Have you ever wondered about the importance of keeping track of your financial statements? Receiving a notification about your credit balance can be a pleasant surprise, letting you know that you have some extra funds available. It's essential to understand what this balance means and how it can impact your overall financial health. Join us as we delve deeper into the details of credit balances and what steps you can take to make the most of them!

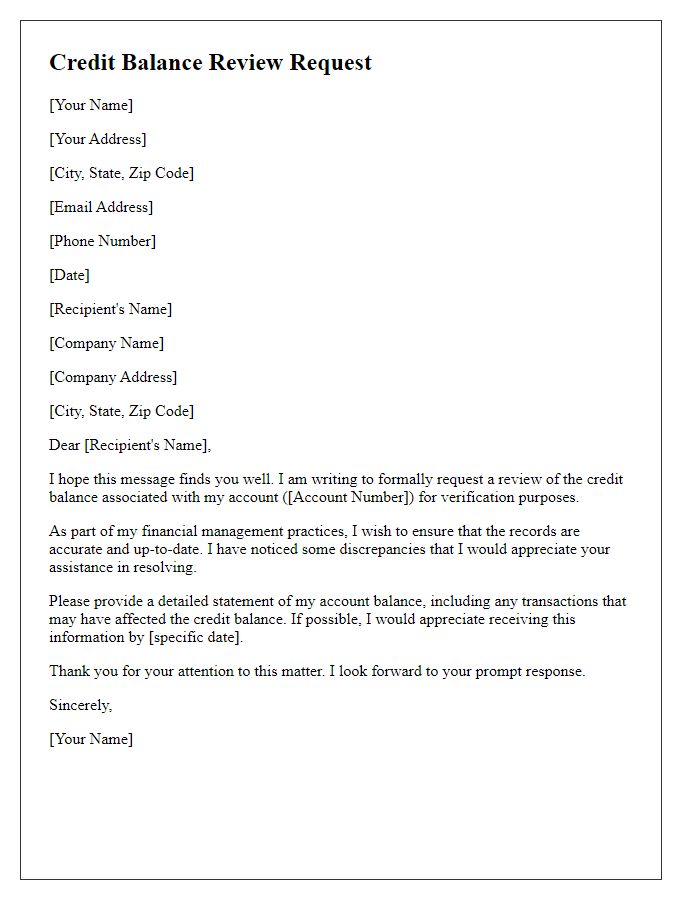

Recipient's contact information

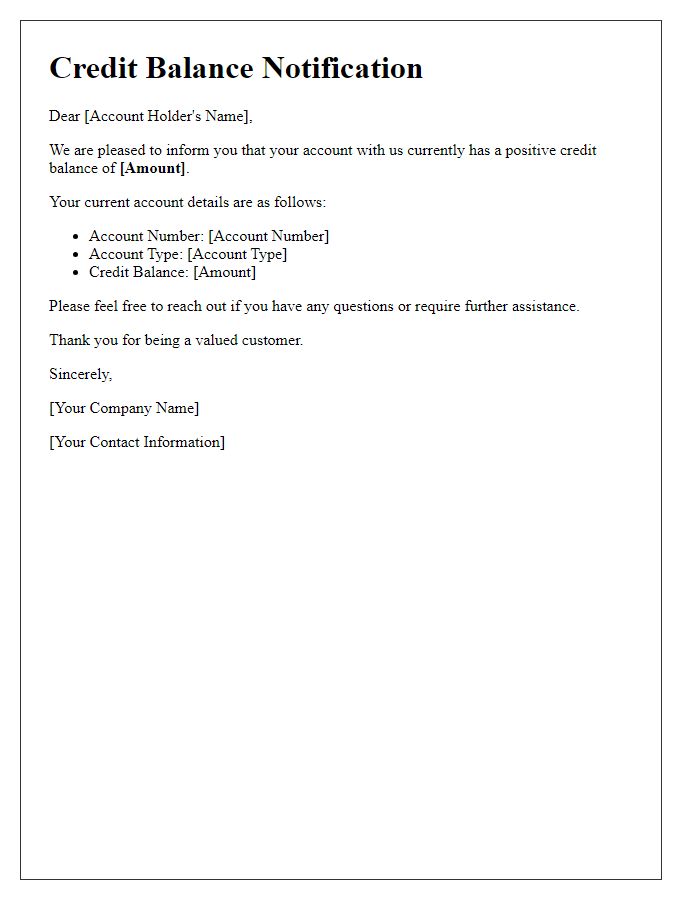

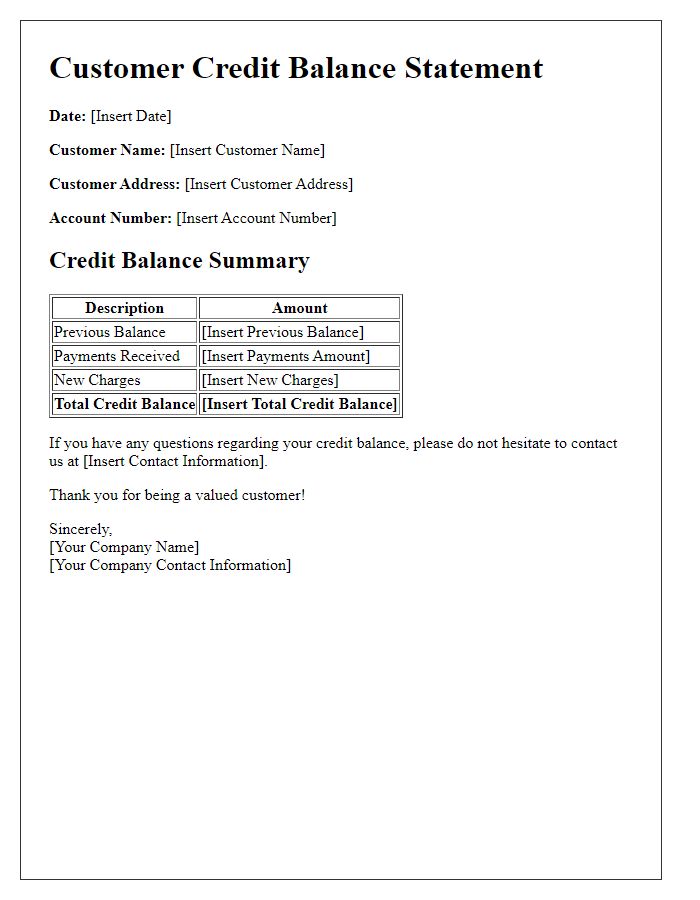

A notification of a credit balance serves to inform the recipient that their account shows a positive balance, typically after a payment adjustment or refund. The communication starts with the recipient's contact information, detailing their full name, address, email, and phone number for clarity and record-keeping. An account number may also appear to ensure easy identification. The notification often includes the balance amount, which might be stated as a precise figure, accompanied by the date of the statement, and any specific details related to the credit transaction such as transaction dates or references. This information ensures the recipient acknowledges their current financial standing and facilitates any necessary follow-up actions regarding the account.

Sender's contact information

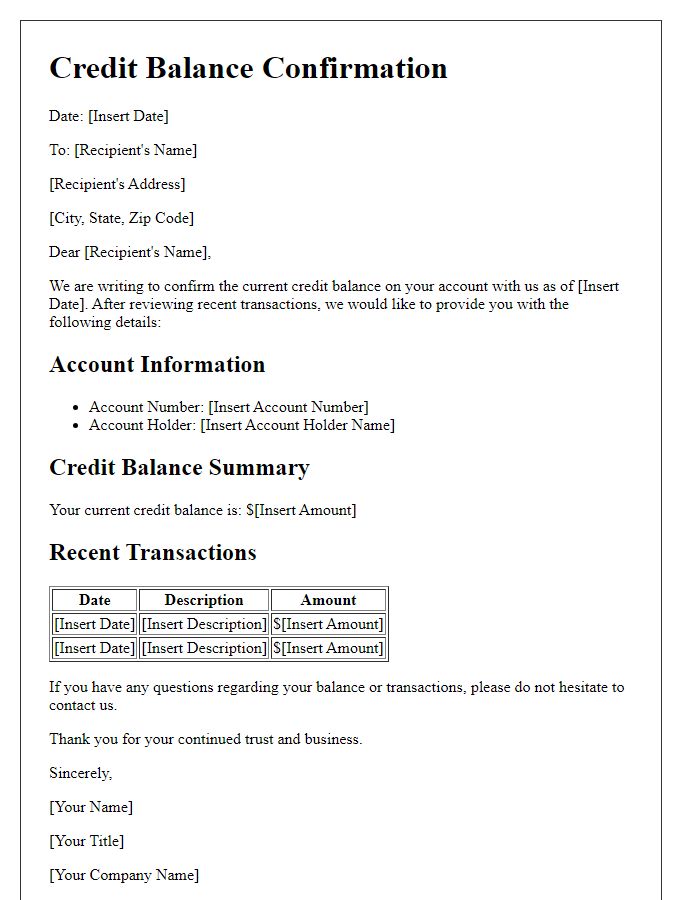

A notification of credit balance serves to inform an account holder about their available balance within a specific financial account. This document typically includes important details such as the account holder's name, account number, date of notification, and the total credit balance amount. Institutions may also include contact information for customer service inquiries, including phone numbers, email addresses, and physical locations like bank branches. Such notifications may additionally indicate any recent transactions that contributed to the current balance, enhancing transparency and providing clarity for account holders managing their finances.

Clear subject line

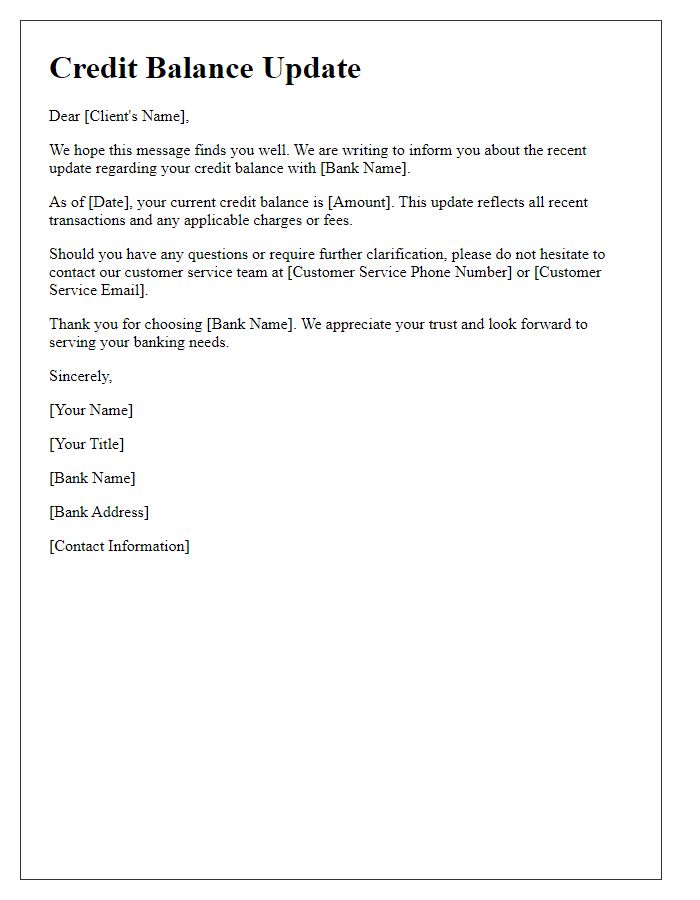

A notification of credit balance serves as an update to inform customers about their account status. The communication usually includes the account holder's name, account number, and the specific credit balance amount, emphasizing transparency in financial dealings. Additionally, the date of the notification should be clearly stated, along with any pertinent details regarding the credit balance, such as the source of the credit, whether it's from overpayment or a refund. Contact information for customer service must also be included, allowing for inquiries or clarification regarding the credit balance. This structured notification ensures that customers are well-informed about their financial position with the organization.

Detailed account balance information

The notification of a credit balance on your account shows a positive figure remaining, which indicates funds available for future transactions. Your account number, specifically designated for your financial activities, reveals a current credit balance of $250.00. This balance reflects recent deposits, payments received, or overpayments made, contributing to the overall credit. Transaction details, including the last deposit on March 5, 2023, of $100, and the last payment received on March 15, 2023, of $150, substantiate this credit. Regular monitoring of this balance can aid in effective financial planning and management, particularly at institutions like XYZ Bank and for services linked to your account.

Call to action or next steps

A notification of a credit balance typically informs customers about their available funds, encouraging them to take specific actions regarding their account. Understanding the importance of this information can improve customer satisfaction and engagement. Customers with a positive balance may want to redeem their credits, apply the funds toward future purchases, or inquire about potential rewards offered by the company. Additionally, providing a clear call to action, such as "Visit your account dashboard to see your credits" or "Contact customer support for assistance," can further guide customers in utilizing their credit effectively. Providing contact information, such as a phone number or email, ensures a seamless follow-up process. Clear and direct communication about next steps will help customers maximize their benefits from the credit availability.

Letter Template For Notification Of Credit Balance Samples

Letter template of credit balance review request for account verification

Comments