Have you ever found yourself in the awkward position of needing to send a payment default notification? It's never an easy task, but communicating effectively is essential to maintaining a professional relationship. In this article, we'll explore the key elements to include in your letter, ensuring that your message is clear and respectful. Join us as we discuss how to craft the perfect payment default notification that opens the door for resolution.

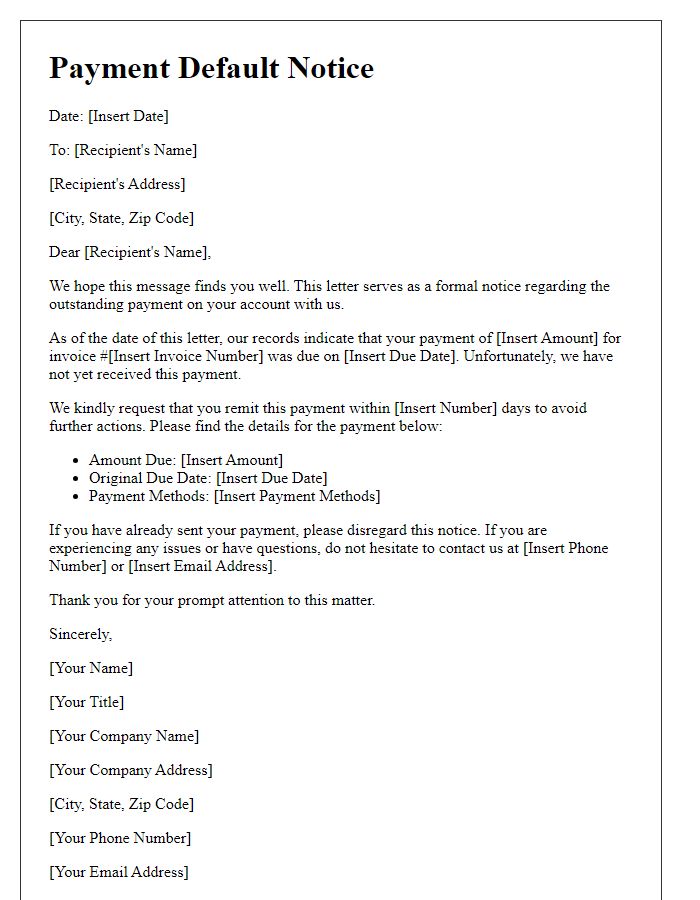

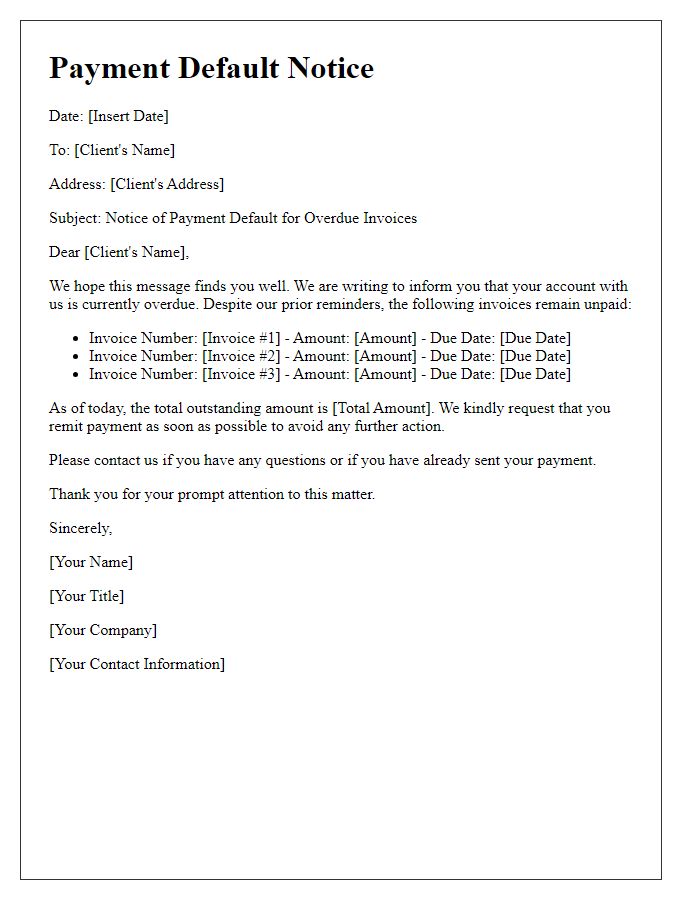

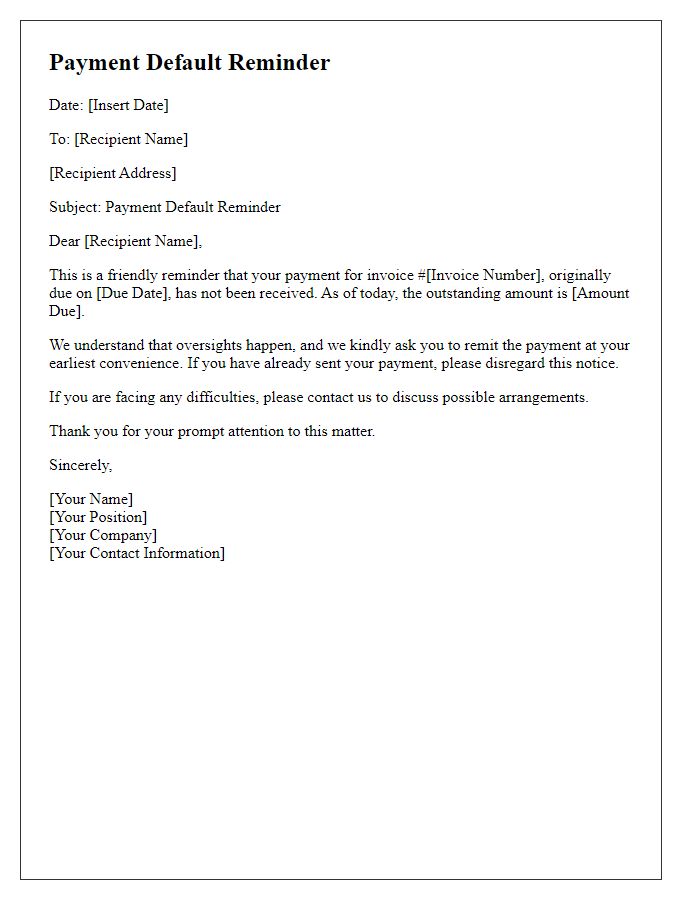

Recipient's Name and Address

Late payments can lead to significant penalties and financial stress for organizations. Invoices overdue by more than 30 days may accrue late fees of up to 1.5% per month. Frequent payment defaults can ultimately damage business relationships and impact future creditworthiness. For example, during the fiscal year 2022, the total amount owed in unpaid invoices was estimated to be $400 billion in the United States alone. Failure to resolve payment issues can also lead to collections procedures, with legal actions taken in approximately 35% of unpaid invoice cases, and can severely affect the reputation of the debtor within the industry.

Account Details and Outstanding Amount

The account status of XYZ Corporation (Account Number: 12345678) indicates a pending payment that remains overdue. As of October 1, 2023, the outstanding amount totals $5,000. This balance pertains to Invoice #98765, dated August 15, 2023, which was due for payment by September 15, 2023. Delayed payments may incur additional fees in accordance with the terms outlined in our service agreement. Immediate action is recommended to prevent any disruption of services provided to XYZ Corporation and to maintain a positive credit relationship.

Due Date and Payment Terms

A payment default notification serves to inform a debtor about their overdue payment obligations, typically related to services or goods received. This notification often includes specific due dates (e.g., March 15, 2023) which clarify when payment was expected. Payment terms may outline conditions such as net 30 or net 60 days, specifying the period within which payment should be made after receiving the invoice. In many cases, financial institutions relay such notifications through registered mail to ensure delivery, while including potential late fees that may accrue for extended defaults. Furthermore, failure to comply may lead to more severe consequences, potentially involving collection agencies or legal action, underscoring the importance of timely payments in maintaining financial health.

Late Fee or Penalty Information

Payment defaults can result in significant financial repercussions for individuals and businesses. Late fees, such as a standard $25 to $50 charge, typically apply when payments are not received by the due date. These penalties can add up quickly, exacerbating the outstanding balance. In specific cases, recurring delays may lead to increased interest rates (often an increase of 1% to 5%) on future payments, further burdening the debtor's financial situation. Timely reminders about payment obligations are essential to preventing default situations, allowing individuals or businesses to avoid unnecessary fees and maintain good credit ratings, which can be crucial for applications for loans or leases in financial institutions like banks or credit unions.

Contact Information for Resolution

Payment defaults can significantly impact financial stability and credit scores. Timely notifications regarding payment issues are crucial. Contact information for resolution typically includes multiple channels such as phone numbers, email addresses, and physical addresses for customer service representatives. For example, a customer service hotline might operate from 9 AM to 5 PM EST, offering immediate assistance. An email address may provide a route for more detailed inquiries, while a mailing address can accommodate formal correspondence related to default notifications. Ensuring clarity in contact details allows prompt resolutions, reducing stress for both parties involved. Neglecting to address these issues quickly can lead to further complications such as late fees or legal actions.

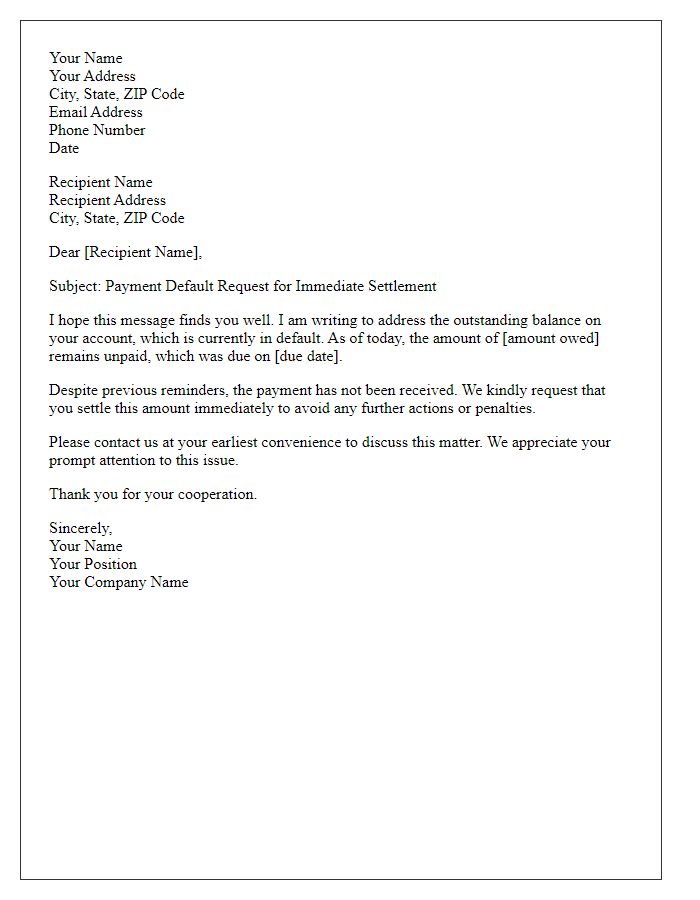

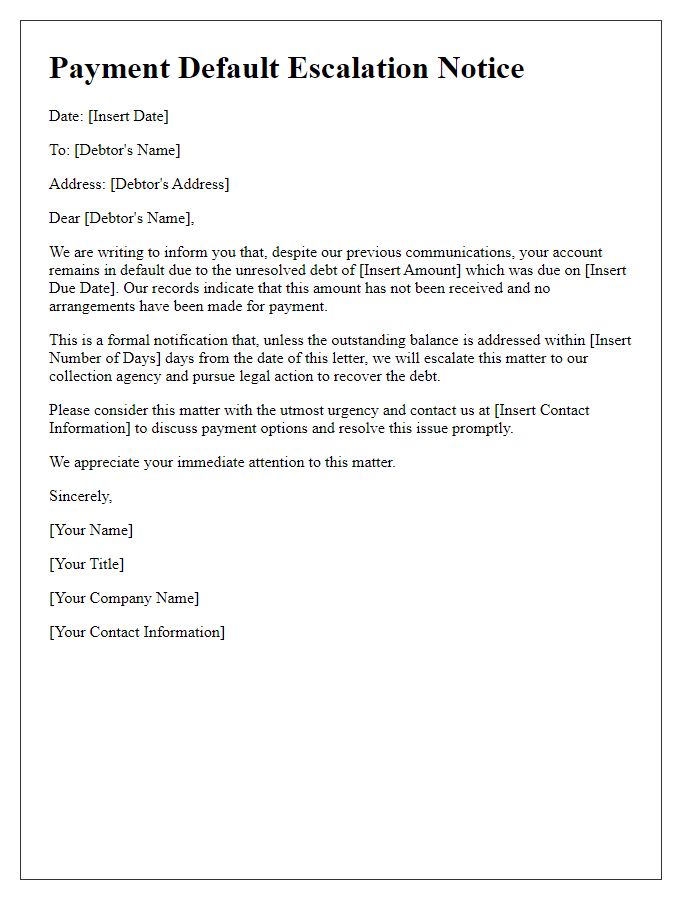

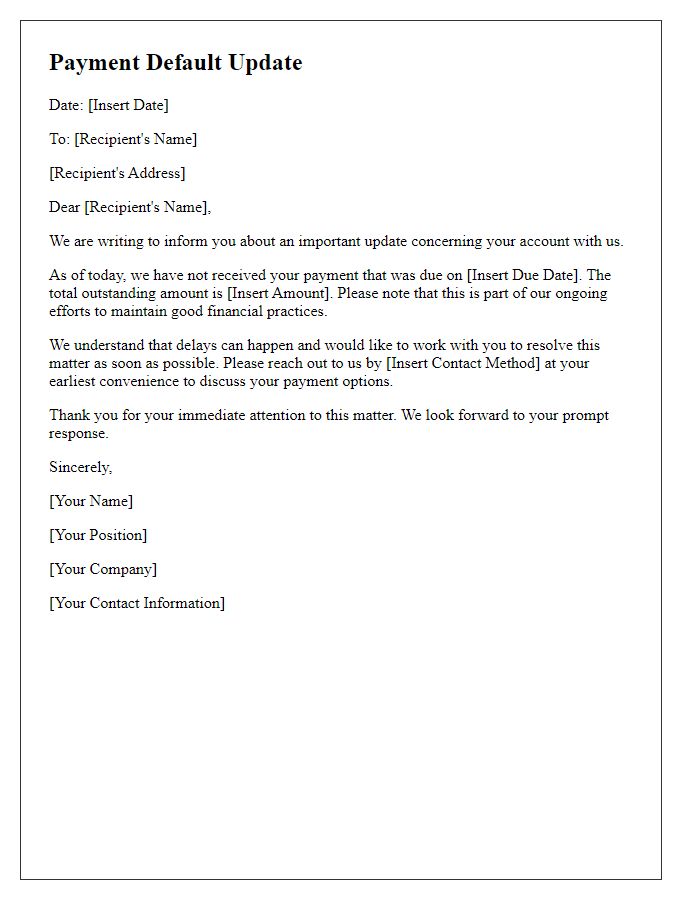

Letter Template For Payment Default Notification Samples

Letter template of payment default correspondence for receivable accounts.

Comments