Are you feeling overwhelmed with your credit card payments and in need of a little breathing room? It's completely normal to face temporary financial challenges, and requesting an extension can be a smart move to regain control of your finances. In this article, we'll walk you through a simple yet effective letter template to help you formally request a payment extension from your credit card issuer. So, let's dive in and explore how to craft your request with confidence!

Reason for extension request

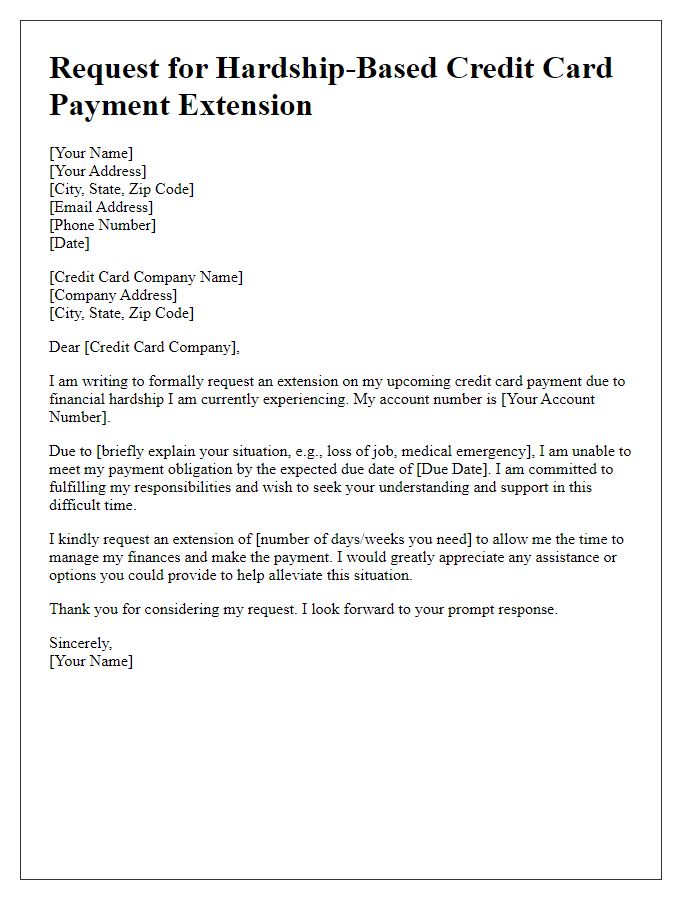

Many individuals seek a credit card payment extension due to unexpected financial hardships, such as job loss or medical emergencies. These circumstances can disrupt regular income flow and make it difficult to meet payment deadlines. For instance, the sudden financial strain from a medical bill that peaks at $5,000 can put significant pressure on personal finances. Additionally, the economic climate, including rising inflation rates of around 6% in 2023, can further complicate cash flow. In such cases, requesting a temporary extension can provide essential relief and allow individuals to manage their budget more effectively while prioritizing essential expenses, such as housing and groceries.

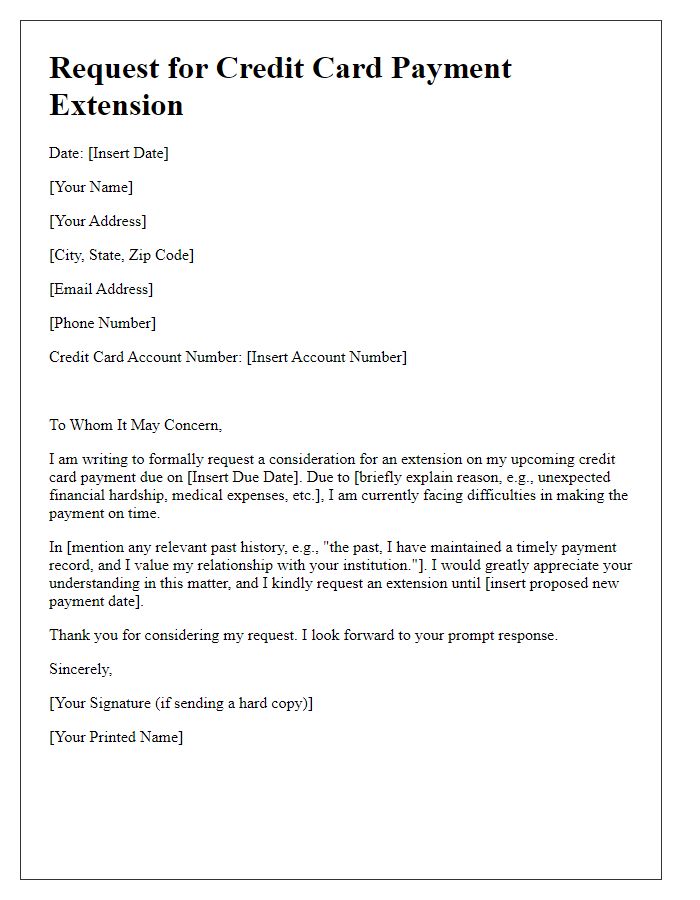

Account information details

The request for a credit card payment extension can be crucial for managing financial obligations effectively. For instance, account information details may include the credit card number (typically 16 digits for Visa, MasterCard), the account holder's name as it appears on the card, and the outstanding balance (often varying based on the billing cycle). Additionally, the due date (commonly set on a monthly cycle, such as the 15th of each month) is essential for indicating the urgency of the request. Payment history might illustrate on-time payments or missed payments, which can influence the extension approval. Contact information, including phone numbers and email addresses, facilitates timely communication. Understanding the credit card company's policies on payment extensions is also vital, as terms can differ significantly across institutions, with some offering grace periods while others may impose late fees.

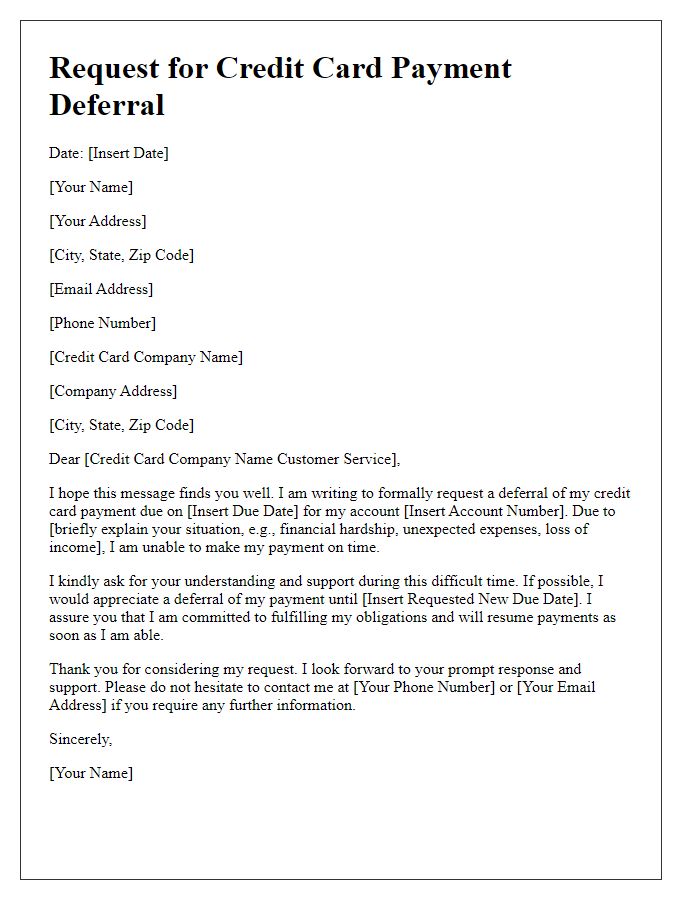

Proposed payment timeline

During financial hardships, consumers occasionally seek extensions on credit card payment due dates. A proposed payment timeline typically outlines specific dates for installments. For instance, a consumer might propose an initial payment of 25% by the end of the current month, followed by two additional monthly payments of 25% each. This structured approach provides clarity and assurance to the credit card issuer, fostering a mutually beneficial agreement. Timely communication with the credit card company is crucial, as it may increase the likelihood of a favorable response and help maintain a positive credit rating during challenging times.

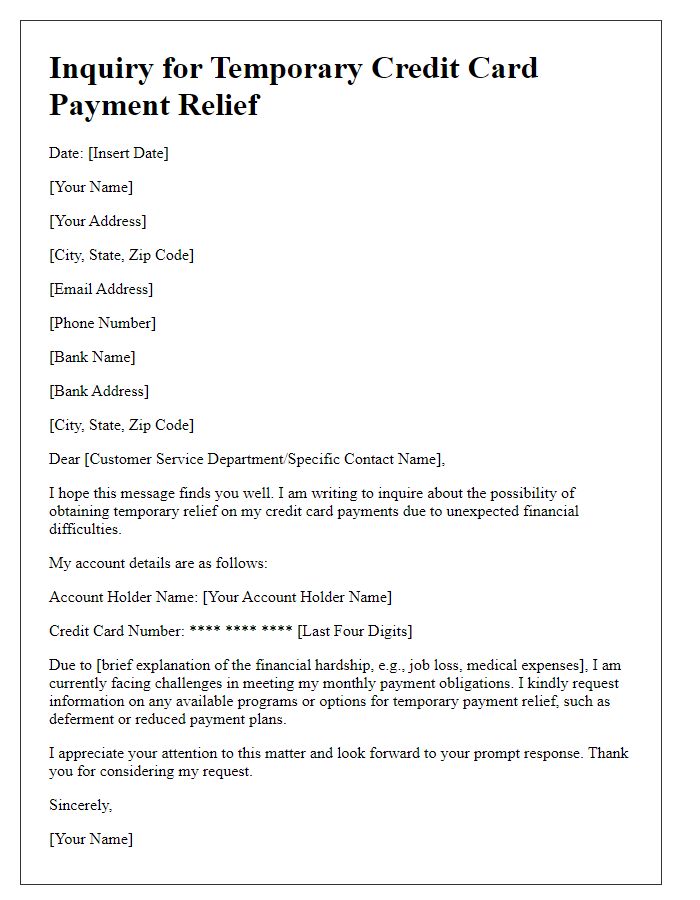

Financial hardship explanation

Financial hardship can seriously impact individuals' ability to meet their financial obligations, particularly regarding credit card payments. Significant life events such as job loss, medical emergencies, or unexpected expenses can lead to difficulties. For example, an individual may experience loss of income due to a layoff from a position at a major company, resulting in an inability to cover monthly bills. Rising healthcare costs from a serious illness may require funds that were previously allocated for credit card payments. Requests for payment extensions can help alleviate immediate financial pressure and provide a chance for recovery. Creditor institutions, such as large banks issuing credit cards, often offer assistance programs for customers facing these challenges, enabling them to keep accounts in good standing while achieving financial stability.

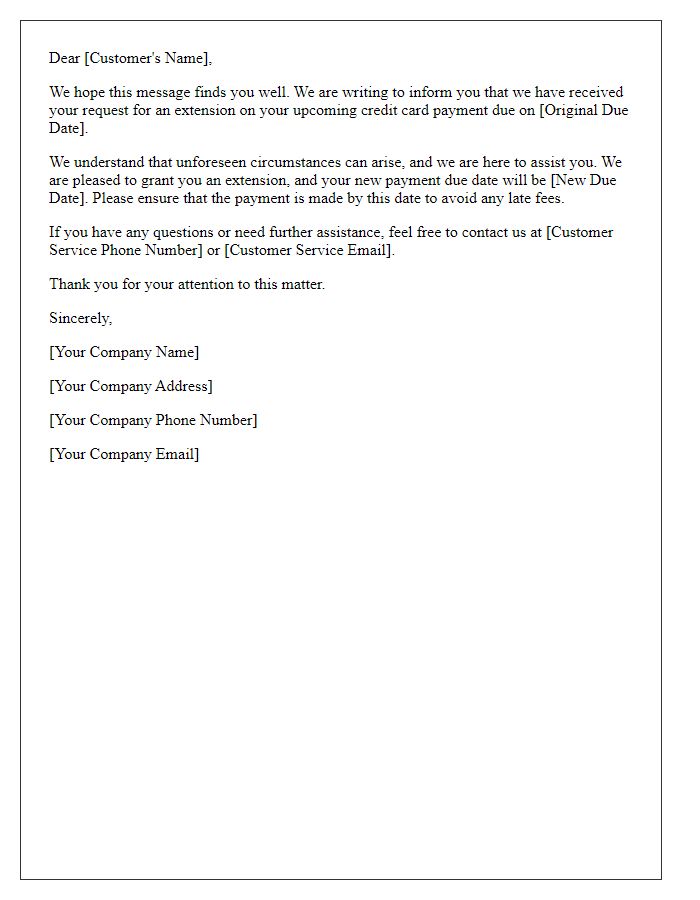

Contact information for follow-up

In financial circumstances where individuals may face difficulties managing their credit card payments, requesting a payment extension from the issuing bank can provide temporary relief. Detailed communication should include essential contact information such as phone numbers for customer service, email addresses for formal requests, and any reference numbers related to the account that can facilitate efficient tracking. It is crucial to specify the reason for the extension request, such as unexpected medical expenses or temporary unemployment. Clarity regarding the desired extension timeframe, whether it is for one month or more, helps in setting realistic expectations. Including pertinent documentation to support the request, such as pay stubs or medical bills, can strengthen the case for receiving a favorable response.

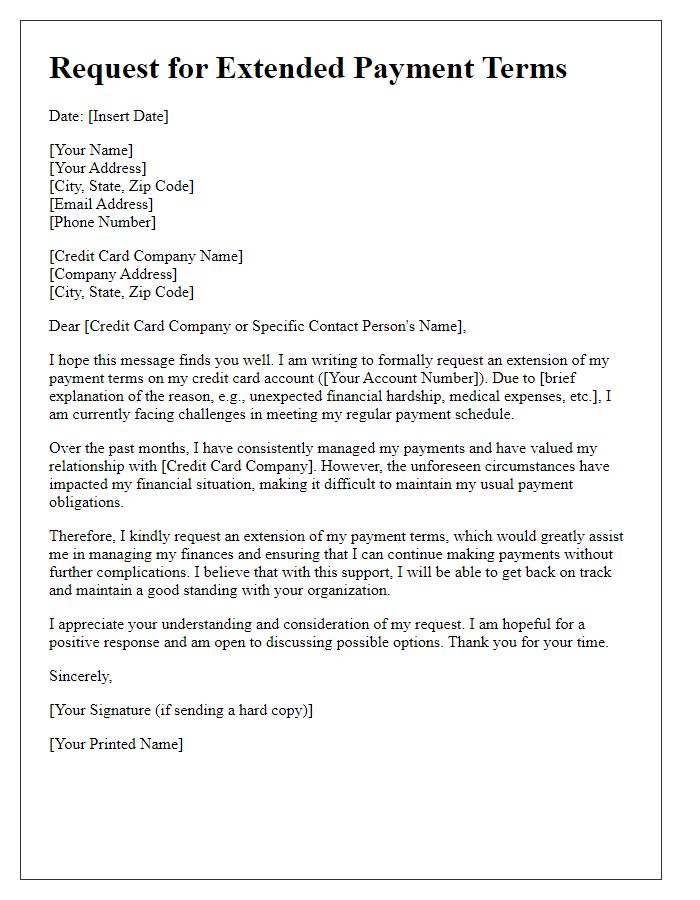

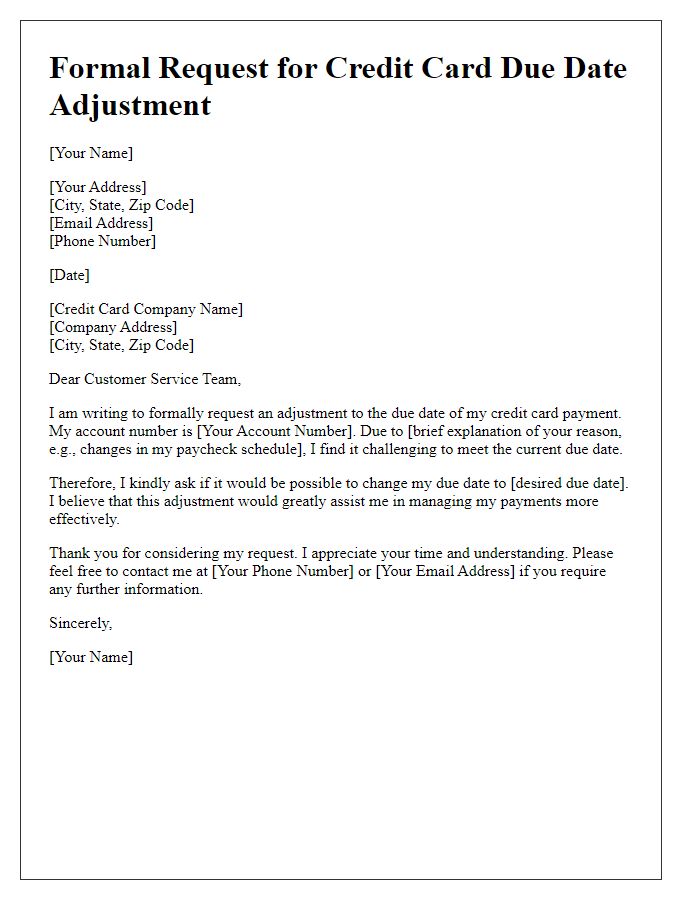

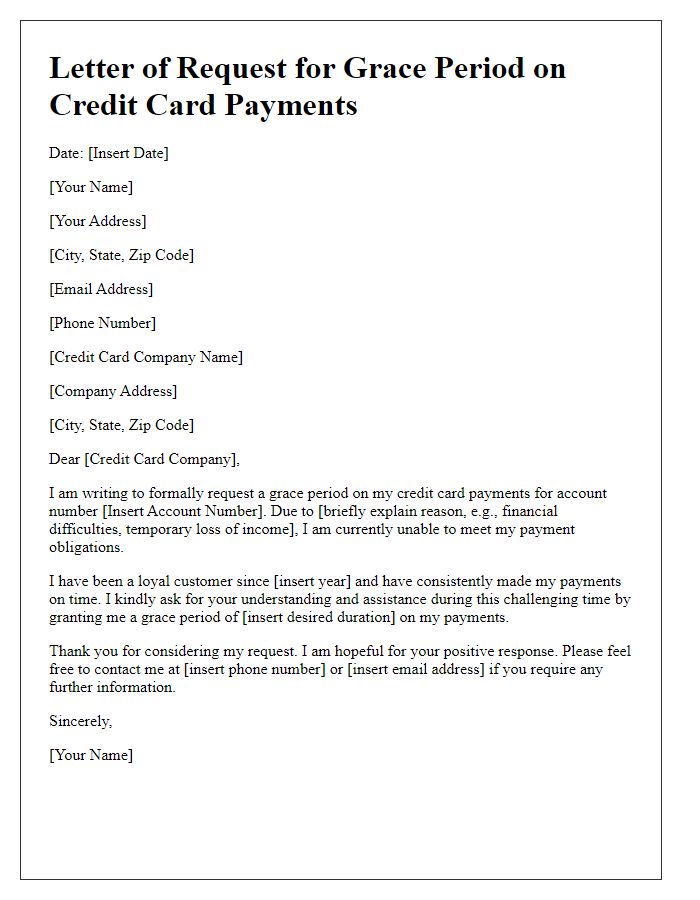

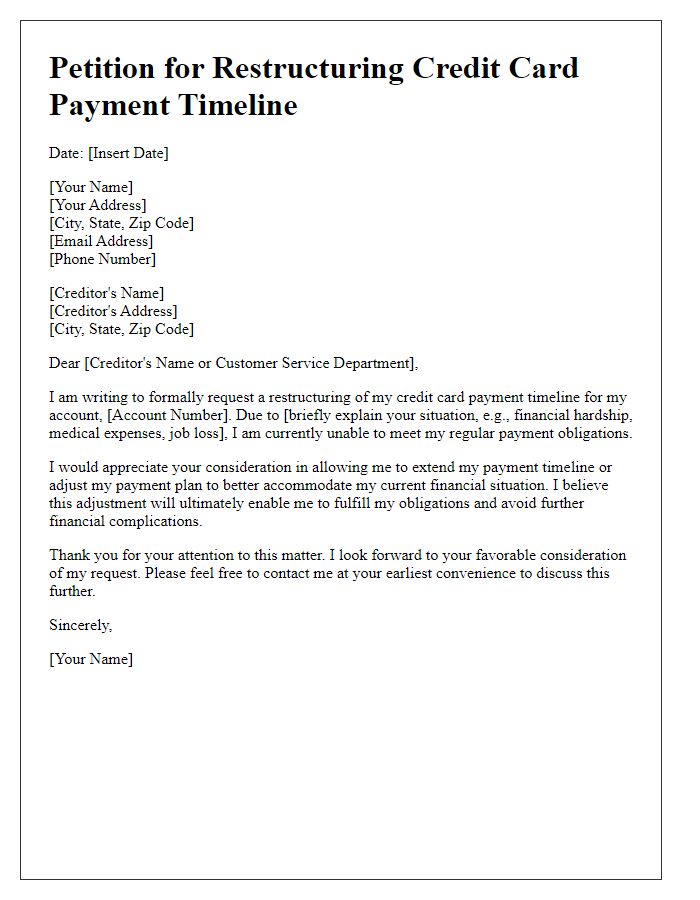

Letter Template For Credit Card Payment Extension Request Samples

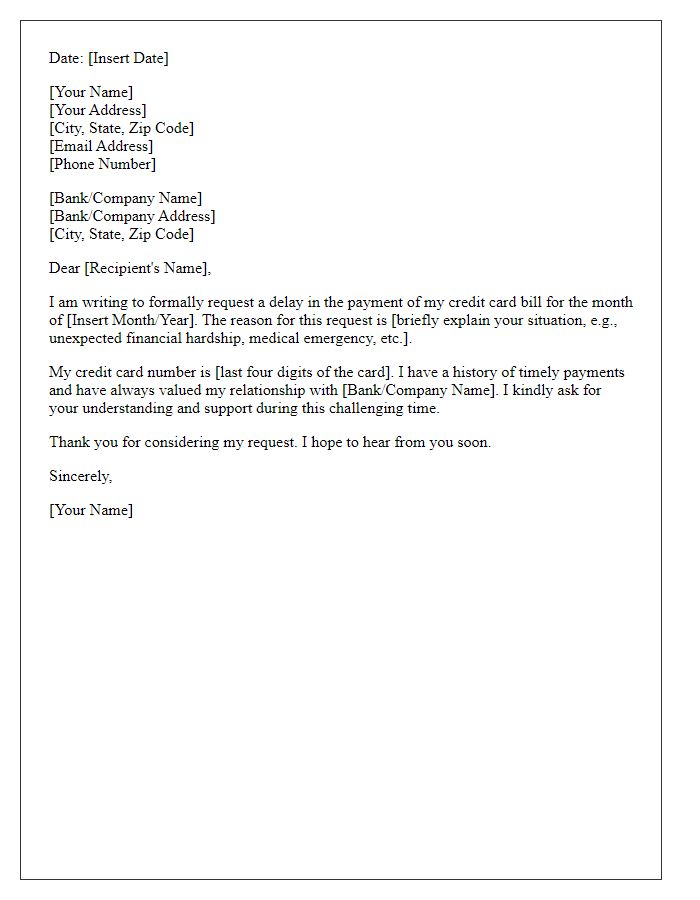

Letter template of submission for credit card payment extension consideration

Letter template of request for hardship-based credit card payment extension

Comments