Are you facing the frustrating challenge of identity theft-related debt? You're not aloneâmany individuals find themselves tangled in this distressing web of financial implications. Understanding how to effectively dispute these unwarranted debts can empower you to reclaim your financial standing. Dive into our comprehensive guide and discover the steps you can take to protect yourself and clear your name!

Personal Information Verification

Identity theft can lead to significant financial distress, manifesting in fraudulent debts attributed to unsuspecting victims. Individuals often experience overwhelming anxiety upon discovering unauthorized credit card debts or loans taken out in their names, typically without consent or knowledge. Institutions such as credit bureaus and debt collectors may report these debts, negatively impacting credit scores, which can drop significantly--sometimes by over 100 points--leading to challenges in securing loans or housing. The Federal Trade Commission (FTC) encourages victims to file reports, and the process requires documentation including identity theft reports, proof of residency, and evidence of the fraudulent activity. Legal frameworks like the Fair Credit Reporting Act (FCRA) empower consumers to dispute these inaccuracies and seek rectification. Timely action is essential, with most disputes needing resolution within 30 days to prevent further financial repercussions.

Detailed Debt Description

Identity theft often results in significant financial repercussions, potentially affecting credit ratings and leading to the accumulation of fraudulent debt. A profound case encompasses several outstanding debts, such as a $3,500 credit card balance from Chase Bank incurred in July 2023. Another significant charge includes a personal loan of $8,000 taken out from Wells Fargo during the same month. Additionally, there is an unauthorized installment plan of $500 for a mobile phone contract with Verizon that began in late August 2023. Each instance has sparked inquiries on my credit report, including a troubling hard inquiry from Experian dated August 15, 2023. Immediate investigation is crucial to prevent further complications as well as to rectify any inaccuracies reflected in financial records.

Identity Theft Evidence

Identity theft can lead to significant financial complications, notably affecting credit reports. Victims may notice unauthorized accounts on their credit reports, often filled with incorrect information regarding personal details like Social Security numbers, addresses, or account balances. Experian, one of the major credit reporting agencies, reported that 1.4 million consumers were victims of identity theft in the year 2020 alone. Gathering evidence, such as police reports, correspondence with creditors, and fraudulent account statements is crucial for disputing debts. It is advisable to immediately notify credit reporting agencies and relevant financial institutions about fraudulent activities to mitigate damage and restore financial integrity. Statutes like the Fair Credit Reporting Act (FCRA) afford rights to consumers, enabling them to dispute inaccuracies in their credit history. Prompt action and accurate documentation are essential for navigating the complexities of identity theft recovery.

Dispute Statement

Identity theft can result in significant financial distress, manifesting through fraudulent debts incurred without your consent. According to the Federal Trade Commission (FTC), identity theft affects millions of Americans annually (over 1.4 million reports in 2020). Victims may observe charges from unfamiliar businesses, indicating unauthorized use of personal information, such as Social Security numbers or credit card details, often in cities like Los Angeles or New York. The negative impact on credit scores can complicate financial stability, with long-lasting repercussions on loans, mortgages, and job applications. Promptly disputing these debts with relevant debt collectors and credit bureaus, such as Experian or TransUnion, can help mitigate damages and restore financial integrity. Providing evidence, including police reports and documentation of communication, is crucial to the resolution process.

Contact Information for Follow-up

Identity theft can lead to significant financial repercussions, affecting individuals across various demographics. In 2022, approximately 1.4 million identity theft cases were reported in the United States, causing billions in losses. Victims often face fraudulent debts that must be disputed. Key entities involved in this process include credit bureaus such as Experian, Equifax, and TransUnion, which maintain individual credit reports. Legal regulations, like the Fair Credit Reporting Act (FCRA) of 1970, protect consumers' rights in addressing erroneous information. Documenting personal details, such as Social Security numbers and account statements, is crucial for substantiating claims. Timely communication with creditors and collection agencies ensures that individuals can clear their records and recover their financial integrity effectively.

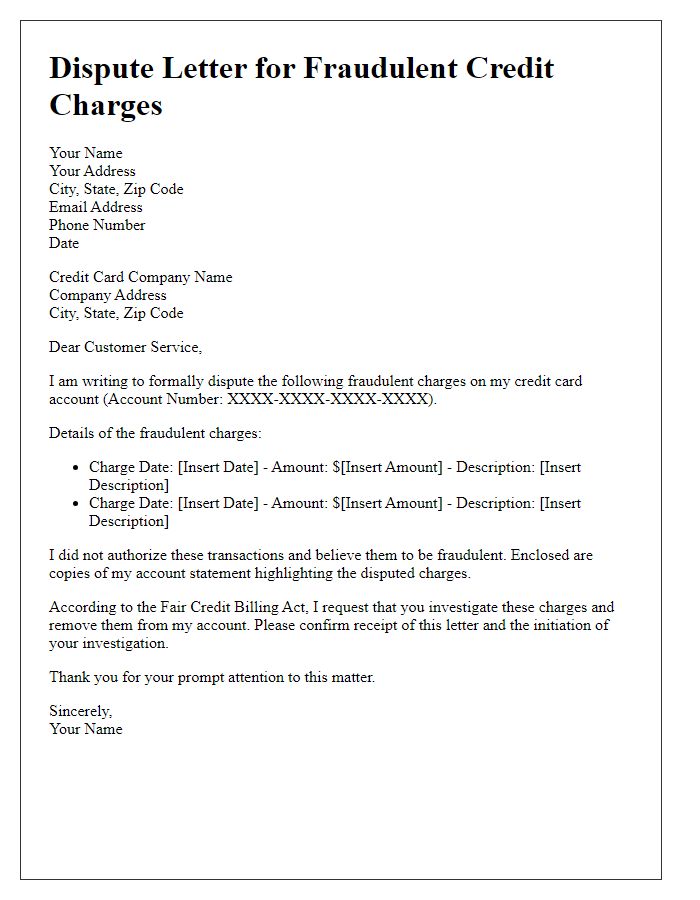

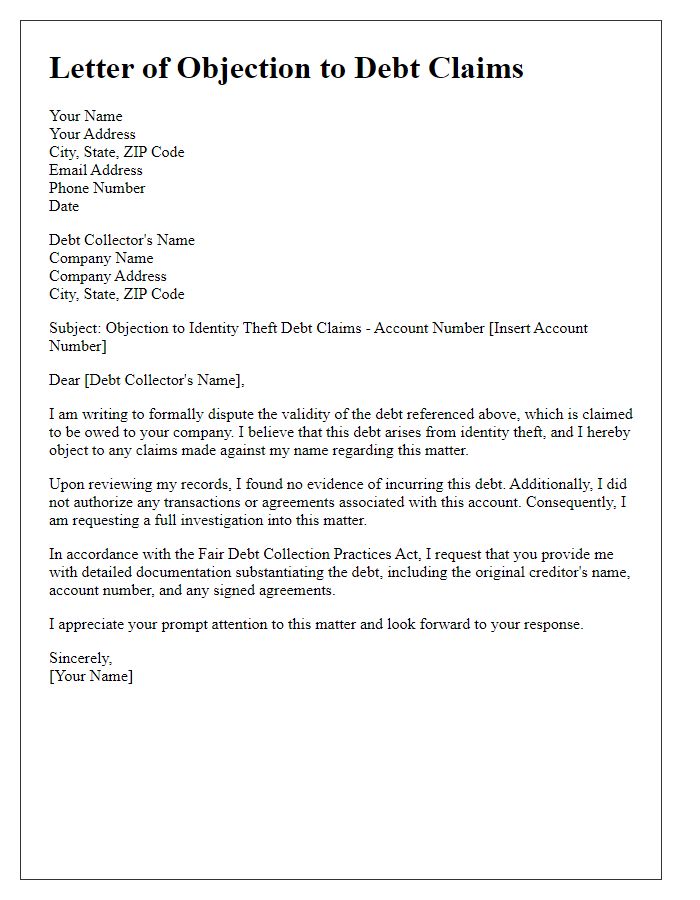

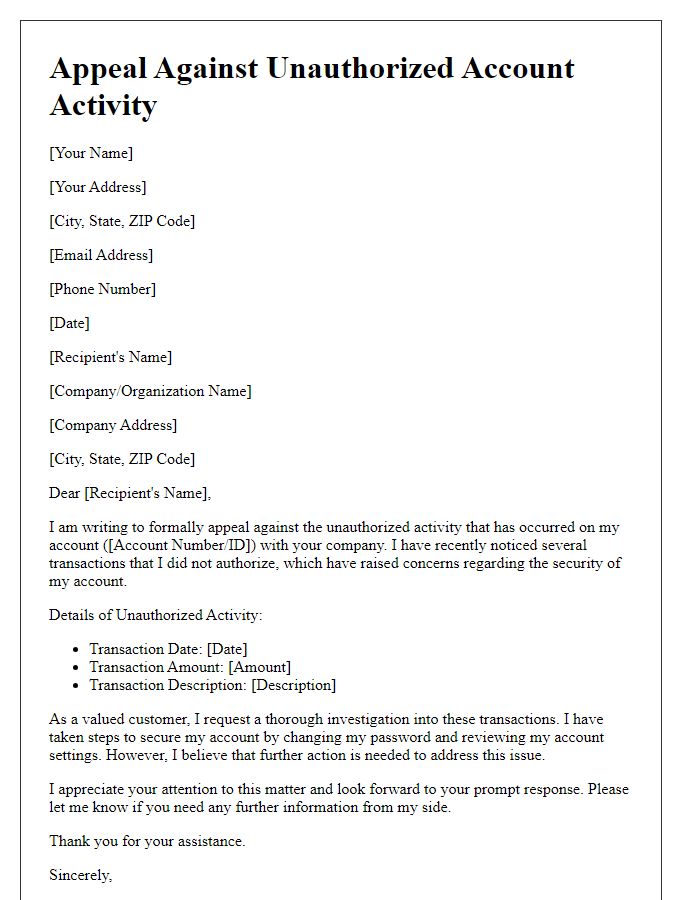

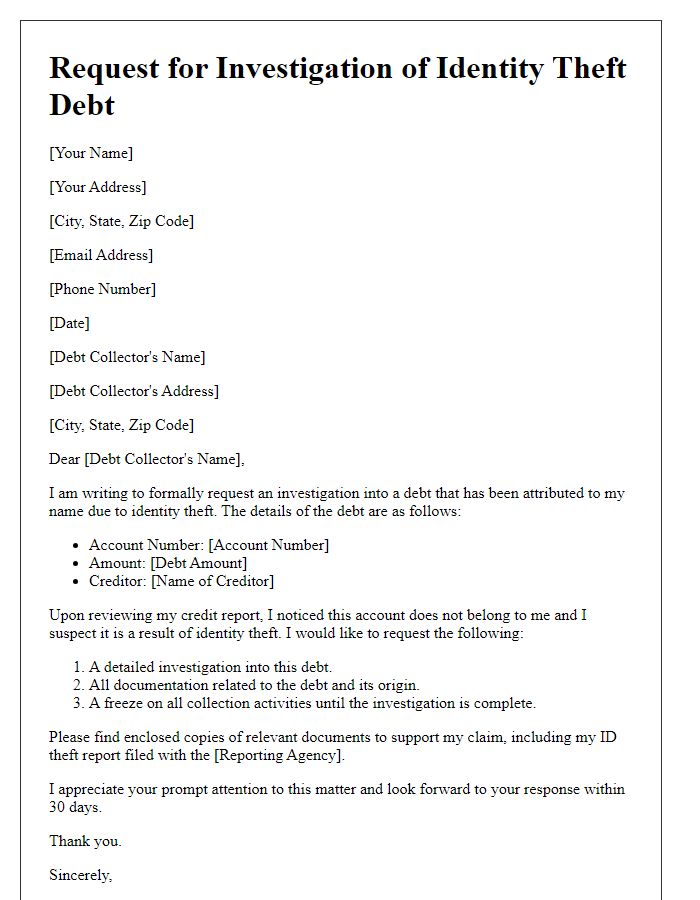

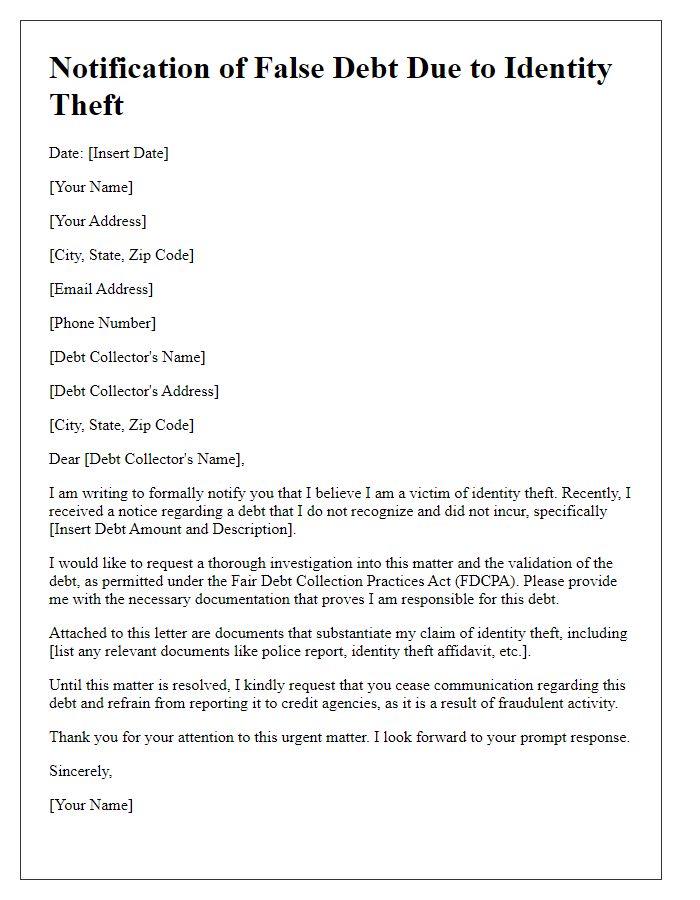

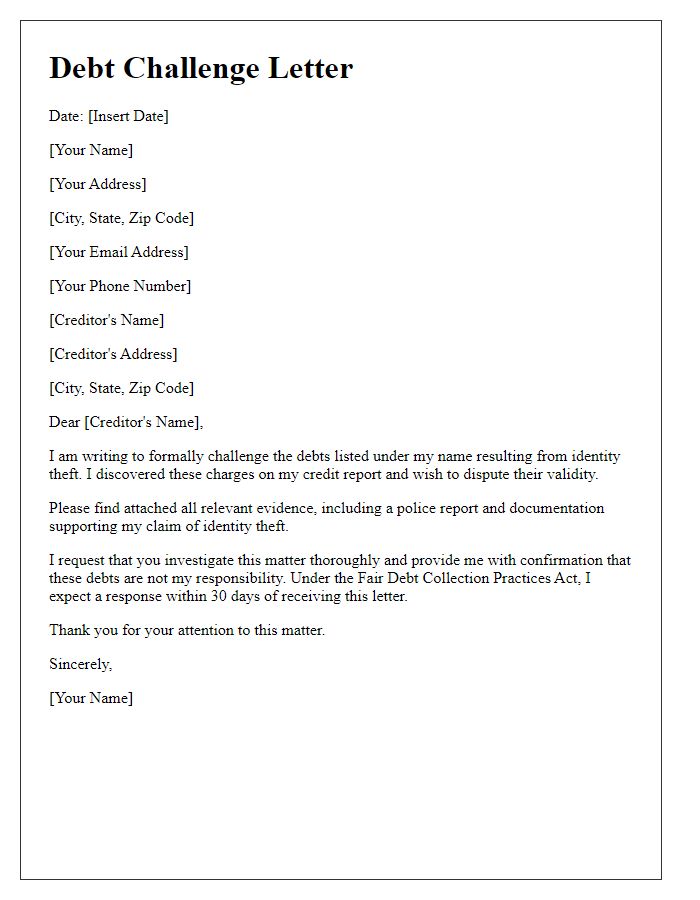

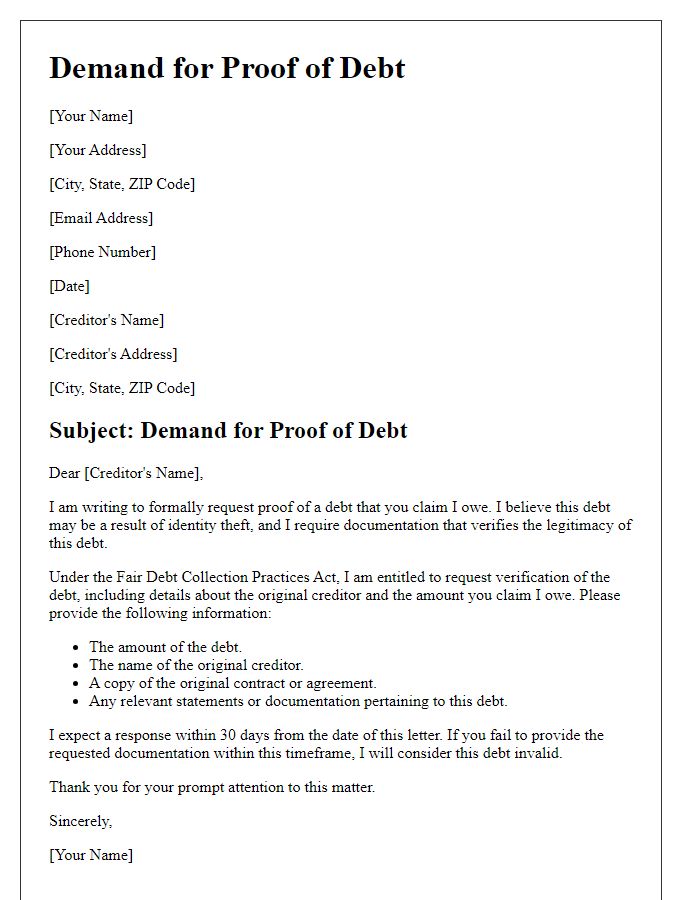

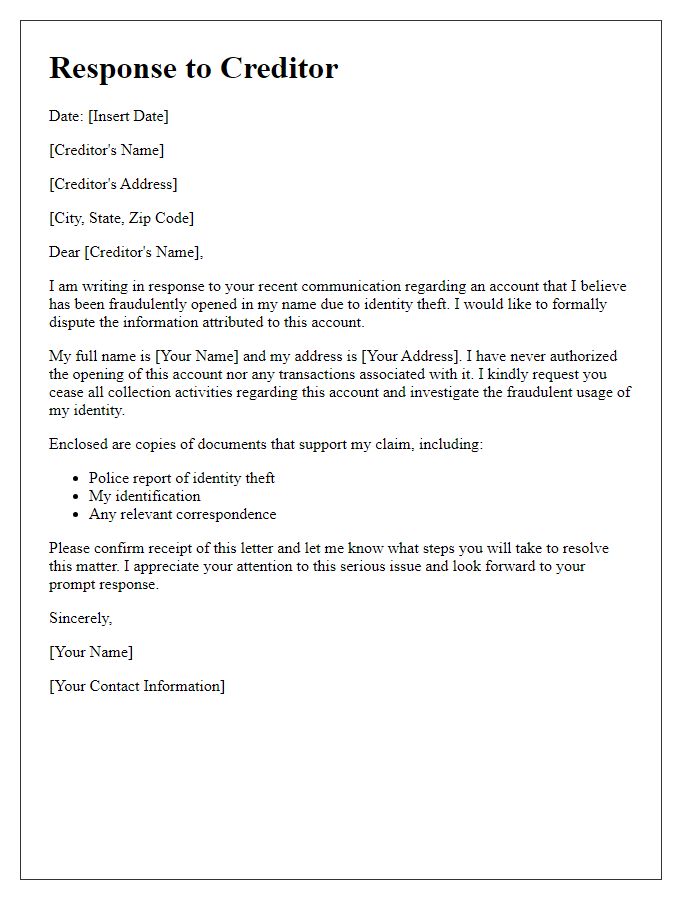

Letter Template For Disputing Identity Theft-Related Debt Samples

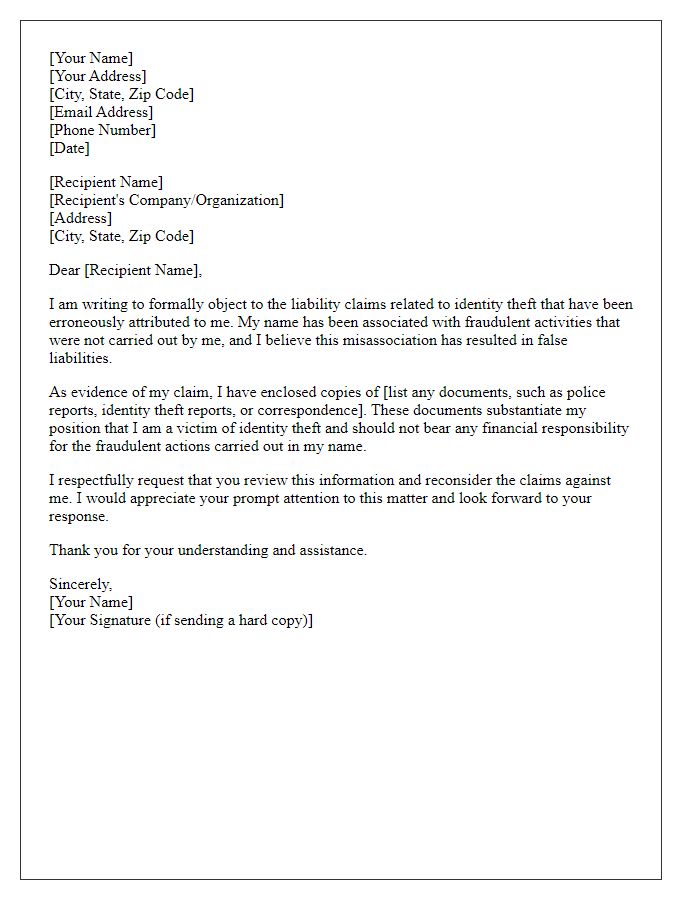

Letter template of formal objection regarding identity theft liabilities

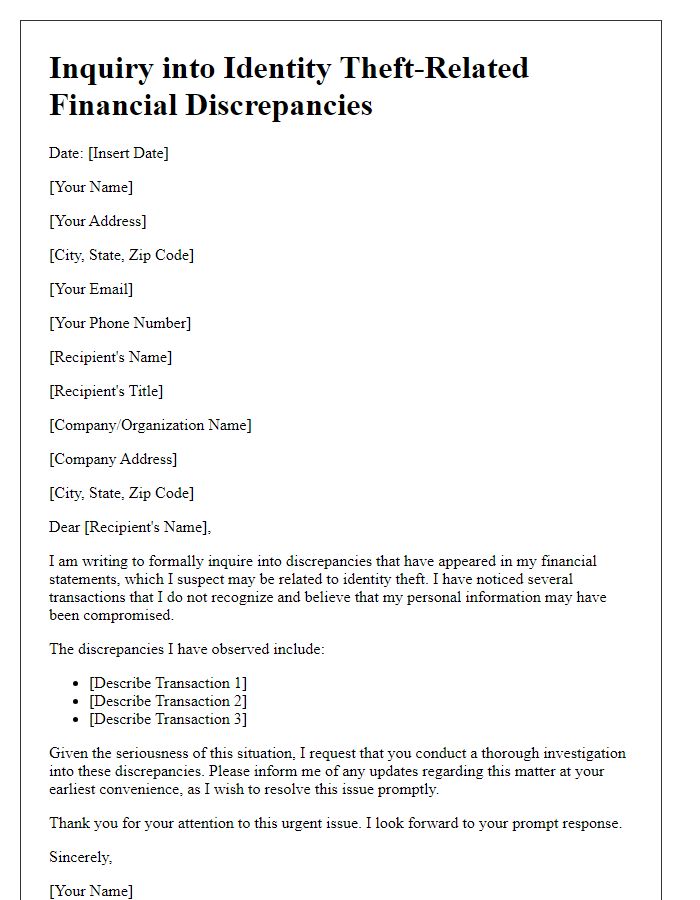

Letter template of inquiry into identity theft-related financial discrepancies

Comments