In the dynamic landscape of mergers and acquisitions, having the right advisory support can be the difference between success and missed opportunities. Our team specializes in guiding businesses through the complexities of M&A processes, ensuring a seamless transition that maximizes value. With our deep industry insights and tailored strategies, we empower companies to navigate negotiations confidently. Curious to learn how we can assist you in achieving your M&A goals? Read on to discover more!

Purpose and Objectives

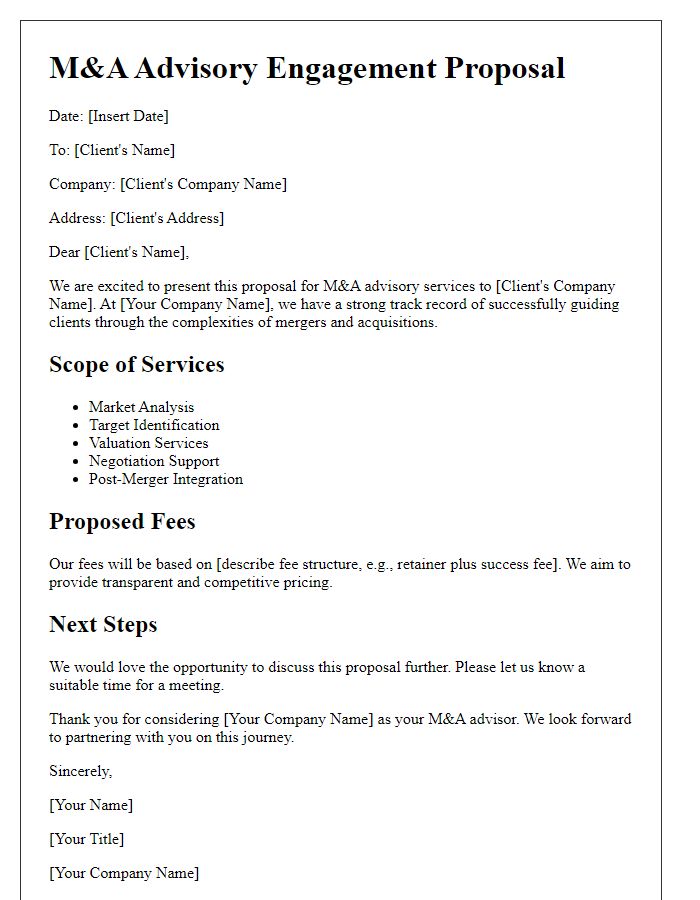

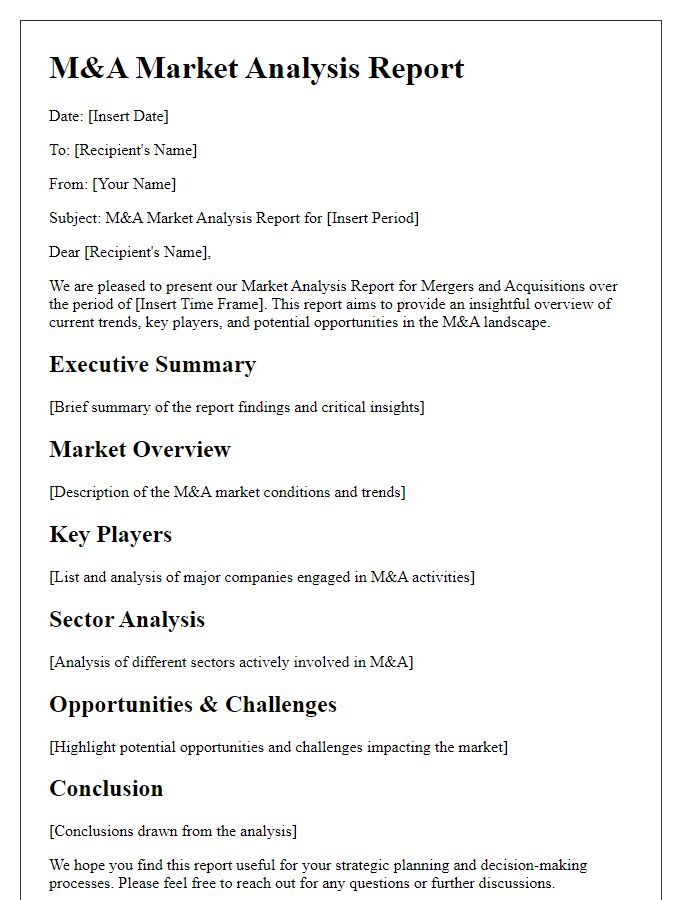

Mergers and acquisitions (M&A) advisory professionals play a crucial role in guiding businesses through complex transactions that involve the consolidation of companies or assets. The primary purpose of M&A advisory is to provide strategic insight, financial analysis, and negotiation expertise to ensure that the transaction aligns with the client's long-term objectives. Key objectives include identifying potential targets or acquirers, performing thorough due diligence to evaluate financial health and operational synergies, and structuring deals to maximize value while minimizing risk. Additionally, M&A advisors facilitate negotiations between parties to reach favorable terms, assist in preparing necessary documentation, and provide essential market insights that help clients navigate regulatory environments, such as the U.S. Securities and Exchange Commission (SEC) guidelines or the European Commission's antitrust regulations. Effective M&A advisory can ultimately lead to successful integrations that enhance market share, drive revenue growth, and provide sustainable competitive advantages in the ever-evolving business landscape.

Key Stakeholders and Decision Makers

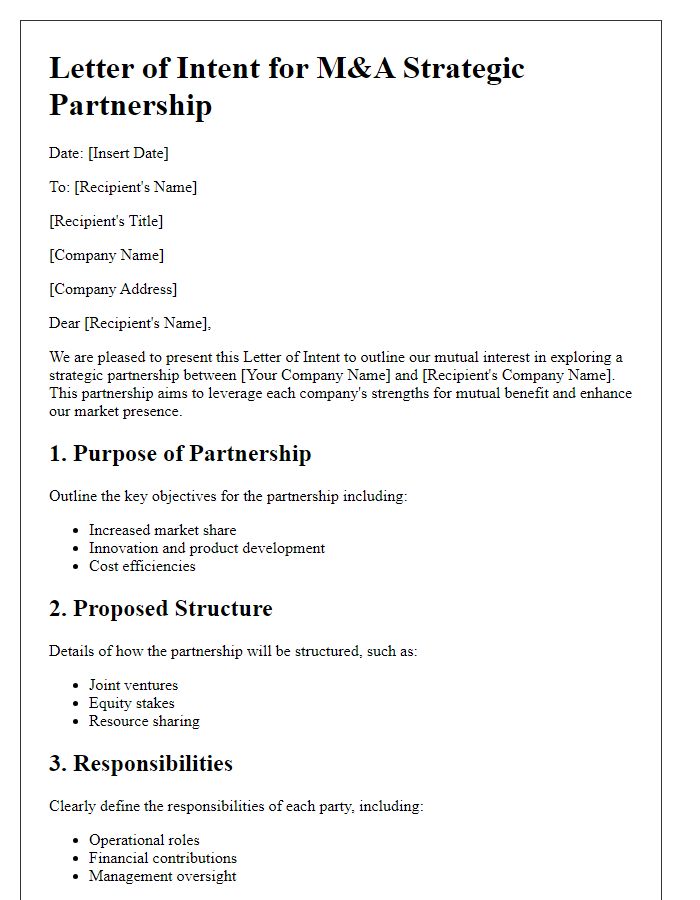

In mergers and acquisitions (M&A) advisory, understanding the roles of key stakeholders and decision makers is crucial for success. Key stakeholders often include shareholders, board members, and executive leadership teams from both companies involved in the transaction, such as CEOs and CFOs. Investment banks and financial advisors play a vital role in providing valuation services, due diligence, and negotiation expertise. Additionally, legal advisors ensure compliance with regulatory requirements and assist in contract negotiations. Each of these individuals or groups contributes to essential aspects of the M&A process, influencing decisions and outcomes that align with corporate strategies and goals. Engaging these stakeholders effectively can facilitate smoother transactions and maximize value for all parties involved.

Timeline and Milestones

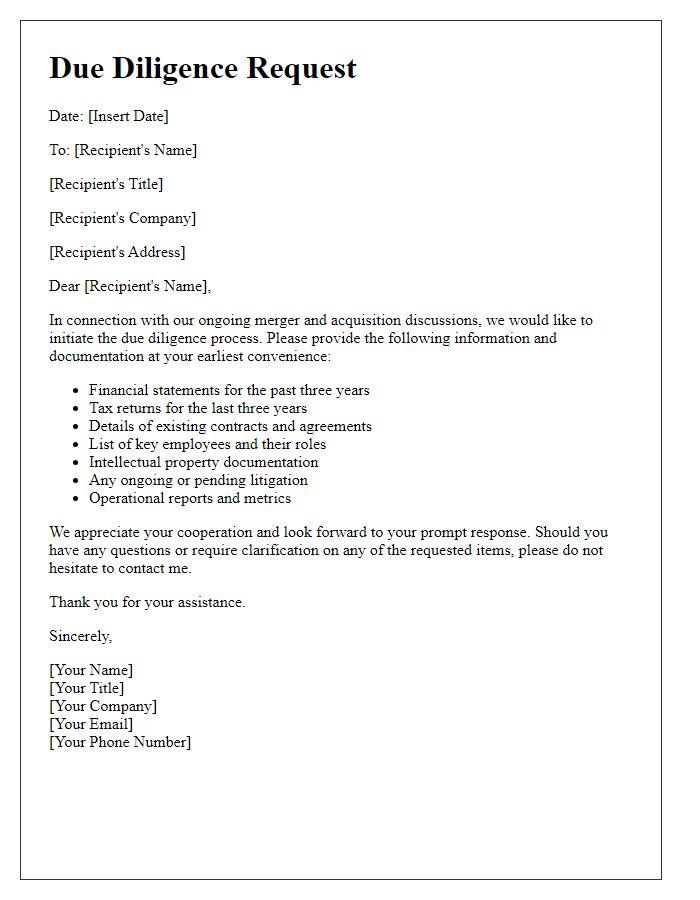

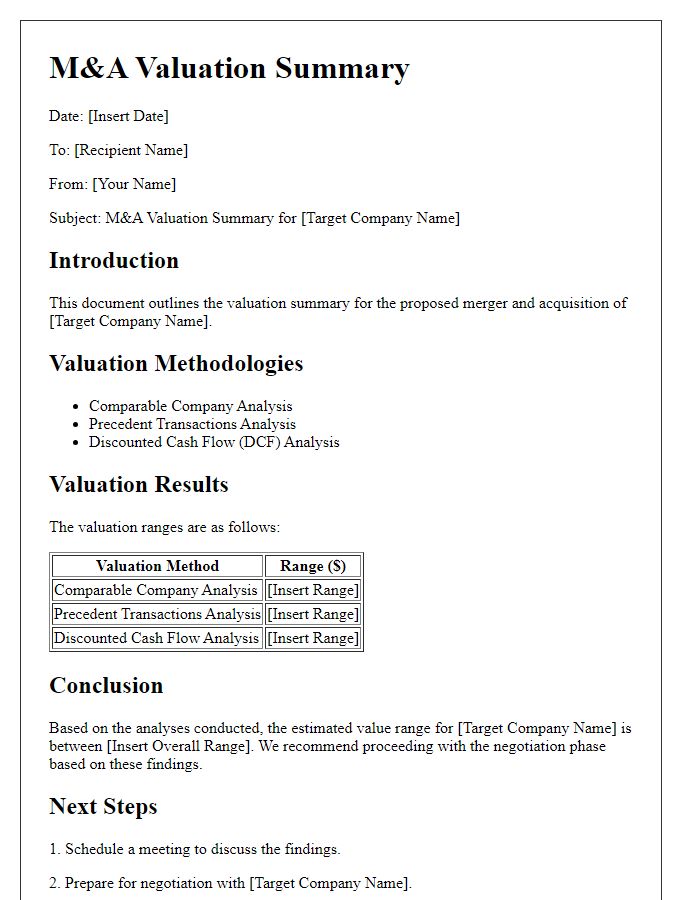

The merger and acquisition process involves several critical timelines and milestones that guide stakeholders through successful transactions. Initial phases often encompass due diligence efforts, where teams gather and analyze essential data on financial statements, client contracts, and market evaluations, typically lasting 30 to 90 days. Next, valuation assessments occur, applying methodologies like discounted cash flow (DCF) analysis or comparable company analysis. Following valuations, the negotiation period begins, where both parties finalize terms, often spanning 2 to 6 weeks. Regulatory approvals from federal entities, such as the Federal Trade Commission (FTC) in the United States, might introduce additional delays, often requiring 60 to 120 days for thorough review. Once all conditions are met, the closing process occurs, marked by signed agreements and executed purchase contracts, generally concluding the M&A timeline within 6 to 12 months from initiation. Each milestone within the process plays a vital role in ensuring a smooth transition and successful integration of the merging entities.

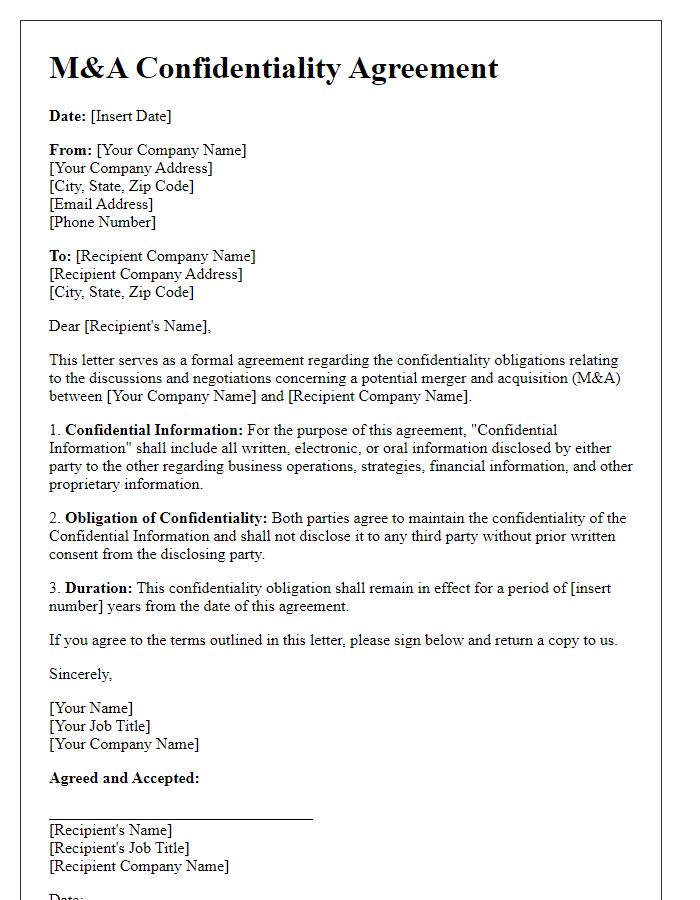

Confidentiality and Compliance

Confidentiality in mergers and acquisitions (M&A) is paramount to protect sensitive information from being disclosed to unauthorized parties. Adhering to strict compliance protocols, such as Non-Disclosure Agreements (NDAs), ensures that financial data, strategic plans, and negotiations remain confidential, safeguarding the interests of all involved stakeholders. Regulatory bodies like the Securities and Exchange Commission (SEC) set guidelines that M&A advisors must follow, ensuring transparency and ethical behavior throughout the process. Additionally, maintaining compliance with international laws, such as the General Data Protection Regulation (GDPR) in the European Union, is crucial when handling personal data of clients and employees. Effective communication and documentation are essential to uphold confidentiality and compliance, fostering trust among parties in high-stakes transactions.

Communication Channels and Processes

Effective communication channels and processes are crucial for successful mergers and acquisitions (M&A) advisory engagements. Key channels include email for formal correspondence, instant messaging for quick updates, and video conferencing for face-to-face discussions, particularly when stakeholders are geographically dispersed. In the process of M&A, critical stages such as due diligence, valuation analysis, and integration planning require structured communication pathways. Teams often utilize platforms like Microsoft Teams or Slack to facilitate collaboration among various departments, including finance, legal, and operations. Regularly scheduled updates, such as weekly meetings, ensure that all parties remain aligned and informed, while systematic progress tracking in shared documents allows for transparency in the acquisition timeline and milestone achievements. Furthermore, dedicated project management tools such as Asana or Trello assist in organizing tasks and responsibilities, enabling efficiency and accountability throughout the M&A process.

Comments