We all know that managing finances can be a daunting task, especially when unexpected debts arise. Sometimes, creditors decide it's best to sell these debts to third-party agencies, which can add confusion and stress to your situation. Understanding the implications of a debt sale is crucial for navigating your financial landscape effectively. So, if you want to learn more about how this process works and what to expect, keep reading!

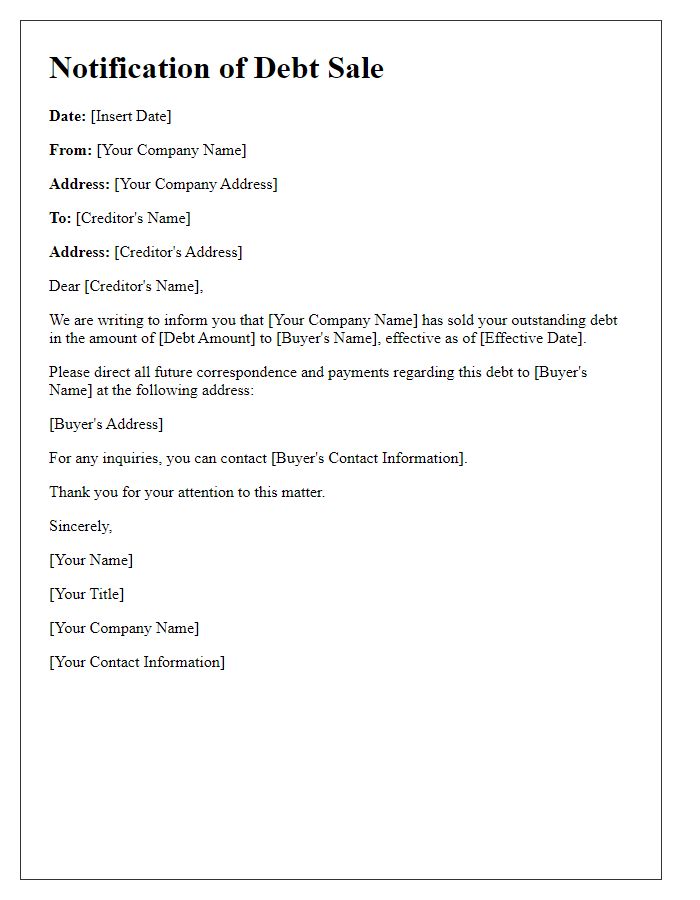

Clear Identification of Parties

The notification of debt sale signifies a crucial financial transaction where a creditor, such as a banking institution or a collection agency, transfers the right to collect an outstanding financial obligation to a third party. This document typically includes essential details, including the full name and address of the original debtor, an individual or company that has defaulted on a loan or credit agreement. The creditor's information must also be presented clearly, identifying the lending institution or agency involved in the transfer. Additionally, the purchaser of the debt must be accurately described, including their company name, contact details, and any relevant registration numbers. These details ensure proper identification and establish legal grounds for the new entity to pursue collection efforts related to the delinquent account. Notably, the notification may require reference to the original account number linked to the debt, ensuring a smooth transition of rights and responsibilities in accordance with applicable laws and regulations.

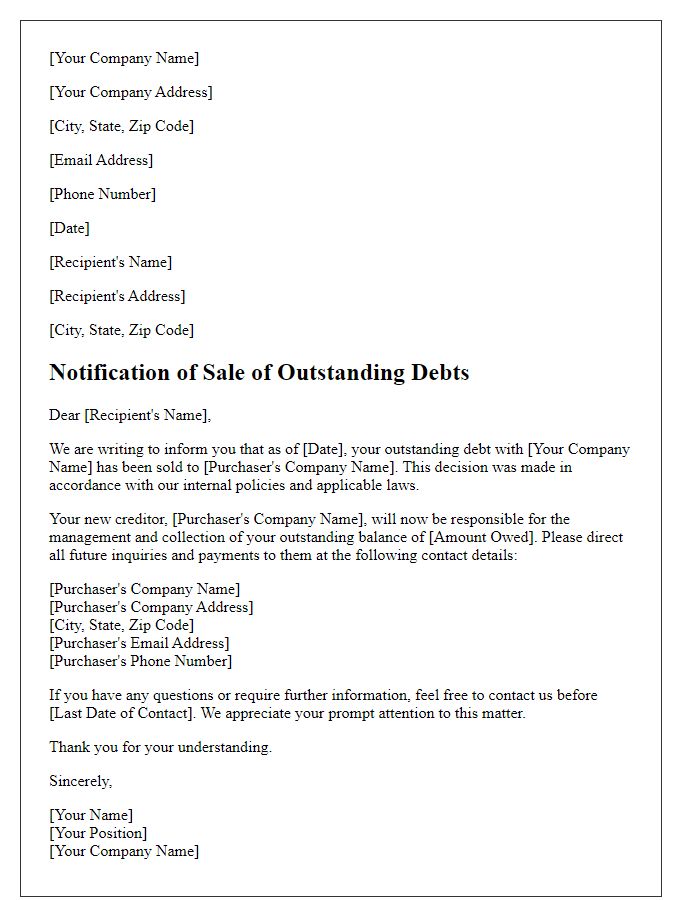

Details of Debt Sold

A notification of debt sale informs debtors about the transfer of their outstanding obligations to a third party. The letter typically includes key details such as the original creditor's name (e.g., Acme Financial Services), the amount of debt sold (e.g., $5,000), the new creditor's name (e.g., XYZ Collections LLC), and the sale date (e.g., October 1, 2023). Debtors should be aware that their payment terms may change, and they should direct future communications and payments to the new creditor. This notification may also specify the account number associated with the debt and any relevant reference numbers to track the account's history. Additionally, the letter reminds debtors of their rights under the Fair Debt Collection Practices Act, ensuring that they understand their options moving forward.

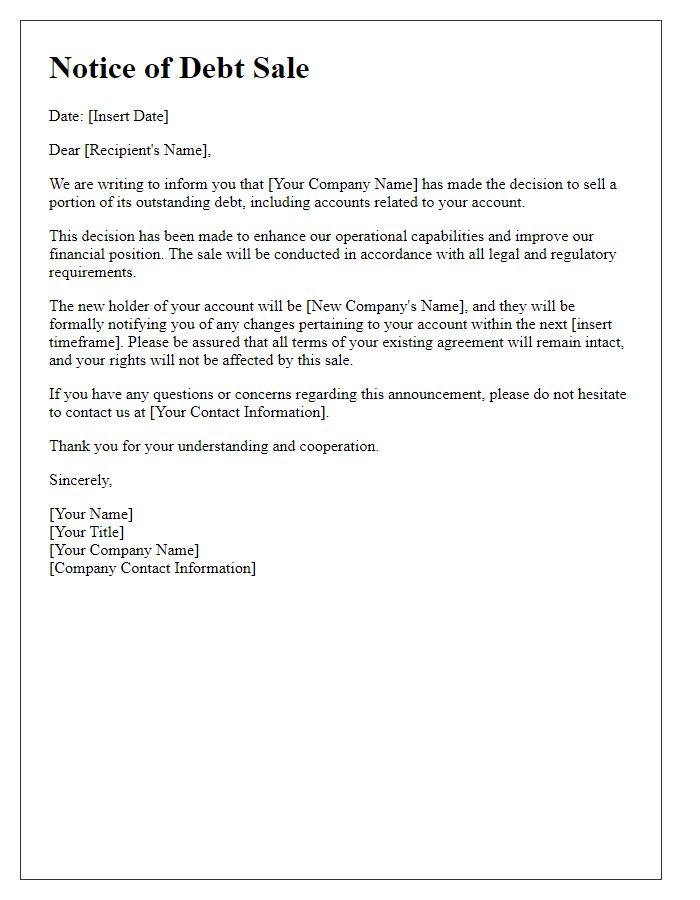

Effective Date of Sale

The notification of debt sale is a critical communication for creditors, often involving a substantial amount of money, legal implications, and specific dates. On October 1, 2023, ABC Collections LLC, based in New York City, will officially transfer an outstanding debt of $250,000 owed by XYZ Corporation (located in Los Angeles, California) to Debt Acquisitions Inc., effective immediately. This sale involves accounts receivable dating back to March 2022, which have remained unpaid despite multiple attempts at collection. The transfer of this debt may impact XYZ Corporation's credit rating and future borrowing capabilities. Recipients of this notification will have until November 1, 2023, to dispute the debt, after which all rights and obligations will be governed by the new holder of the debt.

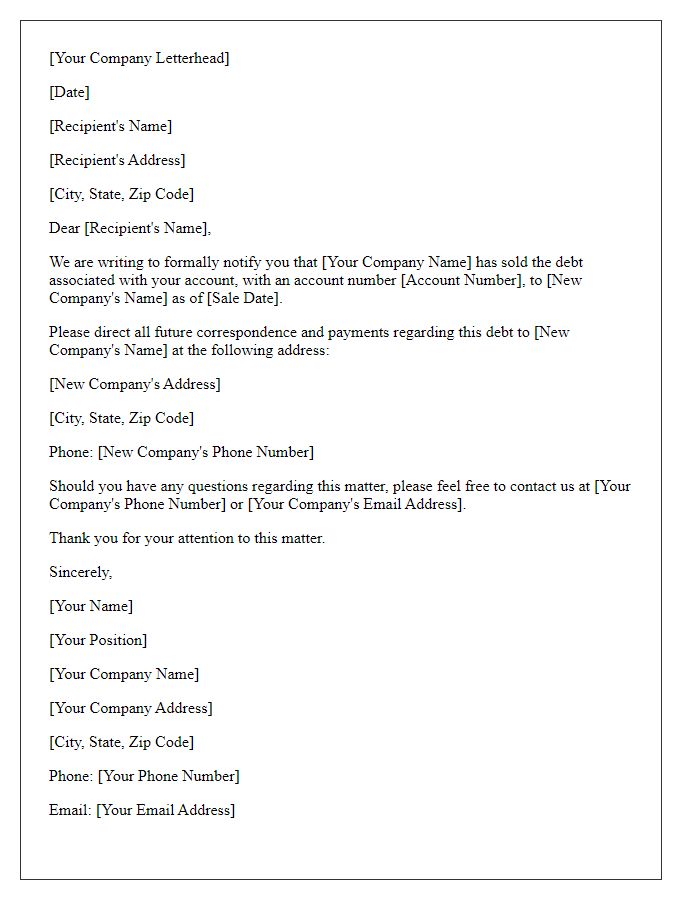

Contact Information of New Creditor

Notification of debt sale typically occurs when a creditor sells an outstanding debt to a different party, known as a new creditor. This notification informs the debtor about the change in account ownership and provides essential contact information to ensure the debtor can address any questions or payment concerns. It is crucial to include the name of the new creditor, their address, phone number, and email address. Additionally, the communication should mention the amount owed and any relevant account numbers to assist the debtor in referencing the specific debt. Such notifications often include instructions on how to proceed with payments to the new creditor and any changes to repayment terms or conditions.

Instructions for Future Payments

The notification of debt sale to original debt holders outlines specific payment instructions to ensure successful management of changed ownership. Debt, originating from financial agreements dating back to 2020, has been assigned to XYZ Financial Services, located in Atlanta, Georgia. Payments must be redirected immediately to the new servicing address at 1234 Main Street, Suite 567, Atlanta, GA 30301. Use the provided account number specific to your debt to avoid confusion. Include the original invoice numbers and all relevant details in the payment remittance to ensure proper crediting. Failure to adhere to these instructions may result in delays or complications in payment processing.

Comments