Looking to check on the statute of limitations for a debt? Understanding your rights regarding debt collection can save you from the stress and confusion that often comes with it. It's essential to know when a debt is considered too old to be legally collected, as this can impact your financial decisions significantly. If you're curious about how to navigate this process and ensure you're fully informed, keep reading to discover valuable insights!

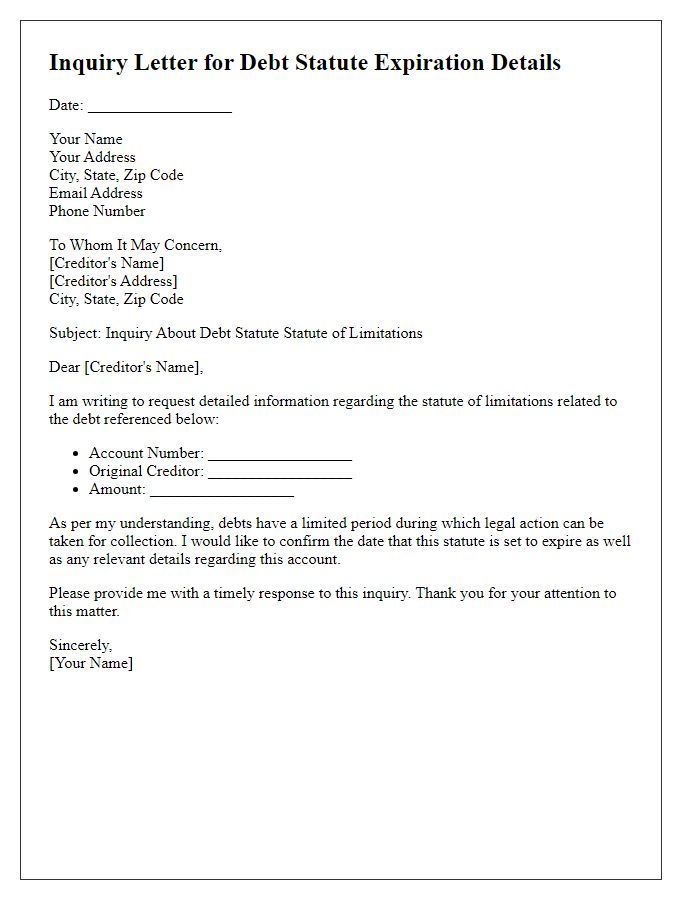

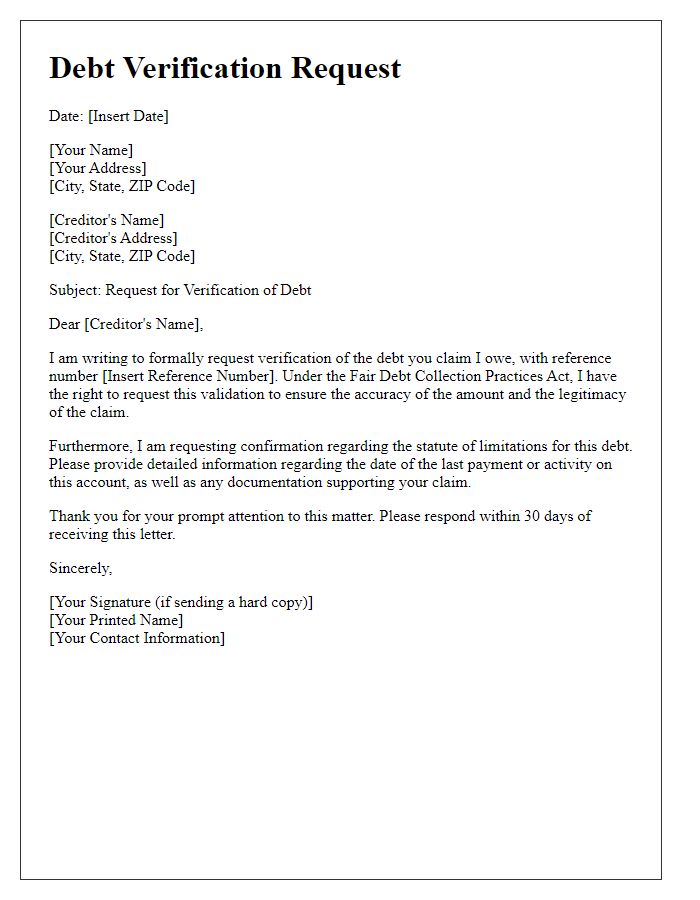

Creditor's information and contact details

The statute of limitations on debt can significantly impact creditors and debtors alike. Each state in the United States has different time frames (ranging from three to ten years) during which creditors can legally pursue unpaid debts. For example, in California, the statute of limitations on written contracts is four years, while in New York, it can extend to six years. Additionally, knowledge of the expiration date requires understanding a creditor's contact information, which may include the full name of the lending institution, physical address, and dedicated customer service phone line. State laws also dictate that certain types of debts, such as credit card balances or medical bills, may have varying statutes, thus necessitating precise tracking of original creditor details for compliance and resolution purposes.

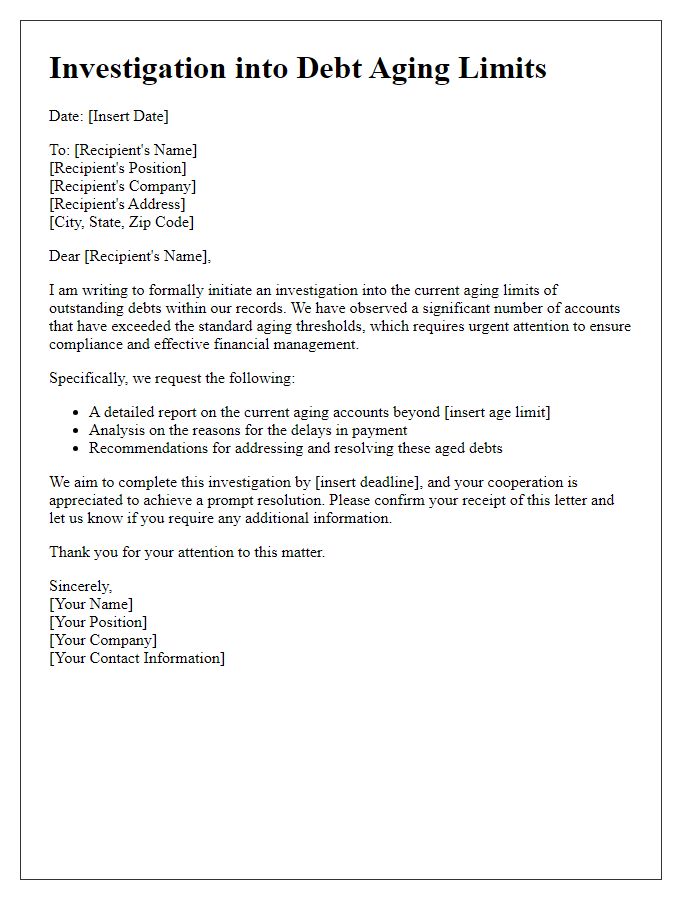

Borrower's account information

Checking the statute expiration on debt involves careful examination of the borrower's account information, including key details such as account number, outstanding balance, original amount borrowed, and date of last payment. Statute of limitations laws, which vary by state--ranging from 3 to 15 years depending on the debt type--play a crucial role in determining the enforceability of the debt. The borrower's personal information, including full name, address, and Social Security number, may also be necessary to accurately identify and track the specific account history. Additionally, understanding the nature of the debt, whether it is unsecured, like credit card debt, or secured, like a mortgage, can influence the statute expiration timeline.

Description of the debt in question

The debt in question pertains to an outstanding credit card balance with ABC Bank, originally totaling $5,000, incurred in January 2020. Due to financial difficulties, payments ceased after March 2021, resulting in a significant accumulation of interest and fees. According to relevant laws, the statute of limitations on credit card debt in the state of California is typically four years from the date of last payment, which raises concerns about the potential expiration of the debt's enforceability by ABC Bank. It is crucial to determine the exact timeline and any possible implications for future collections or legal actions.

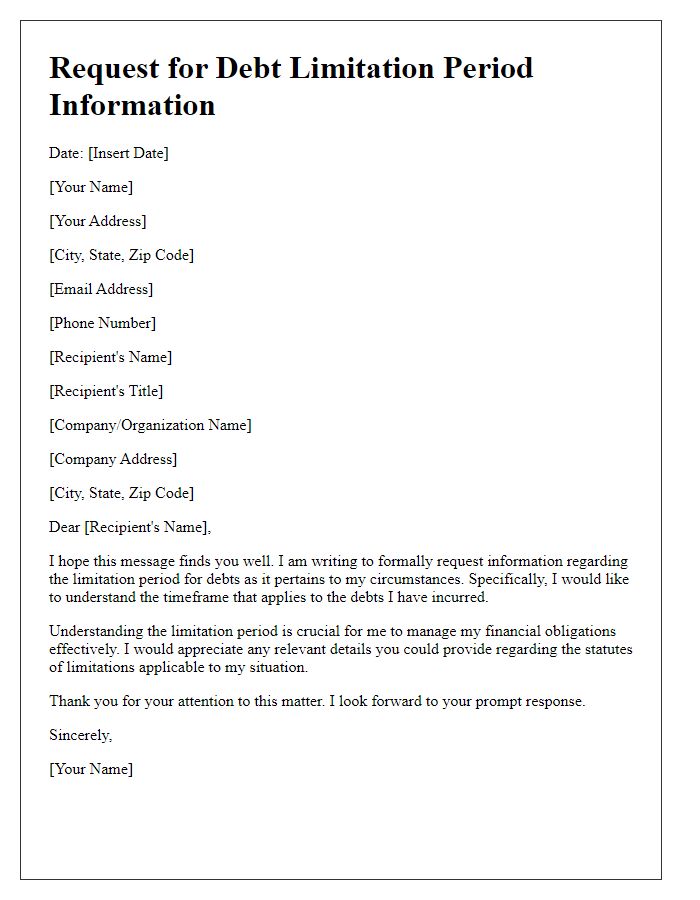

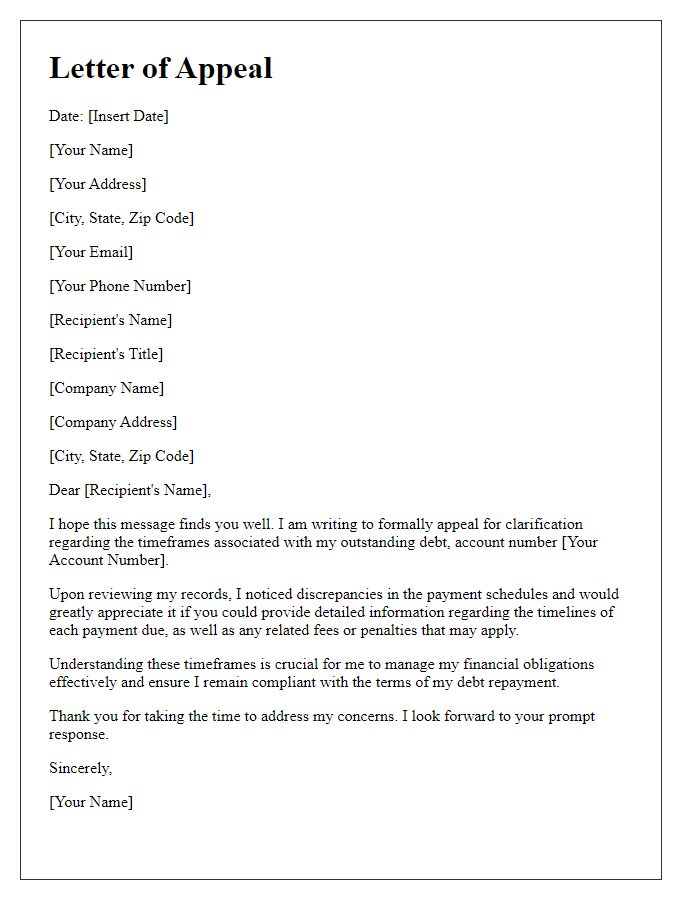

Reference to statute of limitations

The statute of limitations governs the time frame within which a creditor can sue a debtor to collect a debt, varying by jurisdiction and type of debt. For example, in California, the statute of limitations for unsecured debts is typically four years, while in Texas, it can extend up to four years as well. After this period, debts may become unenforceable in court, although the debtor may still owe the amount. Key considerations include the original date of default and any actions taken by creditors to revive the debt's enforceability. Before taking action, it is crucial to confirm the specific statute of limitations applicable to the debt in question, as well as any relevant exemptions or tolling provisions that may alter the timeline.

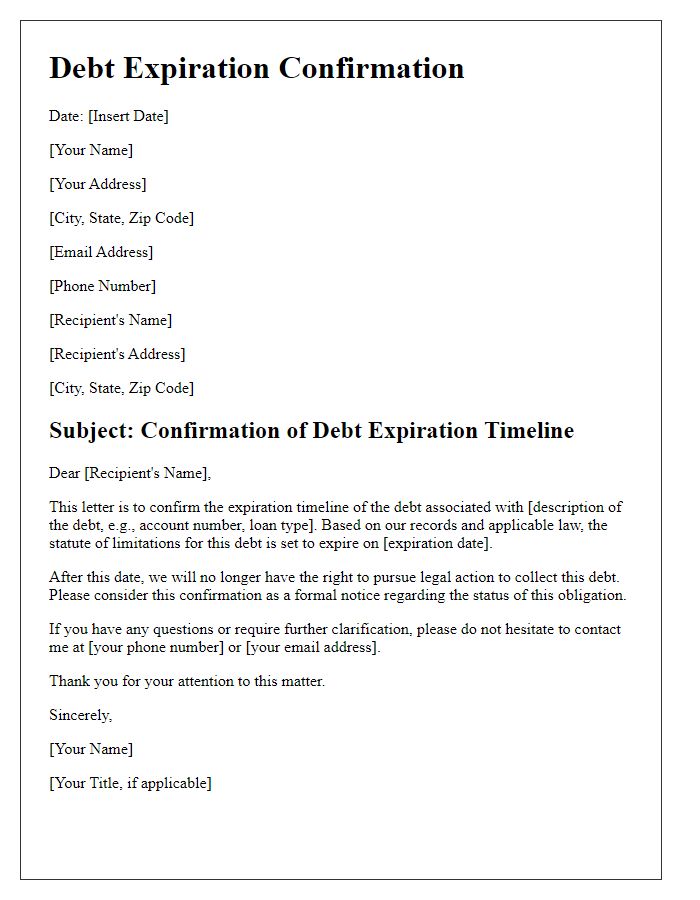

Request for confirmation of expiration status

The expiration of debt statutes can significantly impact the collection process for lenders and borrowers alike. Each state in the United States has its own laws determining the statute of limitations on various types of debts, such as credit cards (typically 3 to 6 years in many jurisdictions) and mortgages (generally ranging from 4 to 15 years). A lender may seek the expiration status of debt to understand their legal ability to collect outstanding balances and to determine if court action is still permissible. In some cases, debts can become outdated after the statute of limitations has passed, which means consumers no longer have a legal obligation to repay them. It is crucial for both parties involved to understand the specific state laws that apply to their situation, as this knowledge can prevent costly legal disputes and facilitate more informed financial decisions.

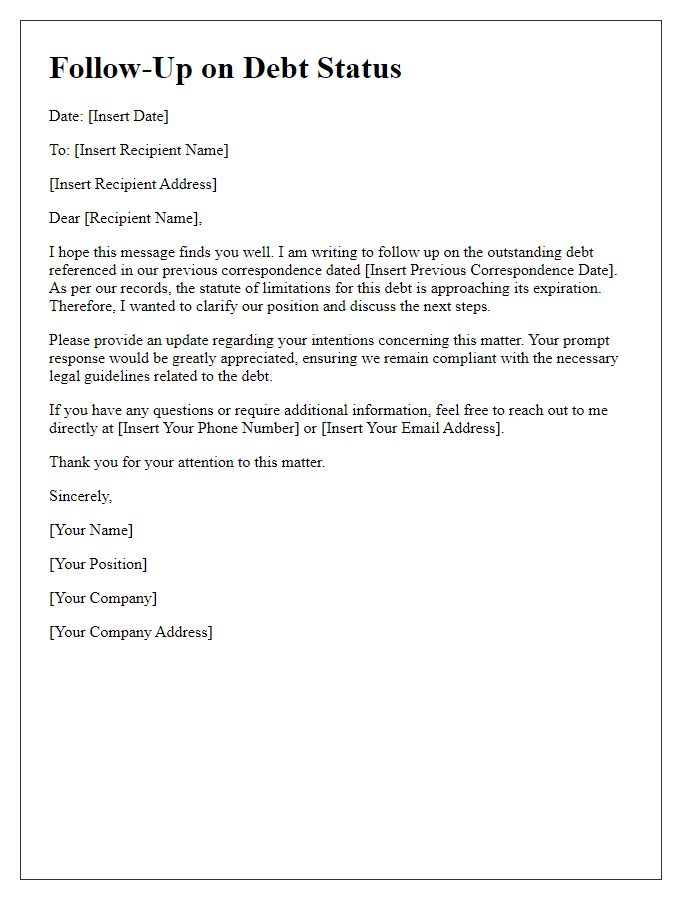

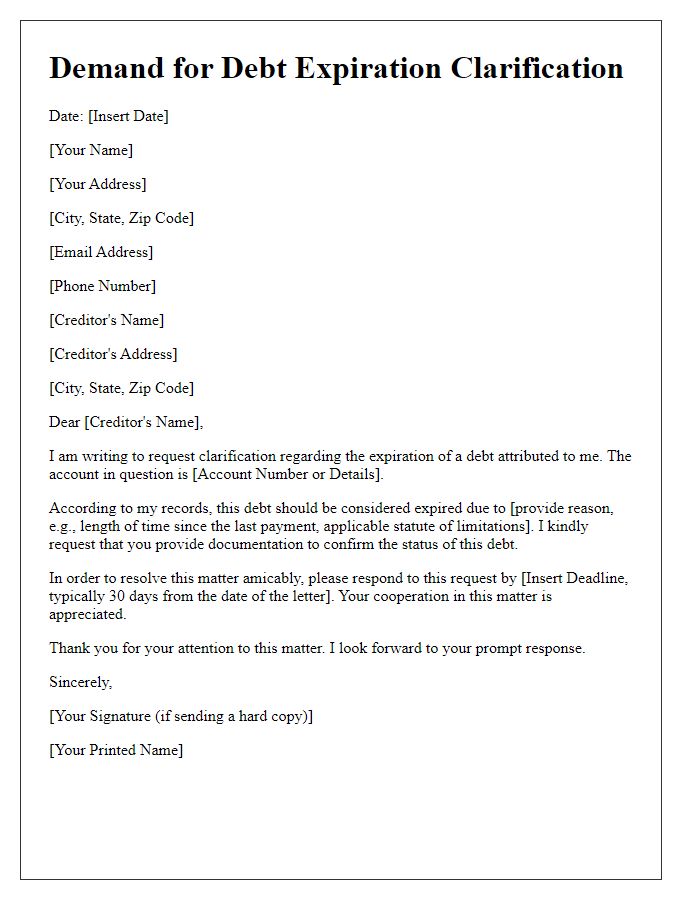

Letter Template For Checking Statute Expiration On Debt Samples

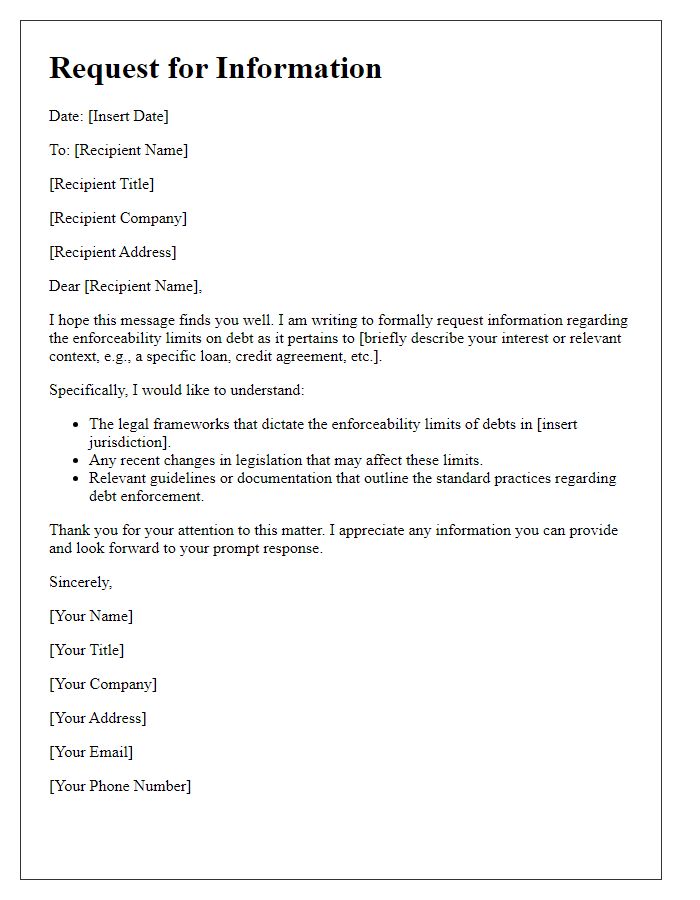

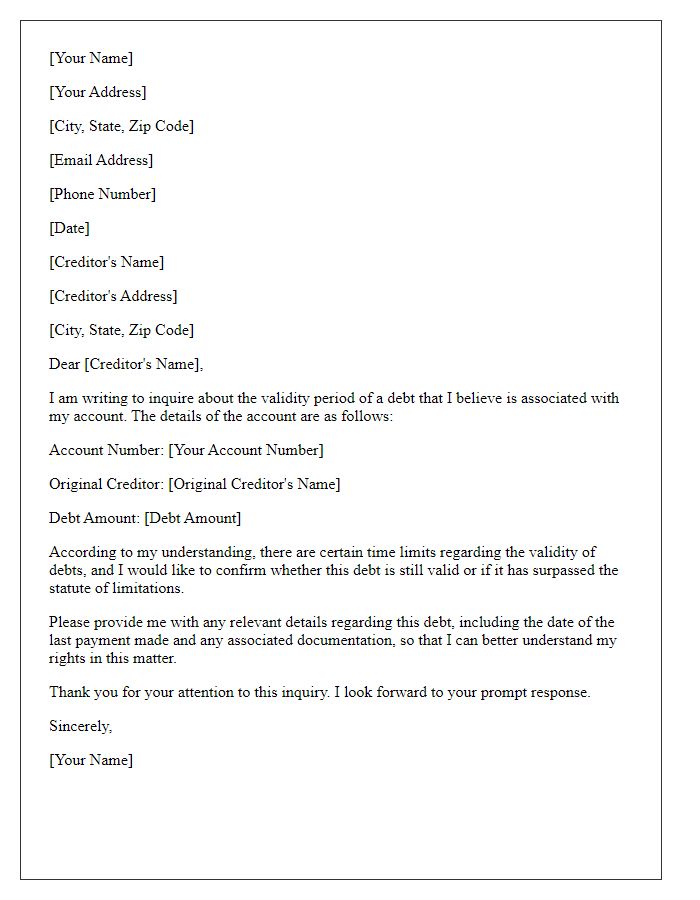

Letter template of request for information on debt enforceability limits

Comments