Are you feeling overwhelmed by rising interest rates on your debt? You're not aloneâmany individuals seek relief from the financial strain that can come from accumulating interest on outstanding balances. In this article, we'll explore a simple yet effective letter template that can help you request a waiver of further debt interest from your lender. Stay tuned as we guide you through the process and offer tips for crafting your own compelling letter!

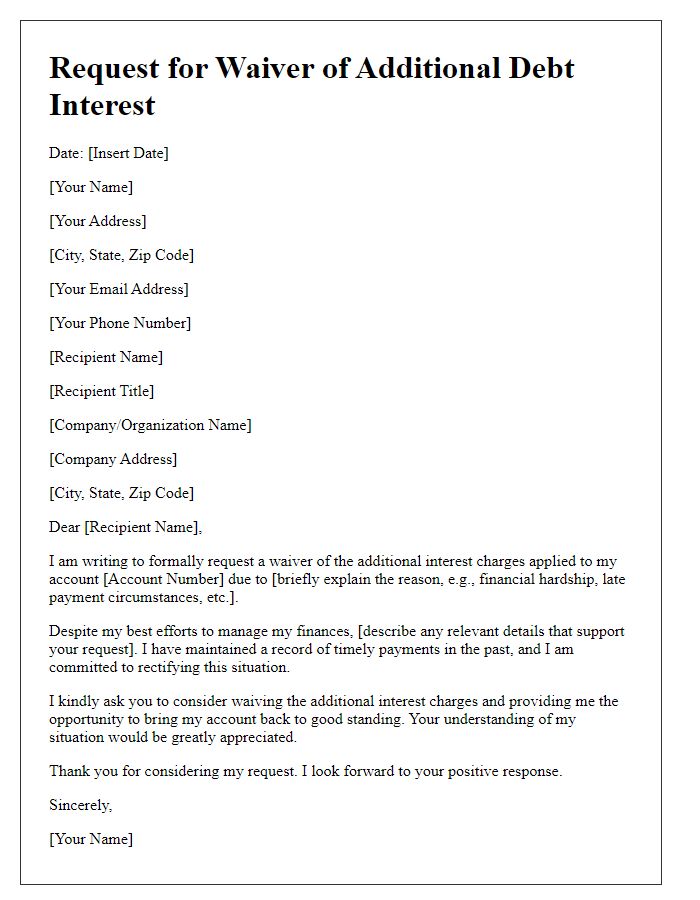

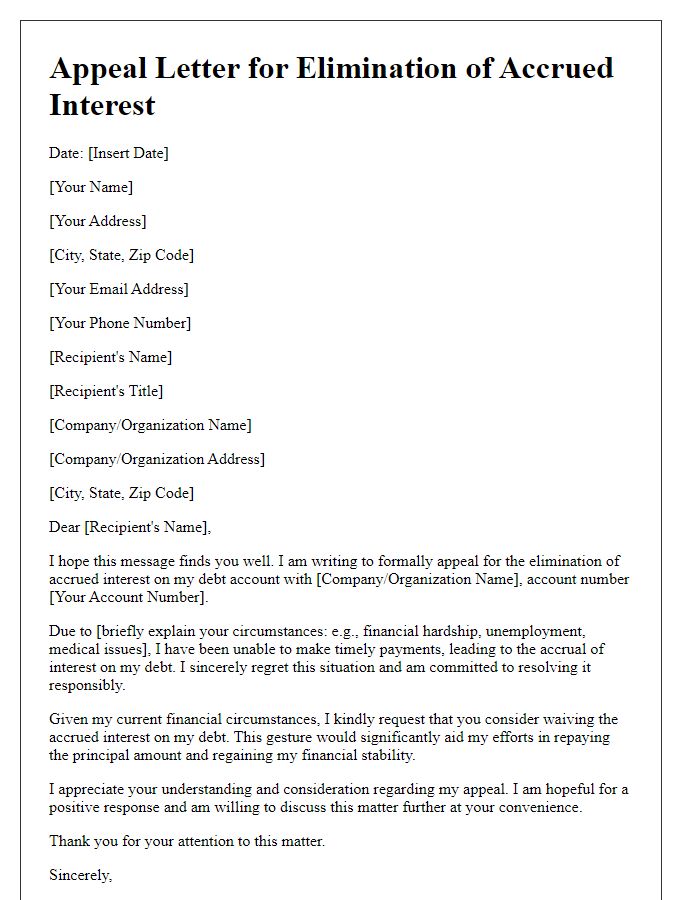

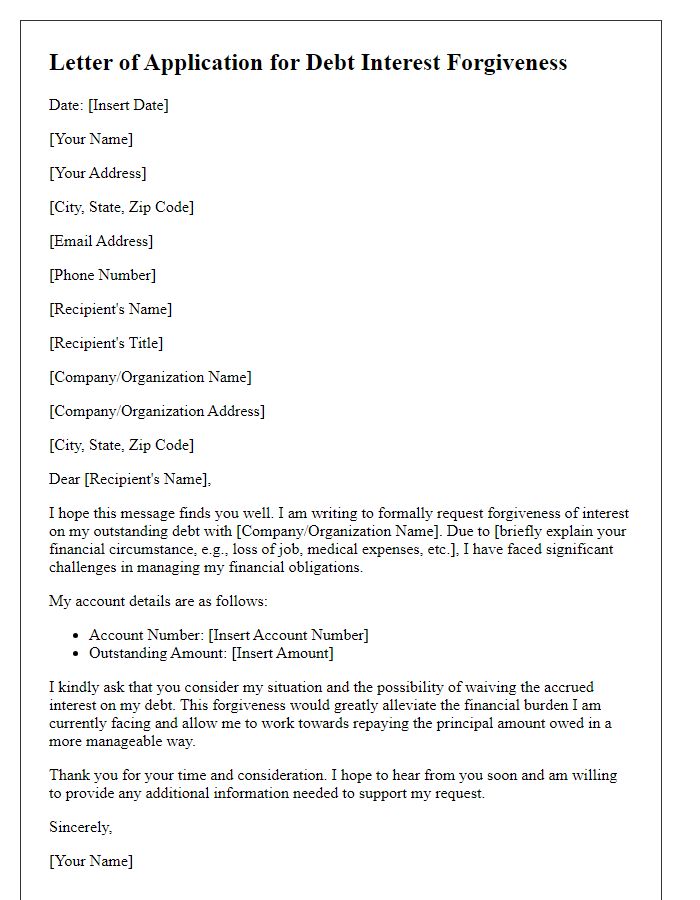

Clear identification of parties involved.

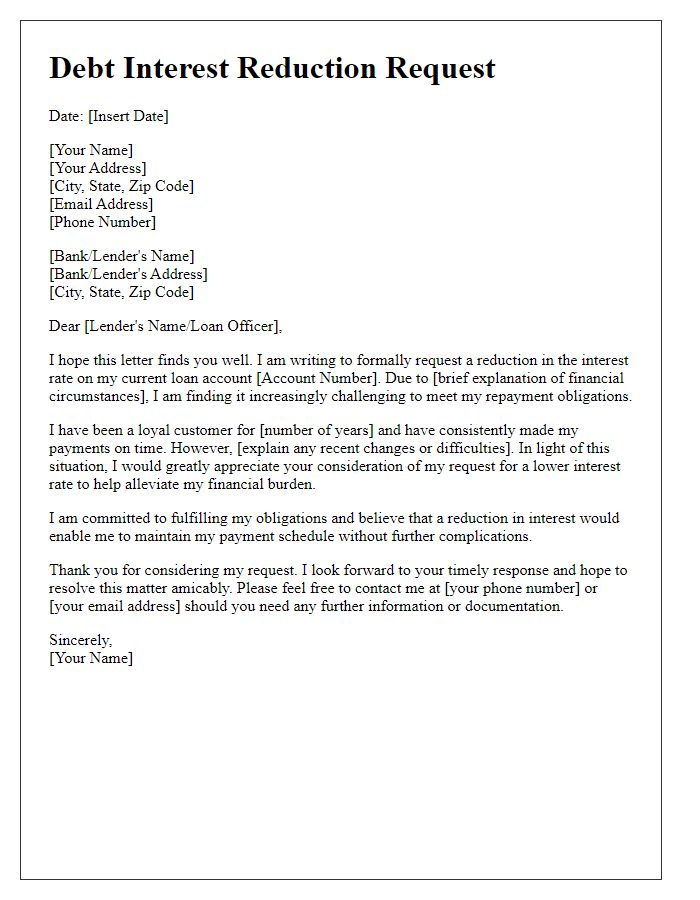

A waiver of further debt interest serves as a formal agreement between the involved parties that stipulates the cessation or modification of interest on outstanding debts. The primary parties typically include the debtor, an individual or entity responsible for repaying the debt, and the creditor, the individual or financial institution that provided the loan or credit. Essential details include full legal names and addresses of both parties, the specific loan amount originally advanced (for instance, $50,000), and the original loan date, which provides context to the financial obligation. Additional information such as the original interest rate (e.g., 5% annually) and reasons for the waiver--such as financial hardship or successful negotiation--should also be documented to establish the rationale and agreement terms clearly. This ensures both parties understand their responsibilities and the implications of the waiver on future financial interactions.

Specific debt details and amounts.

A waiver of further debt interest can provide significant relief for individuals or entities struggling with financial obligations. For instance, a total debt amount of $50,000, with a specified interest rate of 5% per annum, can accumulate substantial costs over time. If granted, this waiver could prevent any additional interest charges from accruing, thereby freezing the total debt obligation at the original amount. For example, if the debt remains outstanding for another year, without the waiver, the accrued interest alone would amount to $2,500, raising the total liability to $52,500. This financial relief could be particularly beneficial for individuals or businesses based in high-cost areas, where expenses continue to accrue rapidly. Additionally, such waivers can be pivotal during financial crises, aiding in the restructuring of payment plans and ultimately allowing for more manageable debt repayment strategies.

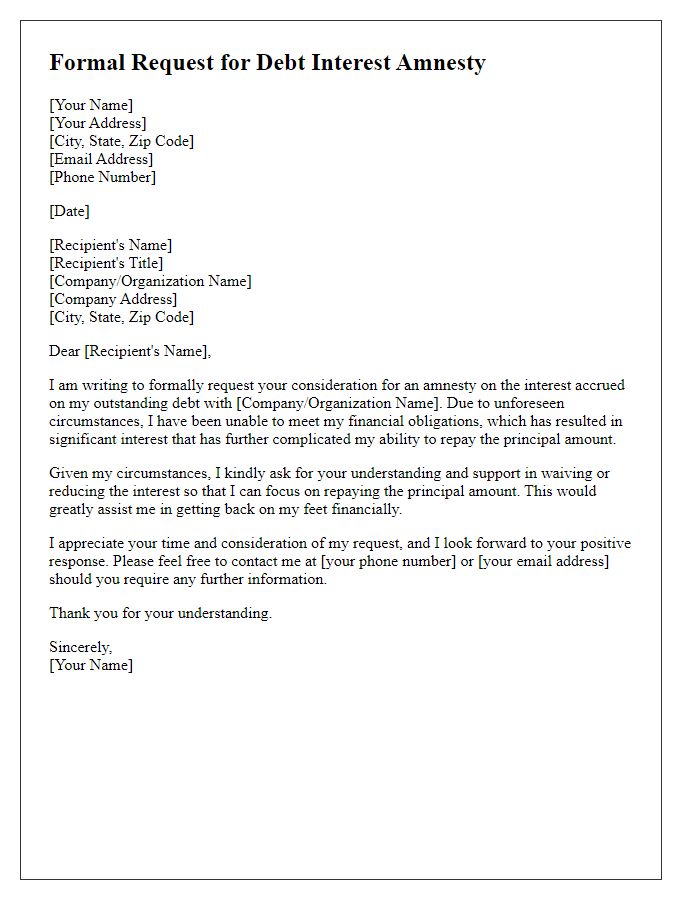

Stated waiver terms and conditions.

In financial agreements, a waiver of further debt interest often includes specific terms and conditions that detail the stipulations under which future interest payments will be suspended. Borrowers may negotiate a waiver with lenders for various reasons, such as temporary financial hardship or ongoing economic downturns. Typically, the waiver can stipulate the duration, often three to six months, during which no interest will accrue, contingent upon the borrower's compliance with outlined payment schedules. This waiver may apply to varying types of debt, including personal loans, mortgages, or credit lines. Additionally, the conditions might require borrowers to provide periodic financial statements to demonstrate continued eligibility for the waiver. It is crucial to ensure proper communication and documentation to protect both parties' interests during this arrangement.

Legal language and disclaimers.

A waiver of further debt interest serves as a legal document that outlines the agreement between the debtor and creditor regarding the cessation of additional interest accrual on outstanding debt. This waiver typically includes specific terms, such as the effective date of waiver, identification of the debt amount, and any potential conditions under which the waiver remains valid. Debtors must acknowledge the implications of relinquishing the right to claim future interest, ensuring they consult their legal advisors. Disclaimers within the document may clarify that the waiver does not discharge the principal debt obligation nor does it prevent future legal actions regarding other terms of the original agreement. Notably, signing parties should ensure compliance with local laws to reinforce the enforceability of the waiver, thus safeguarding both interests in case of disputes.

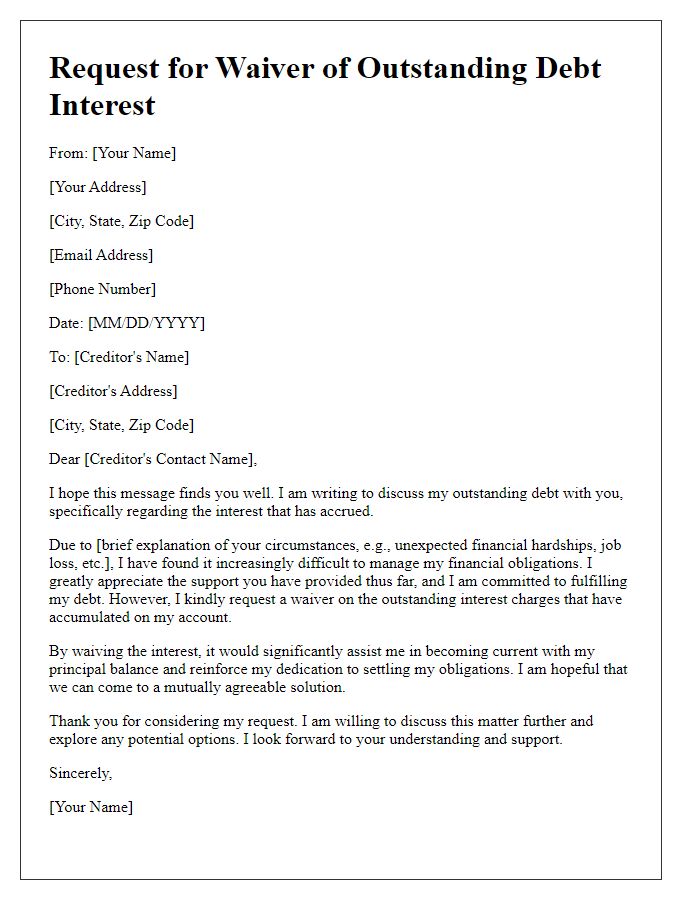

Authorization and signature lines.

A waiver of further debt interest document is a formal agreement between a lender and a borrower, indicating that the lender agrees to forego additional interest charges on a specific debt obligation. This agreement may be crucial during financial hardships when a borrower struggles to meet repayment terms. Including clear authorization lines ensures both parties demonstrate mutual consent. Key components consist of the borrower's name, the lender's name, the specific debt amount (e.g., $10,000), and the effective date of the waiver (e.g., December 1, 2023). A signatures section follows, detailing the named parties' acknowledgment to the waiver, including dates for accountability. Effective language reinforces mutual understanding regarding the waiver's limited duration or conditions, enhancing clarity for future financial engagements.

Comments