Hey there! We all know how easy it is to let things slip through the cracks, especially when it comes to payments. Sometimes, a friendly reminder is all it takes to keep things on track and ensure everyone stays happy. If you're looking for a way to encourage timely payments while maintaining a positive relationship, stick around as we explore some effective letter templates that just might do the trick!

Tone and Language

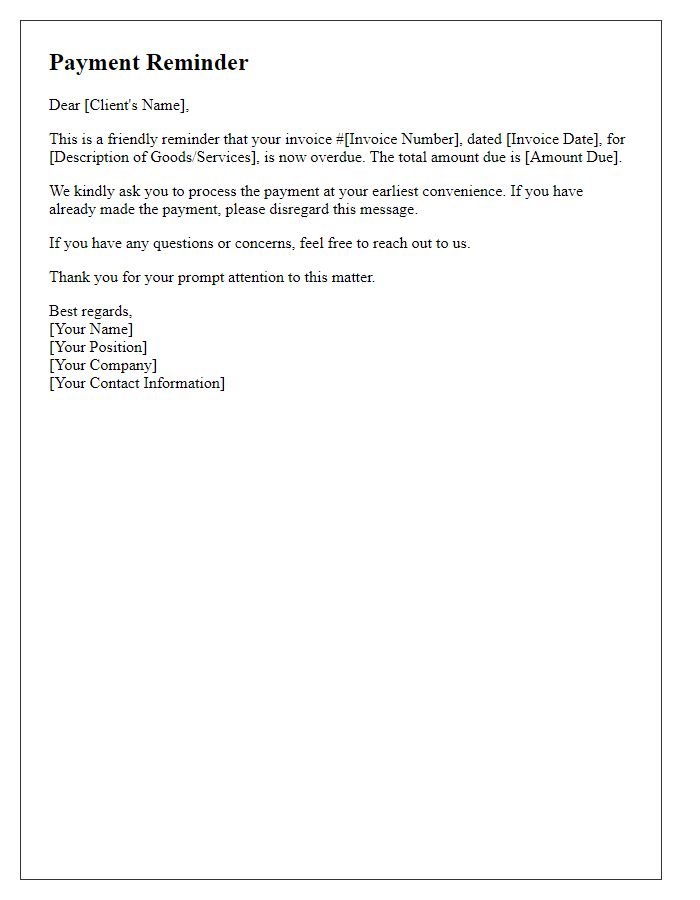

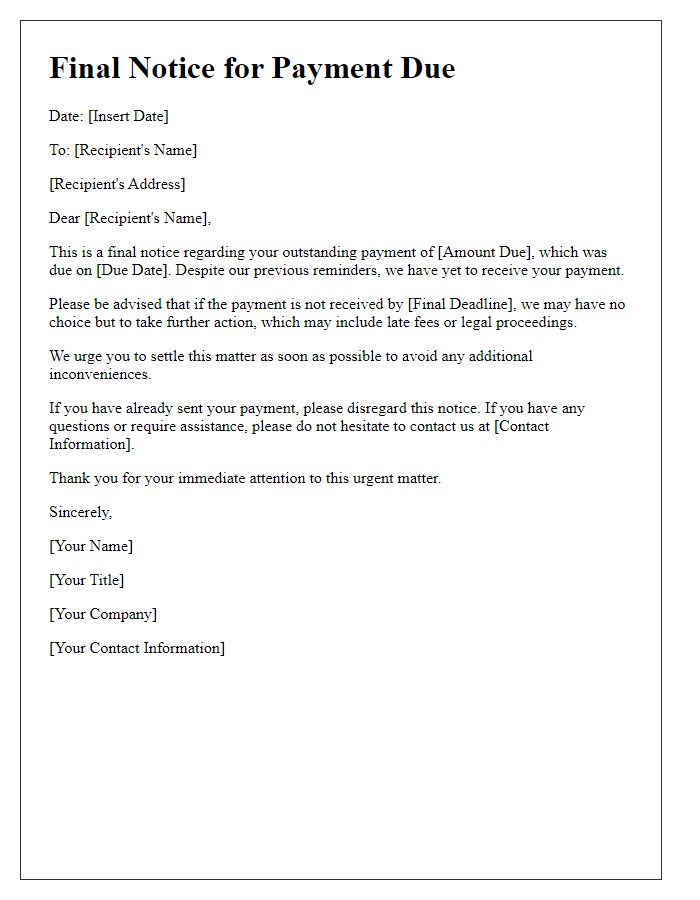

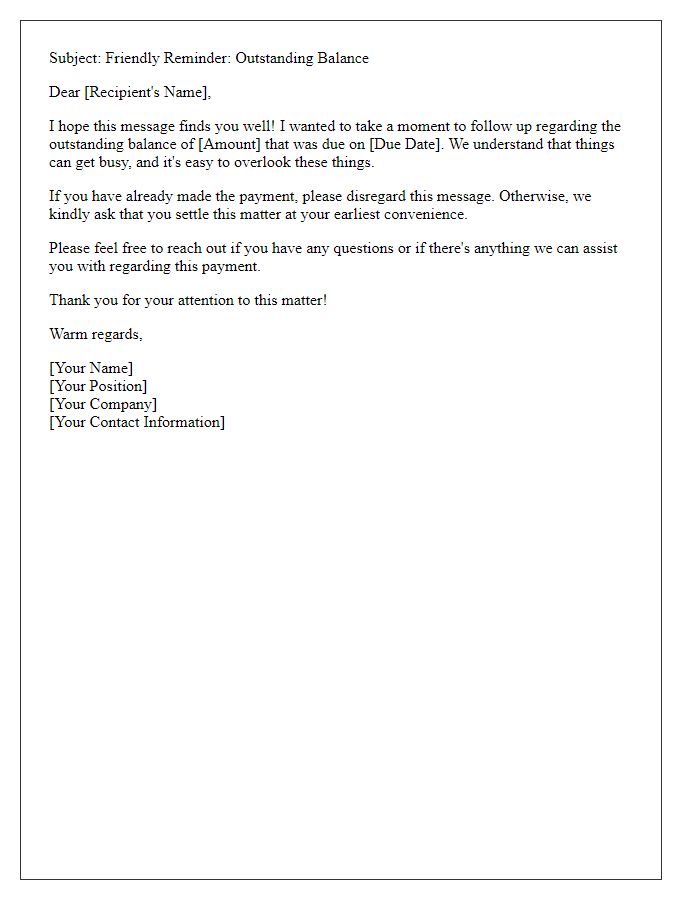

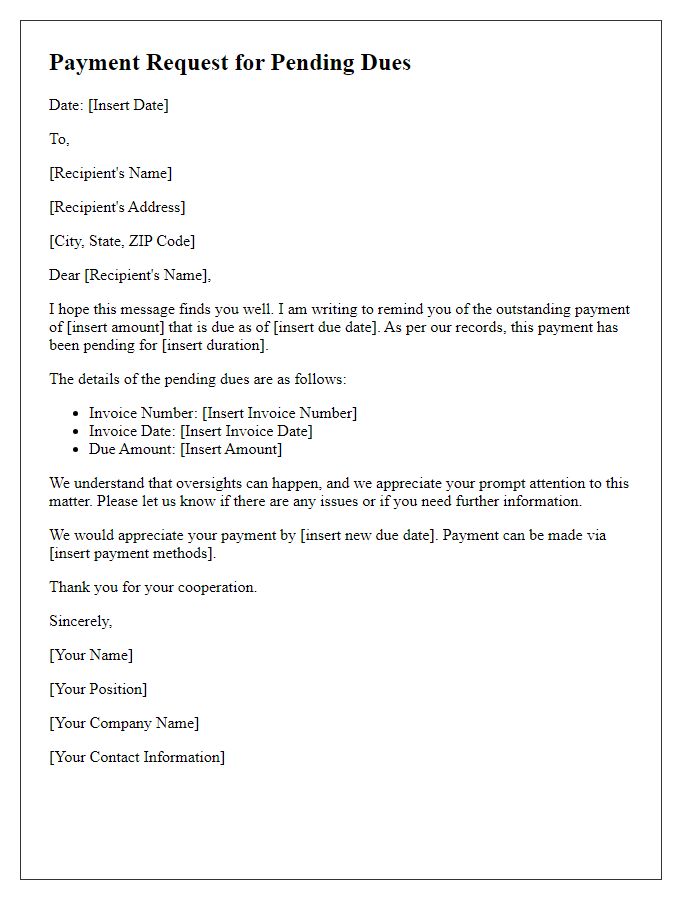

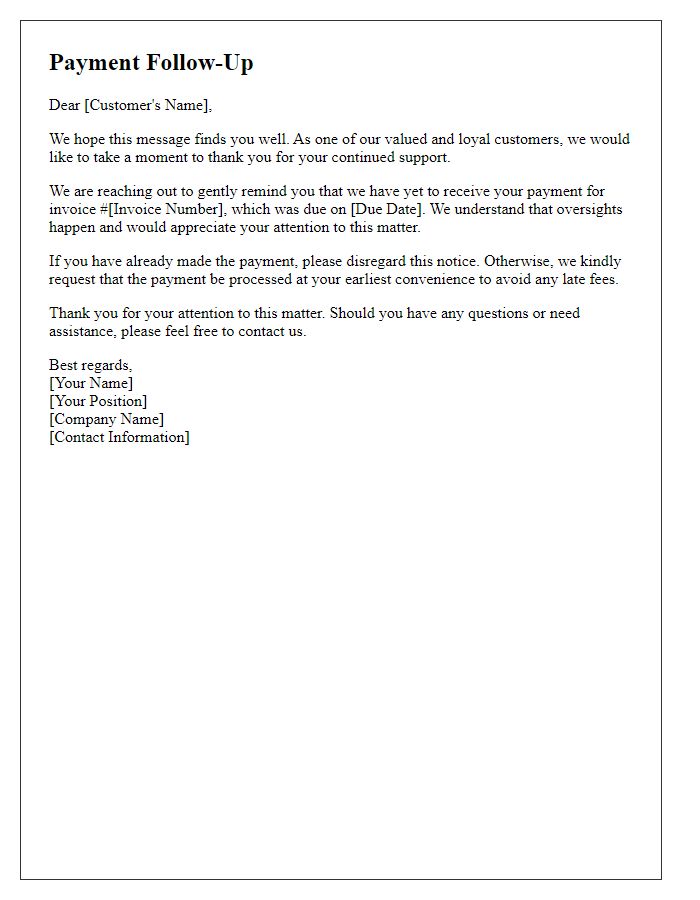

A payment encouragement letter serves as a gentle reminder for outstanding payments, emphasizing a friendly yet professional tone. The language should be respectful and understanding, acknowledging the possibility of oversight. Clear and concise details about the amount due, due date, and payment methods should be included. Friendly phrasing such as "We appreciate your prompt attention to this matter" reinforces a positive relationship, while maintaining professionalism. Closing with an offer of assistance showcases willingness to help if there are any issues, fostering goodwill.

Key Information and Details

To encourage timely payment, businesses often utilize a structured payment encouragement letter. This type of correspondence typically includes essential details such as the invoice number, which identifies the specific transaction. The total amount due is crucial, often accompanied by a precise due date, usually set 30 days from the invoice date. The letter may also reference any payment terms, such as early payment discounts or late fee penalties, ensuring clarity in expectations. Contact information, including a phone number or email address for queries, fosters open communication. Including a polite reminder of past transactions or services, provided by the business, reinforces the relationship while emphasizing the importance of prompt payment. Additionally, the tone remains courteous, enhancing the likelihood of a positive response.

Payment Options and Flexibility

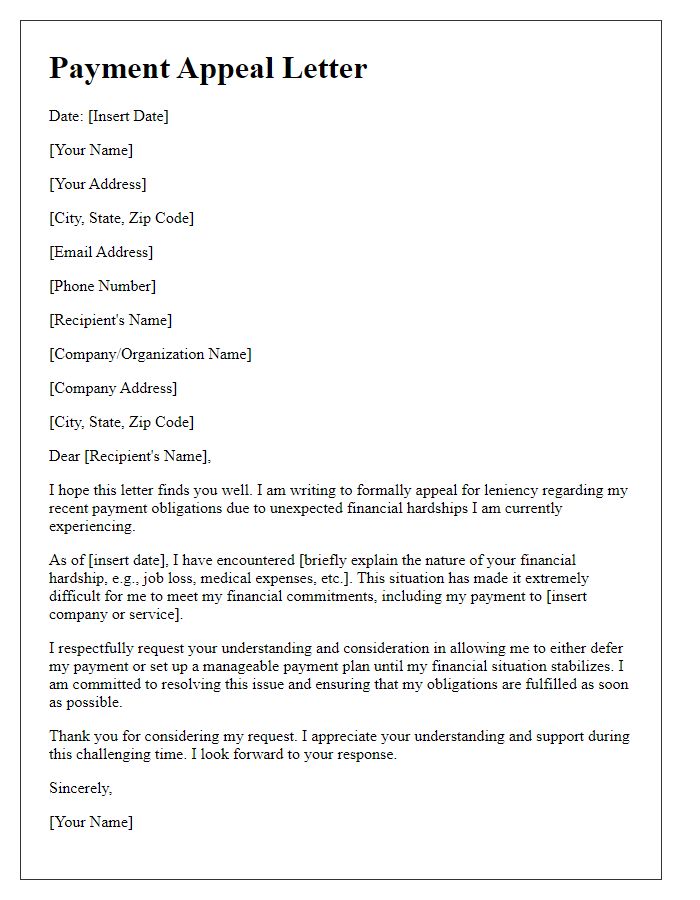

Timely payment of bills is crucial for maintaining a positive credit score and financial health. Many businesses offer multiple payment options, including online transactions, direct bank transfers, and payment plans to accommodate various customer needs. For example, local utilities might allow bill payments through a mobile app, ensuring convenience for users. Additionally, flexible payment arrangements can help ease financial burdens, particularly during challenging times, by spreading costs over several months without accruing high-interest charges. Implementing reminders or scheduling automatic payments can further enhance compliance and accountability for settling responsibilities promptly.

Clear Call to Action

In 2023, many businesses face challenges related to timely payments from clients, particularly in the service industry. A payment encouragement letter serves as a strategic tool to prompt outstanding payments while maintaining professional relationships. Essential elements include a specific invoice number, a due date (for instance, payments past due by 30 to 60 days), and a clear method of payment (such as bank transfer details). Including a direct call to action, such as requesting payment within seven days, helps create urgency for the client. Additionally, mentioning the impact on business operations, including cash flow issues or project delays, can further emphasize the importance of prompt payment.

Contact Information and Support

Prompt payment email reminders can significantly improve cash flow for businesses. Setting clear guidelines, such as specifying payment terms (e.g., net 30 days) and preferred payment methods (e.g., bank transfers, credit cards), fosters timely responses from clients. Regular follow-ups, leveraging customer relationship management (CRM) tools, help maintain communication, ensuring clients are aware of outstanding balances. Offering incentives, such as discounts for early payments or penalties for late ones, can motivate timely settlements. Utilizing professional tone, while maintaining a friendly rapport, creates an atmosphere of mutual respect, encouraging prompt payments.

Comments