Are you feeling frustrated after your request for a payment extension was denied? You're not aloneâsituations like these can happen to anyone, and it's completely normal to seek a little help in crafting the perfect appeal letter. In this article, we'll walk you through a sample letter template that not only addresses the specific reasons for your request but also showcases your understanding and willingness to work through the situation. So, let's dive in and discover how you can effectively advocate for your needs!

Polite and Professional Tone

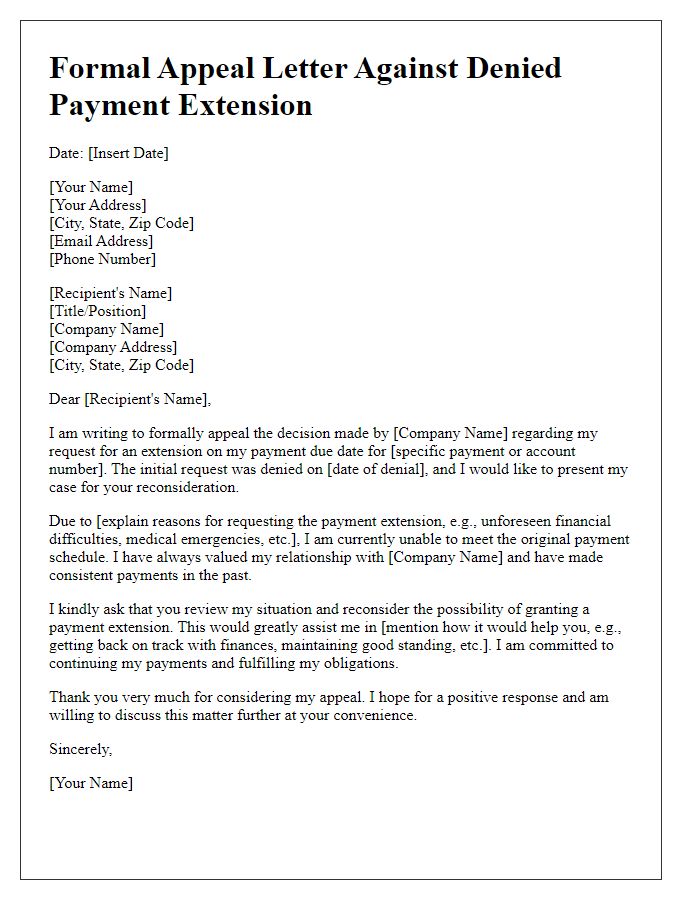

A denied payment extension can impose significant challenges on individuals or businesses managing financial obligations. In such situations, crafting an appeal letter with a polite and professional tone becomes essential. Addressing the recipient with respect is crucial, while clearly stating the intent to request reconsideration of the denial. Providing context about the situation, such as financial difficulties due to unforeseen circumstances like a medical emergency or job loss, can enhance the appeal. It is beneficial to reference specific dates, amounts, and any previous correspondences that highlight a positive payment history. Additionally, expressing a willingness to comply with any conditions for the extension and thanking the recipient for their consideration can make the tone more amicable and improve chances of a favorable response.

Clear Explanation of Circumstances

In challenging financial situations, many individuals struggle to meet payment deadlines, resulting in requests for extensions. A common circumstance involves medical emergencies, wherein unexpected hospital bills pile up, often exceeding thousands of dollars within a short time frame. Additionally, unforeseen job loss can severely impact financial stability, leading to missed payments on essential expenses, such as rent or mortgage, which typically amounts to several hundred or even thousands of dollars each month. Requesting a payment extension allows individuals managing tough situations to regain control over their finances, ensuring necessary obligations are eventually met while avoiding late fees or further complications related to their credit score. Supporting documentation from healthcare providers or letters from former employers can strengthen an appeal, showcasing genuine hardship and transparency.

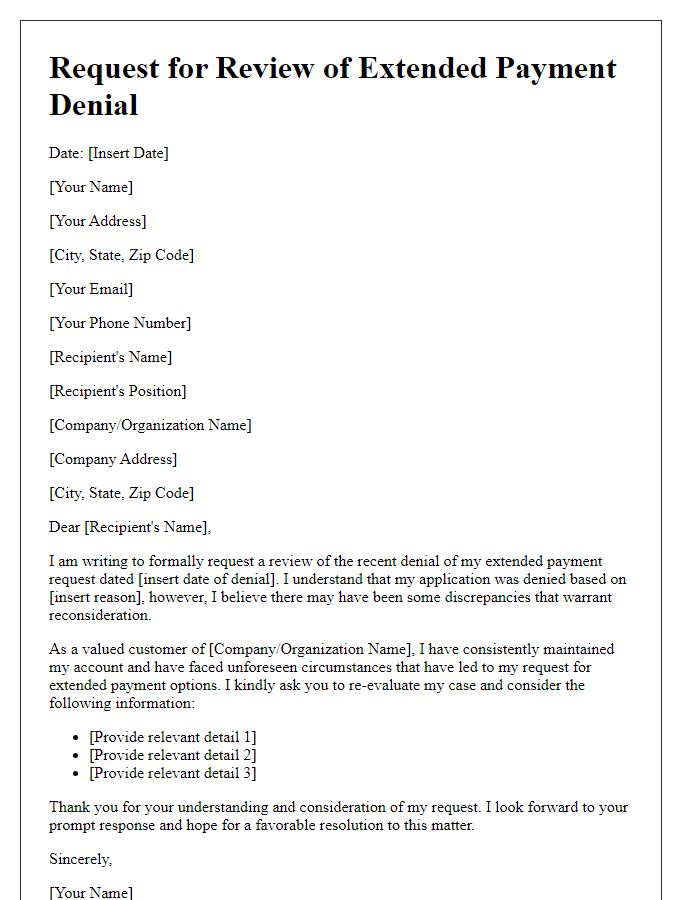

Supporting Documentation

The appeal for a denied payment extension primarily hinges on presenting thorough supporting documentation that underscores the legitimacy of the request. Essential elements include a copy of the initial loan agreement from the financial institution, which outlines repayment terms critical for establishing the borrower's original obligations. Supporting income statements, such as recent pay stubs or tax returns, are vital for demonstrating any changes in financial circumstances that warrant the extension. Additionally, a detailed letter explaining the specific reasons for the request, along with relevant medical or legal documents that support the need for assistance, provides a more comprehensive overview. Including a timeline of previous payments and any correspondence with the lender about the extension enhances the appeal by showcasing the borrower's history of responsibility and ongoing efforts to manage debt.

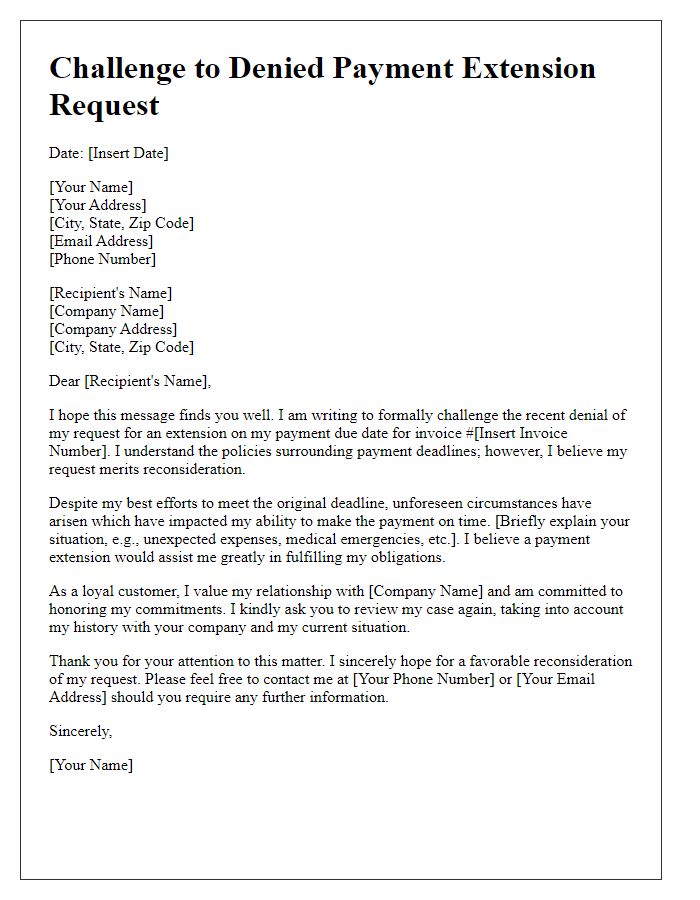

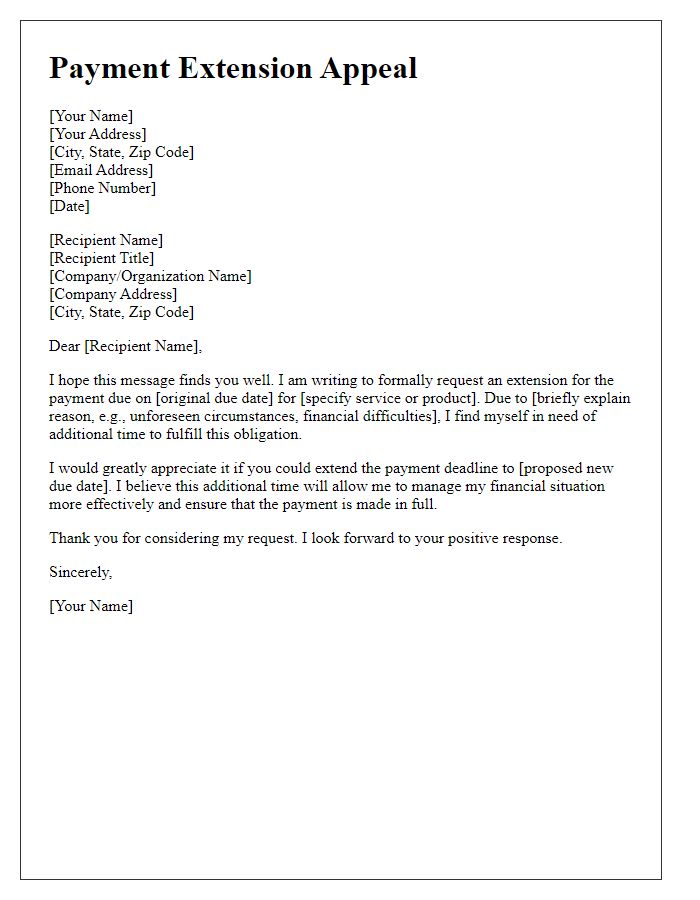

Specific Request Details

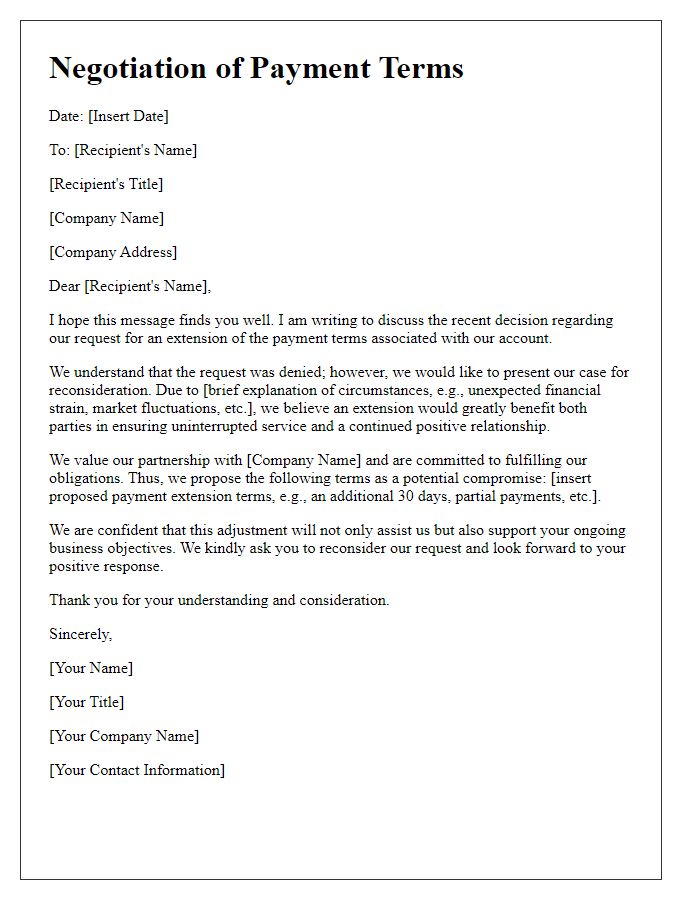

Businesses may face challenges when denied payment extensions for outstanding invoices. Specific circumstances often arise, such as unanticipated financial difficulties or delays in receiving expected revenue. Affected entities typically include small businesses, freelancers, or contractors relying on timely payments to maintain operations. When seeking reconsideration, it's crucial to highlight the initial payment terms, the date of the invoice (for instance, invoices dated July 15, 2023), and previous communication attempts. Providing supporting evidence, such as bank statements or contracts illustrating cash flow constraints, can enhance the appeal's credibility. Additionally, proposing a feasible payment plan (like a 30-day installment agreement starting October 1, 2023) demonstrates commitment to settling the debt while addressing the concerns of the creditor.

Contact Information for Follow-Up

An appeal for a denied payment extension must include essential contact information to facilitate follow-up. Clearly state the name of the applicant, along with the account or reference number associated with the payment request, ensuring visibility for quick identification. Include a reliable phone number, ideally a direct line, for immediate communication regarding the appeal. An active email address should also be provided, allowing for written correspondence and documentation of the appeal process. Consider listing a mailing address, especially for formal notifications or communications that require hard copies. This comprehensive contact information streamlines the follow-up process and underscores the seriousness of the appeal.

Letter Template For Appealing Denied Payment Extension Samples

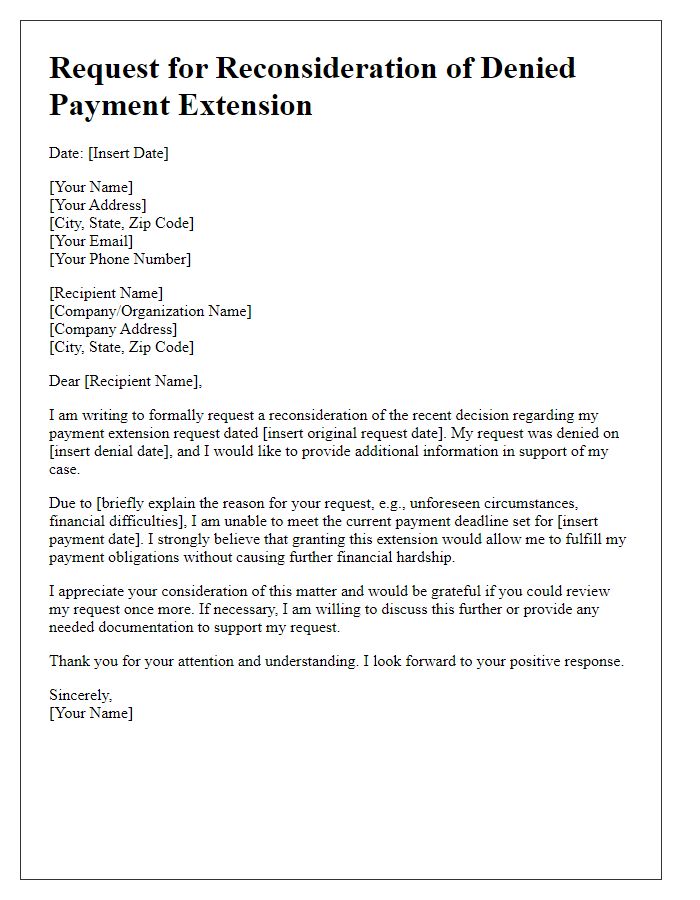

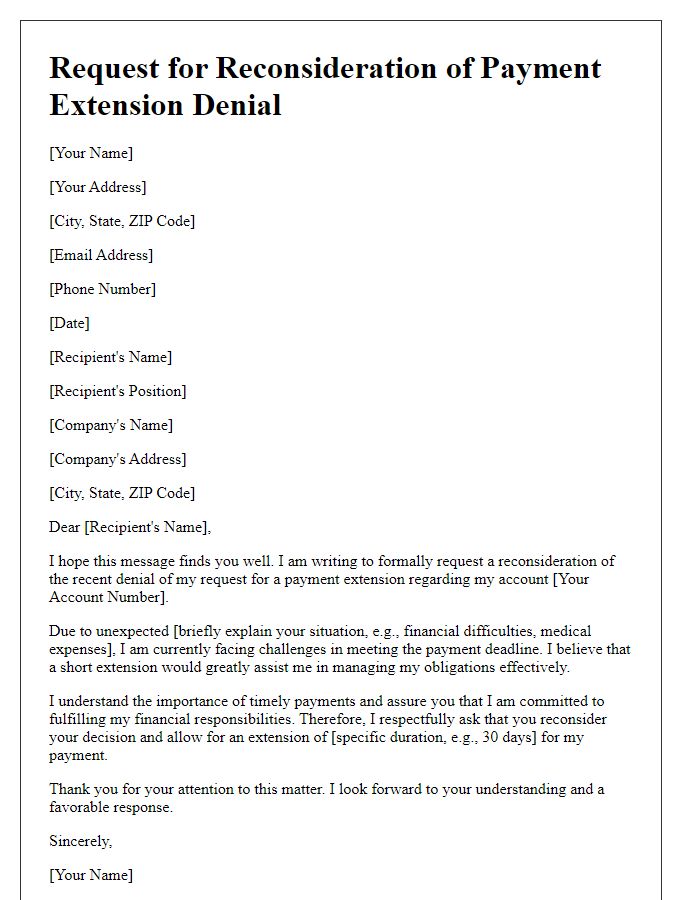

Letter template of request for reconsideration of denied payment extension

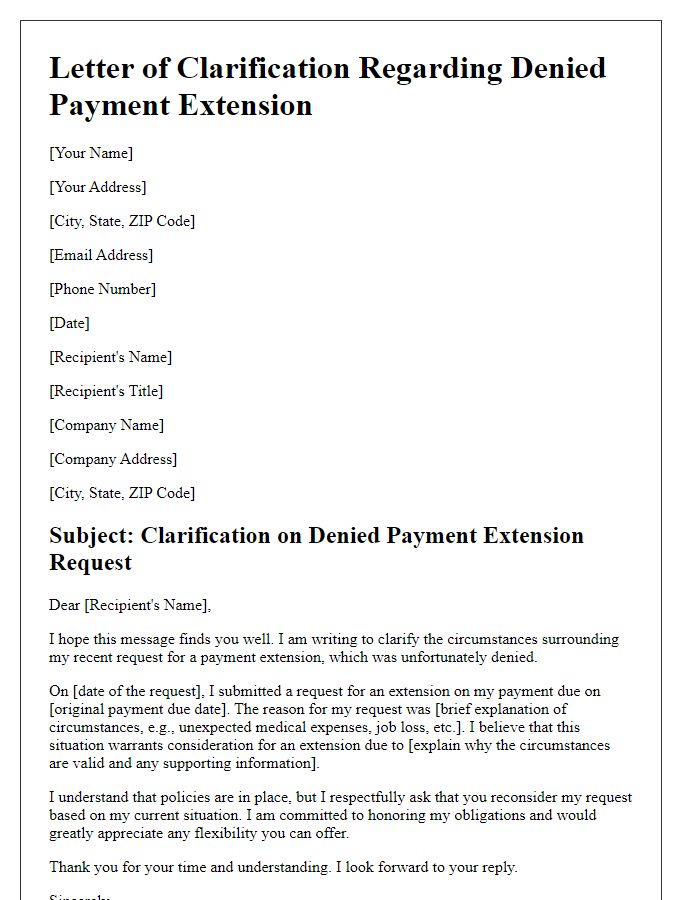

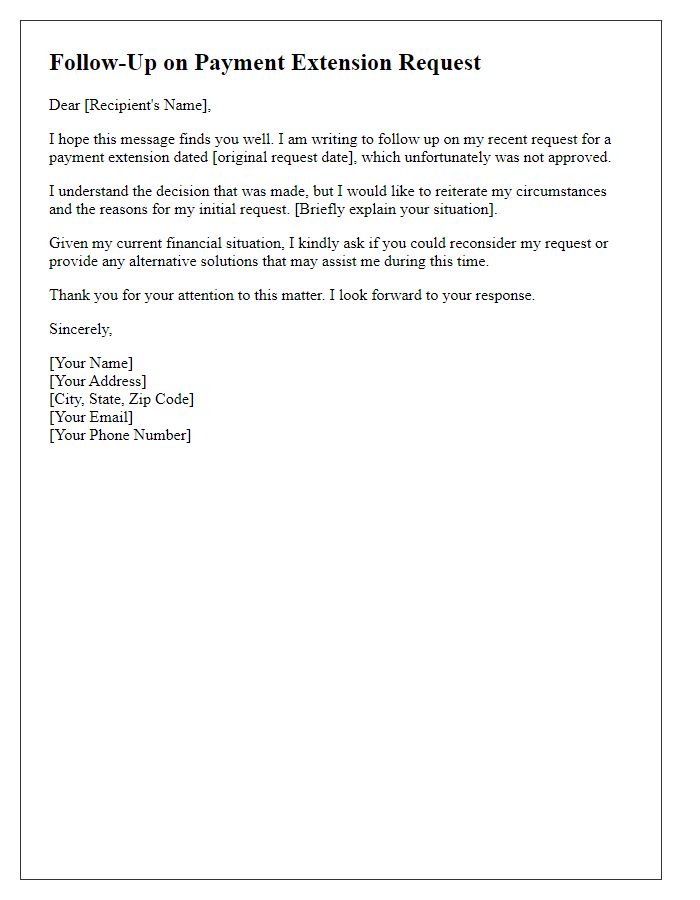

Letter template of clarifying circumstances for denied payment extension

Comments