Are you facing challenges with a recent credit card charge that just doesn't seem right? Navigating the world of credit disputes can feel overwhelming, but you don't have to go through it alone. In this article, we'll provide you with a user-friendly template to help you effectively craft your appeal letter, ensuring that your concerns are clearly conveyed. Stick around to discover tips that can boost your chances of a successful resolution!

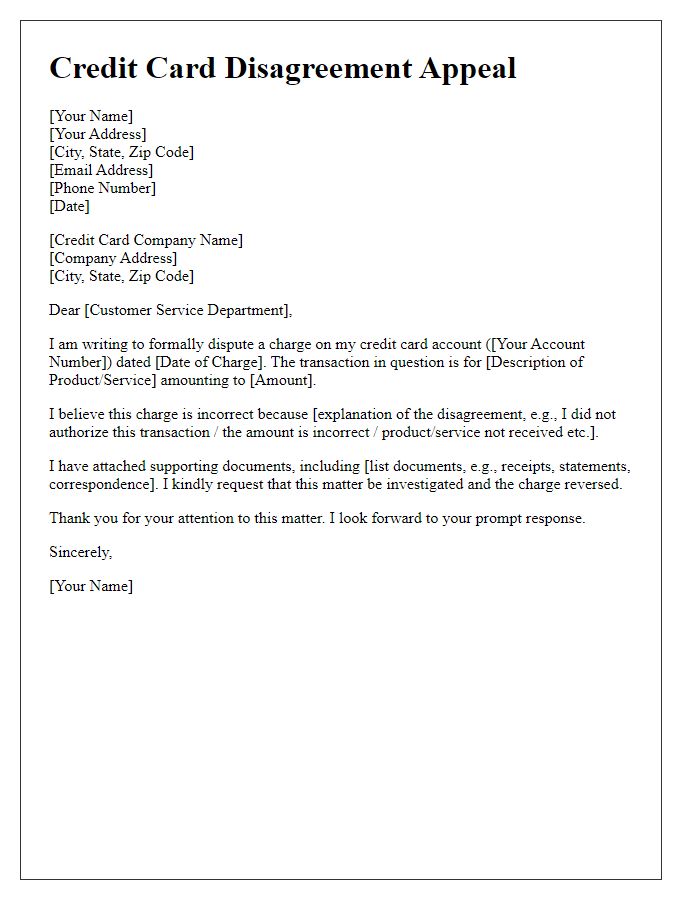

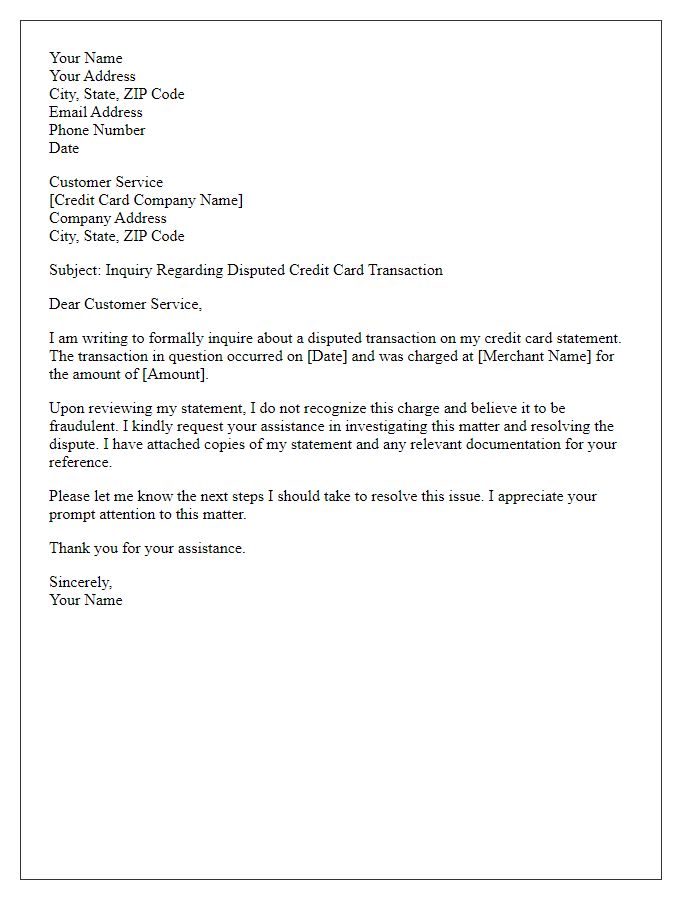

Clear Introduction

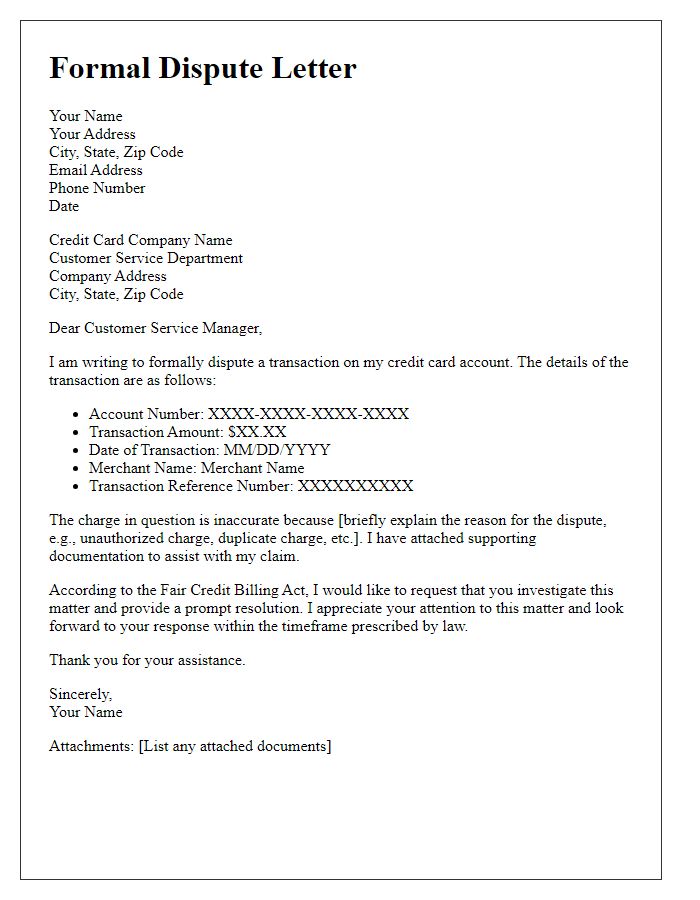

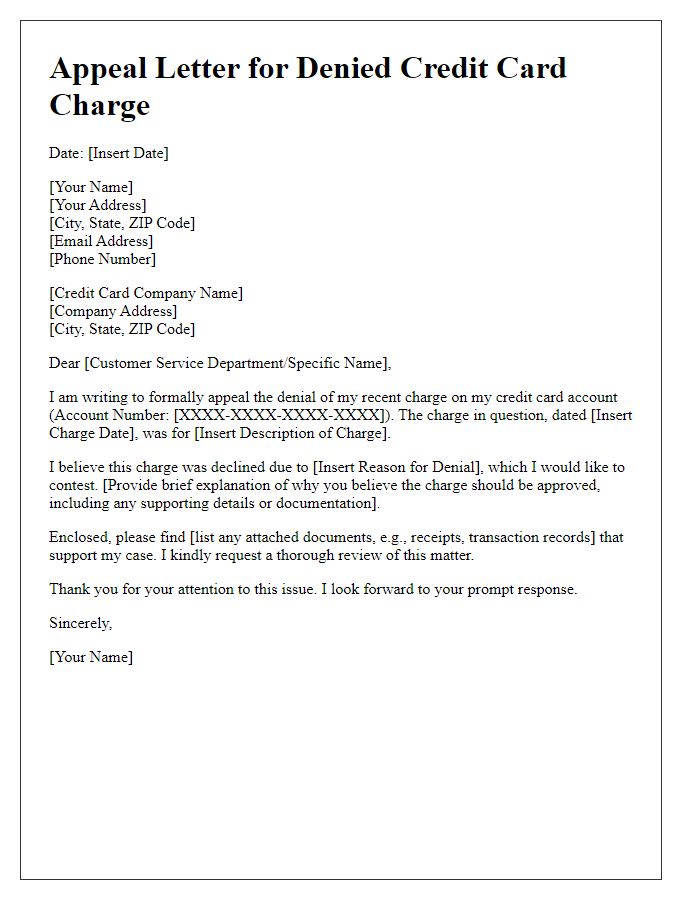

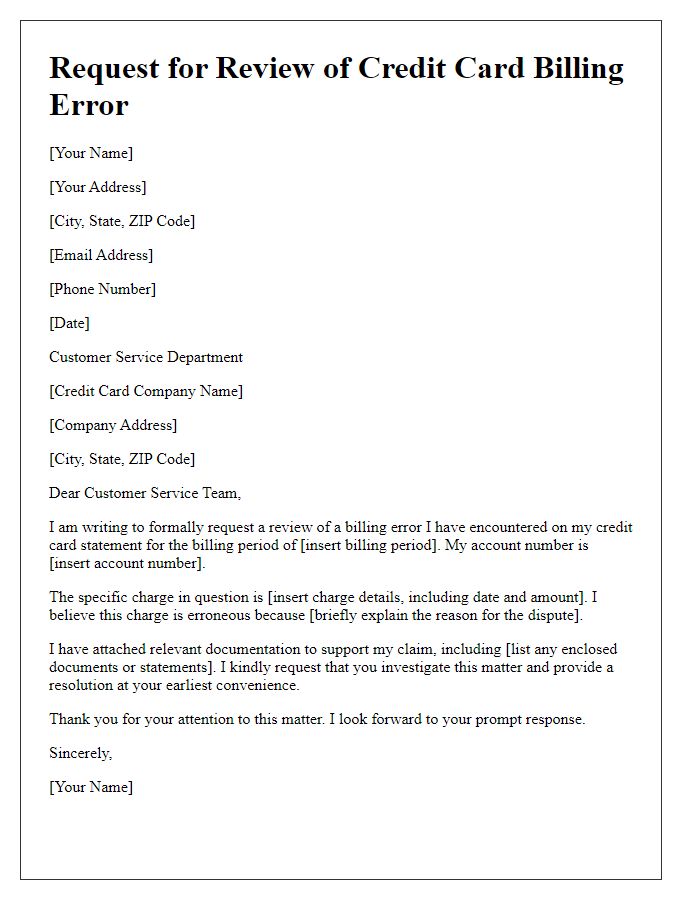

Credit card disputes can arise from various issues, such as unauthorized charges or billing errors. A well-structured appeal letter ensures clarity and effectiveness when addressing the financial institution. Begin with important details, including your name, account number, and the date of the dispute. Clearly state the reason for the dispute, providing specific information about the transaction in question, such as the transaction date, amount, and merchant name. Additionally, include any supporting documentation, such as receipts or correspondence related to the disputed transaction. A concise and professional tone throughout the letter fosters better understanding and increases the likelihood of a favorable resolution.

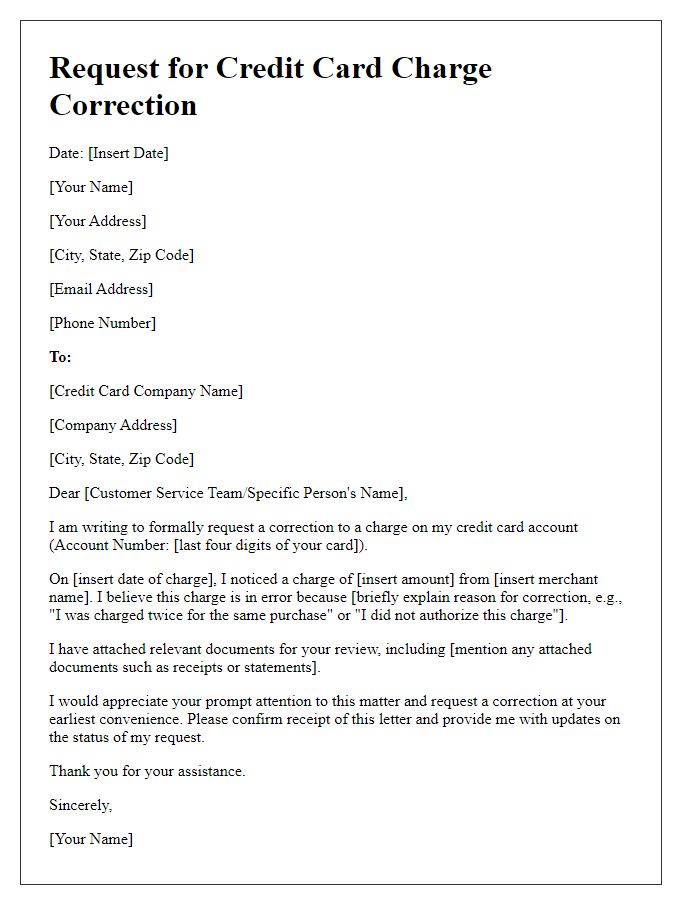

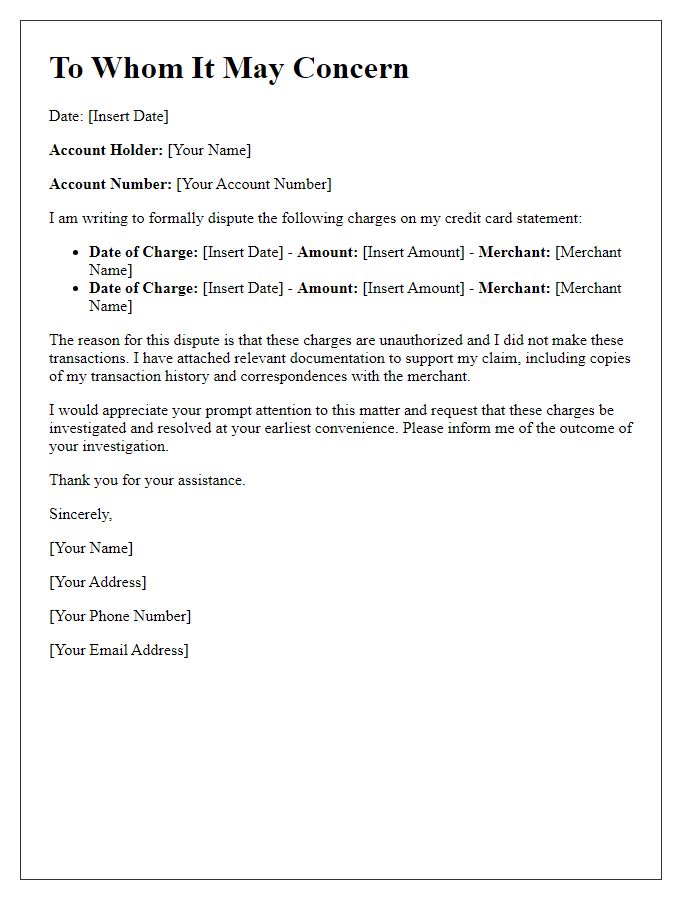

Detailed Transaction Information

Disputes over credit card transactions can significantly impact financial statements and individual credit scores. Detailed transaction information should include the transaction date, the amount charged, the merchant's name, and a clear description of the disputed charge. For example, if a charge of $150.00 appears on a Visa card from a restaurant named 'Gourmet Delights' on September 15, 2023, and the customer did not dine there, this information must be clearly highlighted to ensure proper processing by the credit card company. Additionally, any supporting documentation, such as receipts, emails, or photographs, should be referenced to substantiate the claim, thereby enhancing the chances of a successful resolution. Clear communication and prompt actions can assist in the dispute's favorable outcome.

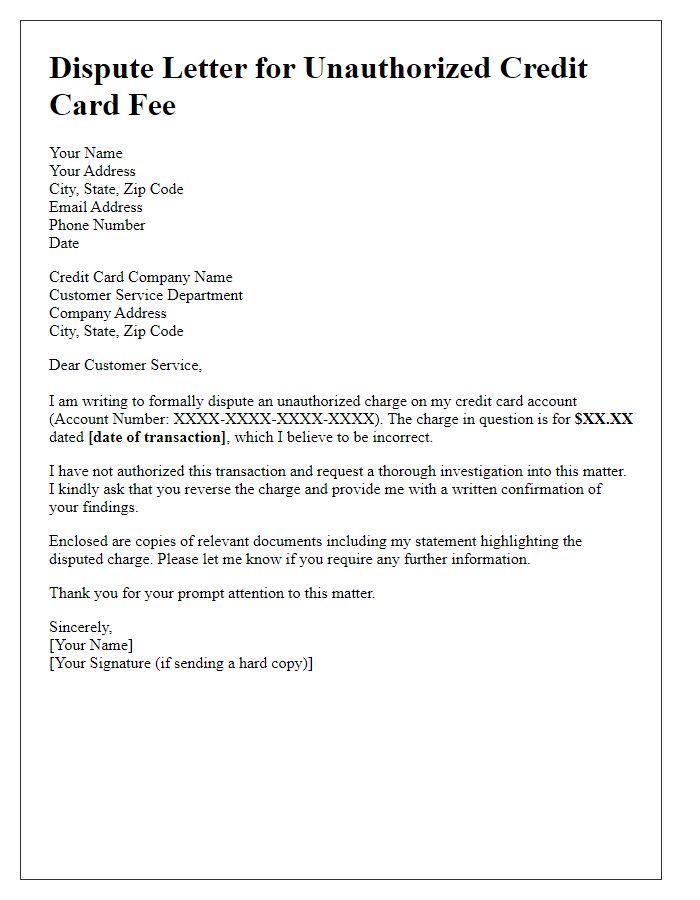

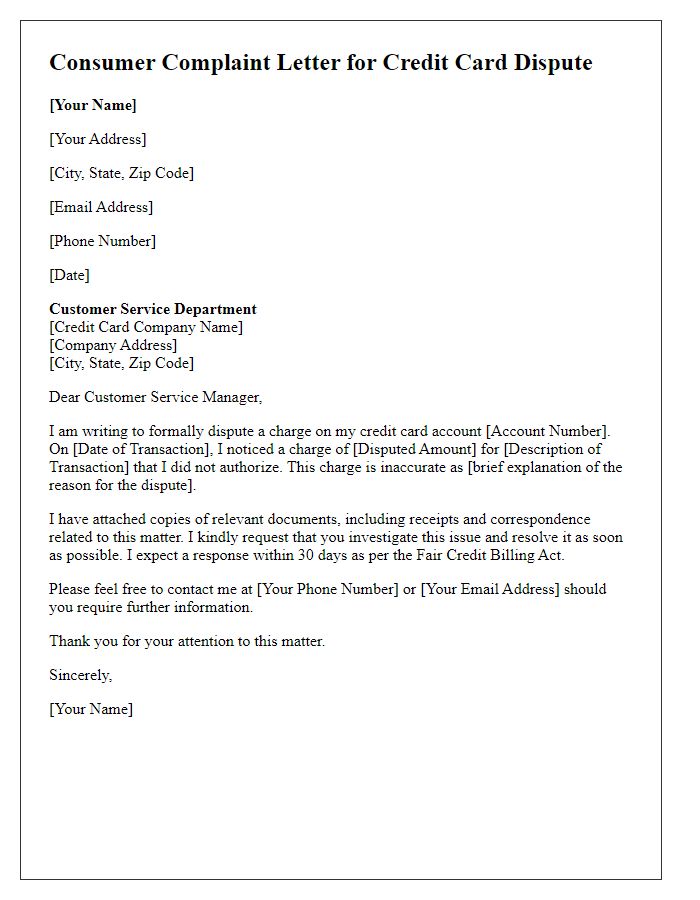

Reason for Dispute

Credit card disputes often arise from unauthorized charges, billing errors, or discrepancies in transactions. A common reason for dispute involves fraudulent activity, which can be particularly concerning for the cardholder. For instance, an unexpected charge of $150 at a retail store like Amazon, which the cardholder did not authorize, necessitates immediate action. Detailed documentation, including transaction dates, charge amounts, and the merchant's location, is essential for substantiating the claim. Additionally, it is vital to highlight any previous communications with customer service regarding the issue, specifying the dates and responses received. This thorough approach aids in resolving the dispute efficiently and helps protect the cardholder's financial interests.

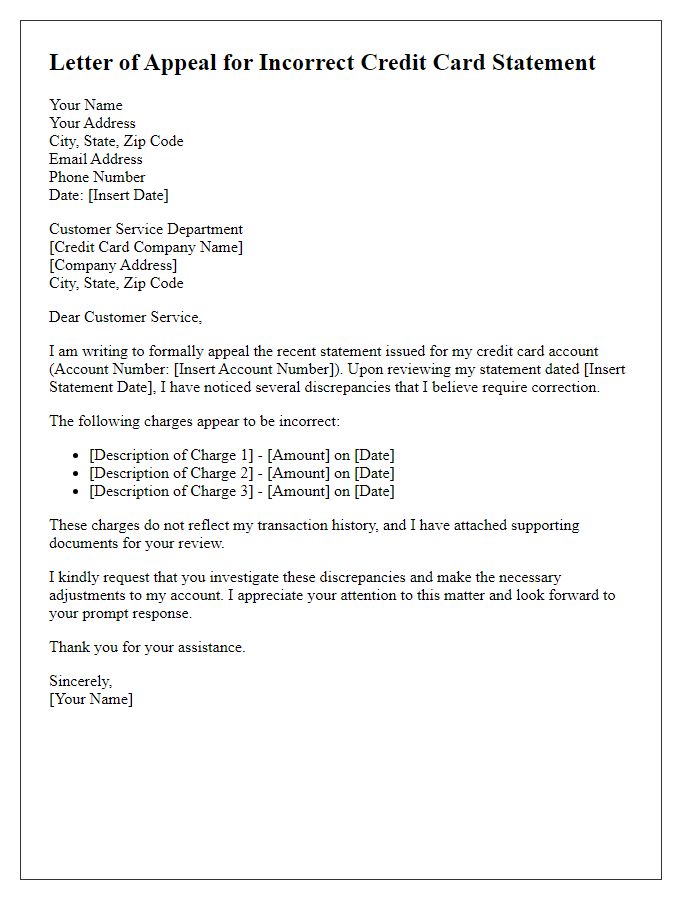

Supporting Documentation

Disputing a credit card charge requires careful documentation and clear presentation of supporting evidence. Essential documents include a copy of the credit card statement, highlighting the disputed transaction, a detailed explanation of the dispute's nature, and any relevant correspondence with the merchant. Other crucial items may involve receipts, invoices, or warranties related to the purchase, especially when issues arise from defective merchandise or unauthorized charges. Additionally, include records of previous communication with customer service representatives, such as names, dates, and reference numbers, to establish a comprehensive timeline of the dispute. This collected evidence strengthens the case during the appeal process with credit card companies like Visa or Mastercard, aiding quicker resolution based on consumer protection regulations.

Contact Information & Next Steps

To effectively navigate a credit card dispute process, clear communication is essential. Gather all relevant contact information, including the credit card issuer's customer service number, mailing address for formal correspondence, and any specific department handling disputes. Document the account number associated with the transaction in question. Outline next steps clearly: begin by submitting a detailed dispute statement via certified mail to ensure delivery confirmation. Attach supporting documents, such as receipts or transaction statements, that substantiate your claim. Keep a record of all correspondence, noting dates and reference numbers for future follow-up. Utilize online banking portals, if available, for additional tracking of the dispute's progress.

Comments