Are you struggling to keep track of your cyber debts? It's easy to feel overwhelmed, especially with the constant influx of digital transactions and online services. But don't worry; you're not alone in this journey, and staying informed is the first step toward financial clarity. If you'd like to learn how to manage your cyber debts effectively and the best practices to ensure you're not caught off guard, read on for helpful tips and insights!

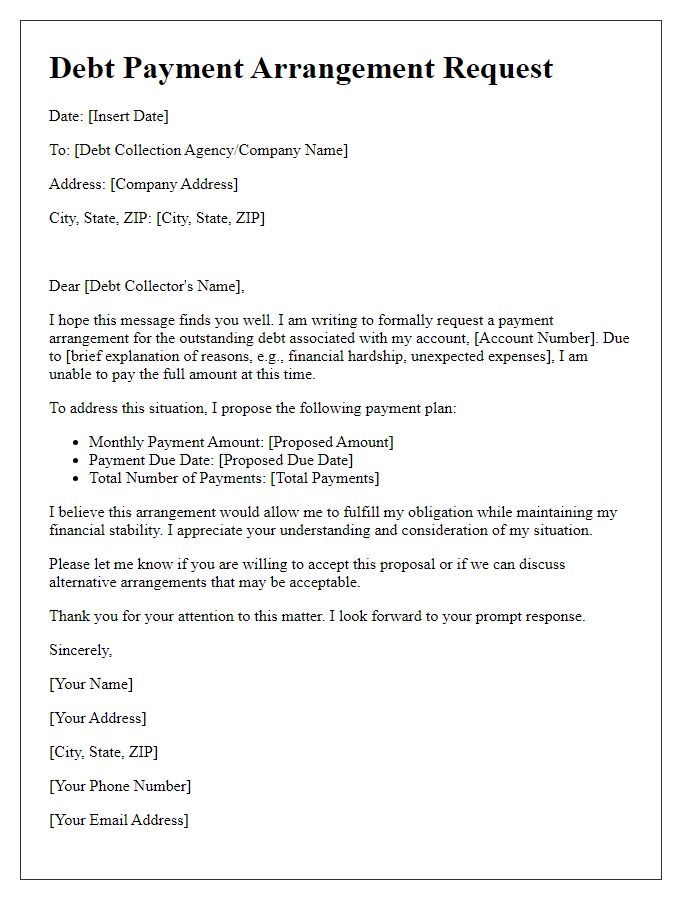

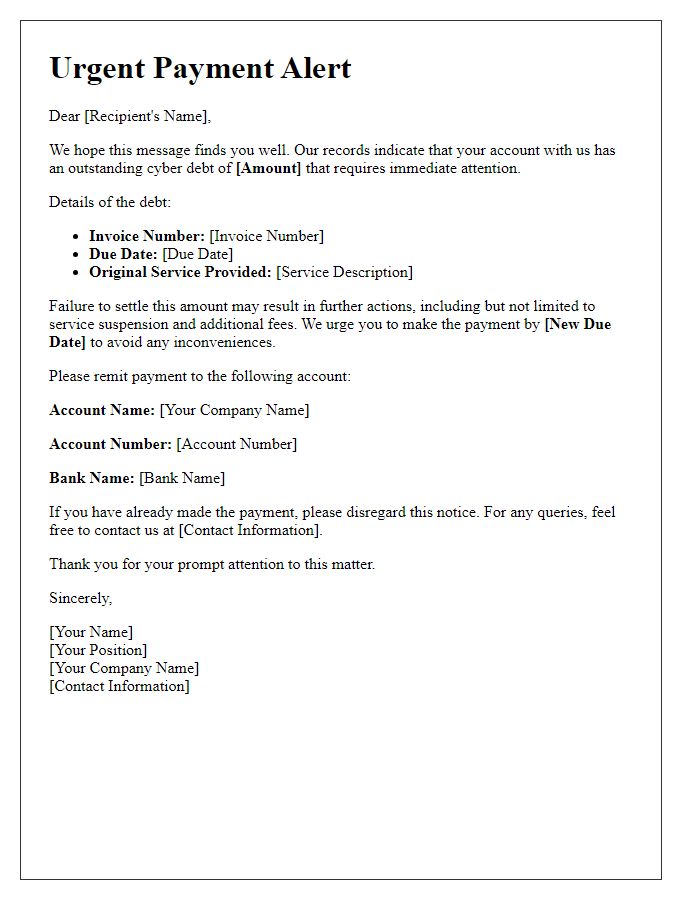

Clear Subject Line

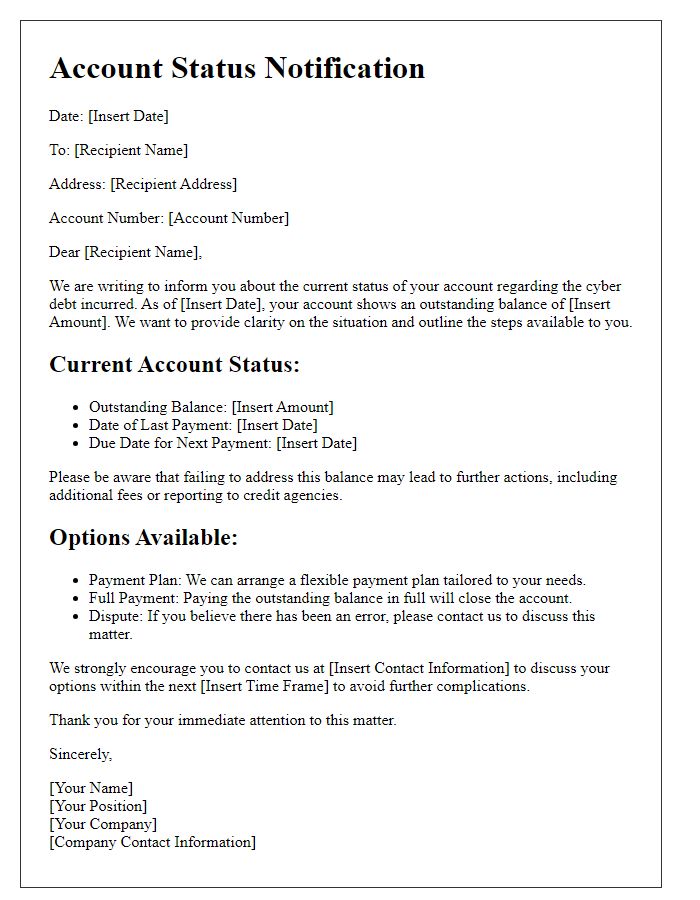

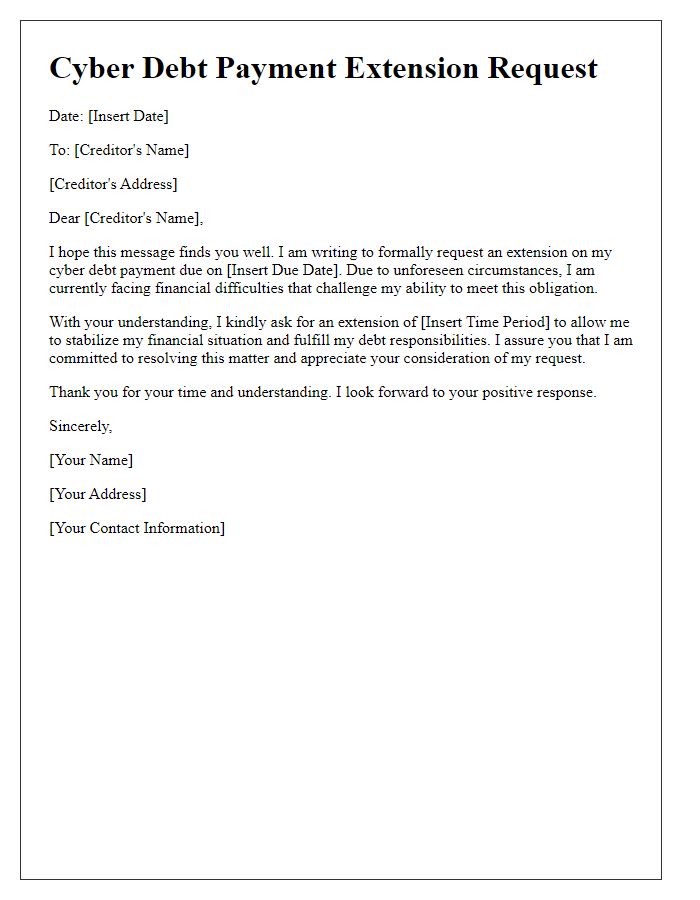

Cyber debt payment alerts are crucial communications for individuals managing financial obligations stemming from digital transactions or online services. The subject line of such alerts should be clear and direct, conveying urgency and relevance. For example, "Immediate Action Required: Cyber Debt Payment Due" effectively informs the recipient of the necessity to address outstanding balances. The alert should contain essential details including the amount owed, payment deadlines, and potential consequences for delayed payments, such as late fees or potential escalation to collections. Providing options for payment methods, along with contact information for inquiries, enhances the recipient's ability to respond promptly and positively to their financial commitments.

Recipient's Personal Information

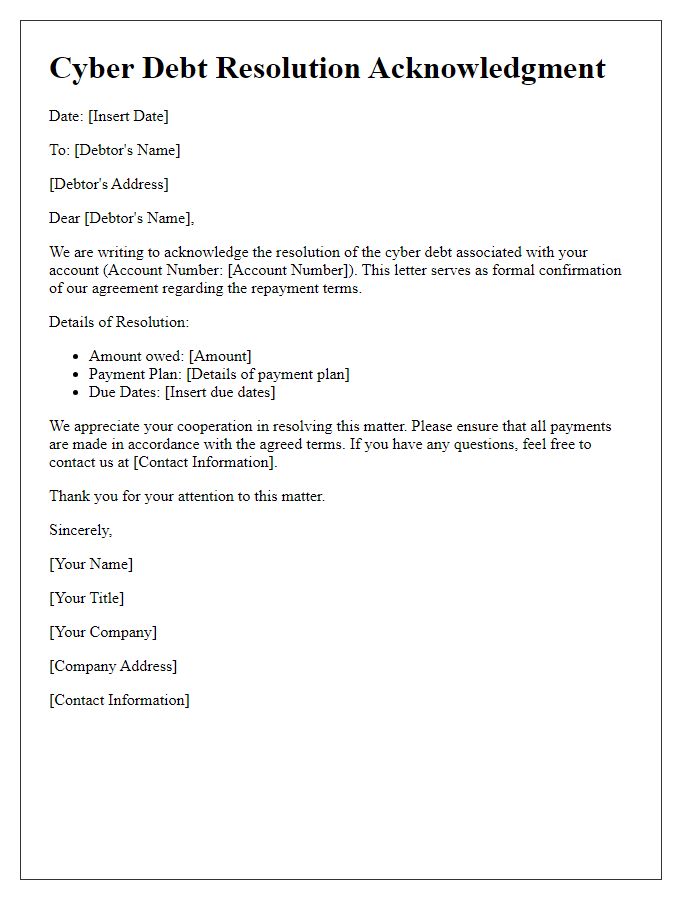

Cyber debt, such as outstanding balances from unauthorized online transactions, can significantly impact personal credit scores and financial stability. Payment alerts are crucial for individuals to address issues such as overdue payments, ensuring compliance with creditor agreements. Personal information, including names, addresses, and account numbers, should be handled securely to protect against identity theft. Ignoring these alerts can lead to escalation in efforts for debt collection, potentially resulting in legal actions or further financial penalties. It's important to verify the authenticity of the alert source to prevent falling victim to phishing scams.

Detailed Debt Information

Outstanding debts can significantly impact credit scores and financial well-being. For instance, a credit score drop (by as much as 100 points or more depending on the total amount owed) can hinder loan approvals or result in higher interest rates. Cyber debt, often accumulated through online lending platforms or unpaid financial services, can vary greatly in amounts, with many borrowers facing balances exceeding thousands of dollars. Debt collection agencies, such as Palladian Financial Services or Apex Recovery Solutions, are legally permitted to pursue payment after an account becomes overdue (typically after 30 days). Each month that debt remains unpaid typically adds more interest, leading to increased financial burdens, especially concerning personal loans or credit card balances. Ignoring such alerts can lead to severe consequences, including legal action or bankruptcy proceedings, which could last for several years and further damage credit ratings.

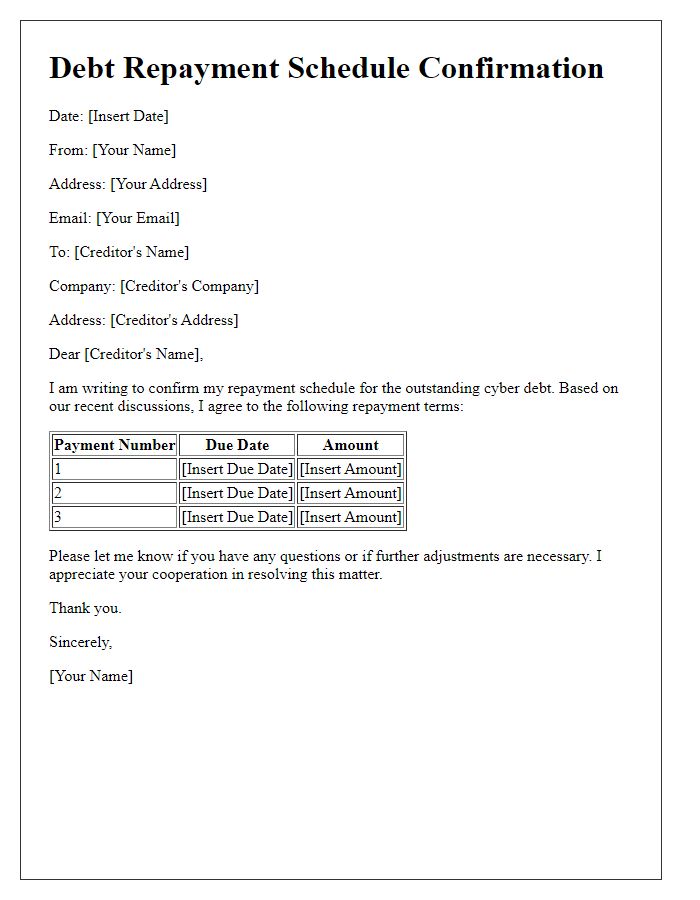

Payment Instructions

Cyber debt payments require meticulous attention to detail for timely processing. Payment methods, such as electronic funds transfer (EFT), credit card, or cryptocurrency transactions, must be clearly specified. For example, EFT routing numbers may be essential, while credit card payments might need account verification. Ensuring adherence to regulatory compliance, like the Fair Debt Collection Practices Act, safeguards consumer rights during the payment process. Furthermore, deadlines for payment schedules, often ranging from 30 days to several months, should be explicitly communicated to avoid penalties. Proper documentation, such as receipts or transaction confirmations, may also serve as crucial evidence of payment for both parties involved.

Contact Information for Queries

Cyber debt payment alerts can serve as crucial reminders for individuals managing their financial responsibilities online. Prompt notifications, often sent via email or text, remind users of their outstanding balances, typically showing amounts and due dates. These alerts may provide direct links to payment portals for swift action. Important contact information for queries, including customer service hotlines or support emails, is usually included. Users should confirm that the communication source is legitimate to avoid phishing attempts. Timely responses to these alerts can help maintain good credit scores and prevent additional fees.

Comments