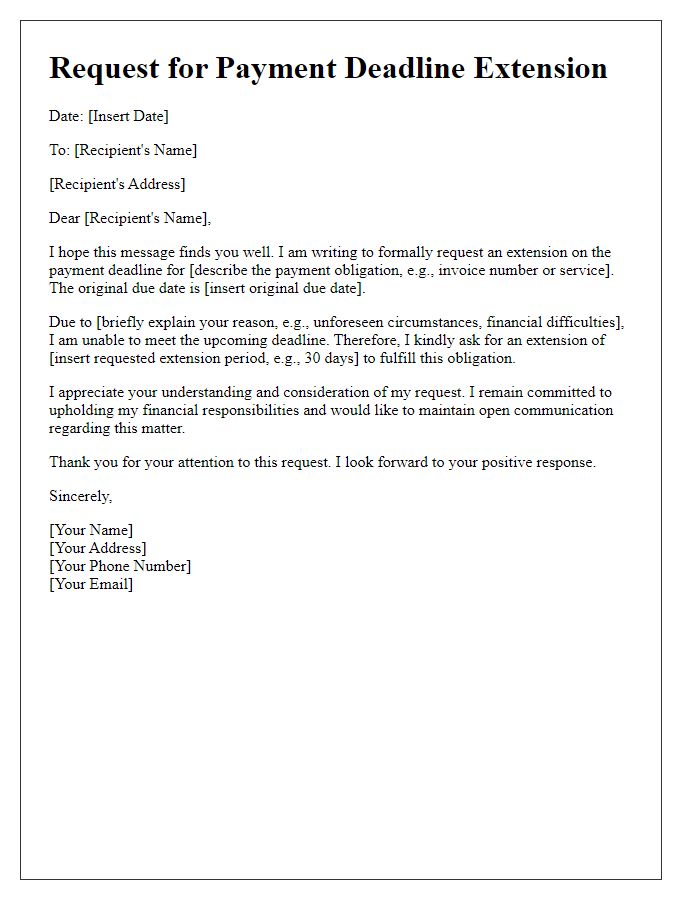

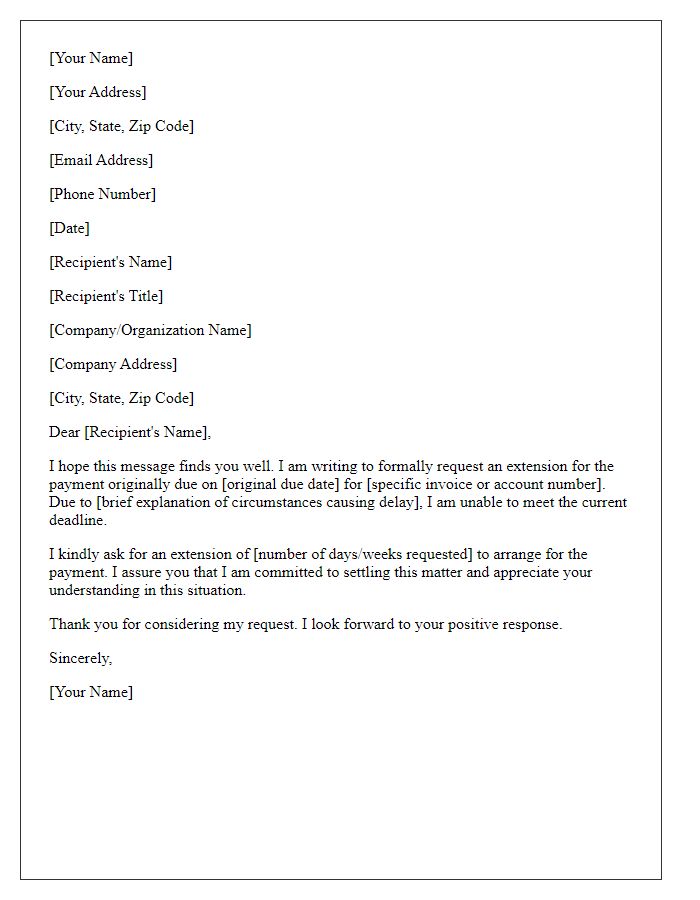

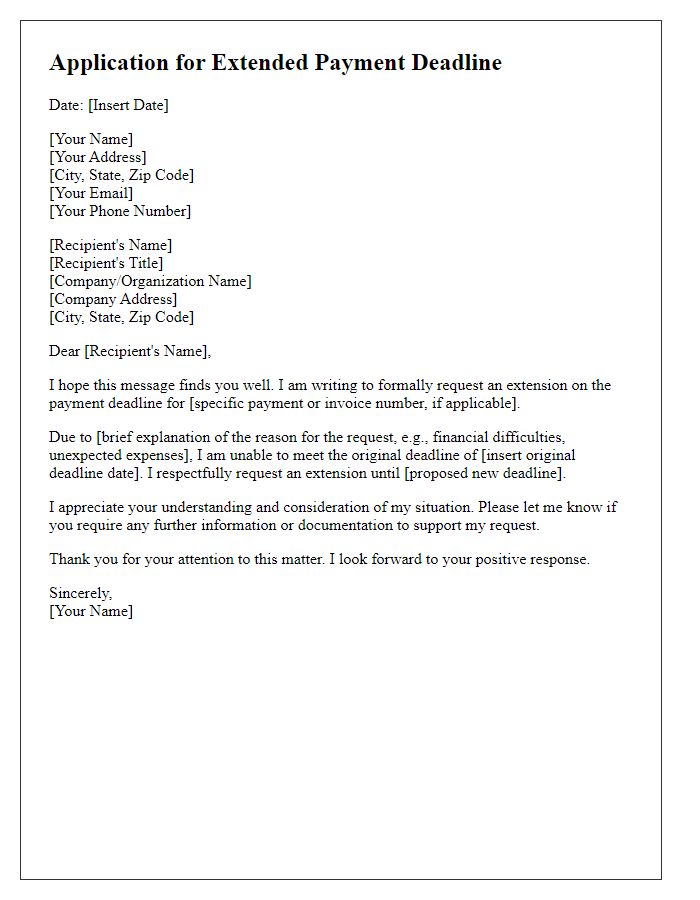

Are you feeling overwhelmed by looming payment deadlines? We've all been there, and sometimes life throws unexpected curves that make meeting financial commitments tough. If you're in need of a little extra time to fulfill your payment obligations, requesting a deadline extension can be a helpful solution. Keep reading to discover a simple letter template that makes this process as smooth as possible!

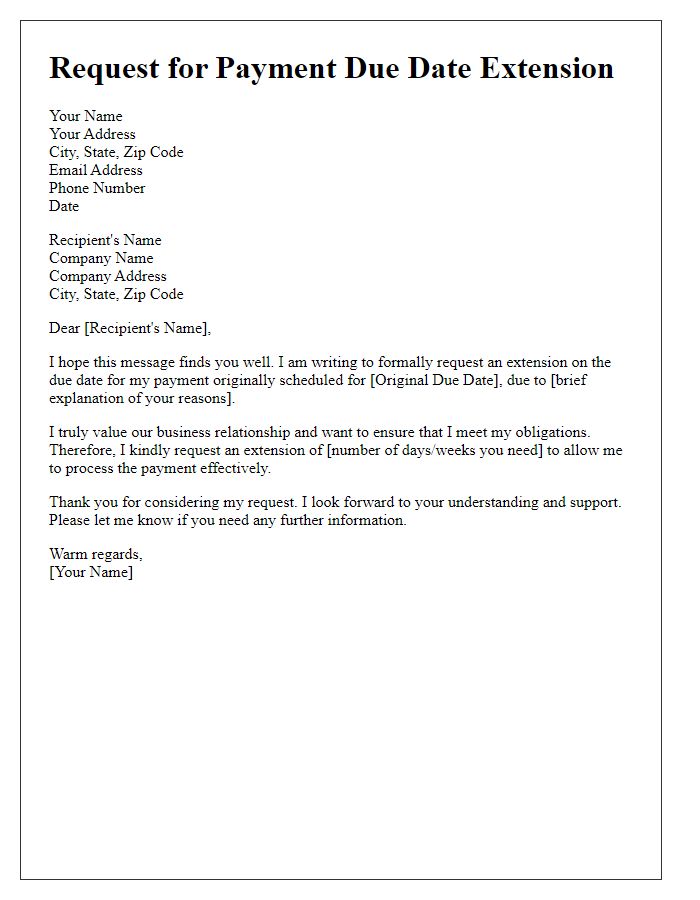

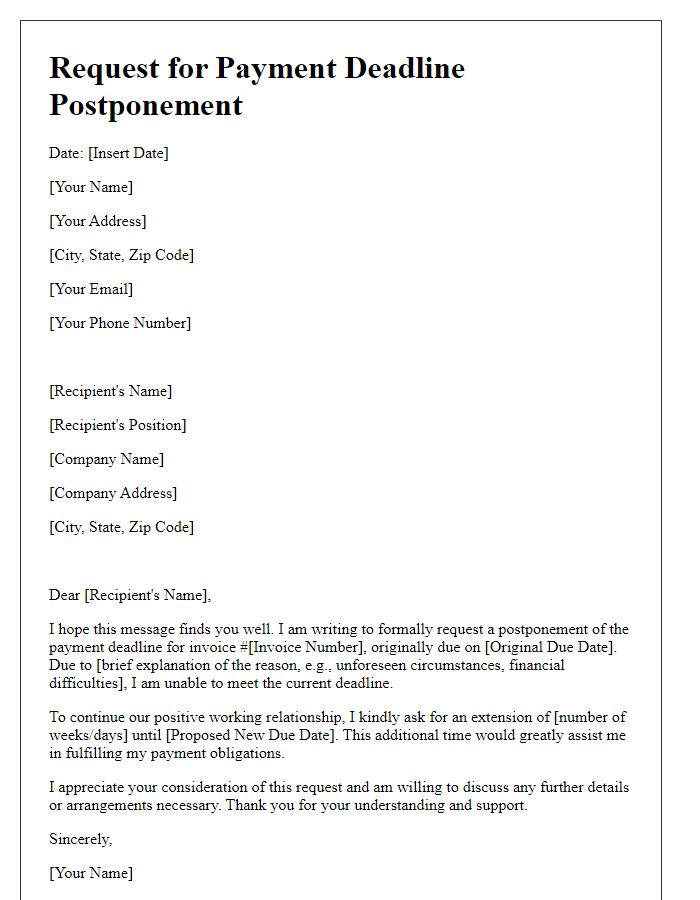

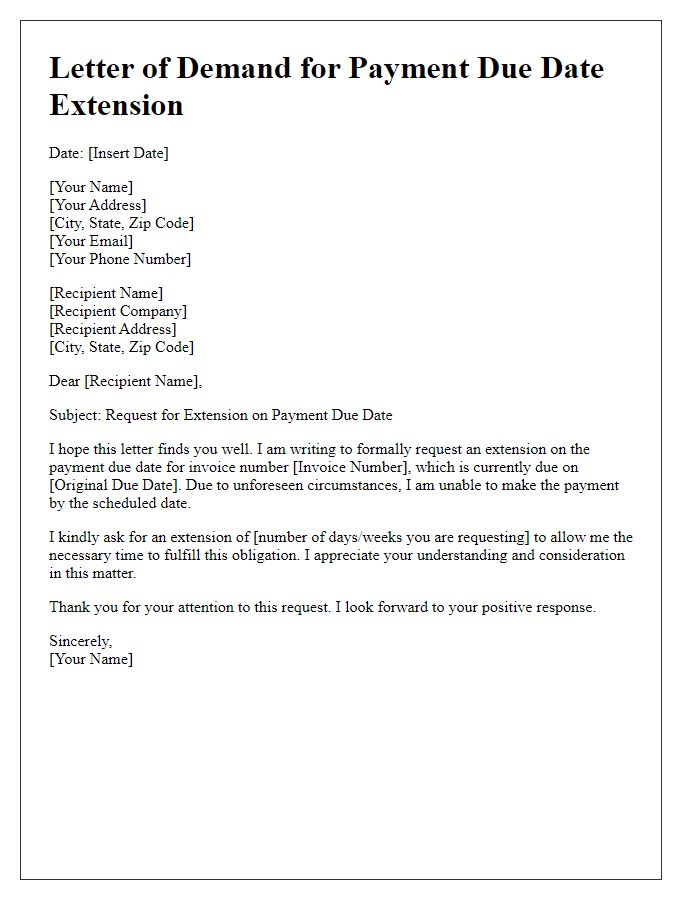

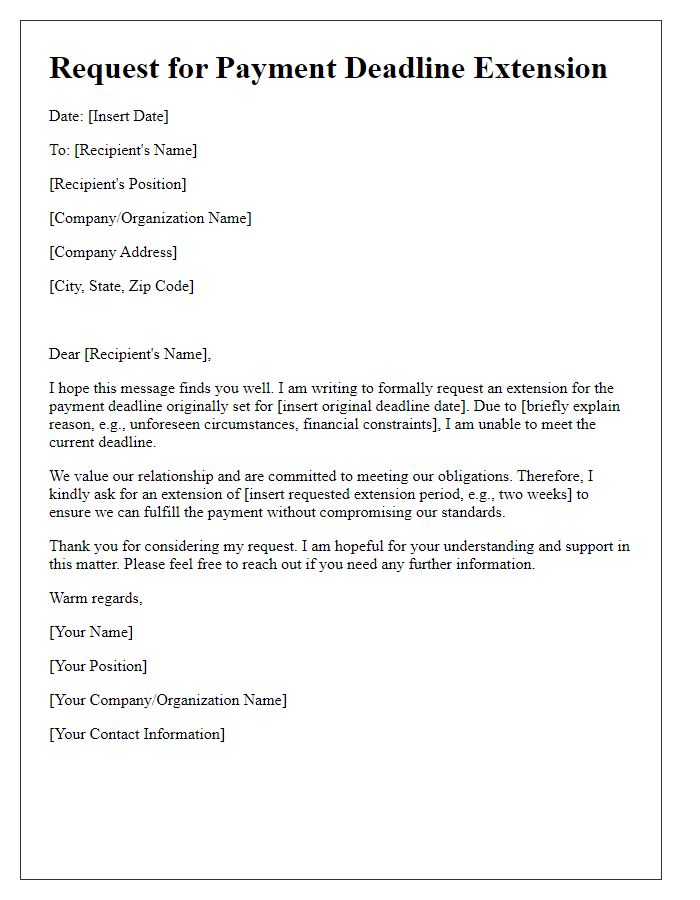

Polite tone and clear request

A significant delay in payroll processing can cause employee distress, particularly when payment deadlines approach. For example, companies like XYZ Corporation reported that late payments affected staff morale as employees faced unexpected expenses. The financial strain during crucial periods, such as holidays or medical emergencies, highlights the need for clear communication regarding payment timelines. Requesting an extension for payment deadlines often involves articulating the reasons behind the delay, emphasizing understanding and politeness, which can foster goodwill between the employer and employees. Timely negotiations and transparency about financial situations are essential in maintaining workforce trust and engagement.

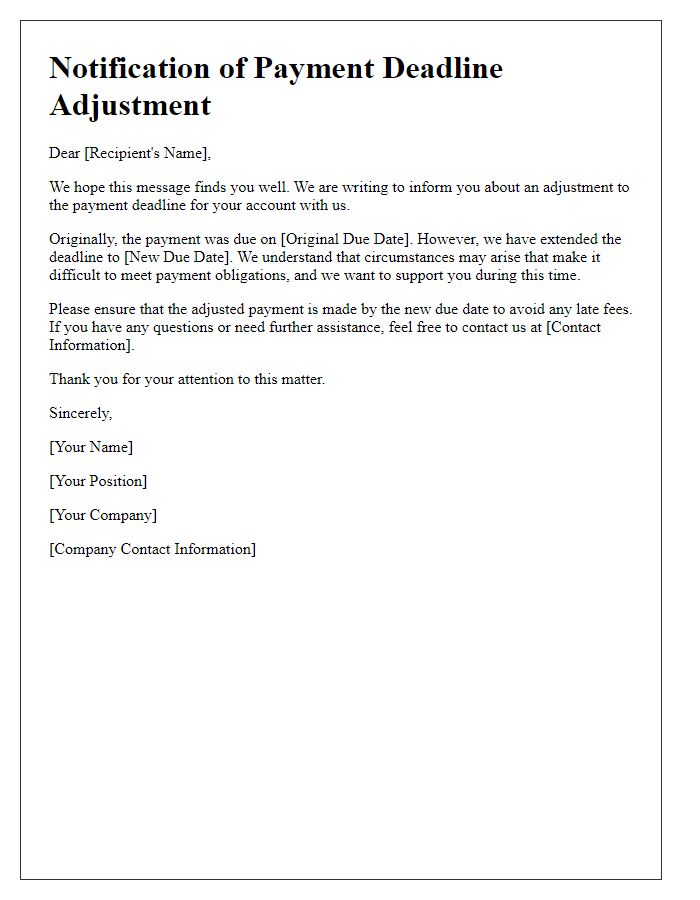

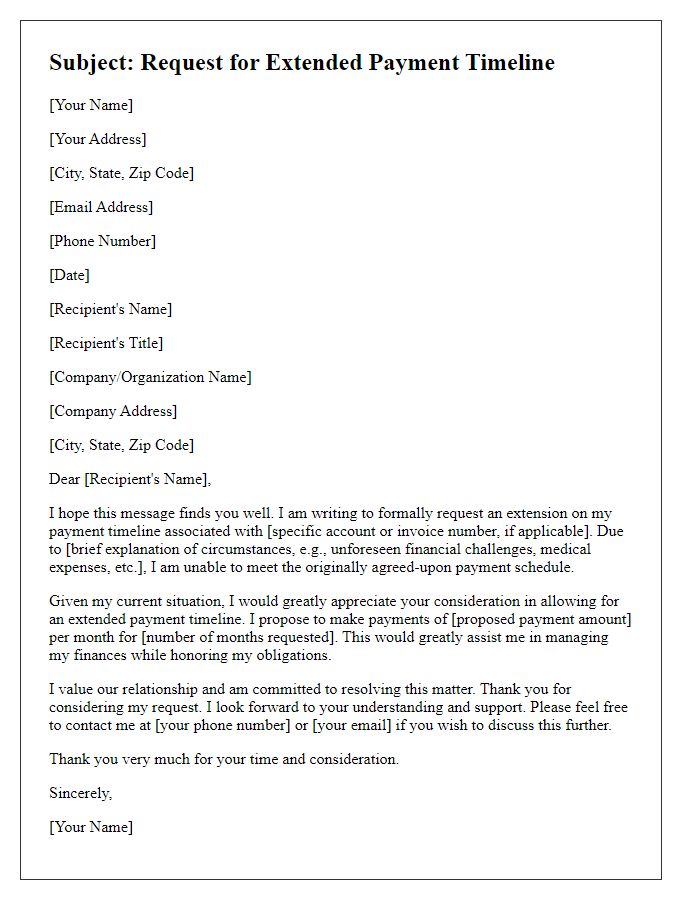

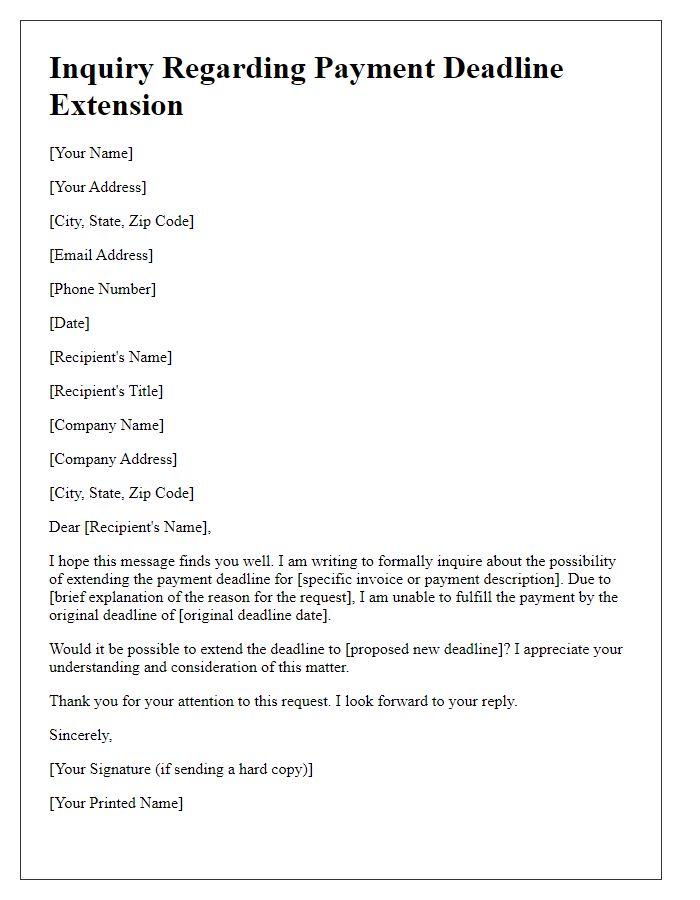

Reason for extension

Payment deadline extensions are often requested in situations involving unforeseen financial difficulties. For instance, a sudden medical emergency may arise, leading to unexpected expenses that strain the budget. Alternatively, delays in receiving income, such as payments from clients or employers, can hinder timely payments. Businesses facing disruptions like supply chain issues or fluctuating market conditions might also seek extensions to manage cash flow effectively. Additionally, natural disasters, like hurricanes or floods, can affect the ability to meet financial obligations on time. When requesting an extension, clearly stating the specific circumstances and demonstrating a commitment to fulfilling the payment when possible can help in obtaining a favorable response from creditors or service providers.

Specific new proposed deadline

Payment deadlines often require clear communication to ensure all parties are informed of their obligations. A request for a deadline extension might involve specific considerations, such as unforeseen financial difficulties or ongoing negotiations. The new proposed deadline could be a date like January 15, 2024, offering a 30-day extension to fulfill the payment obligation. Including details regarding the original deadline, such as December 15, 2023, can clarify the request's urgency. Additionally, providing context around the delay, whether due to international shipment issues or unexpected expenses, can create understanding and potentially foster goodwill between parties.

Assurance of future compliance

A payment deadline extension may provide additional time for financial commitments. This situation often arises during challenging economic periods or unexpected events, such as layoffs affecting cash flow. Timely communication with creditors can mitigate the risk of penalties. For instance, reaching out to a utility company in San Francisco to discuss options may yield positive results. Assurance of future compliance includes detailing an actionable plan, such as scheduled payments over the next three months, ensuring stability in meeting financial obligations. Providing documentation of current financial status, like bank statements or income proof, fortifies the case, demonstrating commitment to responsible payment practices.

Contact for further discussion

Businesses often face cash flow challenges, necessitating communication with creditors. A payment deadline extension may provide necessary relief, allowing companies to stabilize finances. Key points to address include the current financial situation, specific deadline requests, and assurances regarding future payments. Contacting a financial advisor can also provide insights into negotiating terms effectively. Clear communication fosters understanding, potentially leading to favorable agreements that support ongoing business operations.

Comments