Facing financial difficulties and considering a bankruptcy claim can be overwhelming, but it's important to know you're not alone in this journey. Many people find themselves in similar situations, and understanding the process can provide some relief. This letter template for bankruptcy claim notification is designed to help you communicate effectively with creditors and legal representatives. Keep reading to discover how to navigate this challenging time with confidence and clarity.

Debtor Information

In a bankruptcy claim notification, debtor information includes critical details about the individual or entity that has filed for bankruptcy under United States Bankruptcy Code. This typically comprises the debtor's full legal name (for individuals, this includes middle names), current address (specific street address along with city, state, and zip code), bankruptcy case number (unique identifier assigned to the case), and date of filing (indicates when the bankruptcy petition was submitted). Additional relevant information might include the type of bankruptcy filed (Chapter 7, Chapter 11, or Chapter 13), list of creditors (entities owed money), and any co-debtors involved in the case, ensuring all parties have accurate contact details for legal notifications regarding the proceedings.

Creditor Details

Creditor details in a bankruptcy claim notification are crucial for identifying the parties involved in the financial distress case. The creditor's name should include the official business title recognized in legal documents. Contact information must encompass the physical address (including city and state), phone number, and email for correspondence. Account numbers related to the debt must be included for precise identification. The claim's amount must specify the total outstanding balance due, accompanied by documentation highlighting the type of debt (secured or unsecured). Additionally, any relevant dates, such as the date of last payment or the initiation of the debt, should be transparent to provide full context to both parties involved.

Amount Owed

Individuals seeking bankruptcy relief often face overwhelming financial burdens. A bankruptcy claim notification outlines the amount owed, detailing specific debts such as credit card balances, personal loans, medical bills, or tax obligations. For example, a typical credit card debt might reach $15,000, while medical expenses could amount to $5,000, reflecting a growing trend of rising healthcare costs. In some cases, individuals might owe significant back taxes exceeding $10,000 to the Internal Revenue Service (IRS), adding further stress to their financial situation. This formal notification serves as an essential step in the legal process, ensuring all creditors are informed and encouraging a thorough evaluation of the debtor's financial status.

Reasons for Bankruptcy

The significant increase in operational costs, including rising labor expenses, has led to the inability of numerous businesses, such as retail stores, to maintain profitability. The economic downturn, particularly noticeable during the pandemic (2020-2022), resulted in decreased consumer spending and disrupted supply chains. Additionally, competition from online retailers, showcasing the shift in consumer behavior, has further strained traditional brick-and-mortar establishments. A decline in available credit options, attributed to tighter lending practices by financial institutions, has made it challenging for some enterprises to invest in necessary resources for recovery. As a result, numerous companies are filing for Chapter 7 or Chapter 11 bankruptcy protection to seek relief from overwhelming debt and to restructure their operations for potential resurgence.

Contact Information

The bankruptcy claim notification must include essential contact details, such as the name of the business or individual filing the claim, the complete mailing address, including street number, city, state, and ZIP code, along with an email address for further correspondence. It is imperative to provide a phone number that allows for direct communication, ensuring prompt response and clarification. Including the case number, if available, related to the bankruptcy proceedings, aids in tracking and referencing the claim efficiently. Providing accurate contact information is crucial for effective communication during legal processes.

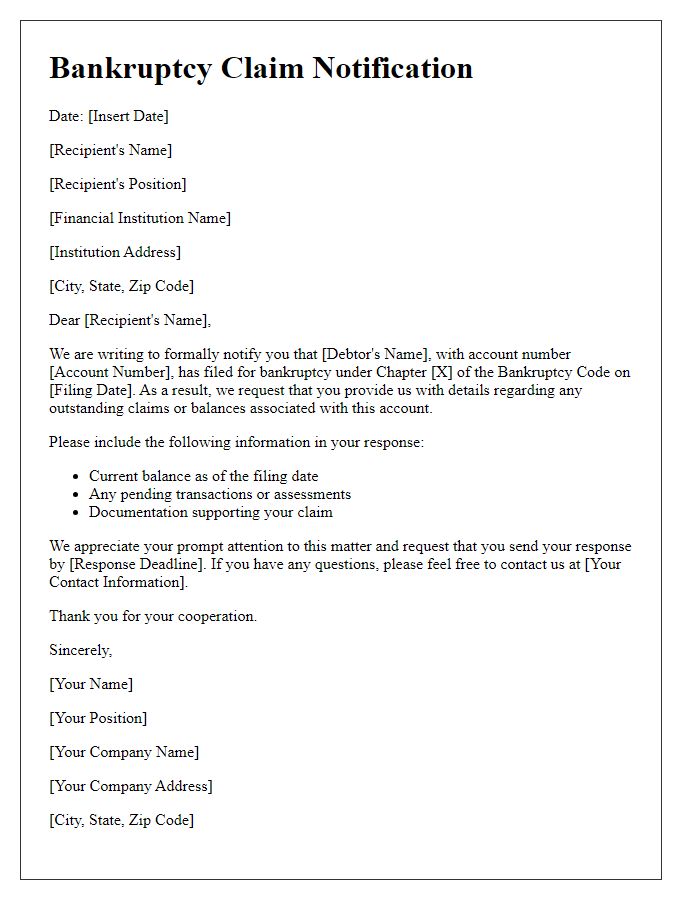

Letter Template For Bankruptcy Claim Notification Samples

Letter template of bankruptcy claim notification for legal representatives

Letter template of bankruptcy claim notification for government agencies

Comments