Are you feeling overwhelmed by overdue debts and unsure how to communicate with your creditors? You're certainly not alone, as many people face this challenging situation at some point in their lives. In this article, we'll explore a sample letter template for an overdue debt notice, making it easier for you to approach this delicate matter with clarity and confidence. Read on to discover practical tips and a customizable letter that can help you take control of your financial situation.

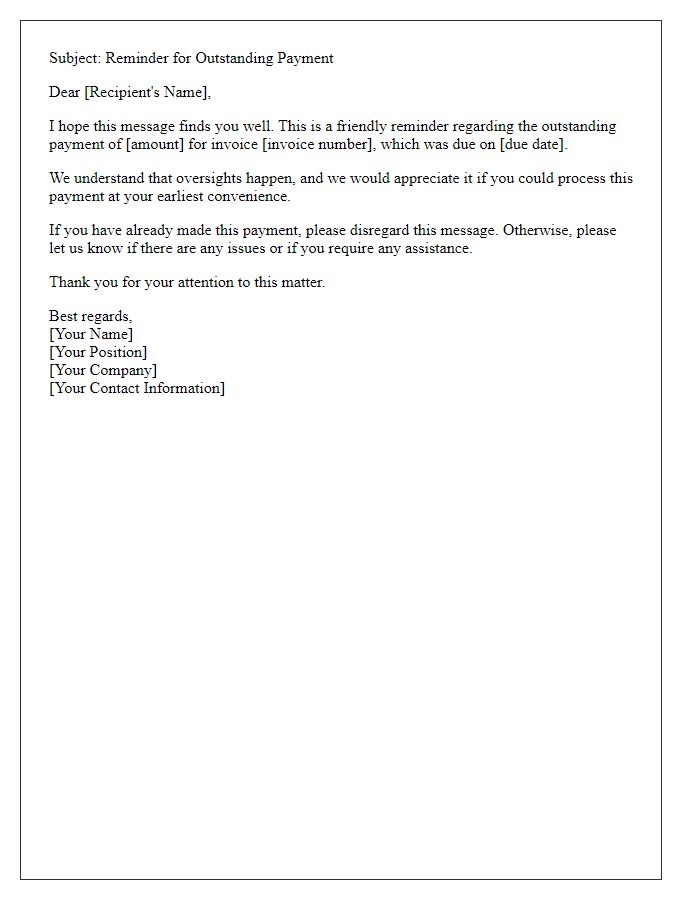

Clear identification of debtor and creditor

An overdue debt notice is essential in financial communications as it outlines the necessary information regarding the parties involved. The debtor, an individual or entity responsible for the outstanding payment, must be clearly identified by name (e.g., John Smith) and unique identification details (such as account number 123456). The creditor, the individual or organization owed the money, should also be identified by name (e.g., ABC Financial Services) and any relevant identification (such as tax identification number 7890123). Including the total amount owed (e.g., $2,500) along with a specific due date (e.g., August 15, 2023) helps clarify the urgency and necessary action. Furthermore, providing detailed payment instructions (such as online payment options or mailing addresses) encourages timely resolution.

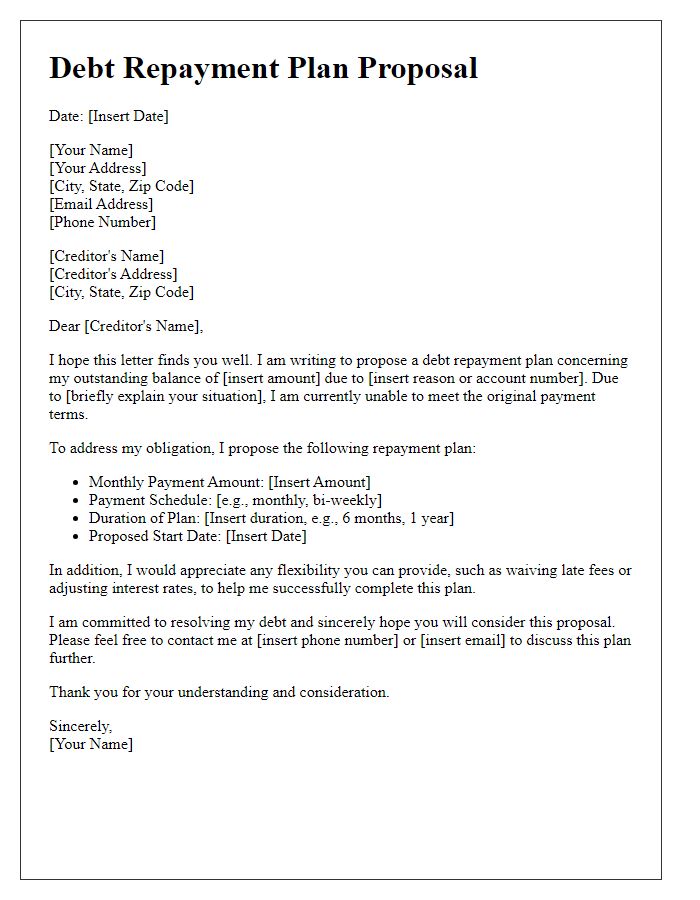

Specific due date and amount owed

A letter template for overdue debt notice typically includes essential information regarding the financial obligation that needs addressing. The specific due date, such as "September 15, 2023," indicates when the payment was originally expected. The amount owed, for instance, "$1,500," denotes the total that remains unpaid. Additionally, the communication should reference previous reminders or established payment plans, if applicable, emphasizing the importance of timely resolution to avoid further complications such as interest charges or legal actions. Clear contact information should be provided for follow-up inquiries, maintaining a professional tone throughout.

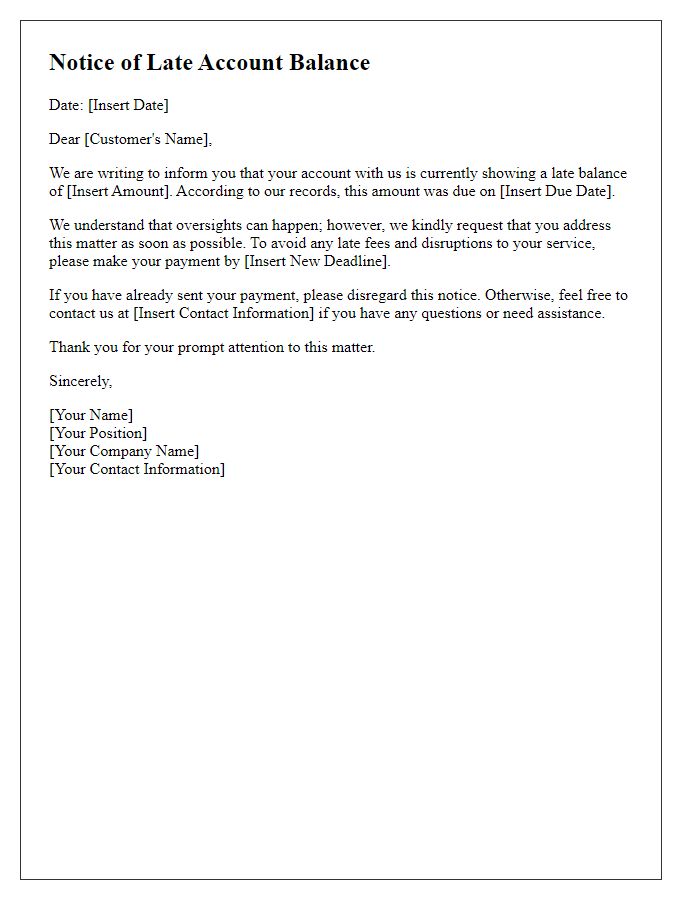

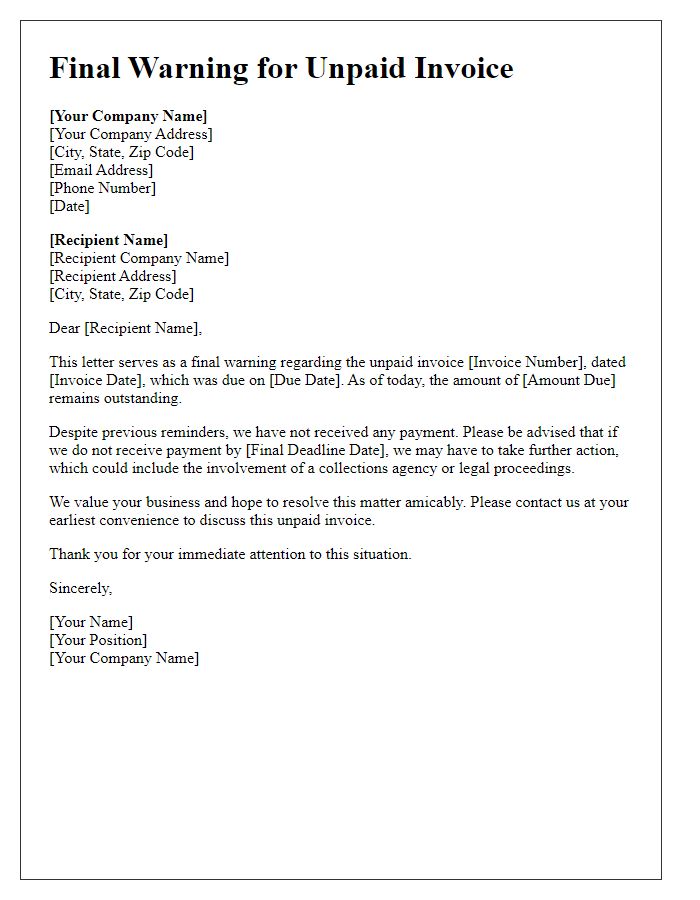

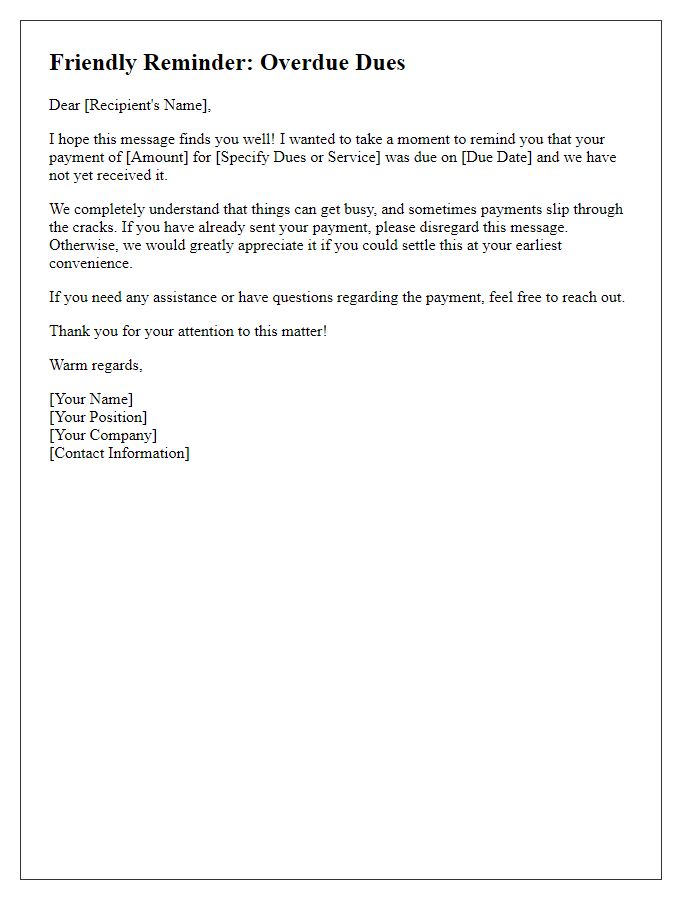

Payment methods and instructions

Overdue debts can significantly impact financial stability, prompting creditors to issue formal notices. Methods for payment typically include options such as bank transfers, credit card payments, and online payment platforms like PayPal. Specific payment instructions may include details like account numbers (usually six to ten digits) and due dates (commonly within 30 days of notice issuance) to ensure processing. Providing clear deadlines and consequences for non-payment is essential, as it encourages timely responses while maintaining a professional tone. It is also prudent to include contact information for customer service inquiries, ensuring that all parties can resolve any confusion promptly.

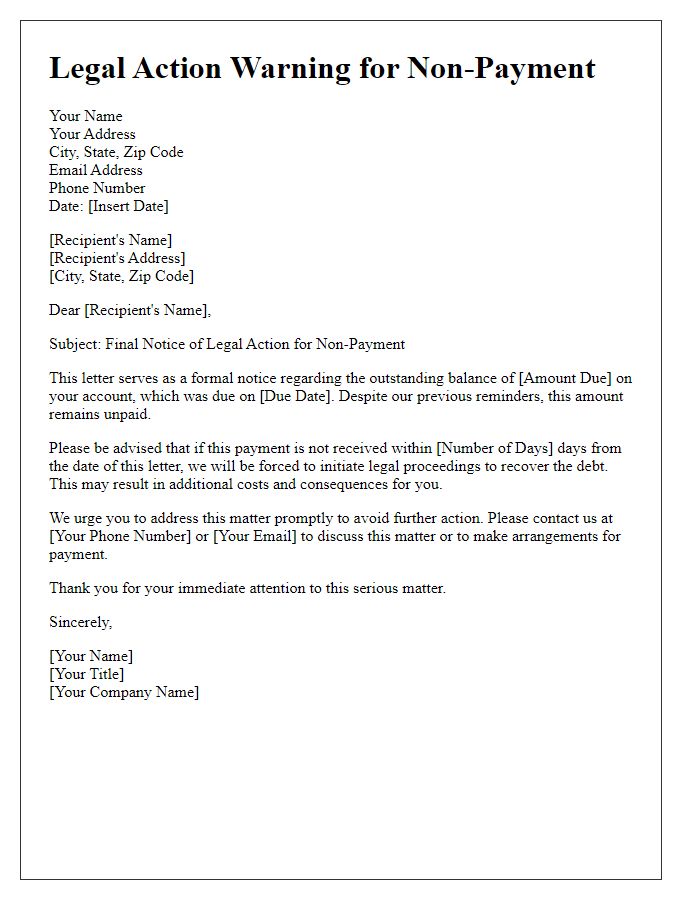

Consequences of non-payment

Non-payment of overdue debts can lead to significant financial repercussions for individuals and businesses alike. Ignoring unpaid invoices, such as those from credit card companies or service providers, can result in late fees, often ranging from $25 to $50, and increased interest rates, which may soar to 29% annually. Additionally, persistent non-payment could lead creditors to report delinquencies to credit bureaus like Experian or TransUnion, negatively impacting credit scores. This drop in credit ratings, potentially by 100 points or more, can affect future borrowing capabilities, mortgage approvals, and insurance premiums. In extreme cases, legal action may be taken, resulting in costly court fees and possible wage garnishment where a portion of income may be deducted directly to satisfy the debt. Understanding these consequences is crucial for maintaining financial health and avoiding further complications.

Contact information and support options

When a debtor falls behind on payment obligations, it is crucial to communicate effectively regarding overdue debts. A clear overdue debt notice should include key contact information for a debt collection agency. Include relevant support options for assistance. These may encompass direct phone numbers (preferably a toll-free number), email addresses for inquiries, and physical addresses for sending payments or correspondences. Furthermore, providing a dedicated website link can offer resources and FAQs for debt resolution. Specify the urgency of the matter to motivate prompt action. Make sure to highlight any possible consequences of continued non-payment, such as late fees or credit score impacts, to emphasize the importance of addressing the overdue debt swiftly.

Comments