When it comes to managing our finances, staying informed is key, especially regarding debts. A debt status update request letter can be a straightforward way to get the information you need to stay on top of your commitments. It not only helps clarify your current balance but also provides insight into any potential changes or upcoming payments. Let's dive into how to craft an effective letter that gets you the answers you seek!

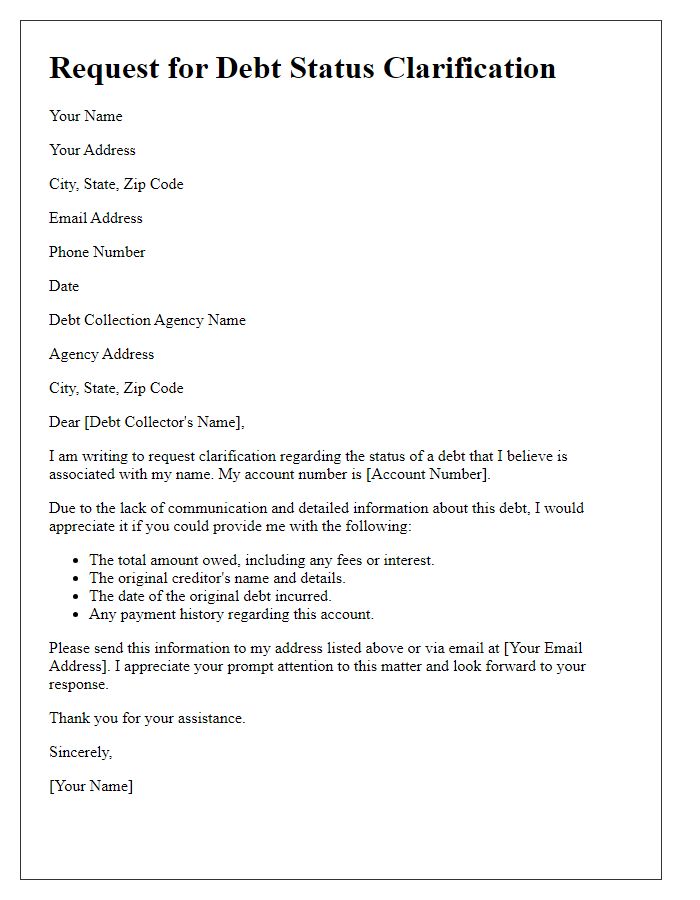

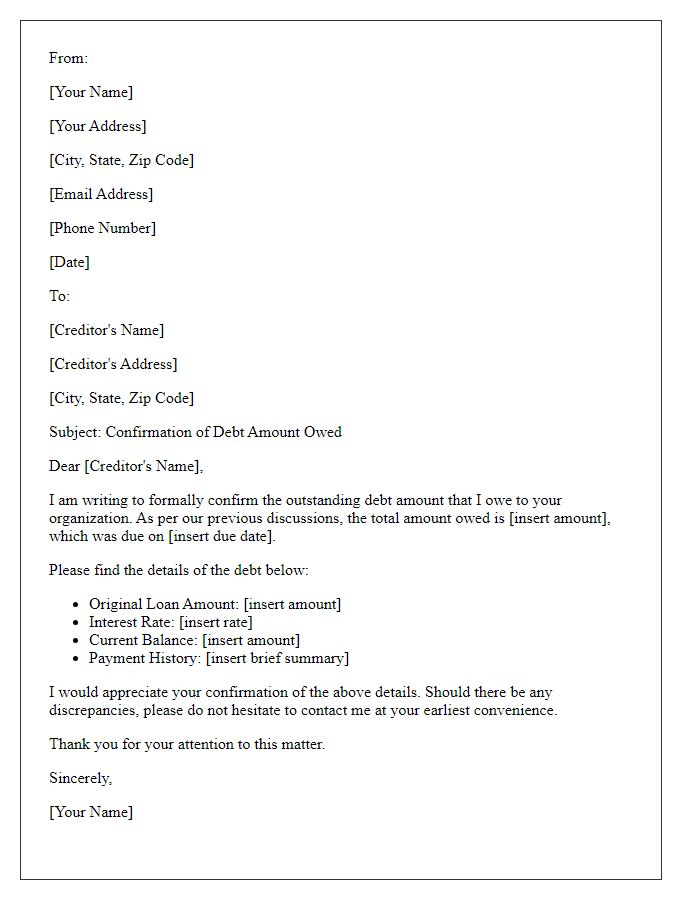

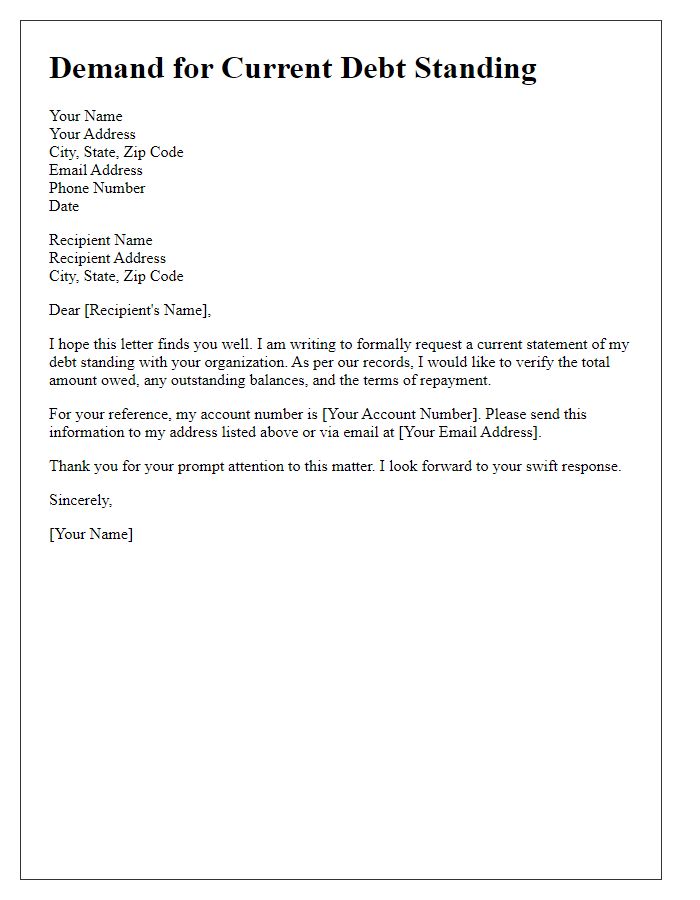

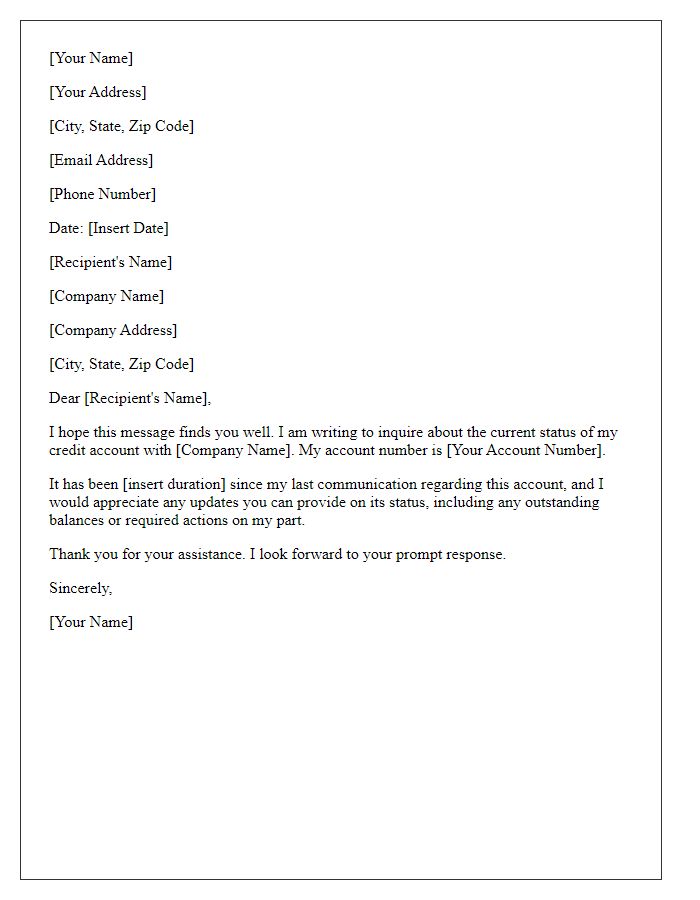

Debtor's contact information

Debtors often require an update on their financial obligations, making an accurate status report essential. The debtor's contact information typically includes the full name, email address, mailing address, and phone number, which facilitate clear communication. For instance, a debtor residing in New York City may have a ZIP code of 10001, while a telephone number would include an area code like 212. Ensuring these details are current is crucial for timely updates regarding outstanding balances, payment schedules, or any modifications in the terms of repayment, which can significantly affect the financial planning process for the debtor.

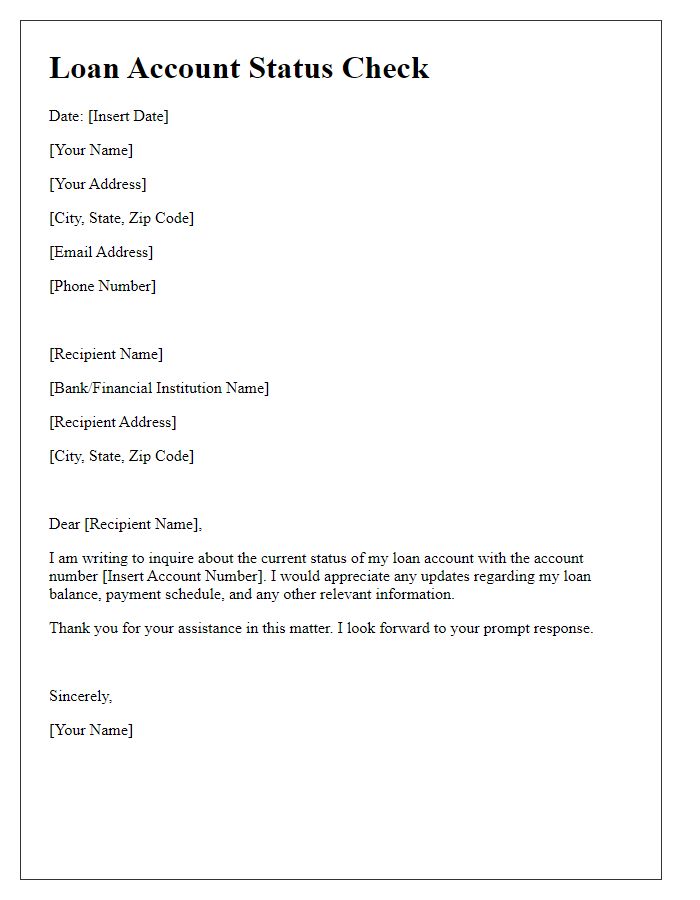

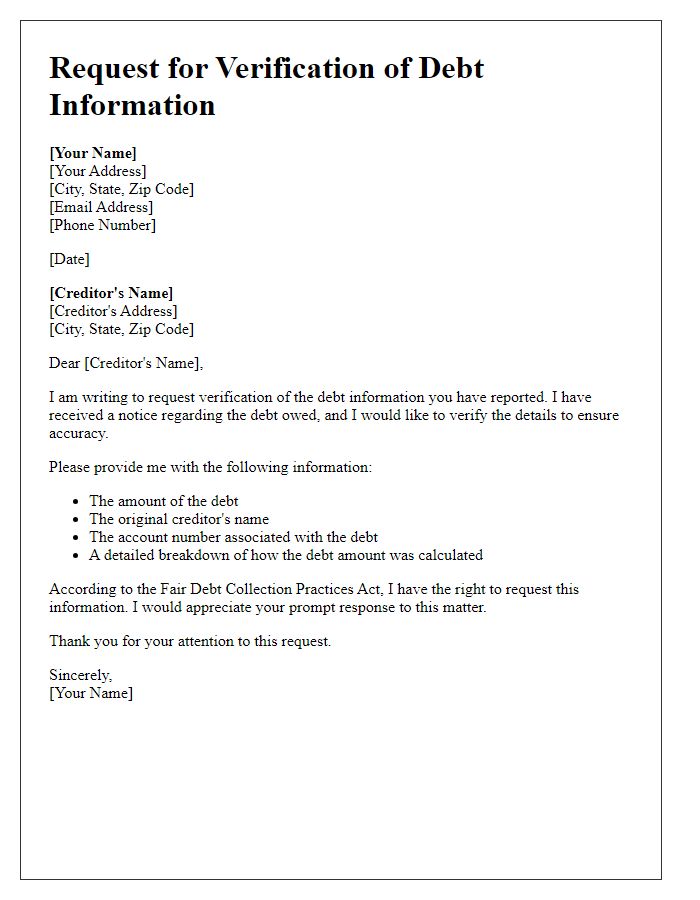

Creditor's contact details

A debt status update request is crucial for maintaining transparency in financial obligations. Borrowers should make this inquiry clear and direct to ensure prompt communication. The request should include comprehensive creditor contact details, encompassing the creditor's name, phone number, email address, and mailing address. It's essential to reference the specific account or loan number associated with the debt, along with due dates and outstanding balances, eliminating confusion. Timely updates (preferably within 30 days) allow borrowers to assess their financial obligations accurately and develop effective repayment strategies. Clear documentation enhances accountability and builds trust in financial transactions.

Account or reference number

The account number (XYZ123456) pertains to the financial obligations owed to ABC Financial Services, a leading provider of consumer loans and credit solutions. This reference is crucial for identifying specific transactions linked to the outstanding debt. An updated status on the debt, including remaining balance and payment due dates, is essential for effective management of financial responsibilities. Previous communications regarding this debt, dated between January 2022 and October 2023, may include important information necessary for current and future payment arrangements.

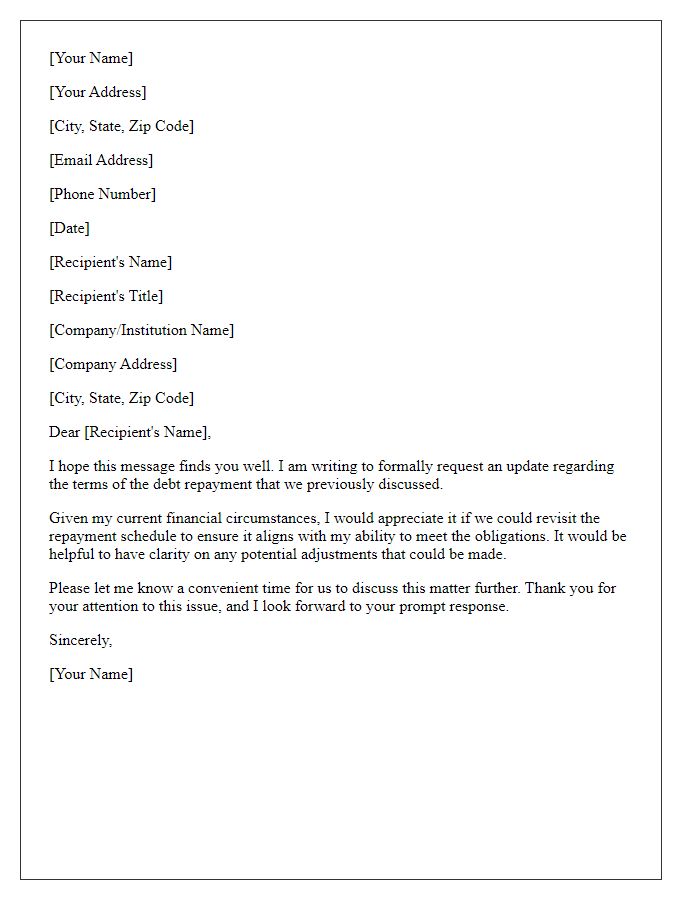

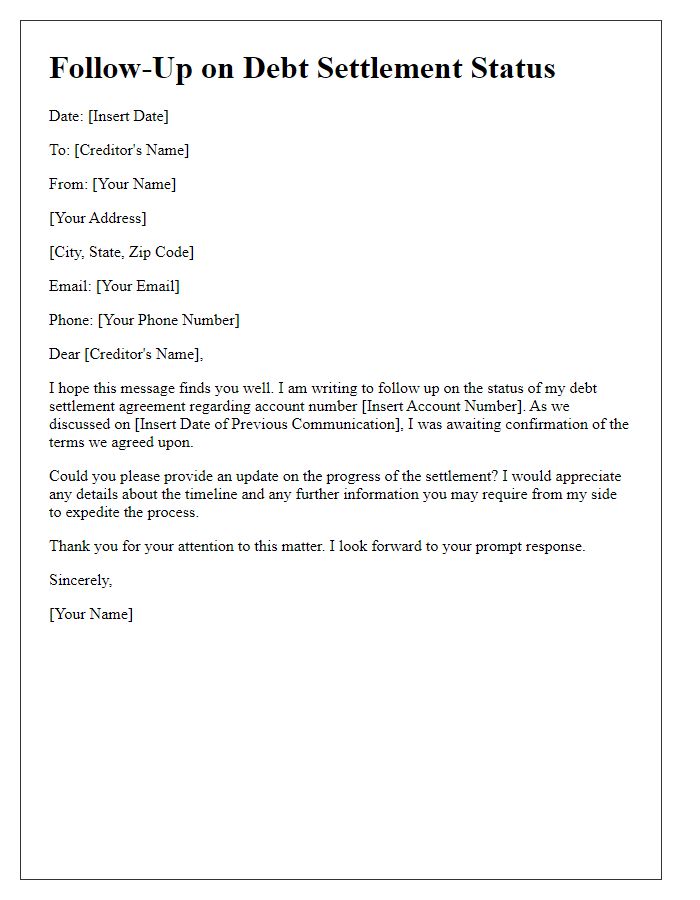

Statement of purpose

A statement of purpose outlines an individual's motivations and objectives regarding a specific goal, often used in academic or professional contexts. When detailing a debt status update request, clarity regarding the outstanding amount, terms previously agreed upon, and the current financial circumstances is essential. It involves providing relevant personal information, such as full names, contact details, and account numbers, to facilitate accurate tracking of the request within databases. Specific timelines may be requested for updates to ensure a prompt resolution, while references to previous communications can streamline the process. A focus on respectful language fosters positive relationships with financial institutions or creditors, ultimately aiming for effective financial management and timely information.

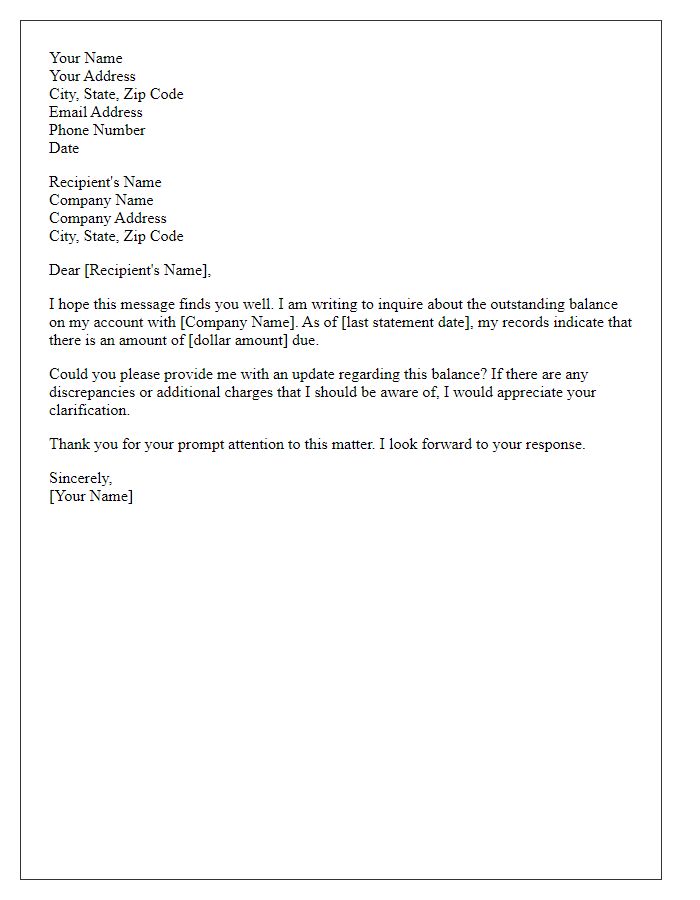

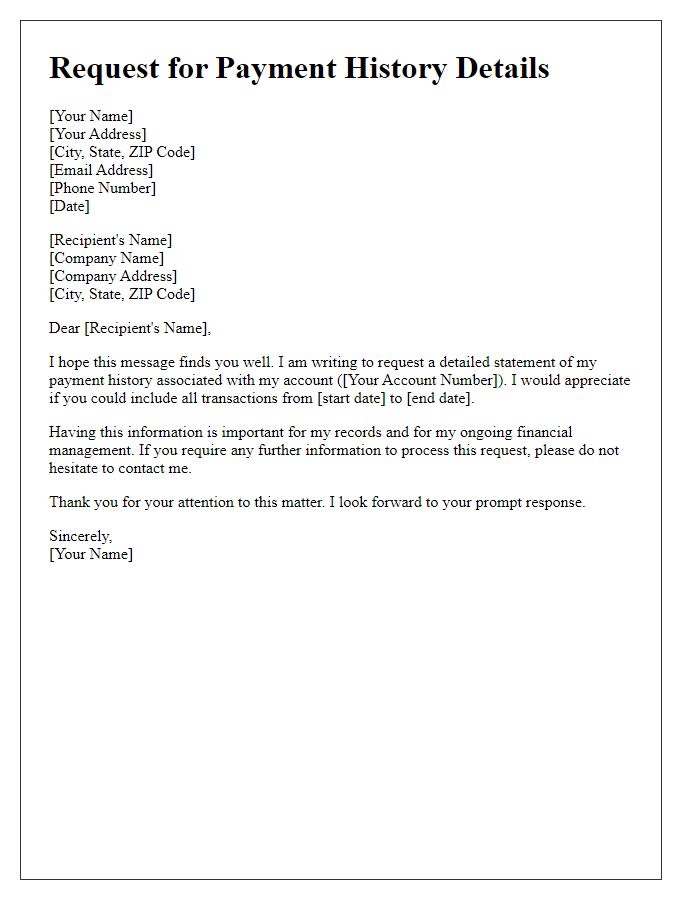

Request for current balance and payment history

Debtors often seek clarity regarding their financial standing when managing outstanding balances. A debt status update request is crucial for obtaining the latest information about the current balance owed--essential for budgeting and planning payments. The payment history details previous transactions, showcasing both timely payments and any late payments, which can impact credit scores. This request typically targets the accounts department of the corresponding creditor or financial institution, detailing specific information such as account numbers, debtor names, and preferred communication methods. Timely responses to these inquiries enhance transparency in debt management and foster trust in financial relationships.

Comments