Are you feeling overwhelmed by credit card debt and looking for a feasible way to make your payments more manageable? You're not alone; many individuals find themselves in a similar situation and often seek options for relief. In this article, we will explore a straightforward credit card payment arrangement proposal that can help you regain control over your finances. So, if you're ready to take the next step towards financial freedom, read on to discover how you can craft an effective letter to your credit card issuer!

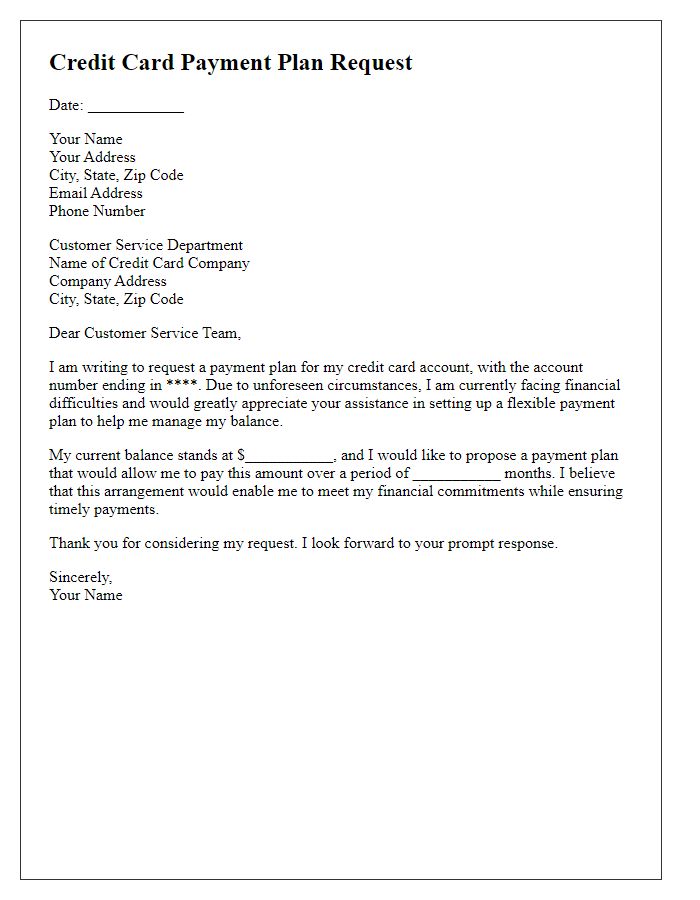

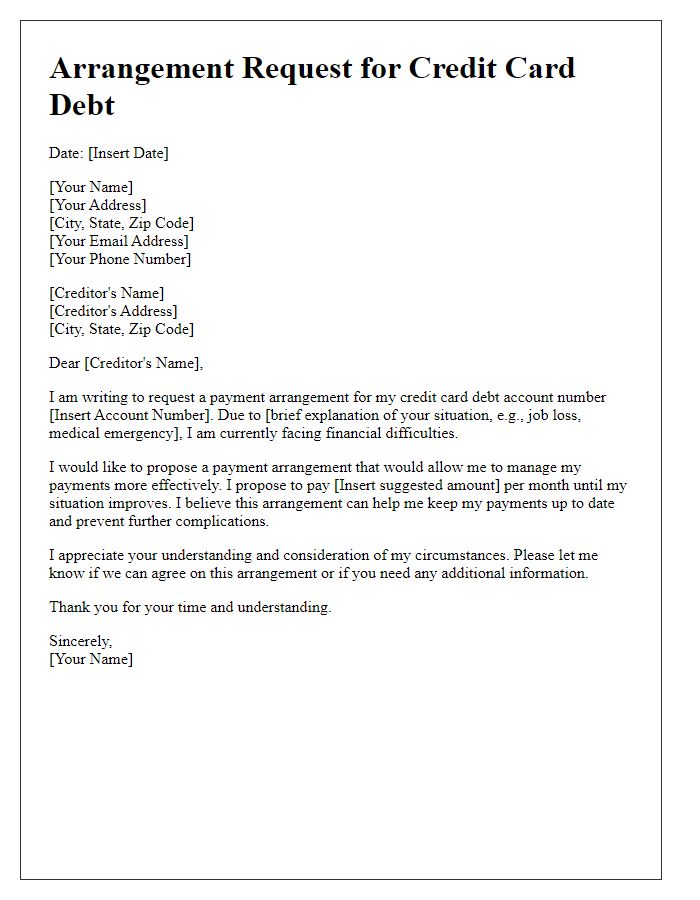

Contact Information

Credit card payment arrangements can be crucial for individuals facing financial difficulties. A well-structured proposal outlining payment terms can facilitate communication with credit card issuers. For example, providing clear contact information, such as a personal cell phone number (e.g., 555-123-4567) and an email address (e.g., user@example.com), allows for effective follow-up. Including specific dates for proposed payment plans enhances clarity, such as a commitment to pay $100 monthly starting on April 1, 2024. Engaging customer service representatives from major financial institutions, like Capital One or American Express, can yield beneficial arrangements, ensuring timely processing and encouraging negotiation of lower interest rates or waived fees.

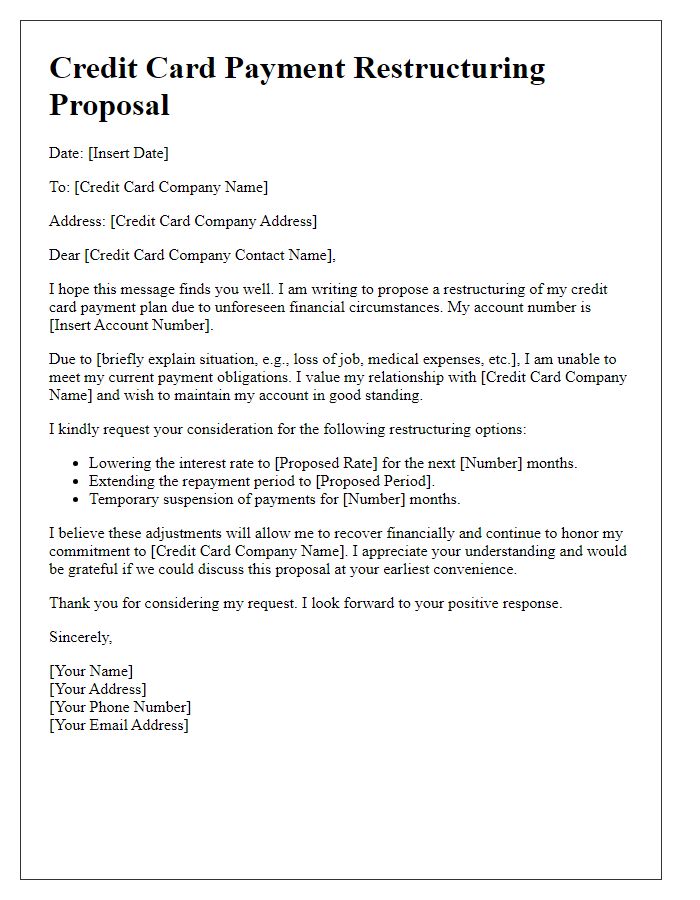

Account Details

Creating a successful credit card payment arrangement proposal involves presenting account details clearly and concisely. The account information typically includes key elements such as account number, card type (Visa, MasterCard, etc.), balance owed, payment due dates, and suggested payment amounts. It is crucial to emphasize deadlines and consequences of missed payments. Engaging in a proactive communication strategy with the financial institution can demonstrate commitment to resolving outstanding debts. Documentation should follow a professional format, ensuring all personal and financial information is accurate and up to date to facilitate approval of the arrangement.

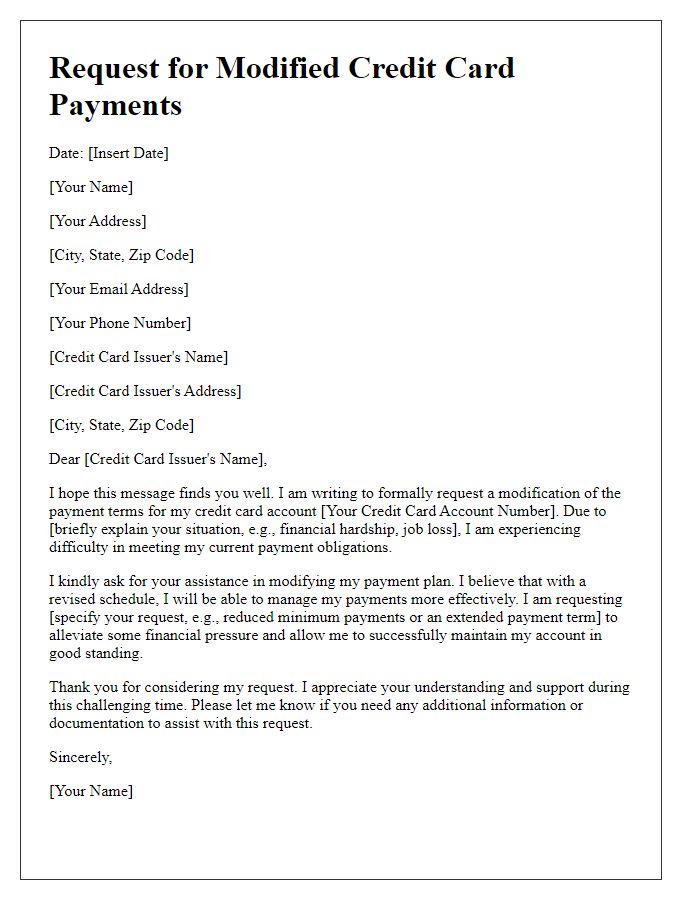

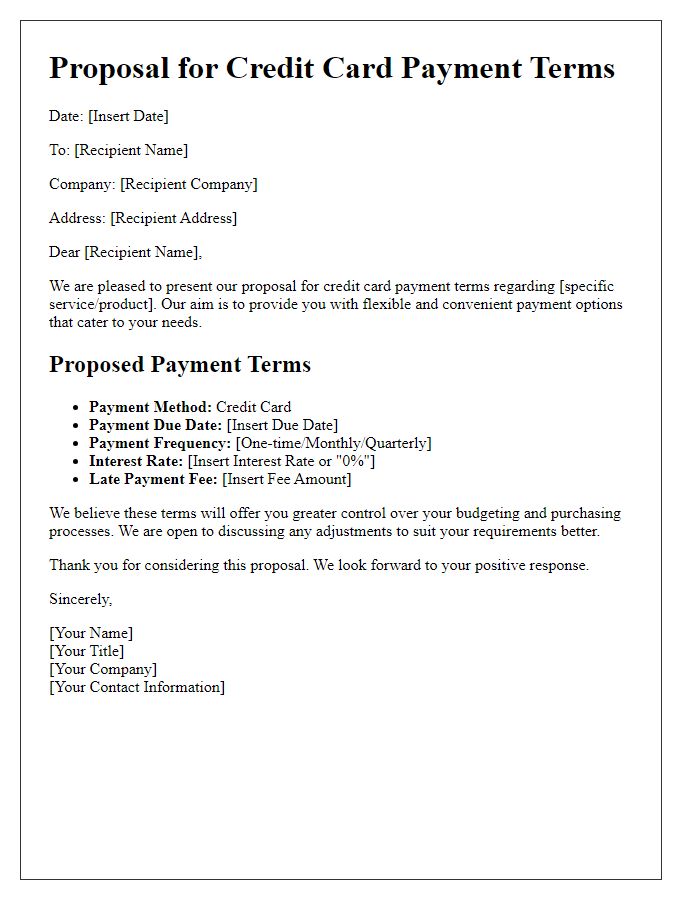

Proposed Payment Plan

Proposed payment plans for credit card debt can significantly ease financial burdens. For instance, the average American credit card debt hovers around $5,315 as of 2023. A structured payment plan might involve breaking the total amount into manageable monthly payments over a specified period. Establishing a timeline of 12, 18, or 24 months can provide clarity for individuals. Low-interest options can enhance affordability. Furthermore, due dates aligned with paydays can improve the likelihood of on-time payments. This approach considers factors such as the individual's income, expenses, and financial goals, ensuring a comprehensive and realistic pathway toward debt relief.

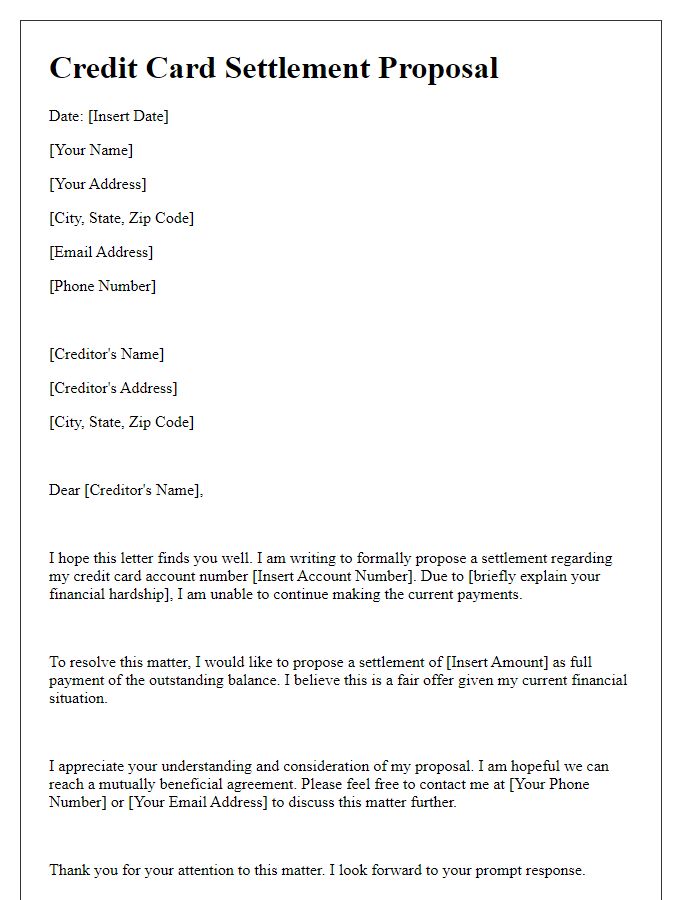

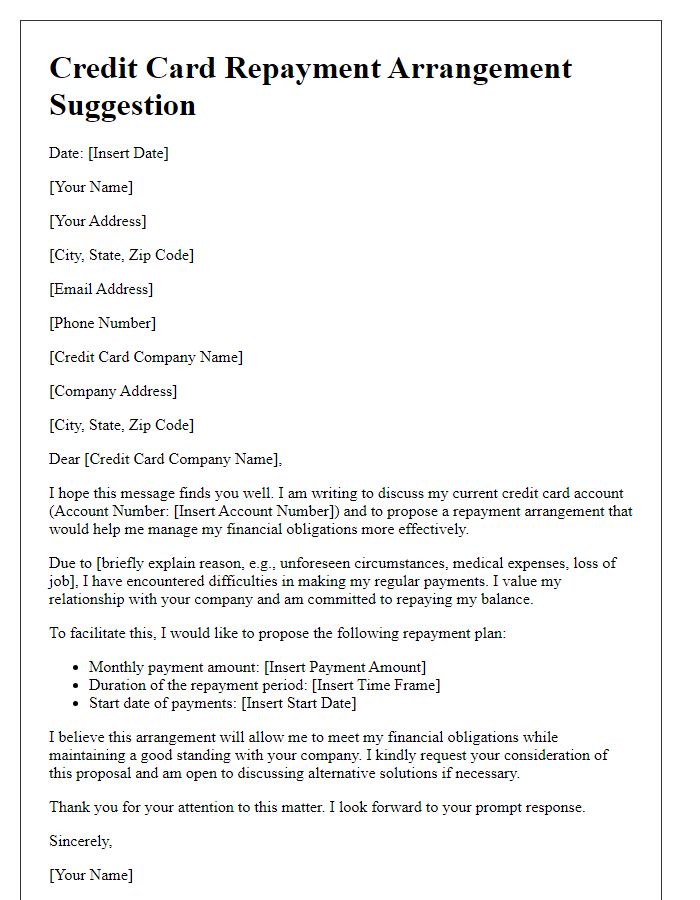

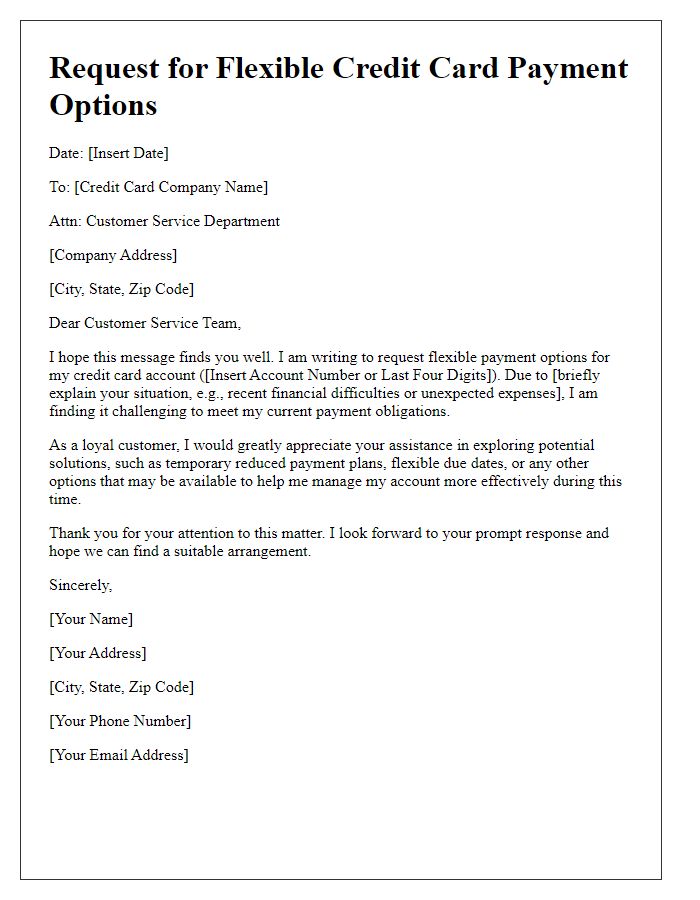

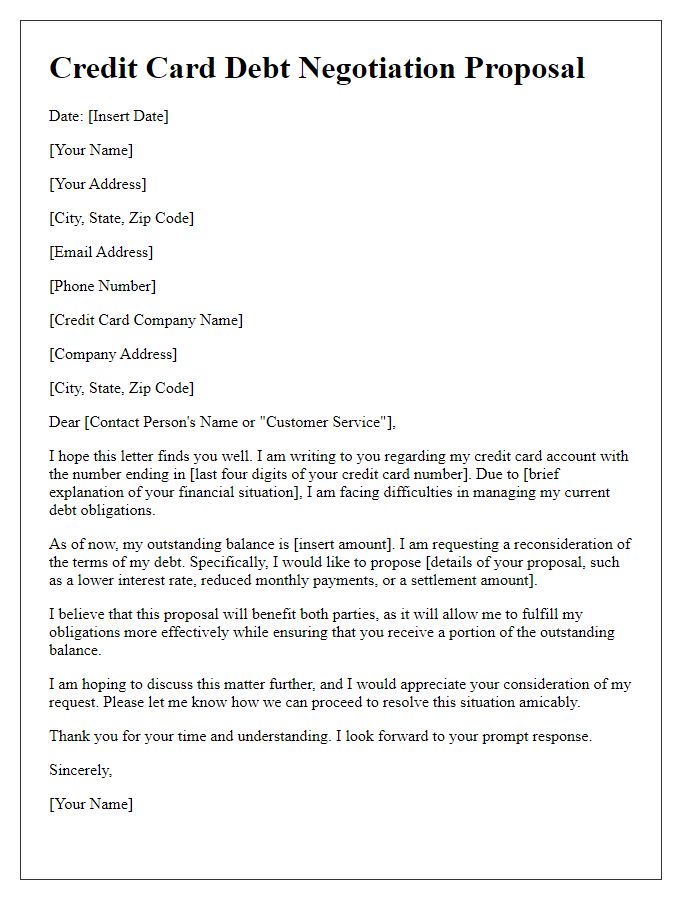

Financial Hardship Explanation

Financial difficulties can lead individuals to seek payment arrangements for credit card debts. A significant portion of the population may experience monetary challenges due to unexpected events such as job loss, medical emergencies, or economic downturns. For instance, in the United States, approximately 30% of adults reported financial strain in 2021, emphasizing the need for flexible repayment options. Credit card companies, like Visa or Mastercard, often have programs in place to assist those in distress. These arrangements can include lower interest rates or extended repayment periods, designed to alleviate financial burden. For example, a borrower struggling with a $5,000 credit card debt may propose a payment plan that reduces monthly payments from $200 to $100, easing their financial obligations. It is essential for individuals to communicate their situation clearly when seeking assistance from financial institutions to foster understanding and support.

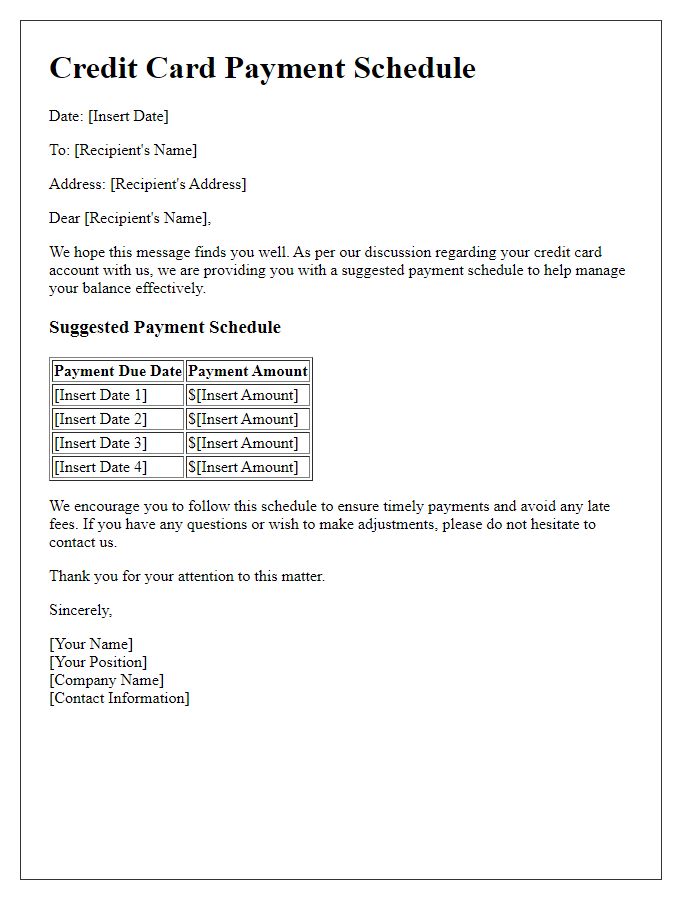

Terms and Conditions Agreement

Creating a credit card payment arrangement proposal involves outlining specific terms and conditions for repayment. This agreement typically includes payment schedules, interest rates, penalties for late payments, and guidelines for adjustments or disputes. Notable elements might include total debt amount, which could be thousands of dollars, the monthly payment amount, often a fixed sum, and the duration, which may range from several months to years. Clarity on the payment method, such as direct bank transfer or online payment portal, is crucial. Additionally, details about the credit card issuer, such as Visa or MasterCard, insurance, and consumer protection laws in the respective jurisdiction, play an important role in ensuring both parties understand their obligations and rights.

Comments