Are you considering asking your credit card issuer for a limit increase? It can be a daunting task, but with the right approach, you can make a compelling case to boost your credit limit. In this article, we'll walk you through a useful letter template that outlines your request clearly and persuasively. So, if you're ready to enhance your financial flexibility, let's dive in and explore how to craft the perfect letter!

Account Information

A credit card limit increase request requires detailed information to ensure optimal processing. The account information section should include the credit card issuer's name, account number (typically a 16-digit number), account holder's full name as it appears on the card, the credit limit currently established (for example, $5,000), and the duration of account ownership (such as two years). Additionally, include the total monthly income (e.g., $6,000) and any additional financial obligations (like car loans totaling $300 monthly). Understanding recent payment history (such as on-time payments over the past year) can also reinforce the request's credibility, showcasing responsible credit management. Lastly, express the purpose for the requested increase, whether for travel expenses, emergencies, or improved purchasing power.

Reason for Increase

Increased credit card limits can provide consumers with greater financial flexibility and support larger purchases, such as home renovations or travel expenses. Additionally, a higher limit may enhance one's credit utilization ratio, an essential aspect of credit scoring models, potentially improving overall credit scores. For example, keeping utilization below 30% is often recommended by financial institutions. Furthermore, maintaining an account in good standing over a period, typically involving timely payments and low outstanding balances, can demonstrate responsible credit use, increasing the likelihood of approval for limit increases.

Current Credit Standing

Current credit standing plays a crucial role in determining eligibility for a credit card limit increase. Factors influencing this standing include credit score, which typically ranges from 300 to 850, and payment history, detailing on-time payments versus late payments within a specific timeframe. Credit utilization ratio, ideally below 30%, reflects the proportion of available credit being used. Additionally, the length of credit history, encompassing the age of accounts and types of credit, significantly impacts overall creditworthiness. Regular monitoring of credit reports from agencies like Experian, TransUnion, and Equifax can help identify any discrepancies or improvements over time, ultimately influencing a successful request for an increased credit limit on credit cards like Visa or Mastercard.

Financial Stability

Demonstrating financial stability is essential when requesting a credit card limit increase. A steady income, preferably above the national average (around $55,000 annually in the United States), reflects an individual's ability to repay debts. Maintaining a positive payment history, including on-time payments over at least 12 months, strengthens the request. A low credit utilization ratio, typically below 30%, indicates responsible usage of available credit. Additionally, having a long-standing account with the issuer, ideally over three years, signals trustworthiness and reliability. Providing evidence of an increase in income or unexpected expenses, such as medical bills or educational costs, can also support the rationale for seeking a higher limit.

Contact Information

Requesting a credit card limit increase can greatly enhance financial flexibility. Customers should reach out to their credit card issuer, such as Visa or MasterCard, directly through official contact numbers or secure online messaging platforms. Providing personal details like full name, account number, and current limit is crucial. Additionally, it's important to include income figures, employment details, and recent payment history to strengthen the case for an increase. Many companies consider account usage patterns, such as maintaining a low balance relative to credit limit, as favorable indicators. Clear and concise communication can often lead to successful limit adjustments.

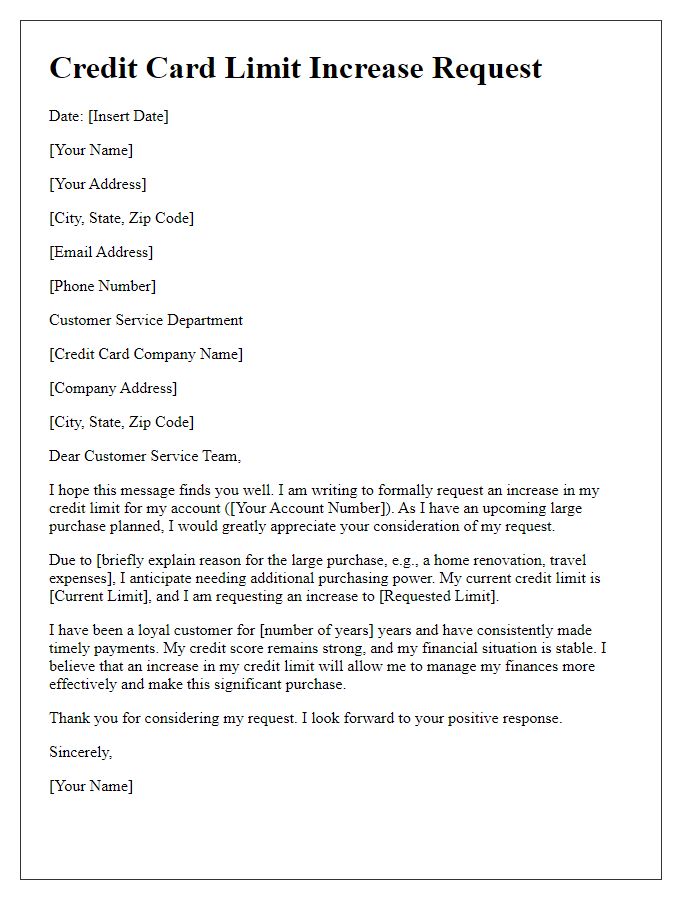

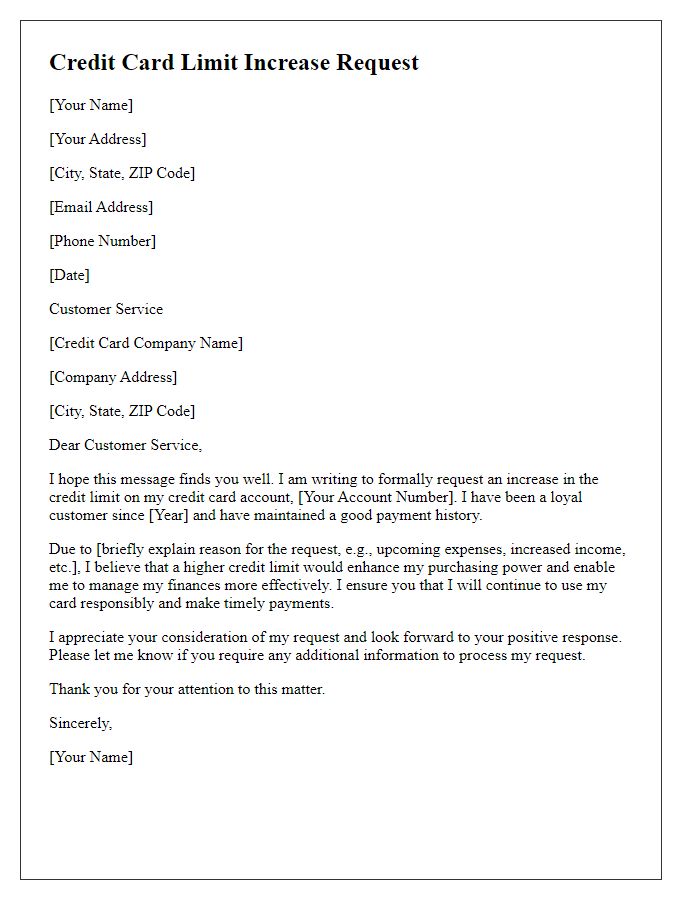

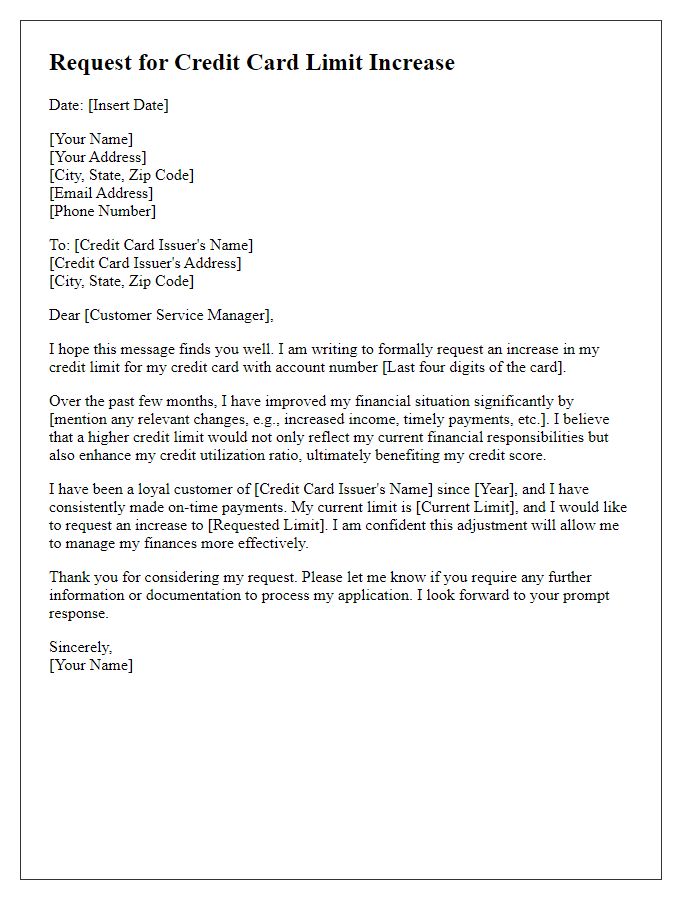

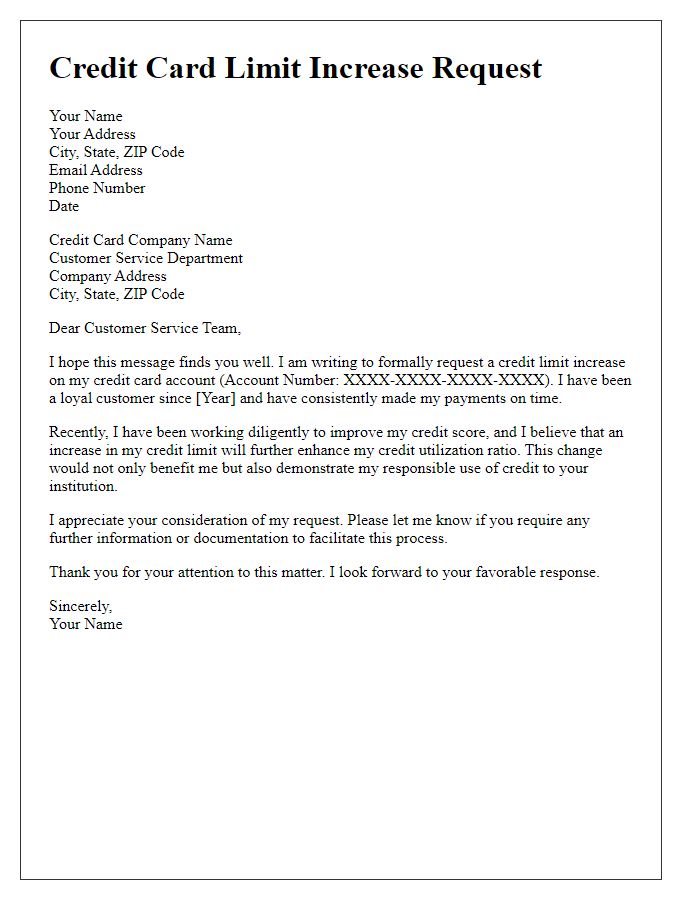

Letter Template For Credit Card Limit Increase Request Samples

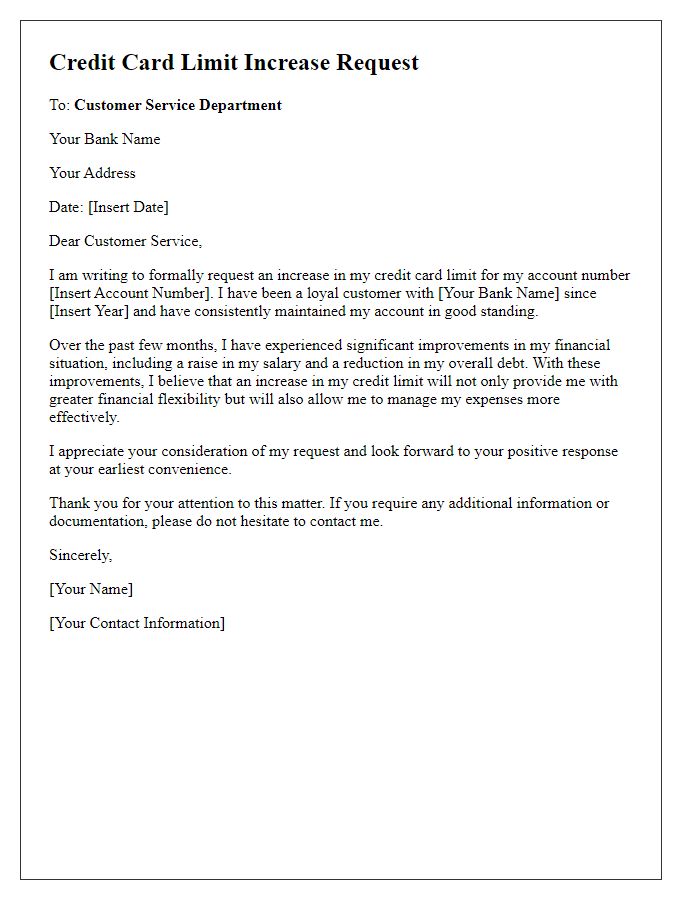

Letter template of credit card limit increase request for financial improvement.

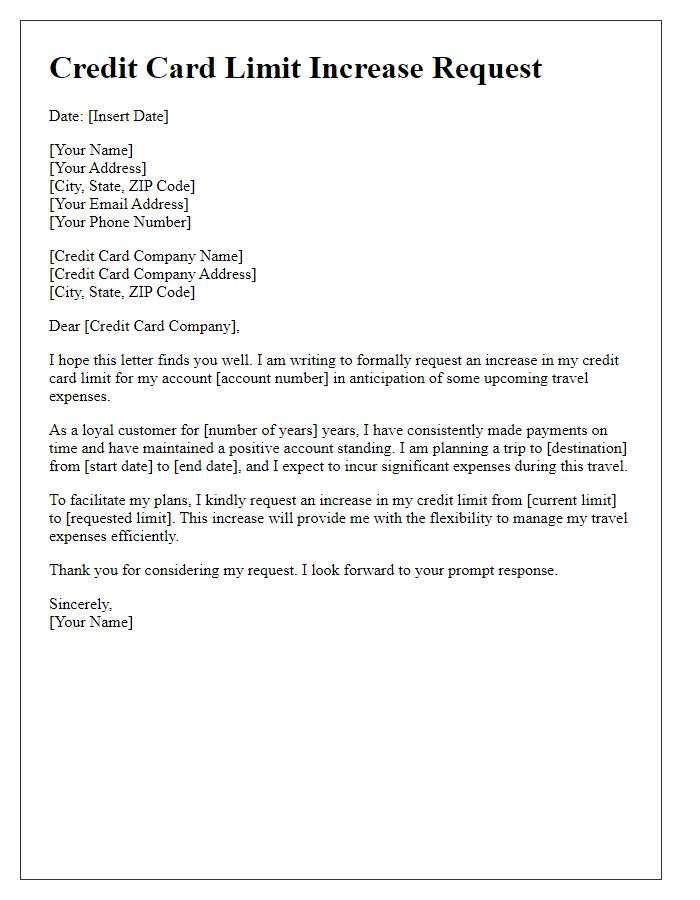

Letter template of credit card limit increase request for anticipated travel expenses.

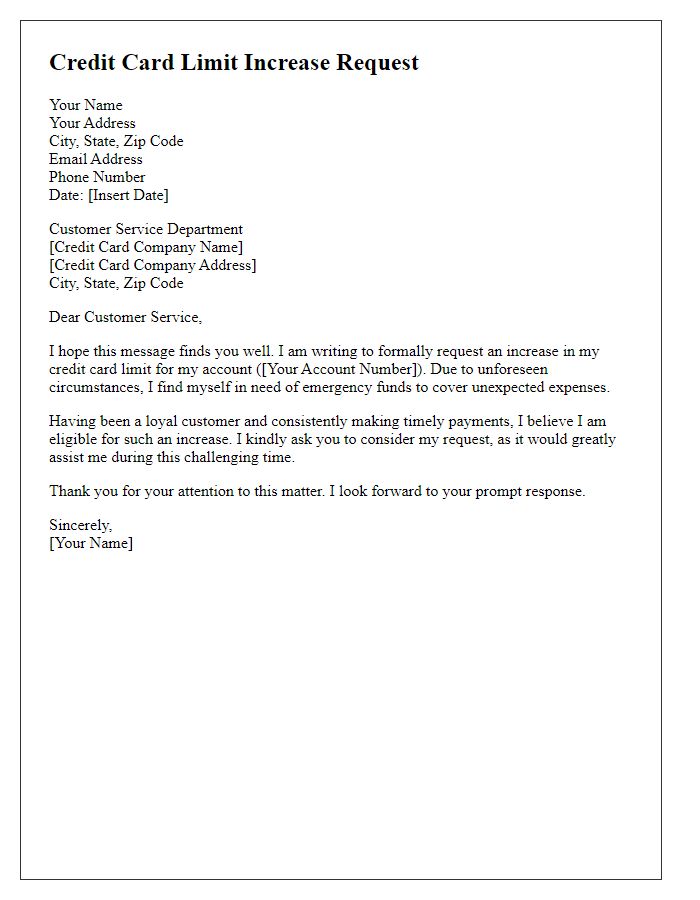

Letter template of credit card limit increase request for emergency funds.

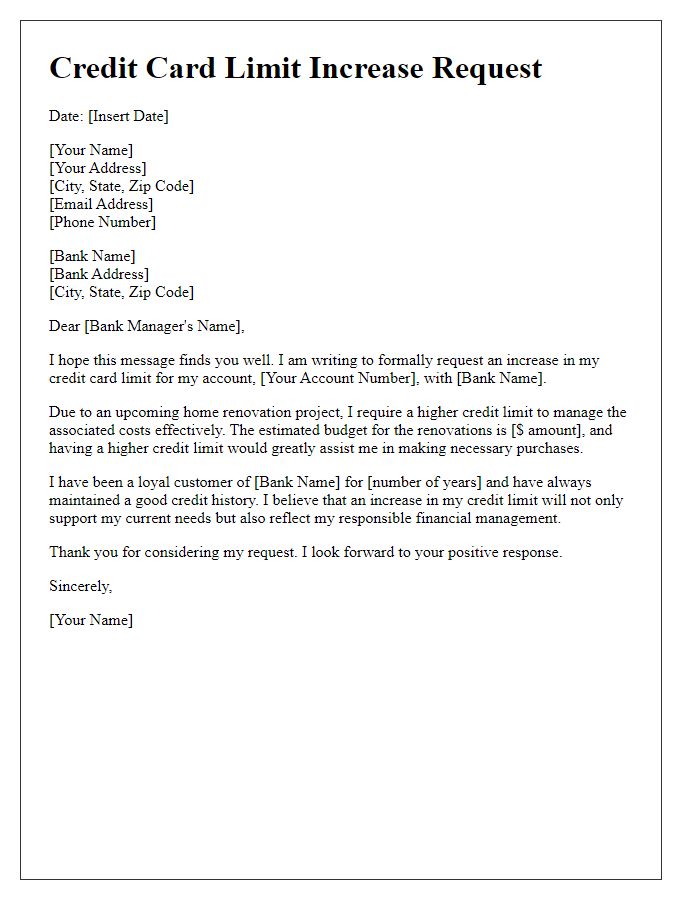

Letter template of credit card limit increase request for upcoming large purchases.

Letter template of credit card limit increase request for enhanced purchasing power.

Letter template of credit card limit increase request for better credit utilization.

Letter template of credit card limit increase request for improved credit score.

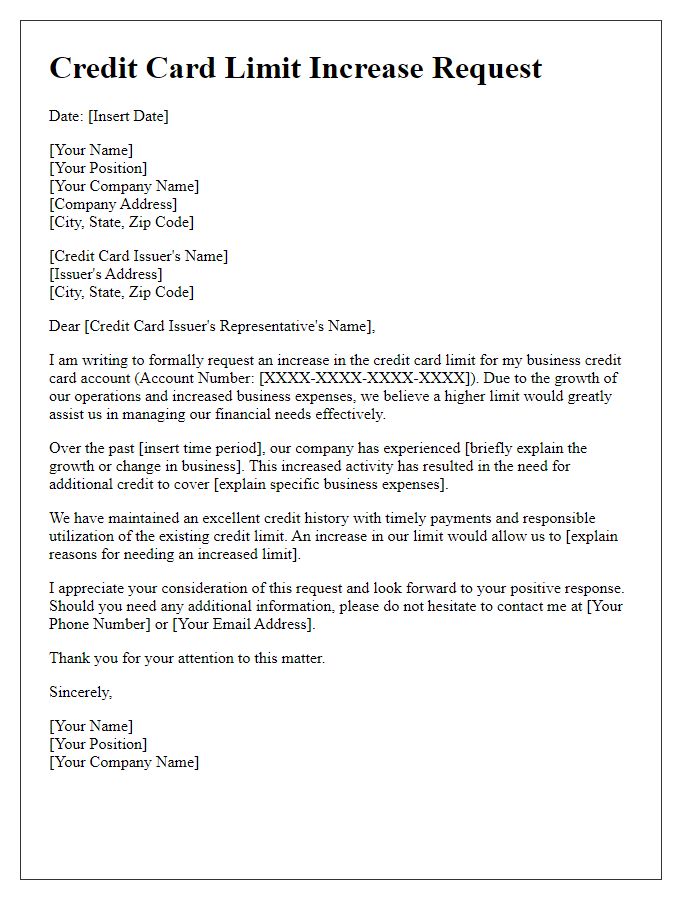

Letter template of credit card limit increase request for business expenses.

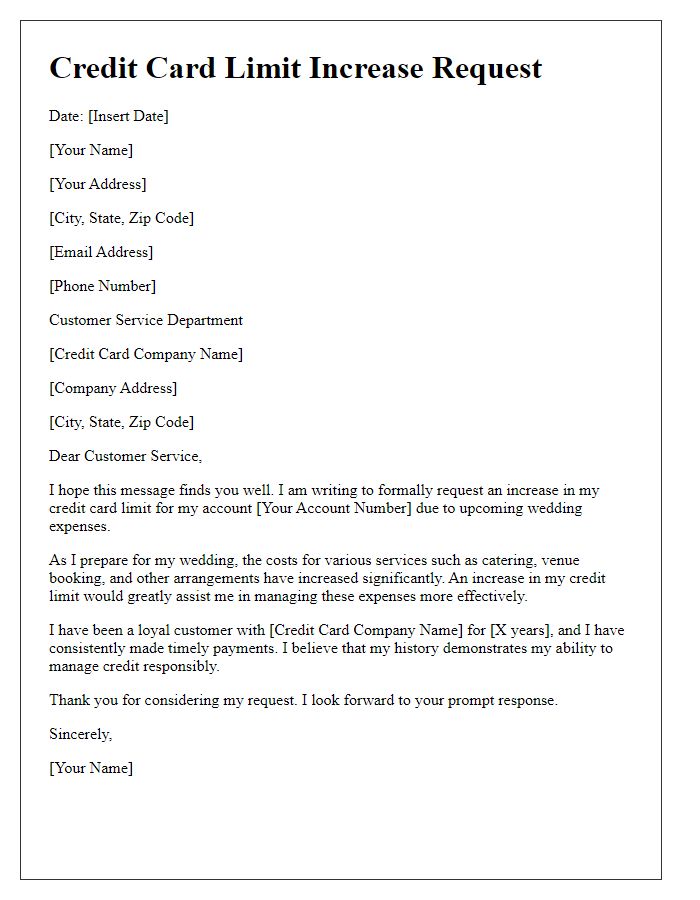

Letter template of credit card limit increase request for wedding expenses.

Comments