Are you feeling overwhelmed by debt and unsure of your rights? If so, a debt validation request might be just what you need to regain control and clarity. This simple yet effective letter can help you ensure that the debt is legitimate and that you're dealing with the right creditors. Ready to learn how to craft the perfect debt validation request? Read on!

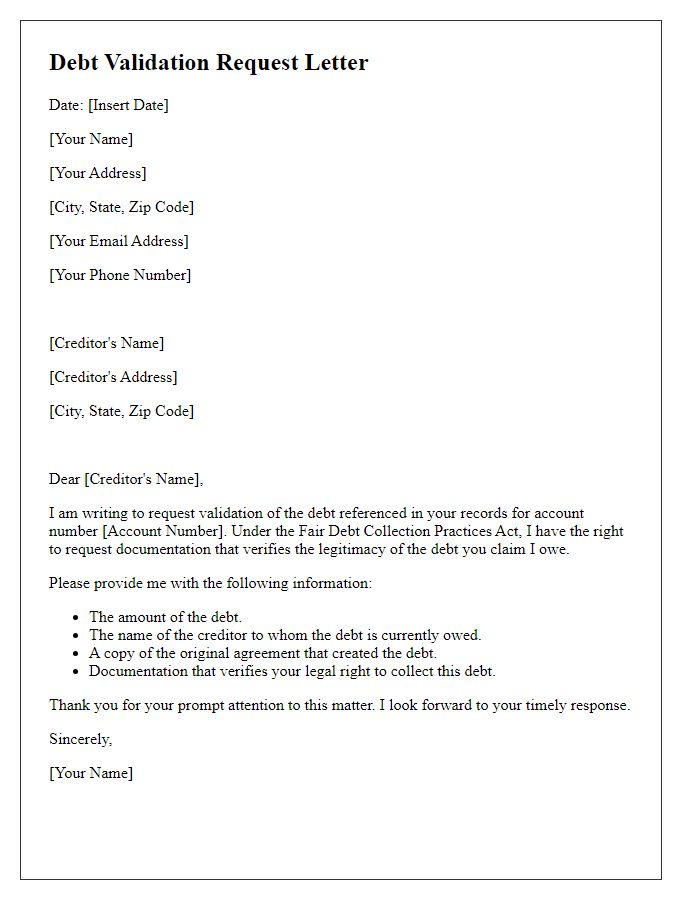

Creditor's information.

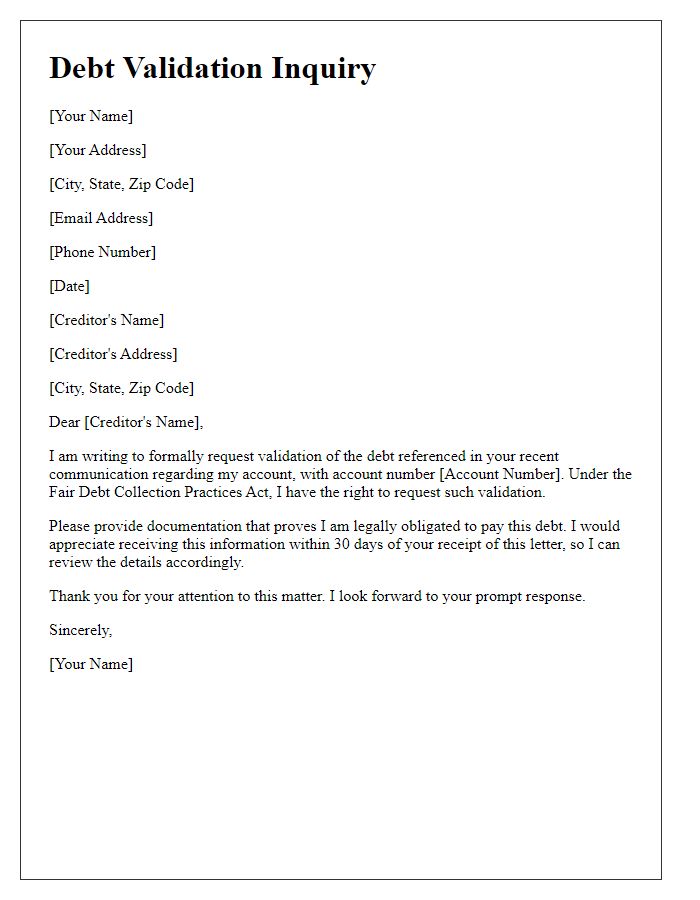

Debt validation requests are essential for consumers seeking to understand their financial obligations better. Creditors, like XYZ Collections Agency located at 123 Main Street, Anytown, USA, often require specific details to verify outstanding debts. A formal request should include identifying information such as account number 456789, amount owed $2,500, and date of last payment June 15, 2022. This process allows consumers to ensure the accuracy of billing and seek clarification on the nature of the debt, including any relevant agreements or contracts associated with the transaction. It is crucial to maintain records of all correspondence during this process for future reference and potential disputes.

Account reference number.

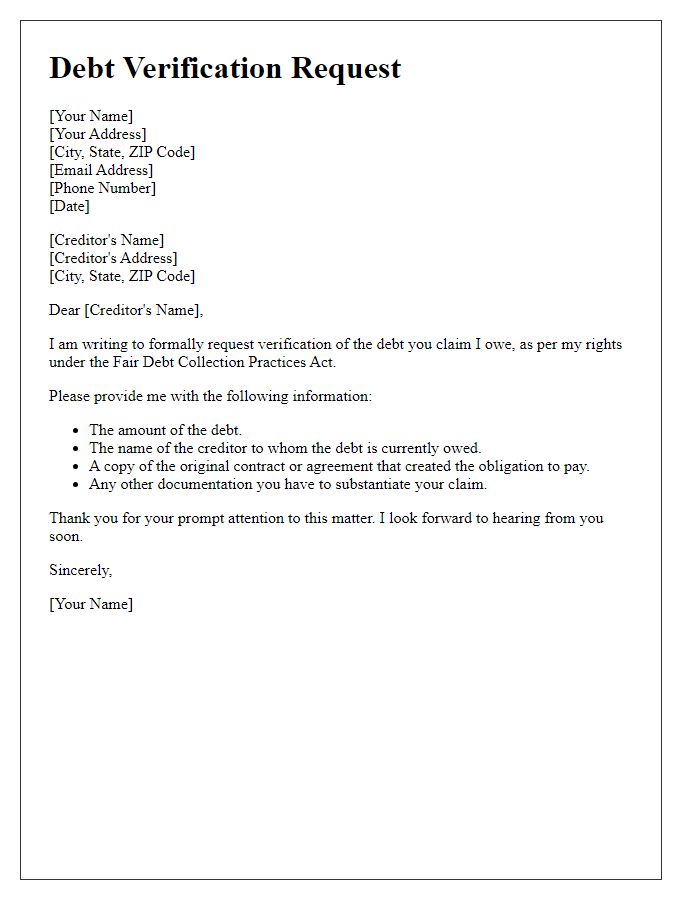

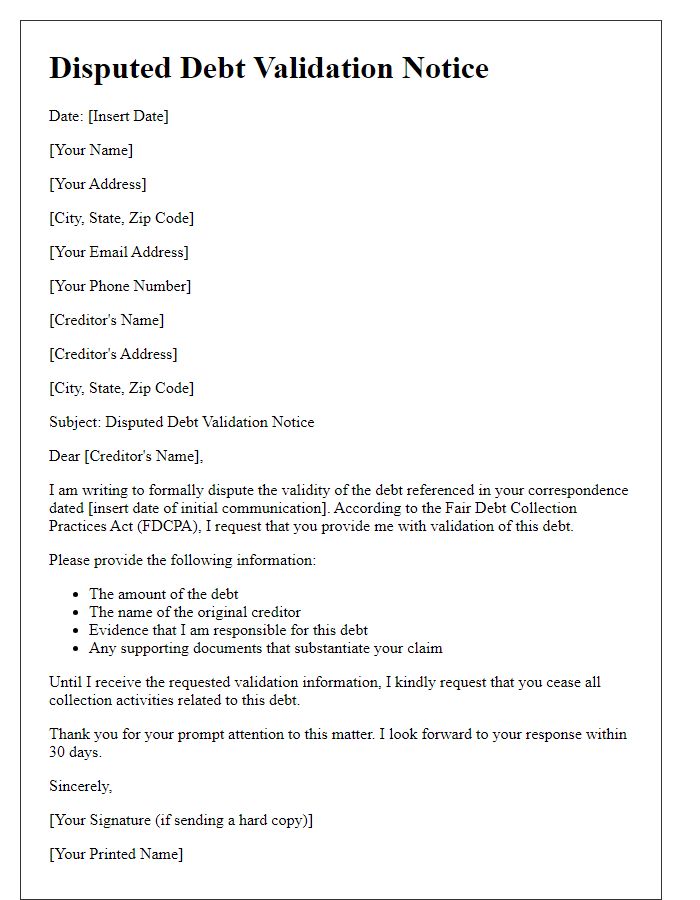

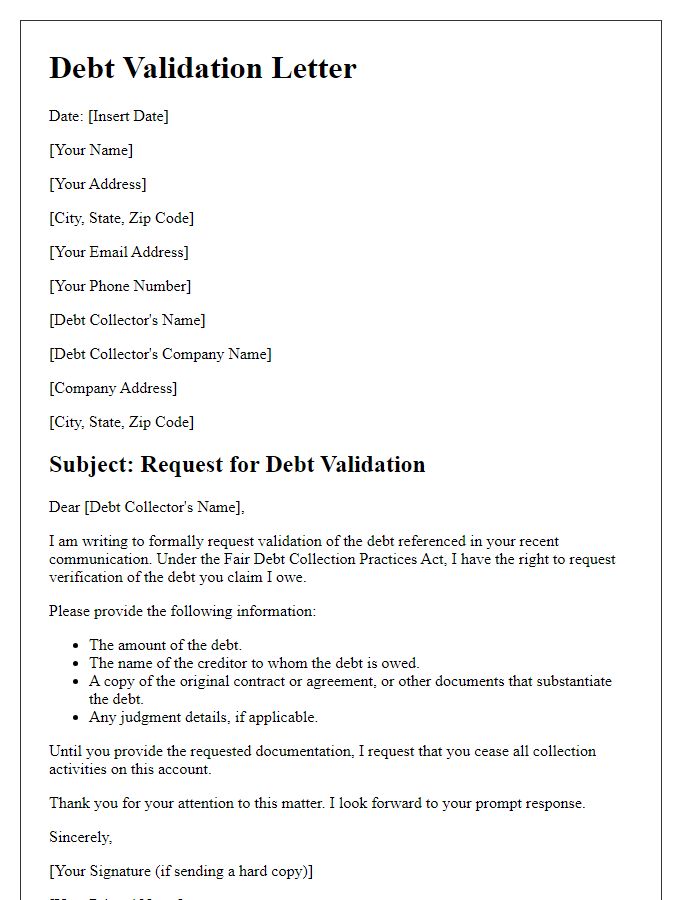

Debt validation requests are formal communications sent to creditors to verify the legitimacy of a debt. Typically, these requests include specific references, such as an account reference number, which identifies the consumer's account linked to the disputed debt. An account reference number, often composed of alphanumeric characters, provides a unique identifier for tracking and managing financial records. Effective debt validation letters also cite relevant laws, such as the Fair Debt Collection Practices Act (FDCPA), which requires creditors to provide evidence of a debt's validity upon request. This ensures that consumers are protected against fraudulent claims and empowers them to ensure the authenticity of debts attributed to them.

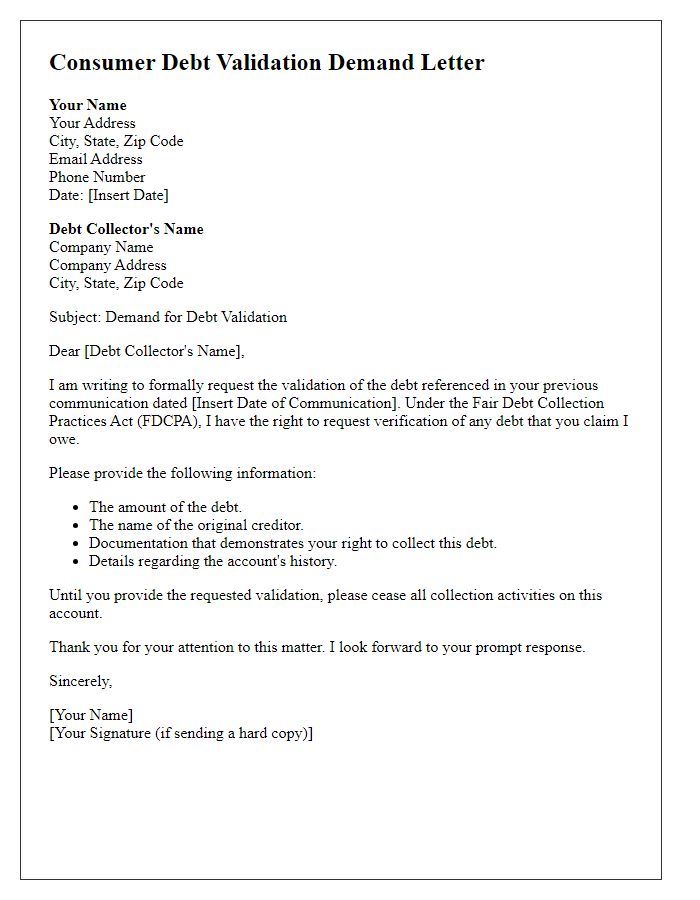

Detailed debt description request.

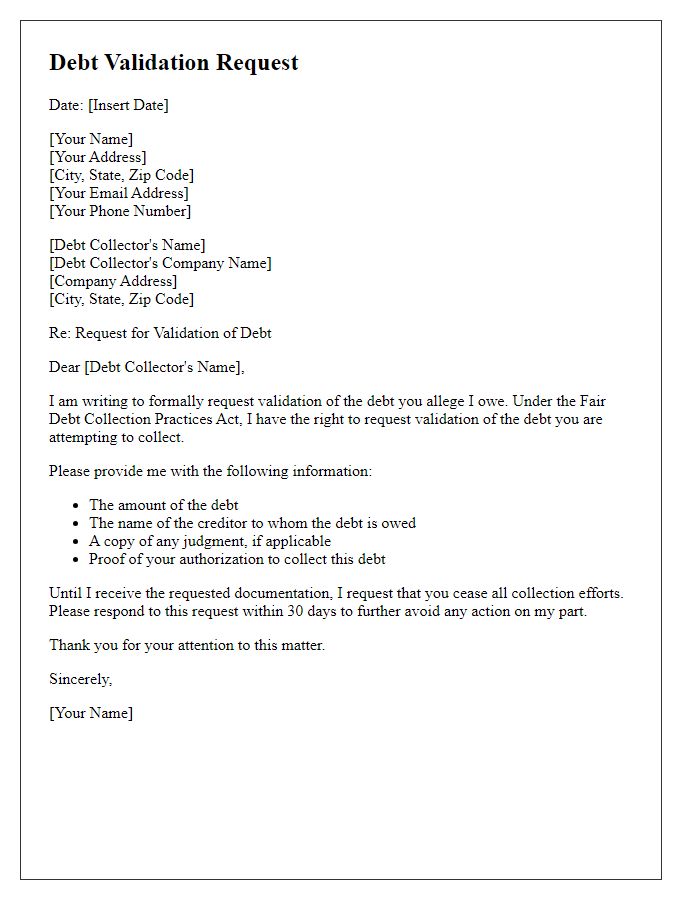

A debt validation request is essential when seeking clarity on outstanding financial obligations, particularly for items such as medical bills, credit card debts, or personal loans. The Fair Debt Collection Practices Act (FDCPA) mandates that creditors provide a written validation of the debt, which should include specific details such as the original creditor's name, the amount owed, and any relevant account numbers. For example, a credit card debt may originate from a well-known bank, and the amount might represent the remaining balance as of a specific date. Additionally, it is important to request any documentation supporting the validity of the debt, such as transaction histories or signed agreements. Addressing the letter to the specific debt collector, including their name and address, ensures that the request reaches the right party and assists in maintaining accurate financial records.

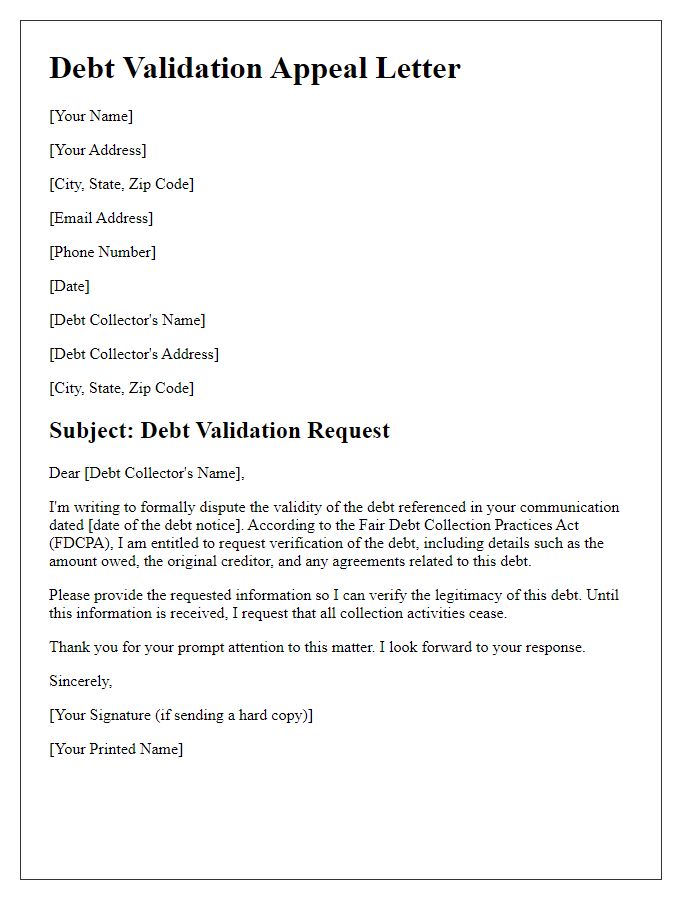

Proof of creditor's ownership.

A debt validation request is essential for consumers seeking clarity on outstanding debts. Debt collectors must provide proof of ownership for debts, including documentation like account summaries, purchase agreements, or relevant court judgments. These documents demonstrate the legitimacy of the claim, ensuring consumers are aware of the nature and status of the debt. Validation requests should be sent via certified mail to the collector, establishing a record of communication. Consumers should specify the exact amount claimed, the original creditor's name, and any pertinent details related to the debt, such as account numbers. This ensures that the collector checks their records accurately and responds with valid documentation.

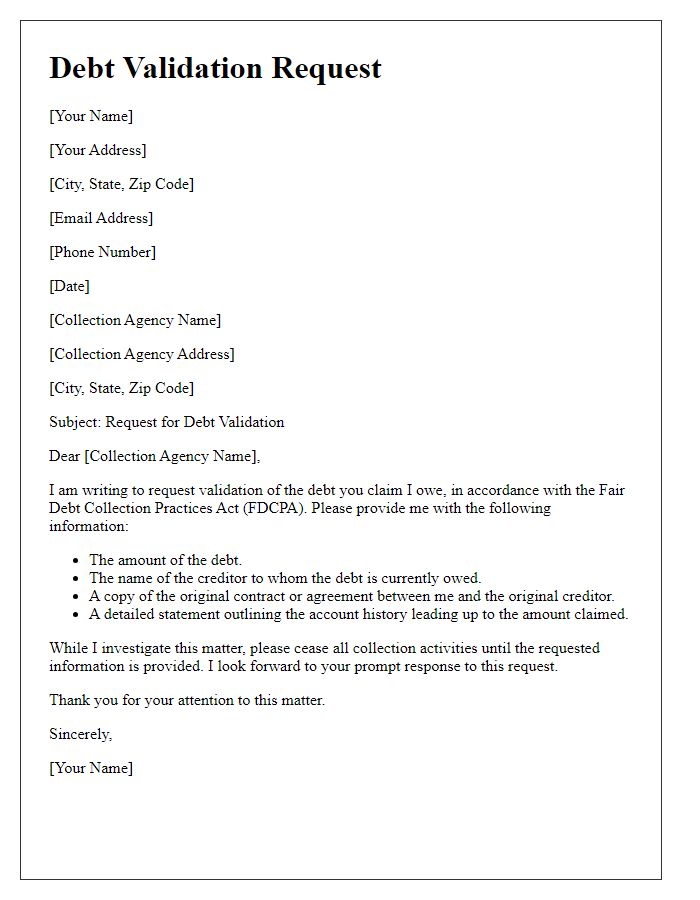

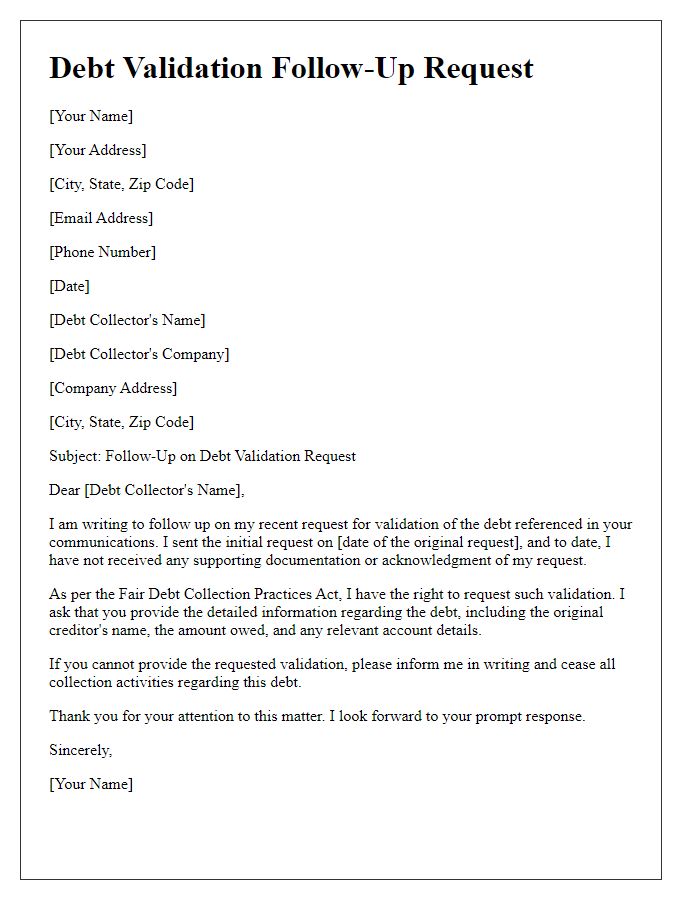

Response deadline and legal references.

Debt validation requests must adhere to the Fair Debt Collection Practices Act (FDCPA), established in 1977, which provides consumers with the right to request verification of debts. A validation request should include specific details: the name of the creditor, account number, and the amount owed. Under Section 809 of the FDCPA, a consumer has 30 days after receiving the initial communication to dispute the debt or request validation. Failure by the creditor to respond within this period can hinder their ability to collect on the debt, reinforcing the importance of timely and documented communication. The request should invoke the relevant sections of the FDCPA and demand a written response before the deadline to ensure compliance with consumer protection laws.

Comments