When it comes to conducting due diligence, clear communication is key! This letter serves as an important notification to ensure all parties are on the same page as we navigate this vital process. It's not just about checking boxes; it's about building trust and transparency in our dealings. So, let's dive in and explore what you need to know about due diligenceâread on for more insights!

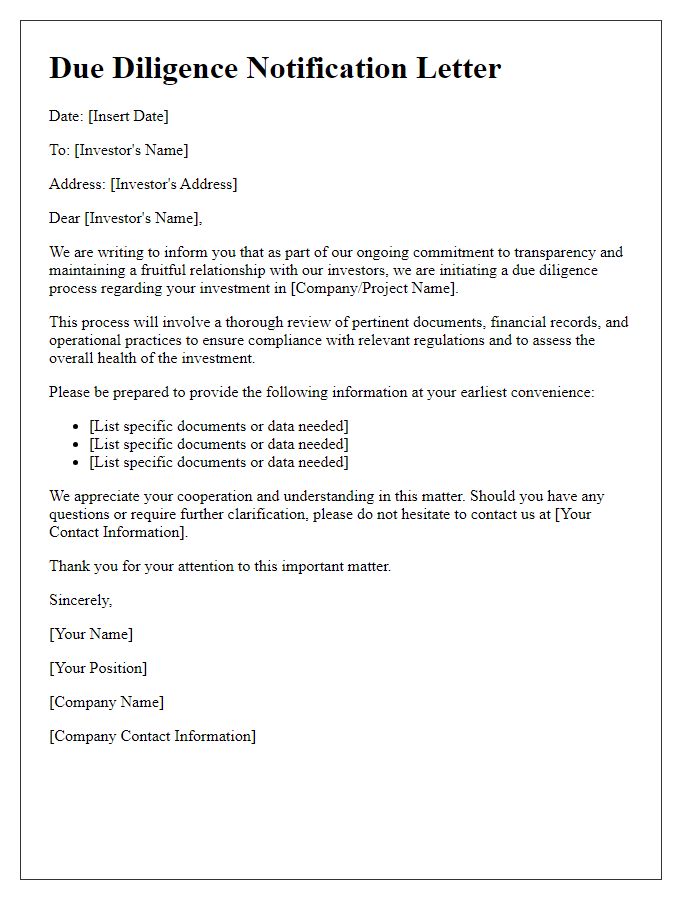

Clear Subject Line

Due diligence notifications involve careful assessment and analysis before financial transactions or business commitments. Due diligence refers to the process of investigating or auditing potential investments to confirm all material facts. Essential for mergers, acquisitions, and real estate transactions, due diligence aims to mitigate risks. The notification should include key elements such as the name of the parties involved, the purpose of the diligence, deadlines (often set in days, like 30 or 60), and specific documents required (financial records, contracts, or licenses). Clear communication ensures stakeholders understand the requirements and expected timelines, fostering successful and informed decision-making.

Introduction and Purpose

Due diligence is a comprehensive and systematic process aimed at evaluating potential investments or business transactions. This critical phase involves assessing all relevant information and risks associated with a particular entity or asset. The purpose of undertaking due diligence is to ensure informed decision-making, typically involving financial audits, legal reviews, and operational assessments. Conducting due diligence is essential for investors, partners, and stakeholders to gather insights and make strategic choices based on accurate and thorough data analysis. A meticulous approach in due diligence not only identifies potential red flags but also highlights opportunities, ultimately supporting the sustainability and profitability of the investment or business deal.

Detailed Requirements

Due diligence processes in corporate transactions require meticulous examination of financial records, legal compliance, operational practices, and other critical aspects. Financial statements, including the balance sheet, income statement, and cash flow statements, should span at least three fiscal years to provide a comprehensive view. Legal documents must encompass contracts, agreements, and any ongoing litigation, ensuring adherence to regulations from governing bodies such as the Securities and Exchange Commission (SEC). Operational assessments should evaluate supply chains, employee structures, and systems of internal control, often necessitating site visits to locations like manufacturing facilities or corporate headquarters. Additionally, interviews with key executives and stakeholders can elucidate strategic objectives and potential risks, facilitating informed decision-making.

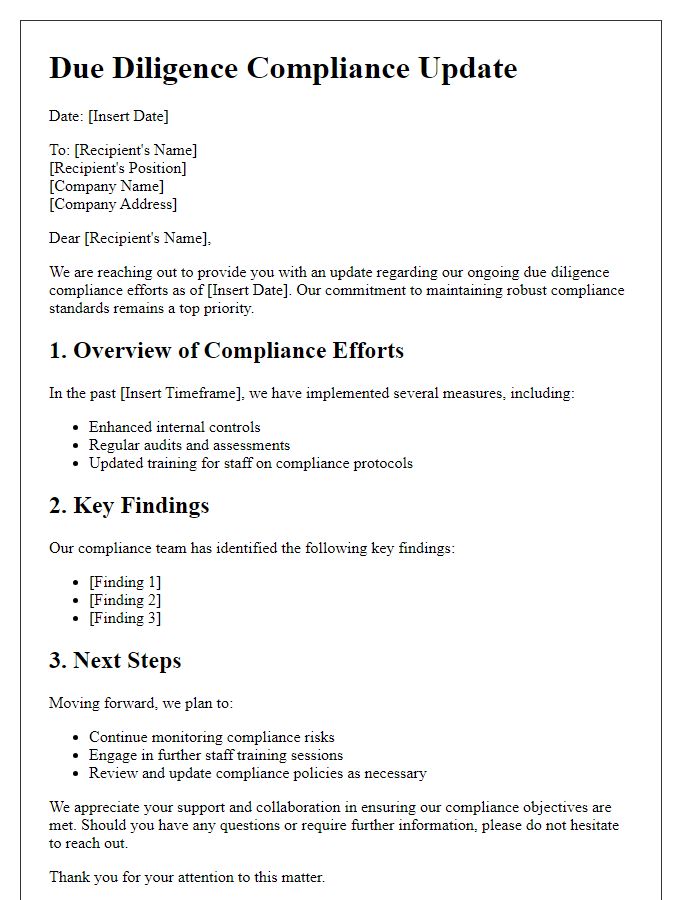

Timeline and Deadlines

Due diligence is a critical process in various business transactions, often involving a thorough investigation of financial records, legal documents, and operational practices. Timelines for due diligence typically span from 30 to 90 days, depending on transaction complexity. Key deadlines often include the initial data request, which is usually set within the first week, followed by iterative reviews of the findings over the subsequent weeks. Specific milestones may include a preliminary report on financial assessments due by the midway point, typically around the 45-day mark. The final due diligence report, encompassing all facets of risk assessment and compliance, is generally expected by day 90. Stakeholders, including investors, legal advisors, and compliance officers, play essential roles throughout this process, ensuring adherence to all regulatory requirements.

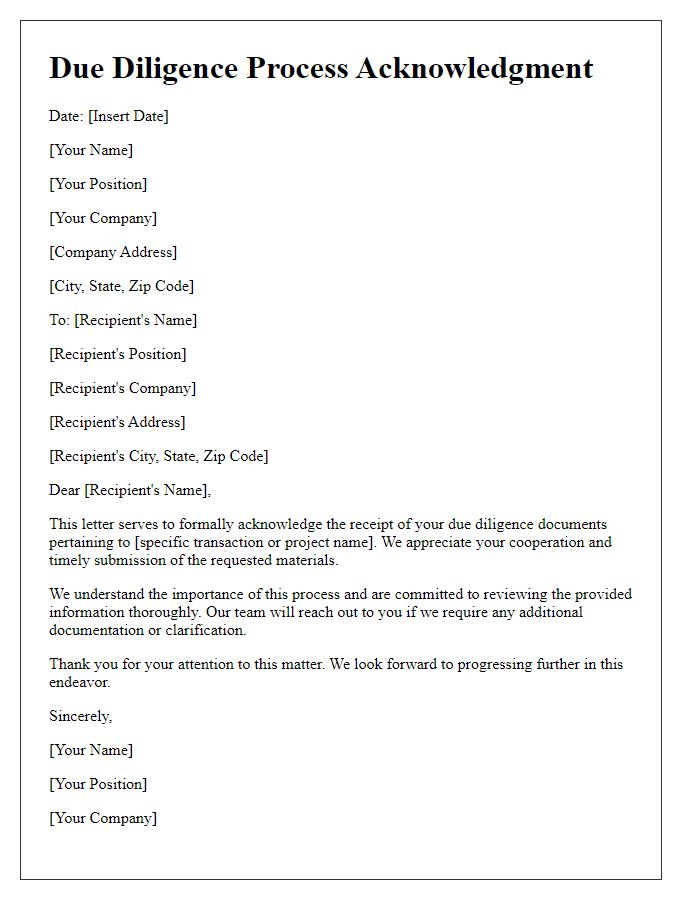

Contact Information

Due diligence notification involves a comprehensive review process taking place in various business settings, such as mergers and acquisitions. Key components of this process include assessing financial records, legal compliance, and operational management. During this review, critical areas such as accounting audits (often including three to five years of financial statements) and regulatory compliance (e.g., adherence to industry-specific regulations, such as those outlined by the SEC for publicly traded companies) are thoroughly examined. In this context, maintaining accurate contact information for all stakeholders (e.g., legal advisors, financial analysts, and company executives) is essential, ensuring efficient communication during the due diligence process. In scenarios related to significant business events like IPOs (Initial Public Offerings) or major investments, accurate and updated contact details can facilitate timely decision-making and enhance the quality of the review outcomes.

Comments