plan for your cash reserves is more important than ever. Join us as we explore effective techniques and strategies to help you optimize your cash flow and maximize your potentialâread more to uncover the secrets of successful cash reserve management!

Purpose and Objective

Effective cash reserve optimization plays a crucial role in enhancing a company's financial stability and operational efficiency. By strategically maintaining an optimal level of liquid assets, organizations can ensure they meet short-term obligations, navigate unexpected expenses, and capitalize on growth opportunities. The primary objective involves assessing current cash reserves, identifying excess liquidity, and reallocating resources to investments that yield higher returns or reduce risk. Implementing this process can improve overall cash flow management, minimize idle cash, and ultimately support long-term financial health.

Current Financial Analysis

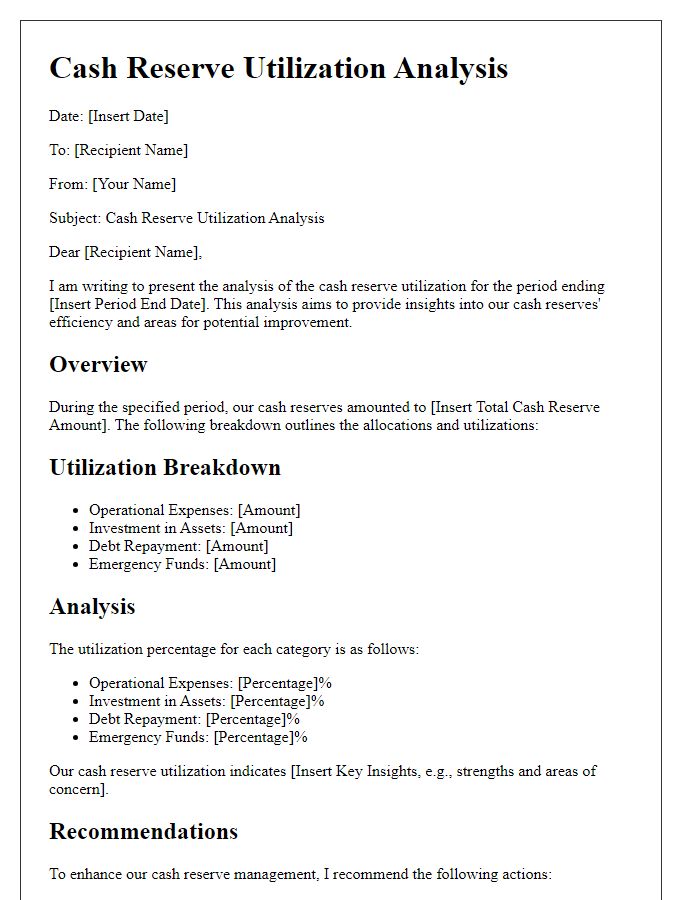

Current financial analysis reveals the necessity of cash reserve optimization for improved liquidity management and enhanced strategic flexibility. Companies frequently maintain cash reserves, typically representing 5-10% of their total assets, to manage operational costs and unexpected expenditures. An evaluation of cash conversion cycles, averaging 30-45 days in many industries, emphasizes the importance of timely receivables collection and efficient inventory turnover to maximize cash flow. Furthermore, maintaining reserves in high-yield savings accounts or low-risk investment vehicles can yield interest rates of 1-3%, contributing to better returns on idle funds. Regular financial reviews, ideally quarterly, are essential to adjust reserves based on fluctuating market conditions and business forecasts, ensuring sustainability and growth potential.

Risk Management Strategy

Cash reserve optimization involves strategically managing liquid assets to enhance financial stability and support operational efficiency in businesses. An effective risk management strategy should focus on maintaining an optimal cash reserve level, typically between three to six months' worth of operational expenses. This approach mitigates risks associated with unforeseen events such as economic downturns or sudden market shifts. For instance, during the COVID-19 pandemic (March 2020 onwards), many companies faced liquidity crises, highlighting the importance of maintaining sufficient cash reserves. Additionally, businesses should regularly review and adjust cash reserves based on projected revenues and expenses, market conditions, and industry-specific risks, such as fluctuating supply chain costs. Utilizing financial tools such as cash flow forecasting can provide insights into the timing of cash inflows and outflows, allowing for proactive adjustments to reserves.

Cash Flow Projection

A cash flow projection is essential for effective cash reserve optimization in businesses, particularly for accurate financial planning. This financial document outlines anticipated inflows and outflows of cash over specific periods, often monthly, to ensure liquidity. Accurate estimates are critical; for instance, a business with projected revenues of $150,000 may also anticipate expenses of $120,000, providing a positive cash flow of $30,000. Tools like spreadsheets or specialized software can help model different scenarios, adjust for seasonality, and identify cash peaks and troughs. Maintaining a cash reserve equivalent to three to six months of operating expenses (approximately $10,000 to $20,000), depending on industry variability, mitigates risks during unforeseen downturns. Analyzing historic data, alongside market trends specific to the business sector, enhances the reliability of projections, ensuring sustainable operations in dynamic environments.

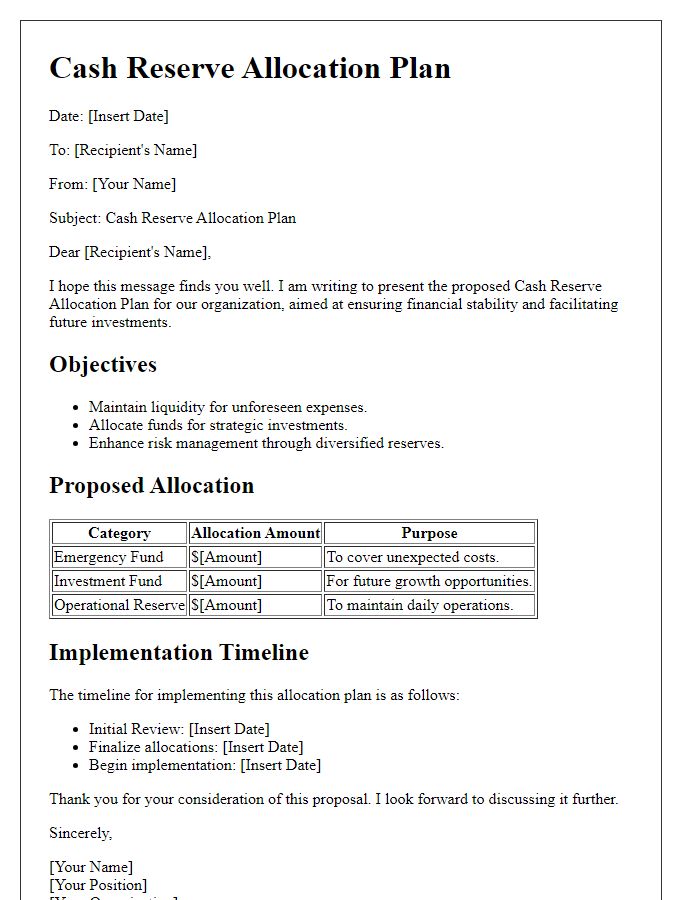

Implementation and Monitoring Plan

Implementing a cash reserve optimization strategy involves systematic analysis and proactive management of liquidity resources. Establishing a target cash reserve ratio, typically ranging from 10% to 20% of total operating expenses, ensures sufficient coverage for unexpected financial fluctuations. Utilizing software tools, such as Microsoft Excel or QuickBooks, facilitates real-time monitoring of cash flow patterns, enabling timely adjustments. Conducting quarterly reviews, aligned with key financial events like fiscal year ends or major investments, provides insights into reserve adequacy and identifies trends. Engaging with financial advisors or utilizing frameworks like the 80/20 rule helps prioritize cash allocation, focusing on high-impact areas, thus enhancing the efficiency of cash reserves while safeguarding financial stability.

Comments