Hello! Have you ever found yourself in a pinch because you overlooked a credit card payment? It happens to the best of us, and understanding how to address this situation can save you from unnecessary fees and stress. In this article, we'll discuss a handy letter template for notifying your credit card company about an overlooked payment, ensuring you communicate effectively and professionally. So, let's dive in and explore how you can tackle this issue head-on!

Account Details

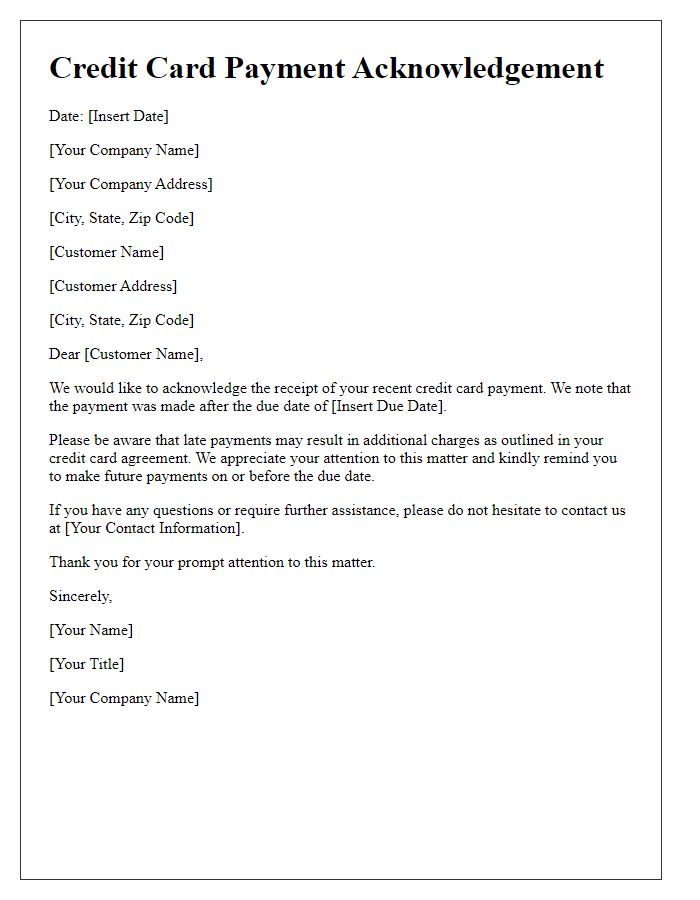

Credit card payment notices are critical reminders for cardholders regarding outstanding balances. The notice typically includes account details such as the account number (a unique identifier for each cardholder's financial account), due date (the specific date payments must be received to avoid late fees), and payment amount (the total sum required to stay in good standing). Additionally, it may provide previous payment history (documenting past transactions and any missed payments) and current balance (the total amount owed at the time of notice). This information is essential for maintaining credit health and avoiding potential penalties or interest rate increases.

Payment Due Date

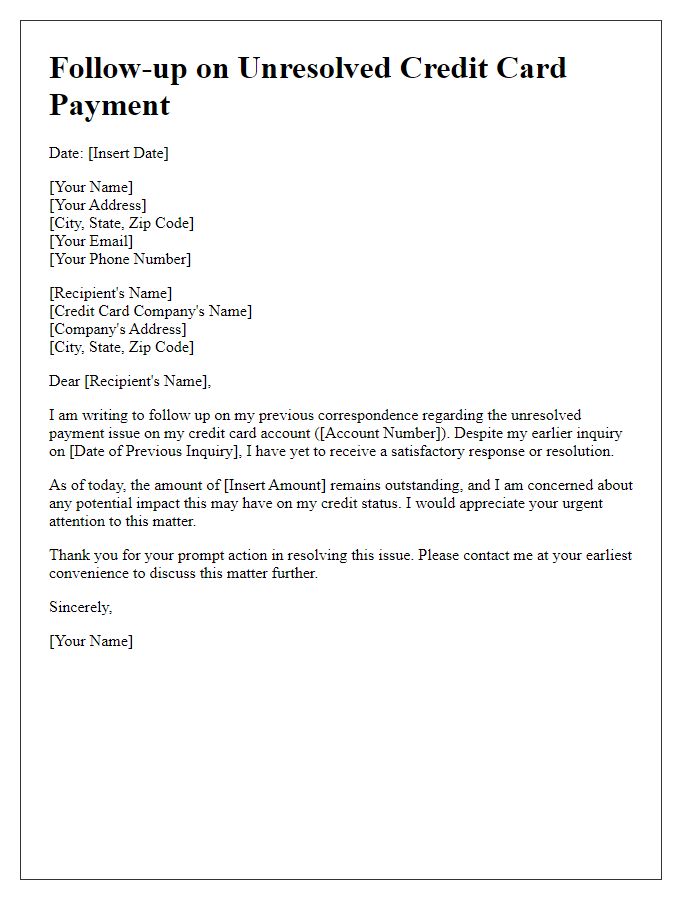

Failure to address overlooked credit card payments can result in significant financial implications for cardholders. Payment due dates, typically issued monthly by credit card issuers, are critical for maintaining credit score integrity. A missed payment can lead to late fees, which may range from $25 to $40, and a potential increase in the annual percentage rate (APR), impacting the overall cost of borrowing. Furthermore, payment history accounts for 35% of credit scores, meaning that a single overlooked payment can have lasting effects on an individual's financial future. Regularly reviewing statements and setting reminders for due dates can mitigate these risks, ensuring timely payments and preserving one's creditworthiness.

Outstanding Balance

An overlooked credit card payment can lead to an outstanding balance on accounts, impacting credit scores and increasing interest rates. Credit cards typically have a grace period of 21 to 25 days, during which payments can be made without incurring extra fees. Missing this deadline may result in late fees, often ranging from $25 to $40, as well as potential penalty interest rates, which can rise to 29.99%. The unpaid balance can be reported to credit bureaus, affecting scores, especially if the payment is 30 days past the due date. Moreover, contacting customer service can help individuals set up payment arrangements or discuss possible fee waivers.

Late Fee Waiver Option

Credit card holders may receive an overlooked payment notice for their accounts, especially from major financial institutions like Visa or Mastercard. This notification often addresses payments overdue by 30 days or more, potentially leading to a late fee of up to $35. Many banks offer a late fee waiver option, which enables customers to request a one-time removal of the fee, particularly for those with a solid payment history. This appeal for leniency can result in a restored account standing, allowing continued access to credit without the penalty. Customers facing this issue should promptly contact their bank's customer service, usually reachable via a dedicated phone line or online messaging, to discuss their options. Maintaining awareness of payment deadlines, typically the same date each month, is crucial to avoiding these situations.

Payment Methods

Credit card companies often send payment notices to remind customers of overlooked payments. These notices typically highlight previous due dates, outstanding balances, and late fees incurred. For example, a customer with a Visa credit card from Bank of America might receive a payment alert if their due date was June 15, 2023, and payment of $75 was missed. The fine print may specify a late fee of $30 and mention that any continued non-payment could adversely affect the customer's credit score, managed by major agencies like FICO or Experian. Immediate action through online payment systems or mobile banking apps is encouraged to avoid further charges.

Comments