Are you feeling overwhelmed by debt and unsure about your obligations? It's crucial to understand your rights and get clear information on your debts, which is where a debt verification demand comes into play. This powerful tool not only helps you confirm the legitimacy of the debt but also protects you from potentially fraudulent claims. Curious to learn how to craft an effective letter for debt verification? Read on!

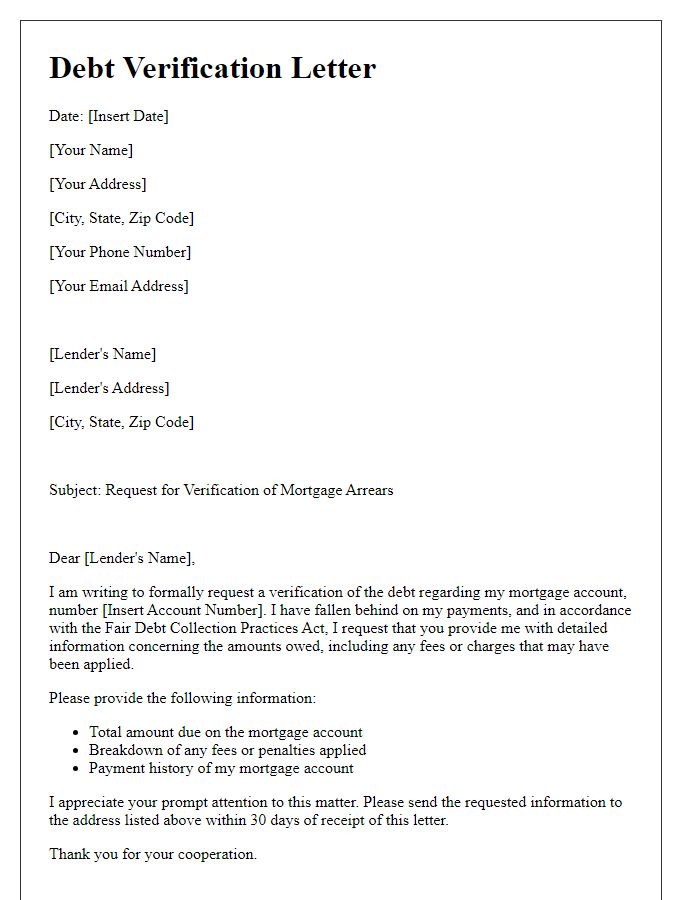

Creditor's contact information

Debt verification demands typically require clear identification of the creditor. Essential elements include name of the creditor (for example, "ABC Financial Services"), physical address (such as "1234 Main Street, Suite 100, Anytown, USA"), contact number (like "(555) 123-4567"), and email address (for instance, "info@abcfinancial.com"). This information allows the debtor to verify the legitimacy of the debt and facilitates efficient communication regarding any disputes or questions that may arise about the outstanding amount owed. Having accurate contact details ensures that both parties can engage effectively in the debt resolution process.

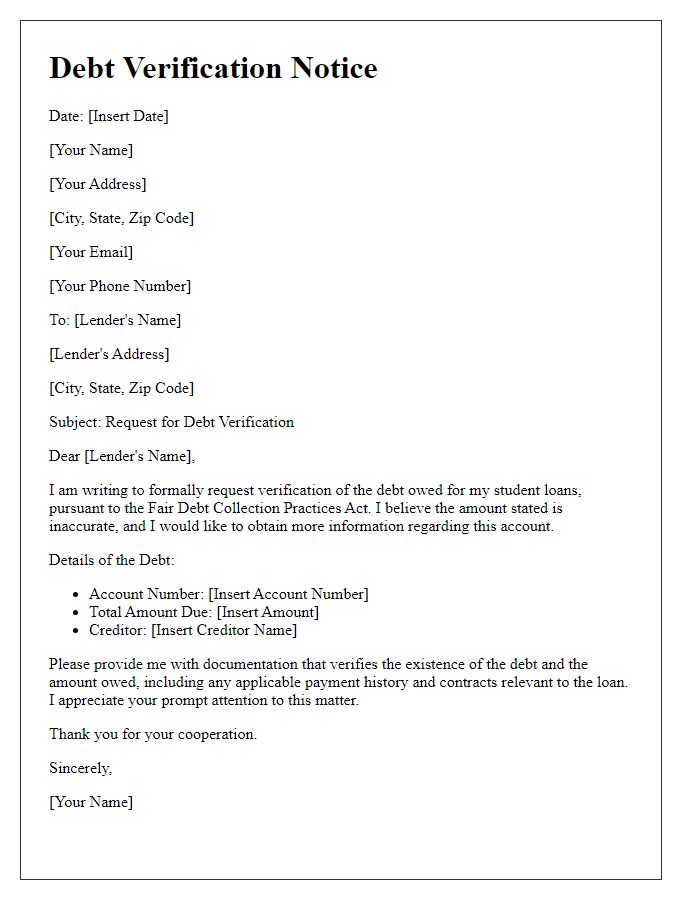

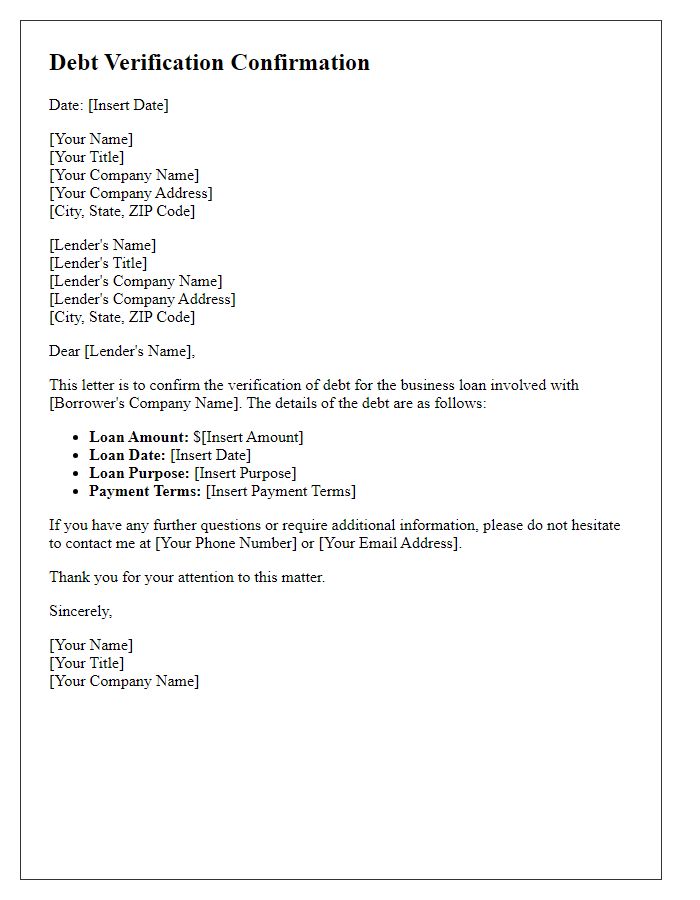

Detailed account information

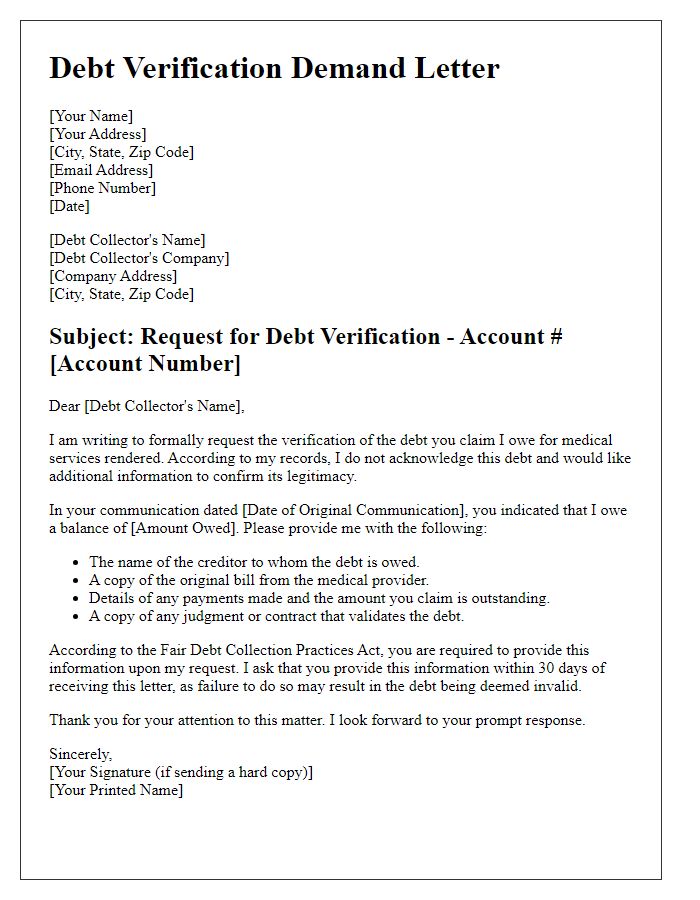

A debt verification demand seeks detailed account information from a creditor, typically involving a consumer's outstanding balance. The Fair Debt Collection Practices Act governs this process, ensuring individuals have the right to dispute debts and request validation. Critical details include the original creditor's name (for instance, American Express), the total amount owed (often specified in documents with figures such as $1,500), account numbers for reference (usually a string of digits like 123456789), and any additional fees related to the debt (such as a late fee of $50). Moreover, documentation around the debt's origin, including dates of transactions or last payment, plays a significant role. This verification helps ensure transparency and provides an opportunity for individuals to confirm accuracy before settling debts.

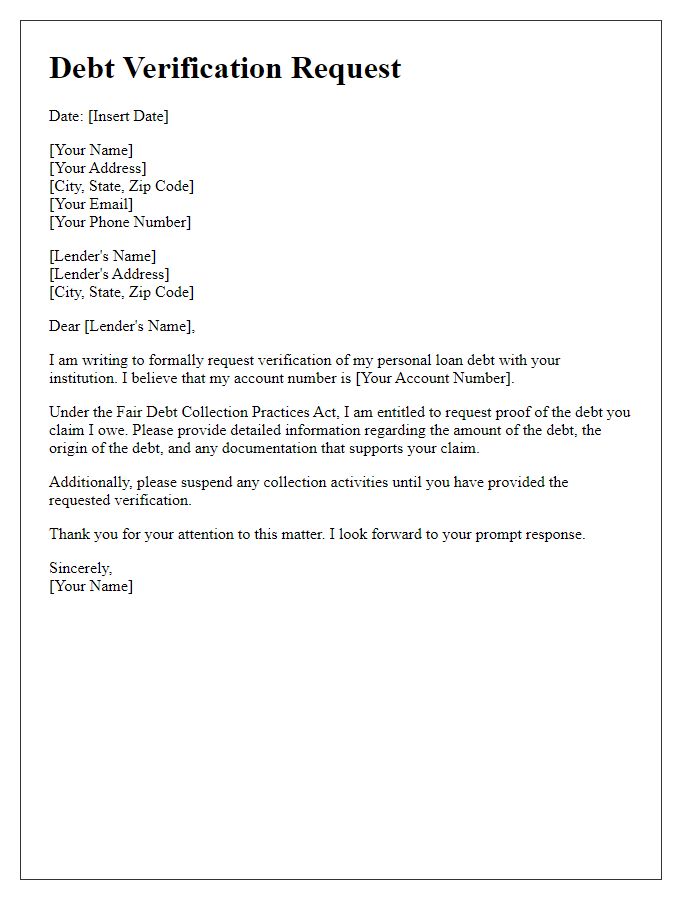

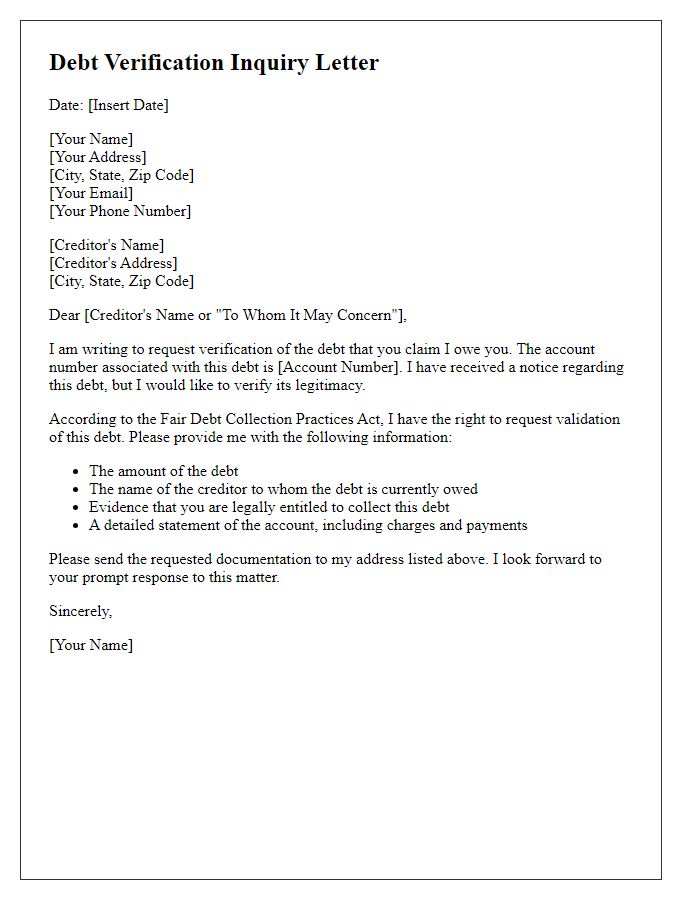

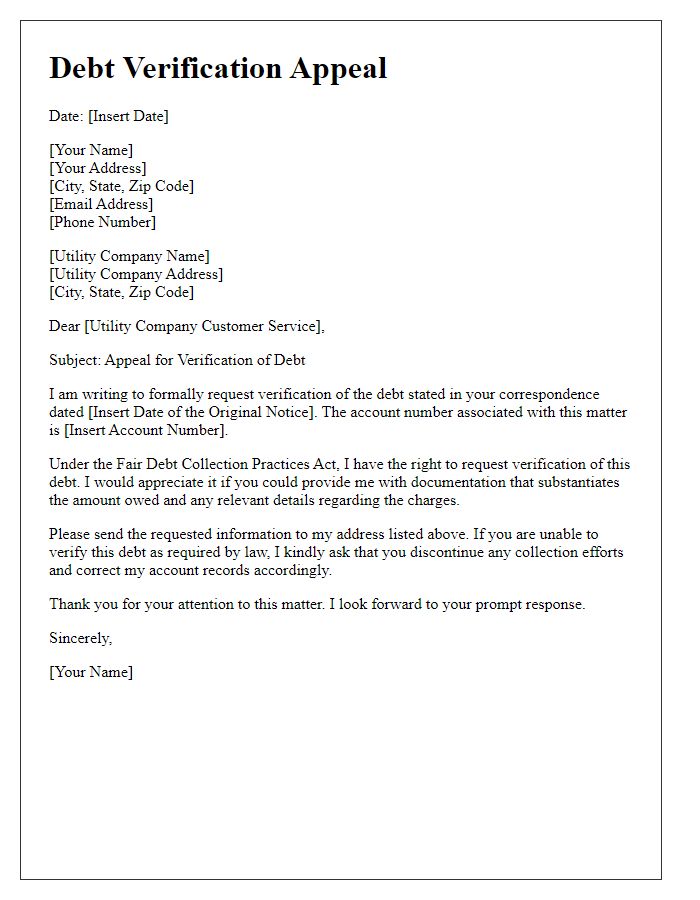

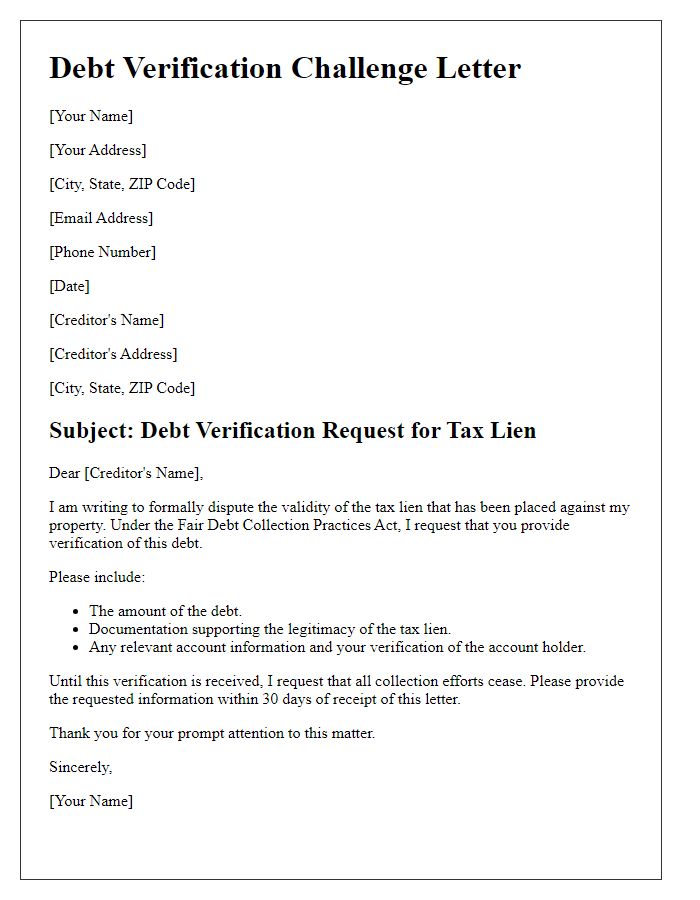

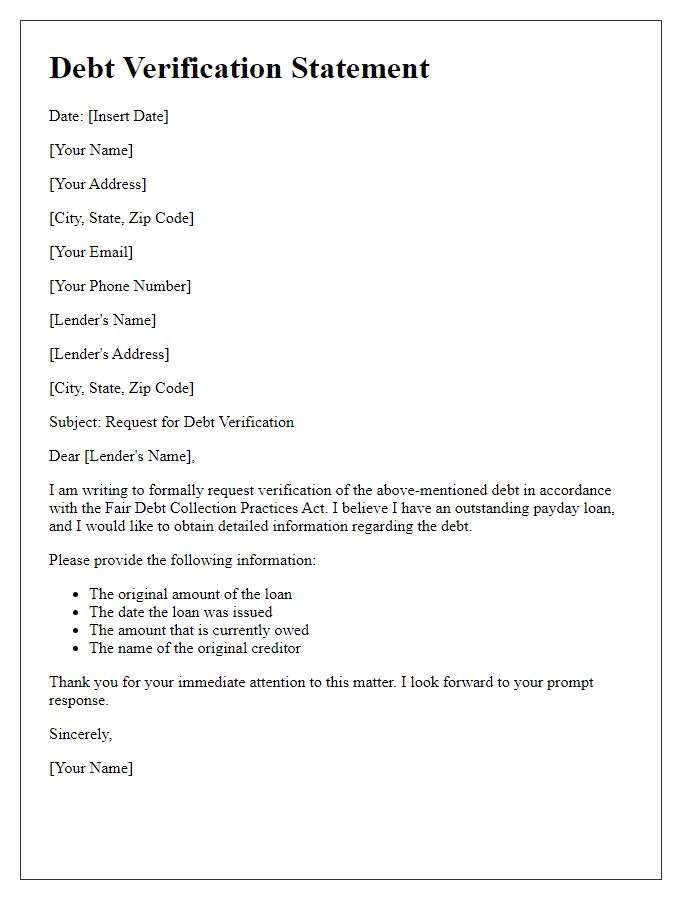

Request for validation documentation

A debt verification demand serves as a formal request for validation documentation regarding an alleged debt. This communication typically outlines essential details, such as the name of the creditor (for example, ABC Collections), the original amount claimed (e.g., $2,500), and the account number (e.g., 123456789). It is important to reference relevant regulations, such as the Fair Debt Collection Practices Act (FDCPA) in the United States, which mandates that debt collectors provide a verification of the debt upon request. Furthermore, the request should specify a timeline, generally 30 days from receipt, for the creditor to respond with supporting documents, including payment history, original creditor information, and any agreements related to the debt. Maintaining a written record of this communication is crucial for future reference and potential dispute resolution.

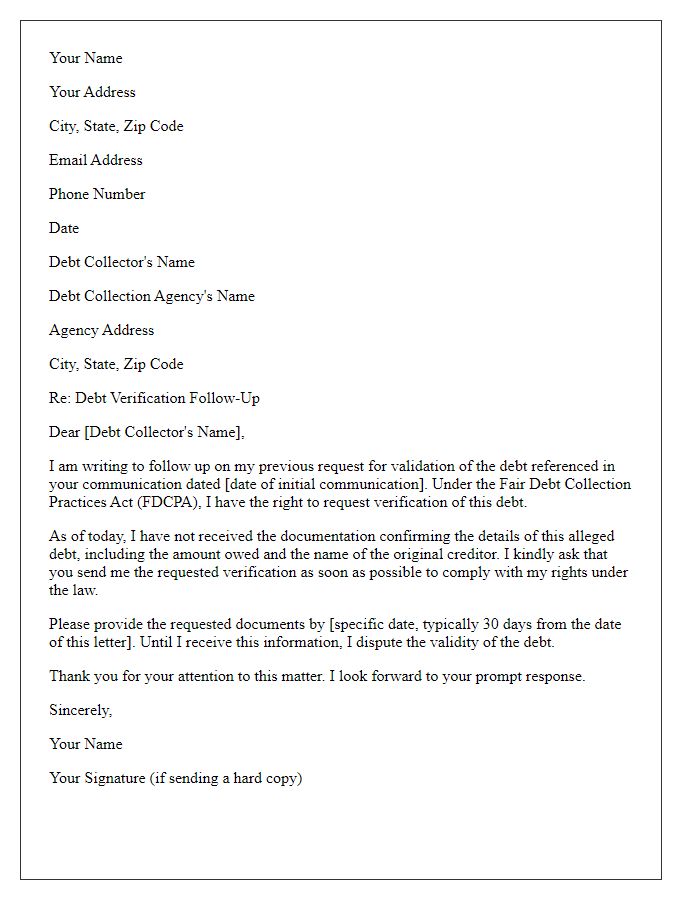

Response deadline

Debt verification demands play a crucial role in consumer rights, particularly under the Fair Debt Collection Practices Act (FDCPA). A debtor must respond to a debt verification request within 30 days to dispute the validity of the debt, which can involve amounts exceeding thousands of dollars. Verification must include specific details such as the original creditor's name, account number, and the total outstanding balance. Ignoring this deadline may lead to legal consequences, including further collection actions and credit reporting implications. Moreover, the formal nature of such communication can significantly affect the debtor's ability to negotiate or settle the debt effectively.

Statement of rights under relevant statutes

Debt verification demands notify individuals about the process of validating debts under laws like the Fair Debt Collection Practices Act (FDCPA) in the United States. Individuals have the right to request the original creditor's name, the amount owed, and additional details related to the debt within 30 days after the initial communication from a debt collector. Statutes such as the Rosenthal Fair Debt Collection Practices Act in California provide similar protections, emphasizing consumers' rights to dispute debts and request verification documentation. Failure to comply with a verification demand may restrict collectors from pursuing collection actions and may lead to legal repercussions for violations of consumer rights statutes.

Comments