Have you ever found yourself puzzled over a mysterious charge on your credit card statement? It's a common dilemma that many face, and understanding how to verify transactions can make all the difference. In this article, we'll walk you through a straightforward template you can use to address any discrepancies with your credit card provider. So, let's dive in and empower you to take control of your financial peace of mind!

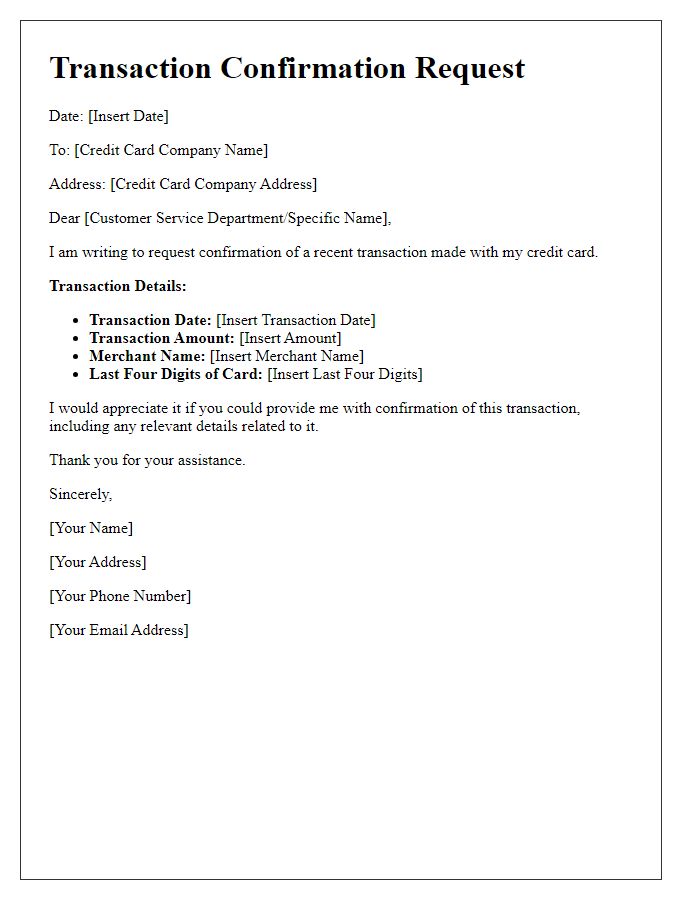

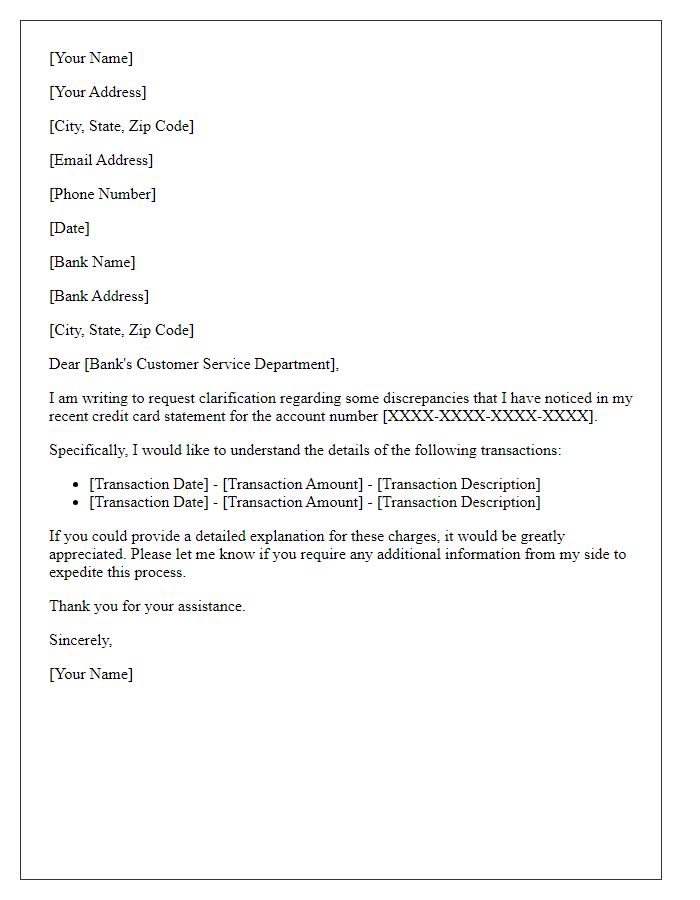

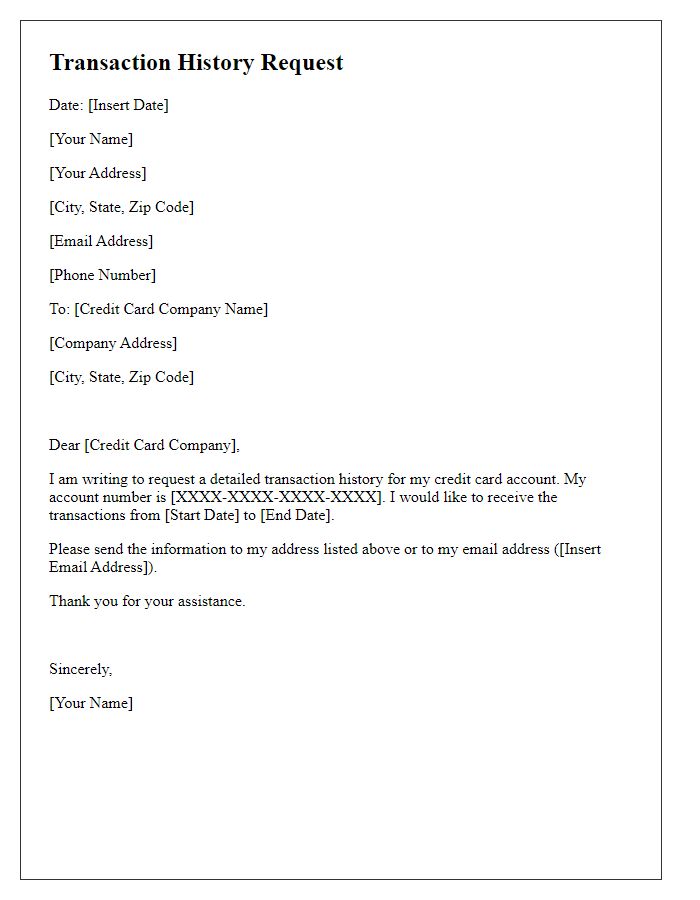

Customer Information

Credit card transaction verification processes are crucial for maintaining security and safeguarding personal information. Essential customer information includes the full name of the cardholder, associated billing address, and contact details such as a phone number or email. Verification typically requires card details like the last four digits of the credit card number, expiration date, and CVV code. Organizations may also request transaction specifics, including the date, time, and amount of the transaction. This information helps in confirming the legitimacy of the transaction and preventing fraud. Establishing secure communication channels, such as encrypted emails, ensures protection of sensitive data during verification.

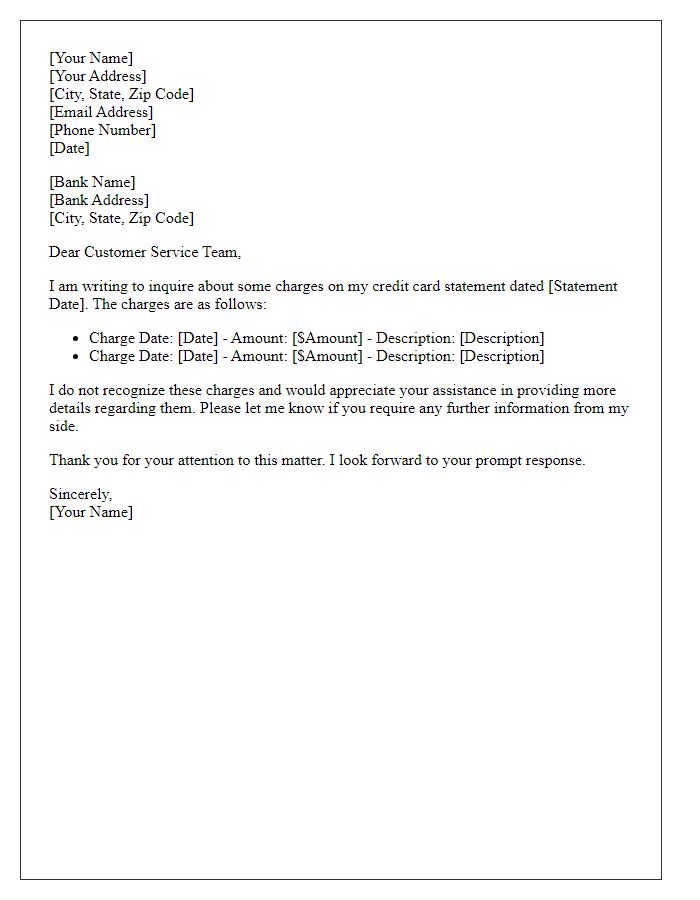

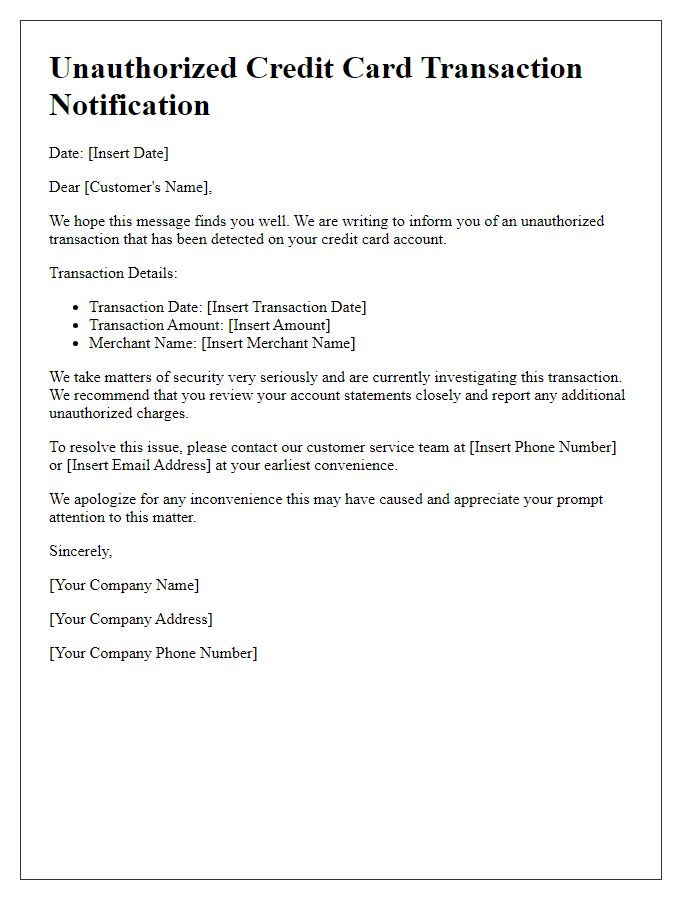

Transaction Details

A credit card transaction verification process is essential for maintaining security and accuracy in financial dealings. Transaction details include transaction number, date, time, amount, merchant name, and cardholder information. For instance, a transaction number might be a unique identifier for an online purchase made at Amazon on October 12, 2023. The amount could be $49.99 for electronic goods, processed at 3:45 PM. This ensures that both the customer and the merchant can cross-reference records for discrepancies, assisting in fraud detection and resolution of issues. Transaction verification is crucial for safeguarding sensitive financial data and fostering trust in payment systems.

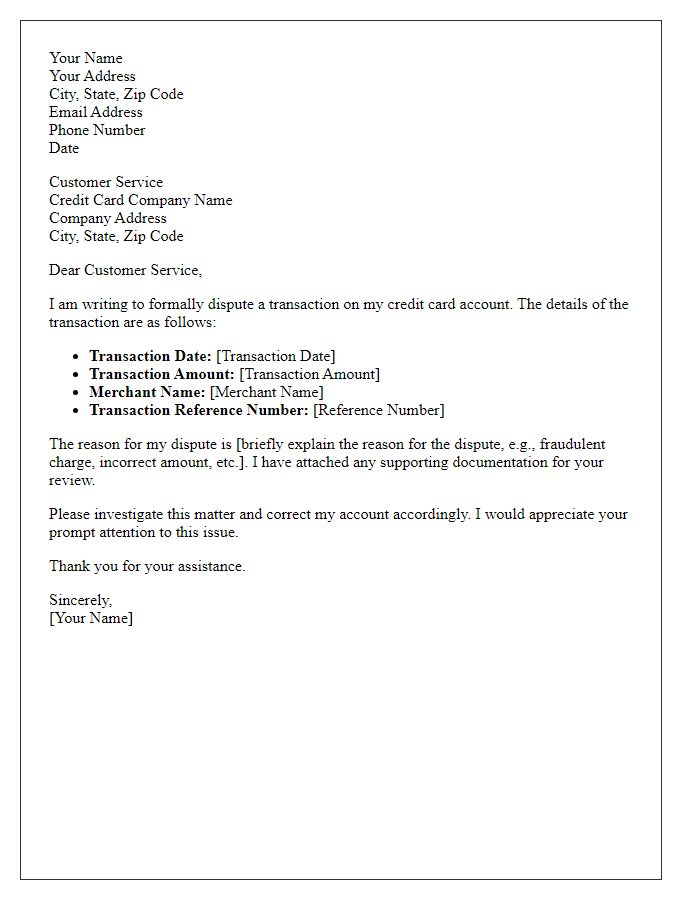

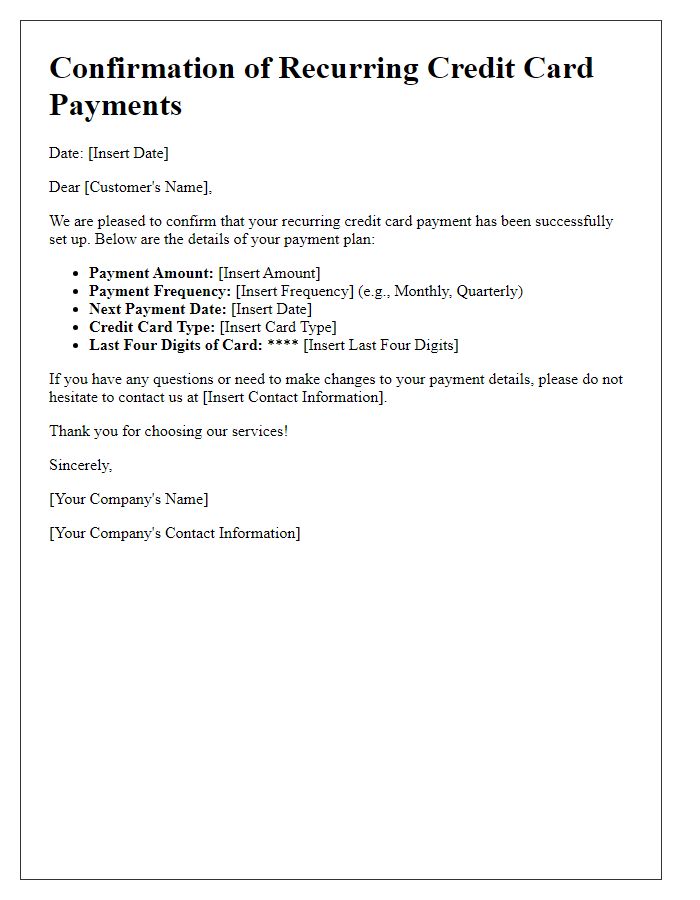

Verification Instructions

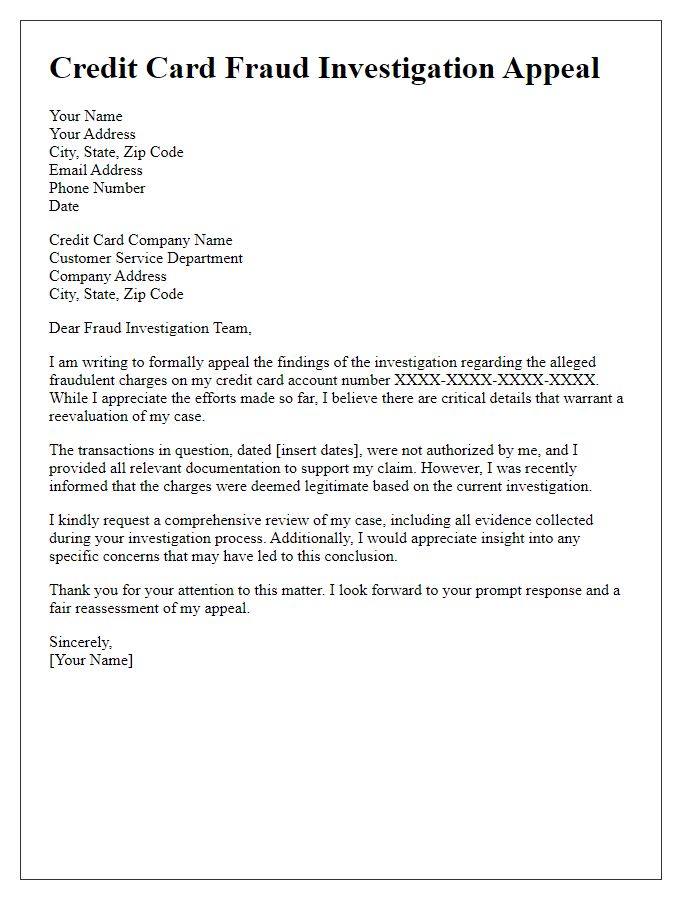

Credit card transaction verification involves a series of important steps to ensure the security and accuracy of financial transactions. Users should check transaction details, including transaction date (specific day in the month), amount (total sum charged), and merchant name (business entity or service provider) associated with the transaction. Users must contact their card issuer (financial institution that issued the credit card) promptly if any discrepancies arise. Maintaining communication with customer service (dedicated support for cardholders) is crucial for addressing potential fraud or unauthorized charges. Additionally, users should review account statements (monthly financial summaries) to verify all transactions within a specified billing cycle (typically 30 days) for accuracy. Keeping personal and card information secure (such as passwords and PINs) is vital to prevent unauthorized access.

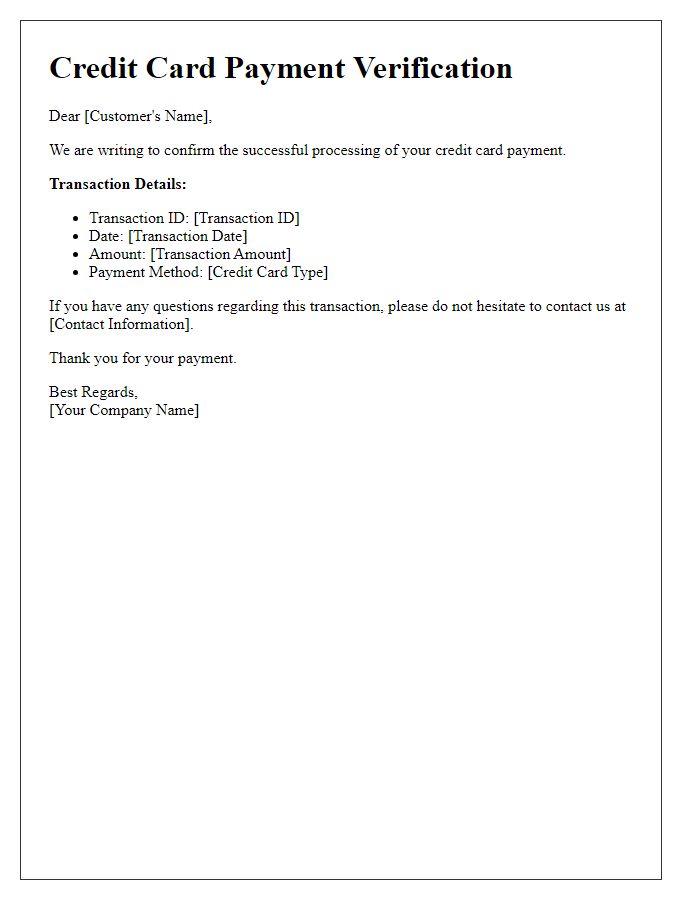

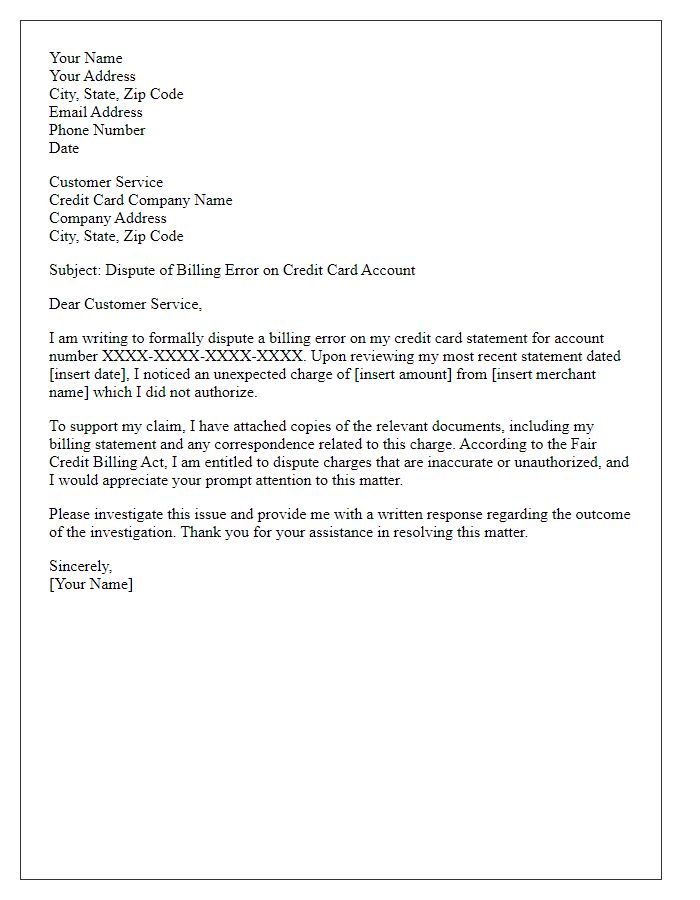

Contact Information

Credit card transaction verification is crucial for financial safety, particularly concerning personal security. Records show that fraud-related incidents have surged by 30% in 2022 compared to previous years. Institutions like Visa and Mastercard emphasize the importance of verifying questionable transactions immediately. Consumers must provide specific details such as transaction date (typically a day/month/year format), merchant name (establishments can range from retail giants to local cafes), and transaction amount (which can vary widely based on the service or product purchased). Verifying contact information is essential; users are encouraged to reach out directly through the customer service numbers provided on the back of their credit cards, ensuring that communication remains within the official channels and safeguarding against phishing attempts.

Security Measures

Credit card transaction verification involves several critical security measures to protect consumers and financial institutions. Encryption technology, such as AES (Advanced Encryption Standard), secures sensitive information during online transactions. Two-factor authentication (2FA) enhances security by requiring users to verify their identity through an additional method, like SMS codes or biometric verification. Continuous monitoring systems flag unusual activity in real time, enabling swift responses to potential fraud, with machine learning algorithms analyzing transaction patterns. Additionally, Secure Socket Layer (SSL) certificates are essential for establishing encrypted links between web servers and browsers, ensuring that data remains confidential during transmission. Regular audits and compliance with PCI DSS (Payment Card Industry Data Security Standard) bolster system integrity, protecting cardholders against data breaches and unauthorized transactions.

Comments