Are you looking to secure your financial future and make informed decisions for the long haul? Understanding long-term financial projections can be a game changer for individuals and businesses alike, serving as a roadmap to guide you toward your financial goals. In this article, we'll break down the essentials of crafting effective financial projections and share valuable tips to enhance your planning process. So, let's dive in and explore how you can elevate your financial strategy!

Introduction and Purpose

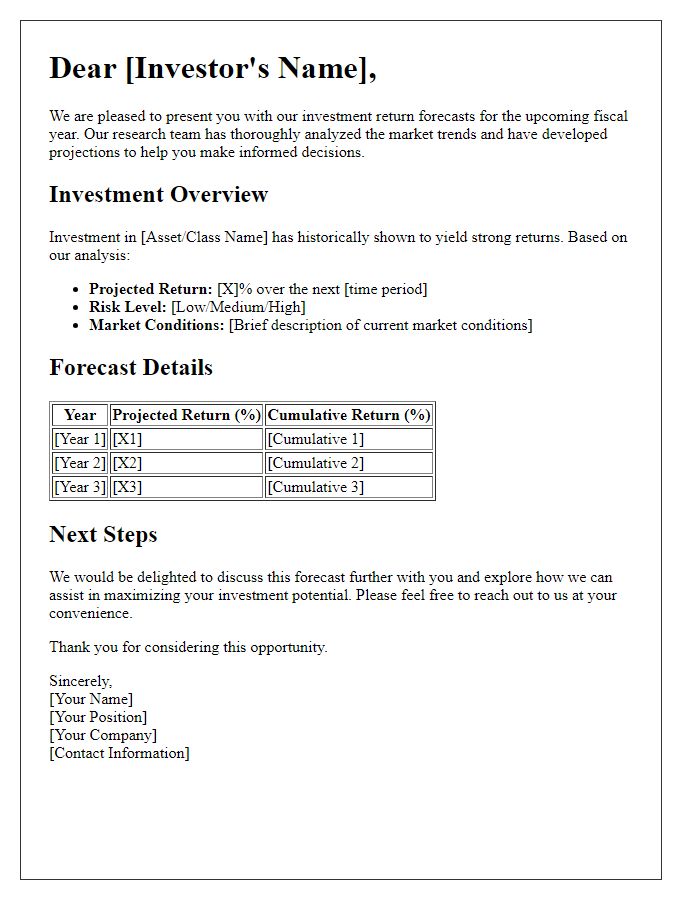

Long-term financial projections are critical components of any business strategy, serving as a roadmap for anticipated growth and financial health over extended periods, typically spanning five years or more. These projections encompass key financial statements, including income statements, balance sheets, and cash flow statements, which collectively outline revenue expectations, expense management, and funding requirements. Understanding market trends, competitive landscapes, and internal capabilities allows businesses to make informed decisions regarding investments, resource allocation, and strategic initiatives. Moreover, these projections play a vital role in attracting potential investors or lenders by demonstrating a clear vision for sustainable growth and profitability, ultimately contributing to a firm's long-term stability and success.

Key Assumptions

Long-term financial projections rely on critical assumptions that influence future performance, including market growth rate, consumer behavior trends, and economic conditions. For instance, an annual market growth rate projected at 5% allows for a steady increase in revenue expectations over the next five years. Additionally, considering inflation rates averaging around 2% can significantly impact cost estimates. Regulatory changes, particularly in industries like healthcare or technology, introduce variables that may affect investment returns. Moreover, assumptions regarding operational efficiencies, such as reducing overhead costs by 10%, are essential for creating a realistic financial outlook. Understanding these key assumptions helps in forming a comprehensive financial model to guide strategic planning and investment decisions.

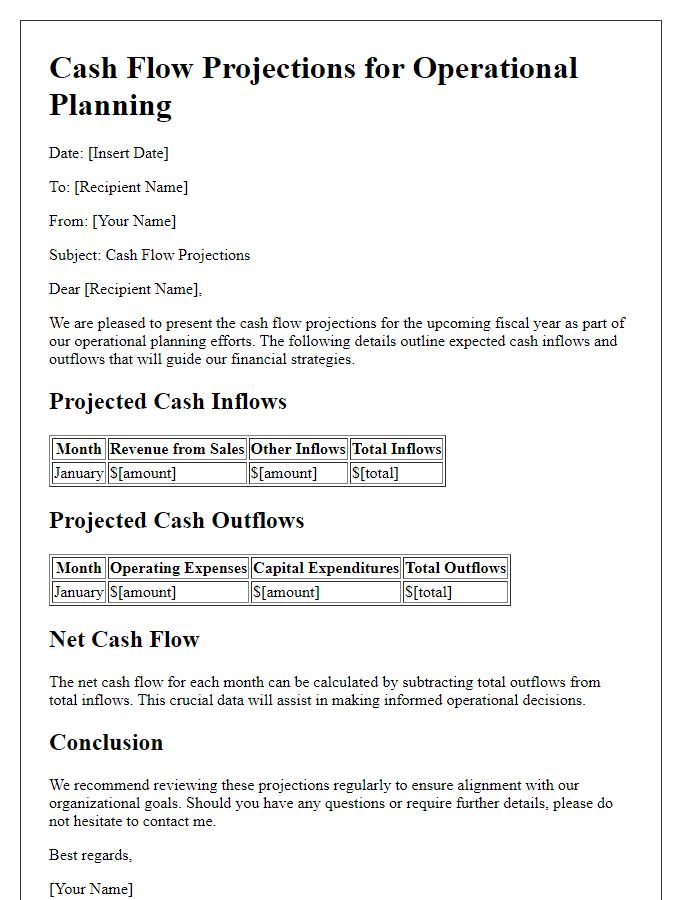

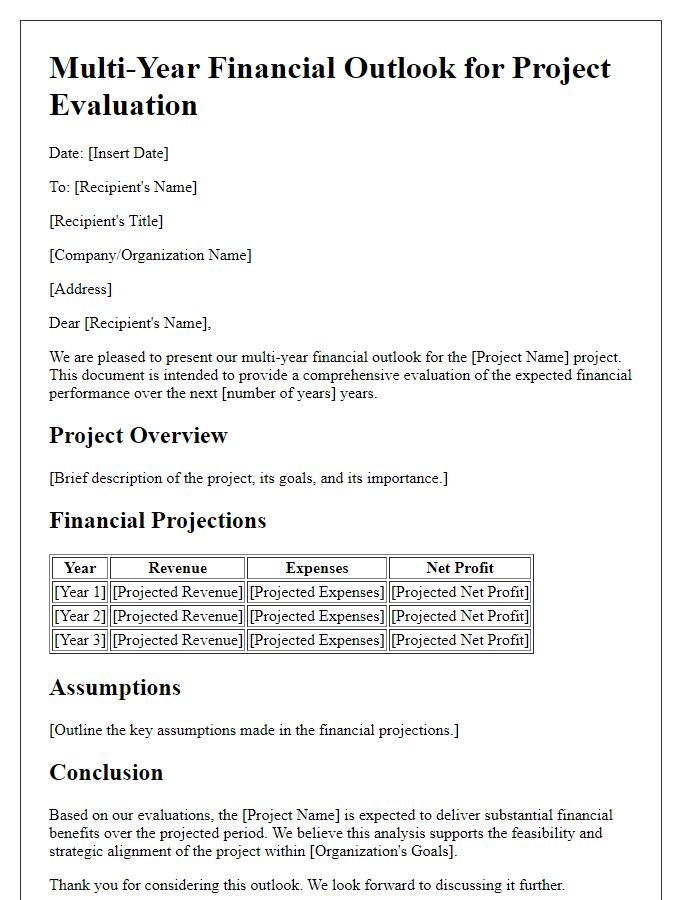

Projected Financial Statements

Projected financial statements serve as essential tools for analyzing future financial performance. These documents include projected income statements, balance sheets, and cash flow statements, typically covering three to five years. Projected income statements outline anticipated revenues and expenses, detailing projections for sales growth, cost of goods sold, and operating expenses. Projected balance sheets provide insights into expected assets, liabilities, and equity, reflecting changes in capital structure and working capital requirements. Projected cash flow statements illustrate cash inflows and outflows over time, assessing the company's liquidity and financial stability. Accurate projections rely on market research, industry trends, and historical data, including growth rates of 5% to 10% annually for similar businesses. Developing these statements involves careful consideration of macroeconomic factors, investment opportunities, and risk assessments associated with market fluctuations.

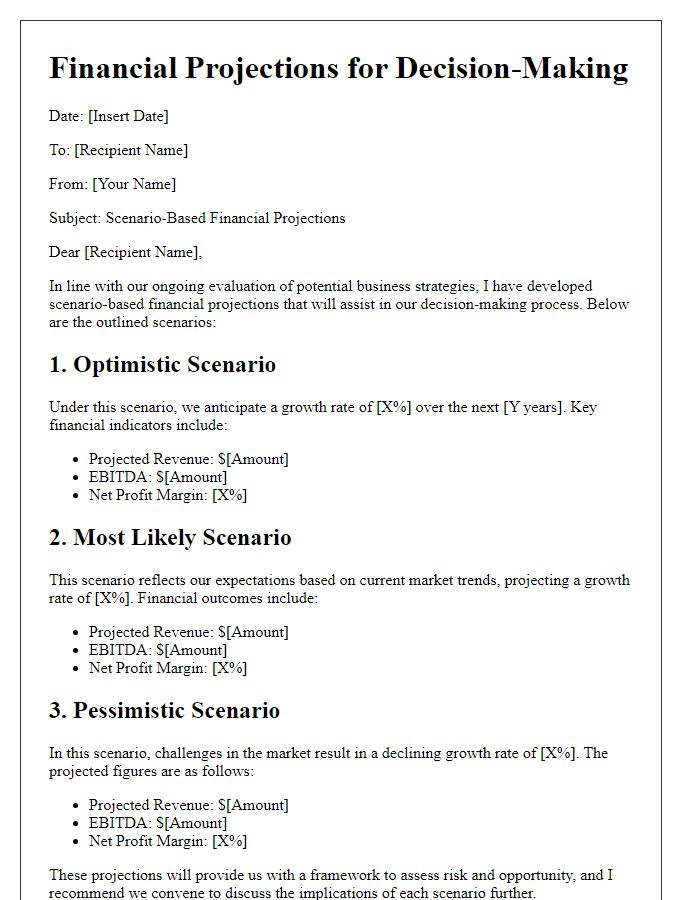

Risk Analysis and Contingencies

Long-term financial projections require a thorough risk analysis to identify potential challenges. Market volatility, influenced by economic factors like inflation rates (for instance, over 5% in 2022) and interest rate changes (the Federal Reserve's recent hikes), can impact revenue forecasts significantly. Additionally, regulatory changes, such as tax reforms in various states, pose compliance risks. Unexpected events like global supply chain disruptions, highlighted during the COVID-19 pandemic, can affect operational costs. Contingency plans should address these risks, including maintaining emergency funds that cover at least three to six months of operating expenses. Utilizing scenario analysis to predict different financial outcomes, especially in sectors like technology and healthcare, enhances resilience against uncertainties. This strategic approach ensures sustainability in challenging times while securing long-term financial health.

Conclusion and Call to Action

Long-term financial projections are essential for guiding strategic business decisions, determining feasible investment opportunities, and ensuring sustainable growth. Accurate forecasts, covering a timeline of five to ten years, require analysis of market trends, historical data, and economic indicators. Engaging with stakeholders, including financial analysts and market strategists, can provide invaluable insights into potential risks and reward scenarios. Clear communication of projected financial health through an accessible report will empower decision-makers to align resources effectively. Stakeholders should review these projections regularly and adjust strategies in response to emerging challenges and opportunities in the marketplace. It is imperative that immediate steps be taken to implement proactive financial planning based on these projections to secure continued success in a competitive landscape.

Letter Template For Long-Term Financial Projections Samples

Letter template of detailed long-term financial projections for growth strategy.

Letter template of comprehensive financial forecasting for investment planning.

Comments