Are you feeling overwhelmed by financial worries? You're not alone; many people face similar anxieties as they navigate budgets, debts, and unexpected expenses. In this article, we'll explore practical strategies to help you manage your financial stress and regain control over your situation. So, let's dive in and find some solutions together that can lighten your financial burden!

Personal Greeting

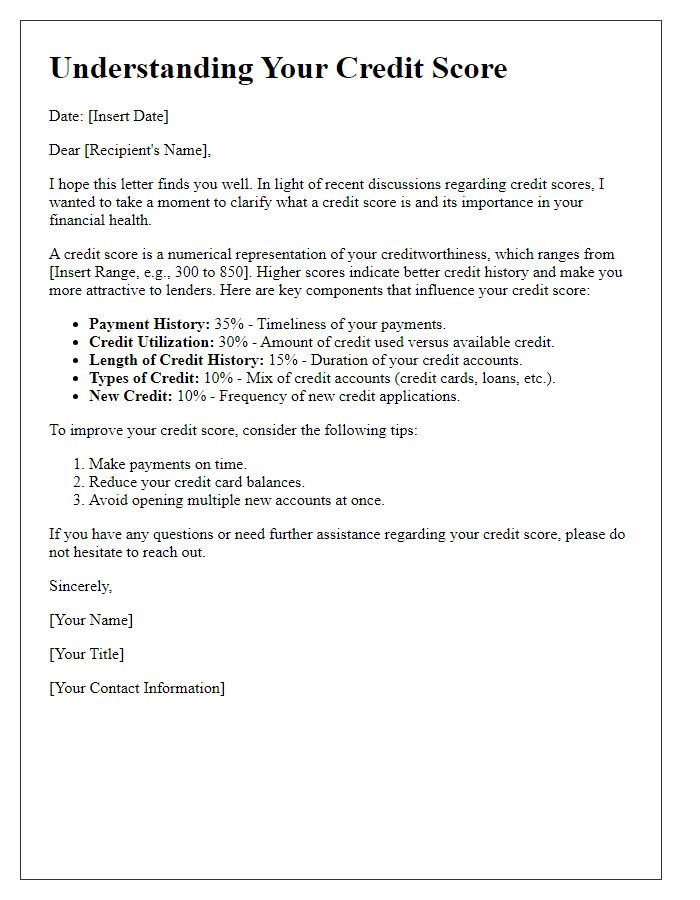

Addressing financial anxieties often involves discussing budgeting strategies, saving habits, and debt management techniques. Individuals facing such concerns may benefit from exploring various financial tools, such as budgeting apps, which assist in tracking expenses. Events like economic downturns, such as the 2008 financial crisis, can exacerbate these feelings of insecurity. Seeking guidance from financial advisors or support groups can provide encouragement and knowledge. Creating a financial plan that includes emergency savings goals--typically three to six months' worth of living expenses--can foster a sense of security.

Acknowledgment of Concerns

Financial anxieties can stem from various sources, including unexpected expenses, unemployment rates, or fluctuating stock markets. Individuals often experience stress due to rising costs of living, such as housing prices exceeding average incomes in cities like San Francisco or New York. Credit card debt levels reaching highs of over $800 billion in the United States can amplify feelings of uncertainty. Additionally, economic events, including recessions, can exacerbate financial worries, leading to mental health challenges such as anxiety or depression. Effective strategies for addressing these concerns include budgeting, financial counseling, and building emergency savings, which can provide a buffer against unforeseen financial challenges, ultimately fostering a sense of security and control.

Empathetic Statement

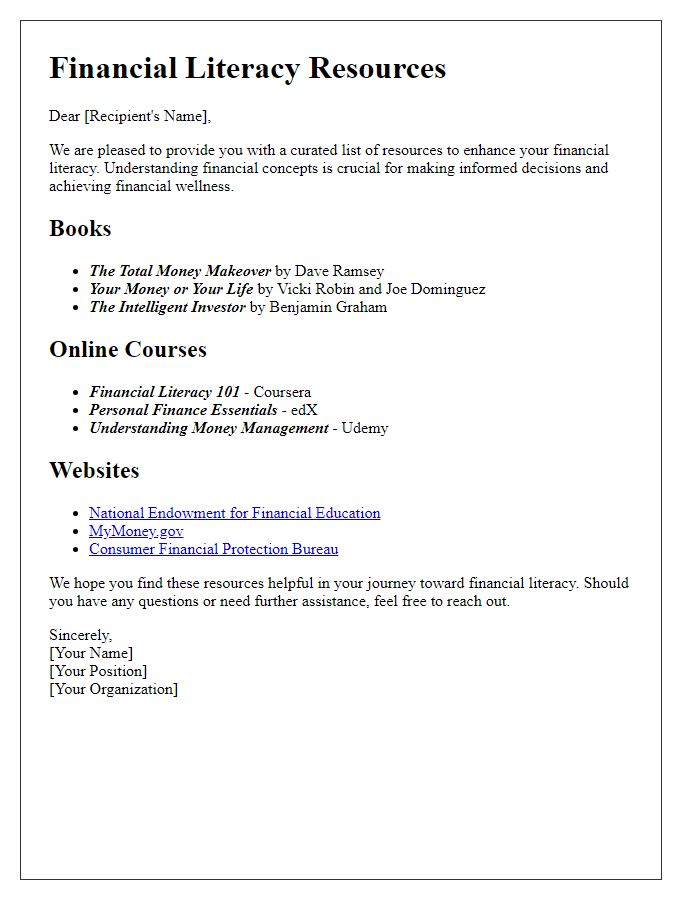

Financial anxieties often stem from various sources, such as fluctuating market conditions or unexpected expenses. Individuals experiencing these feelings may struggle with sleepless nights and increasing stress levels, particularly during economic downturns like the 2008 financial crisis, when unemployment rates soared to over 10%. The impacts can be profound, affecting mental health and overall well-being. It's essential to acknowledge these emotions and validate concerns surrounding budgeting, savings, and debt management. Financial literacy resources and support networks can play a crucial role in alleviating these issues. Seeking guidance from financial advisors or joining community workshops can empower individuals to regain control over their financial situation and reduce anxiety-related symptoms.

Reassurance and Support

Financial anxiety can stem from various factors, including fluctuating economic conditions and unexpected expenses. Individuals often experience increased stress levels when managing debts such as credit card bills or student loans, especially during times of recession or unemployment. A budget (a financial tool that outlines income and expenses) can help provide clarity and control, assisting in prioritizing essential costs like housing (mortgage or rent) and groceries. Seeking guidance from financial advisors or community resources can also offer support, helping individuals navigate their financial landscapes with confidence and alleviate overwhelming feelings associated with money management.

Contact Information for Further Assistance

Financial anxieties often stem from fluctuating economic conditions, unexpected expenses, or personal circumstances. Many individuals experience stress related to managing budgets or debts, particularly during events like job loss, medical emergencies, or economic downturns. Resources such as financial advisors or local support organizations provide guidance and strategies to alleviate these concerns. Notable entities like the National Foundation for Credit Counseling (NFCC) offer services designed to help individuals regain control over their finances. Additionally, workshops in community centers frequently address financial literacy, empowering participants to make informed decisions about savings and investments. Utilizing such resources is essential for navigating financial uncertainties.

Comments