Are you or a loved one facing the financial challenges that often accompany military deployments? Understanding the complexities of debt relief can make a significant difference during such a demanding time. By exploring the various options, you can find support that eases your financial burden while you focus on serving your country. Dive into our article to discover effective strategies for military deployment debt relief!

Creditor's contact information

Military personnel facing deployment often encounter financial difficulties due to the sudden nature of their assignments. Creditors, such as banks and credit card companies, should be informed of the service member's deployment status to explore debt relief options. Creditors may offer programs like reduced interest rates, deferment of payments, or flexible payment plans. It's crucial for service members to gather specific details, including account numbers, outstanding balances, and relevant military orders, to discuss potential solutions with their creditors effectively. Effective communication may alleviate financial stress during deployment, ensuring service members focus on their duties.

Service member's identification and deployment details

Military service members often face unique financial challenges during deployment, particularly regarding debt management. Deployment periods, typically ranging from six months to a year or more, can lead to increased financial strain due to separation from family and additional expenses associated with military life. Service members, identified by their military identification number (usually a combination of letters and numbers), may qualify for specific debt relief options. Various programs, such as the Service Members Civil Relief Act (SCRA), provide interest rate reductions on existing debts, which can be particularly beneficial for personal loans and credit card debts incurred before deployment. For example, active duty service members deployed to conflict zones like Iraq or Afghanistan may seek relief on debts at financial institutions willing to cooperate with military regulations. Furthermore, the U.S. Department of Defense (DoD) consistently updates policies to support active-duty personnel navigating these financial hurdles.

Request for debt relief or deferment

Active duty military personnel often face unique financial challenges during deployment, particularly when managing debts. Service members can encounter difficulties in meeting financial obligations while stationed in overseas locations such as Afghanistan (often facing heightened expenses) or during training exercises. The Servicemembers Civil Relief Act (SCRA) provides essential protections, including interest rate reduction (to 6% on certain debts) and the possibility of deferment. Service members experiencing economic hardship due to deployment can formally request debt relief or deferment from lenders. This process may involve submitting documentation, such as deployment orders (indicating the start and end dates) and a detailed financial hardship statement. Timely communication with creditors is crucial to secure any available relief that can alleviate the financial burden during such demanding periods.

Legal protections and entitlements under military service

Military deployment can trigger a range of legal protections and entitlements aimed at alleviating financial strain. The Servicemembers Civil Relief Act (SCRA) provides safeguards like reduced interest rates on loans (capped at 6%), postponement of civil court proceedings, and protection against eviction for servicemembers deployed to active duty. During deployment, military families may also access benefits under the Department of Defense's Financial Counseling Program, which offers assistance in managing debts and expenses. Additionally, deployment status may qualify servicemembers for deferment of student loans, offering them financial respite while focusing on their mission. Veterans Affairs (VA) also provides access to low-interest home loans, ensuring housing stability post-deployment.

Documentation and evidence supporting deployment status

Military personnel facing deployment can request debt relief by providing specific documentation and evidence of their status. Critical documents include deployment orders issued by the respective branch of service--Army, Navy, Air Force, or Marines--detailing the deployment's duration and location, such as the Middle East or Korea. Service members must also supply their Military Identification Card as proof of active duty status. Additional evidence might include recent Leave and Earnings Statements (LES) to show income changes due to deployment. Utility company bills or credit statements reflecting financial strain during deployment can further substantiate the request for relief. This compilation of documents supports the claim for assistance under the Servicemembers Civil Relief Act (SCRA) which aims to ease financial burdens during periods of military service.

Letter Template For Military Deployment Debt Relief Samples

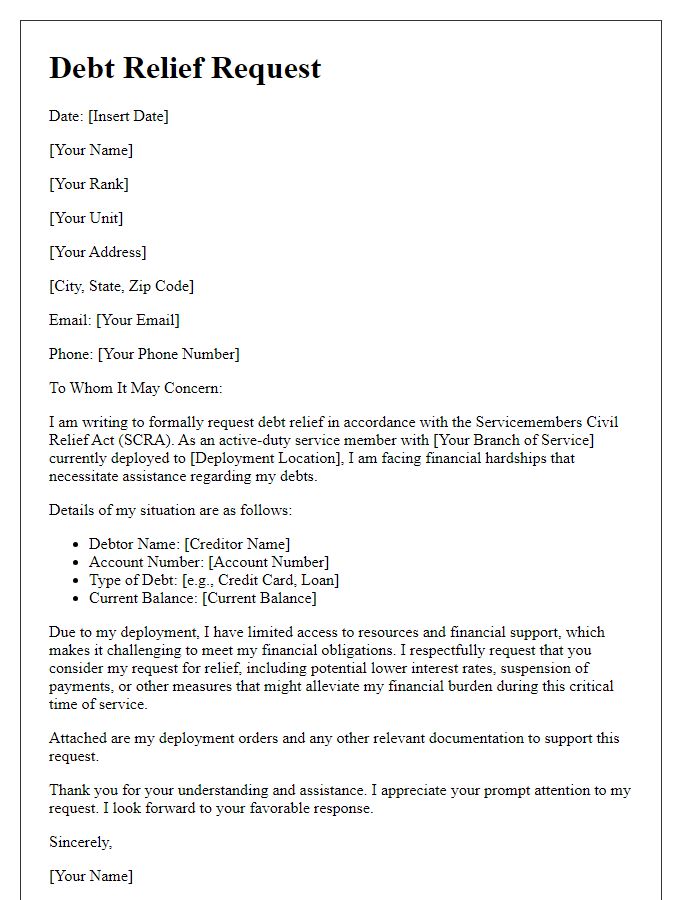

Letter template of military deployment debt relief request for active-duty service members.

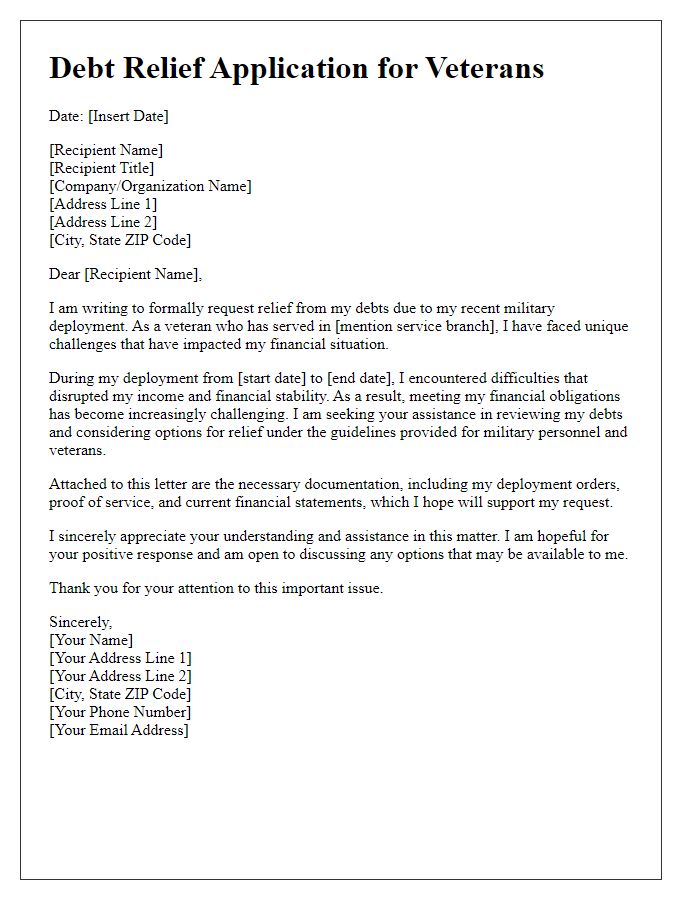

Letter template of military deployment debt relief application for veterans.

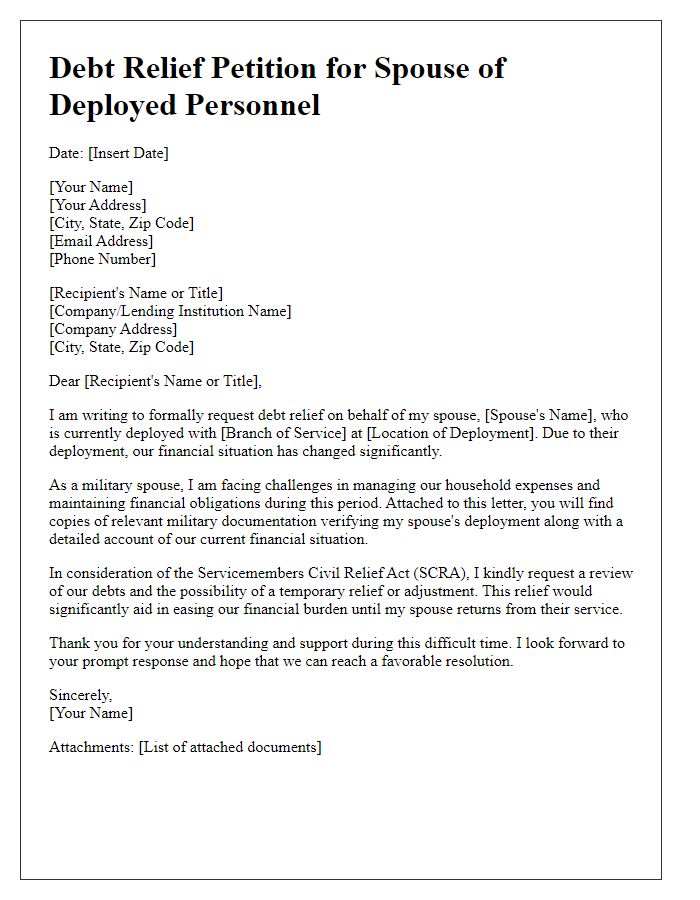

Letter template of military deployment debt relief petition for spouses of deployed personnel.

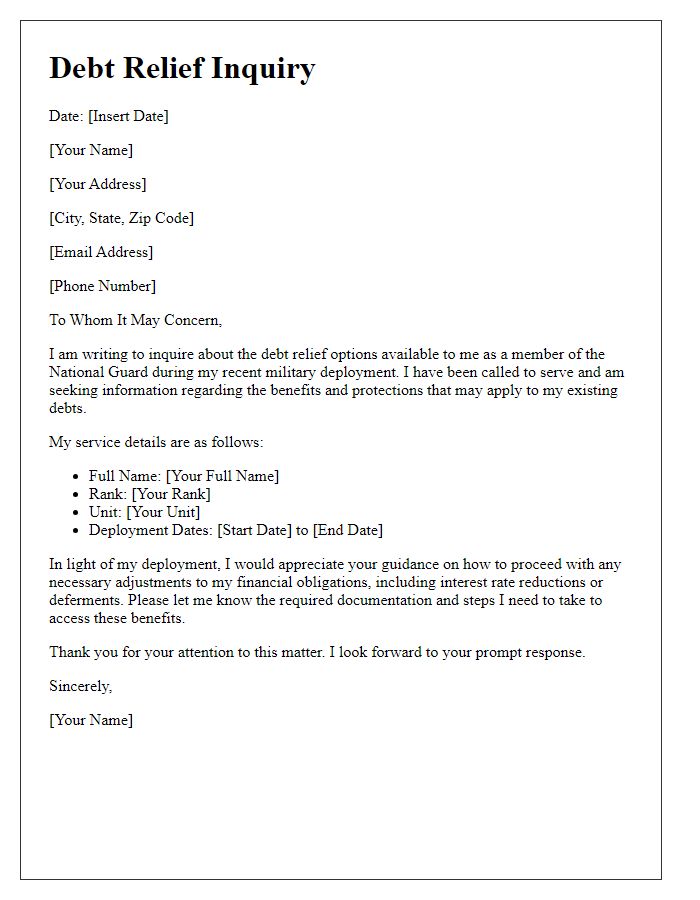

Letter template of military deployment debt relief inquiry for National Guard members.

Letter template of military deployment debt relief notice for reserve forces personnel.

Letter template of military deployment debt relief explanation for financial institutions.

Letter template of military deployment debt relief appeal for denied applications.

Letter template of military deployment debt relief confirmation for eligible beneficiaries.

Letter template of military deployment debt relief update for ongoing cases.

Comments