Are you feeling overwhelmed by debt and unsure about how to address it? Crafting a letter to resist acknowledging your debt can be a crucial step in managing your financial situation. In this article, we'll guide you through the essential components of drafting a clear and assertive letter while ensuring your rights are protected. Keep reading to discover helpful tips and templates that can empower you in your financial journey!

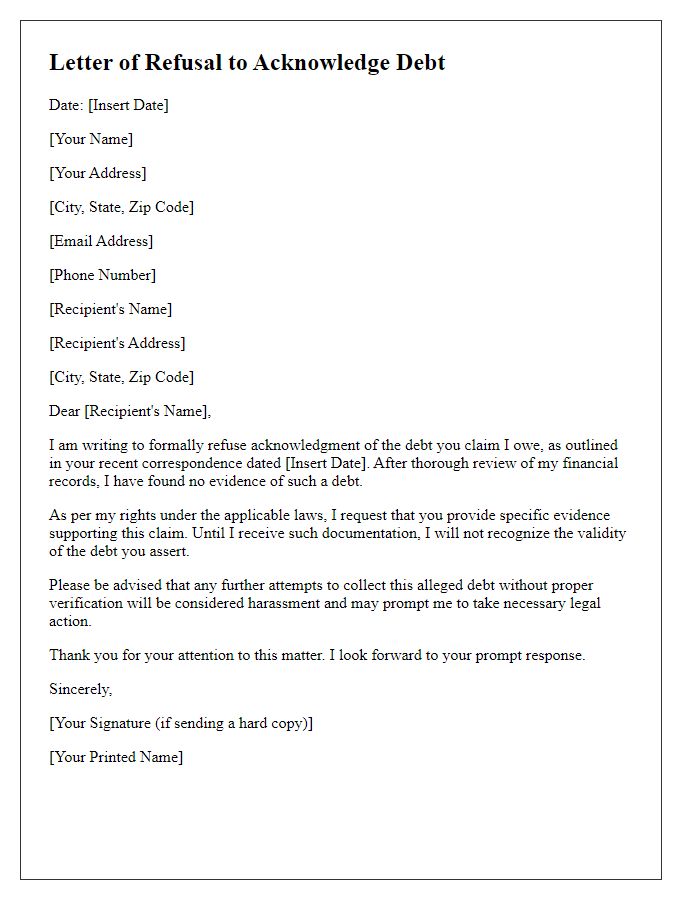

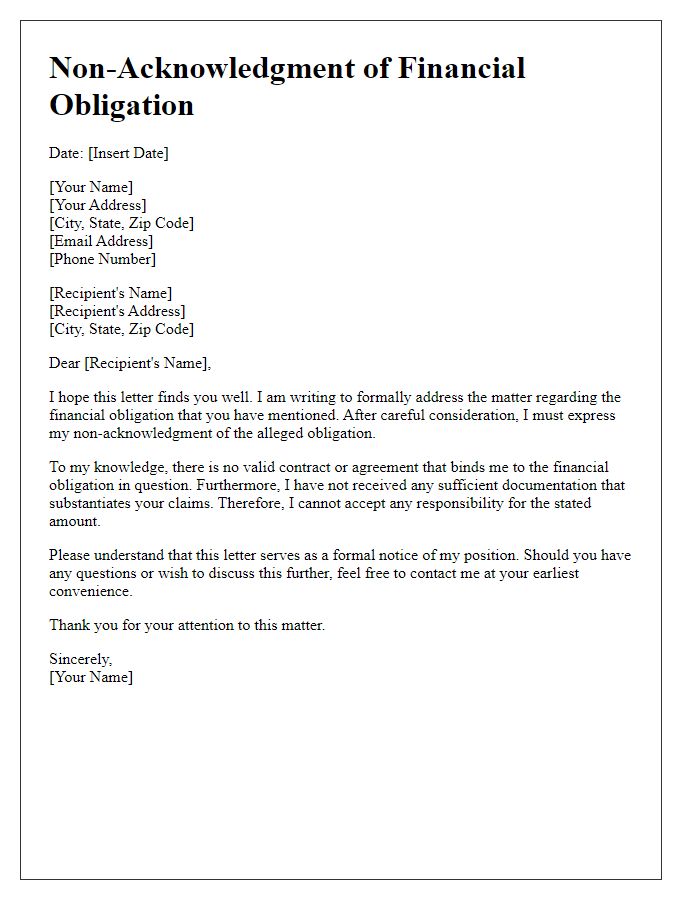

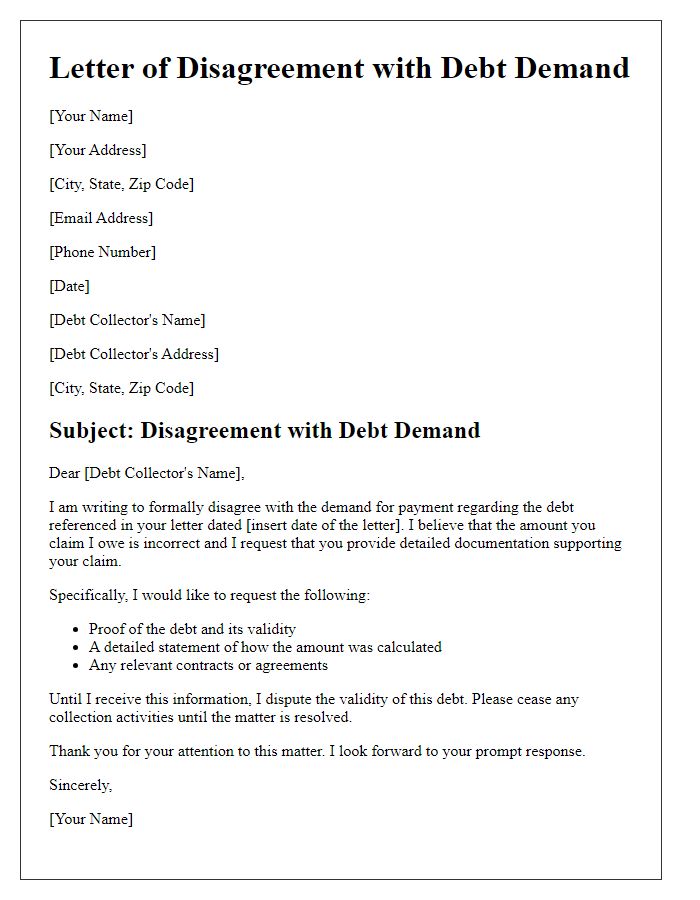

Clear statement of non-acknowledgement

Debt acknowledgment resistance can stem from various reasons, including errors in billing or disputes over the amount owed. Individuals disputing debts often cite discrepancies in account information, such as incorrect balances or unauthorized charges. It is crucial for debtors to document all communication regarding the claim, including dates and times of contact with creditors. Providing clear evidence of the dispute strengthens the position against acknowledgment of the debt. Legal requirements for debt acknowledgment may also vary by jurisdiction, emphasizing the need for utmost diligence in understanding local regulations. Debtors are encouraged to assert their rights and seek professional legal advice when necessary to safeguard their interests.

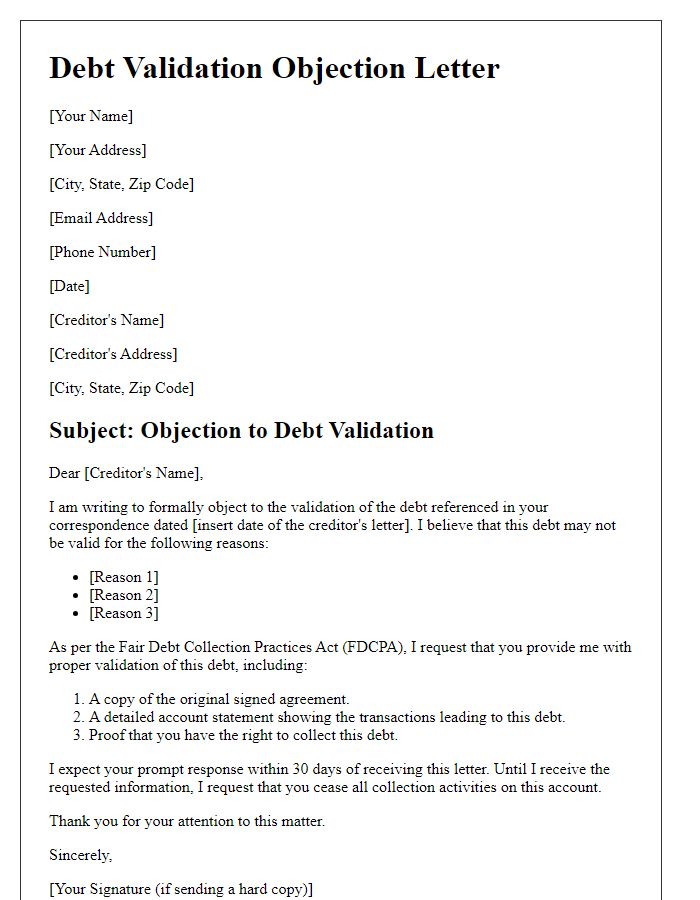

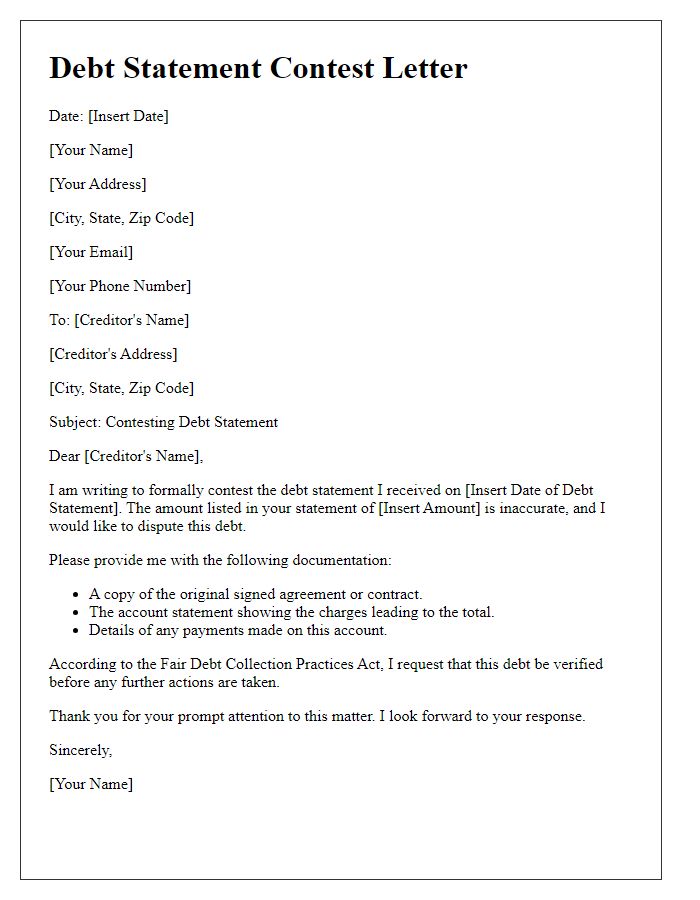

Legal references and statutes

Individuals facing debt acknowledgment challenges often reference statutes such as the Fair Debt Collection Practices Act (FDCPA) enacted in 1977, which safeguards consumers against abusive debt collection practices in the United States. Key legal rights include the right to dispute the debt within 30 days after initial communication. Under the Uniform Commercial Code (UCC), debtors possess certain rights regarding secured and unsecured obligations. In addition, state-specific statutes, such as the California Civil Code Section 1788, offer additional protections for consumers against unfair collection methods. Legal counsel may utilize these references to effectively resist debt acknowledgment, ensuring compliance with applicable laws while addressing inaccuracies or disputes concerning the debt amount or ownership.

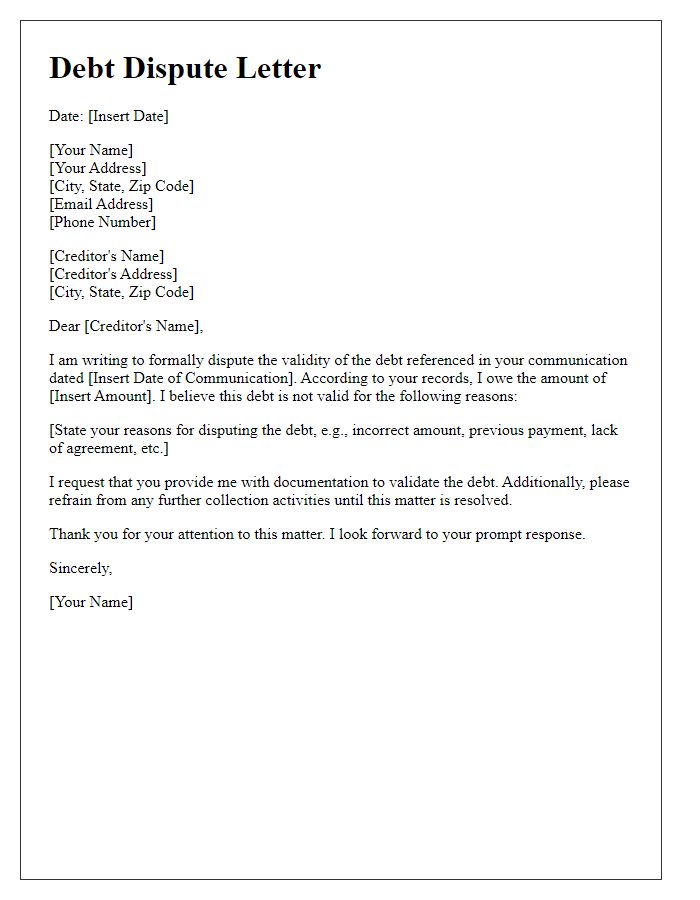

Detailed account verification request

In response to a debt acknowledgment notice from XYZ Collections Agency regarding account number 123456789, a detailed account verification request is submitted. This account pertains to a claimed outstanding balance of $2,500, allegedly derived from an original creditor, ABC Bank, for a personal loan initiated in March 2021. The request seeks to validate the authenticity of the debt, including copies of all relevant documents such as the original loan agreement, transaction history detailing charges, payment records, and any assignments of debt substantiating the transfer of ownership. Without this documentation, the legitimacy of the claimed amount remains in question, requiring thorough investigation into the accuracy of reported financial data and adherence to Consumer Financial Protection Bureau (CFPB) regulations for fair debt collection practices.

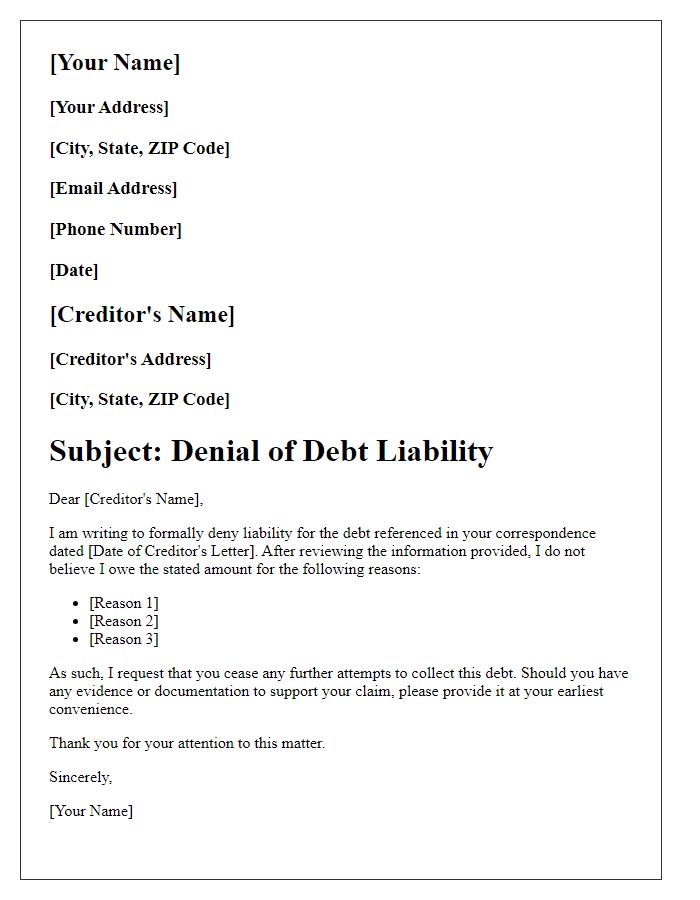

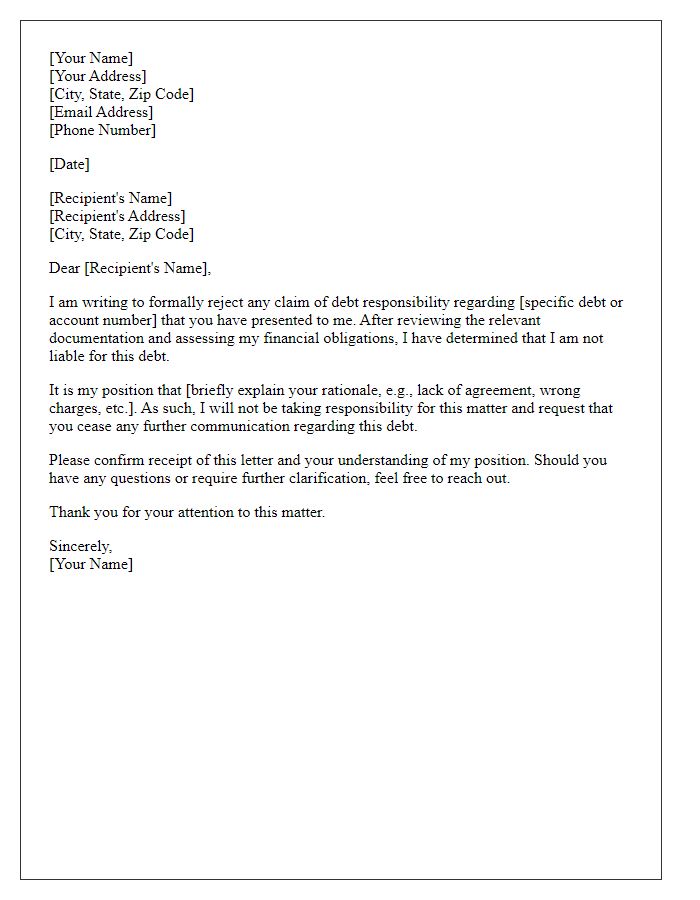

Personal contact information

Resistance to debt acknowledgment involves disputes regarding financial obligations, often linked to legal or contractual agreements. This issue can arise with institutions, individuals, or entities such as banks, credit agencies, or service providers. Disputes may include unclear terms of a loan, unexpected fees, or classification errors in financial records. Significant dates like the debt acquisition date or the last payment made become crucial in these discussions. Regulations such as the Fair Debt Collection Practices Act (FDCPA) also play a role, protecting consumers from abusive practices in debt collection. Personal contact information serves as a key identifier, playing a vital role in communication and resolution processes. Including details such as full name, address, phone number, and email address can ensure a clear line of correspondence during the dispute resolution process.

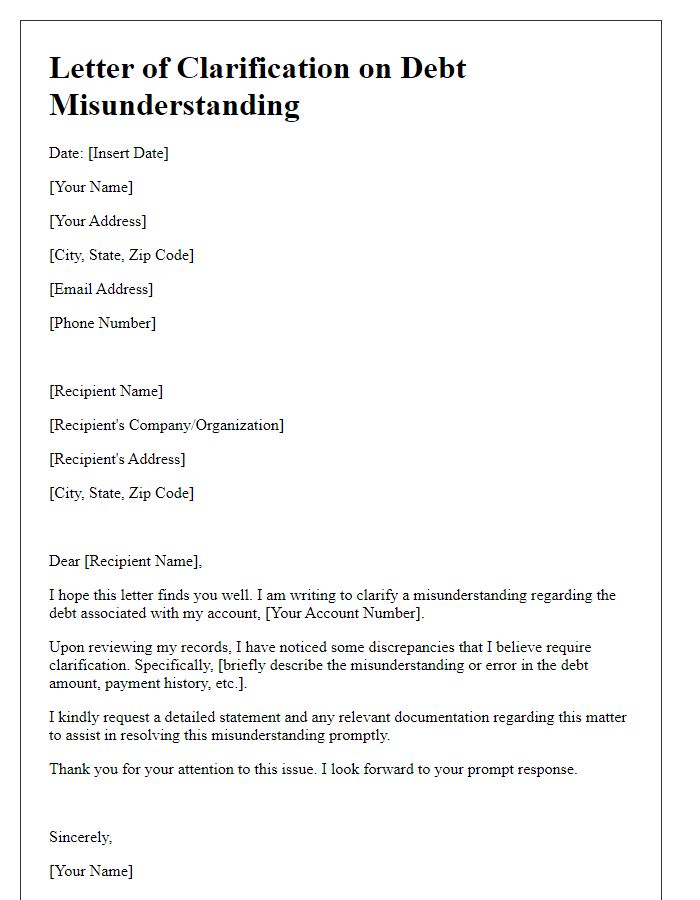

Professional tone and language

Resisting debt acknowledgment involves a careful approach highlighting the specifics of the situation without expressing direct confrontation. Consider the context of credit agreements, such as personal loans or credit cards. Clear understanding of the original loan amount ($5,000), outstanding balance ($2,000), and relevant interest rates (typically 15% APR) is crucial. Furthermore, reference any previous communications dated September 15, 2023, which may have addressed discrepancies in billing or payment records. In legal terms, be aware of relevant statutes such as the Fair Debt Collection Practices Act (FDCPA), which outlines consumer rights in the debt collection process. Documenting all interactions provides leverage in discussions with creditors or collection agencies regarding the validity of the debt.

Comments