Are you curious about how a pension plan can secure your financial future? Understanding the details of pension plans can seem overwhelming, but it doesn't have to be. With the right information, you can navigate through your options and make informed decisions. Join us as we delve deeper into the specifics of pension plans and discover how they can benefit you.

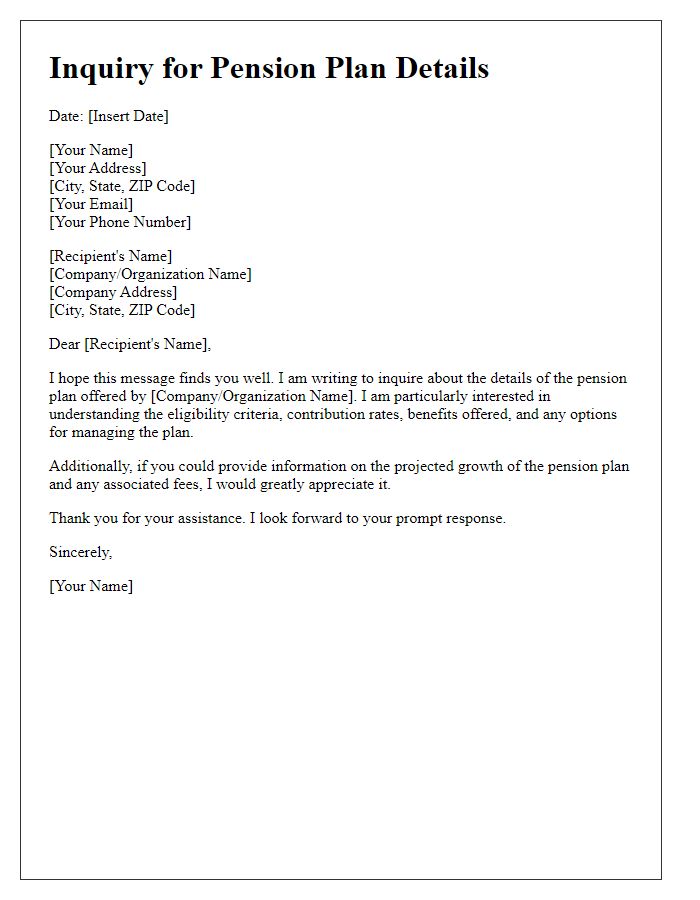

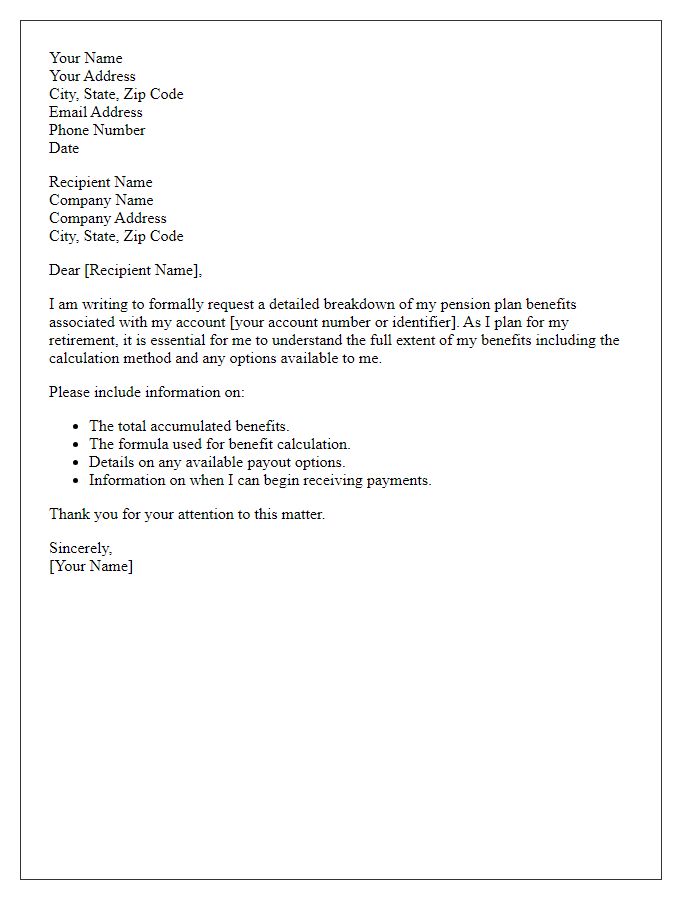

Personal Information Section

The Personal Information Section of a pension plan document includes essential details aimed at accurately identifying the plan participant. Key components include full legal name, date of birth (often required to determine eligibility for benefits), Social Security number (used for tax purposes and to track earnings), and contact information (address, email, phone number). Additionally, beneficiaries must be indicated, specifying their relationships and relevant birthdates, which play a crucial role in distribution calculations. Addressing any discrepancies in personal data is vital to ensure smooth processing of pension claims, preventing delays in financial security during retirement.

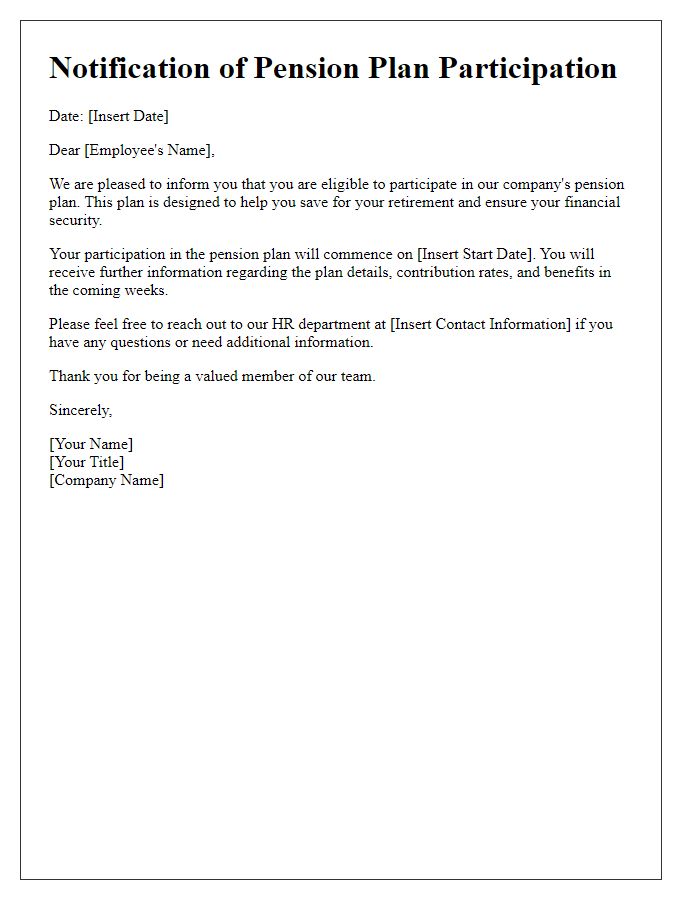

Pension Plan Details

Pension plans, such as defined benefit and defined contribution plans, serve as crucial financial instruments for retirement security. The documents outlining these plans typically detail eligibility criteria, contribution rates, and benefit calculations. Defined benefit plans guarantee specific payouts based on salary and years of service, while defined contribution plans rely on investment performance and employee contributions for retirement income. Information includes vesting schedules, which can range from immediate vesting to multiple years, affecting how soon employees can access their accrued benefits. Additional details, such as the plan's investment options and projected growth rates, provide insights into potential retirement income. Regulations set by entities like the Pension Benefit Guaranty Corporation (PBGC) further ensure plan viability and protection for beneficiaries. Understanding the nuances of these plans is essential for effective retirement planning.

Contribution and Benefits Overview

Pension plans play a vital role in ensuring financial security during retirement, encompassing aspects such as contributions, benefits, and eligibility criteria. Each plan usually requires employees to contribute a percentage of their salary (often ranging from 3% to 10%) into the fund, which accumulates over time, usually growing through investment returns. The employer may match contributions, amplifying the savings potential. Benefits, typically calculated based on a formula involving years of service and average salary, can provide a significant income replacement--often around 40% to 80% of the pre-retirement salary. Additionally, retirement age (commonly between 60 to 65 years) affects when these benefits become accessible. Understanding the specific terms associated with the pension plan, such as vesting schedules (the duration before benefits are fully owned) and withdrawal options, is crucial for effective retirement planning. Ultimately, details about the fund's performance, investment strategies, and changing regulations also play a pivotal role in shaping the financial landscape for future retirees.

Contact Information for Queries

Pension plan members seeking assistance should reach out to the dedicated customer service team at 1-800-555-0199, available Monday to Friday from 8 AM to 6 PM Eastern Time. Queries can also be submitted via email at support@pensionportal.com, ensuring a quick response within 24 hours. For more detailed inquiries, members are encouraged to visit the official pension plan website at www.pensionportal.com, which features an extensive FAQ section covering common concerns regarding retirement benefits, contribution rates, and withdrawal processes. Providing member ID numbers during correspondence will expedite the support process.

Legal and Compliance Disclaimers

The pension plan information provided is subject to legal and compliance disclaimers ensuring adherence to regulations mandated by the Employee Retirement Income Security Act (ERISA). All plan participants should be aware that the details contained herein are not exhaustive and may be affected by changing laws or organizational policy updates. The information is intended for educational purposes only and does not constitute a legal or financial advisory service. Participants are encouraged to consult with a licensed financial advisor or legal professional for personalized guidance tailored to their specific circumstances. Additionally, any discrepancies or questions regarding plan provisions should be directed to the plan administrator located in the financial department of the company's main office at 123 Corporate Drive, Suite 200, Metropolis, NY 12345.

Comments