Are you in need of a simple yet effective way to request your account statement? Crafting a letter for this purpose doesn't have to be complicated; a clear and concise approach can do wonders. In this article, we'll guide you through a template that you can easily personalize to suit your needs. So, let's dive in and explore how to make your request seamless and polite!

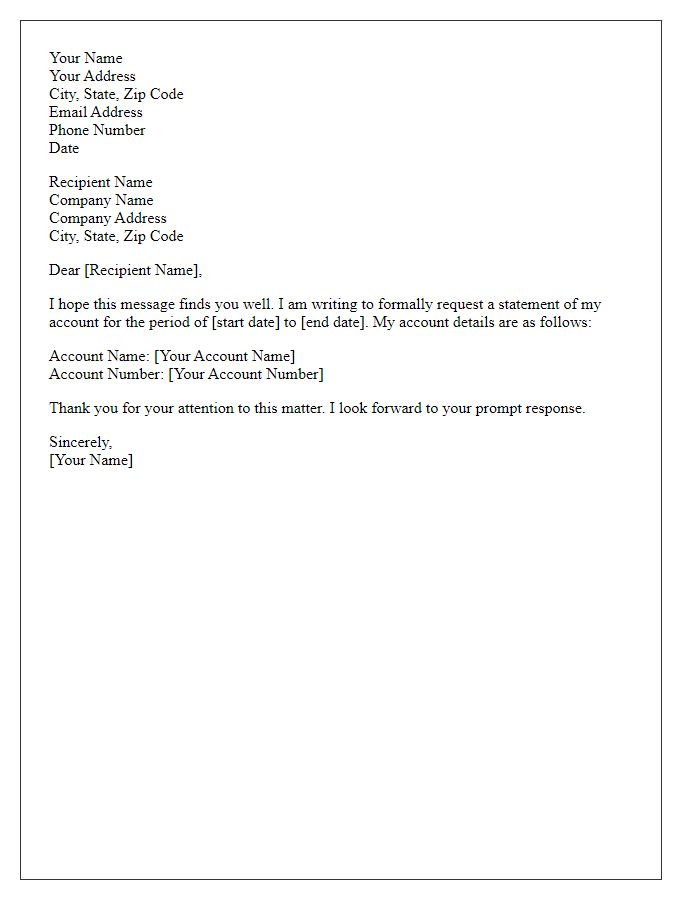

Clear identification details (Name, Account Number)

Requesting an account statement involves providing clear identification details. The name should include the full legal name as it appears on the account, ensuring it matches official records. The account number is crucial for accuracy in processing the request; it typically consists of 8 to 12 digits, unique to each account holder. Additional information may include the type of account (savings, checking) and any specific time periods for the statement requested (for instance, last six months). This clarity aids in quick identification and retrieval of the requested financial records.

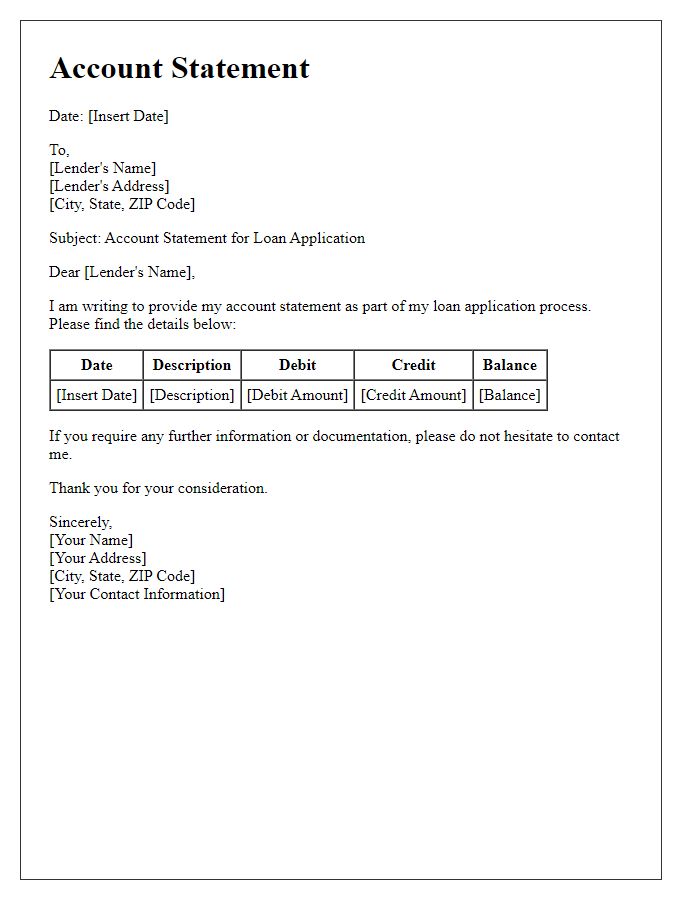

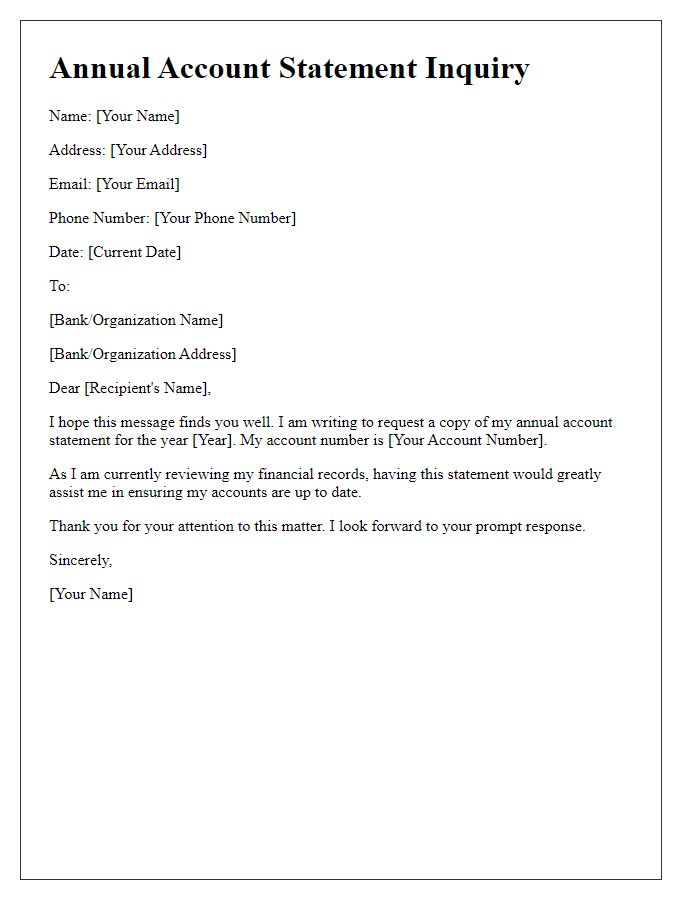

Specific time period for the statement

To obtain an account statement for a specific time period, individuals often need to formally request this information from their financial institution. This statement provides a detailed summary of transactions and balances, which can be crucial for personal financial management or auditing purposes. For instance, requesting an account statement for a particular month, such as January 2023, allows the account holder to review their financial activities during that time frame. Typically, the statement will include dates, transaction types, amounts, and current balance, aiding in better budgeting and financial planning. Institutions may require the request to be in writing, and they often specify forms or formats for submission, including online forms or traditional mailed requests.

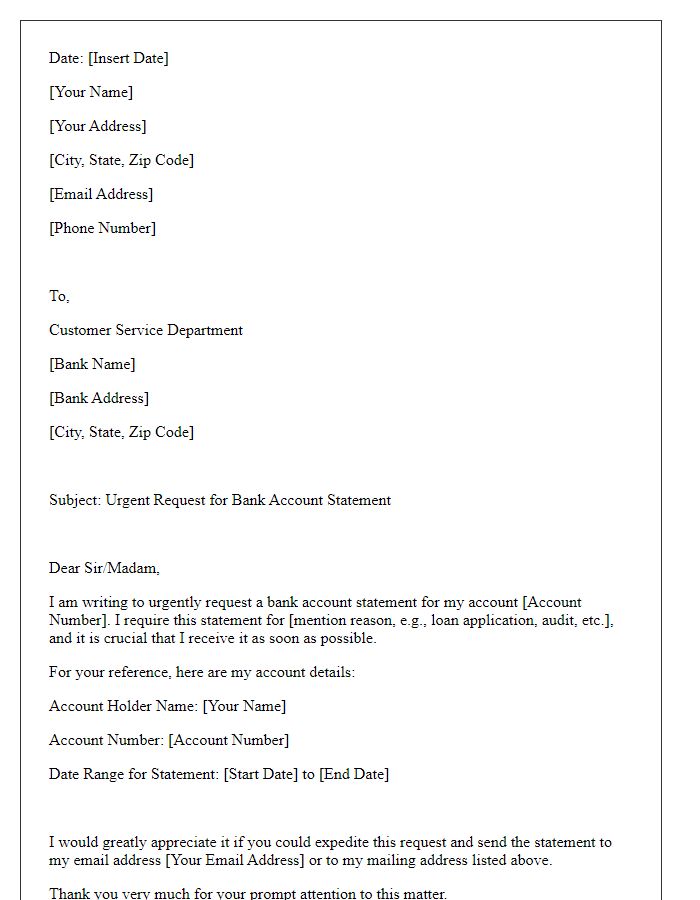

Contact information (Email, Phone Number)

An account statement request often entails specific details to facilitate efficient processing. For example, an individual might provide contact information, including email addresses (for digital correspondence, such as Gmail or Outlook) and phone numbers (typically a mobile or landline format) to ensure prompt communication. Essential elements also include account identifiers (like account numbers or customer IDs) to link the request to the correct financial records. Financial institutions may require a signature for validation, especially for sensitive information, highlighting the importance of secure verification practices.

Authorization statement (if applicable)

Account statement requests typically require authorization from the account holder to ensure privacy and security. An authorization statement includes details such as the account holder's full name, account number (which may be a 10-12 digit number), and the specific dates for which the statement is being requested, such as "from January 1, 2023, to March 31, 2023." It is crucial to include a statement confirming the account holder's consent for the bank or financial institution to release sensitive information. Additionally, the customer may need to provide identification details, such as a government-issued ID number, and contact information for verification purposes. This helps to streamline the process and ensures that the requested information is delivered to the correct party efficiently.

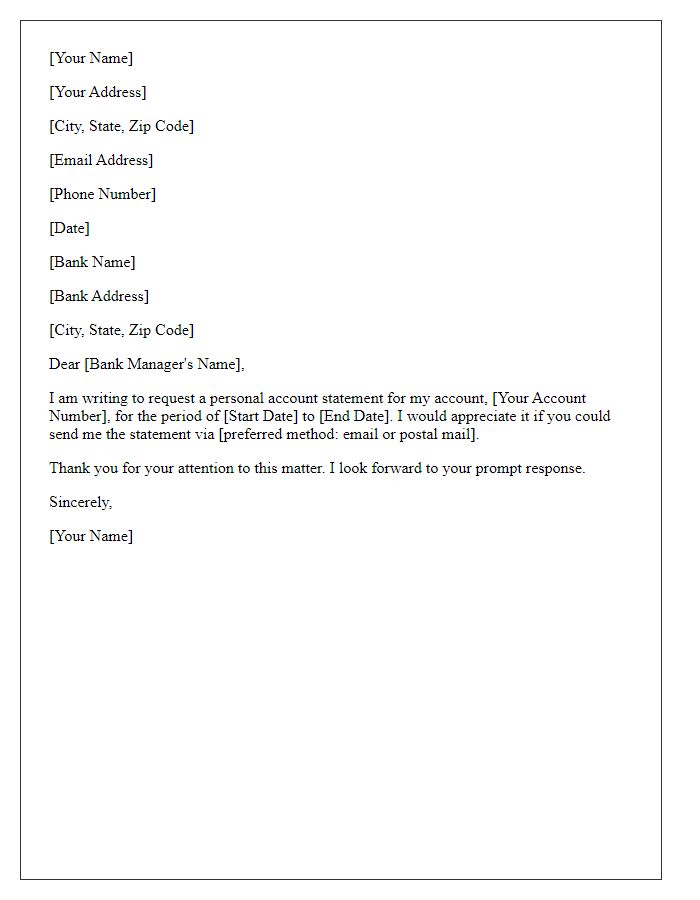

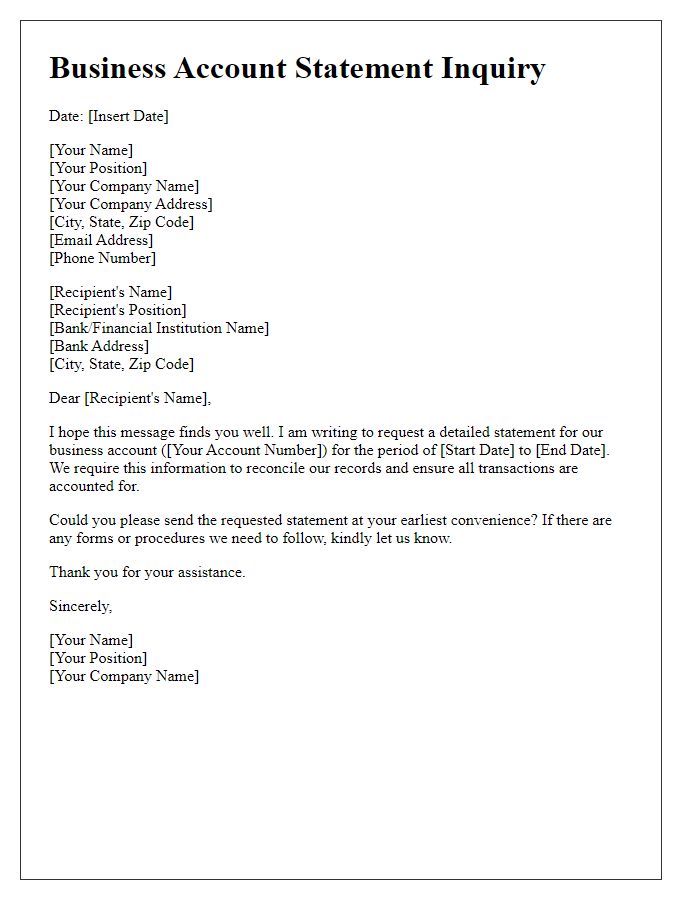

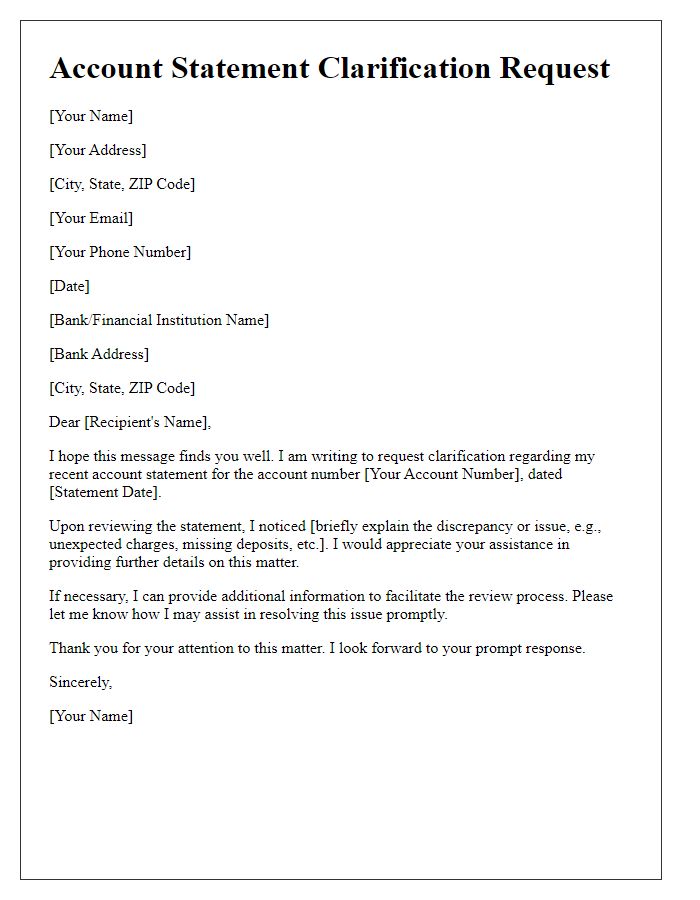

Formal request language

Account statement requests require clear and concise language to ensure effective communication. A formal request typically includes the account holder's name, account number, and the specific time period for which the statement is needed. It is essential to provide details surrounding any particular format or method of delivery, such as physical mail or email. This request should also reference any previous correspondence related to the account to add context. Professional tone is maintained throughout, indicating respect and formality. Note: Formal language emphasizes professionalism and respects the recipient's position.

Comments