Are you feeling weighed down by a low credit score due to past debt issues? You're not alone, and the good news is that there are ways to improve your financial reputation. In this article, we'll guide you through the process of crafting a compelling letter to appeal your credit score, ensuring that you present your case effectively. So, settle in and let's explore how you can take charge of your credit situationâread on to learn more!

Clear explanation of the situation

A credit score can be negatively impacted by unresolved debts, which may arise from circumstances such as unexpected medical bills or job loss. In many cases, debts, outlined as accounts in collections, appear and influence the credit score significantly (often by 100 points or more) in the case of high delinquency rates. Credit utilization ratio, a key metric evaluated by credit agencies, can also suffer due to increased outstanding balances compared to available credit limits. Timely payment history, representing 35% of the FICO score, is crucial; late payments exceeding 30 days can remain on the credit report for up to seven years, causing long-term effects. Providing clear documentation of extenuating circumstances, such as medical records or proof of job loss, may strengthen an appeal to credit bureaus or creditors, potentially leading to debt forgiveness or score recovery.

Supporting documentation

Submitting a credit score appeal due to erroneous debt entries requires clear and concise supporting documentation. First, include your credit report dated from major bureaus such as Experian, TransUnion, or Equifax, highlighting discrepancies in debts listed. Next, attach evidence such as payment receipts, settlement letters, or correspondence with creditors proving that debts have been resolved or inaccurately reported. Additionally, collect bank statements demonstrating timely payments that align with the disputed entries. Include identification details such as your Social Security number (last four digits) and address for verification purposes. Organizing these documents chronologically will strengthen your case, providing a clear narrative of your credit history.

Request for specific action

A credit score appeal can be crucial for individuals seeking to rectify inaccuracies stemming from outstanding debts. Accurate credit scores are essential for securing loans, mortgages, and other financial services, with scores ranging from 300 to 850. Individuals may notice discrepancies due to late payments, collections, or errors in reporting by creditors such as banks or credit card companies. The Fair Credit Reporting Act provides a framework for consumers to dispute incorrect information, requiring a thorough investigation within 30 days. Providing supporting documentation including payment records or account statements can enhance the chances of a successful appeal. Consequently, timely appeals can lead to reinstatement of creditworthiness, ultimately affecting interest rates and borrowing potential for individuals seeking financial stability.

Polite and professional tone

A significant number of consumers face substantial challenges related to credit scores, which can be adversely affected by outstanding debts. These debts, often represented as unpaid bills or charged-off accounts, can lead to a lower credit score, particularly when payment histories are reported by credit bureaus like Experian, TransUnion, and Equifax. A credit score, which ranges from 300 to 850, influences the ability to obtain loans, credit cards, or mortgages. For example, a score below 600 may categorize a consumer as a high-risk borrower, resulting in higher interest rates or declined applications. Addressing inaccuracies or requesting reconsideration for negative items can be vital in improving one's credit health, potentially increasing access to better financial options and contributing to overall financial stability.

Contact information for follow-up

Credit scores, calculated by major bureaus like FICO and VantageScore, can significantly impact financial opportunities. For individuals facing credit challenges, submitting an appeal due to inaccuracies or unjust debt is essential. Key documents, such as credit reports from Experian and TransUnion, showing discrepancies are vital for a compelling argument. Providing accurate, updated contact information ensures timely communication. A well-structured appeal can lead to score improvements, potentially influencing loan approvals or interest rates on mortgages and credit cards. Understanding local consumer protection laws, like the Fair Credit Reporting Act, also empowers individuals in their appeal process.

Letter Template For Credit Score Appeal Due To Debt Samples

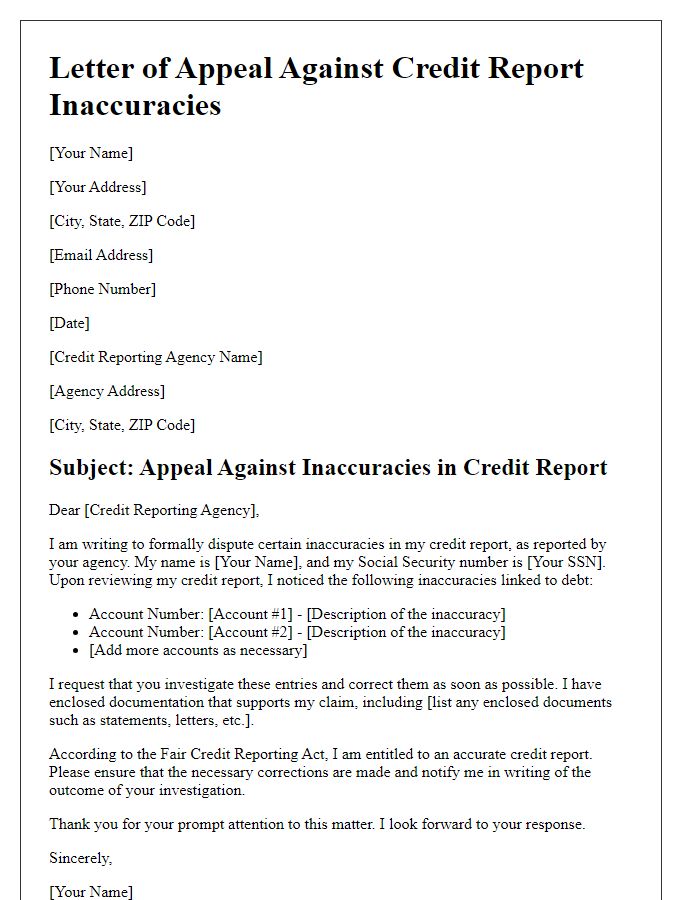

Letter template of appeal against credit report inaccuracies linked to debt.

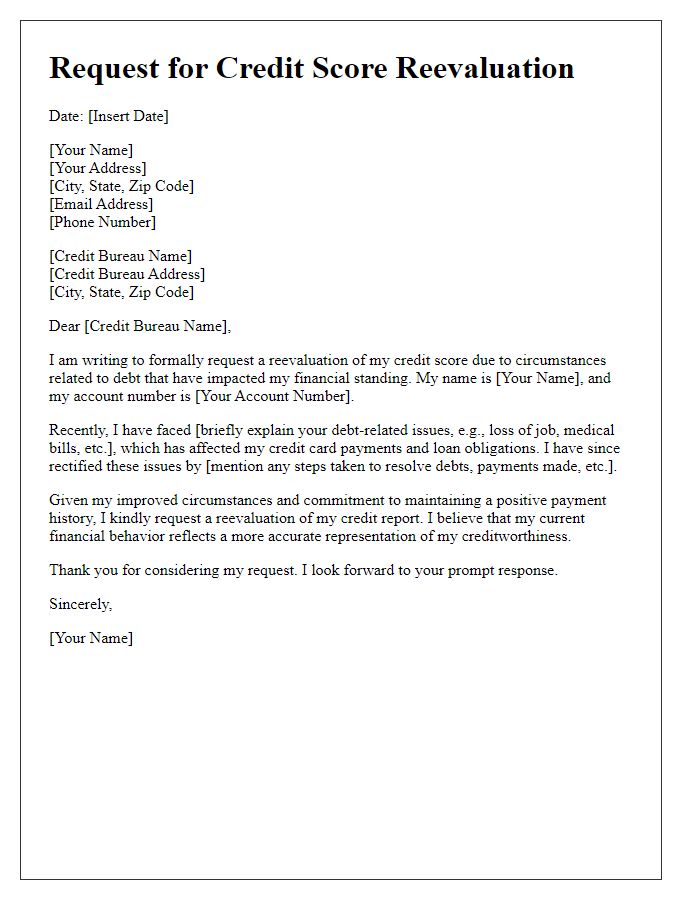

Letter template of request for credit score reevaluation due to debt-related issues.

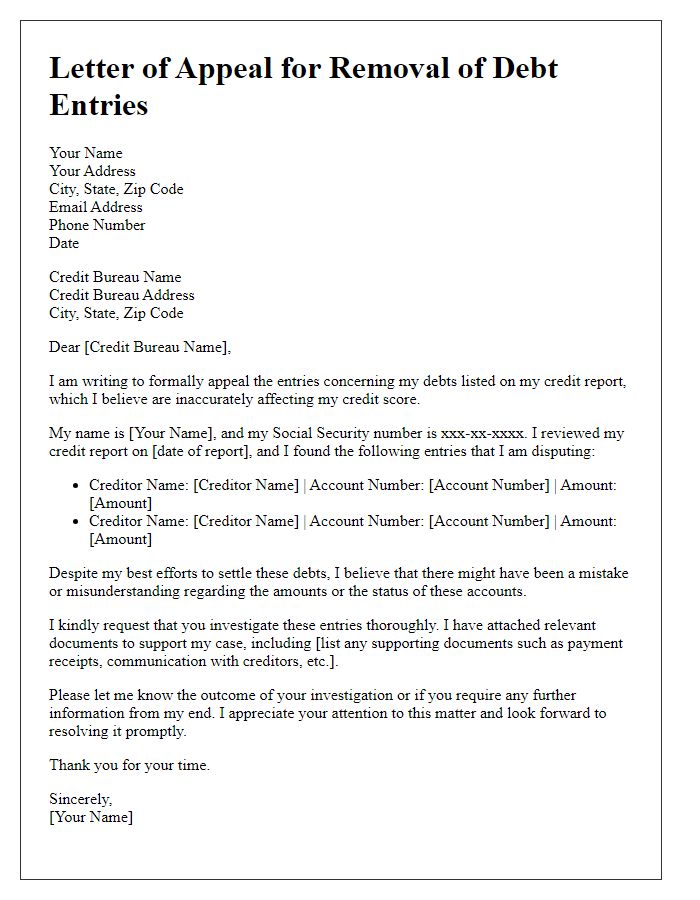

Letter template of appeal for removal of debt entries impacting credit score.

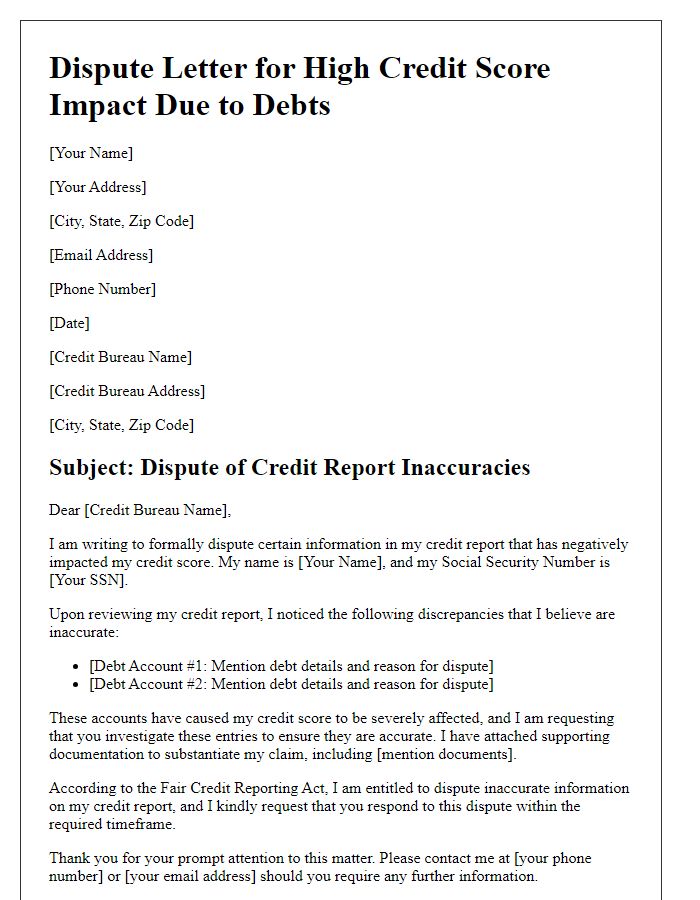

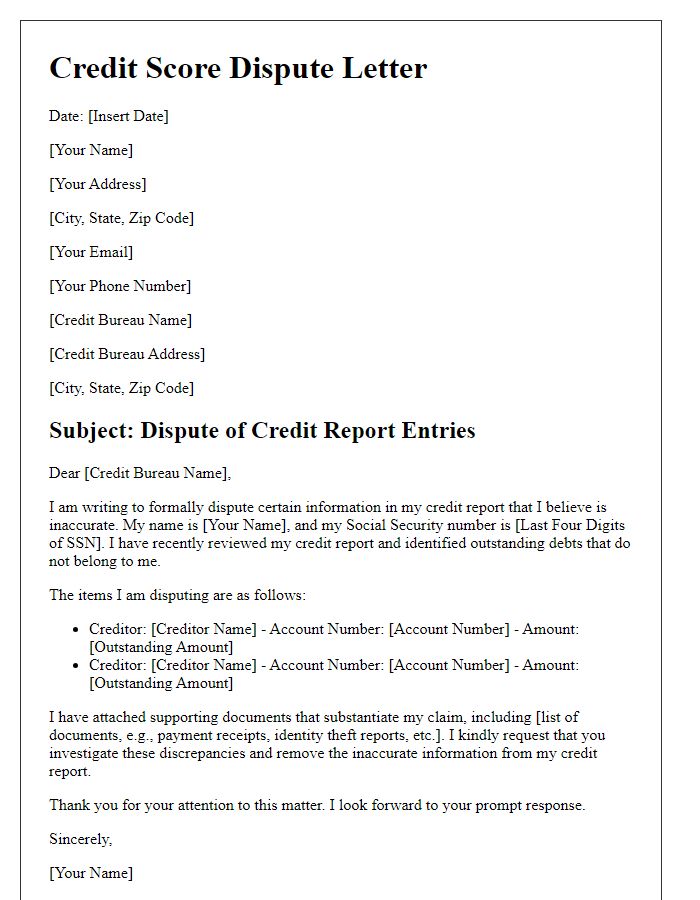

Letter template of dispute letter for high credit score impact due to debts.

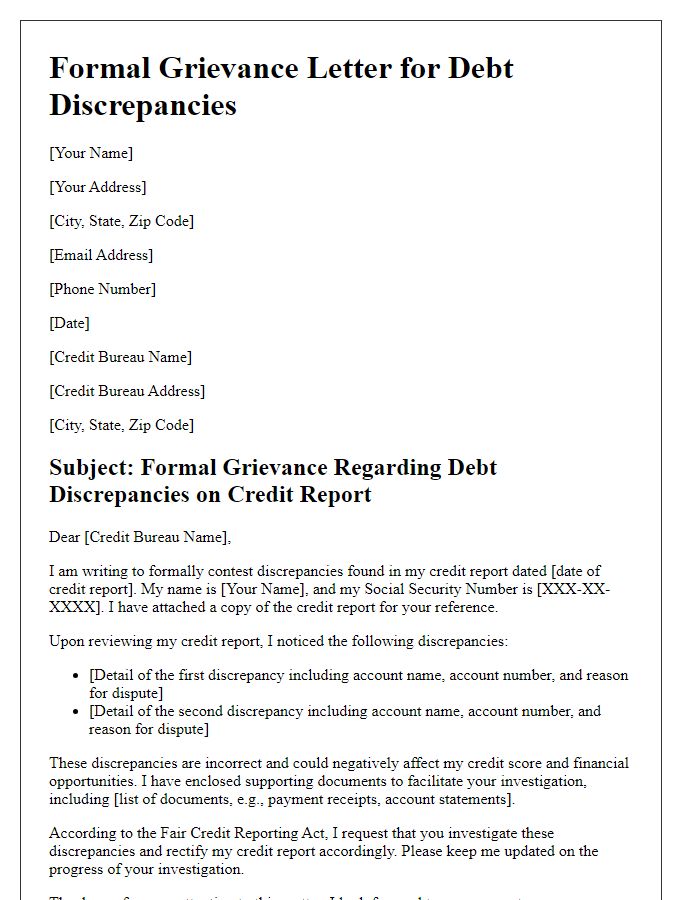

Letter template of formal grievance for debt discrepancies on credit report.

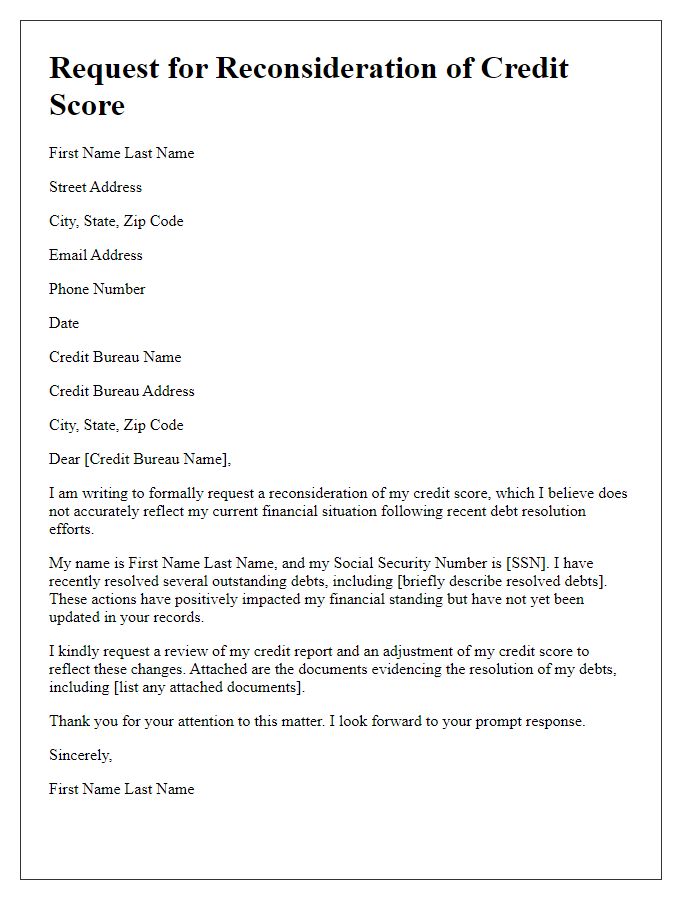

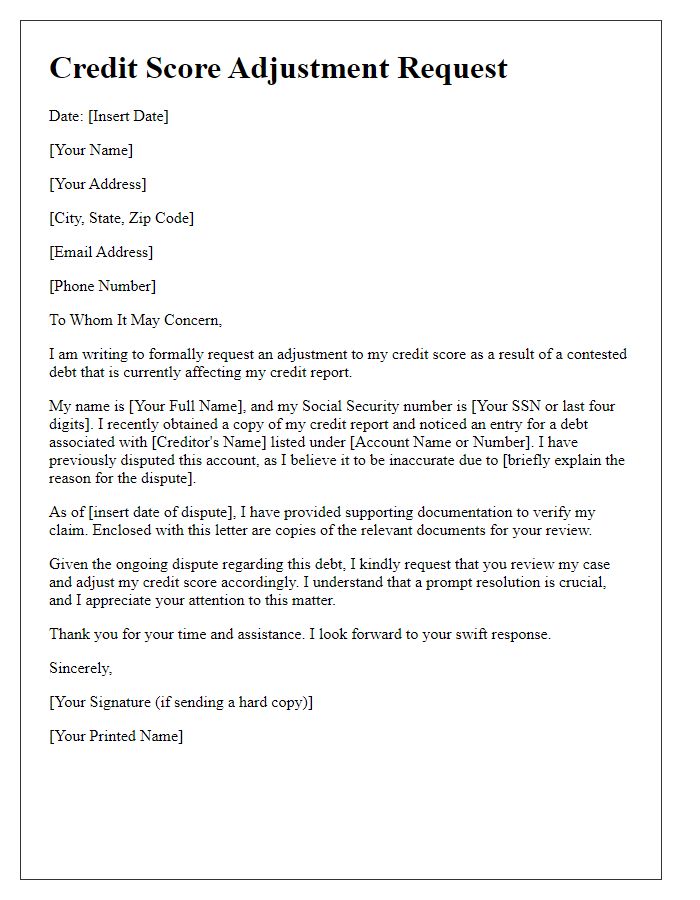

Letter template of request for reconsideration of credit score based on debt resolution.

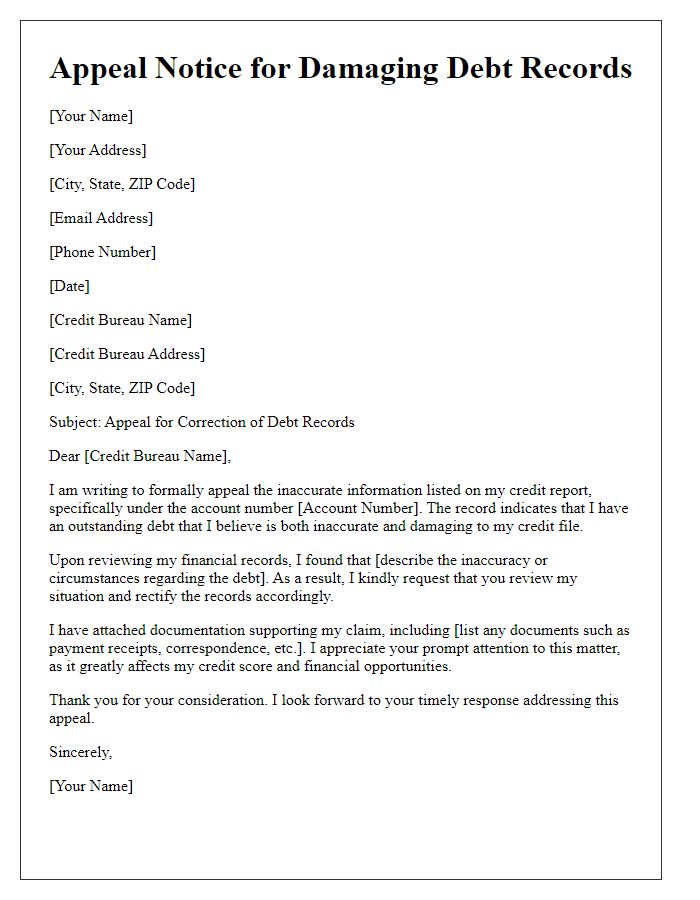

Letter template of appeals notice for damaging debt records in credit file.

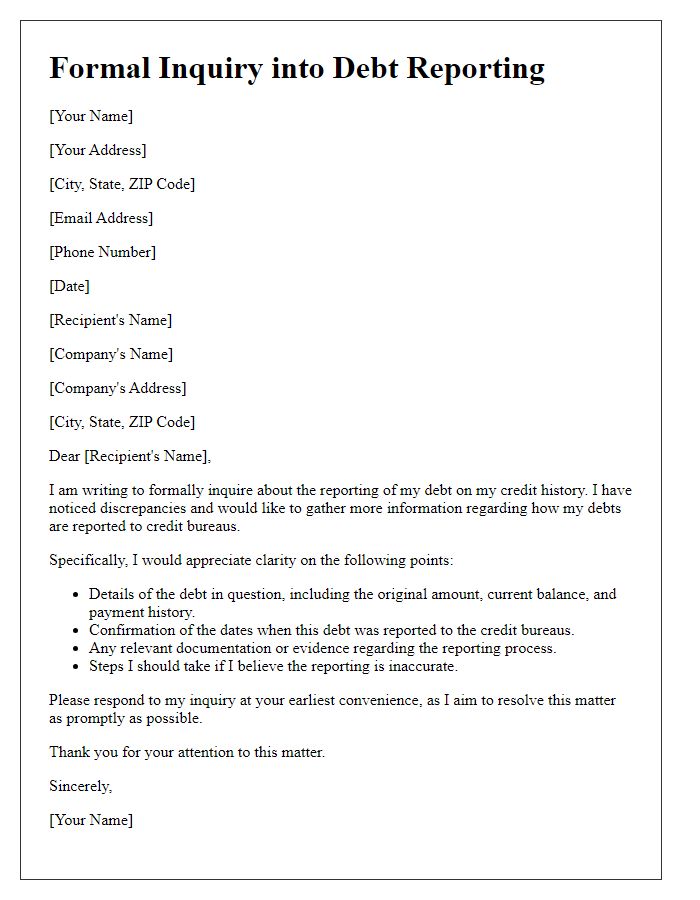

Letter template of formal inquiry into debt reporting on credit history.

Comments