Hey there! If you've ever found yourself in a pinch and struggled to make a mortgage payment on time, you're not alone. Life can throw unexpected challenges our way, and sometimes, we need to reach out and explain our situation to lenders. In this article, we'll discuss how to craft a thoughtful letter that clarifies your late payment, reassures your lender, and sets the stage for open communication. Keep reading to discover tips and templates that can help you navigate this tricky but not uncommon situation!

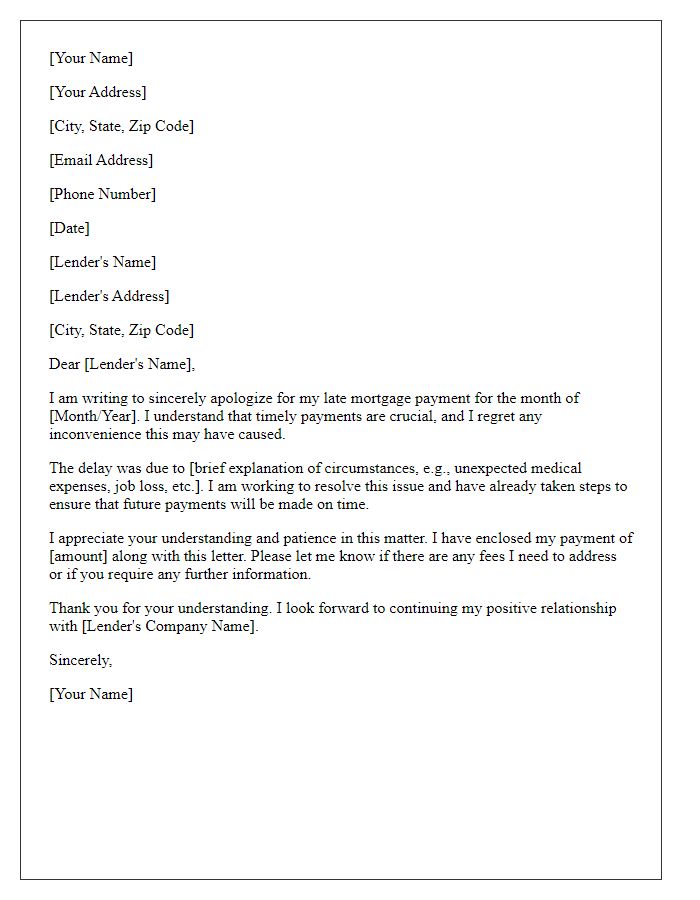

Apology and Acknowledgment

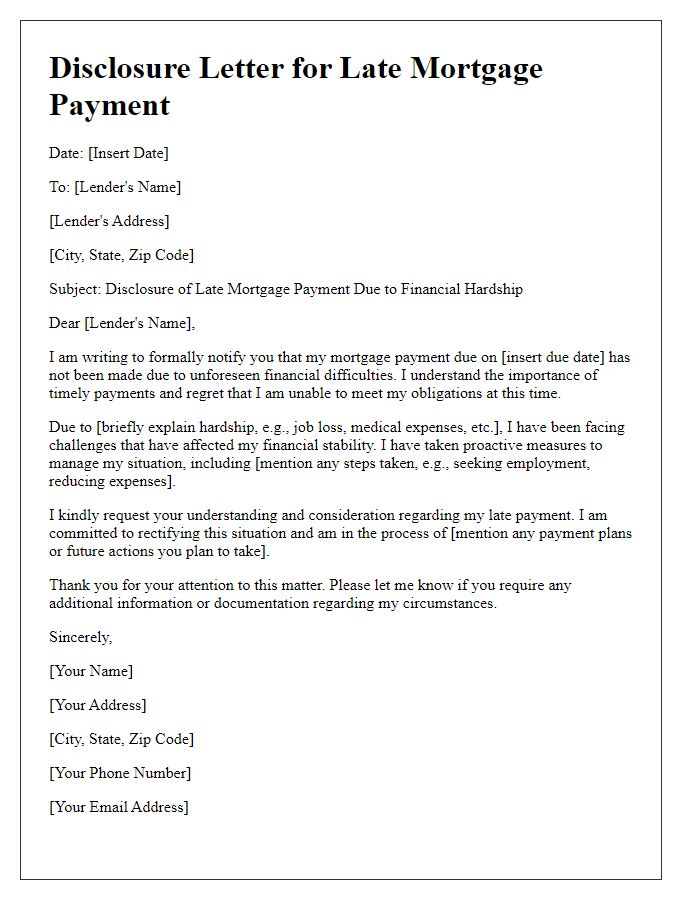

Late mortgage payments can occur due to various reasons, impacting financial stability significantly. Sometimes unexpected life events like job loss (affecting over 3% of workers during economic downturns) lead to late payments. Other times, medical emergencies might arise, with healthcare costs averaging around $10,000 for uninsured individuals in the United States. Communication with mortgage lenders is crucial, as they can offer assistance. Some lenders provide loan modification options or temporary forbearance plans, allowing homeowners to navigate financial difficulties more effectively. Timely acknowledgment of the issue can foster a better relationship with the lender and ensure that future obligations are met on time.

Reason for Delay

Unexpected financial hardships such as medical emergencies or temporary job loss can significantly impact timely mortgage payments, leading to delays. The current economic climate, with inflation rates soaring at approximately 7% as of 2023, has exacerbated budgeting challenges for many homeowners. A recent illness requiring extensive treatment or hospitalization can deplete savings and disrupt cash flow, preventing the fulfillment of mortgage obligations. Furthermore, fluctuations in the job market, with unemployment rates reaching 4% in some areas, can result in gaps in income, making it difficult for individuals to maintain regular payment schedules. Addressing these reasons for delay can foster understanding and facilitate solutions with mortgage lenders, potentially allowing for deferred payments or other accommodations.

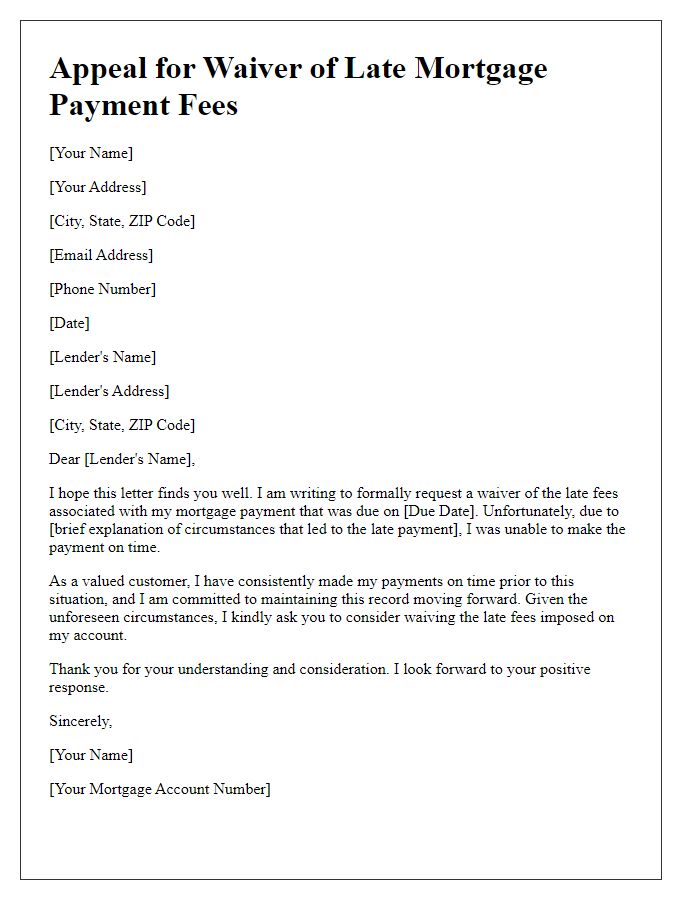

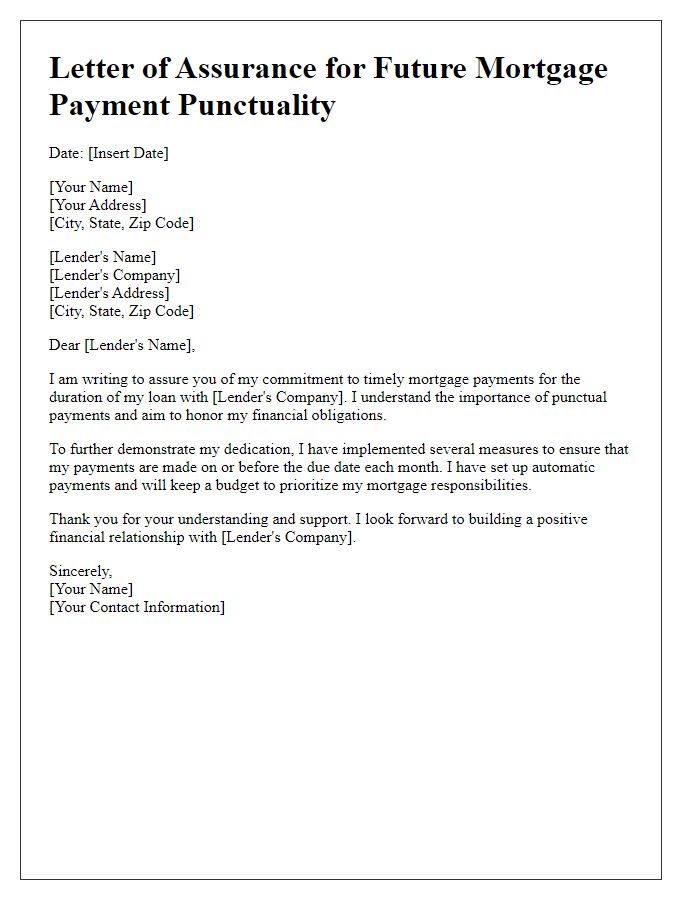

Assurance of Payment

Delayed mortgage payments can often cause concern among homeowners and lenders. Various circumstances, such as unexpected medical expenses or job loss, may contribute to these issues. Communication with the mortgage provider is crucial to ensure understanding and flexibility. Maintaining transparency about financial situations allows for potential loan modification options. Homeowners should be aware of the importance of prompt communication within the grace period to mitigate penalties. Showing commitment to payment assurance can help preserve the relationship with the lender and potentially avoid foreclosure proceedings.

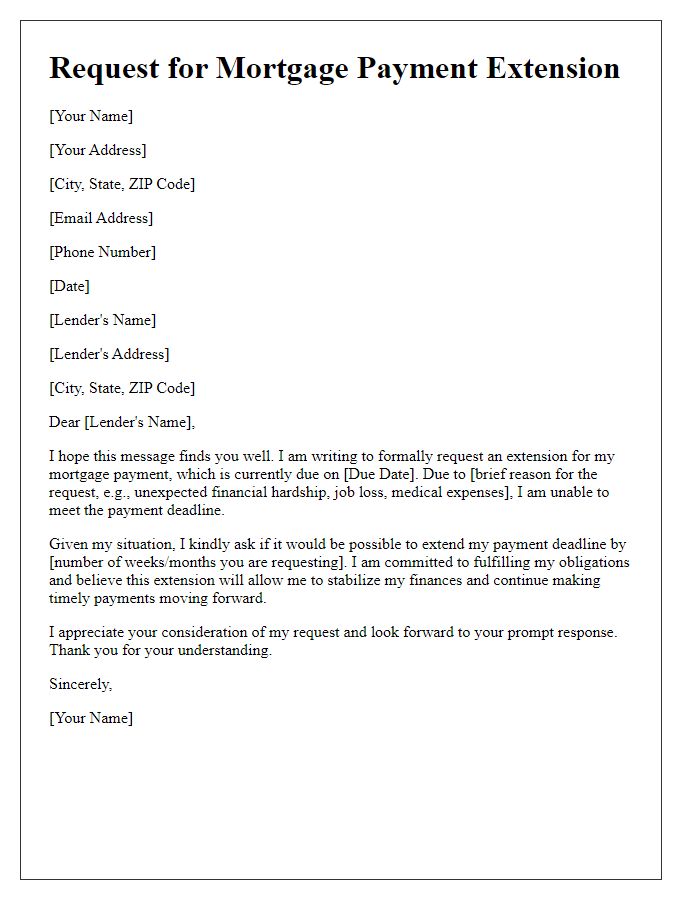

Future Prevention Plan

Late mortgage payments can impact credit scores significantly, often leading to long-term financial repercussions. Mortgage payments, typically due on the first of each month, can be missed for various reasons, such as unexpected job loss or medical emergencies. Establishing a future prevention plan is crucial for avoiding similar situations. Creating a budget that includes an emergency fund--ideally covering three to six months of expenses--can provide a safety net during financial hardships. Automatic payment setups through banks or mortgage lenders can also ensure timely payments, thereby reducing the risk of late fees and negative credit marks. Regularly reviewing financial statements and seeking financial advice from certified professionals can further enhance money management skills, ultimately securing a stable financial future.

Contact Information for Follow-Up

Explaining late mortgage payment requires a clear understanding of financial responsibilities and potential consequences. A borrower might face a late fee, typically around 4% of the monthly payment, if the mortgage payment is not made within the 15-day grace period. Consistent late payments can impact credit scores, potentially dropping them by 100 points or more, leading to higher interest rates for future loans. Communication with the lender is crucial; providing a valid reason such as a temporary financial setback, unemployment, or unexpected medical expenses can foster understanding. Documenting financial situations with pay stubs, bank statements, or medical bills can be beneficial. Seeking advice from financial counseling services can provide strategies for managing payments and avoiding foreclosure risks.

Letter Template For Explaining Late Mortgage Payment Samples

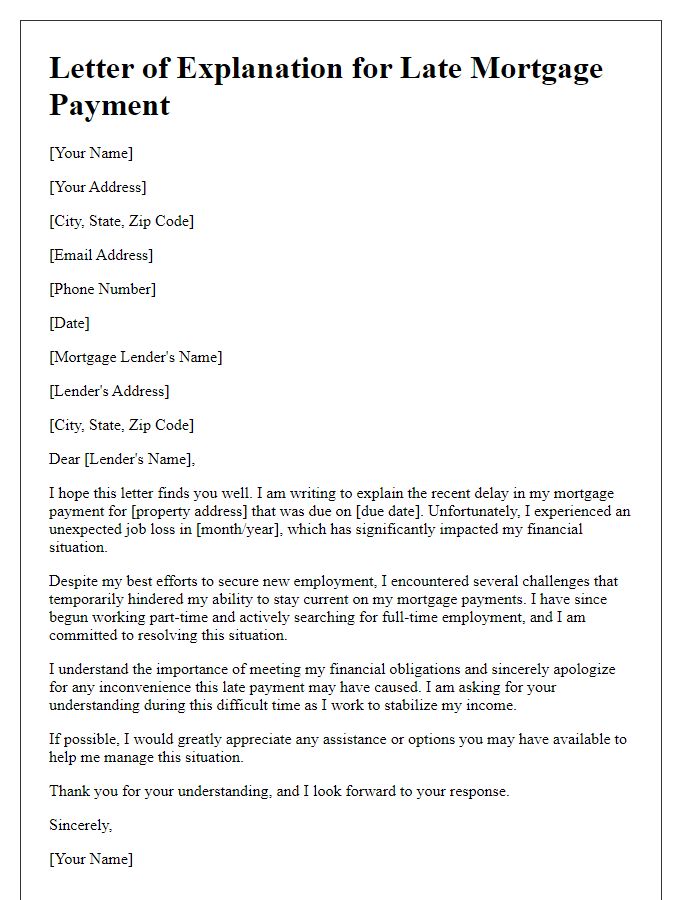

Letter template of explanation for late mortgage payment due to job loss

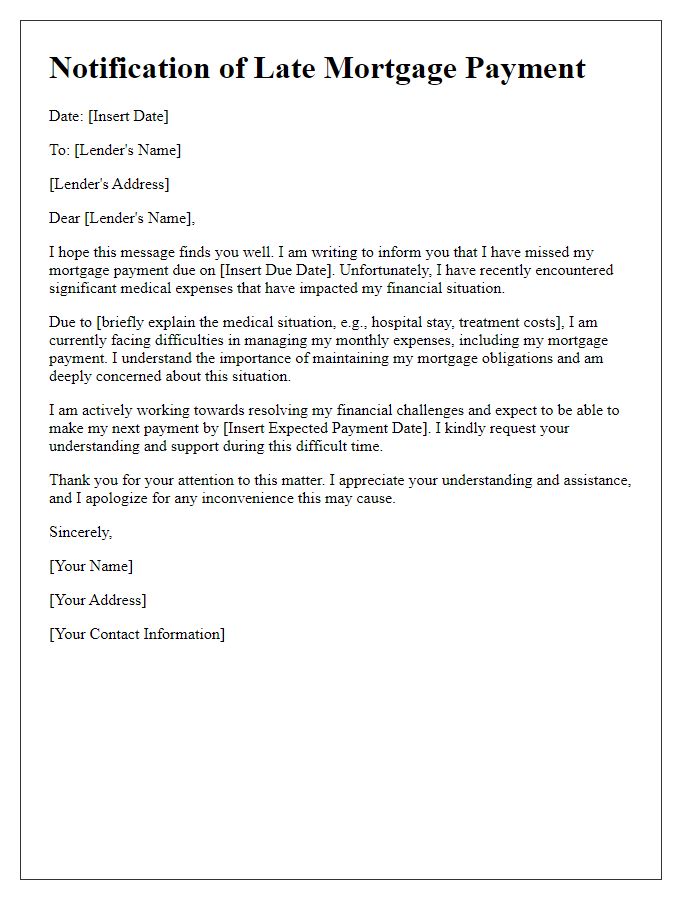

Letter template of notification for late mortgage payment due to medical expenses

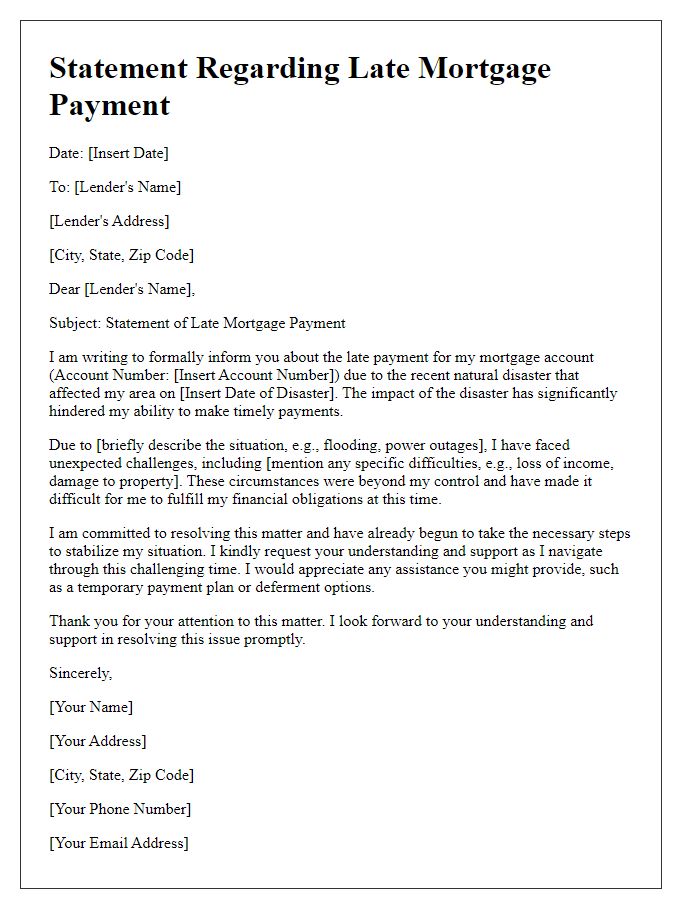

Letter template of statement regarding late mortgage payment due to natural disaster

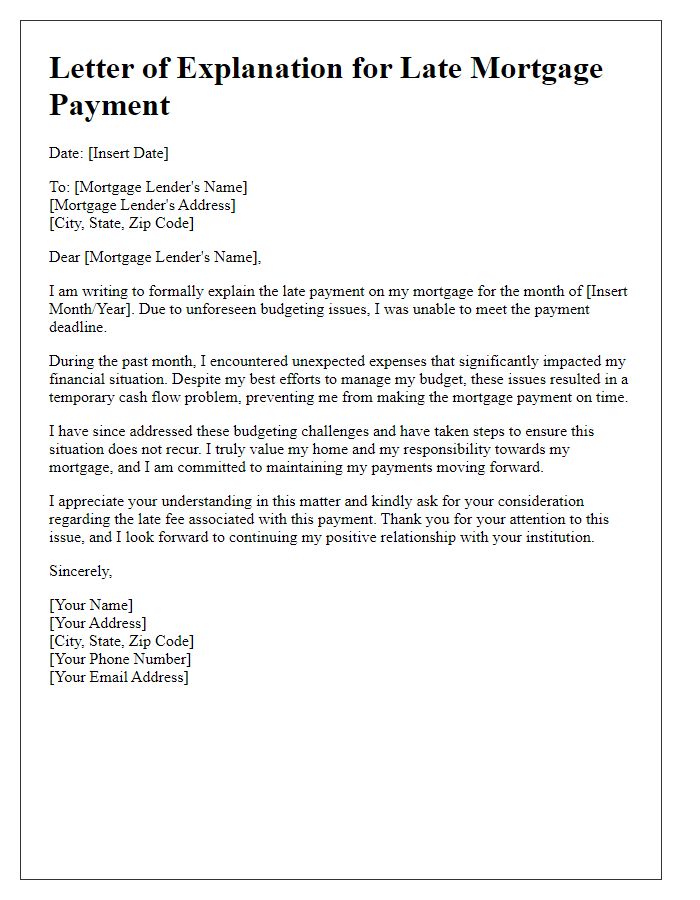

Letter template of explanation for late mortgage payment caused by budgeting issues

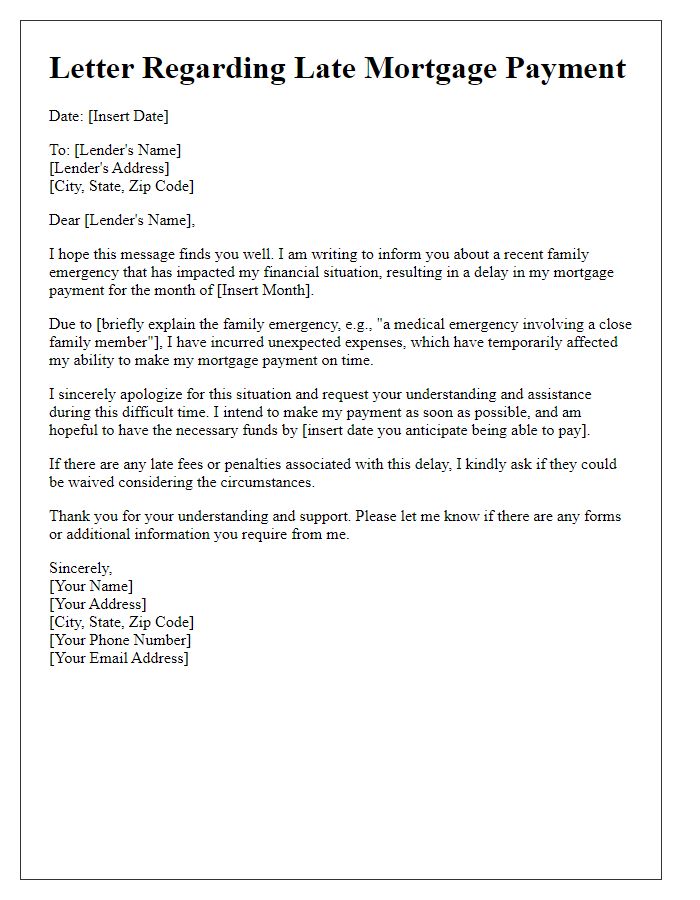

Letter template of communication for late mortgage payment due to family emergency

Comments