Are you feeling overwhelmed by a debt that you believe is inaccurate? You're not aloneâmany people face disputes over debt account statements that can lead to confusion and frustration. In this article, we'll cover a reliable letter template that can help you effectively communicate with creditors and assert your rights. So if you're ready to take control of your financial situation, read on to discover how to navigate the dispute process!

Creditor and Account Information

A disputed debt account statement involves detailed information about creditors and account status. The creditor, often a financial institution like Capital One or Bank of America, may be associated with a specific account number (e.g., 1234-5678-9012-3456). This information is critical for identifying the account in question, especially when discussing discrepancies in balance, payment history, or transaction records. The statement might also include the debtor's name, address, and the date of the last payment. It is essential to note the outstanding balance, which can vary due to accrued interest rates (often between 15% and 25% for credit cards) and late fees. An internal reference number may also be provided to facilitate tracking the dispute process, which can employ regulations under the Fair Debt Collection Practices Act (FDCPA). Documentation supporting the disputed status must be referenced, such as payment receipts or correspondence from the creditor.

Dispute Description and Claims

Disputed debt accounts often stem from inaccuracies in recordings, possibly related to billing errors or identity theft. The Fair Debt Collection Practices Act, established to protect consumers, mandates that collection agencies provide validation of the debt within 30 days of receiving a notice to dispute. Companies such as Equifax or Experian monitor credit reports, and discrepancies can significantly impact credit scores, sometimes reducing them by over 100 points. For example, a report might list an incorrect balance of $1,500 instead of the actual $500 due. Consumers should not only document their communications but also send certified letters to ensure the dispute is officially recognized. Prompt action is crucial for addressing these financial inaccuracies and protecting one's credit history.

Supporting Documents and Evidence

A comprehensive debt account statement can elucidate financial discrepancies, presenting supporting documents and evidence pertinent to the disputed claim. Items such as transaction records, invoice copies, and payment receipts can substantiate the argument surrounding the disputed debt. Noteworthy timestamps (dates of transactions), amounts involved (monetary values), and account identifiers (such as account numbers and creditor names) can add clarity and context to the dispute. Additionally, correspondence records including emails or letters related to the debt issue can further reinforce the case. Courts and financial institutions may require this documentation to assess the legitimacy of the dispute and establish a resolution based on factual evidence.

Request for Specific Resolution

A disputed debt account statement requires clarity and detail regarding the discrepancies in financial information. Accurate record-keeping is crucial, as errors can stem from various sources, including billing mistakes, unauthorized charges, or identity theft. For example, a medical bill from St. Mary's Hospital totaling $2,500 might appear inflated if insurance reimbursement was not properly applied. Timely documentation, such as initial contracts or payment receipts, is essential for establishing a firm basis for resolution. Furthermore, regulatory compliance with the Fair Debt Collection Practices Act (FDCPA) can guide interactions with debt collectors, ensuring consumer rights. A specific resolution request should outline preferred actions, such as adjustment of records, removal of late fees, or a payment plan based on verified account balances.

Deadline and Contact Information

A disputed debt account statement requires clear and precise details to ensure proper resolution. Debtors should note specific items, such as account number (e.g., 123456789) and balance owed (e.g., $2,500). The deadline for disputing the amount typically aligns with compliance regulations, often set at 30 days from receipt of the statement, thereby emphasizing urgency. Contact information for the creditor is crucial, including the company's name (e.g., ABC Collection Agency), mailing address (e.g., 4567 Elm Street, Suite 100, Springfield, IL), and direct phone line (e.g., 555-0123), facilitating prompt communication. Clear designation of the sender's name and address also verifies legitimacy, ensuring accurate processing of the dispute.

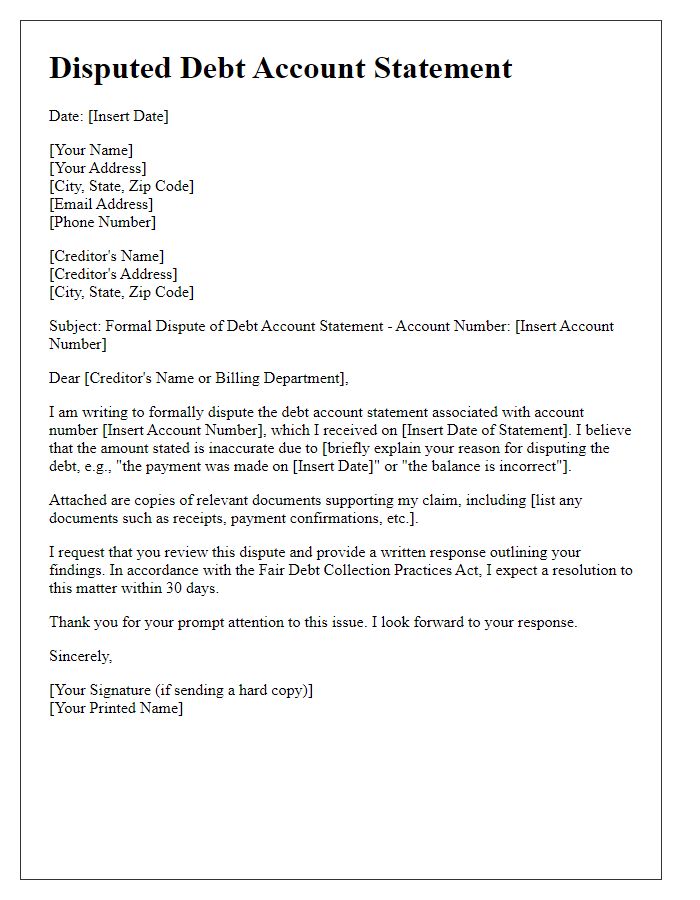

Letter Template For Disputed Debt Account Statement Samples

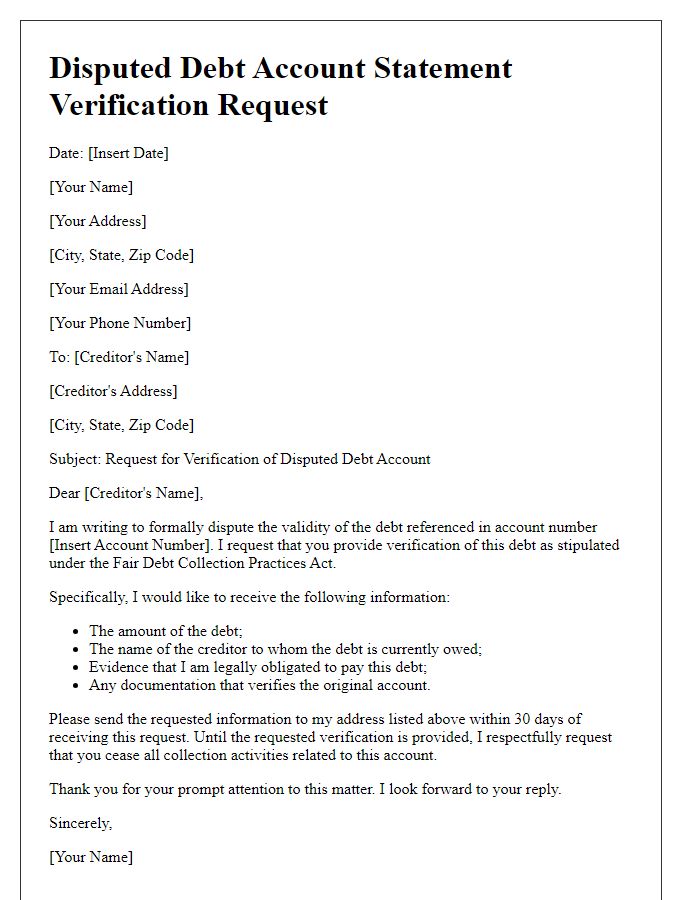

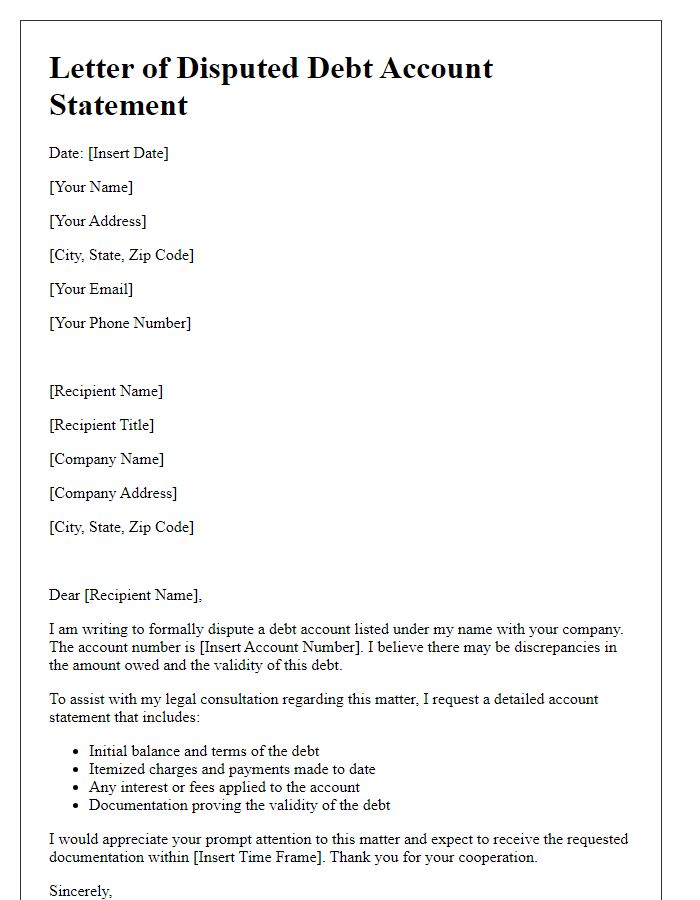

Letter template of disputed debt account statement for verification request

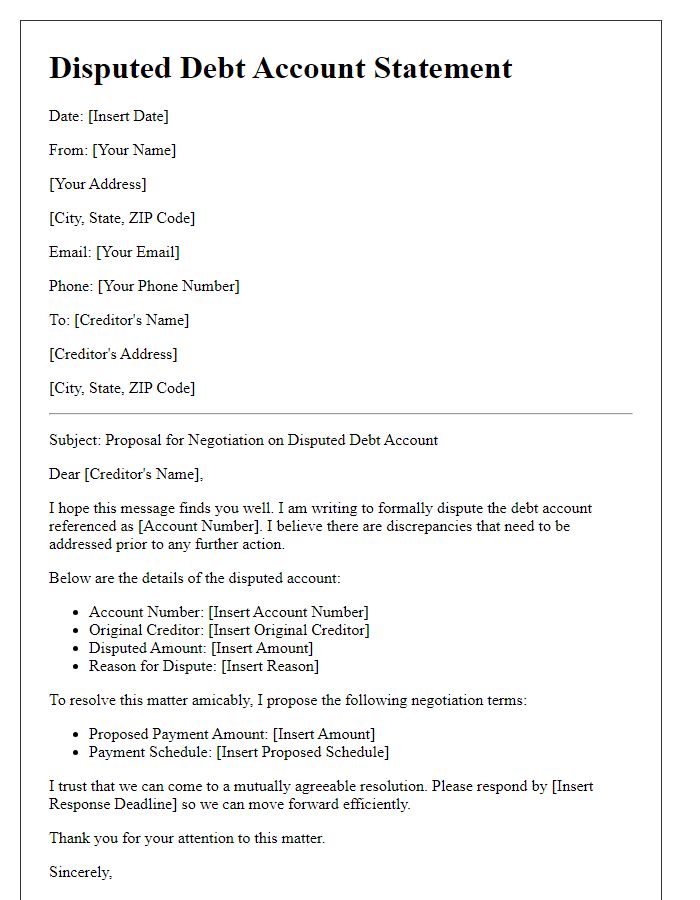

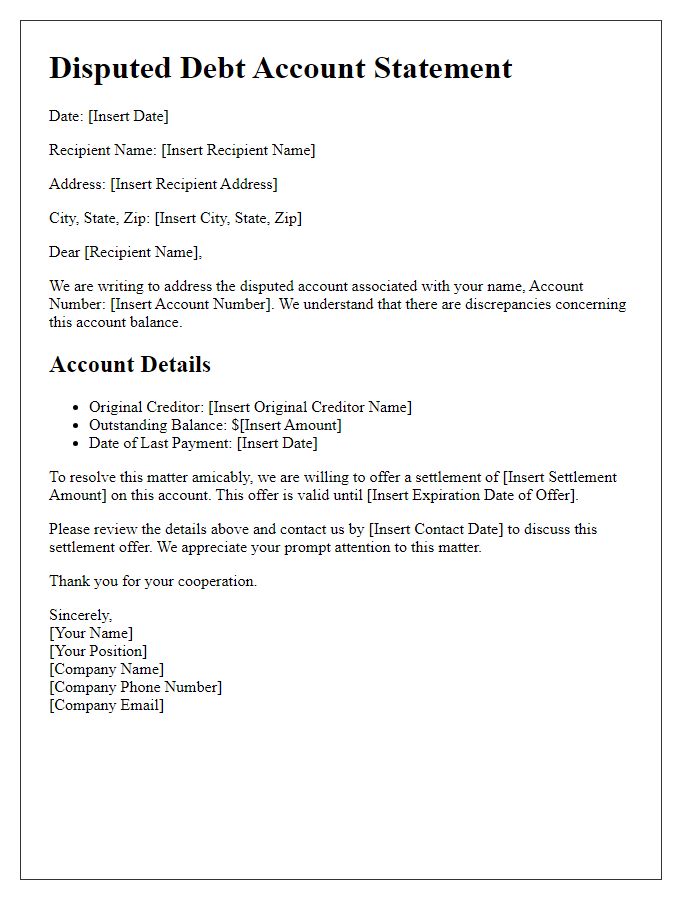

Letter template of disputed debt account statement for negotiation proposal

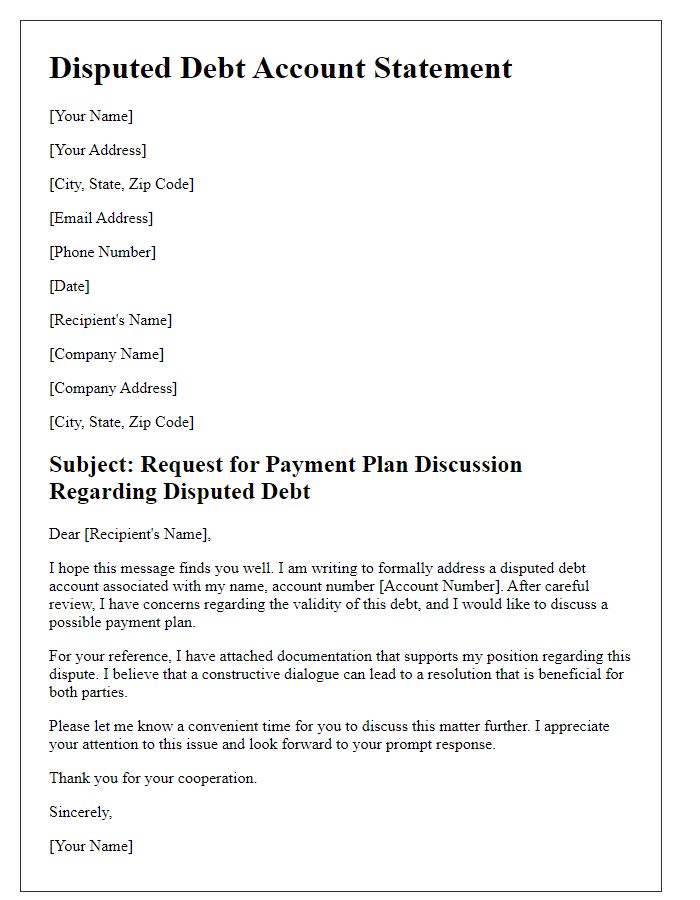

Letter template of disputed debt account statement for payment plan discussion

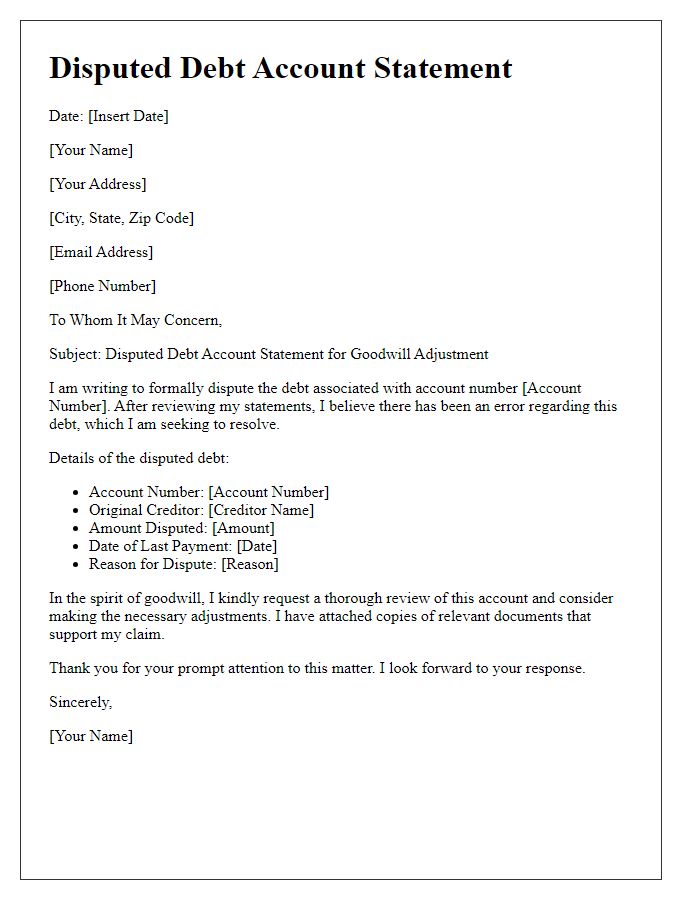

Letter template of disputed debt account statement for goodwill adjustment

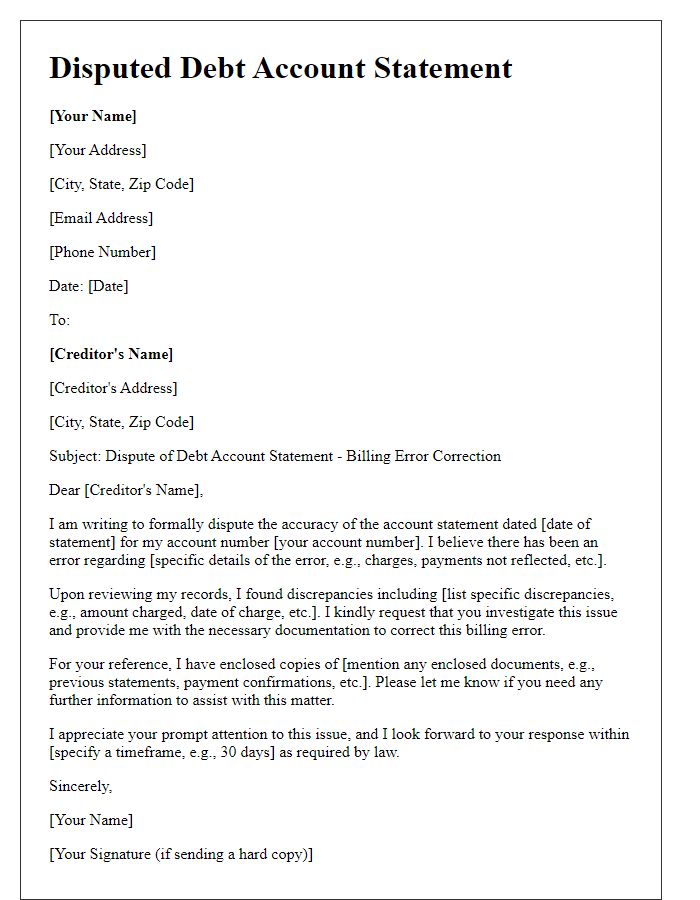

Letter template of disputed debt account statement for billing error correction

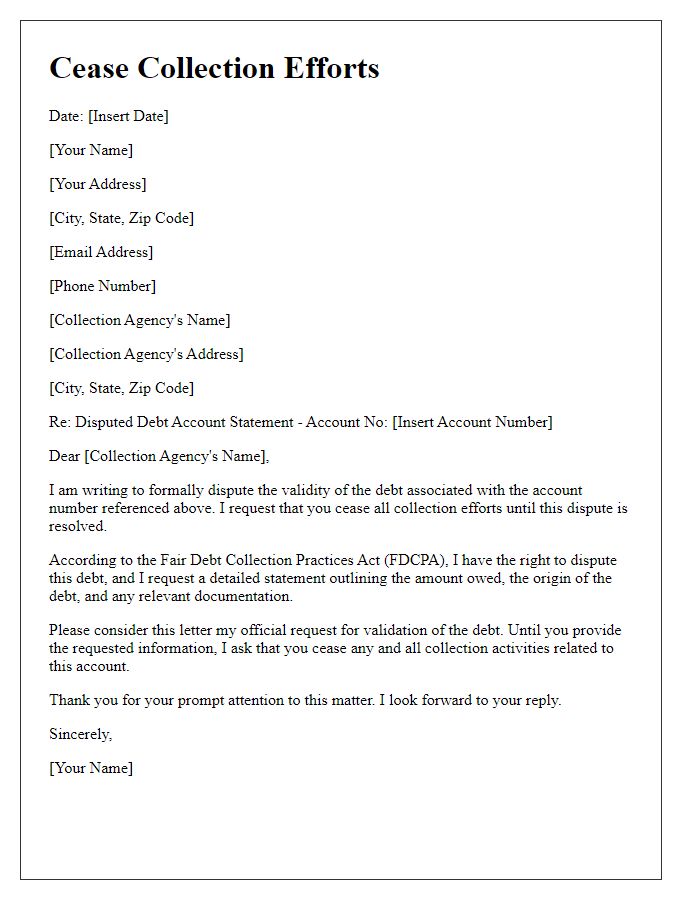

Letter template of disputed debt account statement for cease collection efforts

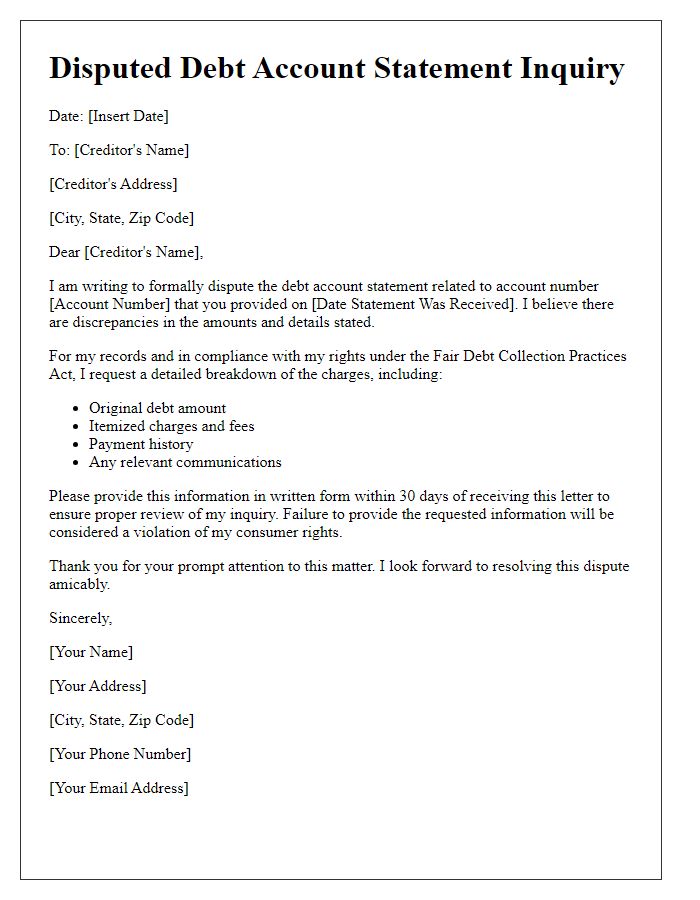

Letter template of disputed debt account statement for consumer rights inquiry

Comments