When it comes to managing your finances, clear communication is key, especially when a third-party collection agency gets involved. Understanding the steps you need to take can significantly alleviate your stress and help you navigate the process effectively. This article will break down essential tips on how to inform a third-party collector about your situation while also protecting your rights. So, let's dive in and explore everything you need to know to handle this matter with confidence!

Clear Identification of Parties

When initiating a notification to a third-party collection agency, clarity in identifying all parties involved is crucial. The sender's information--including name, address, and contact number--should be clearly stated at the top of the document to prevent any confusion. The recipient should be explicitly named as the collection agency, along with their registered business name, address, and any identifying account number relevant to the collection. Additionally, the debtor's identification, including full name, address, and account details, must be included. This clear delineation of parties helps ensure that all involved understand their roles and responsibilities, facilitates communication, and minimizes potential disputes.

Detailed Account Information

A detailed account involving third-party collection agencies typically includes the debtor's account number, original creditor details, outstanding balance specifics, and collection agency contact information. For instance, an account number such as 123456789 may represent an outstanding balance of $1,500 owed to a local utility company, XYZ Energy, established in 2005. This account may be under the management of ABC Collections, a firm headquartered in New York City, operating since 2010, specializing in recovering outstanding debts. Important dates, such as last payment received on June 15, 2023, can highlight payment history and the timeline of collection efforts. Furthermore, a breakdown of additional fees or interest accrued, such as 15% late fees, can provide clarity on the total amount due.

Purpose of Notification

Notification of third-party collection services is essential for informing individuals or businesses regarding outstanding debts. This communication typically highlights the details of the debt, which may include the original creditor's name, the outstanding balance (often specified in dollars), and any applicable collection fees incurred (often a percentage of the debt). The notice indicates that the creditor has engaged a collection agency to pursue the debt, ensuring compliance with regulations, such as the Fair Debt Collection Practices Act (FDCPA) in the United States. The recipient is urged to address the outstanding balance promptly to avoid further actions, such as legal proceedings or additional fees, thereby emphasizing the importance of response and resolution.

Legal Compliance and Regulations

Notifying third-party collection agencies involves understanding legal compliance and regulations such as the Fair Debt Collection Practices Act (FDCPA) in the United States. This act outlines prohibited practices, ensuring that consumers are treated fairly and respectfully during the debt collection process. Agencies must provide clear identification, disclose the purpose of communication, and confirm the amount owed while avoiding harassment or deceptive practices. Compliance with state-specific regulations is also crucial, as these may impose additional constraints on collection activities. Failure to adhere to these rules can result in significant legal penalties, including lawsuits and fines.

Contact and Response Instructions

A notification regarding third-party collection agencies often emphasizes essential contact details and response protocols. The communication should include the name of the collection agency, such as ABC Collections, and specific contact information, including a phone number (555-123-4567) and mailing address (123 Main St, Suite 400, Springfield). The letter must clearly outline the importance of responding within a designated time frame (usually 30 days) to avoid further actions. Including reference numbers associated with the account ensures accurate identification. Instructions for providing written replies, including preferred methods (email to response@abccollections.com or mailed letter), help streamline communication. Such clarity enhances understanding of the process and supports efficient resolution of the debt issue.

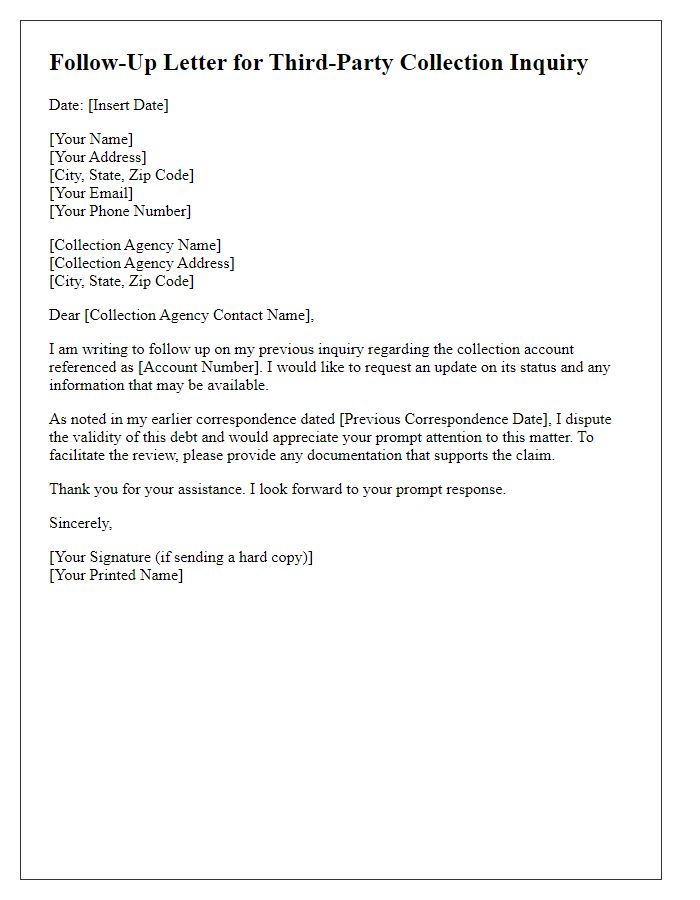

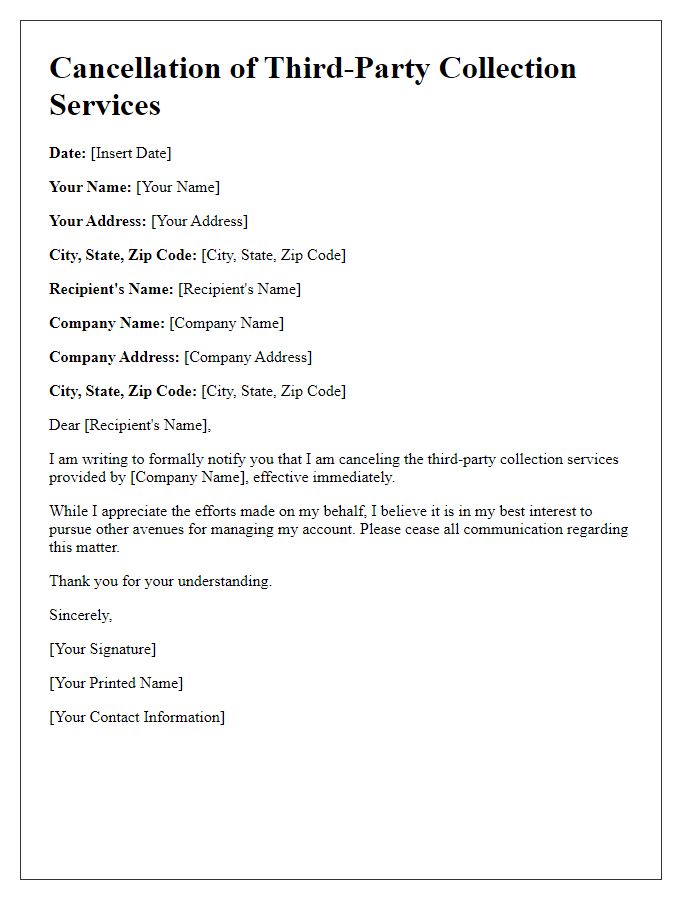

Letter Template For Notifying Third-Party Collection Samples

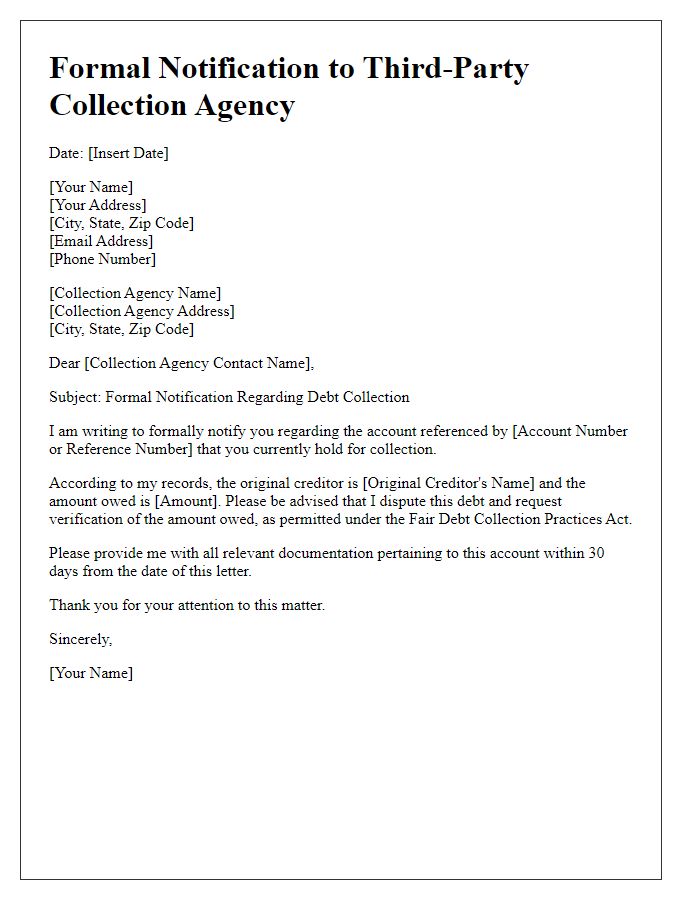

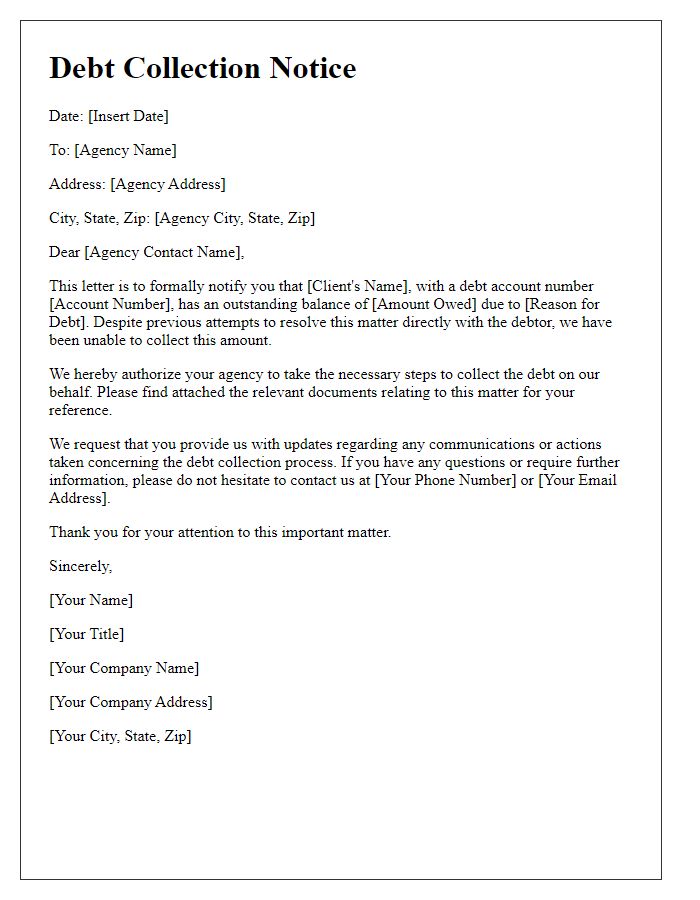

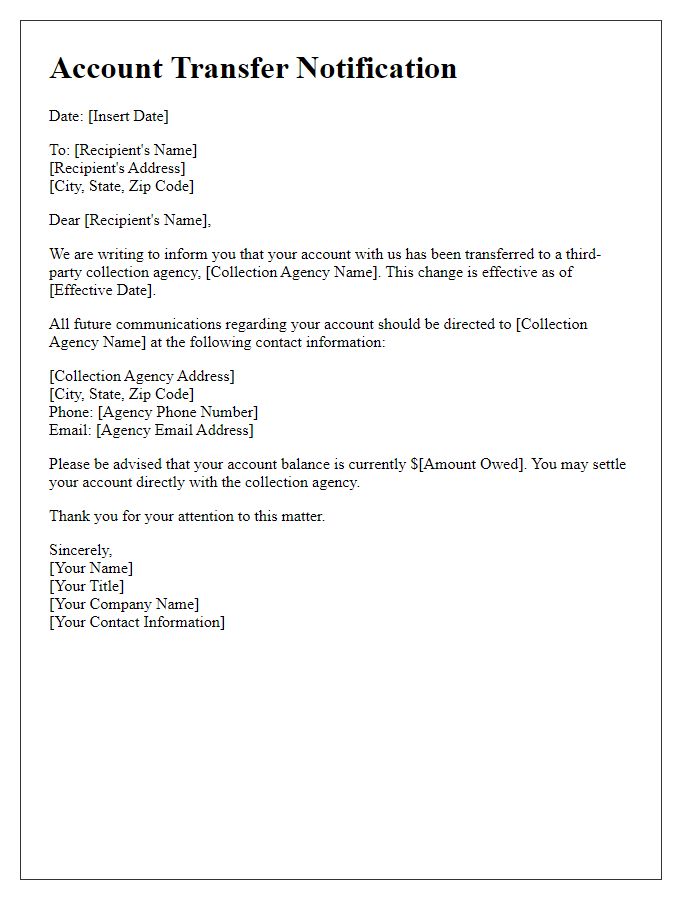

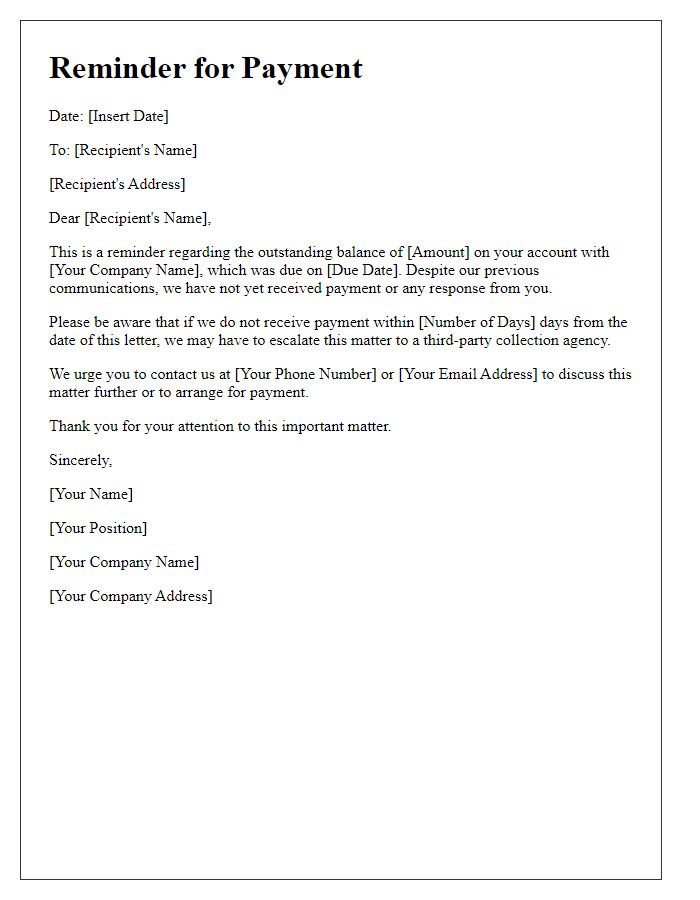

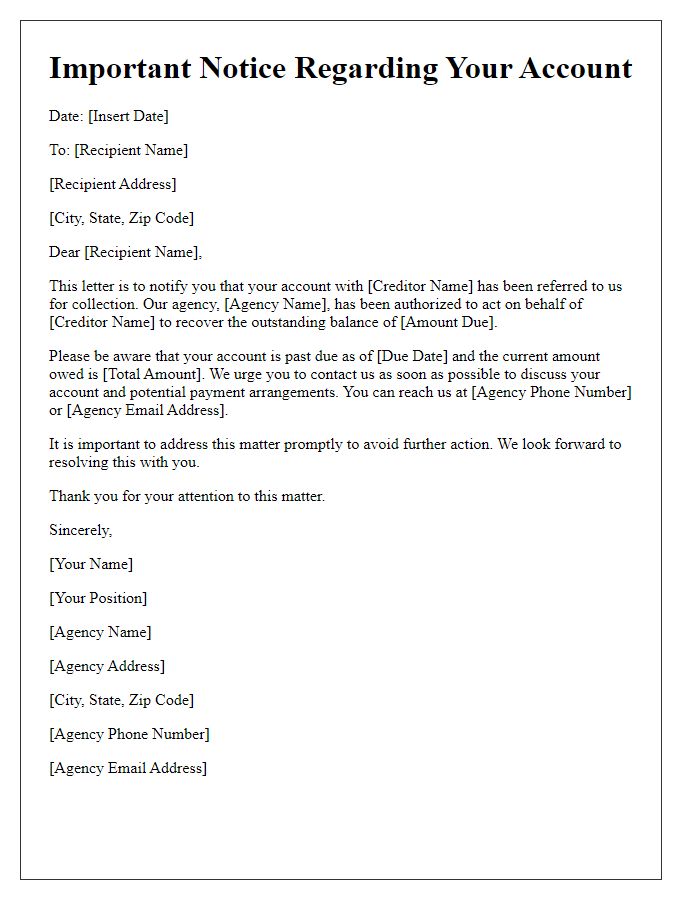

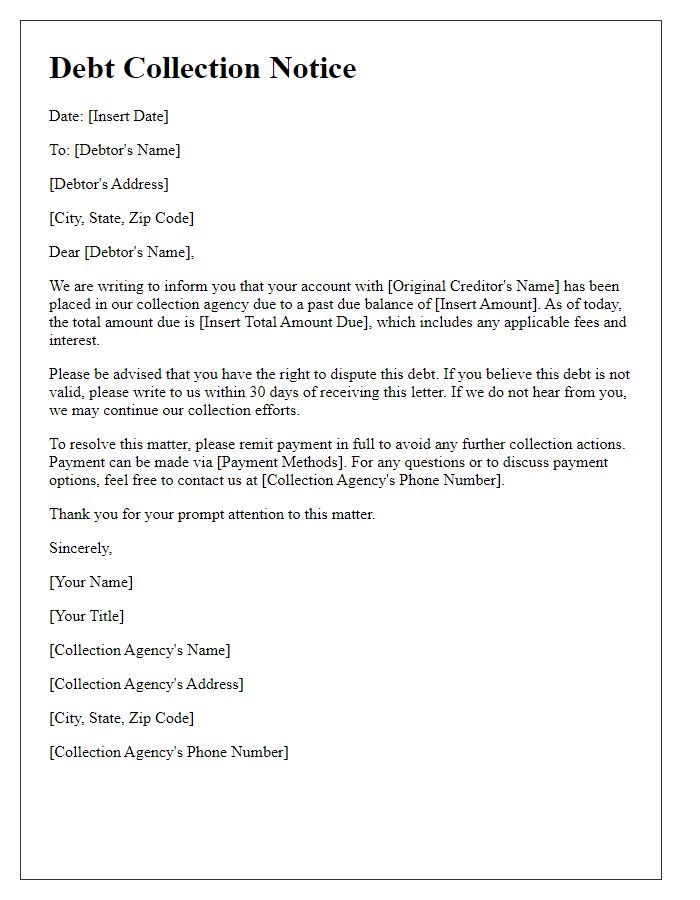

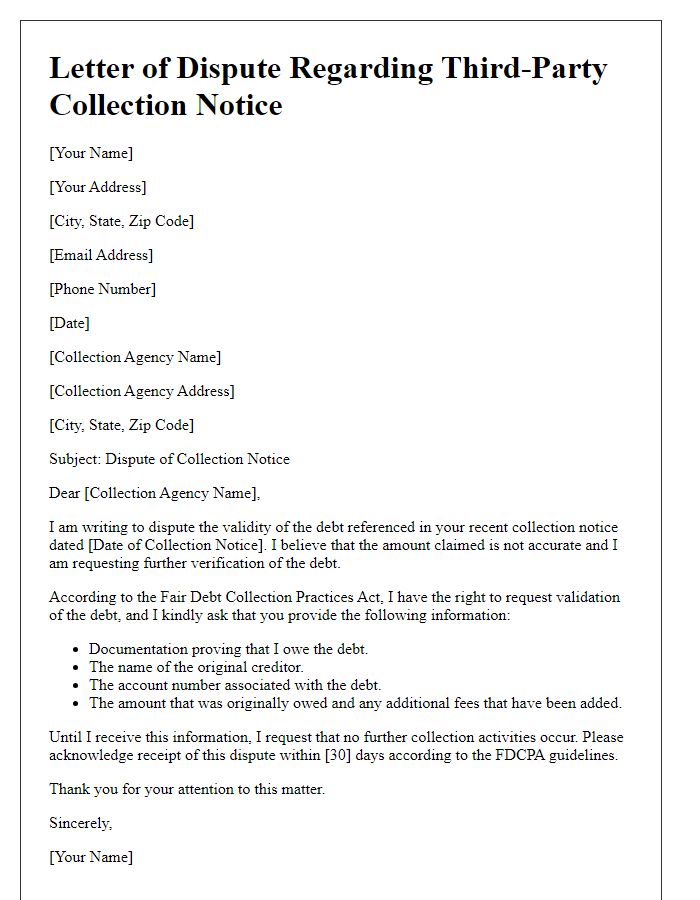

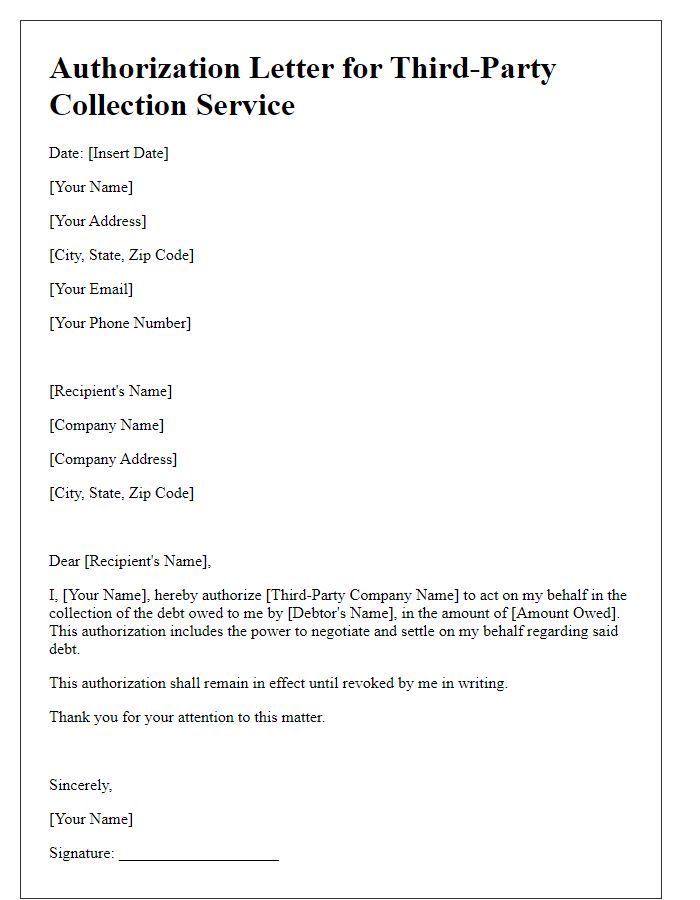

Letter template of formal notification to third-party collection agency.

Comments