Have you ever found unexpected charges on your account that left you feeling frustrated and confused? If so, you're not alone! Many individuals encounter unauthorized account charges, and it's crucial to know how to dispute them effectively. In this article, we'll provide you with a comprehensive letter template to help you reclaim your fundsâso read on to learn more!

Personal Information and Contact Details

Unauthorized account charges, particularly on credit cards or bank statements, can lead to significant financial distress. Individuals may encounter these issues when fraudsters use personal information to create accounts or make purchases. Timely action is crucial in these situations; consumers should note the specific amounts of unauthorized charges, pinpoint dates when they occurred, and reference the account numbers involved. Contacting financial institutions, such as Chase or Bank of America, within 30 days of discovering fraudulent transactions can help to initiate dispute processes. Documentation, including recent account statements and correspondence regarding the unauthorized charges, can support claims and facilitate resolution. Consumer protection laws such as the Fair Credit Billing Act in the United States may provide additional rights and avenues for recourse against unauthorized charges, underscoring the importance of promptly addressing discrepancies.

Account and Transaction Details

Unauthorized account charges can result from identity theft or clerical errors. Review account statements regularly for discrepancies, analyzing each transaction carefully. Identify specific transactions deemed unauthorized, documenting dates, amounts, and merchant names. Note the total amount charged to ensure clarity in the dispute process. Maintain a record of communication with the financial institution, including dates of contact and names of representatives spoken to. Collect supporting evidence such as receipts or emails to establish the legitimacy of your claim. Monitor credit reports from agencies like Experian, Equifax, and TransUnion for any anomalies, providing additional context to support your dispute. Proper documentation can significantly enhance the chances of a successful resolution.

Explanation of Dispute

Unauthorized account charges can lead to significant financial concerns for consumers. For instance, a charge of $150 on a credit card statement from an unfamiliar online retailer may indicate identity theft. Consumers should closely examine transactions, noting that unauthorized charges can arise from data breaches, phishing attacks, or even clerical errors by financial institutions. Reporting these discrepancies immediately, typically within 60 days of the statement date, to the account issuer or relevant bank is crucial. Documenting all communications and disputes strengthens the consumer's case for reimbursement. Additionally, utilizing the Fair Credit Reporting Act can help ensure the swift investigation of fraudulent charges, minimizing potential financial loss.

Requested Resolution

Unauthorized account charges can lead to significant financial discrepancies. Customers often experience distress when transactions appear on monthly statements, which could include credit cards or bank accounts. These charges might originate from fraudulent activities or clerical errors, impacting finances greatly. It is essential to provide specific details regarding the transactions in question, including date and amount, to facilitate an efficient resolution. Timely reporting to financial institutions, typically within 60 days of noticing discrepancies, can aid in dispute processes. Effective communication with customer service representatives, including details of previous interactions, enhances the likelihood of satisfactory resolution.

Supporting Documentation and Evidence

Disputing unauthorized account charges requires precise documentation. A detailed account statement should highlight the disputed transactions, including date, amount, and merchant name. Supporting evidence may include correspondence with the merchant, screenshots of account activity, and copies of receipts, if applicable. Furthermore, providing a copy of your identification and a recent utility bill can verify your address and identity, enhancing the credibility of your dispute. Be sure to document all communication with your financial institution, noting dates and representatives spoken to, which may aid in resolving the issue efficiently.

Letter Template For Disputing Unauthorized Account Charges Samples

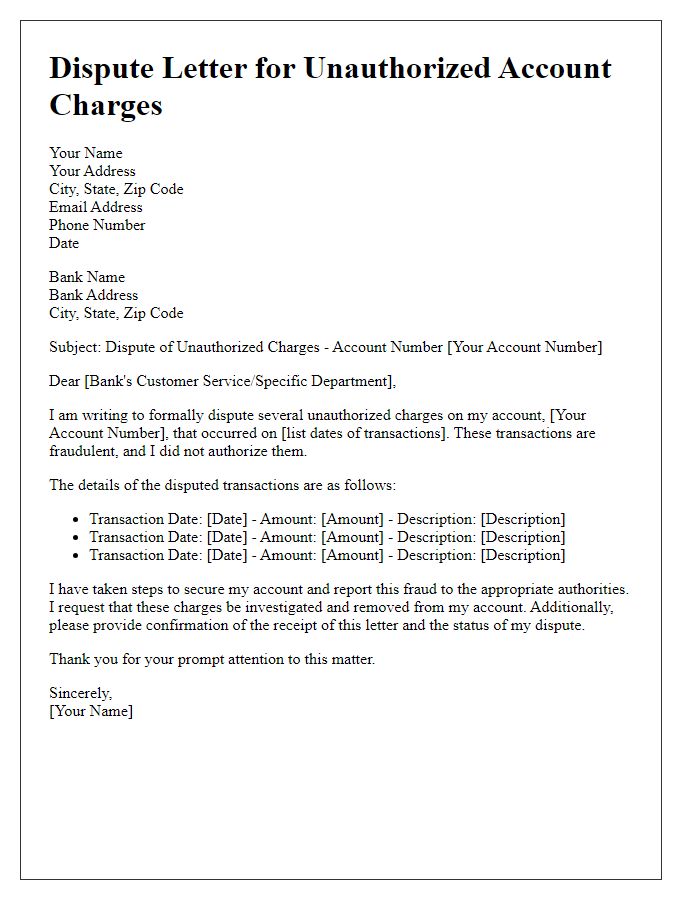

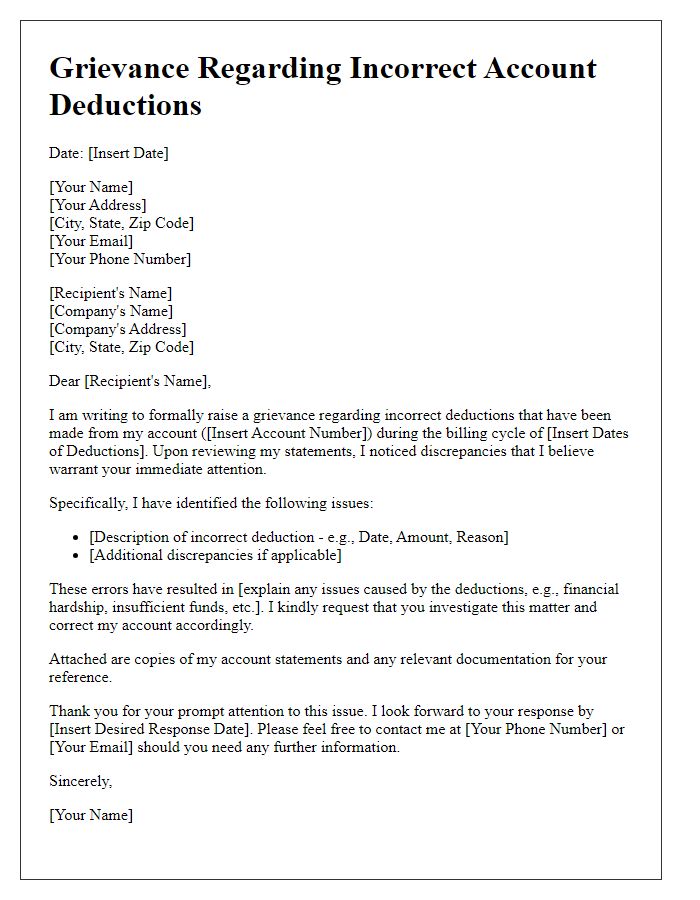

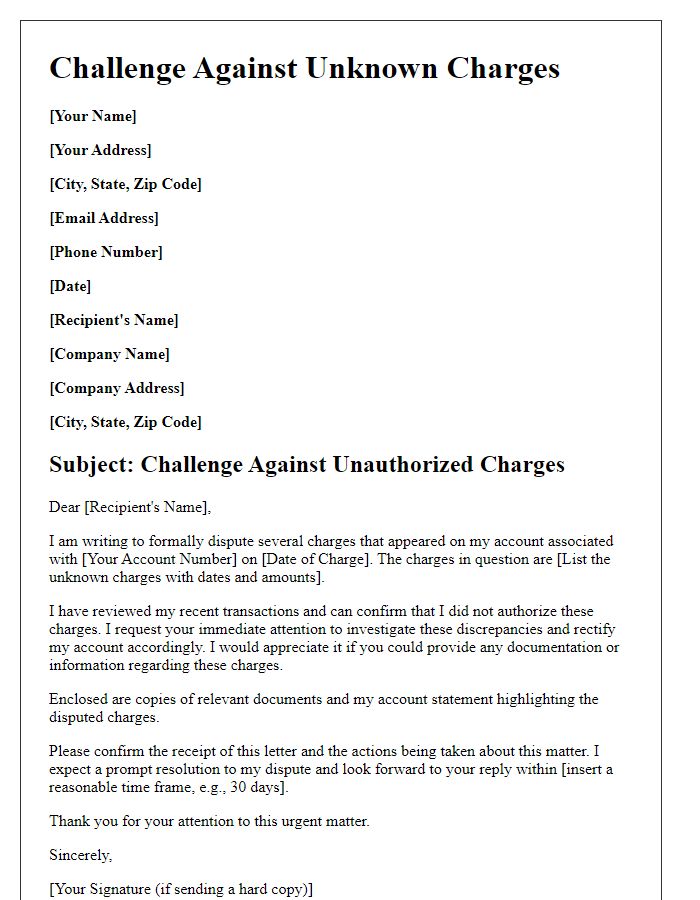

Letter template of dispute for unauthorized account charges due to fraudulent transactions

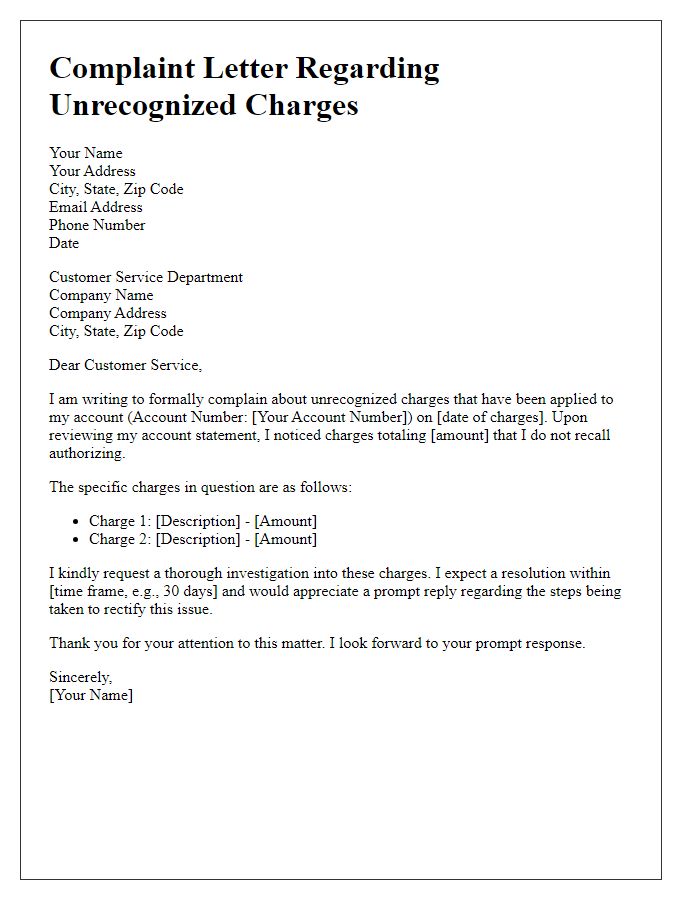

Letter template of complaint regarding unrecognized charges on my account

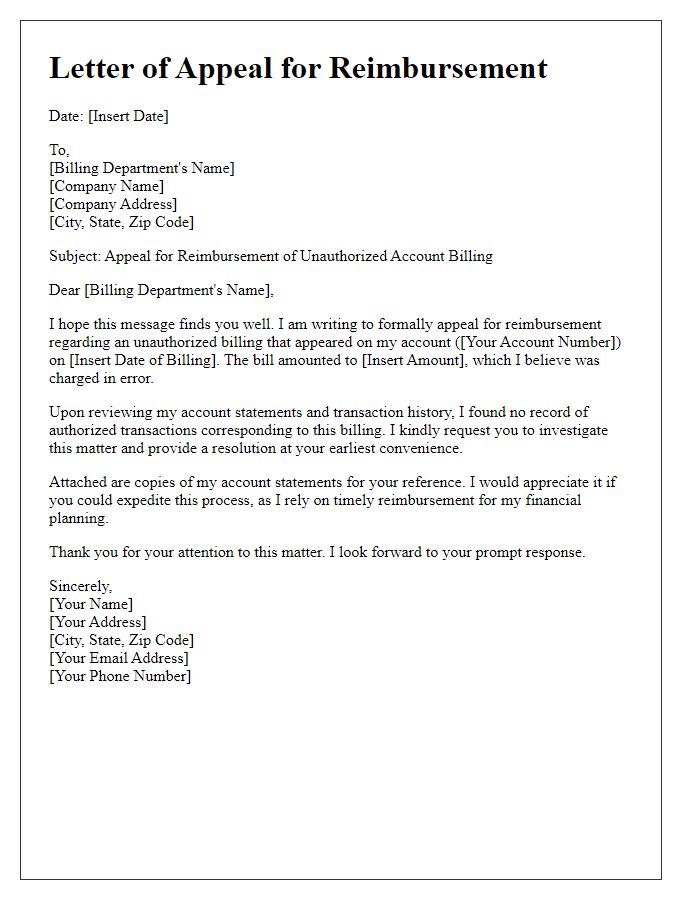

Letter template of appeal for reimbursement of unauthorized account billing

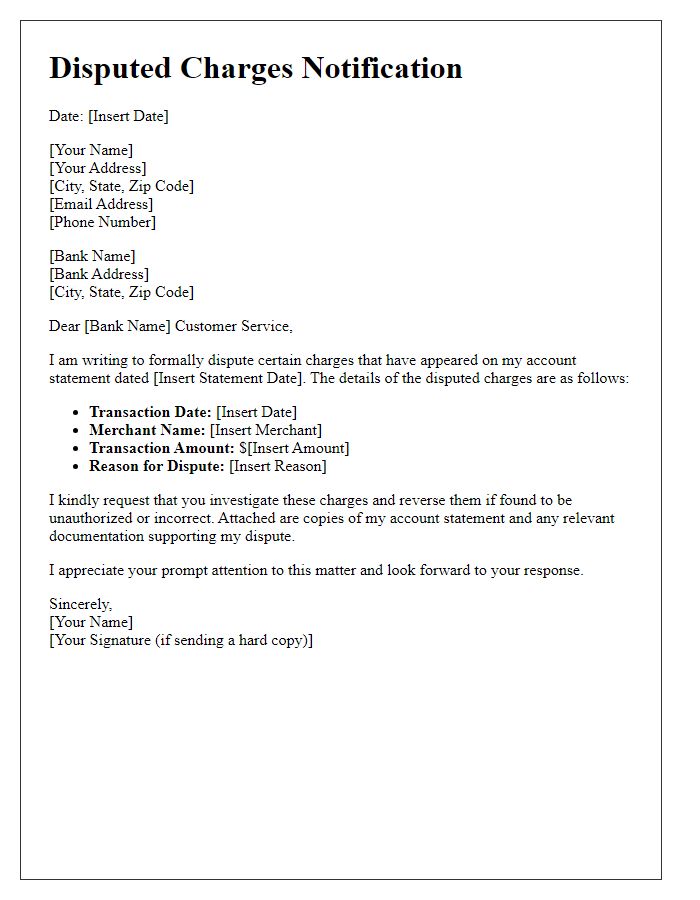

Letter template of notification for disputed charges appearing on my statement

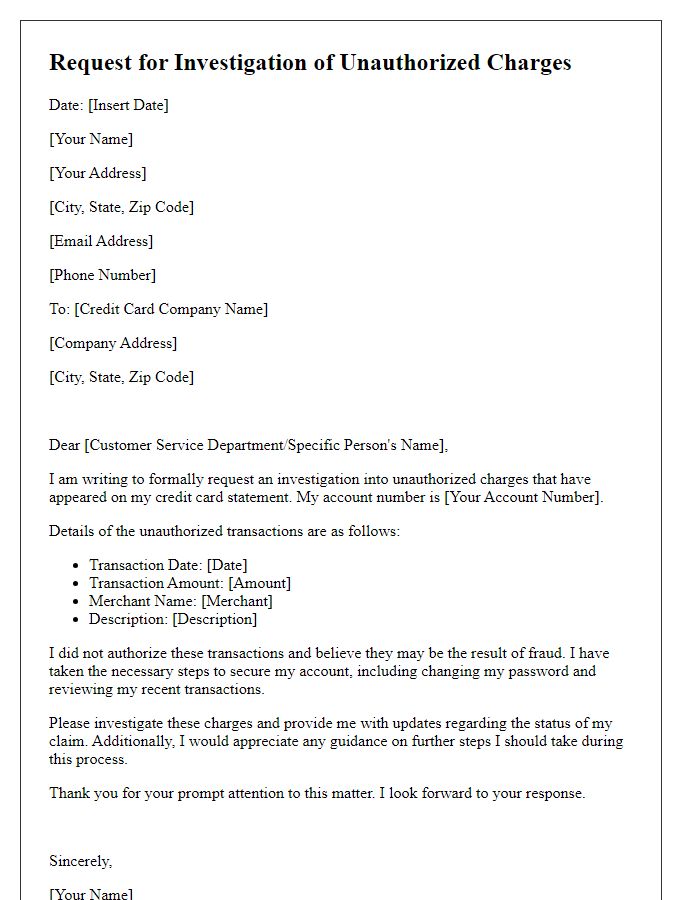

Letter template of request to investigate unauthorized charges on my credit card

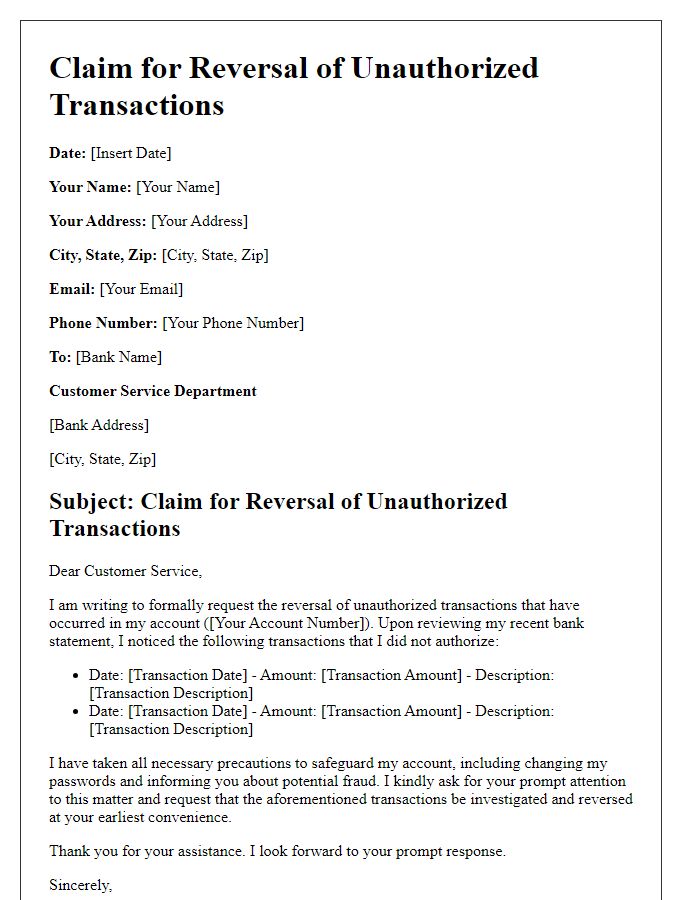

Letter template of claim for reversal of unauthorized transactions in my account

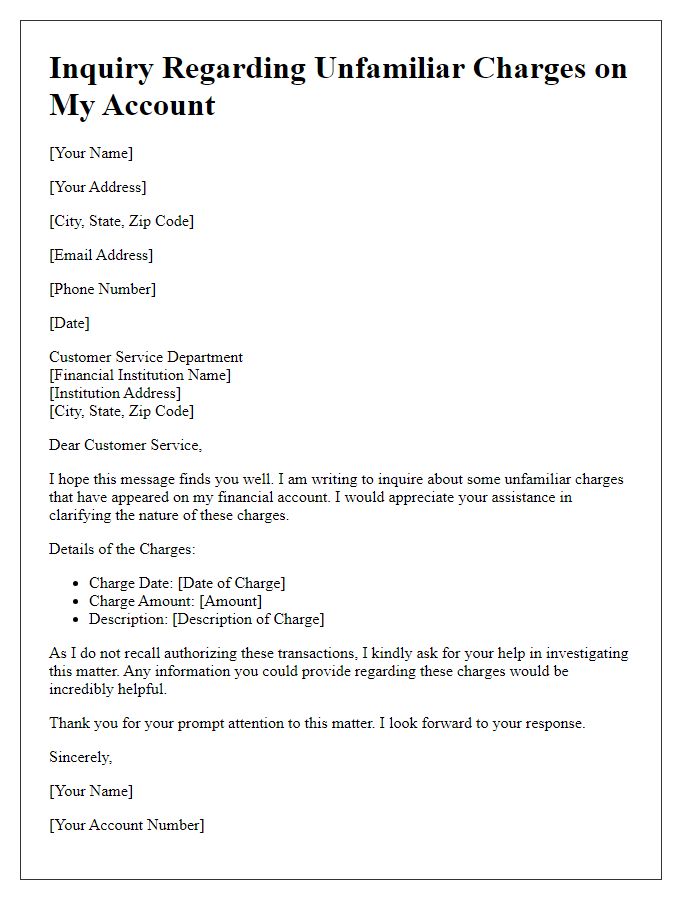

Letter template of inquiry about unfamiliar charges on my financial account

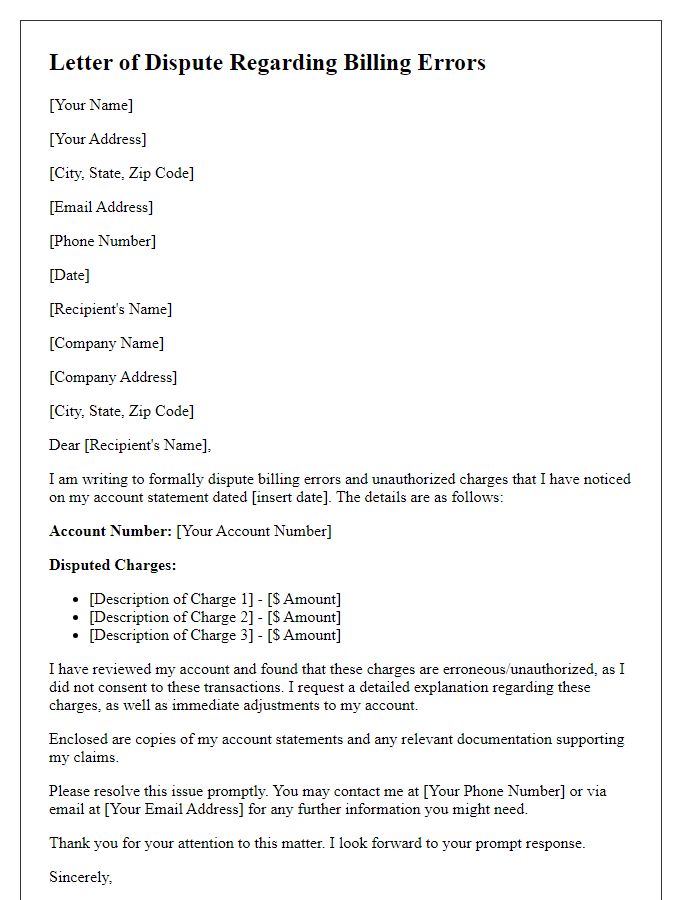

Letter template of formal dispute for billing errors and unauthorized charges

Comments