Have you ever found yourself facing an unexpected debt that just doesn't seem right? It can be incredibly frustrating to receive a notice about a debt you believe is incorrectâespecially when it feels like your financial future hangs in the balance. Crafting the perfect dispute letter is crucial in resolving the matter and protecting your credit score. Ready to learn how to effectively challenge that debt? Read on for a step-by-step guide!

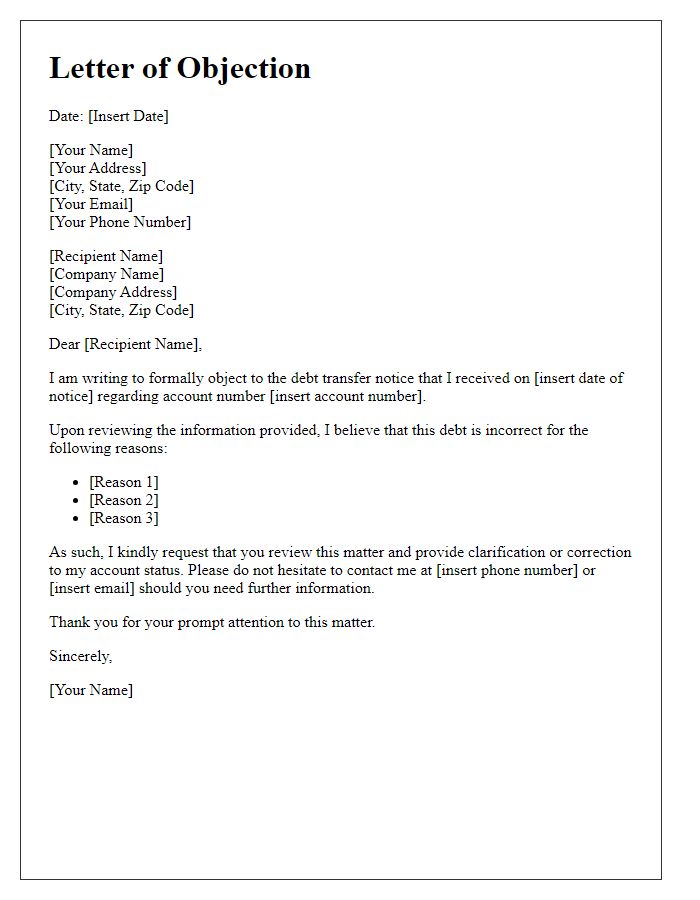

Concise explanation of the error.

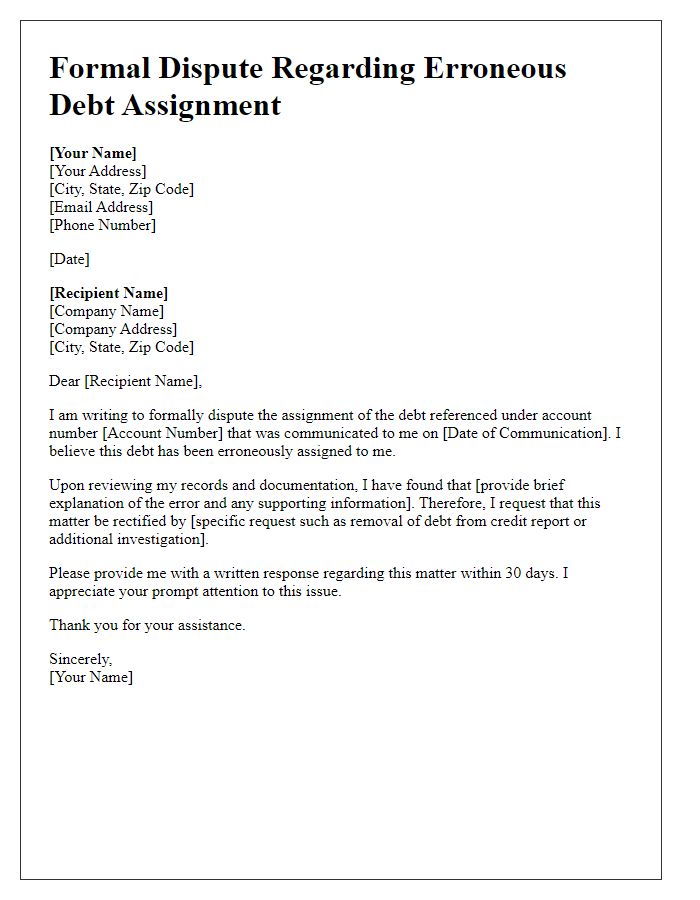

A recent credit report from Experian revealed an erroneous debt assignment linked to account number 123456789. This incorrect entry, attached to the name of John Smith, incorrectly accounts for $5,000 owed to XYZ Collections LLC dated January 15, 2023. However, the legitimate debt was settled on December 1, 2022, confirmed by the payment records from ABC Bank. The inclusion of this inaccurate information has adversely impacted the credit score, creating significant obstacles in securing a mortgage in Boston, Massachusetts. Immediate rectification of this discrepancy is required to ensure accurate reporting and fair access to financial opportunities.

Accurate account information.

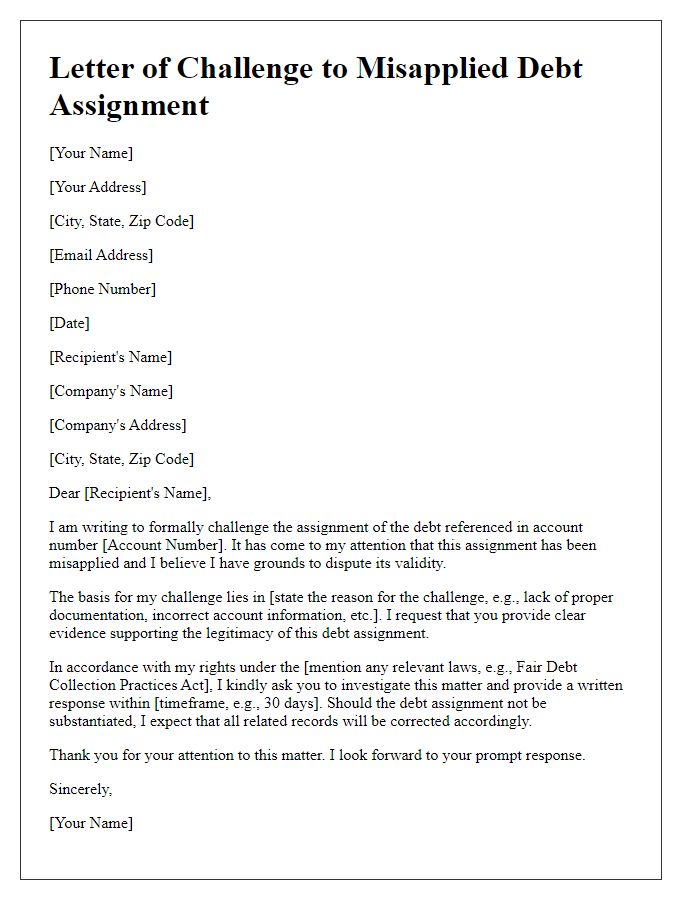

Disputing incorrect debt assignments requires detailed and accurate account information. Inconsistent data, such as incorrect account numbers, misreported balances, or erroneous dates of delinquency, can significantly impact the resolution process. Gathering documents from sources like credit reports or creditor statements ensures that the claims made are backed by verifiable evidence. Clear identification of the debt in dispute, including the creditor's name and the original account details, strengthens your case. Timely submission of this information according to the format set by financial institutions, typically within 30 days, is crucial for compliance with regulations outlined in the Fair Debt Collection Practices Act (FDCPA). Documentation must be sent to the appropriate debt collection agency, often requiring a certified mailing approach for tracking.

Reference to supporting documents.

Disputing an incorrect debt assignment requires a clear and factual representation of the situation. Attach supporting documents such as the original credit agreement, payment records, and any correspondence that contradicts the debt claim. Identify key details such as the creditor's name, the assigned debt amount, and any account numbers relevant to the dispute. Emphasize evidence showing the debt's validity, such as payment confirmations or communications regarding account status. Inclusion of dates, amounts, and parties involved enhances accountability. Ensure to reference any laws or regulations applicable in the jurisdiction, reinforcing your position. Documenting these details convincingly can facilitate resolution.

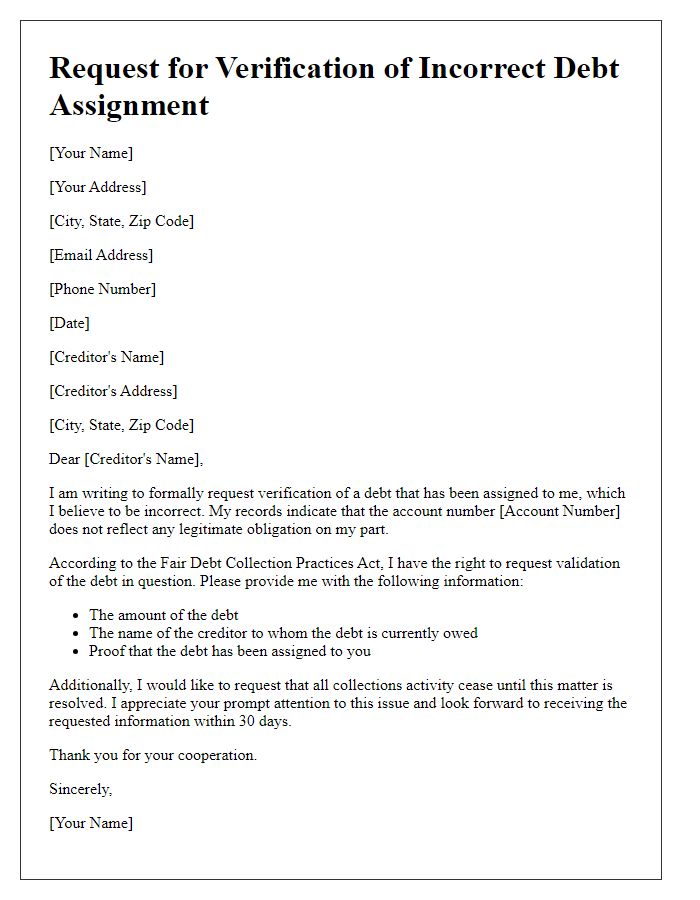

Request for debt validation.

A significant issue arises when individuals receive notices about incorrect debt assignments, often leading to stress and confusion. The Fair Debt Collection Practices Act (FDCPA) requires debt collectors to validate debts upon request, providing essential documentation of the claimed amount. When disputing an incorrect debt assignment, individuals should address the collection agency directly (such as ABC Collections based in New York City) and clearly state their request for validation. It's essential to include personal information such as full name, address, and account number related to the disputed debt while maintaining a record of communication. Timely responses are crucial, typically within 30 days (the standard validation period), as failure to provide adequate proof may result in the withdrawal of the debt claim.

Contact details for follow-up.

Disputing incorrect debt assignments often requires a detailed understanding of the specific debt amount, the original creditor's information, and any relevant account numbers. Clients should include their full name, current address, and contact number in correspondence. For example, if a debt of $1,500 assigned to a collection agency, such as ABC Collections located in New York, is incorrect, the debtor must clearly state the error. Providing documentation like billing statements or account summaries is essential to support their claim. Ensuring that all communication is documented, including dates and descriptions of conversations with creditors, is crucial for resolving disputes effectively.

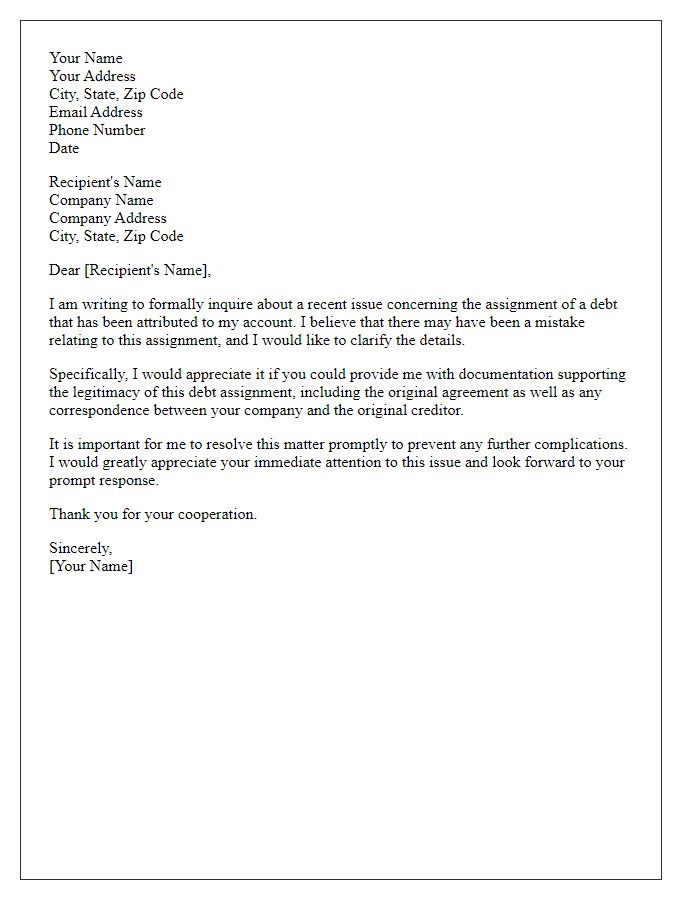

Letter Template For Disputing Incorrect Debt Assignment Samples

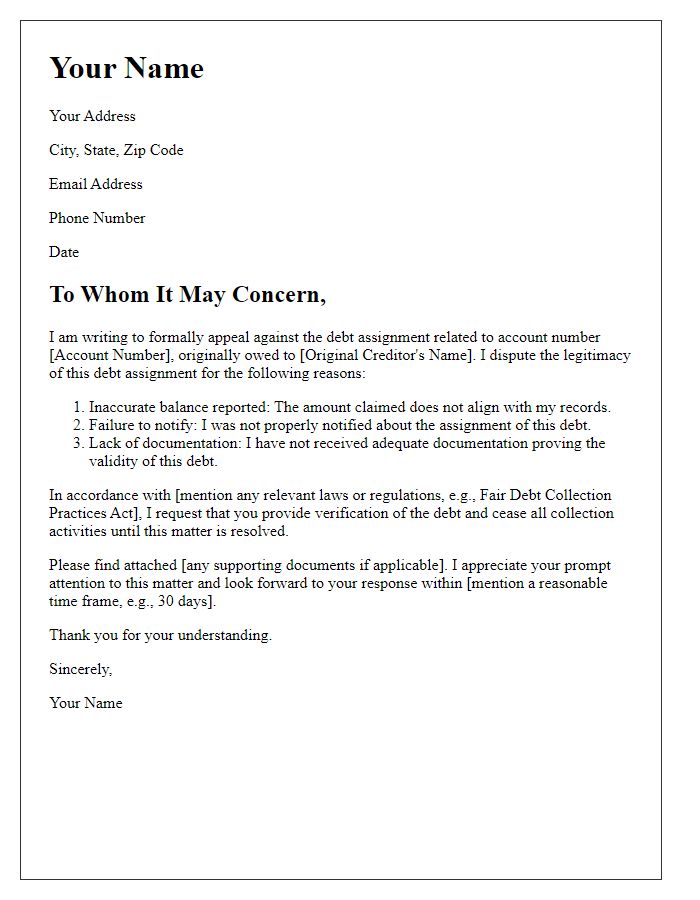

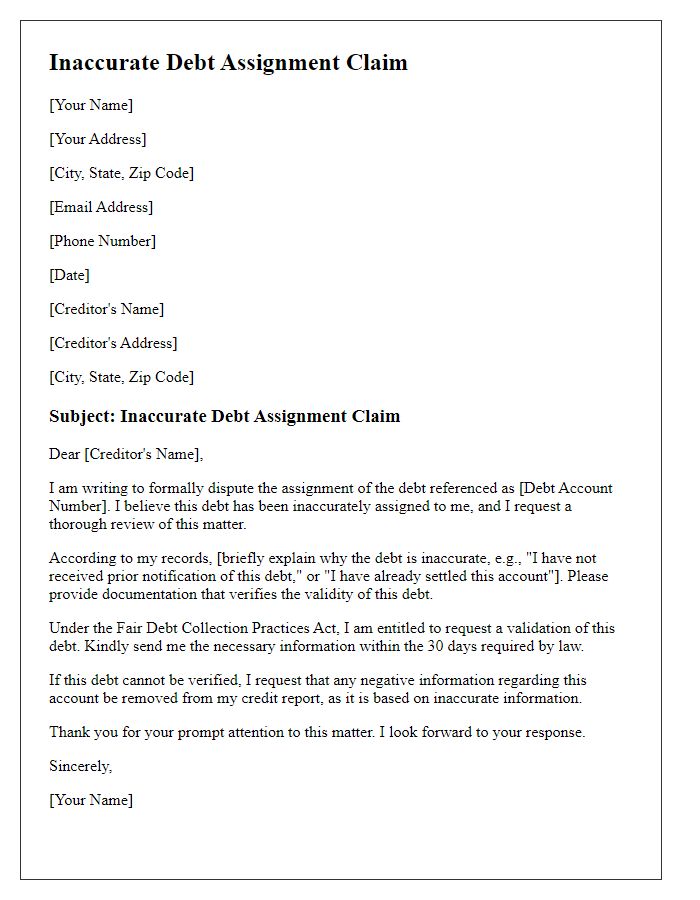

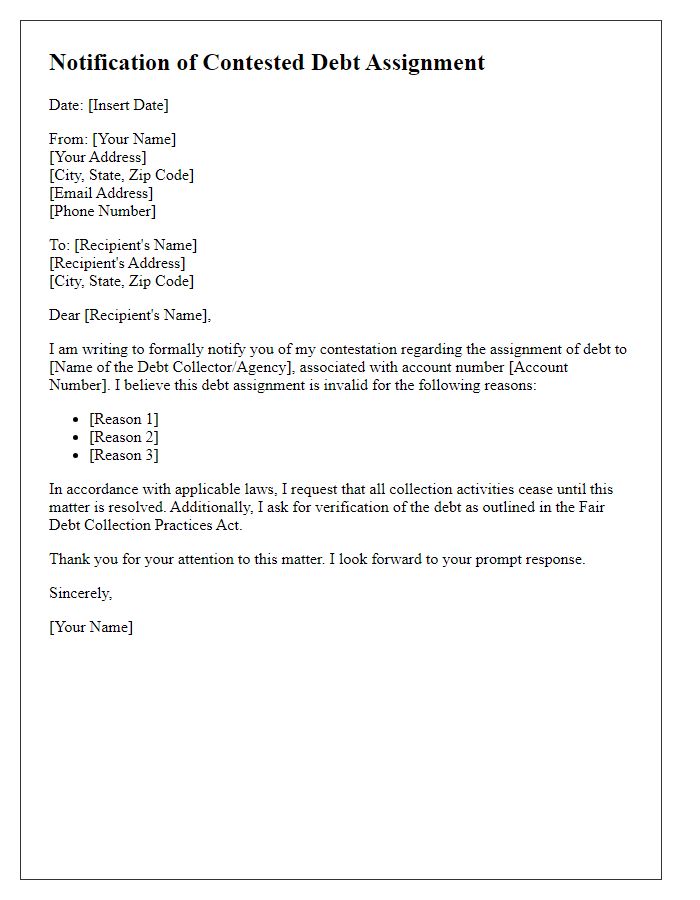

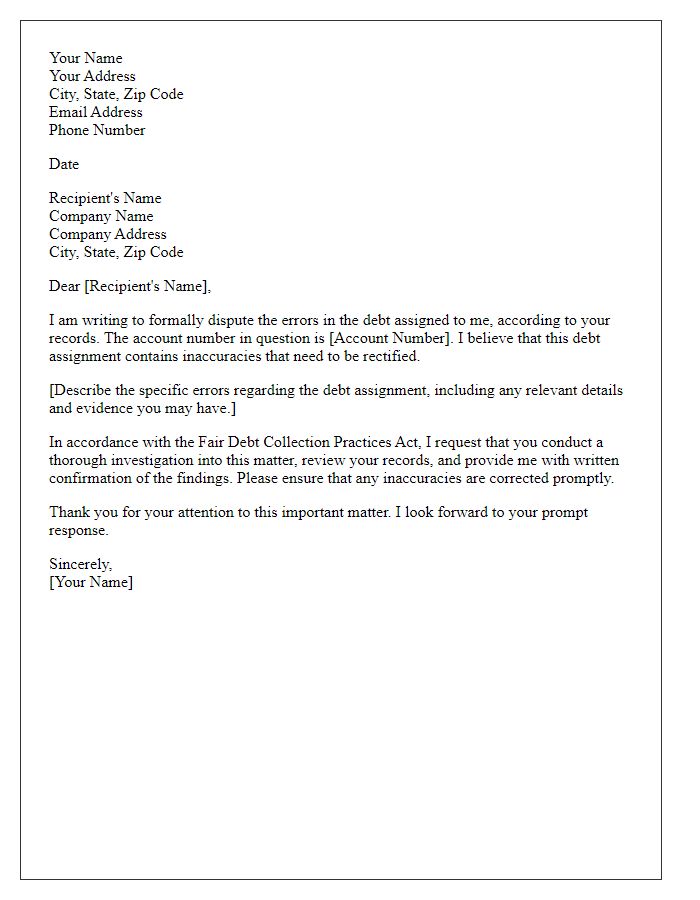

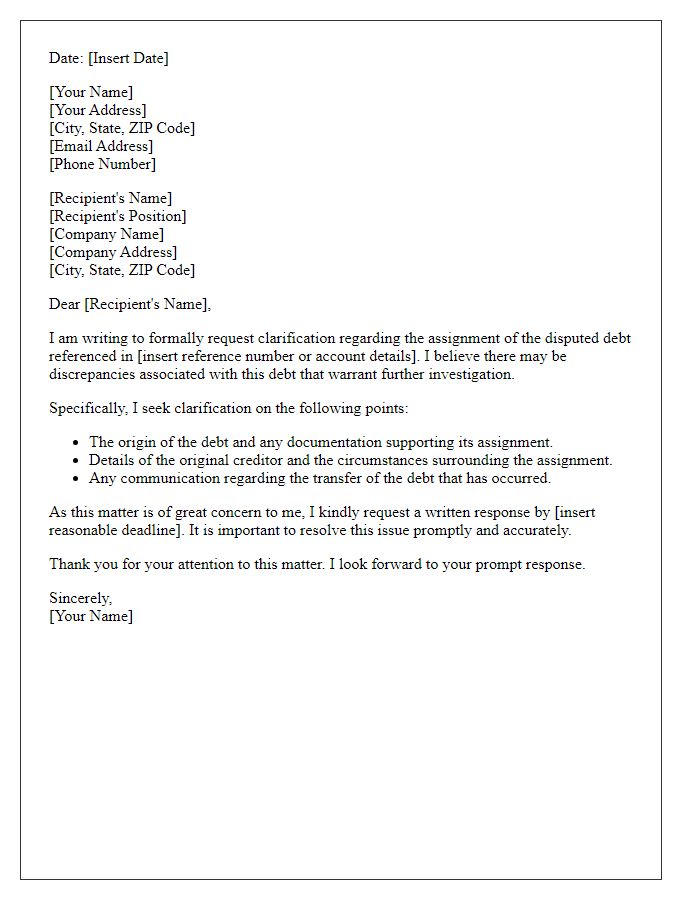

Letter template of request for verification of incorrect debt assignment

Comments