Are you looking for a streamlined way to propose a repayment schedule? Crafting a clear and professional letter can make all the difference in facilitating effective communication between you and your creditor. In this article, we'll explore how to structure your repayment proposal, ensuring you include all necessary details while maintaining a friendly tone. Dive in to discover tips and a helpful template that will make your repayment proposal stand out!

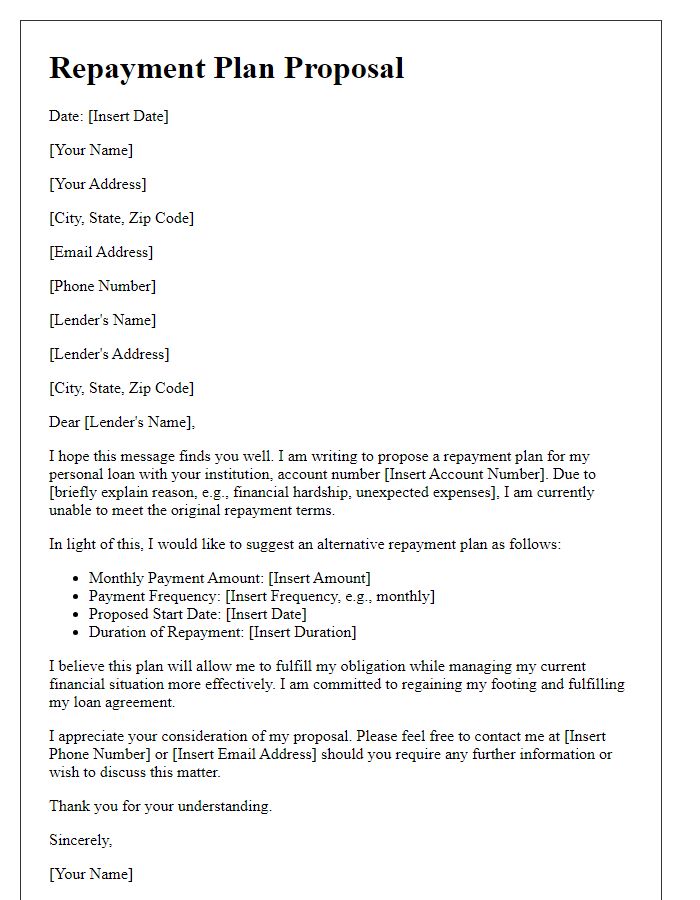

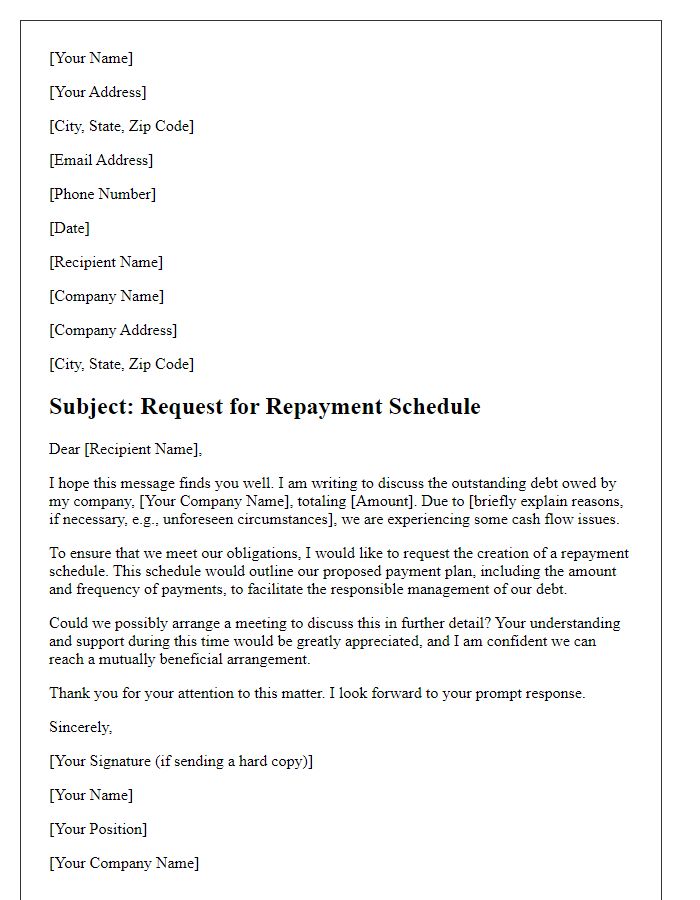

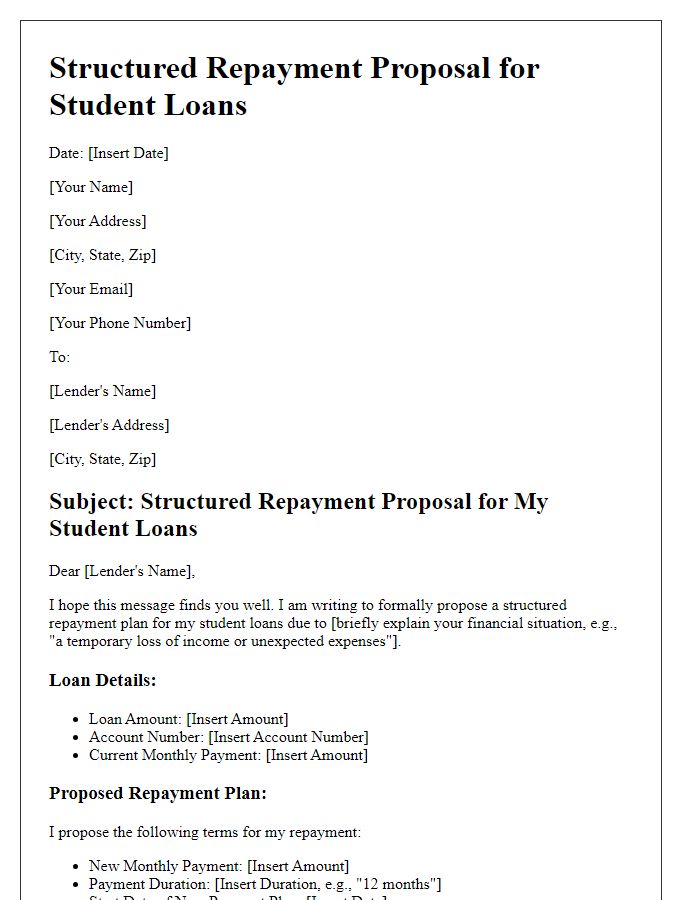

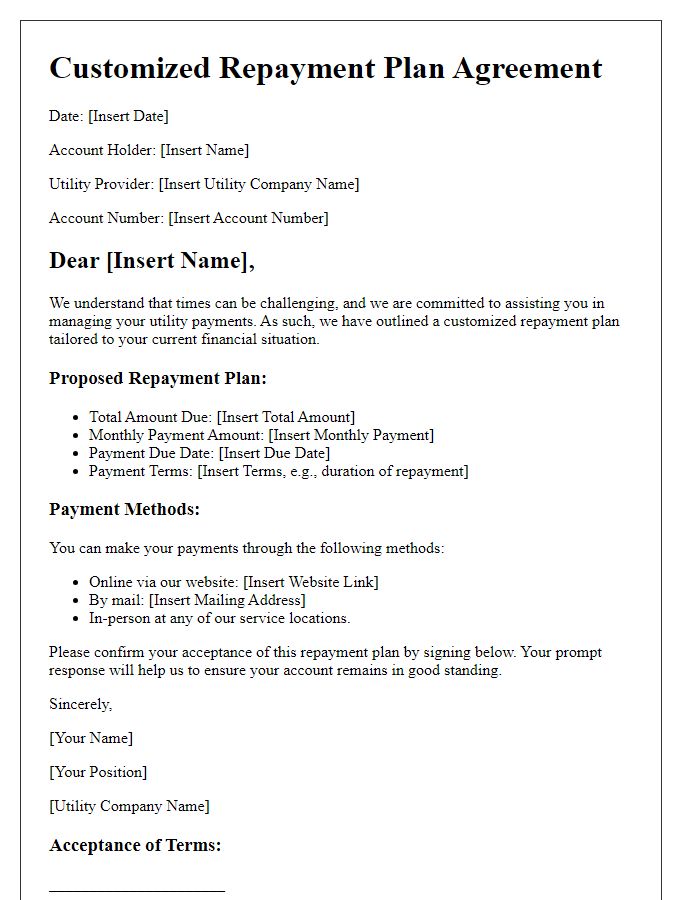

Clear identification of parties involved

In a formal repayment schedule proposal, clear identification of parties is essential. The borrower, an individual or organization seeking to repay a debt, must be outlined with full legal name, address, and contact details. The lender, whether a financial institution such as a bank or an individual creditor, also requires comprehensive identification that includes their legal name, address, and relevant contact information. This clarity ensures accountability and eases communication throughout the repayment process. Additionally, including identifiers like account numbers or loan references can help streamline future correspondence and transactions. Having this information prominently displayed at the beginning of the proposal supports transparency and reinforces the agreement between both parties involved.

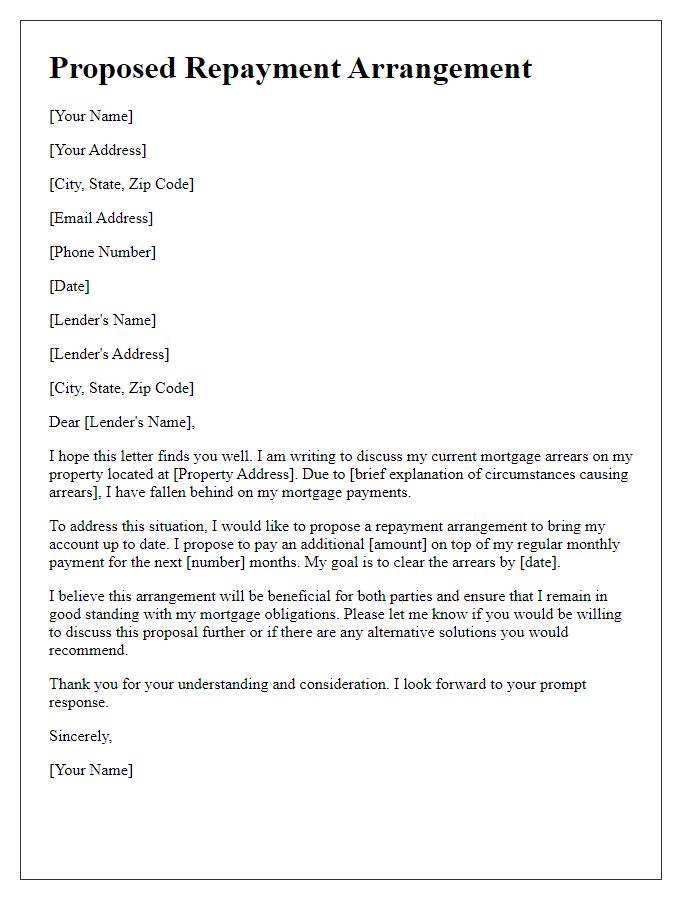

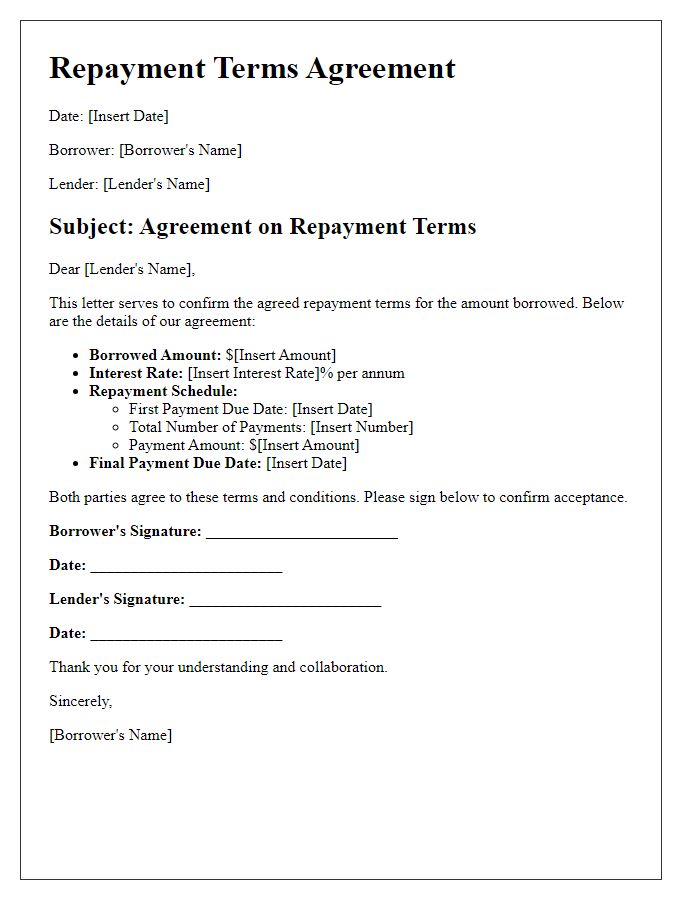

Detailed breakdown of repayment terms

A repayment schedule proposal outlines the specific terms for returning borrowed funds, ensuring transparency and accountability. The key components include the principal amount ($10,000) borrowed, the interest rate (5% annually) applied, and the repayment duration (24 months). Payments are typically made monthly, meaning 24 total installments. Each installment may include a breakdown of interest ($41.67 per month) alongside the principal repayment. A payment schedule table might be included, detailing the due dates (1st of each month) and the remaining balance after each payment, ultimately resulting in a total repayment amount of $11,500 by the end of the term. This proposal serves as a formal agreement, safeguarding both lender and borrower, with specific clauses regarding late payments (1.5% late fee after a 10-day grace period).

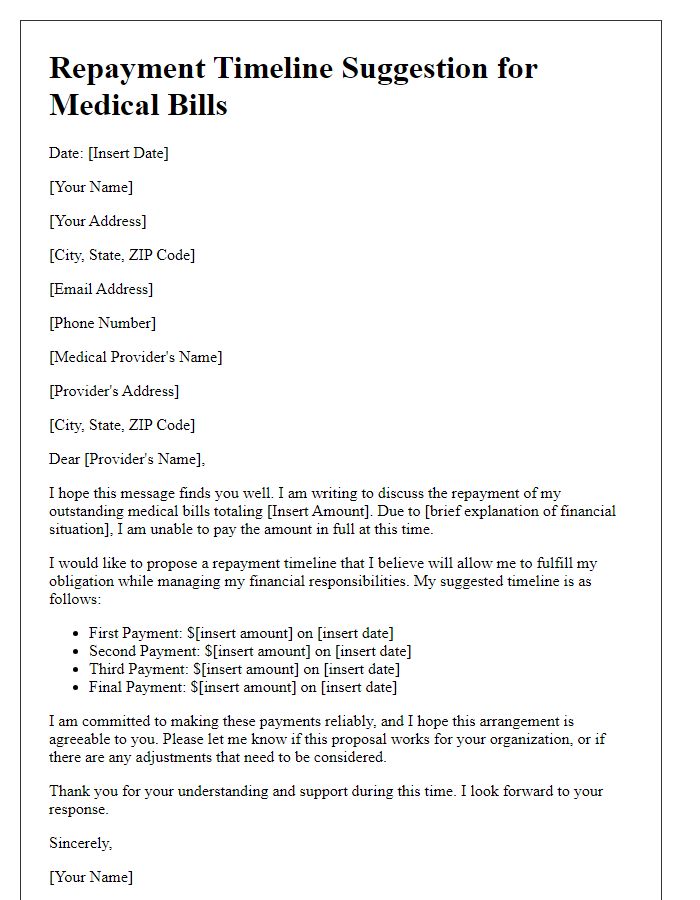

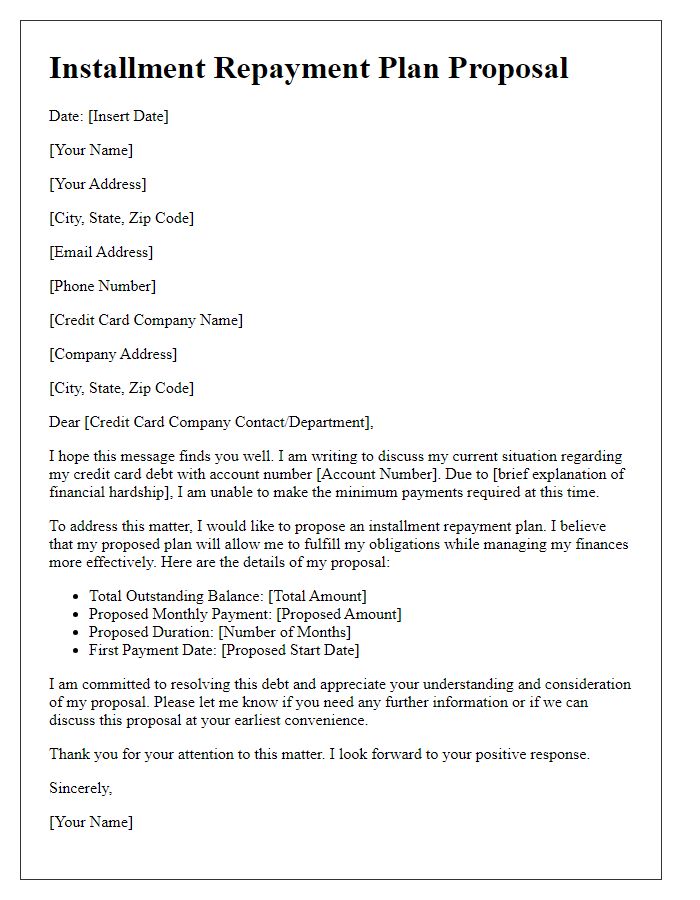

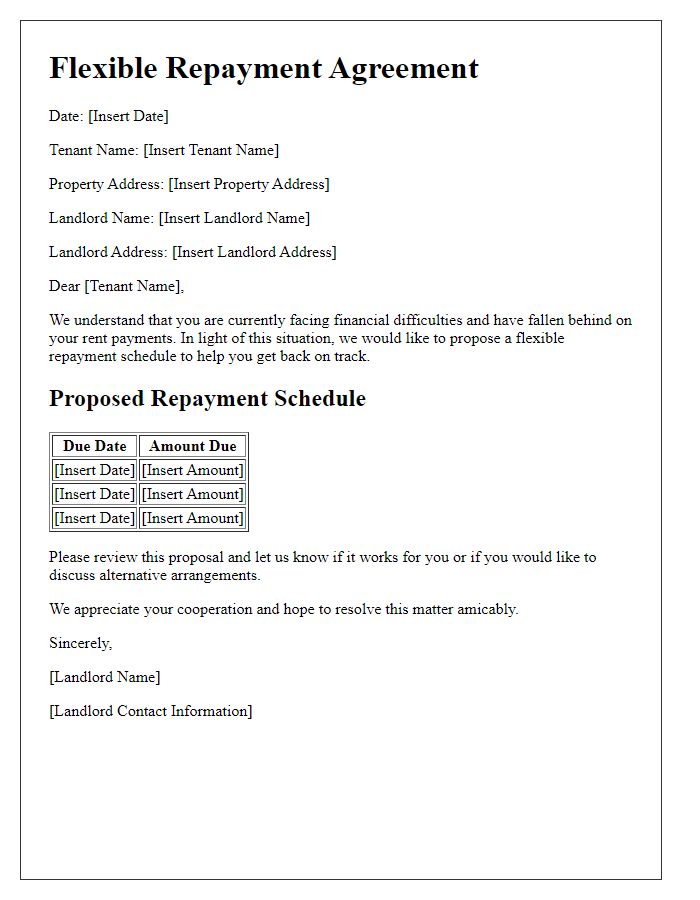

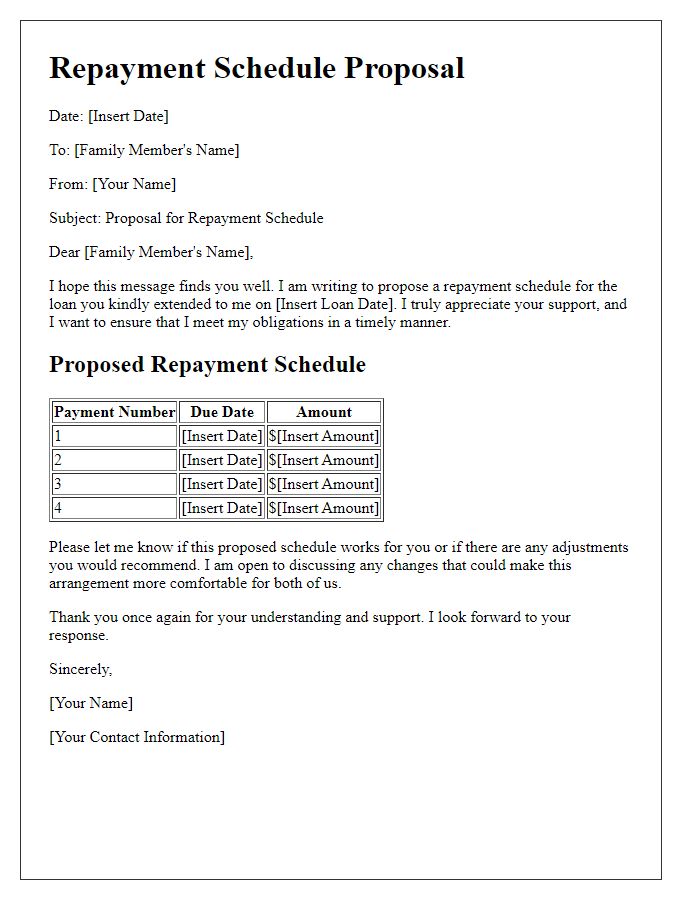

Specific payment amounts and due dates

A repayment schedule proposal outlines the structured plan for returning borrowed money, detailing specific payment amounts and due dates essential for financial clarity. For instance, a borrower might propose a repayment amount of $500 due on the 15th of each month, starting from January 15, 2024, to ensure consistent cash flow and adherence to the plan. The total loan amount of $6,000, with an interest rate of 5% annually, could be structured over a period of 12 months. By listing each due date and payment, such as February 15, March 15, and continuing through December 15, both parties maintain transparency, track progress, and avoid potential disputes regarding payment expectations. This methodical approach fosters trust and accountability in the lending process, beneficial for both lenders and borrowers.

Interest rates and applicable fees

A repayment schedule proposal outlines the plan for borrowers to repay a loan over time. Specific interest rates, which can range from 3% to 20% depending on creditworthiness, are crucial. Applicable fees may include origination fees, typically between 1% to 5% of the loan amount, late payment fees that can reach $50, and prepayment penalties that deter early repayment within the first few years. Clear communication of these terms ensures understanding among all parties involved. Establishing a timeline with specific payment dates, amounts due, and total repayment cost enhances transparency in financial agreements, fostering trust and accountability.

Contact information for queries and support

Creating a repayment schedule proposal is crucial for ensuring clarity in financial agreements. A well-structured document outlines specific terms and conditions while allowing for mutual understanding. The contact information section serves as a vital resource. Include detailed elements: the name of the person or department responsible for handling queries, corresponding email address (for instance, support@companyname.com), and a phone number (e.g., +1-800-123-4567) designated for direct communication. Additionally, specify the working hours during which support is available, such as 9 AM to 5 PM on weekdays. This comprehensive approach fosters trust and transparency, encouraging open dialogue about repayment terms while addressing any potential concerns effectively.

Comments