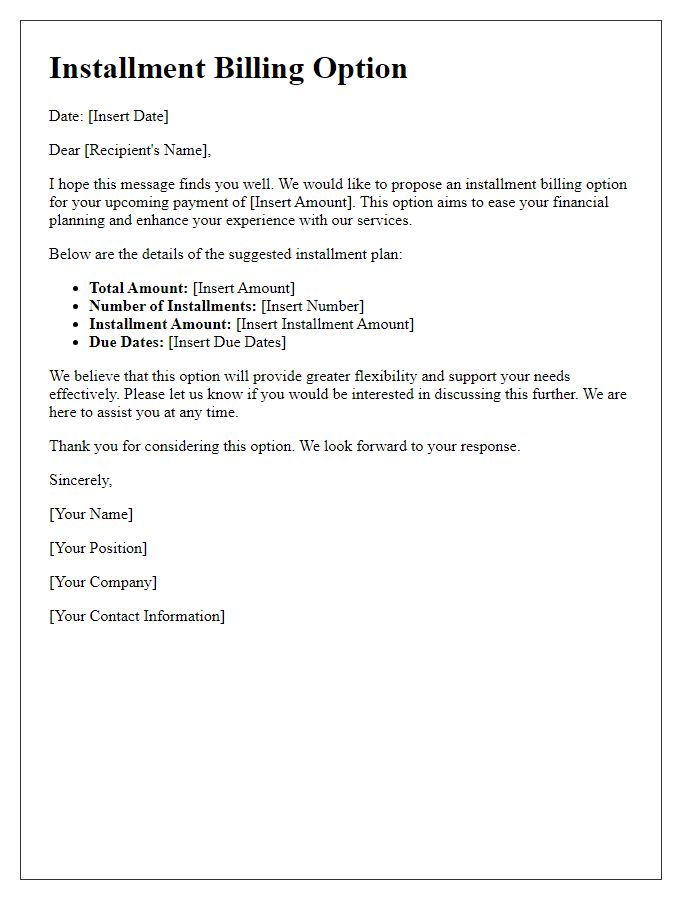

Are you considering making a big purchase but feeling overwhelmed by the upfront costs? An installment payment option might just be the solution you need to ease your financial burden while enjoying immediate access to what you need. With flexible payment plans tailored to fit your budget, you can spread out your payments in a way that works for you. Curious about how to propose this option? Read on for a comprehensive letter template that will guide you through the process.

Clear explanation of installment terms and conditions

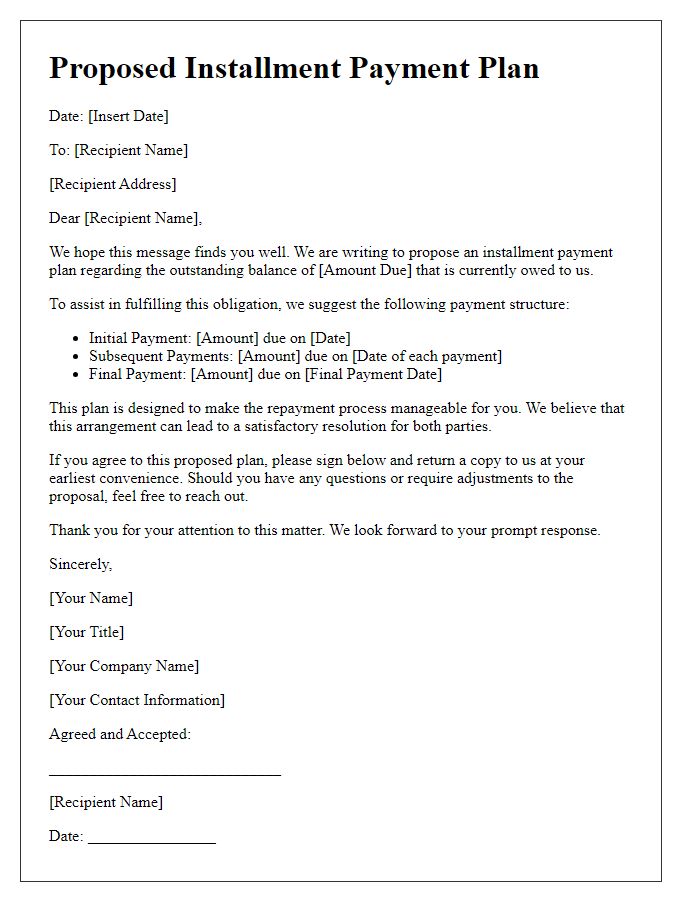

Proposal for installment payment options offers flexibility for customers seeking to manage their financial commitments. Monthly payments can be structured over a 6, 12, or 24-month period, depending on the total purchase amount. For purchases exceeding $500, an interest rate of 5% applies, while transactions below this threshold remain interest-free. Customers must provide proof of income and valid identification, ensuring financial viability. Late payments incur a penalty fee of $25 and affect the customer's credit rating. All agreements require signatures from both parties, solidifying mutual understanding of terms. Customers maintain the option to pay off their balance early without incurring additional fees, promoting greater financial freedom.

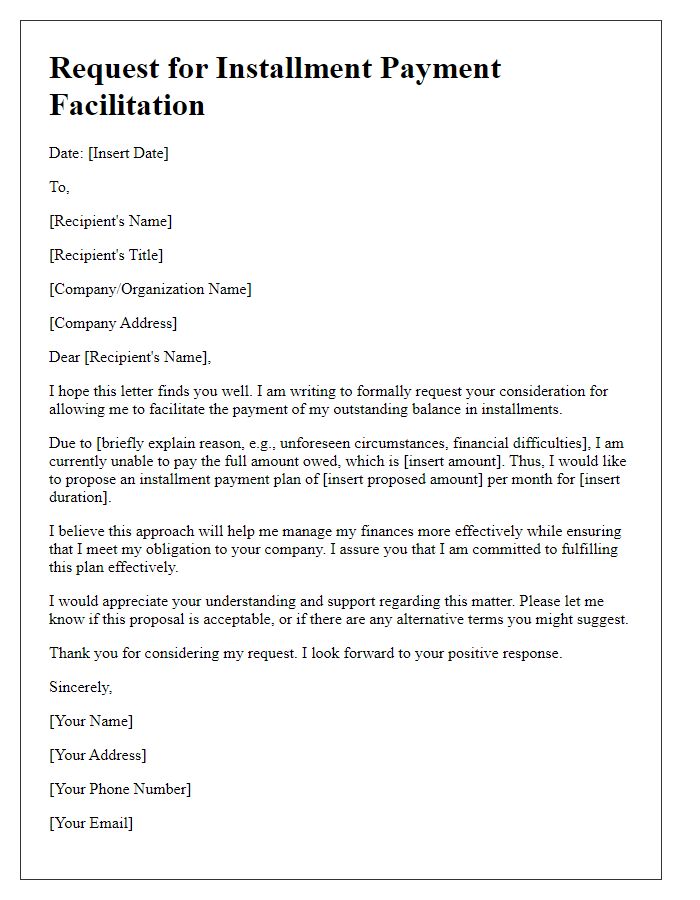

Justification for installment request

Proposing an installment payment option can facilitate financial flexibility and ease the burden of timely payments. Individuals may face unexpected expenses, such as medical bills or home repairs, leading to temporary cash flow constraints. By suggesting an installment plan, like monthly payments over a 6 to 12-month period, beneficiaries can manage their budgets more effectively without defaulting on financial obligations. Locations such as local financial institutions or online platforms often provide supportive frameworks to handle such proposals, ensuring transparency and accountability in the payment process. Furthermore, businesses can improve their cash flow by securing steady income while maintaining customer satisfaction, thereby fostering long-term relationships.

Mutual benefits and advantages

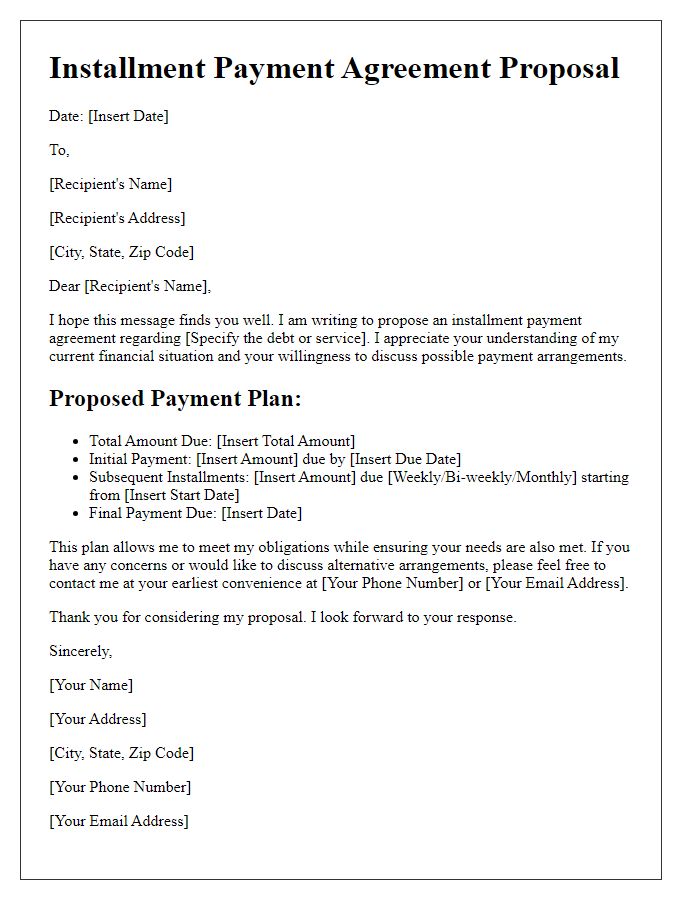

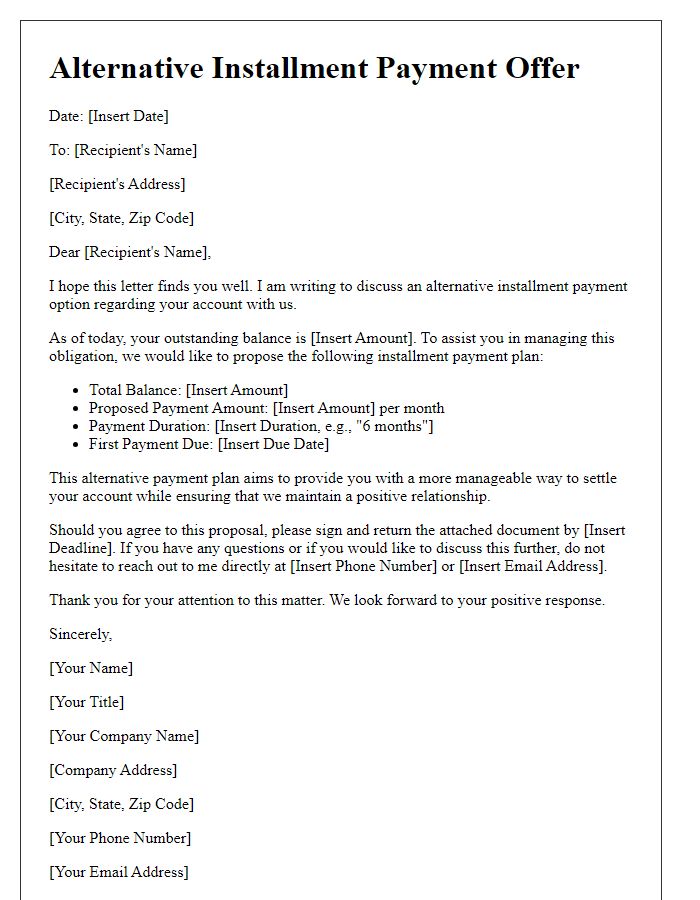

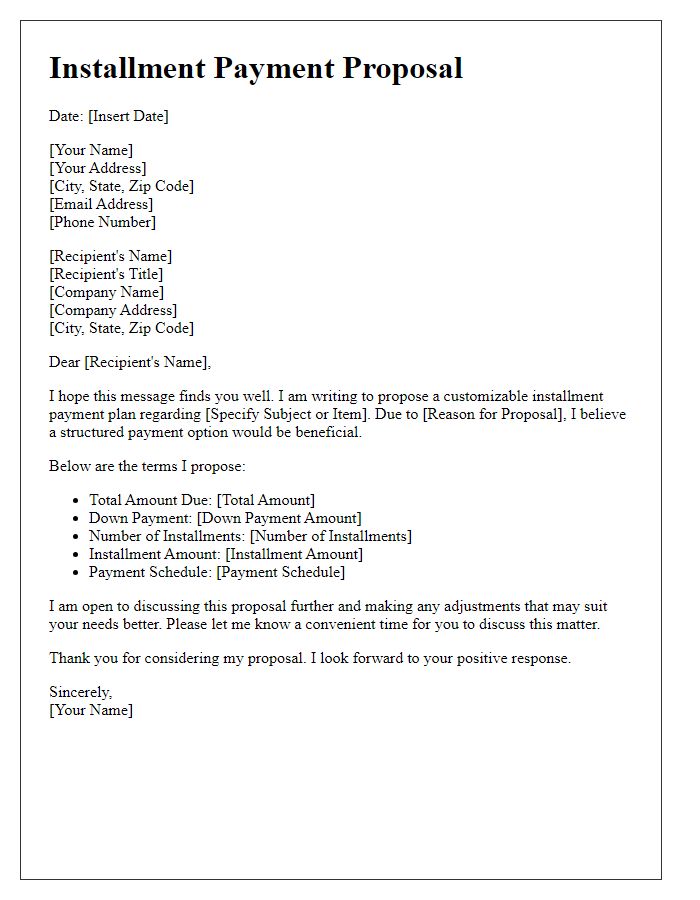

A letter template for an installment payment option proposal outlines a structured approach to facilitate financial agreements between parties. This document serves as a formal communication tool, articulating the terms and conditions of payment arrangements. Essential elements include a clear breakdown of payment amounts, due dates, and the entire duration of the agreement. Mutual benefits typically arise, such as increased accessibility for the payer, easing financial strain while ensuring timely payments for the payee. Advantages include fostering trust through transparent communication and establishing a long-term relationship based on shared financial interests. This strategic tool ultimately contributes to a collaborative financial ecosystem, promoting stability and satisfaction for both sides involved.

Payment schedule and deadlines

An installment payment proposal outlines a structured repayment plan for a financial obligation, typically featuring specific payment amounts, due dates, and total duration of the repayment period. The proposal may detail an initial down payment followed by regular installments, often on a monthly basis. For instance, a common structure might involve a 20% down payment followed by ten monthly payments of a fixed amount. It is essential to specify deadlines for each installment, such as the first payment due on the first of the month. Clarity on late fees may enhance adherence to the schedule. Additionally, including terms for early repayment can provide flexibility and attract more favorable interest terms.

Contact information and further communication details

An installment payment option can significantly enhance accessibility for clients purchasing high-value items, such as electronics or home appliances. Offering flexible payment plans, such as a six or twelve-month installment agreement, can increase affordability by dividing the total cost into manageable monthly payments. The proposal should include details like the interest rate (often between 0% to 10% depending on the provider), payment schedule, and any fees associated (such as late payment penalties). It is essential to highlight how clients can apply for these options, which might involve submitting a credit application or verification of income, and to provide a clear communication channel for inquiries or further negotiations, such as a dedicated customer service hotline or an email address for a financial consultant.

Comments