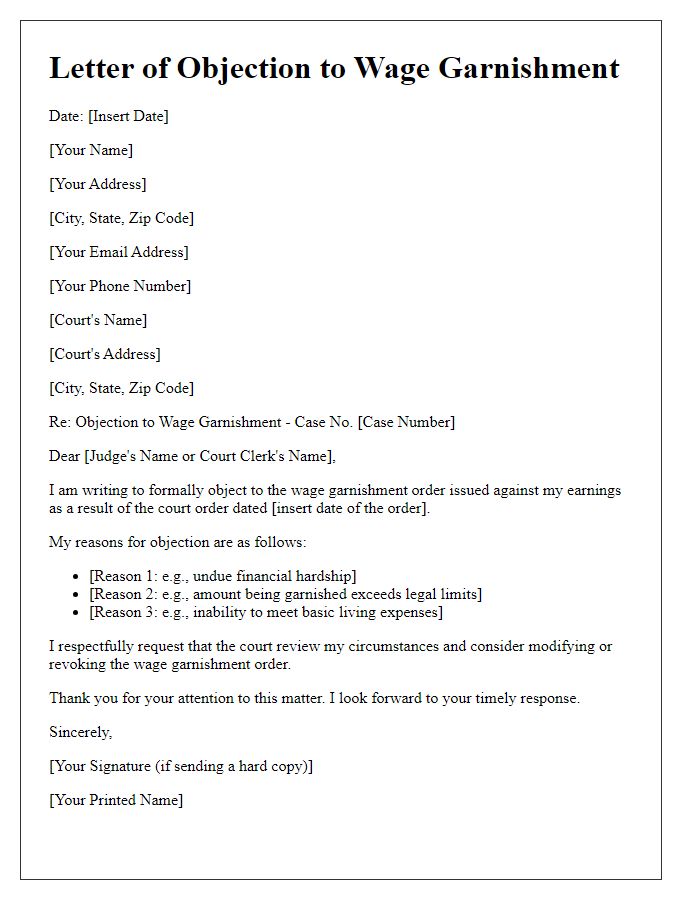

Are you feeling overwhelmed by a garnishment court order? Don't worry, you're not alone, and there are ways to navigate this challenging situation. In this article, we'll walk you through a template for crafting a compelling appeal letter that can help you take control of your finances. So, grab a seat and let's dive into how to effectively communicate your case and potentially turn things around!

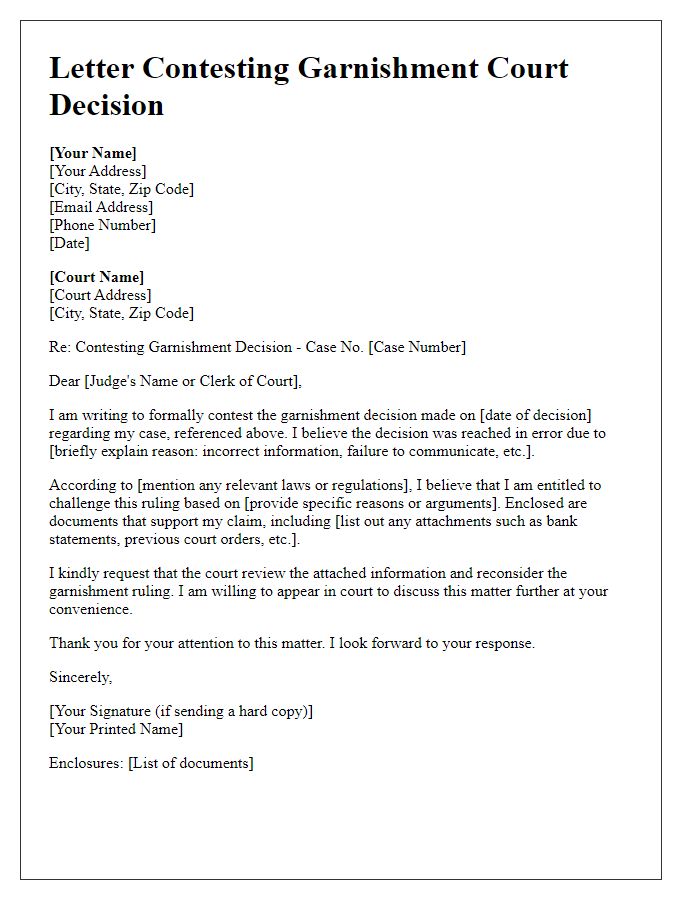

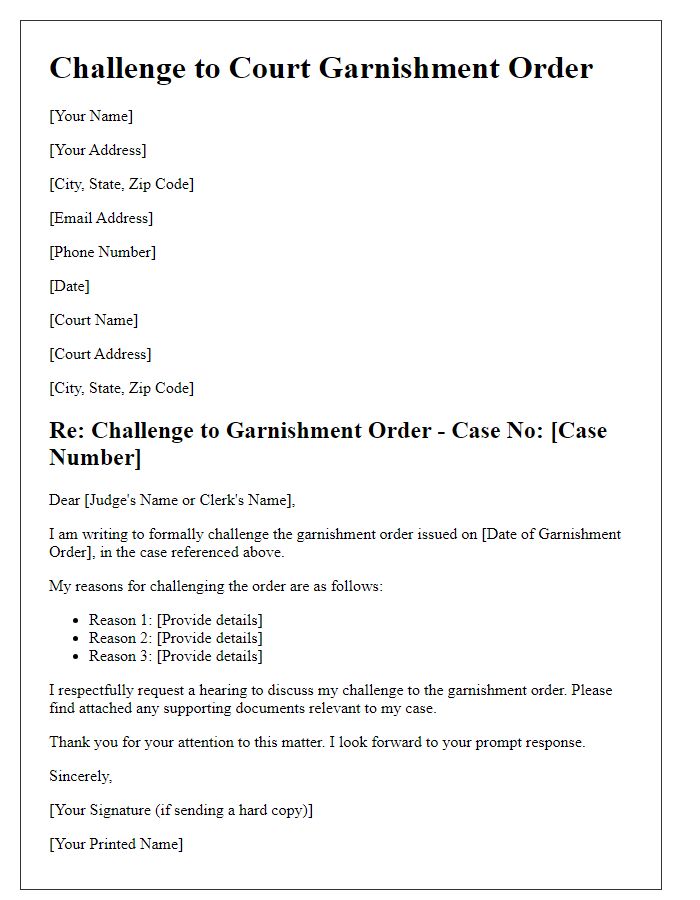

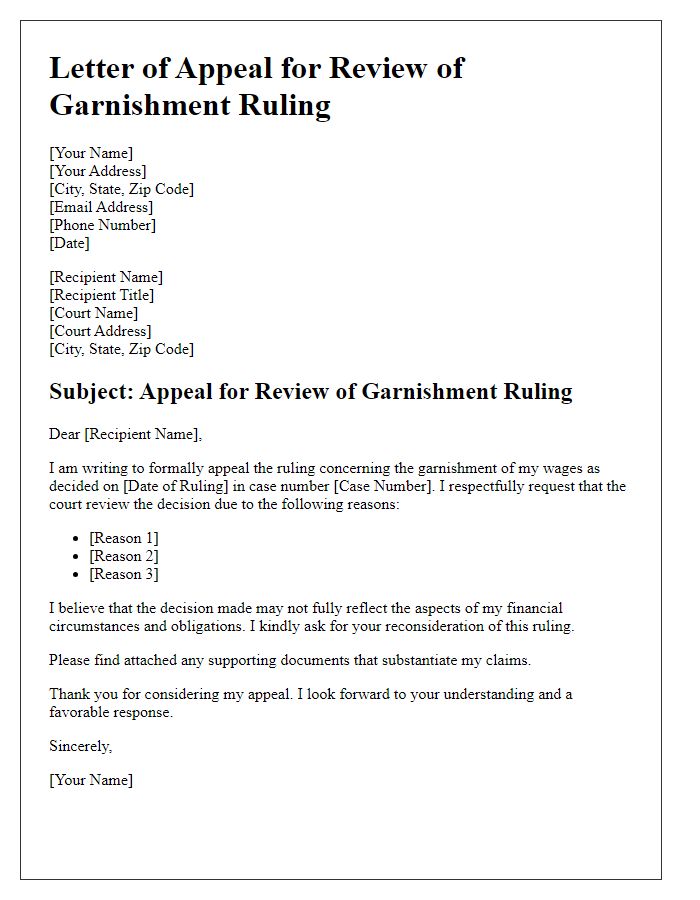

Clarity and conciseness of the appeal

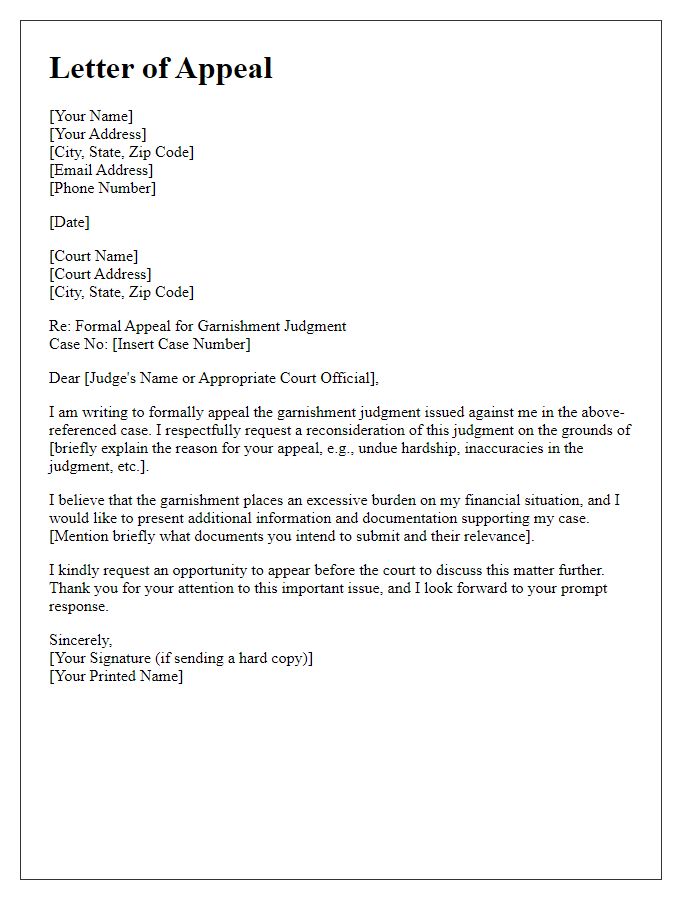

A garnishment court order can significantly impact an individual's financial situation, often requiring prompt legal action for an appeal. Filing an appeal necessitates a clear, concise statement that outlines the reasons for contesting the garnishment. Relevant information may include the original debt amount, the creditor's name, and the specifics of the court order issued, such as the date and jurisdiction of the ruling. Including supporting documentation, such as evidence of payments made or changes in financial circumstances, enhances the appeal's credibility. Legal precedents, particular statutes referring to garnishment limits, and any procedural errors in the original court ruling can also be cited to strengthen the argument against the garnishment. Timely submission of the appeal, adhering to jurisdictional deadlines, is crucial for preserving the right to contest the order.

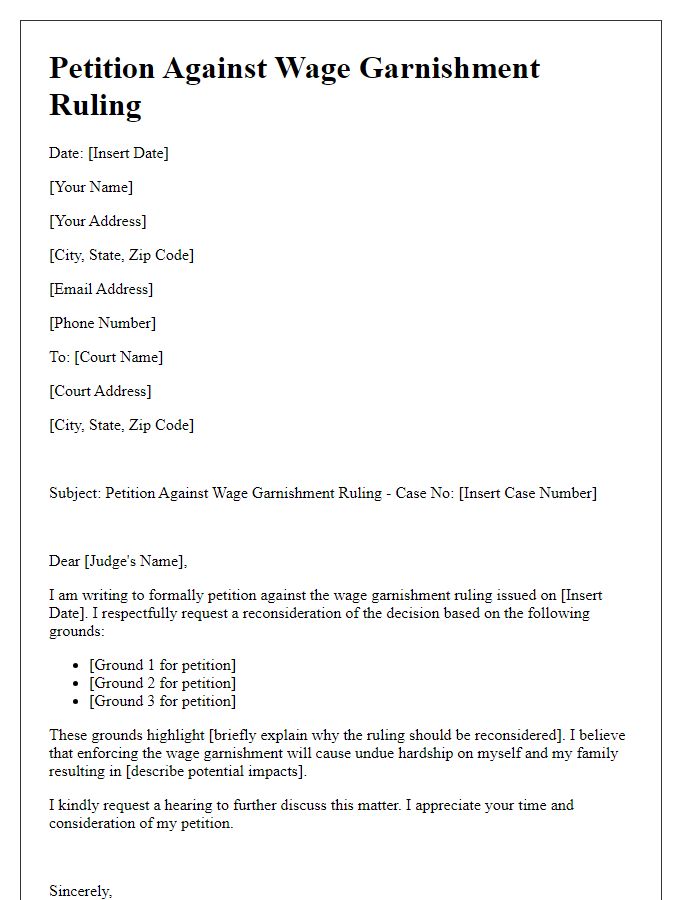

Reference to specific laws or regulations

A garnishment court order can significantly impact an individual's financial stability. Under the Federal Consumer Credit Protection Act (CCPA), specifically, 15 U.S.C. SS 1673, wage garnishment is limited to a maximum of 25% of disposable earnings. Additionally, each state has its own garnishment laws which may offer further protections. For example, California's Code of Civil Procedure SS 706.050 allows for exemptions that can protect a portion of a debtor's income, reflecting the need for financial security. The U.S. Bankruptcy Code also outlines protections against garnishment in the context of insolvency proceedings. Understanding these laws is crucial when appealing a garnishment court order, ensuring the legal rights of the debtor are upheld while addressing any undue hardship imposed by financial obligations.

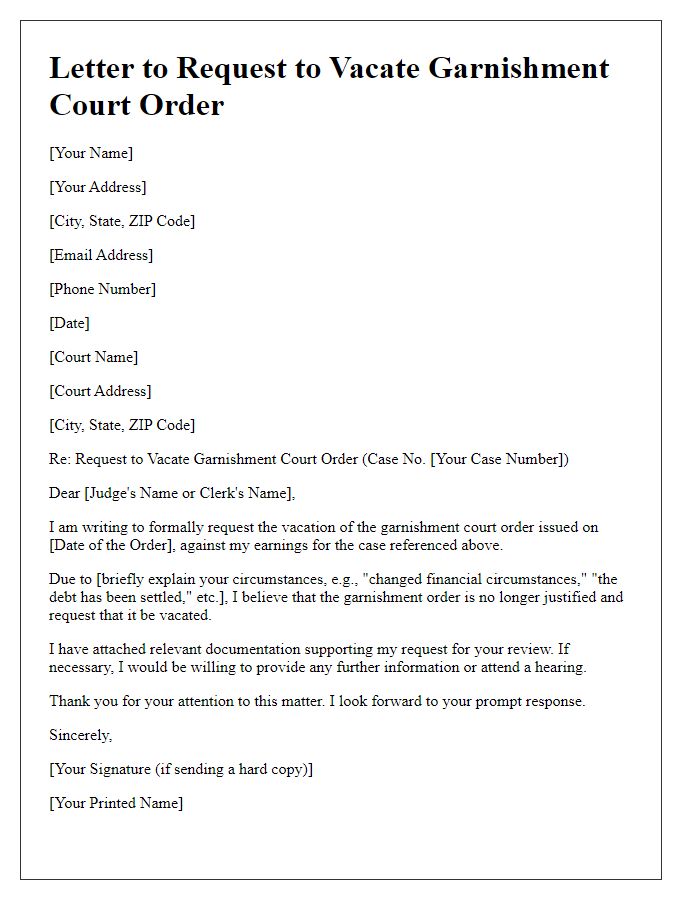

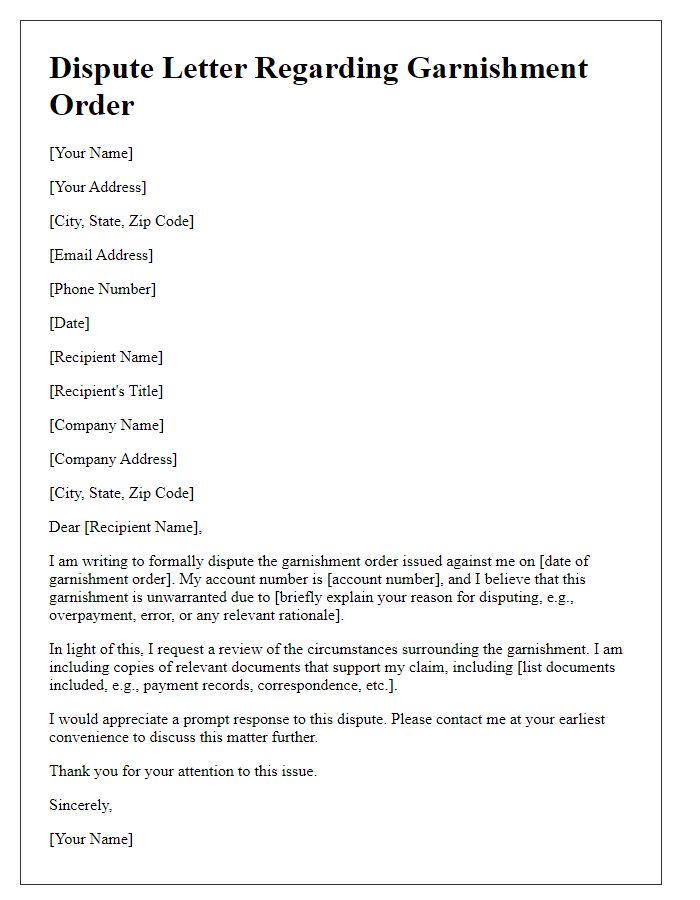

Proof of financial hardship or incorrect calculation

In cases of wage garnishment, individuals often face significant financial hardship, resulting from legal judgments in various courts. Documentation revealing discrepancies in financial calculations may illustrate that garnishment amounts exceed permissible limits set by state laws. Detailed records such as pay stubs, bank statements, and monthly expense reports can effectively demonstrate a household's inability to meet basic living expenses, including rent, utilities, and food costs. Furthermore, it is essential to note local regulations which typically limit garnishment to a fixed percentage of disposable income, often ranging around 25%. Accuracy in calculations must be carefully scrutinized, showing that excessive garnishment can lead to severe economic instability. Individuals may also benefit from citing recent changes in income status due to job loss or medical expenses, providing substantial evidence of their current financial vulnerability.

Inclusion of supporting documents and evidence

Garnishment court orders, issued by courts in jurisdictions such as California or New York, can lead to significant financial consequences for individuals. Supporting documents, such as income statements, tax returns, and bank statements, play a crucial role in providing evidence of financial hardship. Including these documents strengthens the appeal by illustrating inability to pay garnishment amounts without facing undue strain. Additional evidence may include medical bills, child support documents, or job loss letters, all of which contribute to a comprehensive understanding of the individual's financial situation. Proper organization and clarity when presenting this evidence to the court can significantly impact the decision-making process.

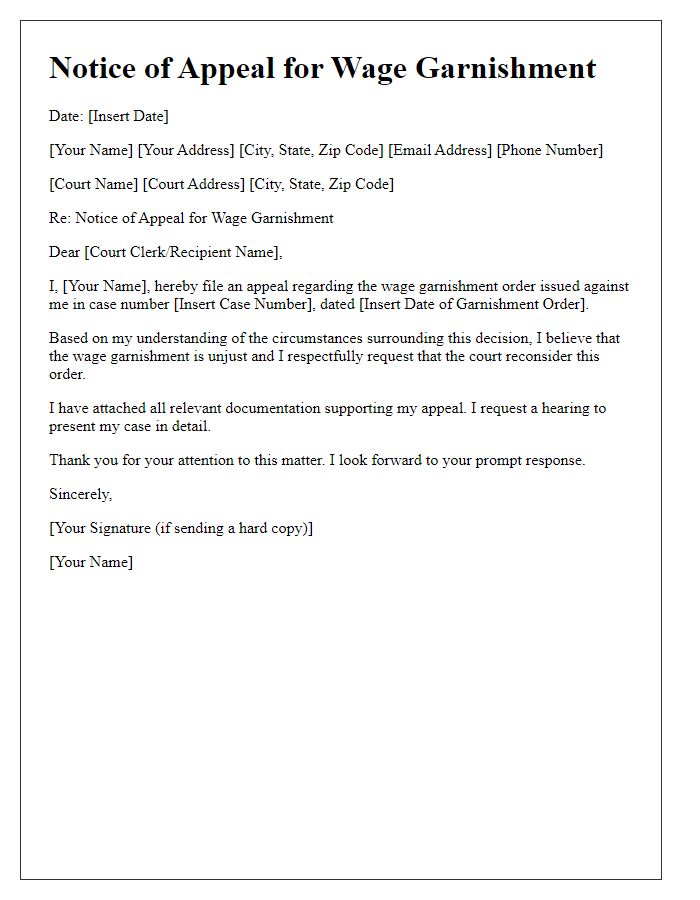

Courteous and respectful tone throughout

Appealing a garnishment court order involves a clear understanding of legal terminology, compliance with local court rules, and presenting a compelling argument. The process typically requires submitting a notice of appeal to the appropriate court while ensuring adherence to deadlines and legal formats. Additionally, gathering supporting documents such as financial statements can strengthen the appeal. Consultation with a legal professional can also enhance the chances of a favorable outcome by ensuring all procedural requirements are meticulously met.

Comments