Hey there! If you've ever found yourself tangled in the intricacies of managing debt, you're not alone. Verifying your debt accounts is a crucial step in ensuring that your financial health stays on track, and understanding the process can seem overwhelming at first. But don't worry! In this article, we'll break down everything you need to know about debt account verification, so stick around for some practical tips and useful templates to get you started.

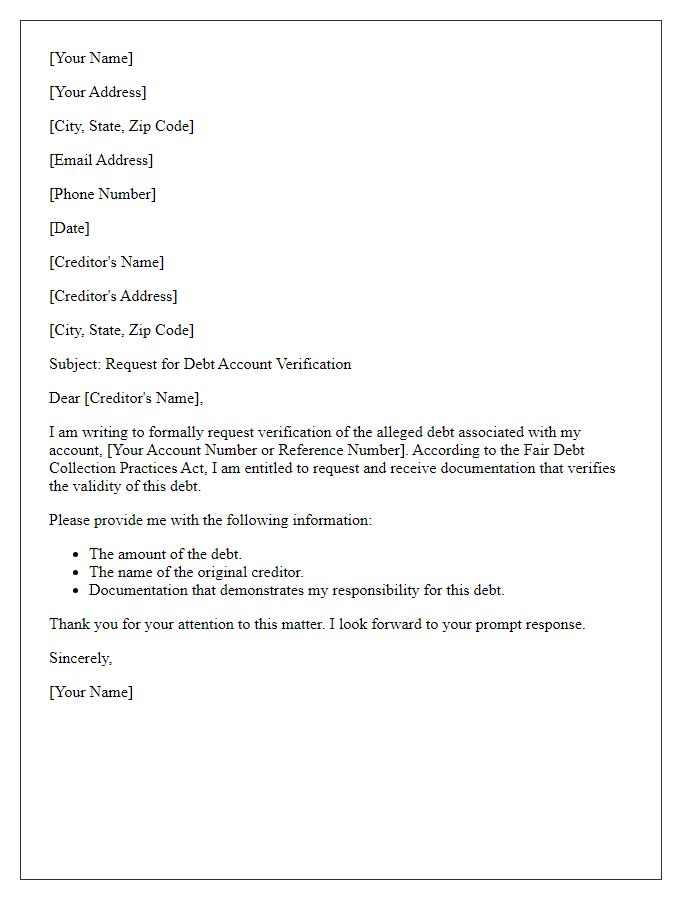

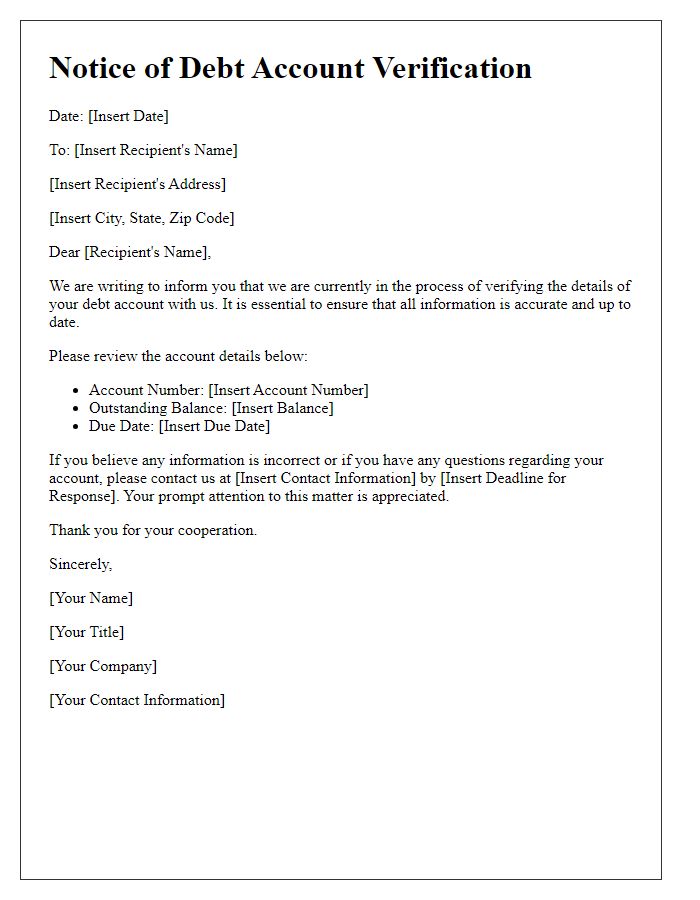

Creditor and Debtor Information

Establishing clear creditor and debtor information is essential during a debt account verification process. Creditors, such as banks or lending institutions, maintain detailed records of debts, specifying account numbers (often unique identifiers), outstanding balances (the total amount owed), and payment history (previous transactions indicating timely or missed payments). Debtors, individuals or businesses owing money, must verify their personal information, including full names, addresses (physical residency), and contact details (phone numbers and email addresses). Accurate documentation, including loan agreements or billing statements, enhances the verification process, ensuring accuracy and clarity in resolving any disputes regarding the debt account.

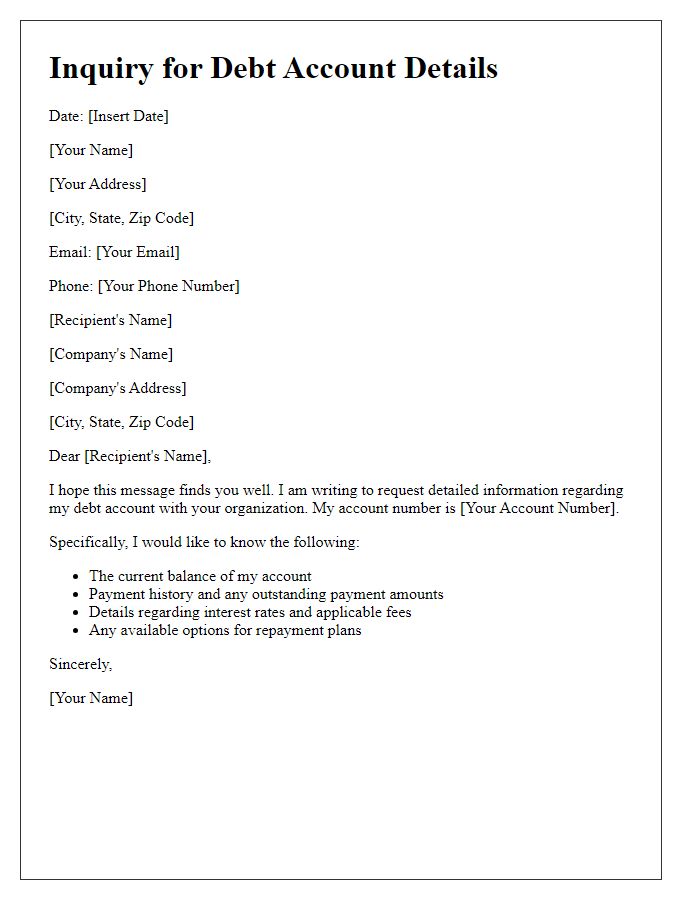

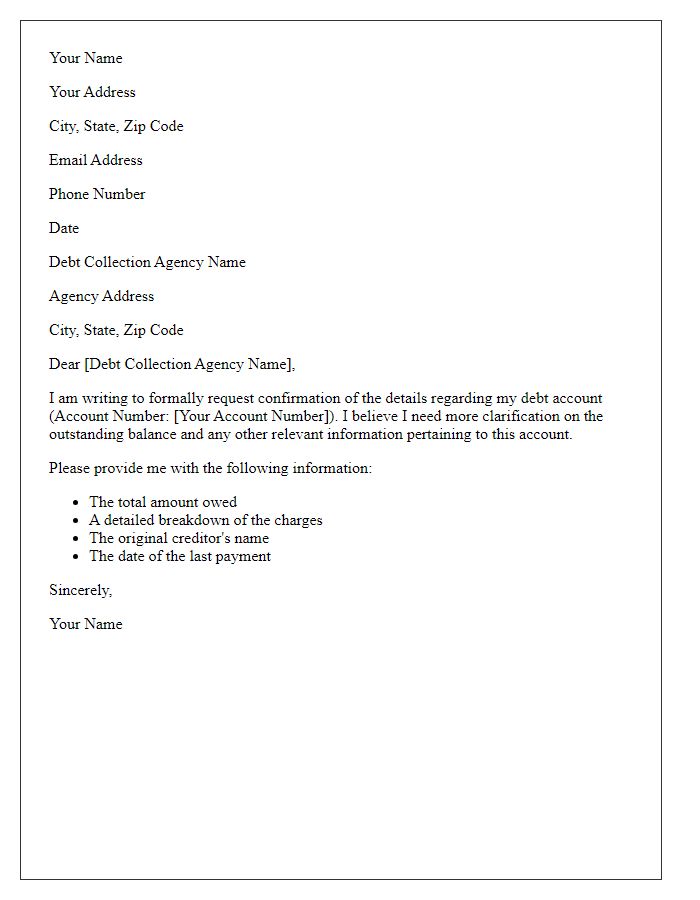

Account Details and Reference Numbers

Accurate debt account verification necessitates comprehensive account details alongside reference numbers. Essential account details include the account holder's name, outstanding balance, payment history, and due dates for repayment. Reference numbers, typically unique identifiers assigned by financial institutions, facilitate the tracking of specific transactions or disputes. For instance, a reference number may correlate to a particular payment made on January 15, 2023, ensuring clarity in account status. Moreover, accurate identification of the creditor's name and contact information enhances the verification process. Proper documentation ensures compliance with regulatory standards, such as those outlined in the Fair Debt Collection Practices Act (FDCPA) in the United States.

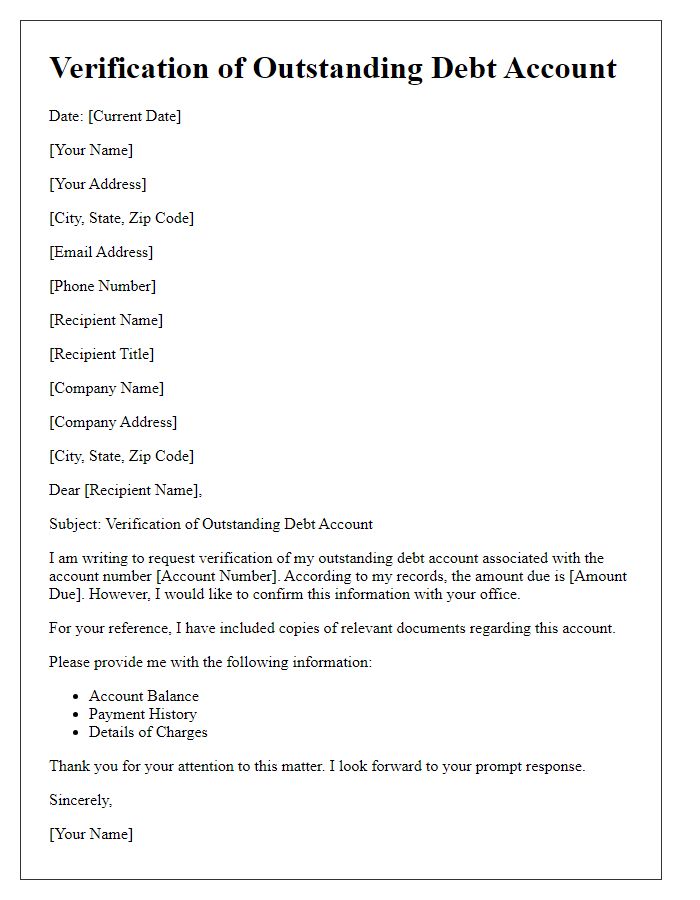

Debt Amount and History

Debt account verification is crucial for accurate financial records and clear understanding of one's obligations. Outstanding debt amounts, such as $5,000 for student loans or $2,500 for credit card balances, must be precisely documented to avoid disputes. History entails a detailed timeline of payments, including dates of missed payments or late fees that could impact credit scores. Additional information might include the creditor's name, such as Discover Financial Services, and account numbers to ensure specificity. Accurate verification is essential for consumers in managing their finances effectively and taking necessary action regarding debt repayment.

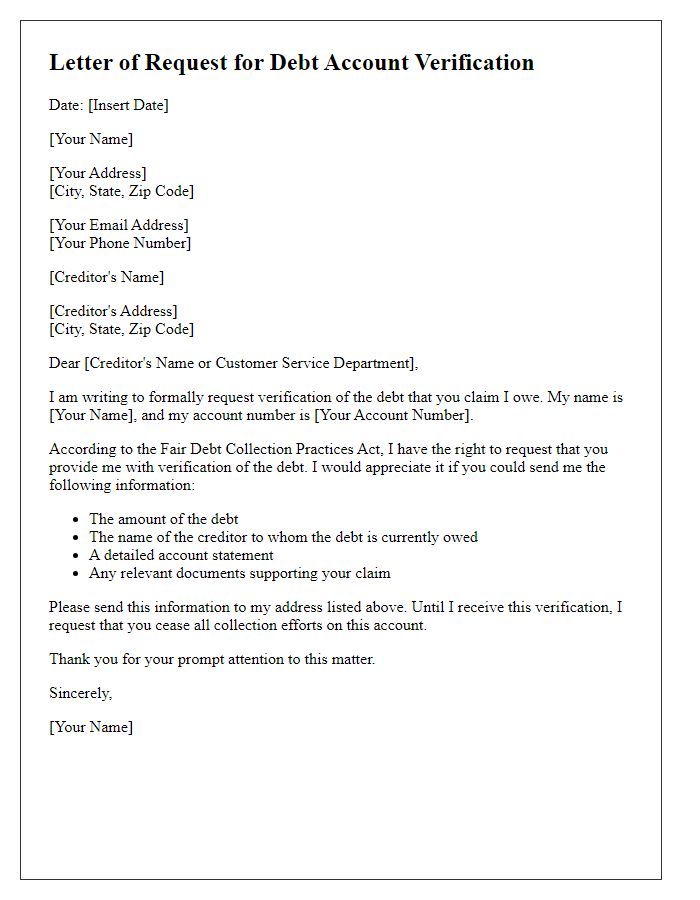

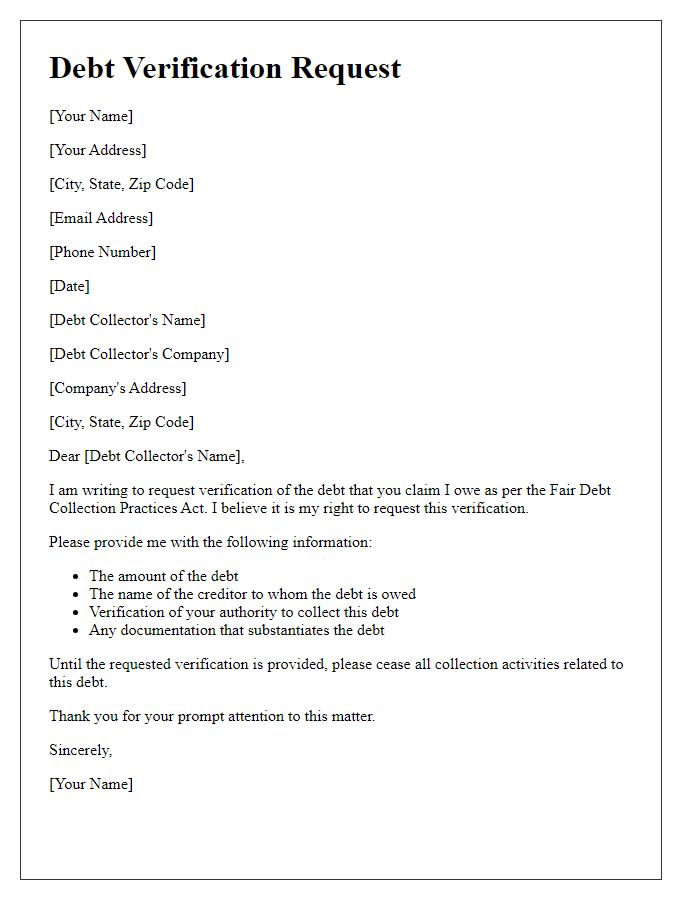

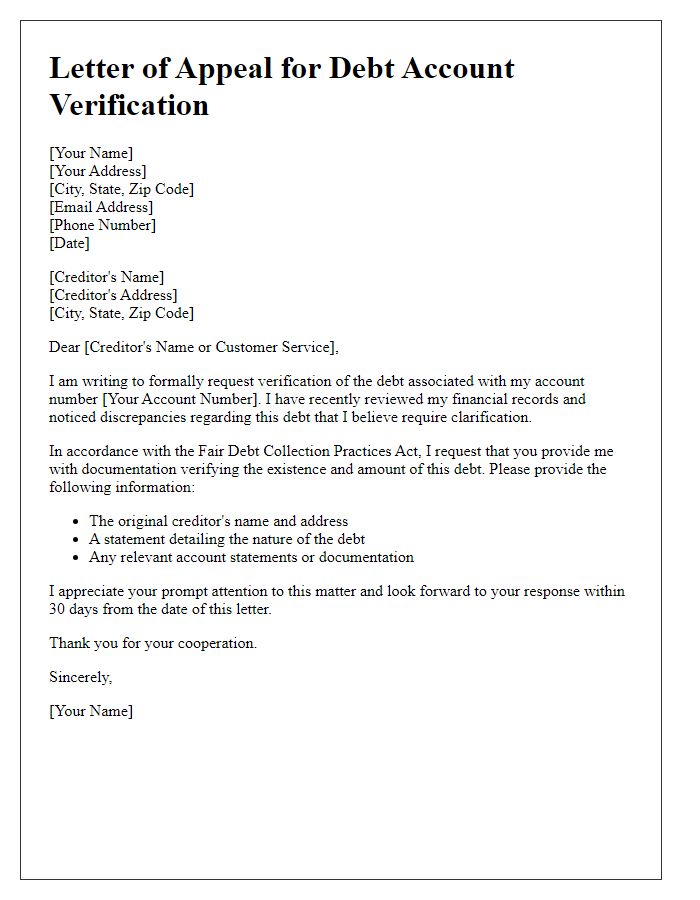

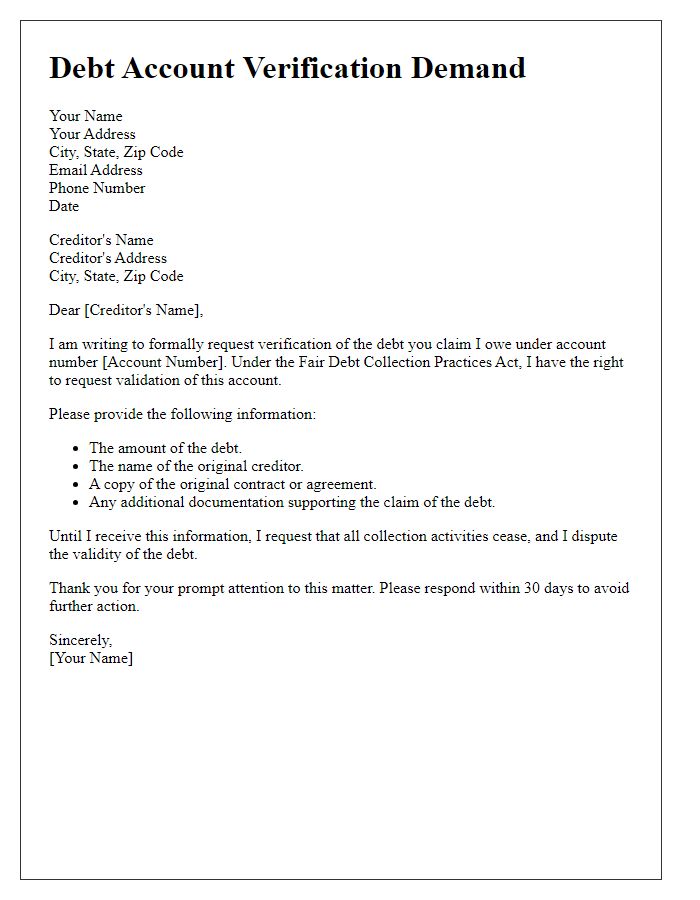

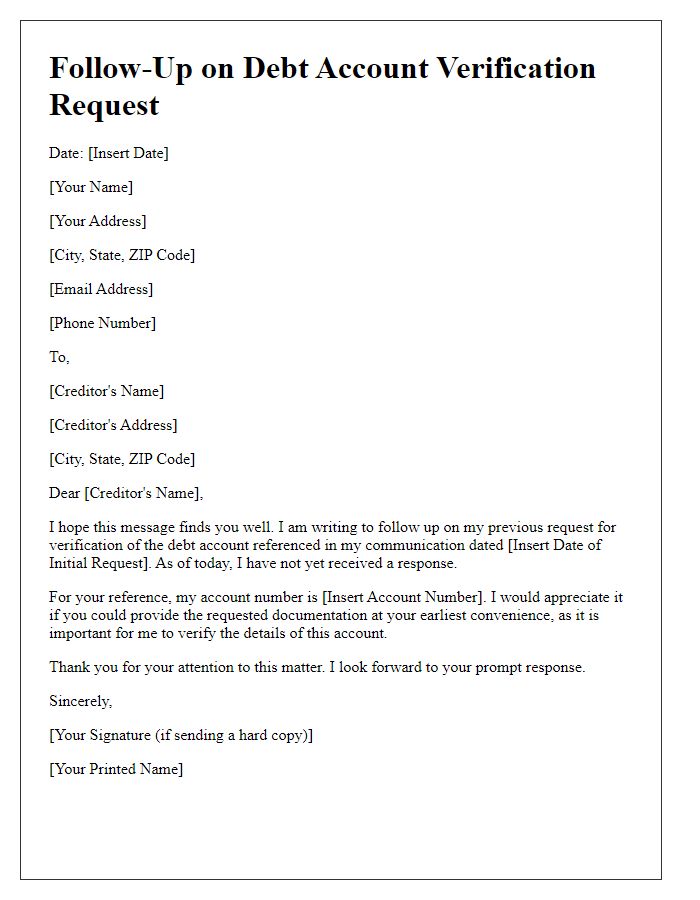

Request for Validation Documents

Requesting validation documents for a debt account is crucial in ensuring accurate information regarding outstanding balances. When addressing a debt collector or creditor, include your full name and account number associated with the debt. Specify the nature of the debt, such as a credit card debt from Chase Bank or a medical bill from a local hospital, and request copies of original agreements, payment history, and any documentation proving the debt's legitimacy. Also state the Fair Debt Collection Practices Act (FDCPA) protections, which grant consumers rights to dispute inaccuracies in debt listings. Ensuring timely acknowledgement of your request is important to assess any potential discrepancies in the reported amount.

Contact Information and Response Timeline

Debt account verification involves ensuring accurate and current data about outstanding financial obligations. First, creditors require contact information, including the debtor's full name, address (both permanent and current), and phone number, to maintain clear communication. Second, the response timeline for validation generally follows a strict protocol; credit agencies are mandated under the Fair Debt Collection Practices Act to respond to verification requests within 30 days. Delays beyond this period can lead to potential disputes regarding the debt's legitimacy. Proper documentation, like account numbers and statements, must be included to facilitate the verification process.

Comments