Hey there! If you've ever found yourself in a situation where an overdue debt is weighing on your mind, you're not alone. Many people struggle with navigating the complexities of debt reconciliation, and a well-crafted letter can make all the difference in addressing these sensitive matters. In this article, we'll explore effective letter templates and strategies to help you communicate clearly and confidently with creditorsâso stick around to find out more!

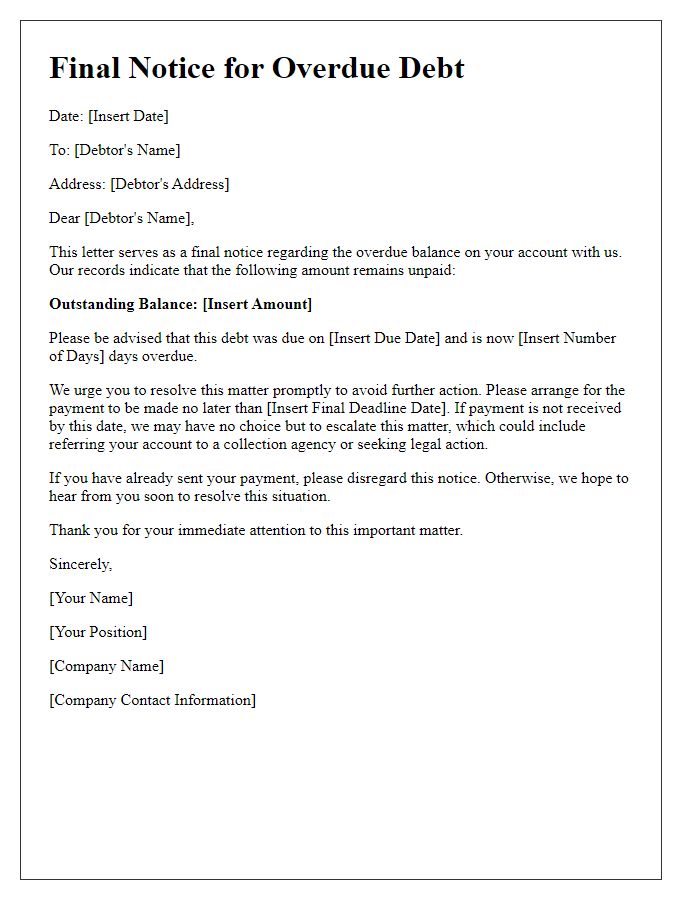

Clear Identification of Debtor and Creditor

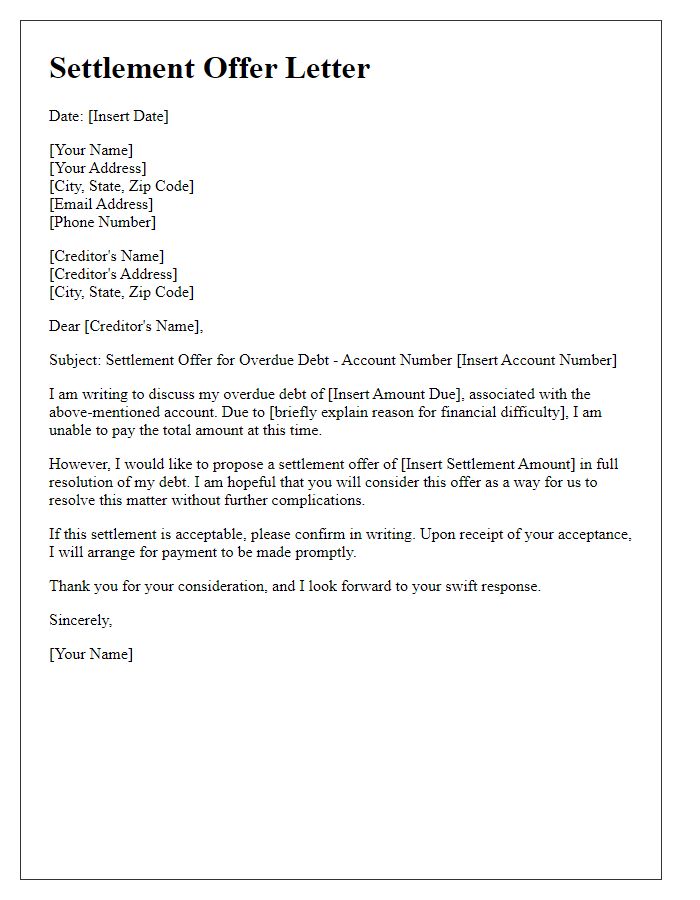

The overdue debt reconciliation process involves a clear identification of both debtor and creditor. Debtor refers to the individual or entity that owes money; for instance, a small business like "ABC Widgets Inc." which has accrued a debt totaling $10,000 since January of the current fiscal year. Creditor represents the individual or entity to whom the debt is owed; for example, "XYZ Financial Services," a lending agency that granted the loan under specific terms of repayment. Documentation plays a crucial role in this process, including invoices dated from early 2023, payment agreements, and communication logs, which help establish the timeline of the debt and the responsibilities of both parties. Effective reconciliation requires a mutual understanding of outstanding balances, accrued interest rates which may have compounded at 5% monthly, and any additional fees associated with the overdue payments. This ensures that both the debtor and creditor have a shared view of their financial obligations, facilitating negotiation and resolution of the outstanding debt.

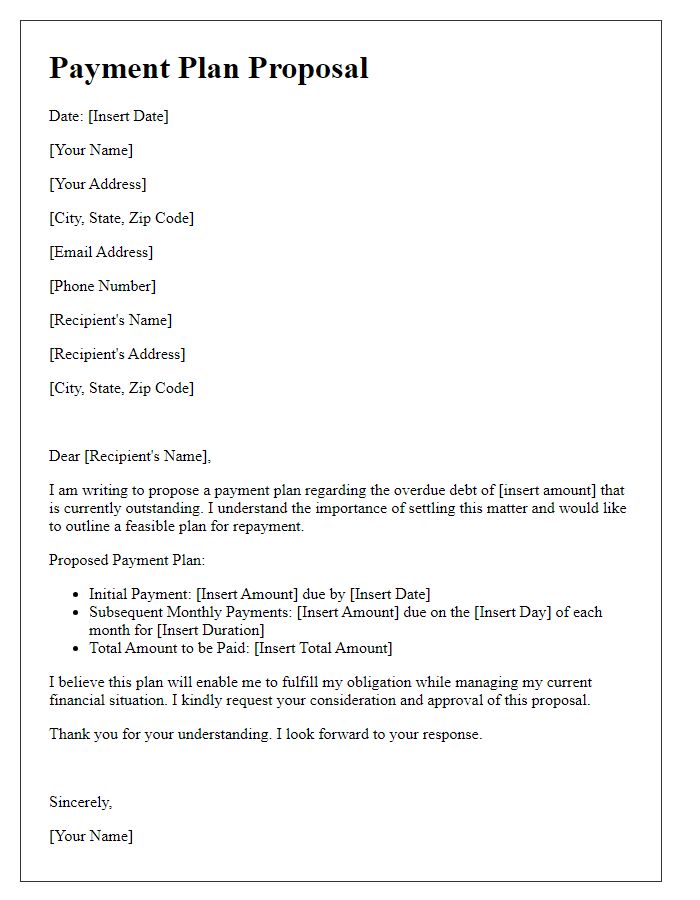

Breakdown of Outstanding Amount

Outstanding debts can significantly impact financial health for both individuals and businesses. A breakdown of the total outstanding amount is essential for clarity. For example, if a business owes $15,000 in total, this might include $5,000 from an unpaid invoice dated March 2023, $7,000 from a loan taken out in January 2022 with a 5% annual interest rate, and $3,000 in late fees accrued due to previous delays. Addressing these amounts systematically can enhance negotiation strategies and ultimately lead to effective debt reconciliation. Proper documentation, including payment histories and communication records, plays a vital role in resolving these financial obligations while maintaining good relationships with creditors.

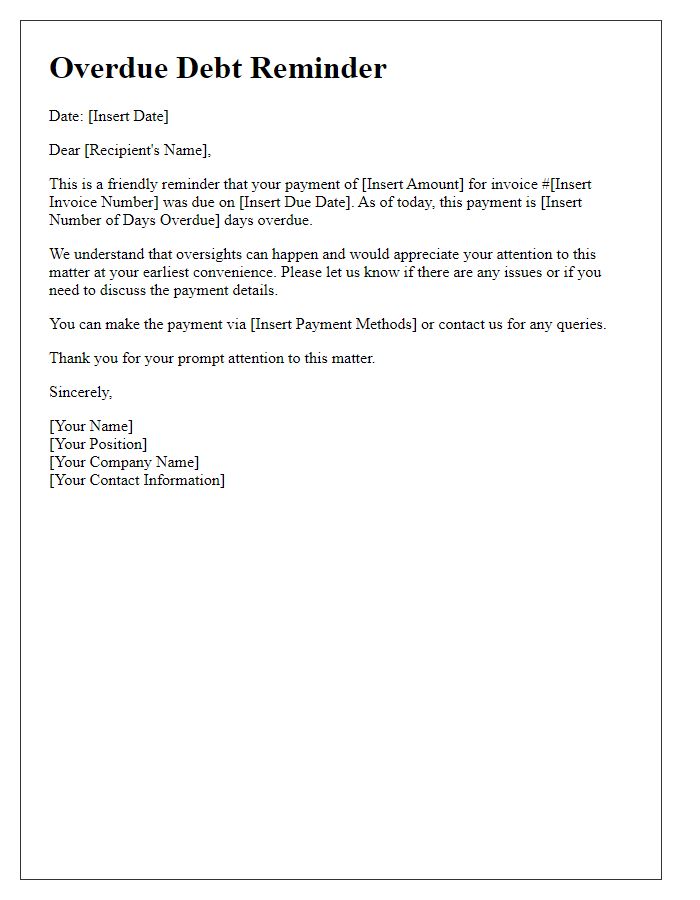

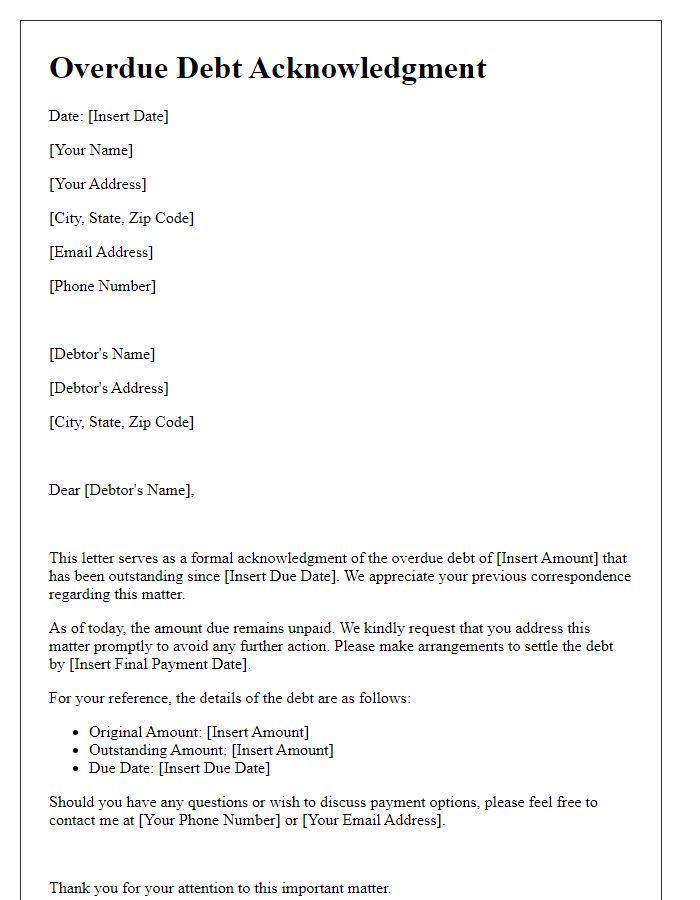

Payment Instructions and Methods

Delinquent debts can disrupt financial stability for both individuals and businesses. To facilitate overdue debt reconciliation, it's essential to provide clear payment instructions and methods that accommodate various circumstances. Payment options like bank transfers, credit card payments, and installment plans can increase the likelihood of settling debts. For example, direct bank transfers often require account details (account number, sort code) for seamless transactions. Credit card payments can be processed through secure gateways ensuring confidentiality and convenience. Additionally, offering installment plans allows debtors to clear balances over time, which can ease financial burdens. Providing thorough information about due dates, minimum payment amounts, and potential late fees fosters transparency and aids in the resolution process.

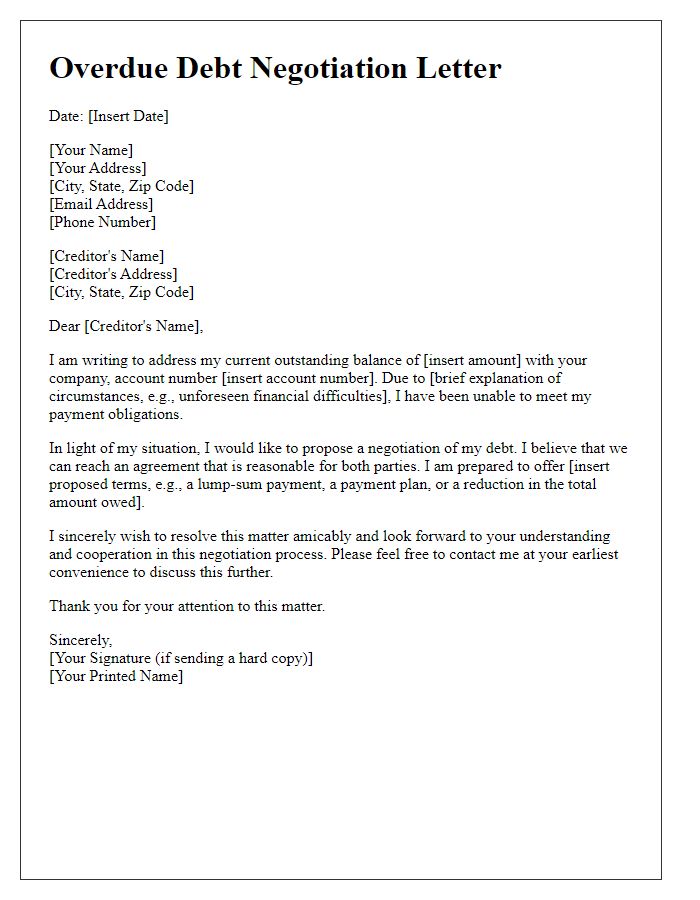

Late Payment Consequences and Penalties

Overdue debt reconciliation involves navigating complex financial obligations, which can carry significant consequences. For instance, late payment penalties typically range from 1% to 5% of the total outstanding balance, leading to increased financial strain. Beyond immediate penalties, creditors may report late payments to credit bureaus, negatively affecting credit scores (with scores dropping as much as 100 points based on late payment history). Additionally, consistent late payments can result in account delinquency, potentially leading to legal actions or collections, which may incur further costs. Businesses situated in major financial hubs like New York City or London often face stricter penalties due to competitive markets, emphasizing the need for timely payments to maintain favorable credit terms and relationships with suppliers.

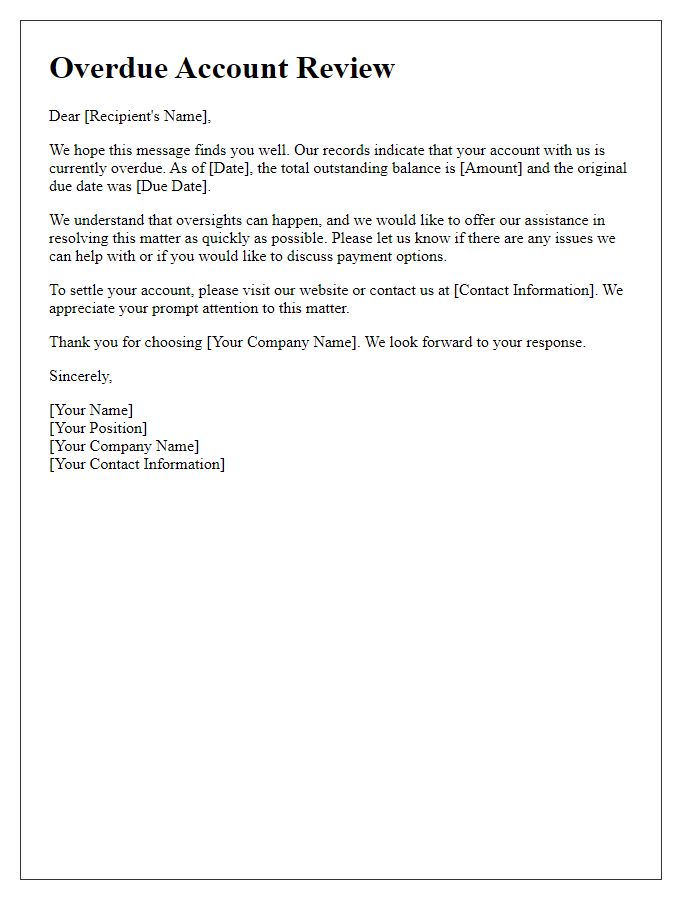

Contact Information for Resolution and Queries

Overdue debts can significantly impact financial stability and lead to potential legal actions if not addressed. Timely communication is essential for resolving these matters. It's important to provide accurate contact information for inquiries, including the primary contact person's name (such as John Smith), phone number (555-123-4567), and email address (john.smith@email.com). Additionally, including the company's mailing address (1234 Financial Ave, Suite 100, Chicago, IL 60601) can facilitate formal correspondence. Prompt actions in reconciling overdue debts can help restore relationships and ensure continuity in services or business transactions.

Comments