Are you feeling the weight of utility bill debt? You're not alone; many are struggling to manage their expenses and keep their services active. In this article, we'll explore practical steps you can take to negotiate a debt settlement for your utility bills effectively. So, if you're ready to take control of your financial situation, read on for valuable insights!

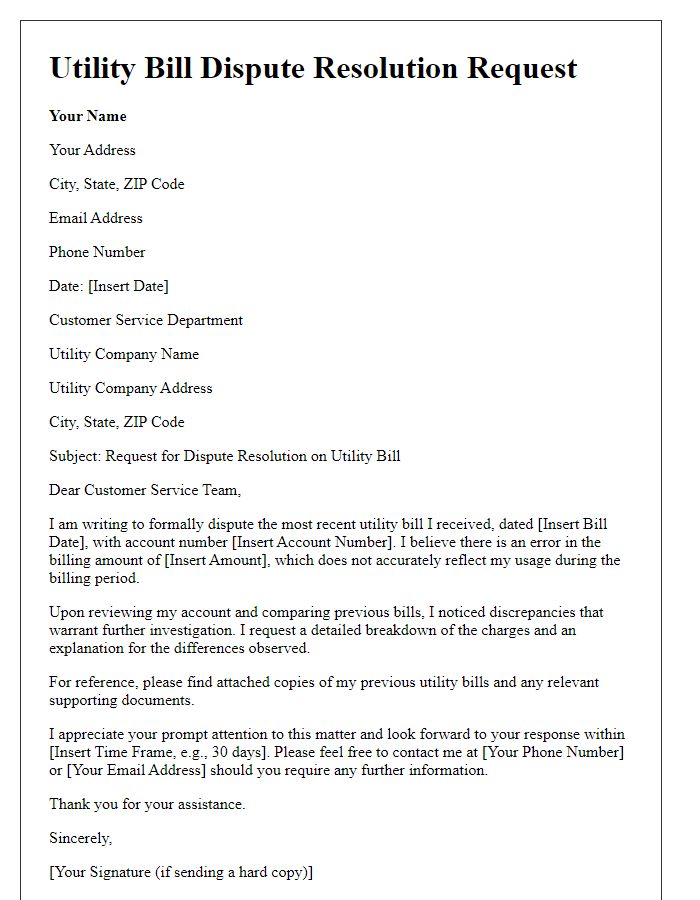

Clarity of Debt Amount

Utility bill debt accumulation can cause significant stress for households, particularly when outstanding amounts grow over time. Analyzing the total debt owed can unveil unexpected discrepancies; for instance, an electric bill may reflect varying usage between 300 to 600 kilowatt-hours monthly, directly impacting the total balance due. Utility companies, such as Pacific Gas and Electric (PG&E) or Constellation Energy, maintain records that detail monthly charges, late fees, and penalties applied if payments are overdue. Contacting customer service representatives can provide clarity on charged amounts, which may also include local taxes or service fees unique to specific municipalities, such as San Francisco's utility tax at 7.5%. Understanding the intricate breakdown of these charges is crucial for individuals seeking to negotiate a settlement or develop a payment plan tailored to their financial situation.

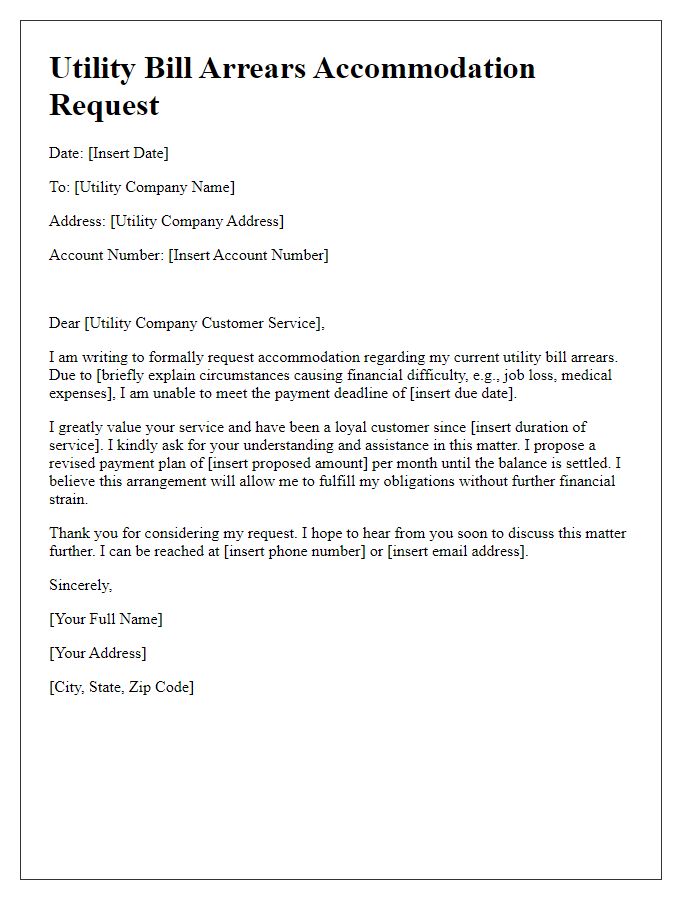

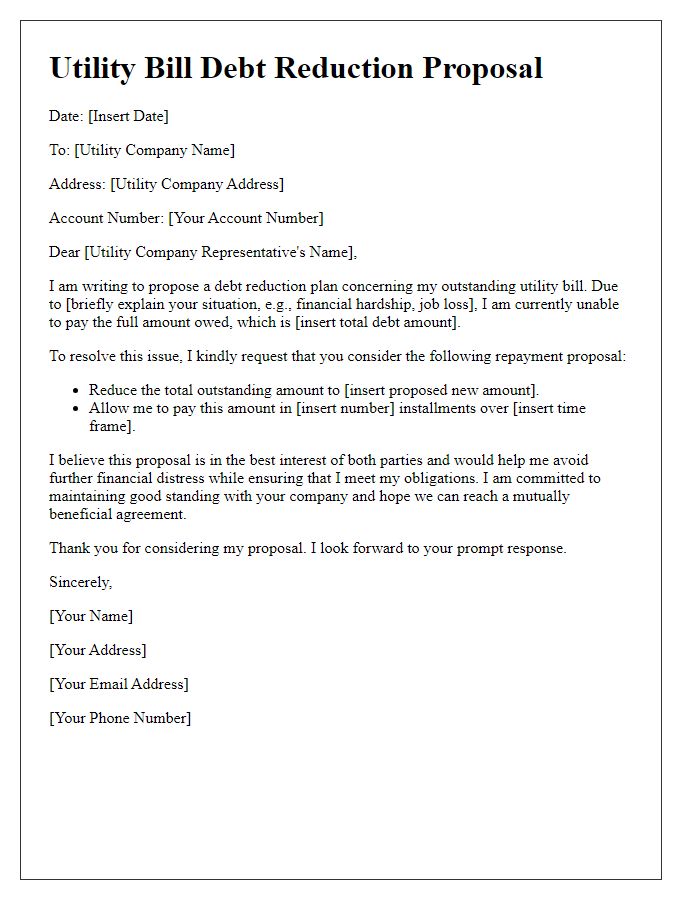

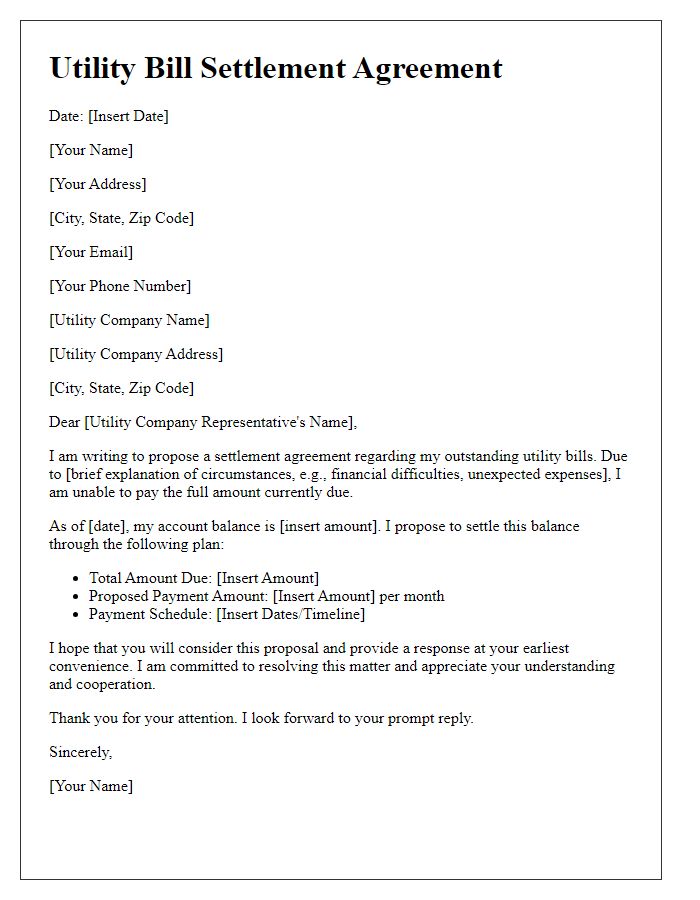

Proposed Settlement Terms

Utility bill debt settlements can provide relief for individuals facing financial difficulties. Proposed settlement terms often involve negotiating a reduced payment amount with utility companies, which are responsible for providing essential services like electricity, water, and gas. Settlement agreements may stipulate a specific lump sum payment, often ranging between 30% to 70% of the original debt, with a deadline for completion. Payment plans can be established to assist customers, allowing for payments spread over 3 to 12 months. It is vital to include clear terms regarding the cancellation of any further collections or negative credit reporting once the settlement is fulfilled, ensuring that customers can move forward without lingering financial burdens. Always document agreements in writing, specifying both parties' responsibilities to enhance accountability.

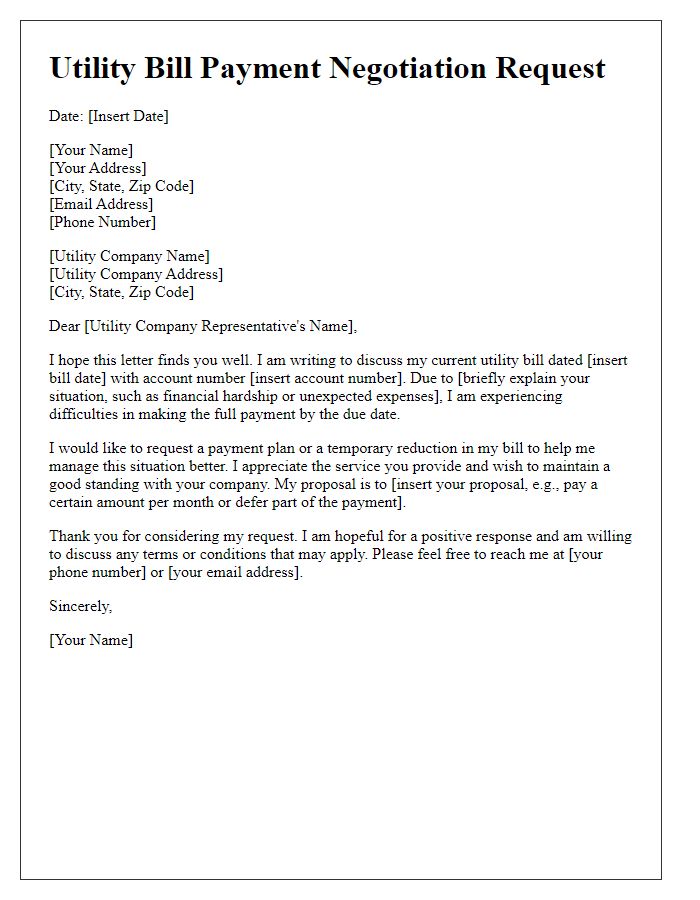

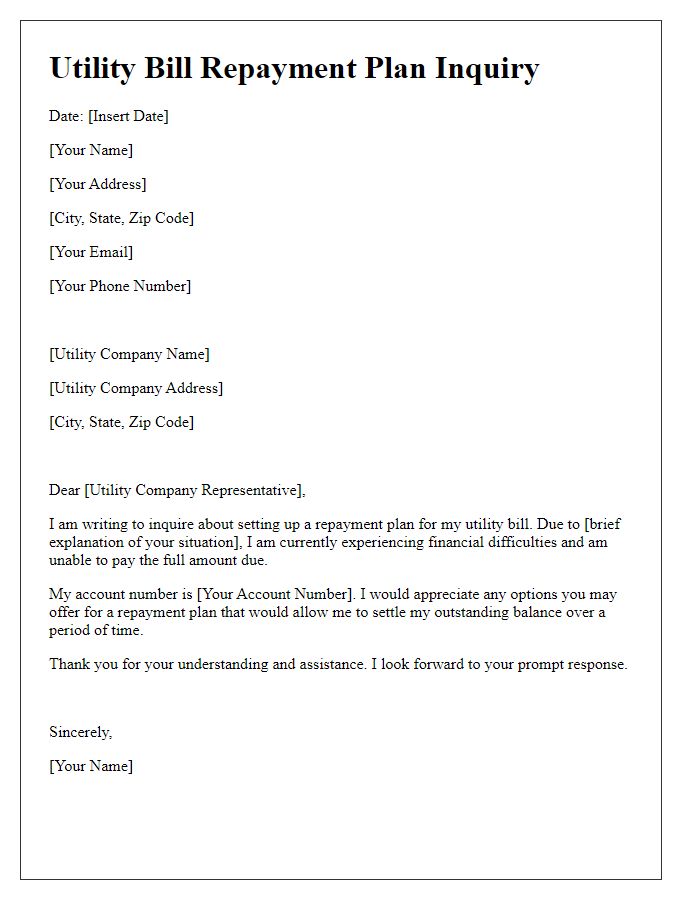

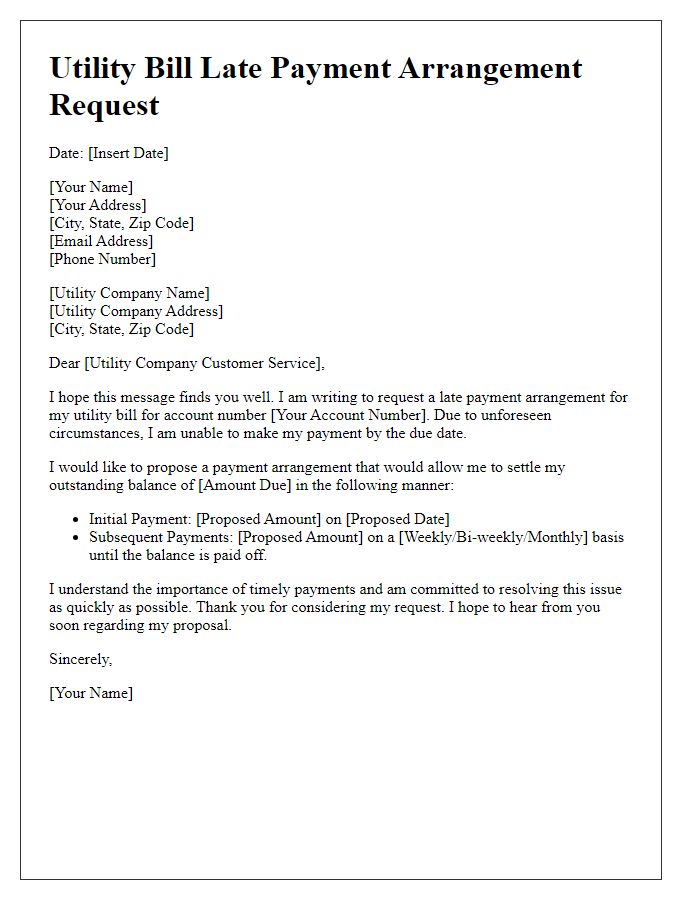

Payment Method and Schedule

Utility bill debt settlement often involves negotiating a repayment plan with utility companies, such as electric or water providers, located in cities like Los Angeles or Chicago. Customers typically owe amounts ranging from hundreds to thousands of dollars, depending on usage and service periods. A common payment method in these negotiations can include monthly installments--often broken down into manageable sums--over a specified period, like six months or a year. This timeline allows customers to effectively manage their finances while slowly addressing the accumulated debt. Additionally, companies may offer options for automated payments through bank transfers or credit cards, ensuring timely payments and helping to avoid further debt escalation. It's essential for customers to maintain clear communication with utility representatives to establish a feasible schedule, as this can significantly impact their credit score and overall financial health.

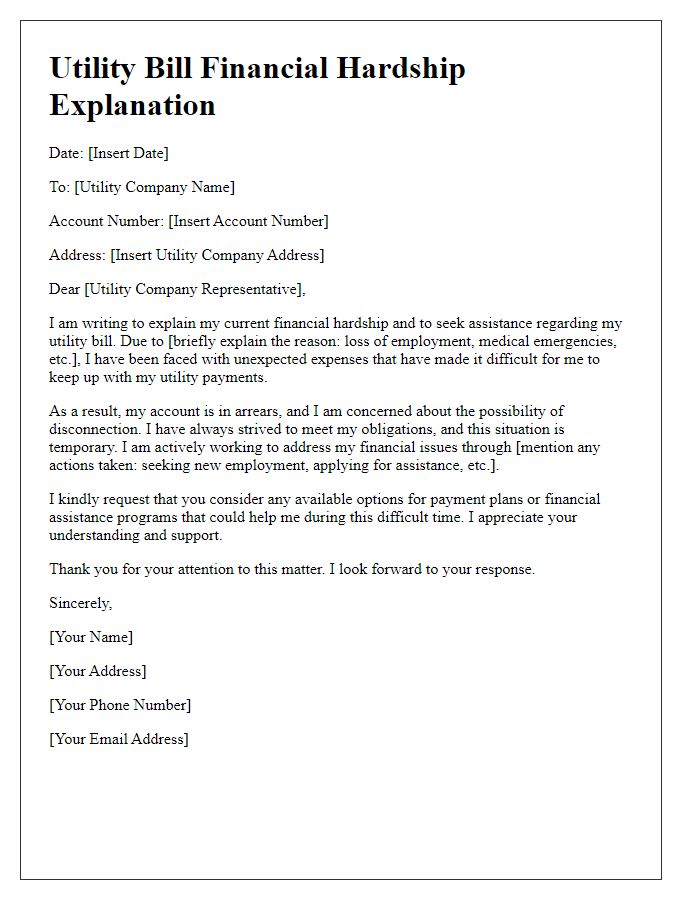

Consequences of Non-Compliance

Failure to address outstanding utility bill debts can lead to severe consequences, including disconnection of essential services. Utility providers, such as electric and water companies, often have policies in place that allow them to terminate service for unpaid balances within 30 to 60 days past the due date. Disconnection can severely impact daily life, forcing households to seek alternative energy sources or rely on bottled water. Additionally, delinquent accounts may be sent to debt collection agencies, resulting in negative impacts on credit scores (potentially dropping by 100 points). Legal actions may arise, leading to costly court proceedings and potential wage garnishments. Regaining service after disconnection may involve significant reconnection fees, often exceeding $100, alongside pressure to settle outstanding debts, which can create further financial strain.

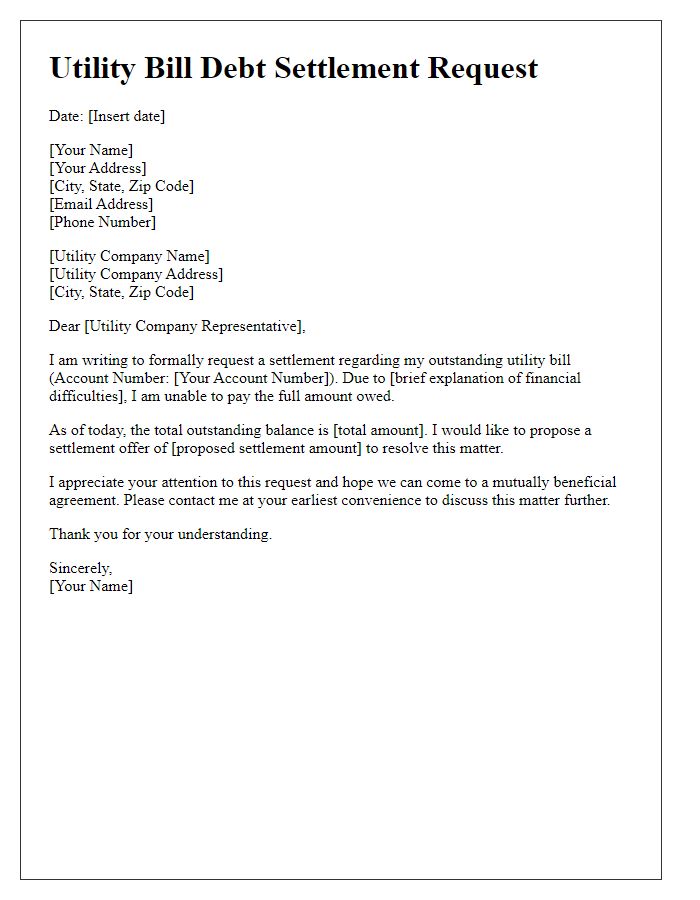

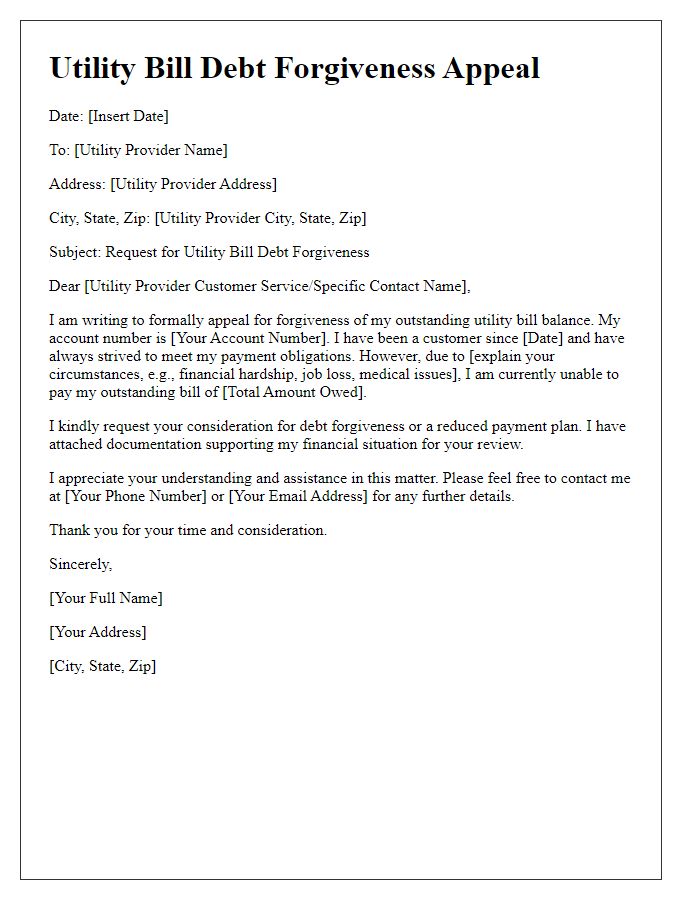

Formal Contact Information

Utility bill debt settlement can be a pivotal process for individuals facing financial challenges. Settlements are often sought to reduce outstanding balances owed to service providers such as electric companies, water utilities, or gas providers. Depending on the jurisdiction, companies may offer payment plans or reduced lump-sum settlement options for bills that have not been paid for several months. For example, a household with an accumulated utility debt of $1,200 might negotiate a settlement amount of $800. Elements such as a history of timely payments and the financial hardship of the debtor can significantly impact the willingness of a utility company to negotiate. Documentation such as payment history, income statements, and hardship letters can further support the settlement request. This process must be conducted formally, often requiring specific contact information and terms to ensure that the negotiation is recognized and documented by both parties involved.

Comments