Are you feeling overwhelmed by credit card debt and unsure where to turn? You're not alone; many people find themselves in similar situations, seeking relief and a way to regain control of their finances. One effective option to explore is a credit card debt settlement, which can help you negotiate a lower amount to pay off your debts. Curious about how to create a compelling letter for your creditors? Read on to discover a useful template that can guide you through the process!

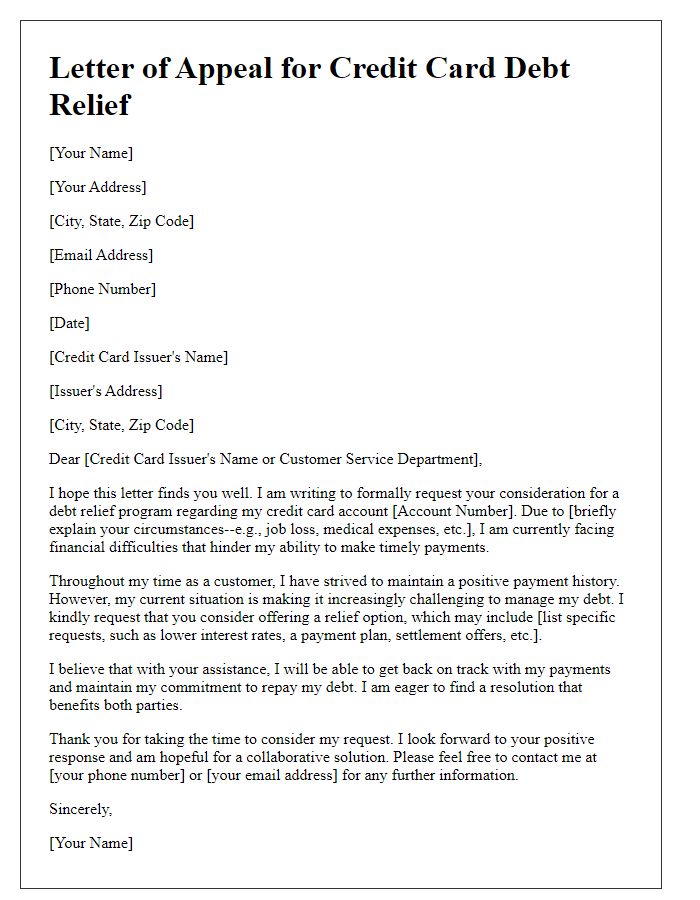

Clear Subject Line

Credit card debt settlement can be a crucial financial process for many individuals seeking relief from accumulating financial burdens. Often involving unsecured debts averaging over $5,000, these settlements typically negotiate with creditors like major banks (e.g., Chase, Citibank) to reduce the owed amount, allowing borrowers to pay a fraction of their total debt. This approach may involve a lump-sum payment or structured payments over a designated period, often facilitated by debt settlement companies or through personal negotiation. It is essential to note that settling debts may have tax implications, as forgiven debt can be classified as taxable income. Additionally, this negotiation process can impact credit scores negatively, reflecting the status of settled debts. Individuals must consider these factors carefully before proceeding with a credit card debt settlement.

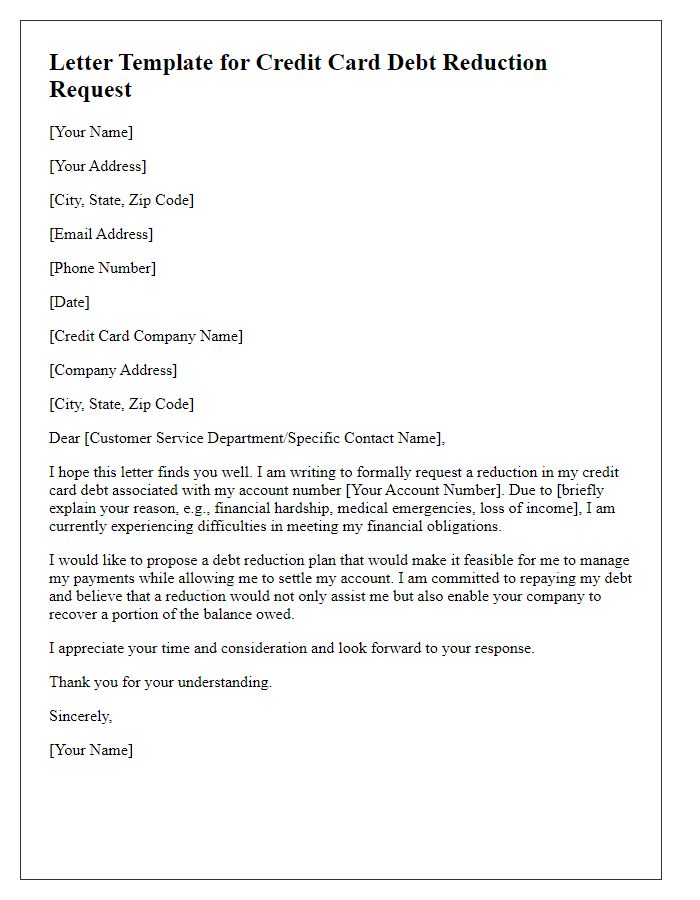

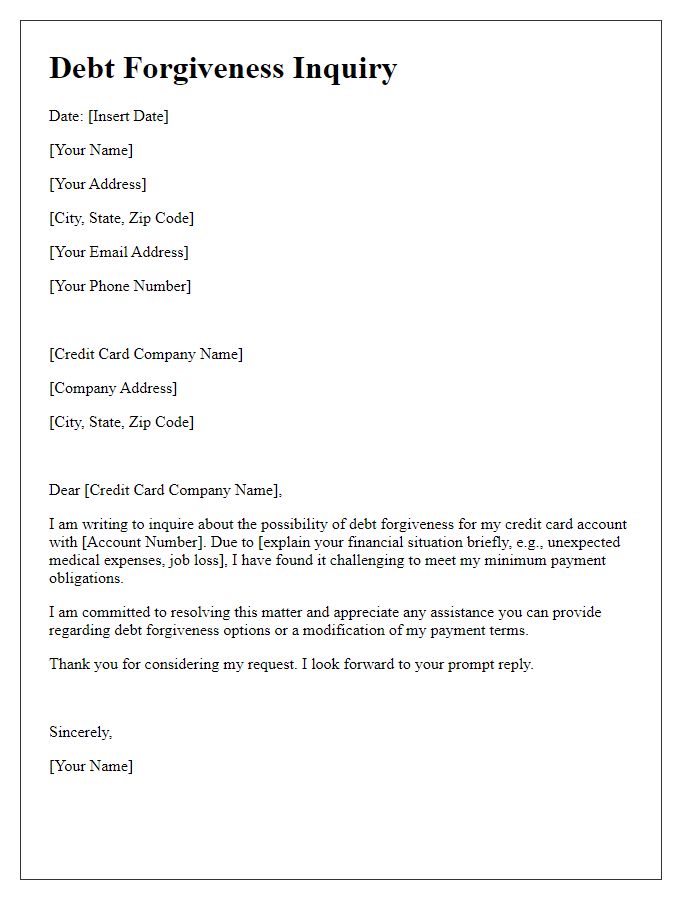

Personal Contact Information

Credit card debt settlement negotiations often require a structured approach to effectively communicate with creditors. To start, including accurate personal contact information is crucial for identification. This typically comprises your full name, which helps in verifying your identity and account details. The physical address should include the street name, city, state, and postal code, providing a formal contact point relevant for official correspondence. Additionally, including your phone number ensures that creditors can reach you promptly for discussions, with area codes denoting your local region. Lastly, an email address offers a modern communication channel, facilitating quicker queries and responses about debt management or settlement terms.

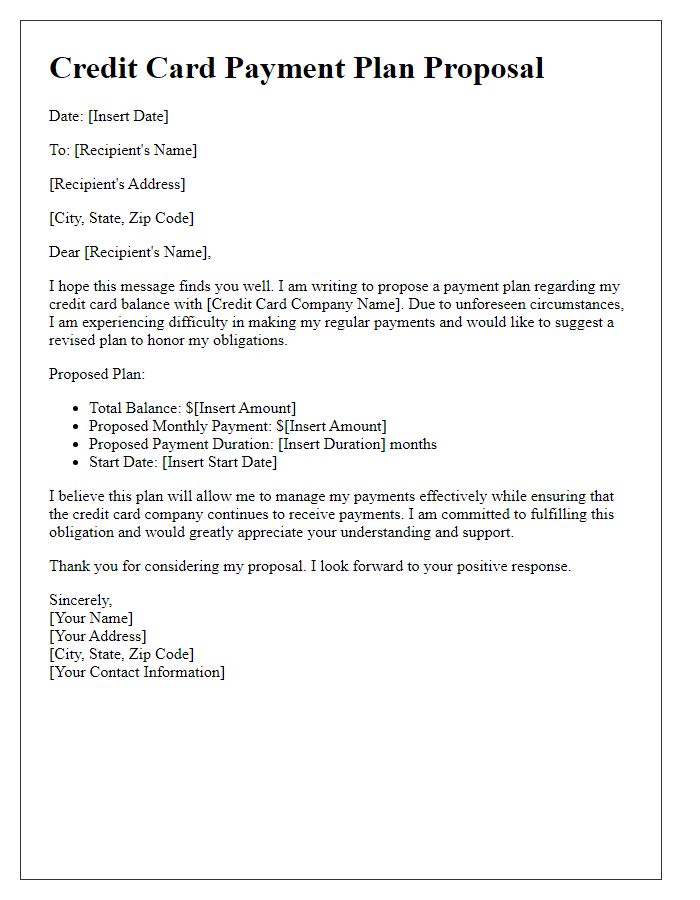

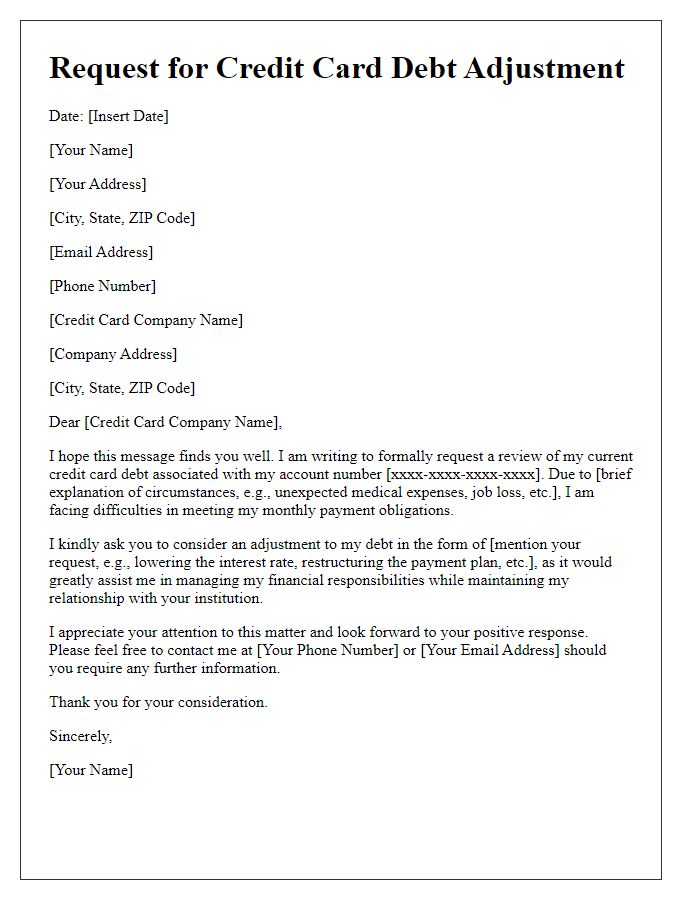

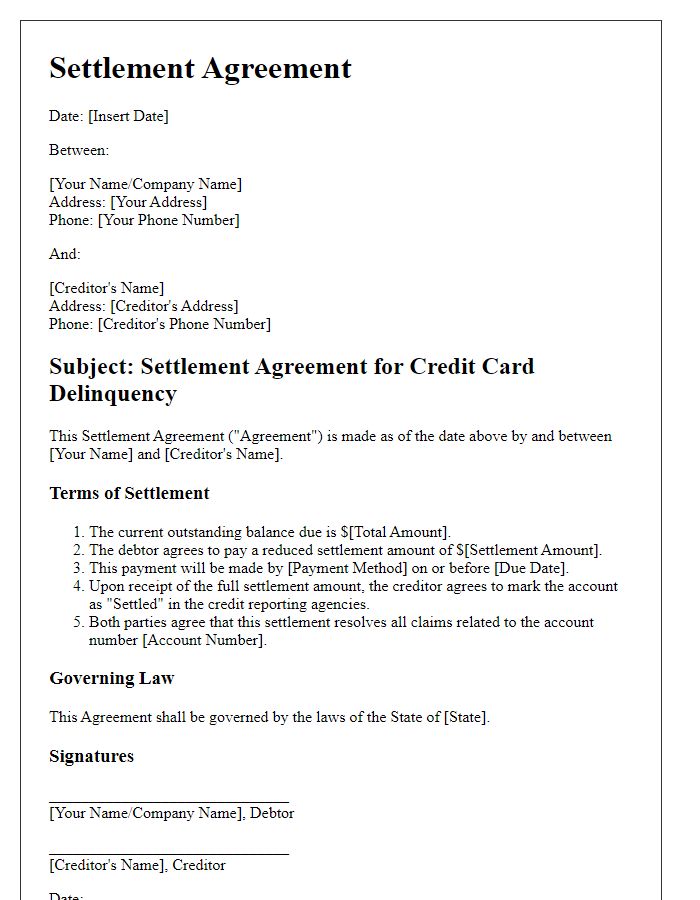

Detailed Debt Information

Credit card debt settlement requires an understanding of total outstanding debt, interest rates, and creditor details. Outstanding balances, often exceeding thousands of dollars, can accrue high annual percentage rates (APR), typically ranging from 15% to 30%. For instance, a $5,000 balance at 20% APR can lead to significant interest charges over time, increasing the total amount owed. Creditors, such as major banks or financial institutions like Chase, Citibank, and American Express, may have varying policies regarding settlement offers. Documenting each account's terms, including payment history, missed payments, and charges, is essential for negotiation. Furthermore, understanding potential tax implications from forgiven debt, typically reported to the IRS on Form 1099-C, is crucial. A strategic approach involving a comprehensive breakdown of the debt situation assists in crafting a compelling settlement proposal to creditors.

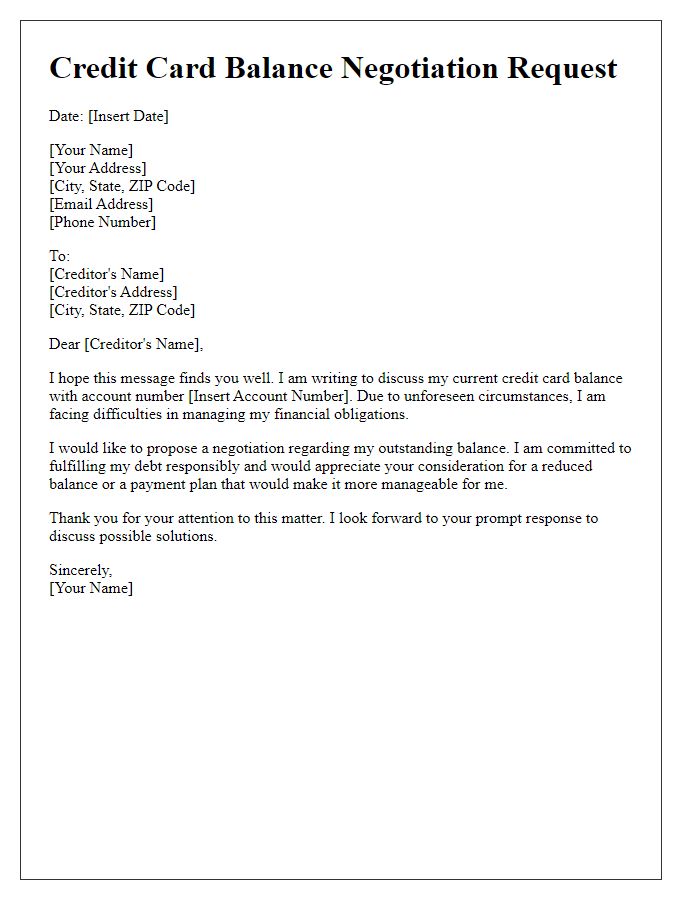

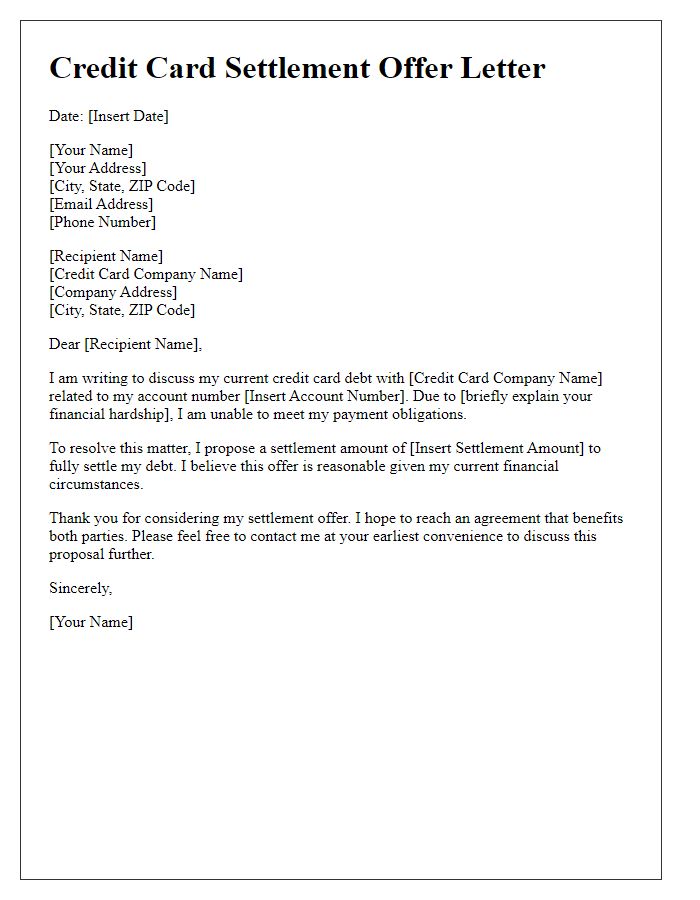

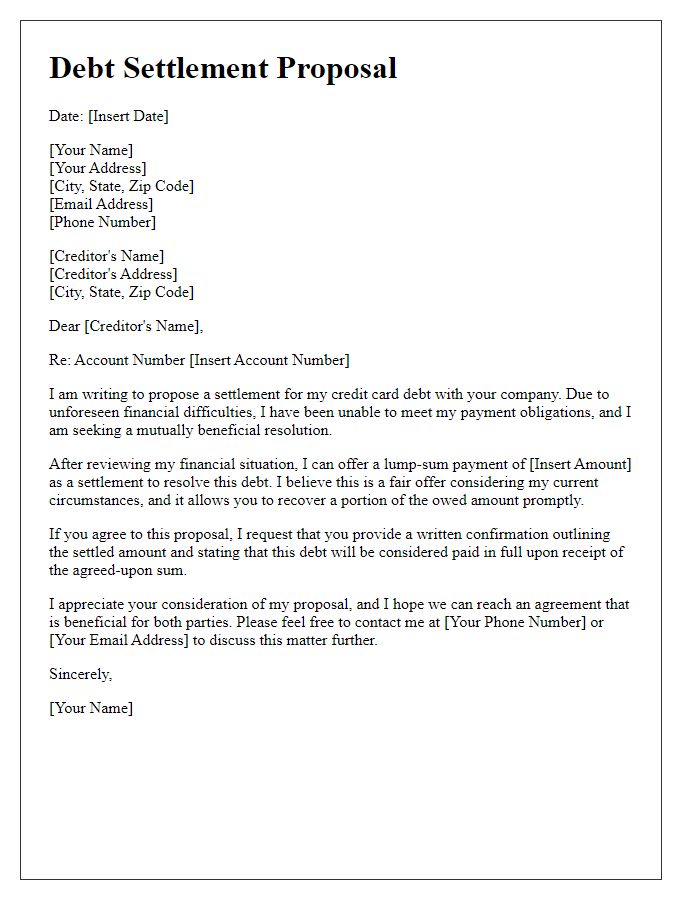

Proposed Settlement Terms

A proposed settlement for credit card debt involves negotiating a reduced repayment amount with the credit card issuer. Typically, a debtor may suggest a lump-sum payment, potentially around 30-50% of the total outstanding balance, depending on the account holder's financial situation. This settlement offer should specify details such as proposed payment deadlines, e.g., within 30 days, to facilitate quick resolution. The agreement would ideally include conditions that prevent the credit card company from pursuing further collection actions after the payment is made. Furthermore, the proposed terms may address the impact on the debtor's credit score, noting the importance of settling accounts in good standing to minimize long-term effects.

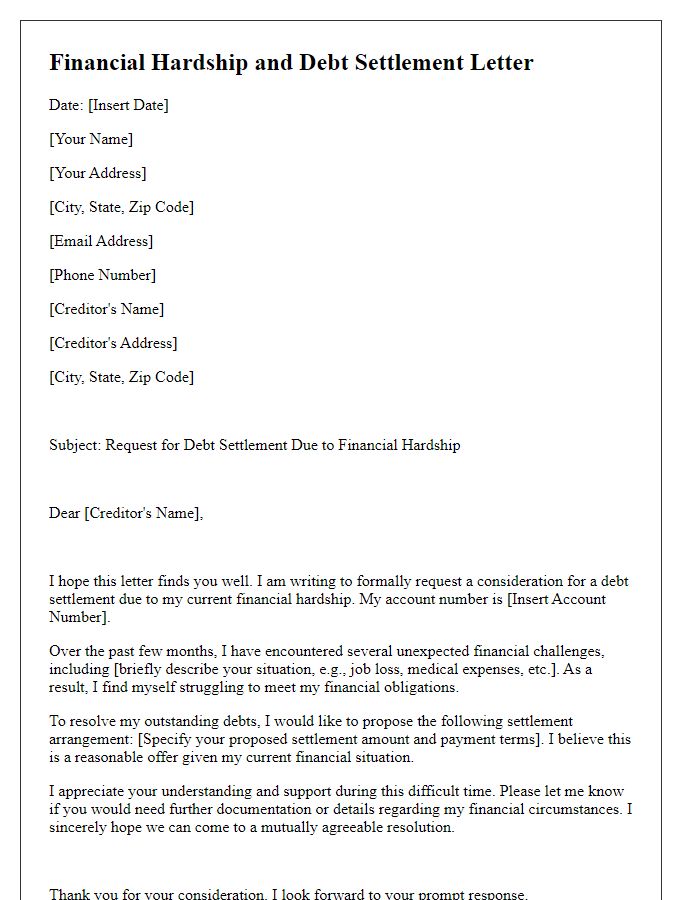

Request for Written Confirmation

Credit card debt settlements require careful documentation and confirmation. A settlement agreement typically arises when a debtor negotiates with a creditor (like Visa or MasterCard) to pay a reduced amount on an outstanding balance, often due to financial hardship. When reaching a settlement, obtaining written confirmation is essential. A confirmation letter should specify the total amount to be paid, the payment terms, and the explicit agreement that the settled account will be marked as "Paid in Full" on the debtor's credit report. Timely communication with the creditor is crucial to ensure accurate record-keeping and to avoid potential misunderstandings that could affect credit ratings.

Comments