Are you feeling overwhelmed by debt and searching for a way to regain control of your finances? Crafting a letter to request debt reduction can be a pivotal step towards alleviating your financial stress. In this article, we'll guide you through the essential elements that will make your letter effective and persuasive. So, grab a cup of coffee and let's dive into the details that could lead you to a more manageable financial future!

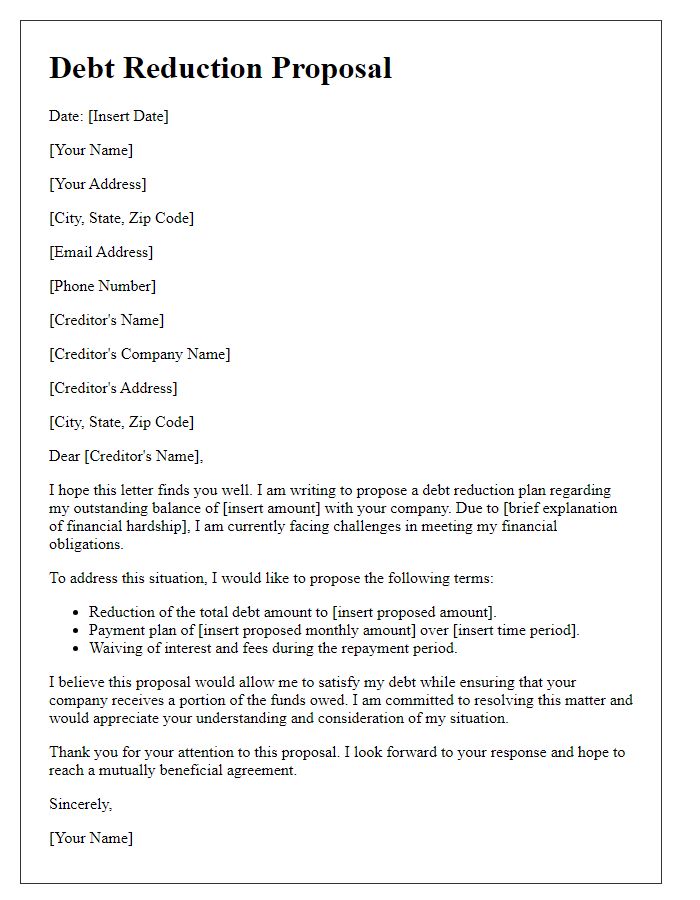

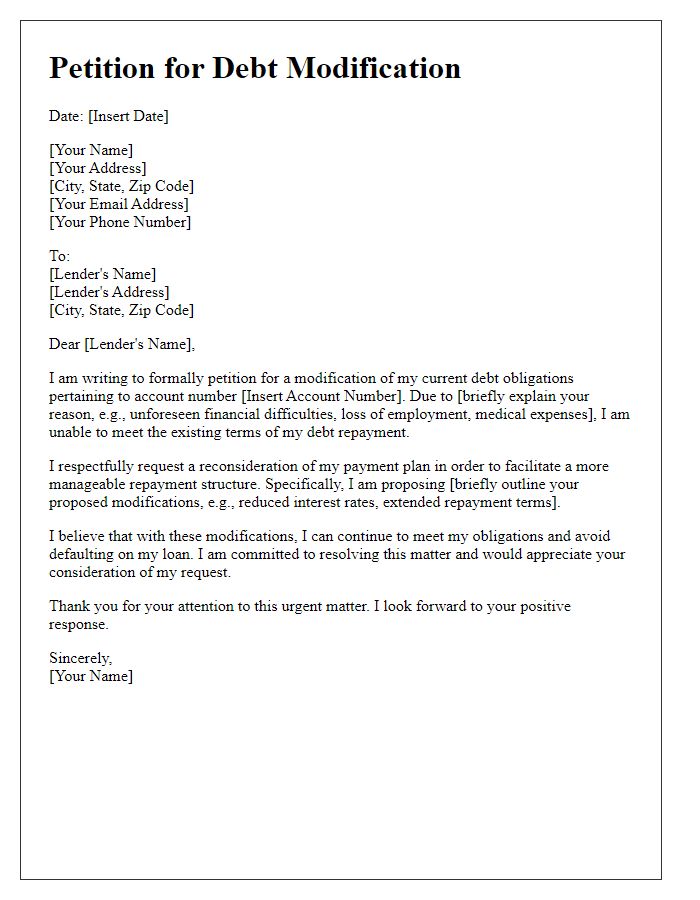

Polite and respectful tone

Debt reduction requests often require a respectful and polite tone, ensuring that the communication remains professional and courteous. A well-crafted request can outline circumstances surrounding the debt, express the desire for a more manageable repayment plan, and show willingness to collaborate with the creditor for a favorable outcome. Presented information should include details about the debt amount, current financial status, and personal commitment to resolving the obligations. Additionally, including a specific request for reduced payments or an adjusted repayment plan can provide clarity for negotiations, fostering a constructive dialogue.

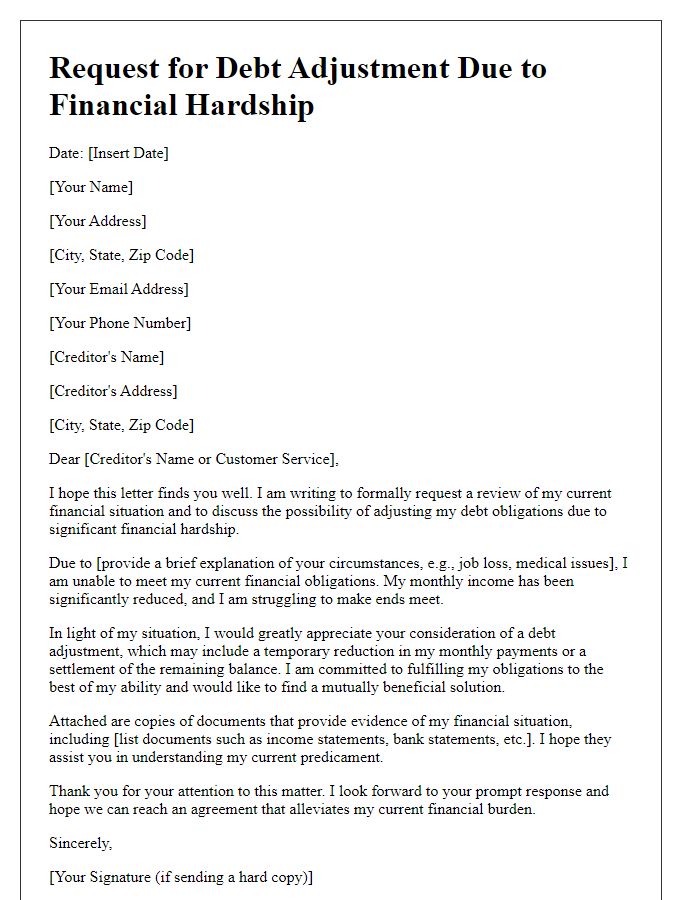

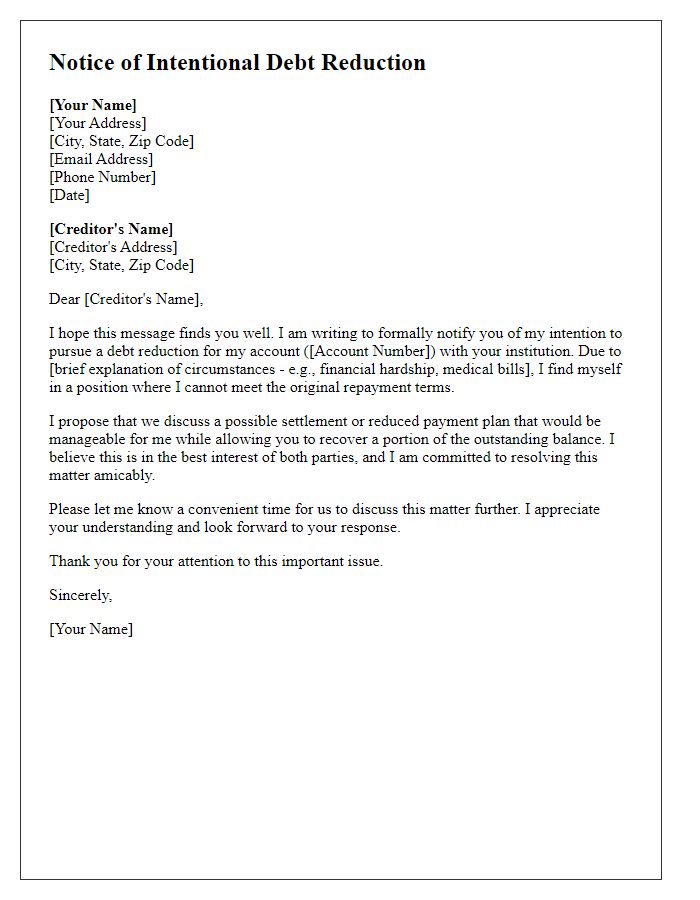

Clear explanation of financial hardship

Financial hardship often stems from various circumstances, such as unexpected medical expenses, job loss, or significant life changes. In a recent case, an individual faced unemployment for six months due to economic downturns affecting sectors like retail and hospitality. These events led to an unsustainable accumulation of debt, with bills rising as high as $1,500 monthly. In this context, the need for debt reduction becomes pressing, as the individual's current income - derived solely from part-time work averaging $800 per month - cannot sustain living expenses or debt repayment. Furthermore, essential costs such as rent in urban areas averaging $1,200, coupled with rising grocery prices, exacerbate this financial strain, making it critical to seek avenues for relief.

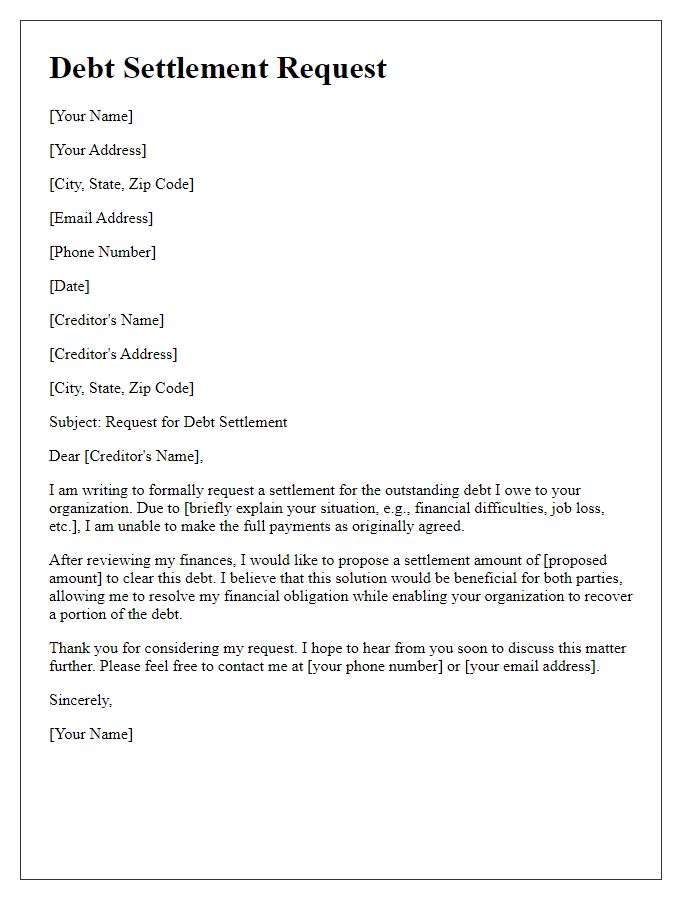

Specific request for debt reduction

Debt reduction requests often involve financial statements, including income and expenses, submitted to creditors like banks or credit card companies. Substantial evidence, such as documentation of financial hardship, can be critical for approval. Successful negotiations can result in reduced balances, extended payment terms, or the elimination of fees; this can ultimately restore financial stability for individuals facing insolvency. Financial education resources are also recommended to ensure long-term debt management strategies.

Proposed repayment plan

The proposed repayment plan outlines structured attempts to settle outstanding debts in a manageable way. Debtors, often individuals or businesses, typically face financial challenges due to unforeseen circumstances, such as medical emergencies or economic downturns. A repayment plan may detail monthly payment amounts, timelines, and specific terms set forth by creditors, including the total debt amount. For instance, a debtor with a $10,000 credit card debt may propose to pay $200 per month over five years, contingent upon interest rate adjustments. Establishing clear communication with creditors is critical, ensuring understanding and agreement on modified payment terms. This approach not only helps in reducing debt but also aims to restore financial stability for the debtor.

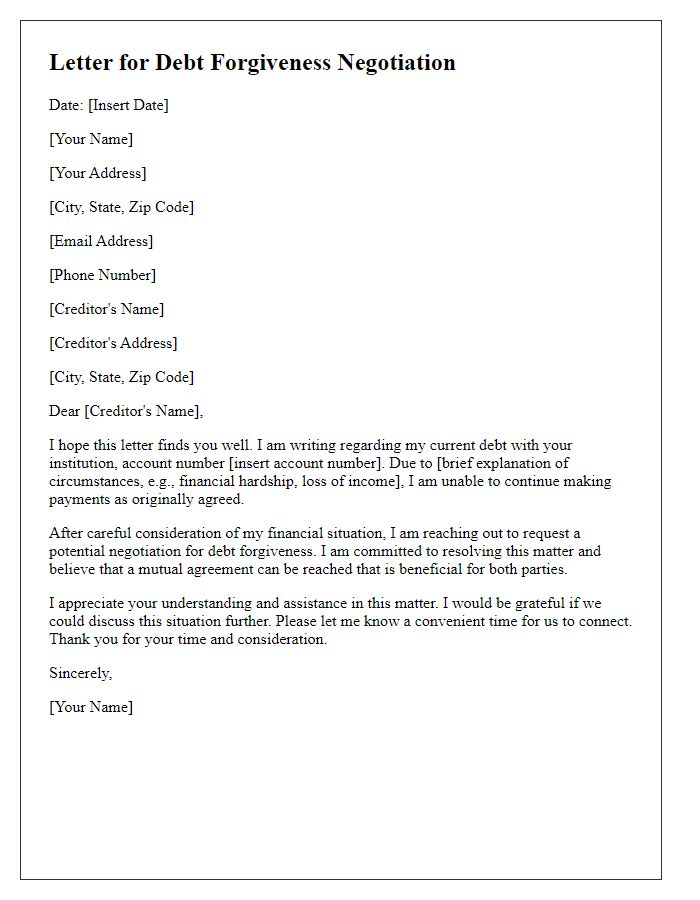

Contact information and willingness to discuss further

A debt reduction request often requires clear communication detailing financial difficulties and a proposed adjustment plan. For those seeking assistance, providing accurate contact information--such as mailing address, phone number, and email--ensures transparency and ease of communication. Establishing willingness to discuss further demonstrates openness to negotiations, allowing for potential adjustments to payment terms, interest rates, or total owed amounts. This approach can foster a cooperative relationship, facilitating more favorable outcomes for debt reduction discussions.

Comments