Have you ever found yourself in a sticky situation with a missed payment plan? It can happen to the best of us, but addressing the issue head-on is crucial for keeping your financial health in check. In this article, we'll guide you through a sample letter template to communicate any breaches in your payment plan effectively. So, if you're ready to take control of the situation, let's dive in and explore how you can write a clear and professional letter that gets results!

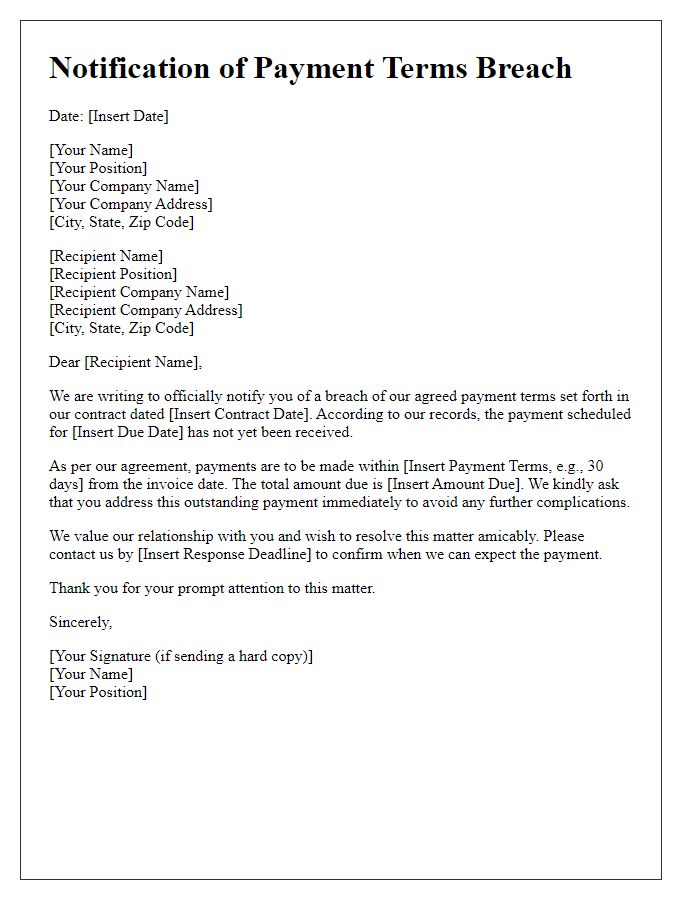

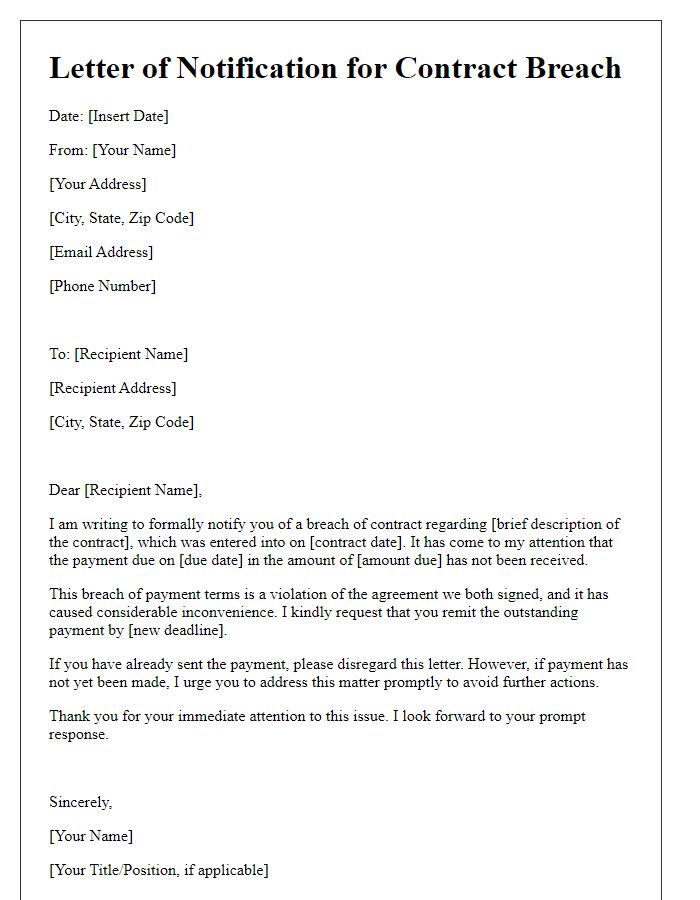

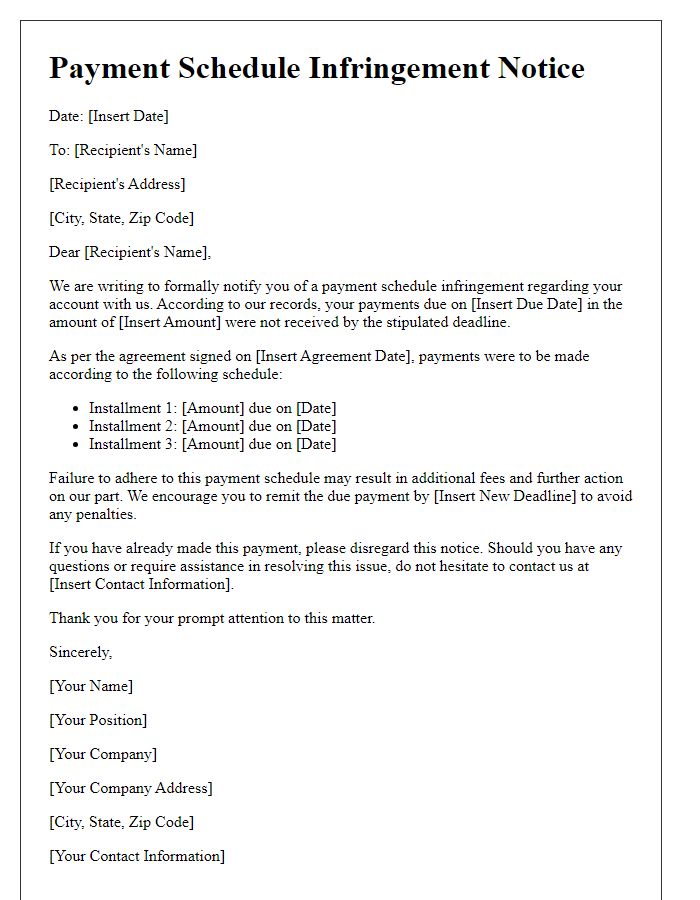

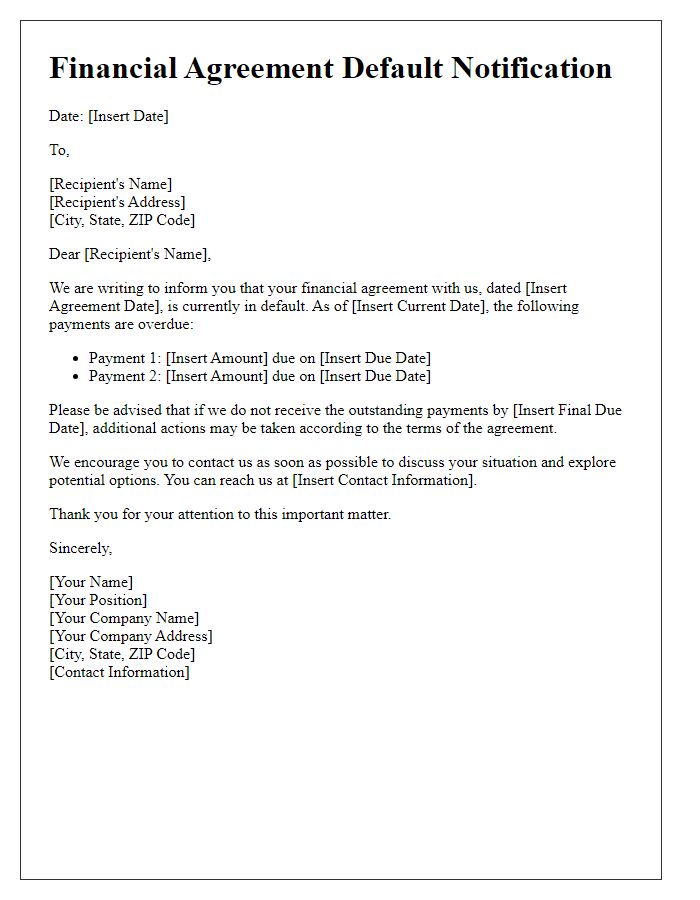

Formal salutation and professional language

In recent developments, numerous businesses have noted significant discrepancies in adherence to payment plans stipulated in signed agreements. A common issue observed involves clients missing payment deadlines, thereby violating terms laid out in contracts. This breach can lead to heightened financial strain on both parties involved, necessitating serious discussions regarding the resolution of outstanding balances. Moreover, assistance from legal counsel may become crucial in addressing the ramifications of such breaches, including possible re-negotiation of terms or escalation to collections. Implementing a structured follow-up system for overdue payments can mitigate future occurrences, ensuring smoother financial operations moving forward, especially in corporate sectors like retail and service industries.

Clear statement of breach details

A payment plan breach occurs when an individual or entity fails to adhere to the agreed-upon payment schedule established in a formal agreement, often resulting in consequences such as late fees or potential legal action. Breach details may include specific payment amounts, due dates, and missed payment occurrences. For instance, a borrower may fail to make scheduled payments of $200 due on the 15th of each month, resulting in a cumulative debt of $600 after three missed payments. Such breaches could also lead to complications with credit scores and might invoke remedies as outlined in the payment agreement, possibly including the acceleration of the outstanding balance or immediate collection actions by financial institutions. Accurate record-keeping and documentation of all communications regarding the breach are essential for resolution and potential court proceedings.

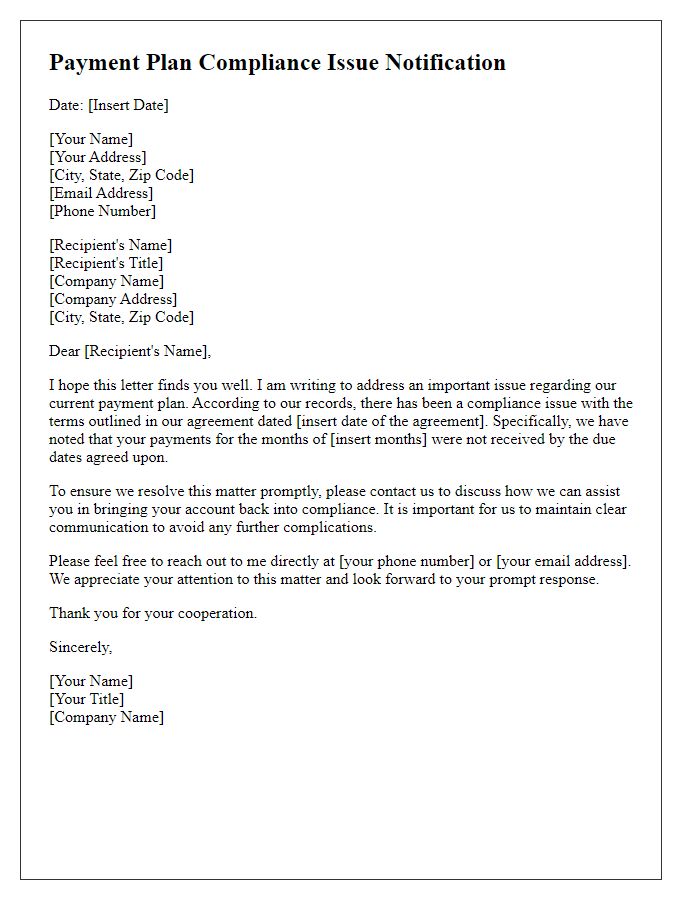

Consequences of non-compliance

Failure to adhere to the established payment plan agreement, such as a structured repayment schedule for outstanding debts, can lead to severe financial consequences. A breach may result in late fees addition, often ranging from $25 to $100, depending on the lender's policies. Additionally, the account in question may be reported to credit bureaus like Experian, TransUnion, or Equifax, adversely impacting credit scores which can drop by 100 points or more. Legal actions could also initiate, leading to potential court judgments that may involve wage garnishments or liens against property. Furthermore, non-compliance might trigger the acceleration clause, demanding immediate payment of the entire balance owed, exacerbating the financial burden faced by the debtor. Terms of the original agreement, typically outlined in documents such as promissory notes or contracts, specify these ramifications clearly.

Offer solutions or revised terms

A payment plan breach can complicate financial commitments, affecting both lenders and borrowers significantly. When borrowers fail to meet scheduled payments in agreements such as those seen in auto loans or personal loans, it is crucial to address the situation promptly. Offering alternative solutions like extending the term of the loan (increasing duration from 36 to 60 months) or reducing monthly payments by adjusting the interest rate (potentially decreasing from 7% to 5%) can ease the borrower's financial burden. Additionally, renegotiating payment schedules, such as proposing a temporary forbearance period of three months, allows the borrower to regroup their finances. Ensuring clear communication about the consequences of continued non-payment, which might include late fees or credit score impact, is essential for maintaining transparency in financial relationships.

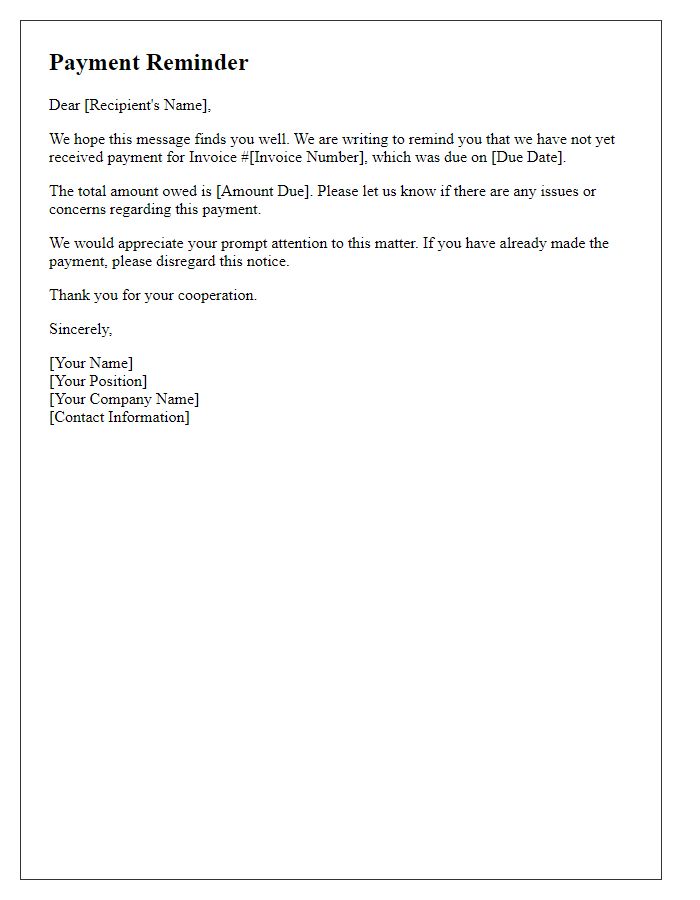

Contact information for resolution assistance

A payment plan breach can lead to various financial consequences, including fees and potential loss of services. Individuals facing such issues should reach out to customer service departments of the respective companies, ensuring they have the account number and personal identification information available for verification. For instance, a mortgage payment plan breach may require contacting the loan servicer's customer support at 1-800-XXX-XXXX, while credit service issues could necessitate assistance from a financial advisor or a certified credit counselor. Seeking help promptly can prevent further complications and aid in negotiating new terms for repayment.

Comments