Are you grappling with questions about how to obtain a lien release? Understanding this crucial process can sometimes feel overwhelming, especially when it comes to navigating complex paperwork and legal jargon. Whether you're a homeowner or a business owner, knowing your rights and the necessary steps can save you time and stress. Join us as we dive deeper into the steps for successfully requesting a lien release and what you need to know to ensure a smooth process!

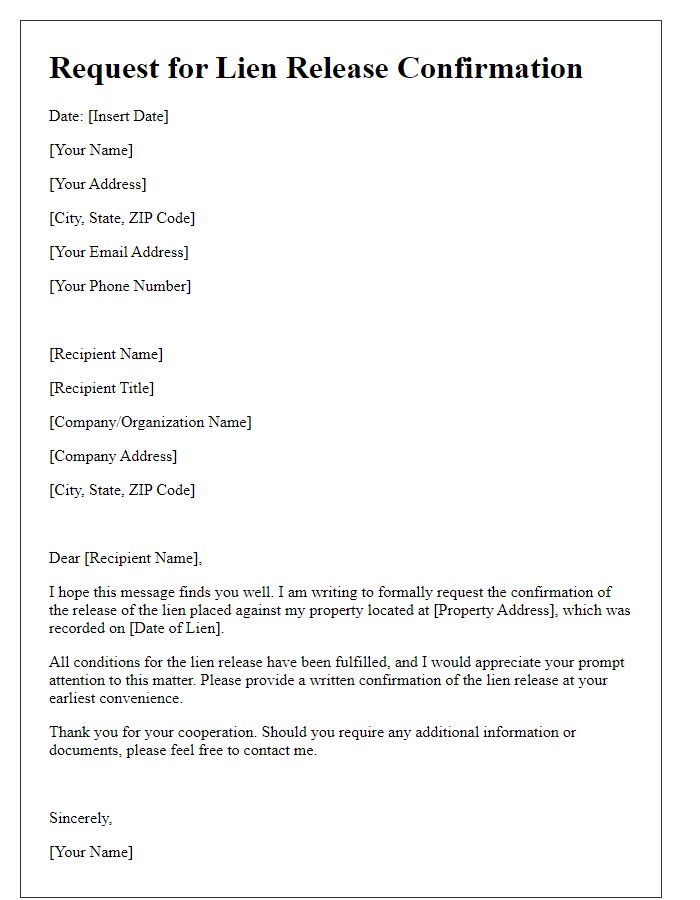

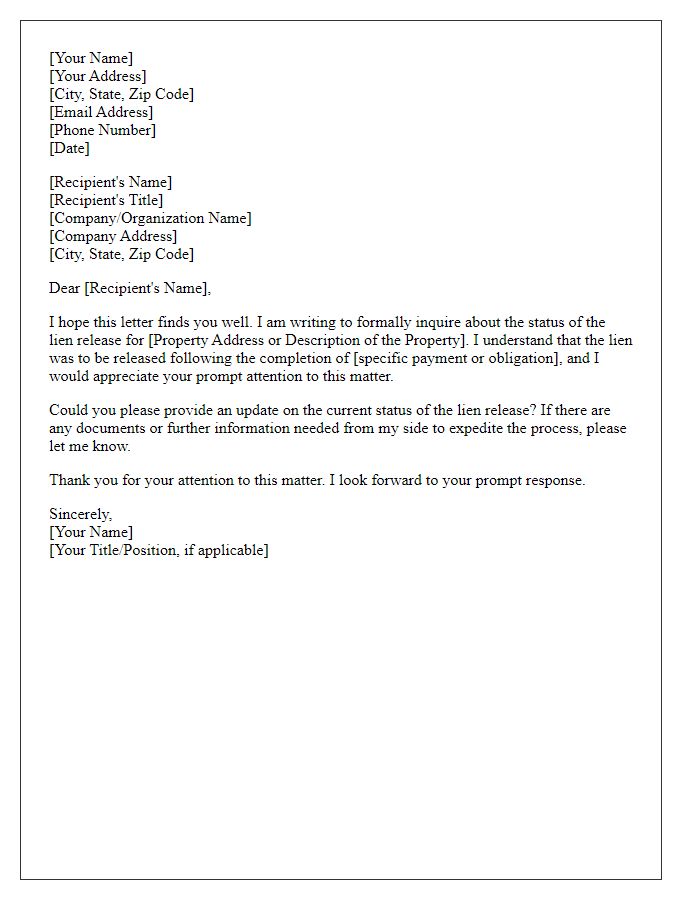

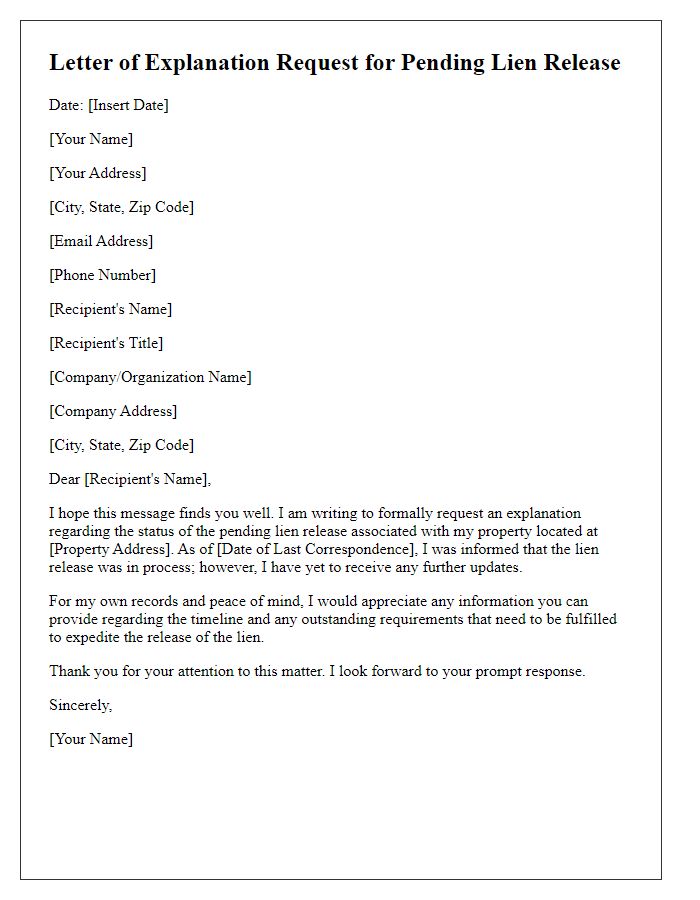

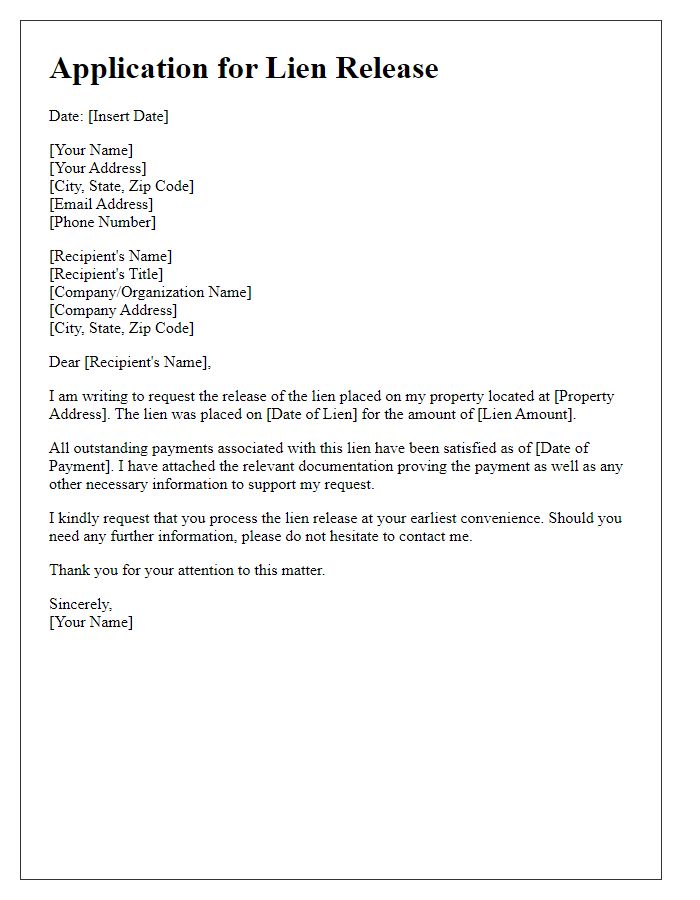

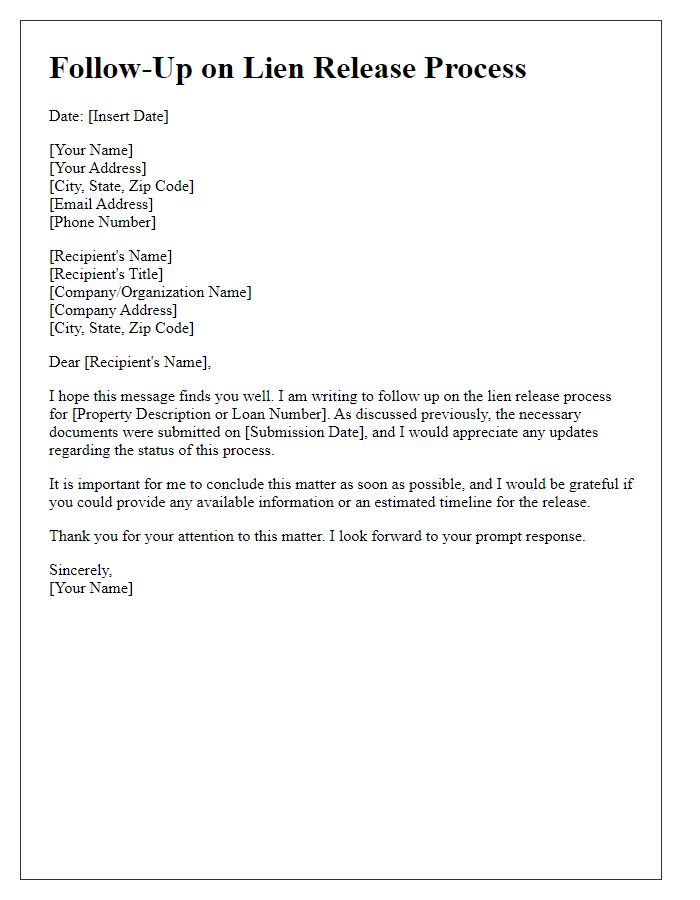

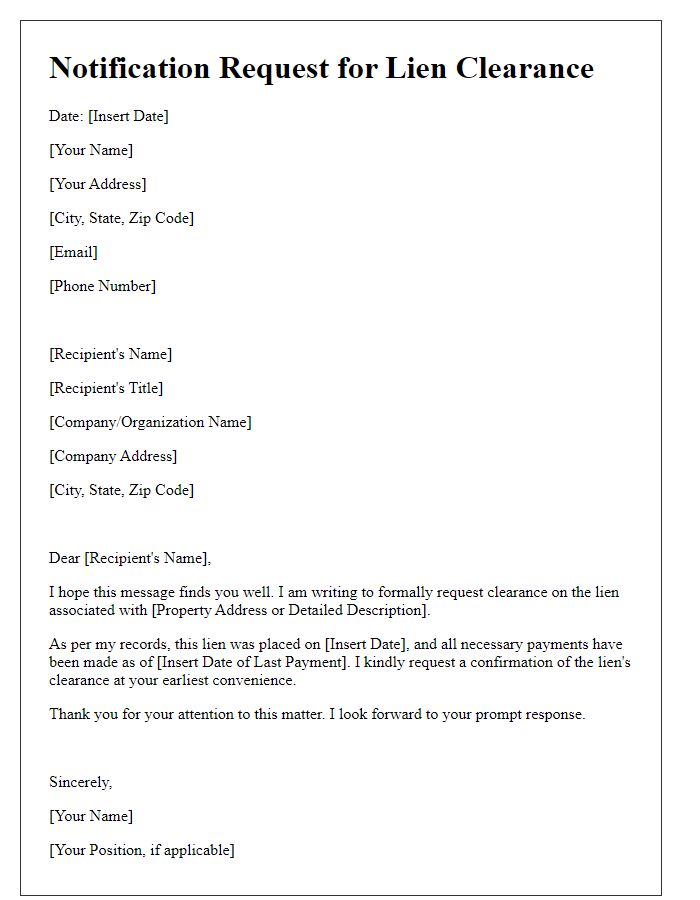

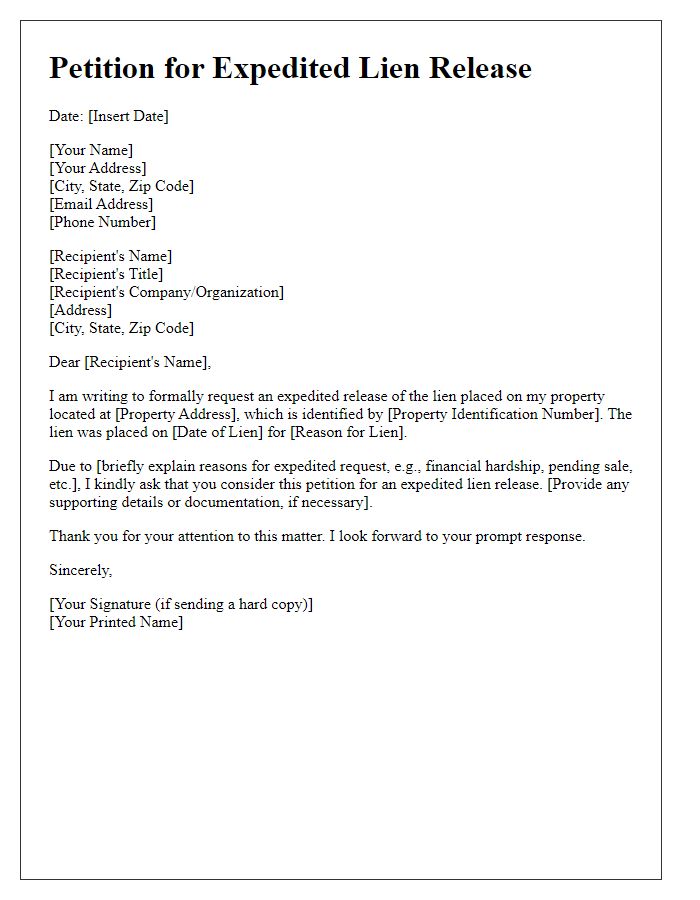

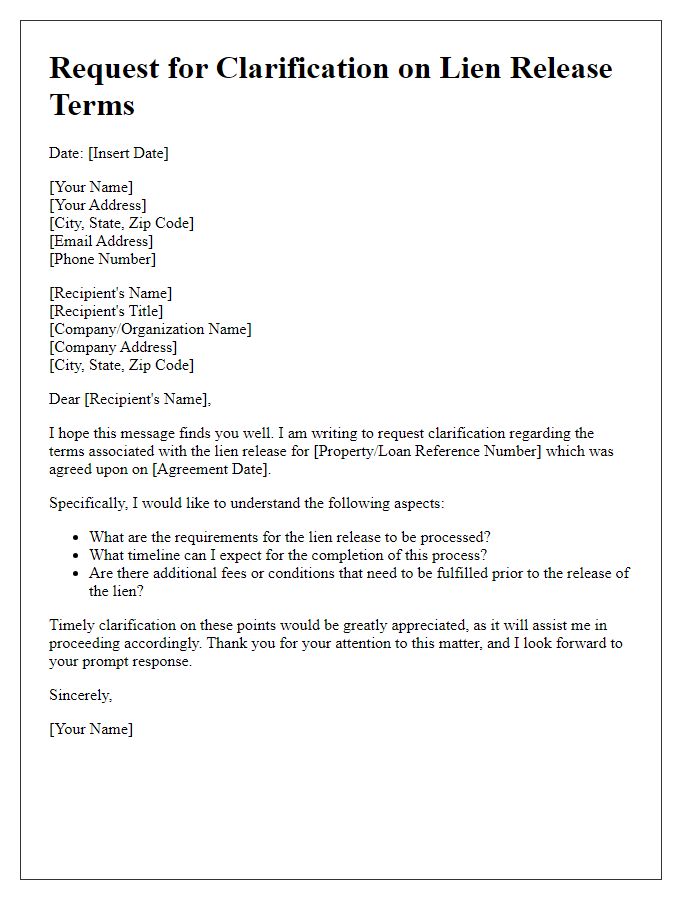

Contact Information

When seeking a lien release, providing clear and precise contact information is crucial for effective communication. Include your full name and current address, ensuring accuracy for correspondence purposes. List your phone number, preferably a mobile number for immediate contact. Add an email address, which allows for quicker and documented communication. Include any relevant account numbers or identification numbers related to the lien, as this can expedite the process when reaching out to the lien holder, such as a financial institution or government authority. Specify the property address associated with the lien to avoid confusion.

Subject Line

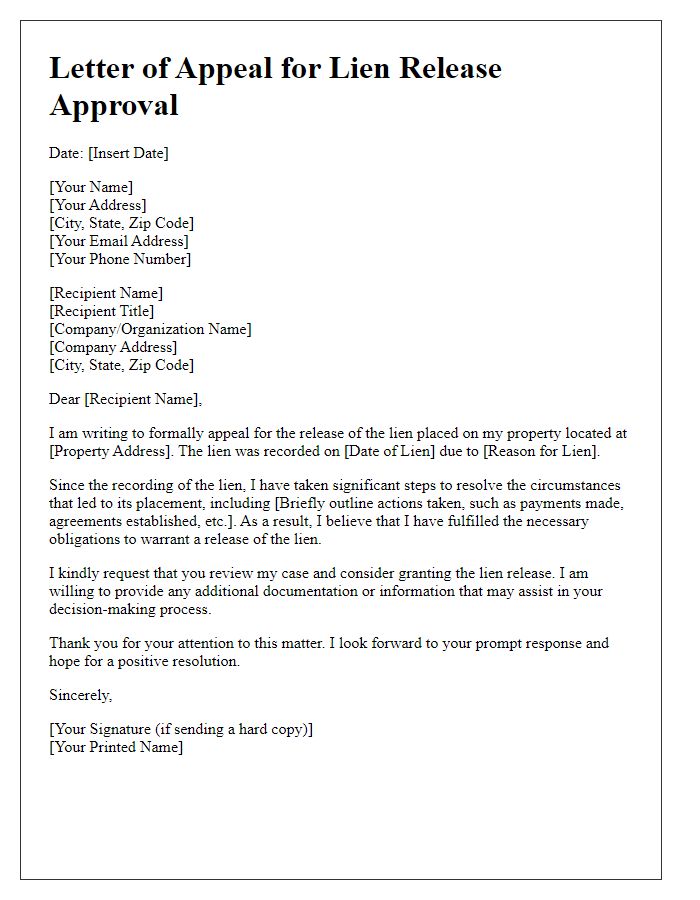

A lien release is a document that clears a property of any legal claims, enabling it to be sold or refinanced. It is commonly issued after the borrower satisfies their debt obligations, such as paying off a mortgage or loan. Financial institutions like banks or credit unions are responsible for generating lien releases. This process typically involves verifying that all payments are complete, which can include final payments as outlined in loan agreements. The lien release must then be filed with local government entities, ensuring public record reflects the property's clear title. Understanding the critical nature of this document is essential for both property owners and potential buyers.

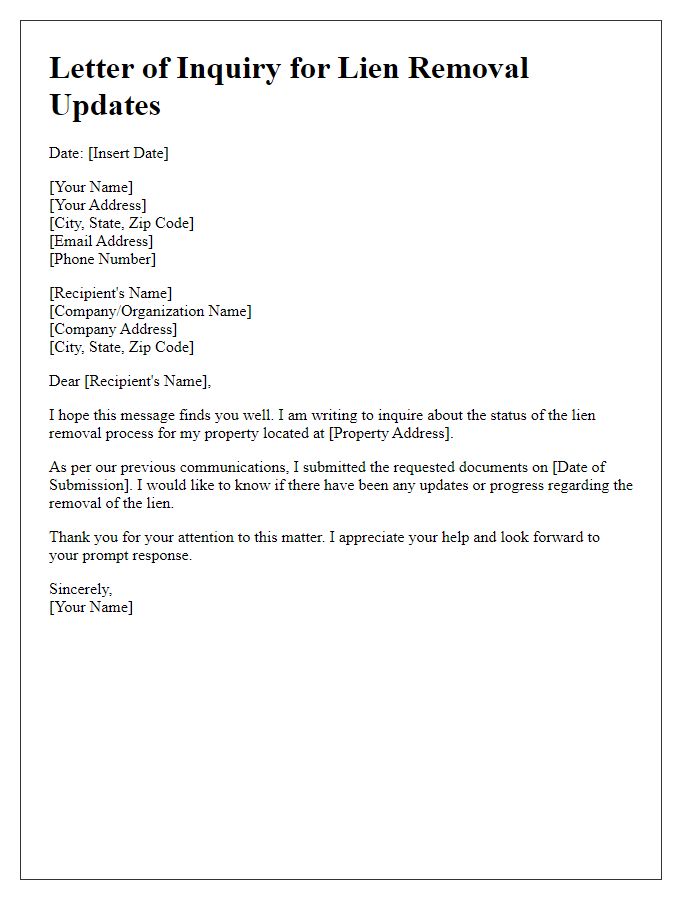

Request Details

A lien release is a legal document that removes a lien from a property, typically issued once a debt has been paid in full. Homeowners frequently encounter this process, often requiring documentation from the lender or lienholder that specifies the satisfaction of the debt. For effective inquiry, individuals should clearly outline essential details such as the property address, specific lien type (e.g., mortgage, mechanic's lien), and any relevant account numbers to expedite the release process. Timely communication with involved institutions can enhance resolution efficiency, ensuring all parties acknowledge the release. Additionally, keeping records of correspondence and transaction notes will facilitate transparency throughout the process.

Property/Loan Information

When considering the process of lien release for real estate properties, understanding property and loan details is crucial. Typically, lien releases pertain to the debt secured by a property, often evidenced through a trust deed or mortgage documentation. For example, a lien placed on a residential property located at 123 Maple Street, Springfield, can be released once the outstanding balance of $200,000 is satisfied. Relevant parties may include lenders like ABC Bank, which issued the loan in 2015, and the borrower, Jane Doe, who aims to ensure that the property title is free and clear. Proper inquiry involves specific details, such as the loan number (56789-101) and date of the original loan agreement (March 1, 2015), to facilitate effective communication with the lender regarding the release process.

Closing Statement and Signature

The request for a lien release can often be complex, involving detailed documentation such as the Closing Statement, which provides a summary of the financial transaction related to real estate, and a Signature that authenticates the request. A lien, a legal claim against a property until a debt owed by the property owner is satisfied, commonly affects the sale or refinancing processes. Proper representation of all parties is crucial during this process to ensure compliance with local regulations, which can vary significantly from state to state, such as California's Civil Code or New York's Real Property Law, both containing specific requirements for lien releases. Key details will include the specific property address (for example, 123 Main St, Los Angeles, CA), the lienholder's details (such as XYZ Bank, established in 1995), and the borrower's account number, ensuring all information is accurately reflected to expedite the release when processing the request.

Comments