Are you facing challenges with a supplier regarding unpaid debts? It's a common issue that can disrupt your business operations and strain professional relationships. Writing a clear and effective letter can help articulate your concerns while opening the door for resolution. Join us as we explore a helpful letter template that will guide you in addressing your supplier debt complaint effectively.

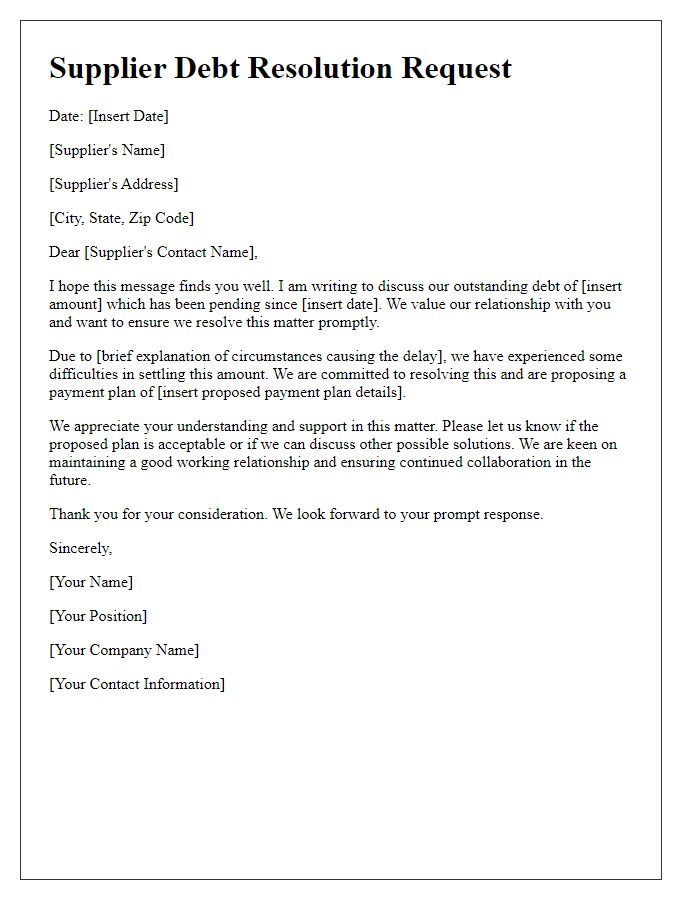

Clear Explanation of Discrepancy

A business supplier debt complaint often arises when there is a clear discrepancy between the goods received and the invoice presented. Common issues include incorrect quantities delivered, such as receiving only 80 units instead of 100, or receiving lower quality items than specified, like damaged electronics that do not meet the agreed-upon industry standards. These discrepancies can lead to significant financial impacts, prompting businesses to seek resolution with their suppliers. In such cases, documentation such as purchase orders, delivery receipts, and the invoice should be gathered to support the claim and provide evidence of the errors. A well-structured complaint will emphasize the importance of rectifying the discrepancies to maintain a healthy business relationship and ensure future transactions are carried out smoothly.

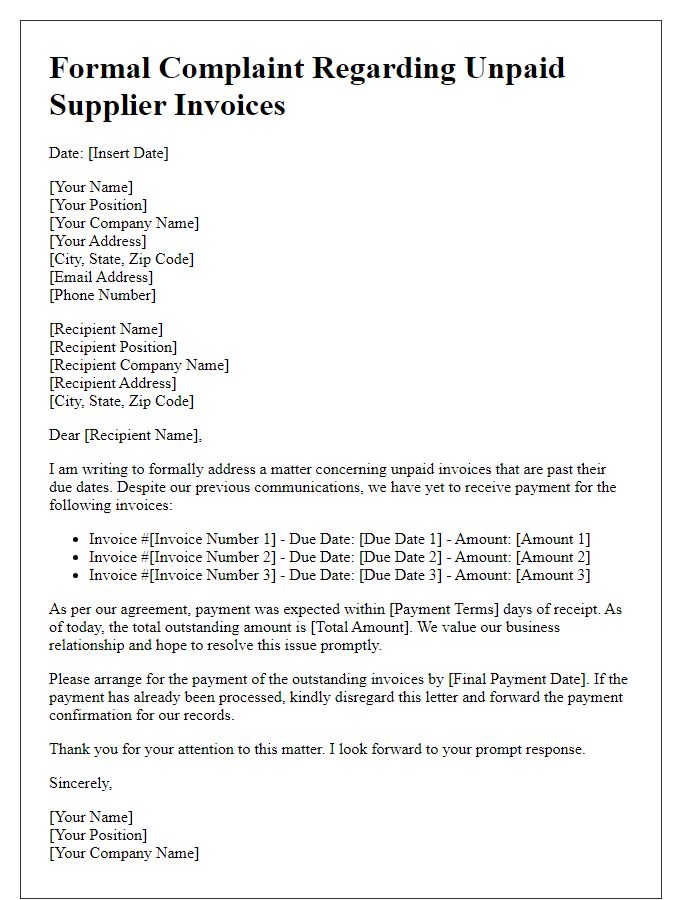

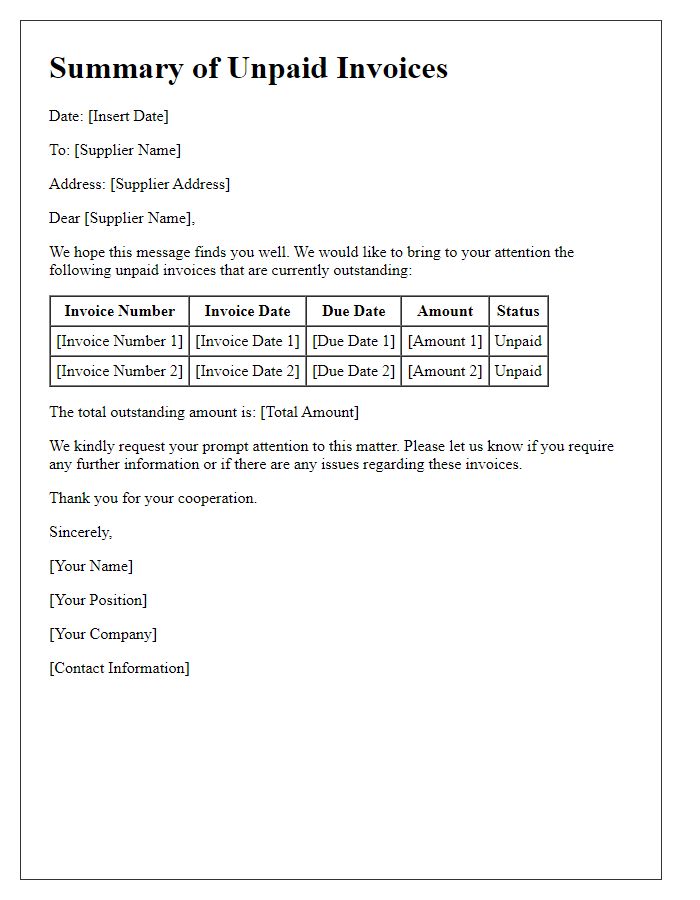

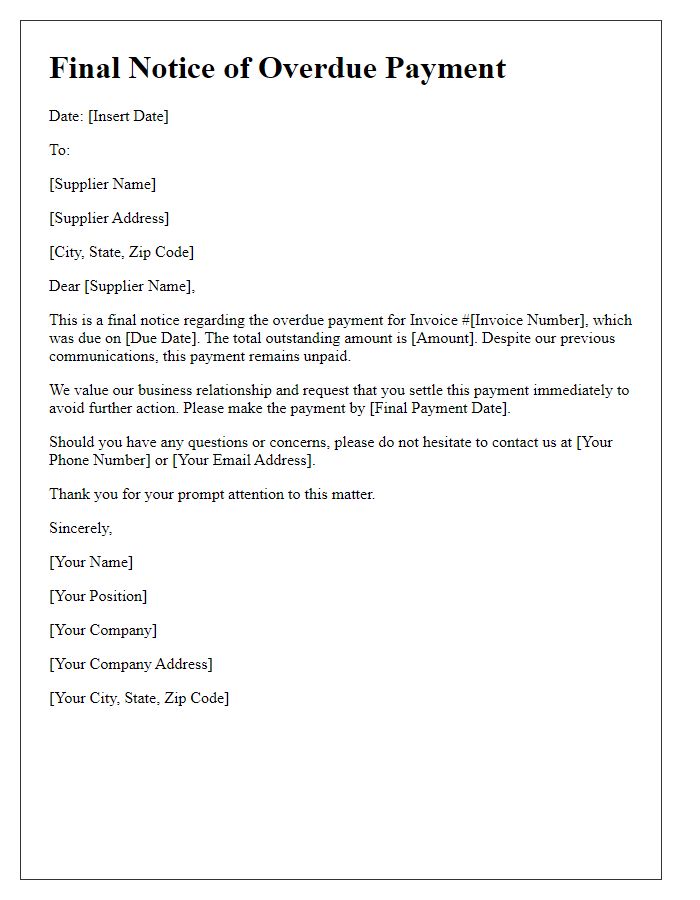

Invoice and Payment Details

A business supplier often faces issues related to unpaid invoices, leading to cash flow challenges. Outstanding invoices, such as Invoice #1543 dated August 15, 2023, for the amount of $2,500, can result from various factors, including procurement delays or miscommunication. Consistent follow-up on payment schedules is essential, as many businesses adhere to specific terms, often net 30 or net 60. Payment details, such as bank transfer information or payment processing methods, must be clear to facilitate timely transactions. Addressing the issue promptly helps maintain supplier relationships and ensures the smooth operation of supply chains.

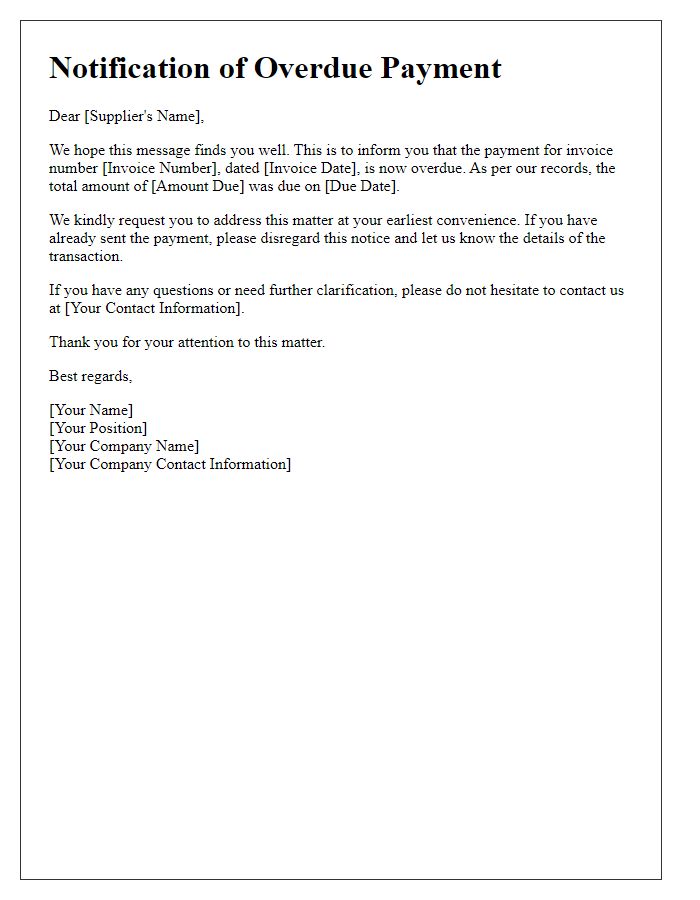

Request for Resolution

Unsettled supplier invoices can strain business relationships and disrupt supply chains in corporate environments. When payments, such as invoice numbers 12345 and 12346 from Acme Supplies, are overdue by more than 30 days, it creates a need for immediate resolution. Correspondence regarding this issue typically highlights the outstanding balance of $12,000, referencing purchase orders made in July 2023. An escalated request for clarification may be necessary to address discrepancies in feed delivery timelines from January 2023. Prompt communication can prevent further complications, ensuring continued collaboration and supply reliability. It is crucial for both parties to address disputes swiftly, ideally within the specified payment terms outlined in the supplier agreement.

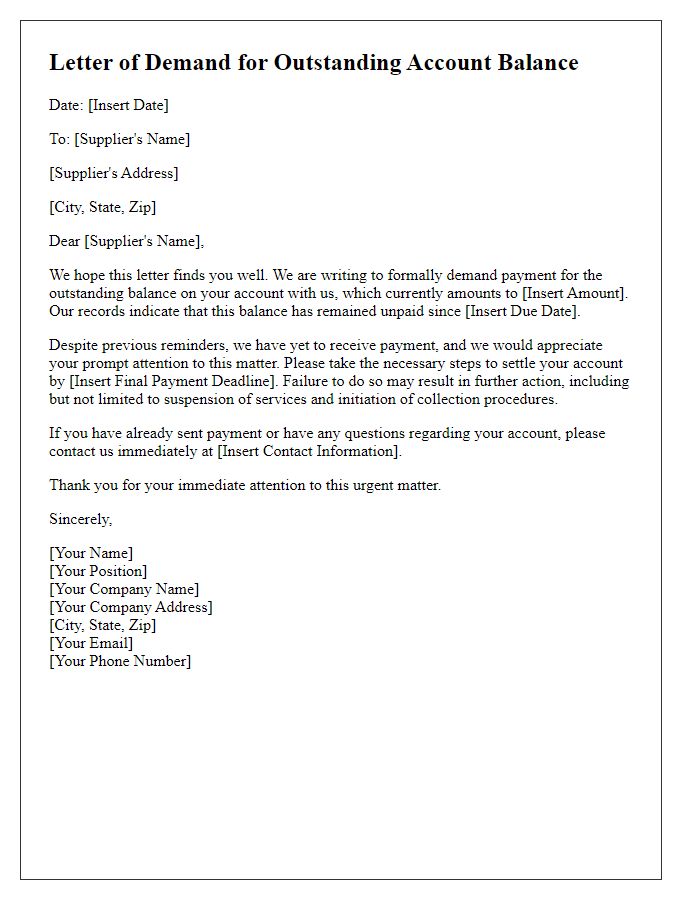

Contact Information for Follow-up

Contact information for follow-up on business supplier debt complaints includes key details such as the name of the supplier organization, typically a corporation or limited liability company (LLC), with at least one designated point of contact. This contact may include an accounts payable representative or a customer service manager. Essential items include complete phone numbers for direct communication, often consisting of local area codes plus seven-digit numbers. Verified email addresses are also crucial, using professional domains related to the supplier's business. Furthermore, mailing addresses for formal correspondence, including the street address, city, state, and zip code, enable efficient communication for resolving disputes. Timely follow-up is imperative, usually within one to two weeks after initial contact, to ensure prompt resolution of outstanding debts.

Professional and Courteous Tone

A business supplier debt complaint can arise when issues with invoices disrupt relationships. Invoices dated from specific months may remain unpaid, impacting cash flow. Timely communication is essential in addressing any discrepancies or misunderstandings regarding payment terms, typically expressed in net 30 to net 60 days. Professional courtesy maintains rapport, allowing for amicable resolution. Clear documentation, including detailed records of the initial contract and previous communications, supports claims effectively. Following up through emails or phone calls reinforces the urgency of the matter while preserving professional integrity.

Comments